Cryptocurrencies

Cryptocurrencies

Articles under the Cryptocurrencies category.

Restaking Goes Multichain: Slashing Meets L2 Reality

EigenLayer turned on onchain slashing in April 2025 and debuted multichain AVS support in July. Here is what is actually slashable, how yields will reprice as risk turns real, and the playbook builders, operators, and restakers need now.

Polygon Rio Goes Live: 5,000 TPS and Near Instant Finality

Polygon activated the Rio upgrade on October 8, 2025, refitting Polygon PoS as a payments-first layer 2 with roughly 5,000 TPS, near instant finality, lighter nodes, and fewer reorgs. Here is what changes for wallets, stablecoin issuers, and merchants and how to integrate it this quarter.

Stocks That Never Sleep: Tokenized Equities Hit Prime Time

In October 2025, tokenized stocks moved from pilot to product. Here is how 24/7 trading actually works, what rights you really get, and the pitfalls to check before you buy.

GENIUS Act Is Law: The 18-Month Race to U.S.-Licensed Stablecoins

Signed on July 18, 2025, the GENIUS Act gives stablecoins a federal rulebook with 1:1 reserves, monthly disclosures, a state and federal licensing split, and clear AML expectations. Here is what changes, the activation timeline, and a builder playbook to ship before the law takes effect.

ICE’s $2 billion bet pushes Polymarket into Wall Street

Intercontinental Exchange will invest up to $2 billion and distribute Polymarket’s event data, signaling that regulated onchain prediction markets are crossing into traditional finance. Here is what changes next and why it matters.

Solana’s Next Gear: Firedancer’s Plan to Uncap Blocks

Solana is preparing to trade fixed block limits for dynamic capacity. Firedancer’s SIMD-0370, planned for the post‑Alpenglow era, could unlock bigger bursts when demand spikes, cut failed trades, and enable new real-time apps. Here is how it works, the risks, and what builders should do now.

Telegram x TON: Mini Apps, USDT, and a United States Wallet

Telegram made TON the exclusive chain for Mini Apps and then shipped a self‑custodial wallet in the United States. With USDT payments embedded in chat, this could be the most credible path to 100 million new crypto users.

Fusaka starts PeerDAS and the blob fee wars across L2s

Ethereum’s Fusaka upgrade is moving through testnets in October with a tentative mainnet window on December 3, 2025. PeerDAS and staged blob increases aim to cut L2 costs, reshape sequencer economics, and reprice data availability markets.

Chain Abstraction Goes Live: Avail Nexus Makes One-Click Swaps

Avail’s September 2025 Nexus upgrade turns multichain into a single click with cross-chain swaps, Avalanche and BNB Chain support, and a TEE-backed coordination layer. Here is how chain abstraction can retire manual bridging and redirect liquidity across L1s and L2s.

Programmable EOAs Are Here: EIP‑7702 Wallets Redefine Web3 UX

Ethereum’s Pectra upgrade unlocked EIP 7702, letting ordinary wallets act like smart accounts for a single transaction. Here is what that means for one‑click flows, gas sponsorship, safer permissions, and the new phishing tricks to watch.

