The 2026 Transmission Pivot: NIETCs and FERC Order 1920

As DOE advances three priority NIETCs into Phase 3 and FERC Order 1920 compliance filings arrive in late 2025 and 2026, the rules for planning and paying for multi-state lines are changing. This is the roadmap and what to do now.

The pivot is here

If you build, finance, regulate, or rely on long lines of steel and aluminum for a living, circle two blocks of time on your calendar. First, December 2025, when the earliest Federal Energy Regulatory Commission compliance filings for Order 1920 arrive. Second, mid-2026, when most other regions turn in their plans and the new rules start to shape what actually gets built. The convergence is deliberate. As the Department of Energy moves three high-priority National Interest Electric Transmission Corridors through Phase 3 toward potential designation, the country is about to test a new approach to planning and paying for multi-state transmission. This shift is arriving as large new loads accelerate, including data centers described in our analysis of AI's gigawatt appetite.

The punchline is practical. Developers, states, and regional planners can now stack three tools to pull risk out of projects: long-term regional planning under Order 1920, targeted corridor designation under the National Interest Electric Transmission Corridor process, and federal financing options that show up once a project sits in the right geography and planning lane. Used together, they shorten timelines, clarify who pays, and improve the odds that steel goes in the ground.

Dates that change the work

Order 1920 sets out when each transmission planning region must file new planning and cost allocation rules. FERC has posted the region-by-region schedule and explains the six-month state engagement window that runs alongside those filings. See the FERC compliance schedule for 1920 for the official list.

Here are the highlights, translated into a working calendar:

- PJM Interconnection: first compliance filing due December 12, 2025. Second filing for interregional coordination due December 12, 2026, with a later coordination milestone in June 2027 for New York ISO and ISO New England.

- California ISO: first compliance filing due December 12, 2025. Second filing for interregional coordination due February 12, 2026.

- NorthernGrid and WestConnect (non-RTO West): first filings due December 12, 2025. Second filings due February 12, 2026.

- Midcontinent ISO: first compliance filing due June 12, 2026. Second filing due December 12, 2026.

- Southwest Power Pool: first compliance filing due June 12, 2026. Second filing due December 12, 2026.

- Florida Reliability Coordinating Council: first compliance filing due June 12, 2026. Second filing due August 12, 2026.

- Southeastern regions SCRTP and SERTP: first compliance filings due June 12, 2026. Second filings due August 12, 2026.

- New York ISO: first compliance filing due April 30, 2026. Second filing due June 14, 2027.

- ISO New England: both first and second filings due June 14, 2027.

What to do with these dates

- Developers: backcast your permitting and commercial milestones from the filing dates above. If your line needs to be considered in a 1920 planning cycle in 2026, the technical work, stakeholder education, and preliminary commercial structure need to be in market by spring 2026 at the latest.

- States: set a statutory or administrative calendar that tracks your region's filing. Build a joint working group charter now, with a concrete goal of drafting cost allocation principles before the six-month engagement window closes.

- Buyers and lenders: time your offtake or capacity commitments to coincide with the regional selection step. Showing up with a partial anchor commitment during evaluation can tip a project into the selected portfolio and reduce risk.

The six-month state engagement window, in plain terms

Order 1920 requires transmission providers to hold a six-month Engagement Period for states to negotiate two things. First, an up-front cost allocation method for long-term regional transmission facilities. Second, a State Agreement Process that lets one or more states voluntarily agree to a tailored cost allocation for a facility or a portfolio after selection. FERC clarifies that this state forum happens before or no later than six months after selection. It also allows extensions of up to six additional months when requested by relevant state entities, as described in the official schedule.

What this means in practice

- If states reach agreement during the Engagement Period, the transmission provider must file that agreement with FERC. That filing becomes the rule of the road for how costs flow.

- If states do not reach agreement, the default cost allocation that the transmission provider files under Order 1920 applies. That default must include at least one method that assigns costs roughly in proportion to benefits, using transparent benefit metrics.

- Extensions are possible, but only with an affirmative request by the relevant state entities. Treat an extension as a negotiating tool, not a fallback plan.

