UK moves to allow tokenised funds as onchain Treasuries surge

On October 14, 2025 the UK FCA opened a consultation to let authorised funds issue on public blockchains. Paired with October’s jump in onchain Treasuries led by BUIDL and BENJI, here is why 2026 could be when funds, collateral, and repo finally move onchain.

The week tokenisation crossed the line from pilot to plan

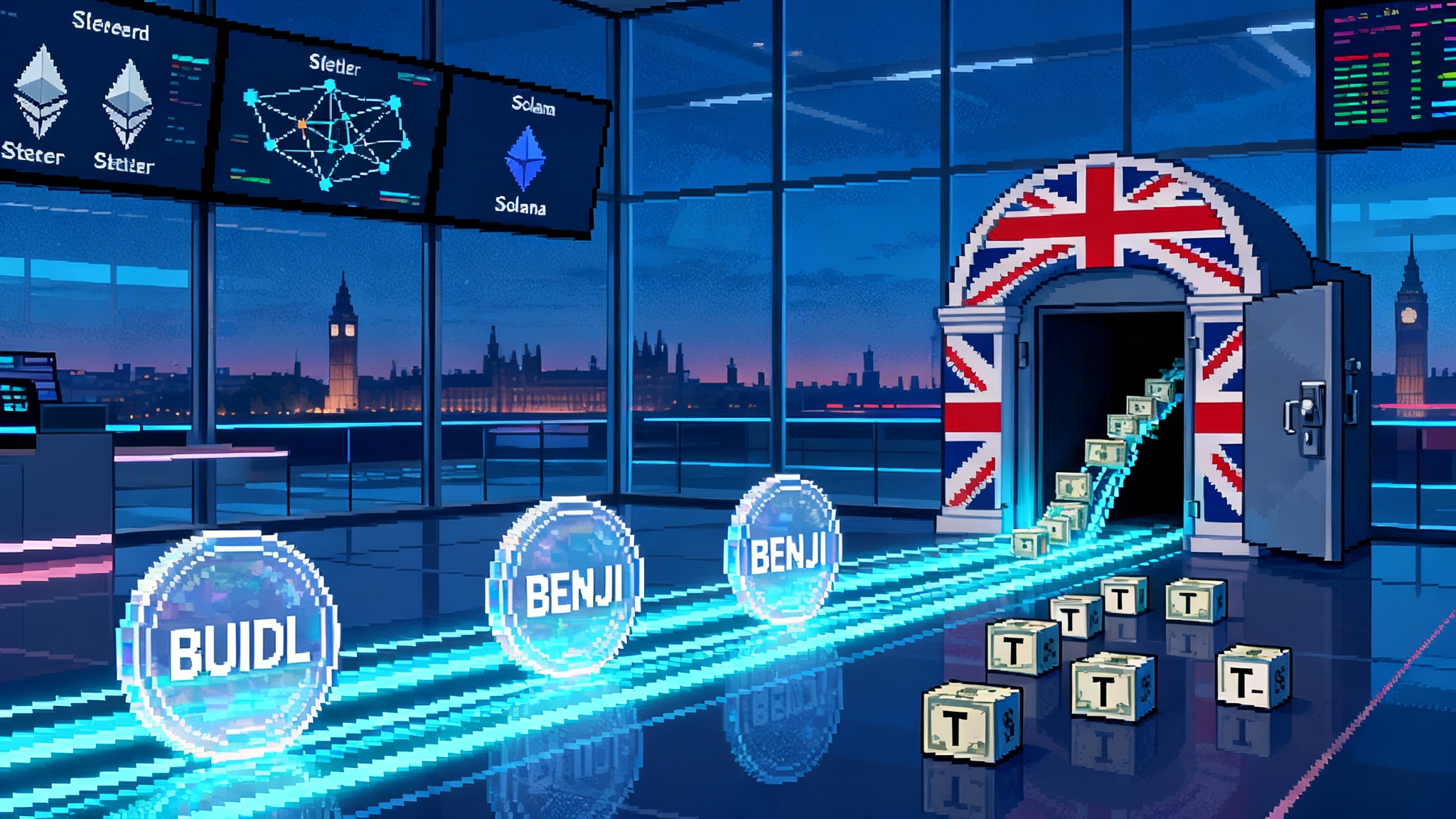

London finally put a date on the future. On October 14, 2025, the UK Financial Conduct Authority opened a consultation that would let authorised funds issue and record units on public blockchains, with an optional direct dealing model that cuts out layers of legacy plumbing. The paper is dry by design, but the implications are electric: a mainstream jurisdiction is saying how, not whether, fund tokenisation should happen. You can read the FCA’s own outline in FCA consultation CP25/28.

In parallel, October’s onchain data delivered a second signal. Tokenised Treasuries have been climbing for months, but this month’s uptick stood out, powered by BlackRock’s BUIDL and Franklin Templeton’s BENJI share class. As of mid October, market trackers show multi billion dollar value outstanding across tokenised cash and Treasuries, with the biggest slices sitting in institutional vehicles. See the RWA.xyz tokenised Treasuries dashboard.

