JPM Coin Debuts on Base, Deposit Tokens Go Mainstream

JPMorgan just switched on a USD deposit token for institutions on Base, signaling that regulated money can finally run on public rails. Here is why deposit tokens are poised to win corporate payments after the GENIUS Act and how builders can ship on bank-grade infrastructure.

The first bank deposit token on a public chain

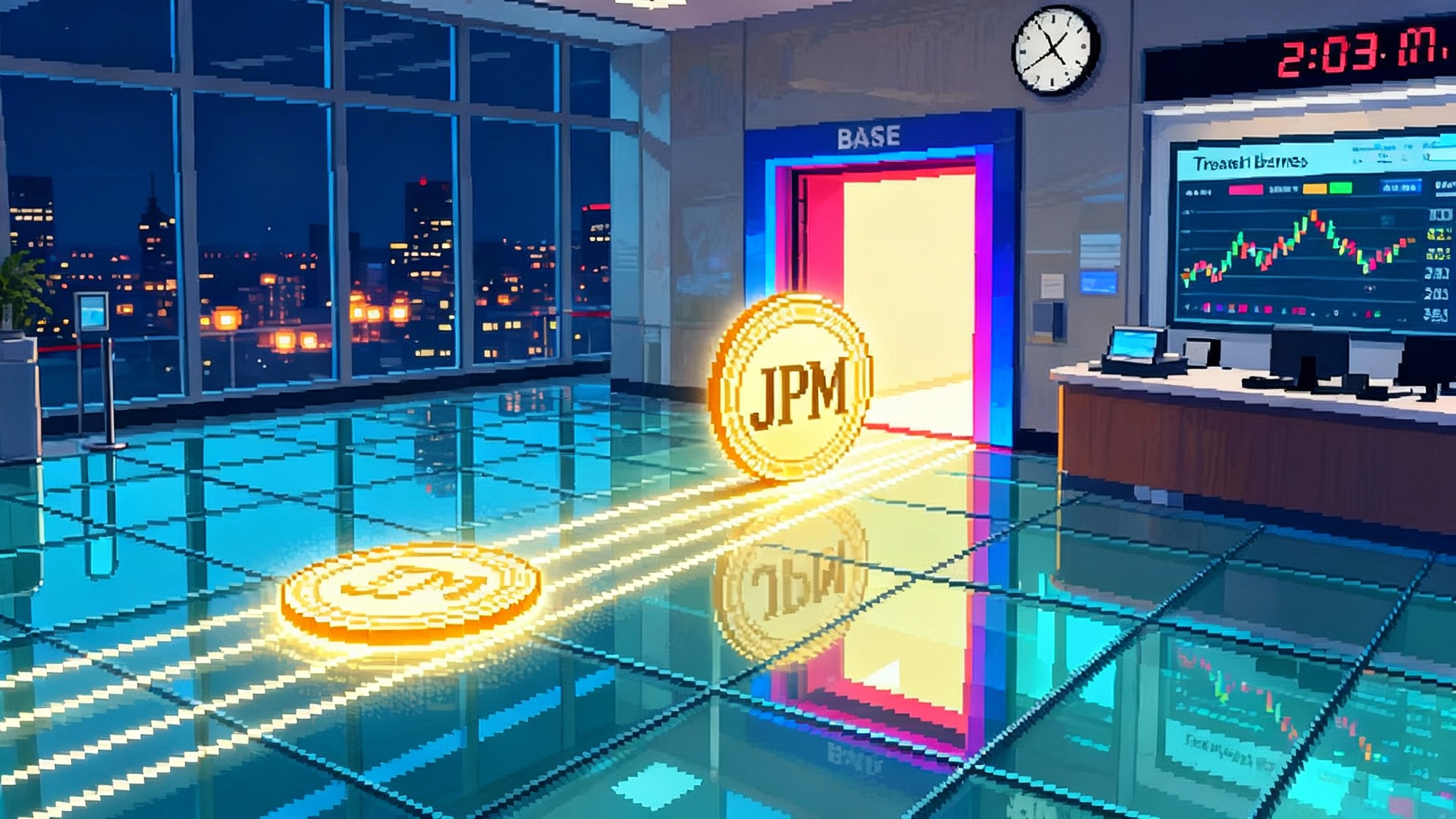

On November 12, 2025, JPMorgan switched on a dollar deposit token for institutional clients, live on Base, the Ethereum Layer 2 network incubated by Coinbase. The bank calls the token JPM Coin with the USD deposit token ticker JPMD. In testing, firms like Mastercard, Coinbase, and B2C2 moved funds in seconds at any hour, demonstrating settlement that does not wait for banking hours. This is the first time a global bank has issued a deposit token on a public blockchain rather than on a private permissioned network. It is a flip from pilots to production and it sets a new reference point for what regulated money can do onchain. See the details on Base support, ticker, and initial use cases in the bank’s payments business in the JPM Coin USD deposit token announcement.