A useful metaphor: think of the Engagement Period as the pre-game coin toss for cost allocation. If states call it clearly and early, they choose the field position. If not, the game starts under the default rules the league just wrote.

NIETC Phase 3 enters the spotlight

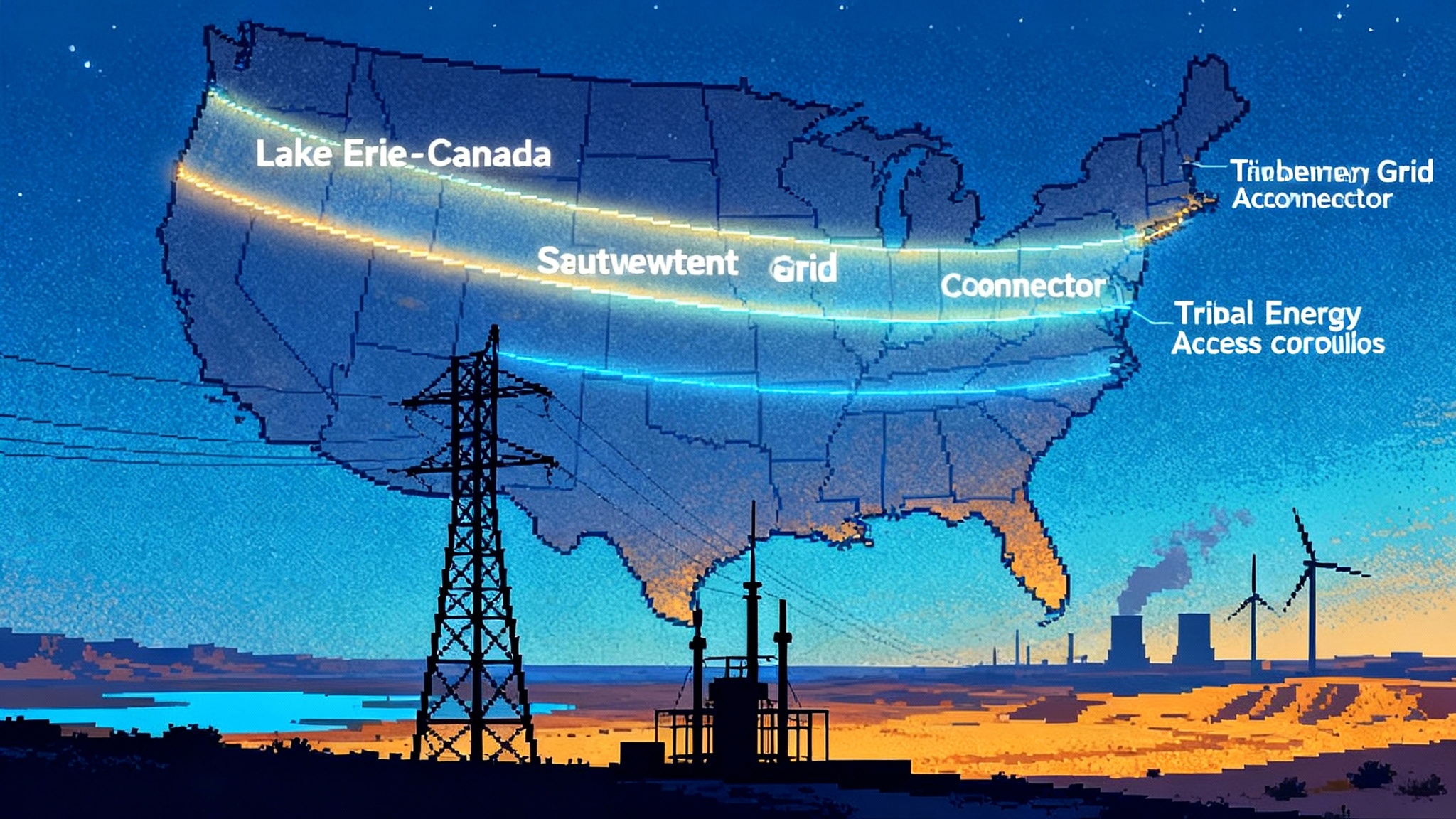

The Department of Energy has moved three potential corridors into Phase 3 of the National Interest Electric Transmission Corridor process, with public engagement and environmental review underway. The corridors are the Lake Erie-Canada corridor, the Southwestern Grid Connector, and the Tribal Energy Access corridor. DOE's process page explains what Phase 3 entails and lists example projects inside each potential corridor. See the DOE NIETC designation process.

