Cryptocurrencies

Cryptocurrencies

Articles under the Cryptocurrencies category.

Tell me the topic and angle to craft your Relay story

Give me a concrete topic and a sharp angle, and I will turn your idea into a 1200 to 2000 word, news‑anchored feature with crisp analysis, named entities, and practical takeaways tailored for Relay readers.

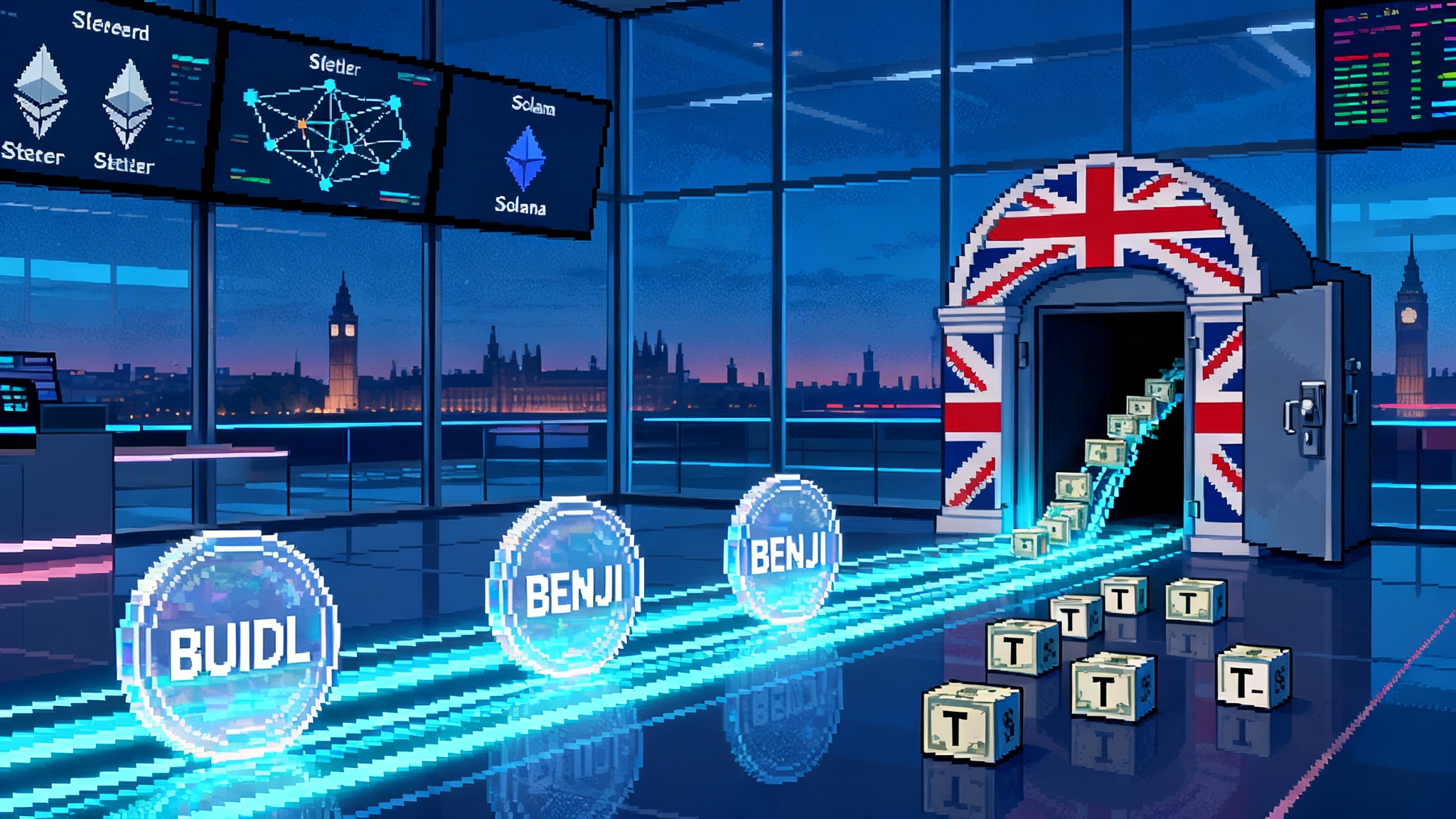

UK moves to allow tokenised funds as onchain Treasuries surge

On October 14, 2025 the UK FCA opened a consultation to let authorised funds issue on public blockchains. Paired with October’s jump in onchain Treasuries led by BUIDL and BENJI, here is why 2026 could be when funds, collateral, and repo finally move onchain.