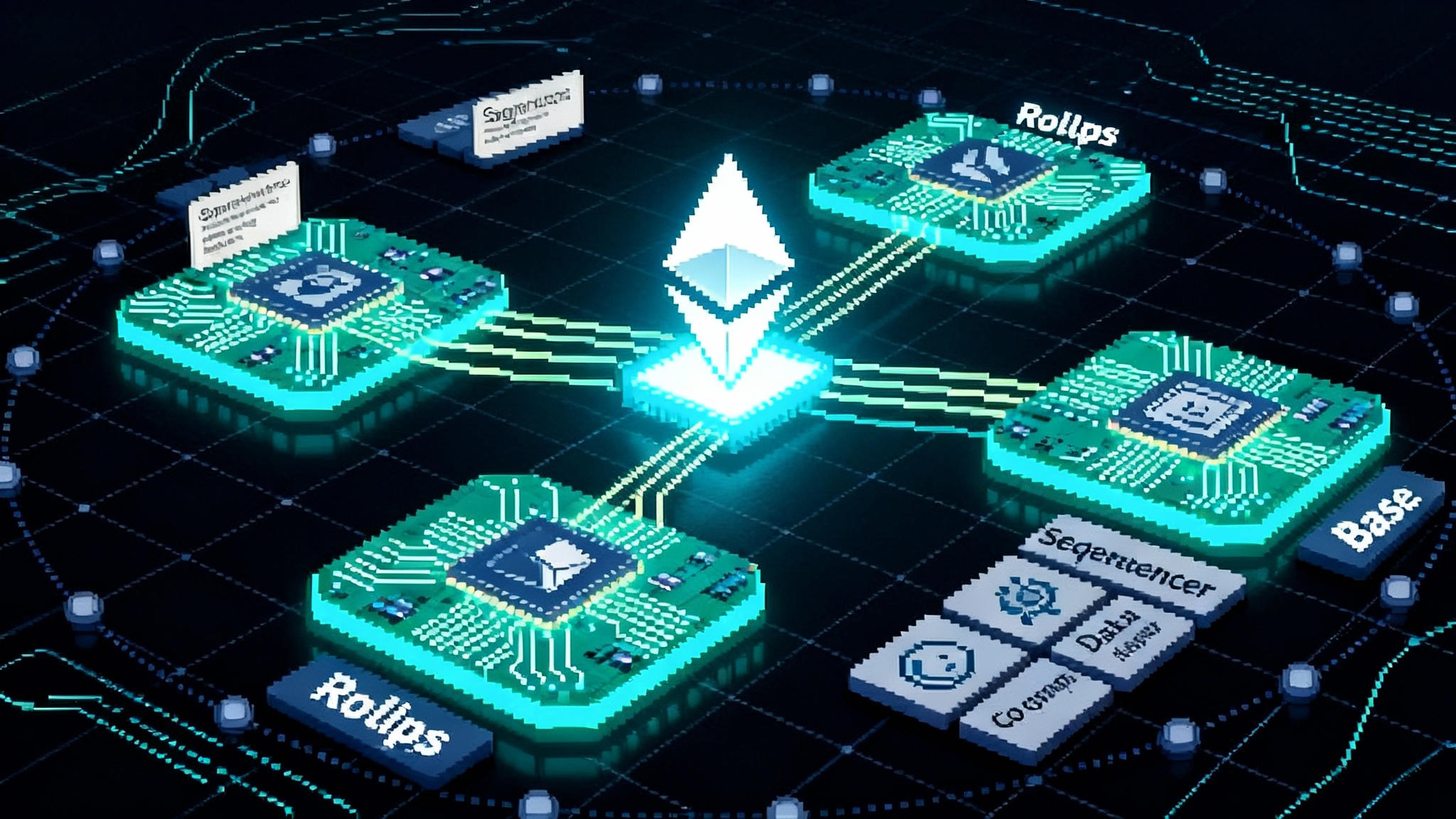

L2s Go Permissionless: BoLD, Base Proofs, Neutral Sequencing

In 2025, rollups crossed a security threshold. Arbitrum activated BoLD on February 12 and Base shipped permissionless fault proofs on April 29, pushing withdrawals beyond trusted operators. This guide explains why it matters and how to build for neutral, shared sequencing and MEV-aware orderflow.

ETF Superweek: How a Solana Approval Rewires Onchain Liquidity

October 16, 2025 is the next SEC deadline for spot Solana ETFs. If approved, new TradFi inflows could reshape staking yields, liquid staking and restaking markets, validator revenues, DeFi liquidity, and MEV. Here is what happens next and how to build for it.

Uniswap v4 hooks + Unichain: a DEX becomes a full‑stack L2

Uniswap’s v4 hooks turned pools into programmable modules, and Unichain added a fast, MEV-hardened home for them. Here is what that platform-plus-chain shift means for traders, LPs, and builders right now.

Stablecoin Rail Wars: Visa and Stripe Go Mainstream

Clear rules just unlocked prime time for stablecoins. After the GENIUS Act became law in July 2025, Visa expanded multi coin, multi chain settlement while Stripe rolled out USDC checkout and a coin issuance platform. Here is what it means for builders, merchants, and finance teams—and how to act now.

Babylon Genesis turns Bitcoin into shared security for Web3

Babylon’s Genesis mainnet turns idle bitcoin into shared security you can stake natively to secure many chains, without wrapping or bridges. Here’s how it works, what went live on April 10, 2025, and why upcoming multi staking and EVM support could reshape rollups and app chains.