Why does this matter now? Because the legal landscape changed in July. The GENIUS Act created a national framework for payment stablecoins, cleared banks to issue tokenized deposits, and set bright lines for disclosures and reserves. If 2023 and 2024 were the years of private pilots, 2026 is shaping up to be the year regulated money turns always on.

Deposit tokens vs. stablecoins, in plain English

A deposit token is a digital wrapper around a bank deposit. Imagine a coat check at a hotel. You hand over your coat and get a ticket. The ticket is not a new coat. It is a claim on the specific coat held by the hotel. A deposit token works the same way. It is a claim on dollars held as a deposit at a supervised bank. The bank’s balance sheet backs it, and banking rules constrain how the bank can lend, secure, and settle against those deposits.

A payment stablecoin is different. It is a digital instrument designed to trade at a fixed price, most often one United States dollar, and it is backed by high quality liquid assets held by the issuer. Some issuers are banks. Many are not. Under the GENIUS Act, nonbank issuers face specific reserve, disclosure, and supervision requirements. A stablecoin is a new instrument that creates its own liability stack under a purpose built law. A deposit token is a tokenized version of an old instrument that lives inside existing bank law. That difference may sound technical. It is everything. Adoption is growing in commerce, as shown by the USDC at checkout momentum.

- If you are a corporate treasurer, a deposit token keeps you inside your bank relationship and inside rules you already know. You can hold and move tokens that sit on your bank account rather than moving into a separate nonbank instrument.

- If you are a fintech or exchange, a deposit token can satisfy institutional compliance teams that require bank custody, bank level know your customer controls, and familiar legal recourse.

- If you are a developer, a deposit token gives you programmable dollars that settle at any hour without leaving the bank perimeter.

Why deposit tokens will outcompete stablecoins for regulated payments

Stablecoins are not going away. They have distribution, liquidity, and first mover mindshare. But for regulated payments that must fit inside corporate policies and bank infrastructure, deposit tokens have structural advantages.

-

Bank liability and supervision. A deposit token is a direct claim on a regulated bank. That means it benefits from prudential standards, access to payment rails, and established recovery and resolution playbooks. Corporate policies that already allow deposits at specific banks can extend to deposit tokens without revisiting an entirely new counterparty policy.

-

Easier treasury integration. Treasury teams live in enterprise resource planning systems, bank portals, and file based payments flows. A deposit token can be swept, reconciled, and reported as a bank balance. The same master service agreement can cover both the traditional account and the onchain representation. The operational lift is lower.

-

Programmable compliance. Banks already implement know your customer, transaction monitoring, and sanctions screening. A deposit token can embed those controls into transfer rules at the token level. That enables compliant decentralized finance experiments where wallets, assets, and apps must satisfy policy checks before flows execute.

-

Post GENIUS Act clarity. The law drew a line around payment stablecoins. It also green lit tokenized deposits. That removes the most common board level concern. The policy question switched from whether it is allowed to how to launch safely. For core provisions and the treatment of tokenized deposits, see the CRS overview of GENIUS Act.

-

Settlement finality with bank grade rails. Because the liability is the bank’s own, finality can map cleanly to bank ledgers. That reduces reconciliation issues that occur when moving out to a nonbank instrument and back again.

Put bluntly, deposit tokens match how regulated institutions already buy and use money. They let these institutions keep their existing counterparty, onboarding, and audit relationships and still enjoy the benefits of programmable, instant settlement.

What this unlocks for 2026

Always on settlement for commerce and capital markets. The obvious win is payments that do not stall on weekends or holidays. Less obvious is how this reshapes liquidity. Committed lines and intraday liquidity buffers are set for weakest link hours. If a retailer can sweep receipts continuously into a bank deposit token and retire payables at 2 a.m., working capital costs fall. In capital markets, collateral can move between venues minute by minute, tightening bid ask spreads and reducing margin friction.

