Cryptocurrencies

Cryptocurrencies

Articles under the Cryptocurrencies category.

Bigger Blocks, Bigger Stakes: Solana’s Firedancer Gambit

Jump Crypto’s Firedancer proposes lifting Solana’s per‑block compute cap after Alpenglow, promising fewer failed trades, new MEV dynamics, and bigger bursts.

Telegram crowns TON and ships TON Wallet to the U.S.

Telegram set TON as the exclusive blockchain for Mini Apps and began rolling out its built-in TON Wallet in the United States. This move turns chats into one‑tap dollar payments, in‑app dApps, and direct creator payouts across a near‑billion user base.

Sovereign HODL: Seven Months Into the U.S. Bitcoin Reserve

Seven months after the March 6, 2025 order that created a Strategic Bitcoin Reserve, Washington has consolidated roughly 200,000 coins and signaled a no sell stance. Here is what October 2025 looks like, how the float tightened, and what comes next.

Swift and Chainlink turn ISO 20022 into onchain fund flows

A new Swift, UBS and Chainlink pilot shows how standard ISO 20022 bank messages can mint and burn tokenized fund units onchain. Here is what shipped, why settlement compresses, what this unlocks for corporate actions and RWAs, and how builders can plug in.

SEC’s 2025 ETF overhaul sparks a multi crypto ETF wave

Two SEC moves in July and September 2025 unlocked in kind creations and generic listing standards for crypto ETPs, setting the stage for the first U.S. multi-asset crypto ETF and a new playbook for liquidity, fees, and design.