Put the two together and a clear picture emerges. Regulation is catching up to demand. If the UK finalises its rules in the first half of 2026, the industry will have a legal lane and a live order book at the same time. That is the setup for a genuine market structure change, not another lab demo.

What exactly changes when a fund goes onchain

A tokenised fund does not change what the fund owns. It changes how ownership is recorded, how subscriptions and redemptions are processed, and how collateral can move.

- Record keeping: Instead of a transfer agent keeping a master unitholder register in a private database, the canonical register can live on a public chain. Each token represents a unit in the fund. Transfers that meet the fund’s rules are final the moment they settle.

- Dealing: Direct to fund dealing means investors mint and burn fund tokens against cash or tokenised cash under the manager’s supervision. That reduces reconciliation work and shortens settlement cycles.

- Collateral: Because fund units are programmable, investors can pledge them into a smart contract that enforces margin calls with clockwork precision. The fund shares themselves become high grade collateral that can be rehypothecated under pre defined rules.

These are not cosmetic improvements. They reduce three chronic frictions in asset management: batch based processing, reconciliation that never ends, and collateral that moves only at the speed of emails and end of day files.

October’s surge, by the numbers and why it matters

Why does a jump in tokenised Treasuries matter to fund tokenisation? Because money market funds and Treasury bills are the safest proving ground for new rails. They settle quickly, they are simple to value, and the investor base is already used to large, frequent cashlike movements.

October’s flows showed two things: the issuer mix is maturing and the network mix is diversifying. BUIDL drew fresh institutional treasury balances, while Franklin’s BENJI continued to expand into new chains and distribution channels. The headline is not a single product win but an asset class that now has depth, breadth, and repeat usage from corporate treasuries and trading firms. Depth matters because it unlocks collateral utility. A market that turns over daily can support margining, securities lending, and repo on the same chain. That is why October’s step up is more than a chart. It is a green light for operations teams to design real workflows around these instruments.

Why 2026 could be the onchain repo moment

Tokenised funds and tokenised Treasuries are the missing puzzle pieces for onchain repo. The mechanics look like this:

-

An investor mints fund tokens against cash held by the fund’s bank. The bank and the fund administrator update their books. The onchain master register updates at the same time.

-

The investor pledges those fund tokens as collateral into a repo smart contract. The counterparty wires tokenised cash into the same contract.

-

The contract handles daily interest and margin. If collateral value falls below the agreed threshold, the smart contract initiates a margin call or a clean close. If the borrower defaults, the collateral is transferred by code, not by email.

All of this can run under the same legal agreements the market uses today, with the smart contract acting as the collateral agent. Tri party repo becomes a smart contract plus a permissioned wrapper that admits only approved wallets. Add a regulatory framework that acknowledges tokenised fund registers on public chains, and you have the ingredients for a controlled, scalable repo market that operates at internet speed.

If the FCA turns today’s consultation into rules by 2026, UK managers will be able to tokenise authorised funds using public networks without bespoke waivers. That timing aligns with the operational readiness of corporate treasury desks that have spent 2024 and 2025 learning how to hold tokenised assets safely. The sequencing is finally right: standards, custody, compliance, then scale.

Which public chains are winning and why

-

Ethereum and its scaling networks: Most institutional funds either issue on Ethereum first or ensure Ethereum is in their supported set. The reason is simple. Institutions want the most battle tested settlement layer, the broadest custody support, and the richest developer tooling. Layer 2 networks such as Base, Arbitrum, Optimism, and Polygon offer lower cost while inheriting Ethereum’s security model, and they can enforce permissioning at the application layer.

-

Stellar for distribution: Franklin’s BENJI made early use of Stellar’s low fees and straightforward account model, which fit a money market fund’s transfer needs. Stellar’s role underscores that settlement cost and predictability matter when tokens behave like cash.

-

Solana for throughput: As fund tokens become collateral in active trading strategies, high throughput chains are attractive. Extensions of large funds to Solana signal that throughput and low latency are becoming relevant to institutional token users. For broader context on Solana’s market position, see the internal analysis on the rails that could reshape crypto.

Expect a portfolio approach. The largest issuers now deploy on more than one chain, then use bridges or cross chain messaging to maintain a coherent cap table while meeting clients where they are. The winners will be the chains that combine three traits: a conservative security story, turnkey integration for qualified custodians and transfer agents, and predictable fees under load.

How bank and exchange integrations are forming

The connective tissue is not a single killer app. It is a series of small, practical integrations.

-

Transfer agents that speak smart contracts: Traditional roles do not disappear. They learn new verbs. Transfer agents and fund administrators that can treat a smart contract as the master register unlock direct to fund dealing and intraday settlements that look like instant subscriptions and redemptions.

-

Qualified custody baked into workflows: The fund token must sit inside custody systems with segregation, insurance, and audit trails. The action is in the pipes between the custodian and the onchain register: pre trade checks, settlement instructions, attestations that a given wallet is eligible to hold a given token, and automated corporate actions like daily income distributions.