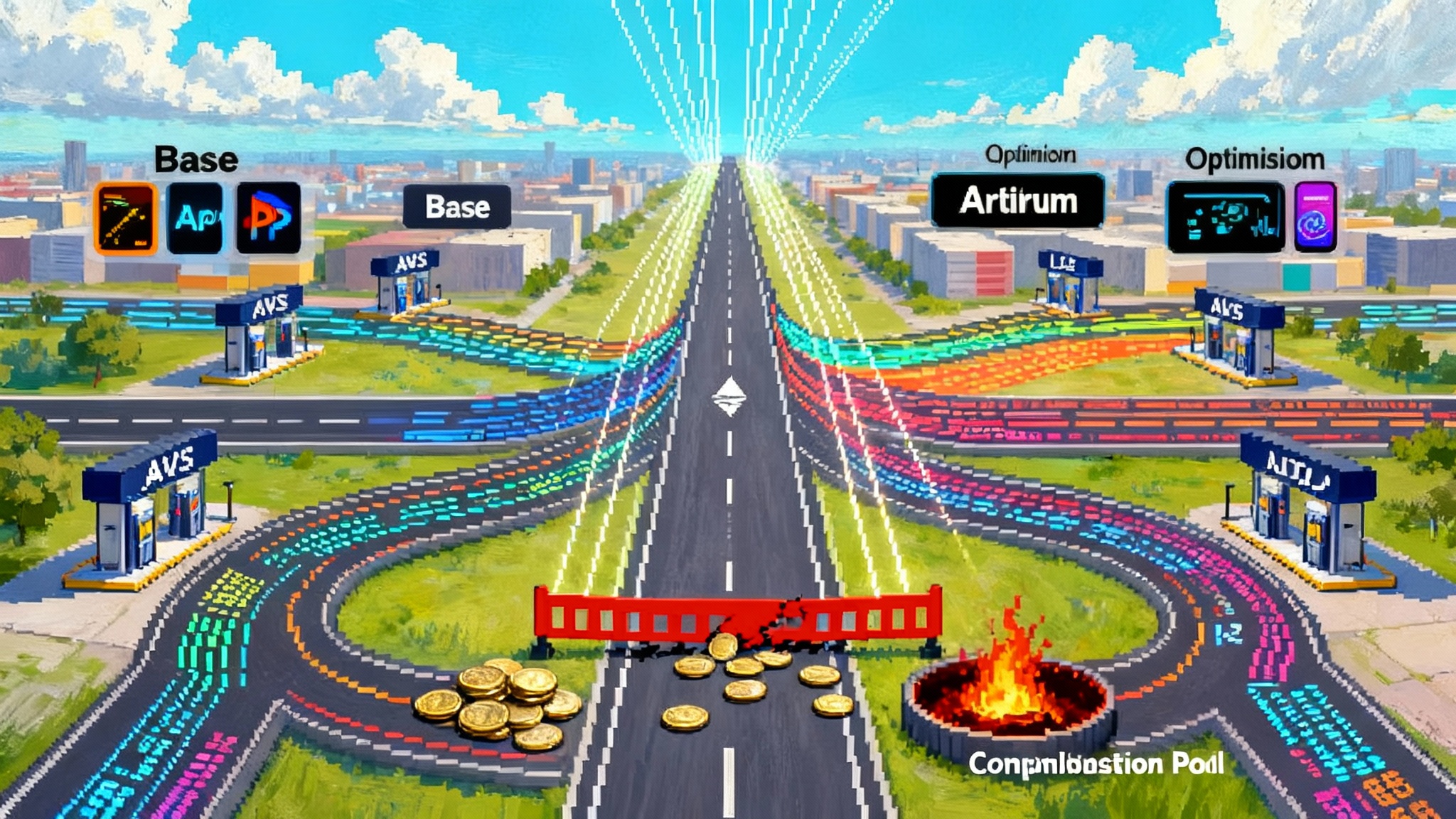

EigenLayer Goes Multichain: Portable AVSs Land First on Base

EigenLayer has switched on multichain verification, starting with Base, allowing AVSs like oracles, data layers, sequencers, and co-processors to run on L2s while staying secured by Ethereum. Here is how this could reshape L2s, MEV, fees, and cross-chain app design.

Tokenized Treasuries Hit $7.9B as DeFi Picks T-bills

By October 2025, tokenized Treasury funds reached about $7.9 billion and began displacing idle stablecoin cash as onchain, yield-bearing collateral. Here is how T-bills are becoming DeFi’s base layer and what to expect over the next 6 to 12 months.

