AI’s Gigawatt Appetite Is Rewiring U.S. Power Markets

AI demand has arrived in force. PJM is moving big loads to the front of the line, tech buyers are inking firm-nuclear and gas-backed deals, and batteries are filling the peaks while everyone asks who pays for the buildout.

The signal: purchase orders, not projections

The data center era has tipped from hype to hard load. In 2025, PJM shifted from caution to acceleration, elevating very large customers into fast-track processes and teeing up board-driven workstreams to handle multi-gigawatt requests. The result is a planning cycle guided by purchase orders and firm load adds rather than long-range forecasts.

What changed in 2025

- PJM introduced a board-initiated fast path for critical issues and explored a streamlined interconnection path for 500 megawatt-plus projects.

- Queue reform and site-readiness screens pushed speculative projects out while rewarding shovel-ready load and generation.

- Utilities began to align capital plans with concentrated data center clusters, often through build-transfer or long-term network upgrade programs.

- Power buyers shifted from annual energy targets to hour-by-hour commitments, raising the bar for deliverability and firming.

Who pays for the rapid buildout

Cost allocation is moving to the forefront. The key questions:

- Which network upgrades are attributable to a specific campus versus region-wide reliability needs.

- How much can be socialized in rates versus recovered from point-of-delivery customers.

- Whether accelerated timelines justify new tariff riders for make-ready infrastructure and local reinforcements.

Expect more granular cost causation, tighter site-readiness requirements, and contracts that blend transmission contributions with energy and capacity products.

Why gas, batteries, and nuclear win now

Near-term reliability favors assets that can reach commercial operation on tight schedules:

- Simple-cycle and fast-start gas provide dispatchable coverage for multi-hour ramps and seasonal peaks.