Treasury as code. Corporate treasurers will be able to publish settlement policies as smart contracts that decide which bills get paid in what order, at which cutoffs, and under which supplier discounts. A purchase order can release a conditional payment that posts only after a carrier confirms delivery. The policy is a program. The dollars are bank liabilities. The ledger is public and auditable.

Programmable accounts receivable. Today, receivables teams reconcile bank files, enterprise resource planning records, and customer statements. With deposit tokens, the payment message can include invoice identifiers, tax fields, and metadata enforced by the token’s transfer rules. That shrinks exception handling, dispute cycles, and days sales outstanding.

Compliant DeFi hooks. The most interesting unlock is not moving money faster. It is connecting money to programmable markets with built in compliance. Banks can restrict which smart contracts can receive or hold their deposit tokens. Approved venues can offer automated financing, hedging, and yield that is both transparent and policy bound. Think of a marketplace where only verified suppliers can borrow against receivables, and only verified buyers can repay, with every transfer logged on Base and mirrored to bank ledgers. Expect designs that echo Uniswap v4 hooks while meeting bank policy reviews.

Interoperability across banks. One bank’s deposit token is useful. A network of bank tokens that can interoperate is transformative. Expect 2026 proofs that allow atomic swaps of deposit tokens across banks, with rules that ensure each transfer clears compliance checks on both sides. Expect early foreign exchange flows where a dollar deposit token clears against a euro deposit token under synchronized limits.

Card and wallet integration. Issuers and processors can treat deposit tokens like funding sources that are always available. A consumer could pay a ride share at 3 a.m., settle to the driver instantly in a deposit token, and let the driver convert to a bank account balance without a traditional payout run.

The Base factor and why public chains matter

JPMorgan chose Base, a public Ethereum Layer 2 with high throughput and low fees, for a reason. Public chains aggregate developers, tooling, and liquidity. If the compliance perimeter is programmable, public networks let banks get the scale benefits without giving up control of their obligations. Base continues to attract core infrastructure, including restaking initiatives such as EigenLayer hits Base L2.

Public chains also give developers a predictable environment. Tooling, security reviews, and monitoring vendors already exist. Analytics firms provide independent visibility. Bugs and best practices are discovered in the open. That reduces the time from proof of concept to production and the risk that a team has to rebuild everything from scratch.

A builder playbook for bank grade rails

You do not need to be a bank to build on bank grade rails. You do need to design for policy from the first line of code. Here is a practical playbook.

-

Model the liability first. Treat the token as a representation of a specific deposit at a specific bank, with a clear owner and contract. Your data model should retain a linkage between onchain token balances and offchain account balances. You will need deterministic reconciliation every day. You will also need a fallback process for forced redemptions or freezes when lawful orders require them.

-

Design transfer controls as modular policies. Write smart contracts that enforce allowlists at the wallet, asset, and venue levels. For example, allow only wallets that have completed bank know your customer checks to hold or transfer the token. Allow transfers only to whitelisted contracts that have passed bank security review. Log policy decisions to an audit feed for regulators and internal audit.

-

Build programmable payments as state machines. A payment is rarely a single event. It is a handshake between systems with preconditions, timeouts, and reversals. Encode these as state transitions that can be audited. For instance, an invoice payment might wait for a delivery oracle, check for sanctions lists at time of transfer, and release only the net amount after discounts.

-

Provide real time treasury visibility. Expose dashboards and application programming interfaces that show balances, pending transfers, net positions by counterparty, and policy exceptions. Corporate treasurers will not adopt what they cannot monitor. Include simple export formats for reconciliation back into enterprise resource planning systems.

-

Start with one venue, one asset, one bank. Do not plan an everything product. Pick a single venue that is willing to go through a bank risk review. Make sure your asset list and transfer types are short and easy to explain. Ship a minimum viable compliance architecture before you scale.

-

Prepare for incident response. Banks must be able to halt transfers to specific wallets or contracts when lawfully required. Your architecture needs an emergency override that is tightly scoped, logged, and auditable. Practice drills. Document playbooks. Share them with the bank.