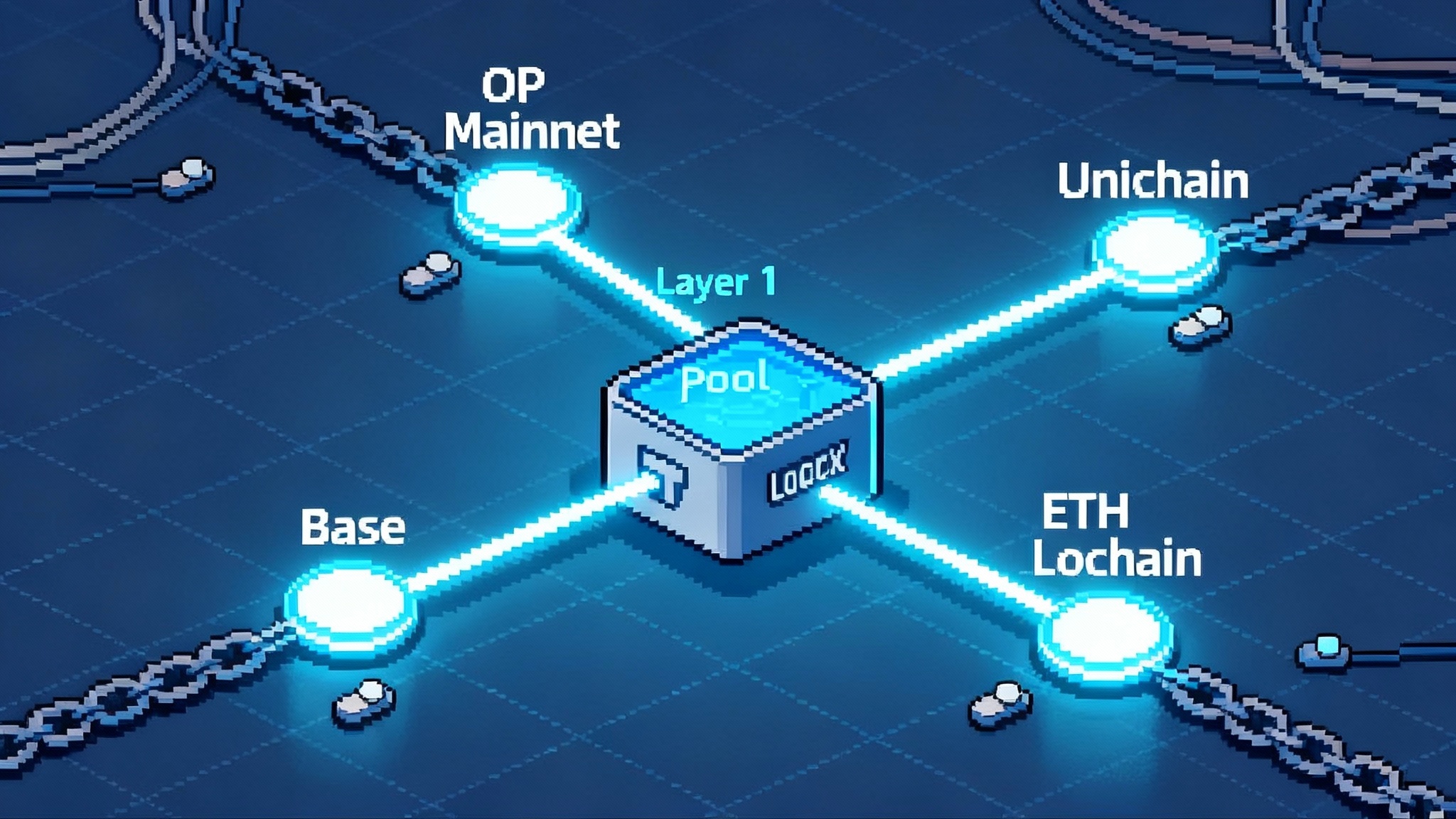

Uniswap v4 hooks: DEX pools become app platforms on L2

Uniswap v4 makes liquidity programmable with hooks. Here’s how dynamic fees, protected orderflow, and in-path automation are reshaping markets and pulling activity to layer 2.

Post-Pectra Ethereum: smart accounts, bigger validators

Ethereum’s Pectra upgrade is live. EIP‑7702 turns every address into a wallet‑native smart account, EIP‑7251 streamlines staking with larger validators and faster deposits, and bigger blob capacity pressures L2 fees while opening new consumer use cases.

Stablecoins hit $300B as Europe warns of new risks

On October 2, 2025 stablecoin supply crossed $300 billion just as Europe’s ESRB called for urgent safeguards under MiCA. Here is how that combo will reshape redemption, liquidity, and routing for builders, treasuries, and traders.

U16a lands on the Superchain: safer rollouts, real interop

On October 2, 2025, the Optimism Superchain rolled out Upgrade 16a across Base, OP Mainnet, and Unichain. System-level toggles, a safer withdrawal path, and ETH Lockbox readiness push OP Stack chains toward configurable, interoperable Layer 2s.

Telegram Wallet puts tokenized U.S. stocks in chat via Kraken

In October 2025, Telegram’s built-in Wallet begins rolling out tokenized US stocks and ETFs powered by Kraken and Backed. Custodial first, then self-custodial via TON Wallet, this shift could compress onboarding, speed settlement, and turn RWAs into everyday chat balances.

SANDchain is live, a creator chain built on zkSync’s ZK Stack

The Sandbox has launched SANDchain, a ZK Layer 2 built on zkSync’s ZK Stack that uses SAND for gas and governance. Here is how branded ZK chains could reset creator funding, distribution, and ownership at scale.

Aave V4’s modular turn: Q4 plan to rewire DeFi liquidity

Aave V4 shifts to a hub and spoke architecture and ERC-4626 vaults, aiming to compress rates, simplify cross-chain UX, and concentrate liquidity in Q4. Here is what changes, who benefits, and how to prepare.

Coinbase’s POL auto-swap makes Polygon’s AggLayer default

Coinbase will pause MATIC activity and automatically convert balances to POL between October 14 and 17. Here is what changes for holders, builders, and liquidity as Polygon’s AggLayer becomes the default path.

After Alpenglow, Firedancer aims to uncap Solana blocks

Jump Crypto’s Firedancer team has proposed SIMD-0370 to lift Solana’s per block compute cap once Alpenglow ships. Dynamic blocks could raise throughput, fee capture, and real user performance, while sharpening debates about propagation limits and decentralization pressure.

BTCFi lands on Starknet: trustless BTC staking, 100M STRK

Starknet has switched on BTCFi, bringing non-custodial Bitcoin staking and a 100 million STRK incentive program to jump-start BTC-backed lending and liquidity. Here is what launched, how it works, the risks, and the scorecard to watch over the next six months.

America’s spot crypto pivot: first movers, fees, and timing

A rare SEC-CFTC joint signal just opened the door for registered US exchanges to list certain spot crypto products. Here is what surveillance, custody, cross margin, fees, and a 3 to 12 month rollout could look like, plus who moves first.

DBS, Franklin Templeton and Ripple make MMFs tradable on XRPL

DBS will list Franklin Templeton’s sgBENJI on the XRP Ledger alongside Ripple’s RLUSD stablecoin, giving accredited and institutional clients a regulated way to trade, pledge and sweep cash into a yield‑bearing fund with on‑ledger settlement and bank‑grade controls.

After Sept 1: Tether’s Rail Switch Is Remaking Payments

On September 1, 2025, Tether ended support for five legacy networks and pushed USDT flows to a few dominant rails. Here is what changed, who benefits, and how teams should migrate without breaking payments.