-

Exchange and dealer connectivity: Funds become collateral when brokers and exchanges accept them for margin. That demands clear collateral schedules, haircut tables, and automated eligibility checks. Expect early acceptances to focus on tokenised cash and Treasury funds before expanding to bond and credit strategies.

-

Bank money onchain: Repo becomes mainstream when cash legs are programmable. Stablecoins backed by bank deposits and tokenised bank liabilities reduce settlement risk and cut failed trades. Recent progress on reopening U.S. crypto banking rails shows how traditional institutions can deliver those cash primitives.

Each of these steps is incremental. Together they add up to straight through processing that does not break during peak hours.

What this means for U.S. policy competitiveness

The UK’s move is a shot across the bow. The United States already leads in asset management, but it risks watching distribution and settlement innovation migrate offshore if registered funds cannot use public chains with clarity.

Here is the competitive reality:

-

Public chain guidance matters more than sandboxes: The UK is writing conditions under which authorised funds can use public blockchains as registers. If the United States continues to treat public chains as experimental for registered funds, issuers will pilot and scale in London, then passport those approaches to other welcoming jurisdictions.

-

Custody rules are the lever: U.S. clarity on how a qualified custodian can hold tokenised fund shares and interact with smart contracts would shorten the path to mainstream use. Without it, managers will concentrate tokenised offerings in jurisdictions that let custodians automate onchain movements.

-

Repo is the prize: If U.S. tri party agents and clearing banks standardise onchain collateral models in 2026, the United States will keep the centre of gravity. If not, early collateral networks will spin up in the UK and Asia, and liquidity will follow the faster workflows.

The choice is not about embracing or rejecting crypto. It is about making regulated funds and cash instruments settle with better plumbing.

Near term risks you should plan around

-

Liquidity pockets: Tokenised funds can become fragmented across chains or wrappers. If liquidity concentrates in one token on one chain, redemptions elsewhere can be slow or expensive. Action: issuers should publish clear cross chain liquidity arrangements and offer native migration windows tied to fund dealing cycles.

-

Custody and key risk: Keys control assets. A single point of failure is unacceptable for institutional funds. Action: require multi party computation or hardware security modules with enforced dual control, and test disaster recovery with real token movements, not tabletop drills.

-

Chain concentration: If most collateral sits on one chain, an outage becomes a market event. Action: build chain diversity into mandates. Issue on at least two chains with tested bridge or migration paths, and specify what constitutes a valid failover in fund documents.

-

Eligibility and compliance drift: A token that can move 24 by 7 can also move into the wrong hands. Action: use onchain allowlists, offchain credential checks, and real time monitoring to enforce transfer restrictions built into the token contract.

-

Legal finality: Smart contracts execute fast, but legal recognition of finality must match. Action: update offering documents to state that the onchain register is the legal record, and align with the laws of the jurisdiction of the custodian and the fund.

Concrete actions for builders, allocators, and policymakers

For builders:

- Build to the register. Treat the onchain register as the source of truth. Expose clean application programming interfaces for custodians, fund administrators, and auditors. Automate dividend distributions and corporate actions on chain.

- Make eligibility programmable. Use identity attestations and allowlists so tokens cannot move to ineligible wallets. Design for instant compliance checks both pre trade and post trade.

- Ship migration tools. Cross chain moves are not edge cases. Build native migration and verifiable bridges that keep the cap table reconciled across networks.

For allocators:

- Ask for chain strategy. Before subscribing, demand the issuer’s chain roadmap and their failover plan. Evaluate how they will maintain liquidity if one network degrades. For stablecoin liquidity considerations, see the internal brief on the control layer stablecoins need.

- Test custody in production. Do a small mint, pledge, margin call, and redemption with your actual custodian. The goal is not yield. It is operational certainty.

- Treat tokens as collateral today. Negotiate with your brokers and trading venues to accept tokenised cash and Treasury funds for margin. Start with conservative haircuts and scale as processes harden.

For policymakers:

- Publish conditions, not case by case waivers. Spell out how fund registers can live on public chains, how direct dealing can work, and how custodians can interact with smart contracts under existing client asset rules.

- Align cash settlement with collateral. Encourage tokenised bank money and high quality stablecoins with clear redemption rights so collateral and cash settle in the same medium.

- Standardise repo smart contracts. Convene tri party agents, clearing banks, and managers to agree on open templates for onchain repo that map to existing legal agreements and supervision.

The bottom line

October gave us both the regulatory roadmap and the market signal. The FCA is telling managers how to tokenise funds on public chains. At the same time, tokenised Treasuries are showing real scale, with BUIDL and BENJI acting as the workhorses of an emerging onchain cash market. If rules arrive on the current timeline and the pipes keep improving, 2026 can be the year funds, collateral, and repo actually move onchain. The prize is not a new asset class. It is the same assets moving on better rails, with fewer breaks, faster cash, and collateral that behaves like code instead of paper.