-

Treat observability as a product feature. You will need alerts on chain events, policy breaches, gas spikes, and contract anomalies. Provide customers with the same visibility you use internally.

-

Write human contracts, then code. Lawyers and auditors cannot approve bytecode. Start with a plain language terms of service and a short product description that maps each policy control to a business rule. Only then harden those rules in code.

What CFOs and product leaders can do next

-

Treasury leaders

- Ask your primary bank for a deposit token roadmap and a list of approved venues and contracts. Request a pilot focused on a single payment type, for example supplier payouts under 50 thousand dollars, with a hard reconciliation target. Require daily reporting across both the bank ledger and the chain.

- Revisit investment policies to allow tokenized deposits held at your banks. Define concentration limits by bank and by chain. Set change windows and emergency procedures.

-

Fintech founders and product managers

- Scope a feature that moves one settlement flow to a bank deposit token. Focus where instant settlement reduces working capital, chargeback risk, or fraud loss. Design for policy decisions at each step and for self service audit logs.

- Partner with banks and with exchanges that have signed on to approved venues. Your goal is to shorten compliance reviews by using known rails.

-

DeFi builders

- Explore a gated pool architecture where only wallets and assets on a bank allowlist can deposit and trade. Restrict strategy code to a small, reviewed set. Focus on real world assets with clear onchain to offchain links. When you pitch, lead with compliance design, not yield.

Risks and unresolved questions

Interoperability across banks. Today, JPM Coin is one bank’s token. If Bank A’s token cannot move seamlessly to Bank B’s token under shared rules, users will face the same friction they have today moving between banks. Expect industry consortia to emerge, and expect regulators to demand guardrails for atomic swaps.

Privacy and data leakage. Public chains are transparent. That is a feature for audit and a challenge for corporate confidentiality. Expect patterns that use encrypted mempools, delayed settlement disclosures, or privacy preserving proofs while still satisfying recordkeeping requirements. Until these patterns are proven, some flows will remain offchain.

Operational risk on public infrastructure. Base provides low fees and throughput, but outages and congestion can still occur. Production systems must queue and retry with clear timeouts and fallbacks to traditional rails when required. Builders should treat chain health as a dependency with service level objectives.

Jurisdictional fragmentation. The GENIUS Act is a United States law. Multinational treasurers will encounter varied treatments abroad. Coordination on anti money laundering checks, data localization, and tax reporting will take time. Cross border flows may rely on multi bank arrangements where deposit tokens represent different currencies under synchronized policies.

Credit and interest. Deposit tokens that represent non interest bearing balances may not be attractive for long holding periods. Expect banks to offer sweep features into short dated instruments for yield, with the token acting as a transactional balance. That raises questions about how interest is calculated, paid, and disclosed onchain.

Vendor and venue concentration. If most activity clusters on a single Layer 2 or a small set of approved contracts, a technical or policy issue could ripple widely. Diversifying across chains and venues will be a priority once standards mature.

The competitive landscape in 2026

Stablecoins will remain dominant in open crypto markets where bank relationships are not practical or desired, especially in emerging market corridors and retail wallets. For regulated payments in the United States, deposit tokens are positioned to win. Banks can offer seamless conversion between traditional accounts and tokens, integrate compliance natively, and bundle services like insured custody and trade finance. Nonbank stablecoin issuers will partner with banks or seek federal or state qualification under the GENIUS Act. Some will pivot to market making and wallet experiences. Others will specialize in cross border flows where bank tokens are not yet available.

Exchanges and payment processors will support both. The winning platforms will abstract the difference for users while honoring the underlying policies. Think of a checkout experience that chooses the cheapest compliant rail automatically. The customer pays. The treasury system decides whether that means a deposit token transfer on Base or a regulated stablecoin on another chain.

A smart conclusion for a new chapter

Bank money just learned to speak the language of public blockchains. JPMorgan’s launch on Base is more than a brand milestone. It is proof that programmable finance can live inside the bank perimeter without giving up the openness of public networks. With the GENIUS Act now law, the next year will be about execution. Treasurers will turn playbooks into pilots. Builders will turn compliance into code. As more banks join and tokens interoperate, payments will start to look like the internet, not like batch files. That is the quiet revolution. Not speculation. Not slogans. Just money that moves when people need it to, on rails that regulators can see, with software that anyone can build on.