Cryptocurrencies

Cryptocurrencies

Articles under the Cryptocurrencies category.

Telegram’s TON Mandate and US Wallet: Crypto’s Superapp Moment

Telegram unified mini apps on TON and rolled out a U.S. wallet, collapsing discovery, onboarding, and payments into one chat. Here is how that changes adoption curves, what to build next, and the risks to manage.

Fusaka blob surge ignites Ethereum’s 2026 DA wars

Ethereum’s December Fusaka upgrade widens the blob pipeline and sets scheduled capacity increases, cutting volatility and enabling policy based routing across data availability layers. Here is how rollups will rebalance between L1 blobs and providers like EigenDA, Celestia, and Avail, and who stands to gain share in 2026.

Arbitrum and OP Stack switch on fault proofs, remaking 2025

Two landmark 2025 activations turned permissionless validation on for the largest rollups. Here is how Stage‑1 decentralization reshapes withdrawals, bridges, liquidity, and the builder playbook.

Polygon’s POL and AggLayer Reset the Multichain Liquidity Map

As major exchanges auto-converted MATIC to POL in mid-October 2025 and AggLayer shipped AggKit for non CDK chains, Polygon is moving to a single network token and standardized cross-chain state. Here is what changes, who captures value, and what builders should ship before 2026.

Monad’s Nov 24 mainnet: can a Solana-speed EVM upend L2s?

Monad is set to launch mainnet on November 24 with a MON airdrop and a promise of Solana-like throughput inside an EVM. Here is the week-one scoreboard and how it could reshape Ethereum rollups and Solana.

Europe’s tokenised funds take off as FCA backs direct to fund

Two moves just flipped tokenised funds in Europe from pilots to plans: the FCA’s direct to fund consultation and a regulated euro stablecoin for atomic settlement. Here is what changes, why it matters, and how managers can act before 2026.

Bitcoin Starts Securing Chains as Babylon Staking Goes Live

Babylon’s April 2025 Genesis mainnet turned native Bitcoin into a live security budget for other chains. Q4 brings EVM support and multi staking, positioning BTC to secure L1s and L2s, unlock native yield without bridges, and challenge Ethereum’s restaking market.

Post Pectra, passkeys make smart wallets the default

Ethereum’s May 7 Pectra upgrade quietly flipped a switch. With EIP-7702 live, any wallet can act like a smart account for gasless, batched, recoverable actions. Over the next year, fintechs and L2s will race to own onboarding and bring 100 million users into crypto.

Frankendancer Crosses the Chasm as Solana Enters Multi-Client Era

Frankendancer has become the default choice for a growing share of Solana validators, pairing MEV-ready economics with real client diversity while Firedancer marches toward full voting. Here is what changes for throughput, risk, and builders.

Uniswap’s DUNA shift primes the era of protocol fees

Uniswap Governance adopted a DUNA legal wrapper called DUNI, giving the DAO real legal personhood. Here is how that shift unlocks protocol fees, reduces liability for contributors, and sets a template other DAOs will copy in 2026.

GENIUS Act Turns Stablecoins Into U.S. Payment Rails

A builder’s field guide to year one under the GENIUS Act: issuer licensing, reserve and disclosure rules, why no-yield reshapes product design, and how wallets, L2s, and merchants plug in.

UBS Just Took Tokenized Fund Orders Live In Production

UBS just ran live onchain subscriptions and redemptions for its tokenized U.S. dollar money market fund using a Digital Transfer Agent standard. Here is how these rails compress reconciliation from days to minutes and make automation the default.

Visa’s Stablecoin Shift Goes Multichain on Stellar and Avalanche

Visa just made card settlement an always-on onchain service. Following its July 31 launch and October 20 updates, USDC, PYUSD, USDG, and EURC now settle across Ethereum, Solana, Stellar, and Avalanche. Here is what unlocks next and how to build on it.

Telegram’s TON-Only Pivot Compresses Years of Crypto UX

Telegram is making TON the exclusive chain for Mini Apps and standardizing wallet links with TON Connect. The shift could bring stablecoin payments, on-chain ads, and DeFi bots to mainstream chat in months, not years.