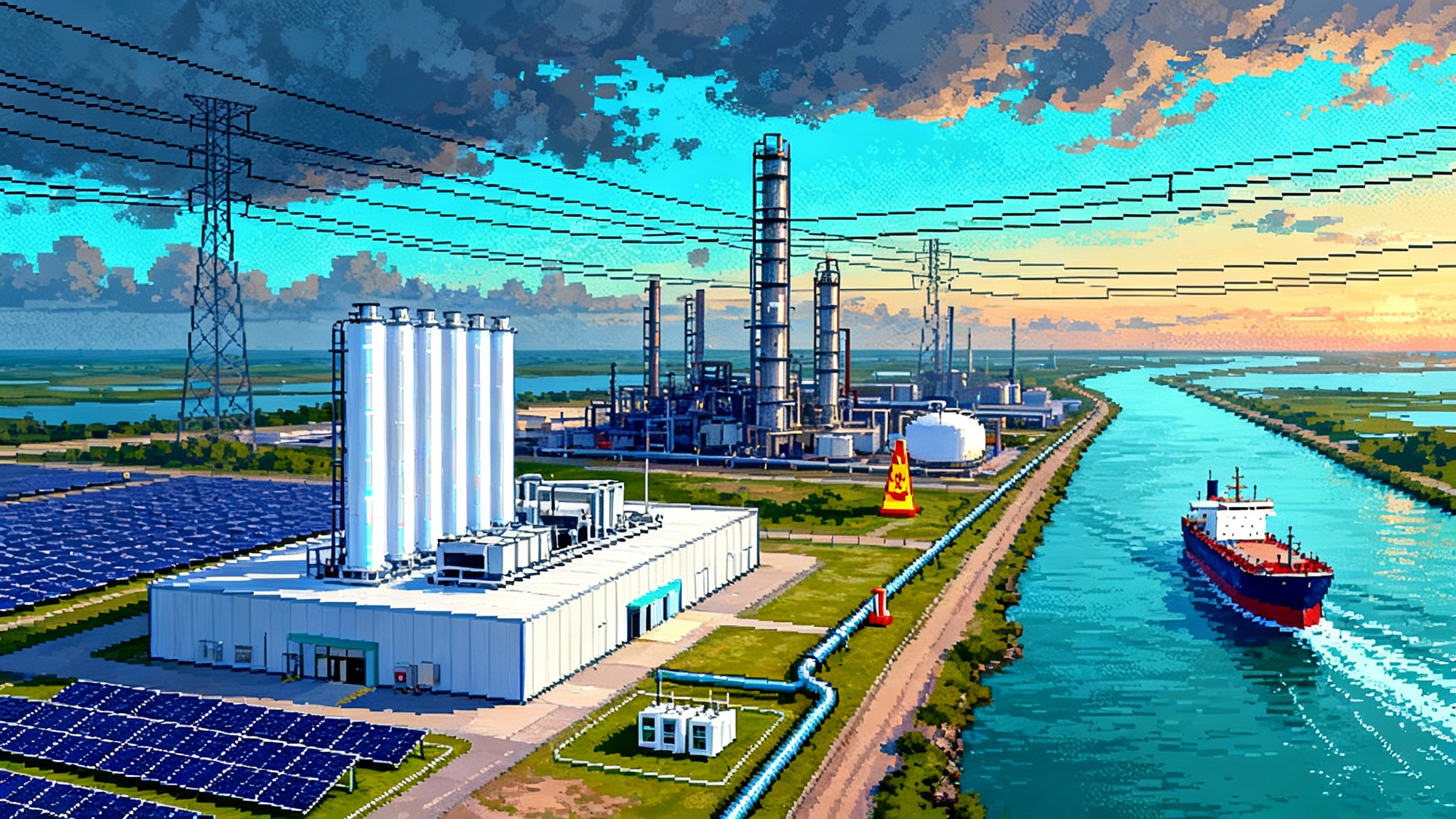

- Four-hour batteries increasingly target evening peaks and congestion relief, with longer-duration pilots trailing but not yet mainstream.