Why these three matter

- Lake Erie-Canada corridor: positions cross-border high-voltage direct current as a reliability and resource adequacy tool for PJM, with the Lake Erie Connector by NextEra Energy Transmission identified by DOE as a project inside the potential corridor.

- Southwestern Grid Connector corridor: targets the seam between the Western and Eastern Interconnections, where projects like the Heartland Spirit Connector and Southline Phase 3 seek to move power between SPP and the non-RTO West.

- Tribal Energy Access corridor: focuses on connecting five Tribal Reservations and surrounding areas in the Dakotas and Nebraska to high-voltage backbones, with the TRIBES project advanced by Western Area Power Administration, Basin Electric Power Cooperative, and the Oceti Sakowin Power Authority listed by DOE as a potential fit.

What NIETC designation unlocks

- Backstop siting under Section 216 of the Federal Power Act. If a state does not act within one year of an application or denies it, FERC can issue a federal permit for projects inside a designated NIETC under its updated siting rule. That does not erase state authority, but it provides a defined federal lane if the state process stalls.

- Federal financing tools. NIETC designation can make projects eligible for the Department of Energy's direct loans under the Transmission Facility Financing program and can strengthen the case for capacity contracts and other support under the Transmission Facilitation Program. In short, NIETC status can make your capital stack sturdier.

Stacking the tools to de-risk a line

A developer building a multi-state line in 2026 can reduce risk by assembling three building blocks in sequence.

- Use Order 1920 to get into a long-term plan portfolio

- Build a quantified benefits case in the format the region's planner must use under 1920. That means reliability benefits, production cost savings, avoided resource adequacy costs, congestion relief, and resilience metrics, not just point to point market spreads.

- Socialize the project with relevant state entities before the Engagement Period starts. Offer specific cost allocation options that you can live with under a State Agreement Process.

- Present a realistic delivery plan, including permitting, supply chain, and construction sequencing that aligns with the region's first 1920 cycle after your compliance filing date.

- Position the route inside a Phase 3 corridor that is likely to be designated

- Map your preliminary route options against the three Phase 3 corridors' boundaries. Where you have discretion, favor alignments that fall within the potential corridor.

- Engage on the public process. Phase 3 is explicitly about refining boundaries and scoping environmental review. Show up with route refinements and mitigation approaches that reduce conflicts.

- Keep the record clean. NIETC designation is not a project approval, but it can trigger eligibility for federal tools and optional federal siting backstop if needed later. A transparent record during Phase 3 shortens downstream federal steps.

- Secure federal support that fits the project's commercial model

- For merchant or hybrid lines, capacity contracts where DOE acts as an anchor customer can provide revenue certainty during financing. This can be the difference between a build that pencils and one that does not.

- For utility-owned lines in a regional plan, direct loans can lower weighted average cost of capital if the project sits in a designated NIETC and meets underwriting standards.

- For cross-seam lines, use the interregional coordination filing deadlines to time joint studies and selection on both sides of the seam. That way, your revenue and cost allocation picture is consistent across regions.

Concrete timelines to work from

The combined effect of 1920 filings and NIETC Phase 3 creates a practical project timeline for the next 18 months.

- By November 2025: in PJM, CAISO, NorthernGrid, and WestConnect, developers should have project benefit cases and preliminary commercial structures well defined. States in these regions should have drafted a menu of cost allocation options to take into the state engagement forum.

- December 12, 2025: first 1920 filings land in PJM and CAISO. Expect intense stakeholder focus on how selected long-term facilities are evaluated and how default cost allocation is written.