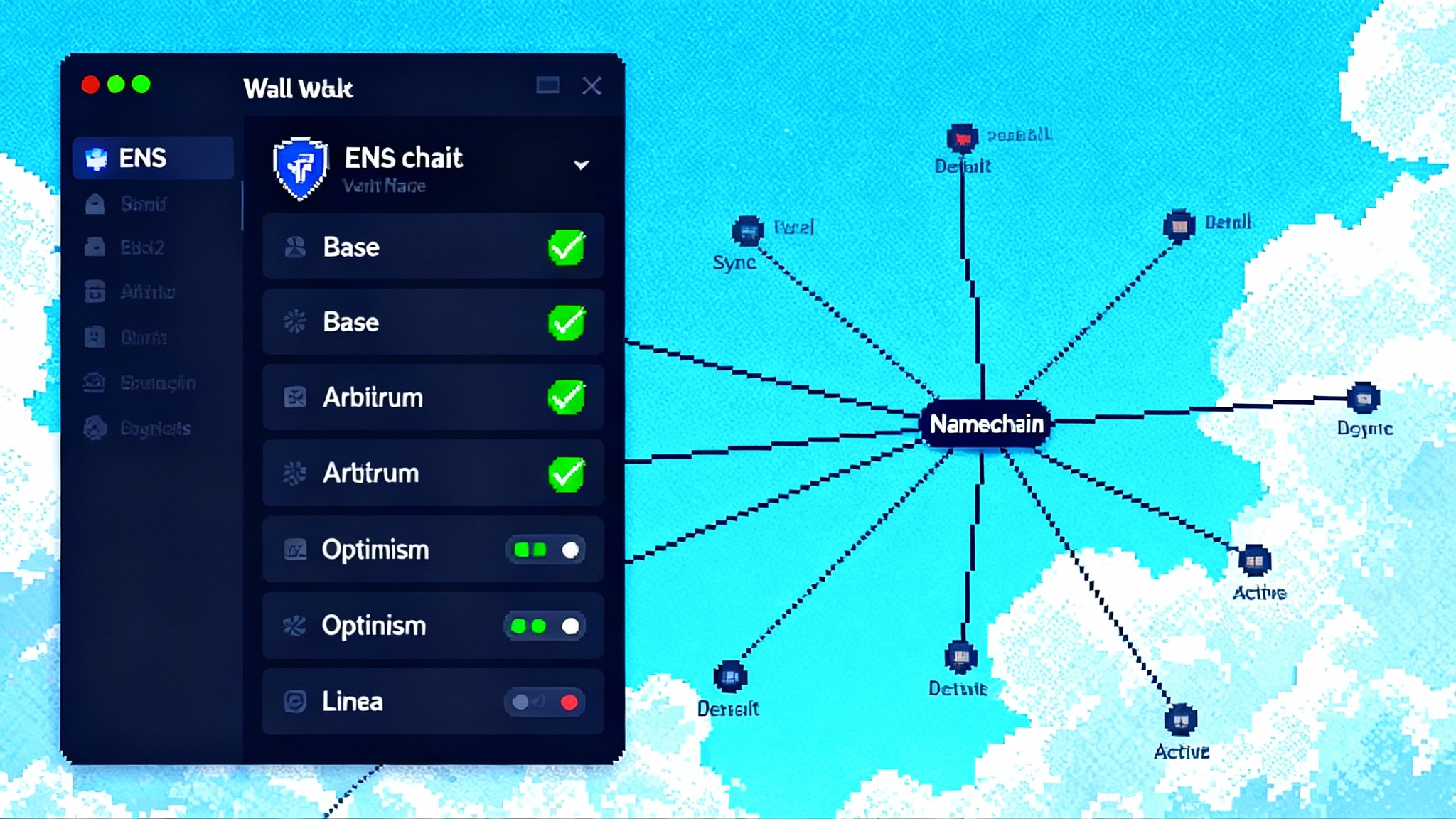

ENSv2’s Namechain and L2 Primary Names reset Web3 UX

ENS is moving identity to Layer 2 with Namechain and L2 Primary Names on Base, Arbitrum, Optimism, and Linea. Here is why it changes onboarding and how developers and brands can implement it now.

Solana Spot ETFs Go Live, Kicking Off the Altcoin Era

In three trading days, Solana crossed from crypto to mainstream. Hong Kong listed ChinaAMC’s SOL ETF on October 27, the U.S. saw Bitwise’s BSOL debut on October 28, and Grayscale followed on October 29. Powered by the SEC’s September 18 rule change, the altcoin ETF era is now real.

Monad Mainnet on Nov 24, Rewriting the L1 vs L2 Playbook

Monad’s high throughput, EVM compatible Layer 1 is slated to go live on November 24 with an airdrop. If it delivers Solana level speed without abandoning Ethereum tooling, the launch could shift user flows, liquidity, and developer roadmaps.

Bitcoin Staking Goes Live as Babylon Unlocks Shared Security

Babylon’s Genesis launch makes native, self custodial BTC staking real. Here is how it works, why it could set a BTC security rate for proof of stake chains and rollups, and the signals to watch as integrations, liquidity, and yields mature.