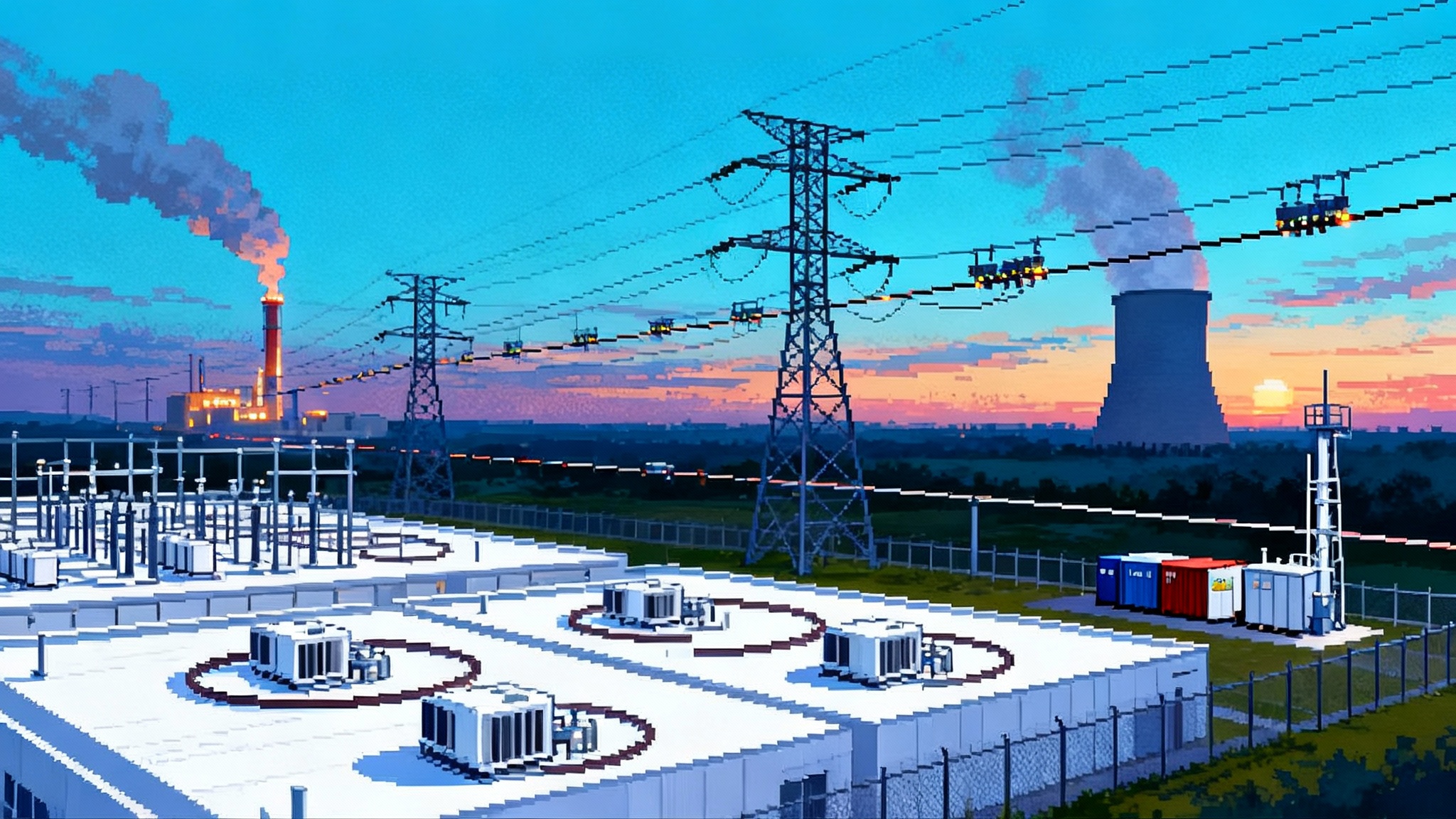

- Firm zero-carbon blocks from existing and uprated nuclear plants anchor 24-7 portfolios, with fuel considerations shaped by the LEU and HALEU fuel pivot.

Intermittent renewables remain essential, but interconnection timing, deliverability, and inverter performance requirements are materially affecting near-term additions, as detailed in our look at FERC's 2025 IBR rule.

Market impacts to watch into 2026

- Capacity market dynamics: Concentrated load growth tightens reserve margins in specific zones, lifting capacity prices and favoring fast-start assets that clear with deliverability.

- Basis and congestion: New load pockets reshape nodal spreads, benefiting projects sited inside the constraint rather than across it.

- Contracting: 24-7 carbon-free energy strategies are moving from annual MWh matching to hourly portfolios that blend nuclear blocks, shaped wind and solar, batteries, and demand flexibility.