- February 12, 2026: second filings start in the West for interregional coordination. Cross-seam projects will want to see their study frameworks reflected here.

- April through August 2026: first filings in MISO, SPP, FRCC, SERTP, and SCRTP arrive. These filings shape how the largest middle-of-the-country lines are planned and paid for.

- April 30, 2026 and June 14, 2027: New York ISO and ISO New England file later. Developers targeting the Northeast should use the extra time to line up firm state engagement and corridor strategy.

For how evolving inverter and resource performance standards may interact with these plans, see our guide to FERC's 2025 IBR rule for wind and solar.

How states can use the six-month window

States have the most leverage in the Engagement Period. Use it deliberately.

- Define benefits and beneficiaries early. Agree on a small set of transparent benefit metrics that reflect reliability, economic, and resilience needs in your footprint. If possible, harmonize those metrics with neighboring regions so interregional projects do not face conflicting math.

- Put real numbers on cost sharing. For example, states can pre-commit to a narrow range, such as 60 to 80 percent postage-stamp allocation for a portfolio that clears an agreed benefit-cost ratio. Clear thresholds avoid deadlock.

- Authorize a State Agreement Process in advance. Write down who can sign, which projects or portfolios it covers, and what consultation is required before signature. The process is voluntary by design, but it only works if the paperwork exists when a project is selected.

Company-level moves that work

- NextEra Energy Transmission on Lake Erie. By building a cross-border high-voltage direct current case that directly supports PJM reliability and resource adequacy, the company can ride the 1920 planning framework while benefiting from NIETC-related tools if DOE designates the corridor. The result is a stronger business case and a clearer permitting path.

- Grid United in the Southwest. A cross-seam project that threads SPP and the non-RTO West can time its interregional coordination to the February 2026 filings, while making sure its route lies inside the Phase 3 Southwestern Grid Connector corridor to qualify for corridor-linked tools if designation occurs.

- Western Area Power Administration and Basin Electric with the Oceti Sakowin Power Authority in the Dakotas. A project designed to increase Tribal energy access benefits from early, thorough Tribal engagement requirements that now exist at both DOE and FERC. Getting that right early reduces litigation risk and speeds later steps, including any potential federal permit if state processes stall inside a designated corridor.

What could still trip up the 2026 pivot

- Interregional coordination that is more paper than practice. The filings need to include workable joint study triggers and a clear path to selection of cross-seam projects. Otherwise, projects die at the seam even if each side believes it has benefits.

- Vague default cost allocation. If the default method does not track measurable benefits, fights shift to selection and litigation. A better default is a portfolio approach with transparent metrics and periodic true-up.

- Weak community engagement. FERC's updated siting rule for federal permits requires landowner and Tribal engagement plans with specificity. Even if a developer never needs a federal permit, those expectations are the new baseline. Build them into schedules and budgets now.

- Underestimating supply chain timing. Conductors, towers, transformers, and high-voltage direct current converter stations have long lead times. Tie procurement to the planning and permitting calendar so that selection in a 1920 plan can lead to construction starts on schedule. For solar-heavy portfolios, factor in the 2025 solar supply shift.

The bottom line

The next 12 to 18 months are a rare moment of alignment. Order 1920 tells every region to plan for long-term, multi-state needs with real cost allocation. Phase 3 NIETC work focuses attention on three corridors where federal tools are most likely to matter. The combination is a faster, clearer pathway from idea to in-service date, but only for teams that move now.

If you are a developer, build your benefits case to the 1920 playbook, choose alignments that sit inside one of the three Phase 3 corridors, and structure your capital stack so that a federal capacity contract or direct loan can slot in alongside state cost allocation. If you are a state, set the rules of the road during the Engagement Period, write your State Agreement Process before decisions arrive, and be explicit about how benefits translate to cost shares. If you are a customer, bring a partial anchor commitment to the table early.

America's 2026 transmission pivot is not an abstract policy shift. It is a practical sequence of filings, forums, corridors, and contracts. The teams that match their calendars to that sequence will be the ones energizing new lines before the decade turns.