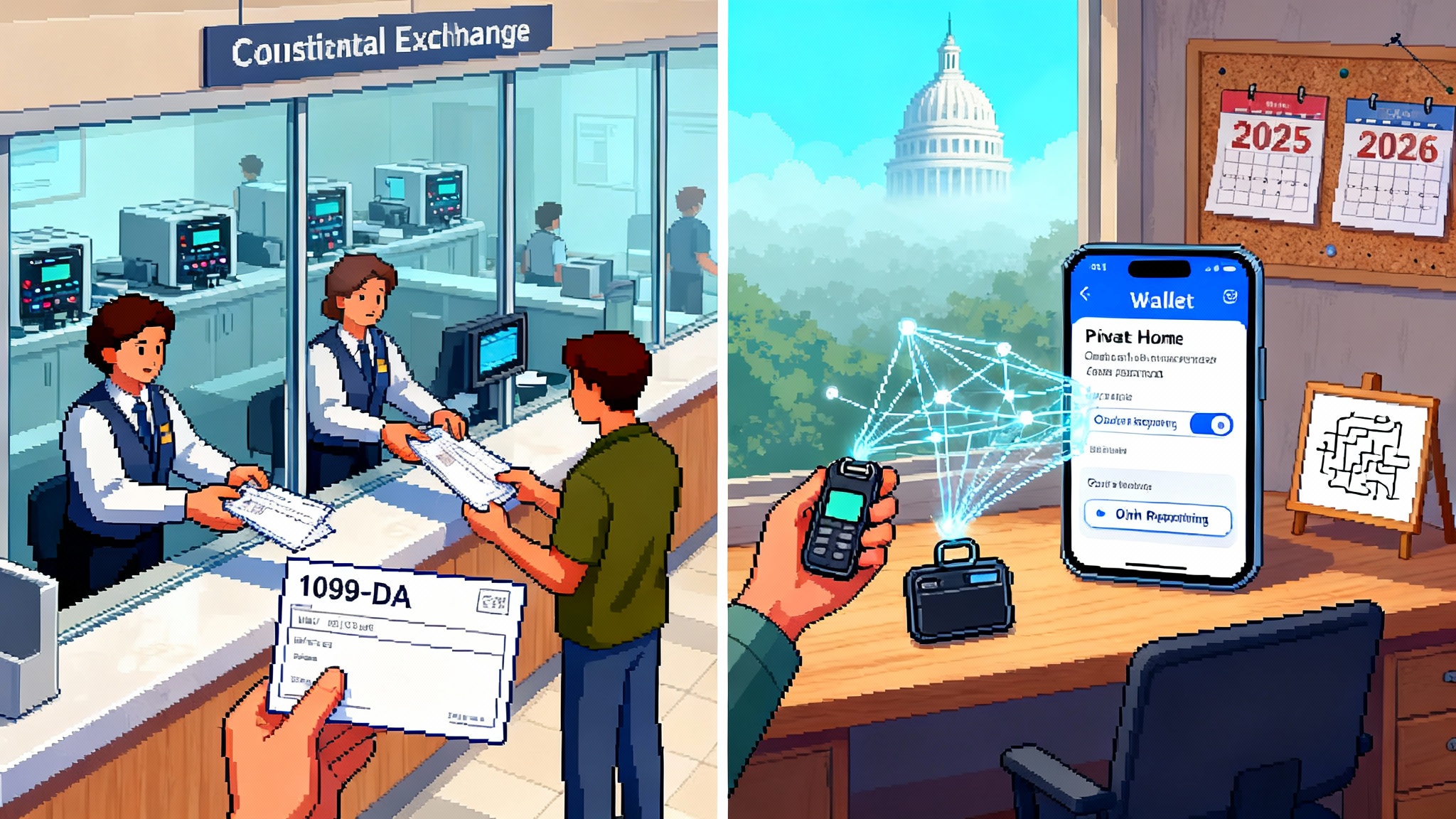

After the DeFi rule repeal: building U.S. onchain compliance

Congress nullified the IRS’s DeFi broker rule in April 2025, pausing noncustodial 1099-DA reporting while custodial brokers move ahead. This practical playbook shows exchanges, wallets, DAOs, and payment firms what to build next for private, user-first onchain compliance.