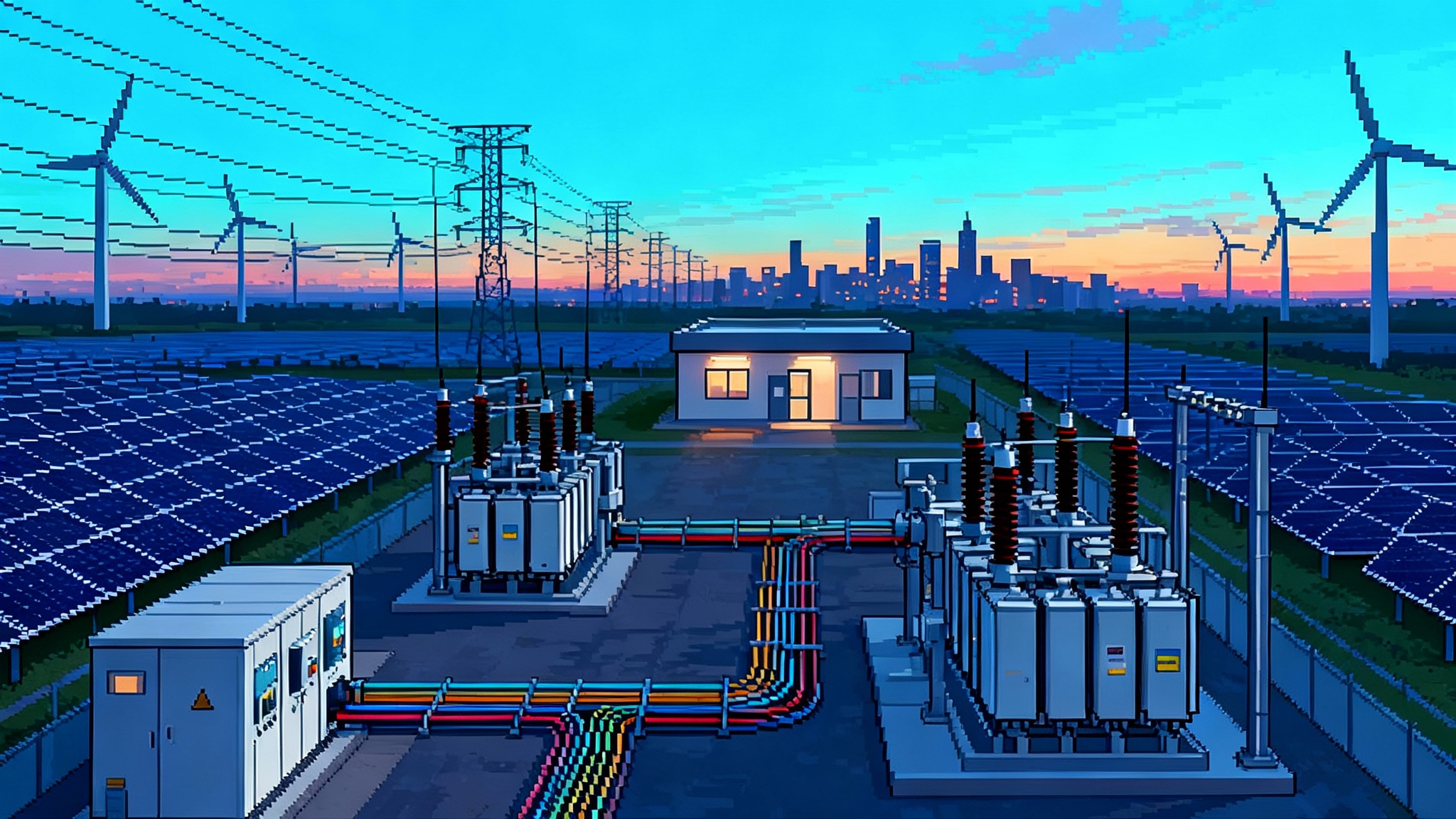

- Colocation and behind-the-meter: Expect more grid-adjacent siting at high-voltage substations and selective behind-the-meter generation where tariffs and interconnection queues are binding.

Playbook for builders and buyers

- Data center developers: Secure dual paths for capacity and energy. Lock site-ready transmission milestones and plan for local backup plus grid services revenue.

- Utilities and wires companies: Prioritize substation expansions and high-capacity feeders that unlock clusters, with clear cost-sharing rules.

- IPPs and OEMs: Package gas peakers with battery augmentation and deliverability guarantees. Offer nuclear-backed firm blocks where available.

- Traders and retailers: Hedge with zonal-aware shapes and storage tolling. Focus on congestion products tied to emergent load pockets.

- Policymakers and regulators: Align cost causation, protect reliability, and accelerate permitting for grid-critical reinforcements.

Demand flexibility moves from nice-to-have to necessary

Virtual power plants and load orchestration can shave coincident peaks and reduce upgrade costs. For a deeper dive on portfolio design and monetization pathways, see our analysis of virtual power plants in 2025.

Risks and blind spots

- Local impacts: Water use, noise, and land pressure can stall otherwise bankable projects.

- Supply chain and fuel: Turbine lead times, transformer scarcity, and nuclear fuel availability remain gating factors.

- Policy drift: Evolving interconnection, deliverability, and performance standards can change project economics late in development.

Bottom line

AI-driven load is accelerating grid expansion by contract. In the near term, gas, batteries, and nuclear are the practical tools that meet firm, hourly requirements while the next wave of transmission and long-duration resources comes into place.