The Rewards vs. Interest Fight Over U.S. Stablecoins

Banks are challenging stablecoin reward programs just months after the GENIUS Act became law. Here is how issuers, exchanges, and regulators will draw the line between interest and incentives, and why onchain dollars will keep gaining speed.

Telegram goes all in on TON for mini apps and payments

Telegram is standardizing on TON for all Mini Apps, bringing checkout into chat and unifying wallet auth with TON Connect. Here is how USDT, Stars, and Toncoin turn Telegram into a complete commerce stack and how builders can capture the opportunity.

Japan’s Megabanks Unite on a Shared Yen Stablecoin Rail

MUFG, SMFG, and Mizuho agreed on a unified, bank-grade yen stablecoin standard that could become Asia’s corporate settlement backbone, speed cross-border B2B and FX with embedded compliance, and force U.S. and EU answers.

OCC greenlights Erebor, reopening U.S. crypto banking rails

The OCC’s conditional charter for Palmer Luckey’s Erebor Bank reopens a supervised path for onshore settlement, compliant custody, and narrow‑bank reserves. The decisive next steps rest with FDIC insurance and a Federal Reserve master account.

Samsung makes Galaxy Wallet crypto-native with Coinbase

On October 3, 2025, Samsung gave U.S. Galaxy owners special access to Coinbase One inside Samsung Wallet, turning the default phone wallet into a crypto on-ramp and previewing how OEM-native wallets could reshape stablecoin spend and DeFi access.

Onshore Prediction Markets: Kraken and Polymarket Deals

Two U.S. deals just reset the map for event trading. On October 16, 2025, Kraken agreed to acquire The Small Exchange, a CFTC Designated Contract Market, and on July 21, 2025, Polymarket bought QCEX. Together they signal crypto-native prediction markets moving into the regulated U.S. perimeter.

PYUSD’s Mega Mint Shock: The Control Layer Stablecoins Need

A brief PYUSD minting error flashed trillions on chain before being burned. Paired with new U.S. rules, a global warning, and U.K. caps, the takeaway is clear: programmable dollars need an onchain control layer to scale safely.

Grayscale’s TAO Form 10 Is AI Crypto’s New On-Ramp

Grayscale filed a Form 10 for a Bittensor Trust on October 10, 2025, a faster path to SEC reporting status that can open OTC access for U.S. institutions. Here is why this matters more than an ETF today, the 3-6 month catalyst map, and what it could mean for AI and DePIN.

Solana ETF Decision Day: The rails that could reshape crypto

The SEC’s new generic listing standards rewired today’s Solana ETF timeline. Here is what approval or denial actually means for capital, staking, liquidity, and what to watch on day one.

S&P’s Digital Markets 50 ushers in crypto’s index age

S&P’s hybrid benchmark of 15 tokens and 35 crypto-linked stocks debuted October 7, 2025. With Dinari planning a tokenized wrapper, advisors get a defensible reference and DeFi gets diversified collateral. Here is what changes, and what could go wrong.

CME goes crypto native with 24/7 access and SOL XRP options

A top U.S. derivatives venue is moving to always‑on crypto trading and has launched options on Solana and XRP. Here is how continuous, regulated derivatives can tighten weekend spreads, deepen liquidity, and reshape basis and volatility markets.

Uniswap v4 Hooks Are Live: From DEX to Liquidity OS

Uniswap v4 turns pools into programmable engines with hooks that enable dynamic fees, MEV defenses, and on-chain limit orders. Here is what changed on January 31, 2025, how Unichain fits in, and the patterns builders and wallets should adopt now.

Polygon’s POL Switch Is On as Coinbase Auto-Swaps MATIC

From October 14 to 17, Coinbase is auto-converting MATIC to POL, marking Polygon’s switch to Polygon 2.0. Here is why POL is more than a ticker change and what users, builders, and validators should do now.

After GENIUS, Banks Race to Mint the Compliant Digital Dollar

The United States GENIUS Act, signed on July 18, 2025, gave stablecoins a national rulebook. By October, major banks were prototyping G7-pegged tokens. Here is who wins and loses, how payments and yields realign, and a builder playbook for the next 18 months.

Training Wheels Off: BoLD and Base Unlock Stage 2 Exits

Arbitrum has activated BoLD and Base has switched on permissionless fault proofs, bounding withdrawal times and removing allowlists. It is the clearest step yet toward consumer‑grade onchain experiences over the next year.

Monad's Oct 14 airdrop opens as a fast EVM L1 pressures L2s

Monad will open its airdrop claims portal on October 14, 2025, spotlighting a parallel EVM and near‑instant confirmations that could reset Layer 2 fee dynamics and MEV flows. Here is what builders and users should watch over the next 30 to 90 days.