Cryptocurrencies

Cryptocurrencies

Articles under the Cryptocurrencies category.

Sibos 2025: Corporate Actions Get an Onchain Golden Record

At Sibos 2025 in Frankfurt, a production workflow from Swift, DTCC and Chainlink standardizes corporate actions into on chain golden records mapped to ISO 20022. The result is faster timelines, fewer breaks and a clear path to tokenized funds at scale.

Ethereum L1 zkEVM: The 12-month Plan That Rewrites L2s

The Ethereum Foundation set a one-year target to bring L1 zkEVM online, starting with optional proof verification on mainnet. Here is what real-time proving, multi-proof clients, and native zk-rollups could mean for gas limits, MEV, and every L2 team.

Kraken xStocks puts blue chips on chain as Europe opens

Kraken has taken tokenized equities from pilot to production in Europe, adding Ethereum support and self-custody so blue-chip exposure can plug into DeFi. With MiCA setting a clear runway, on-chain equities look set to compound liquidity into 2026.

Timeboost on trial: Arbitrum’s auctions and the next fix

A new empirical study of Arbitrum’s Timeboost auctions challenges the fast lane narrative. Here is what the data actually shows, the levers governance can tune now, and how OP Stack and shared sequencers reset the race.

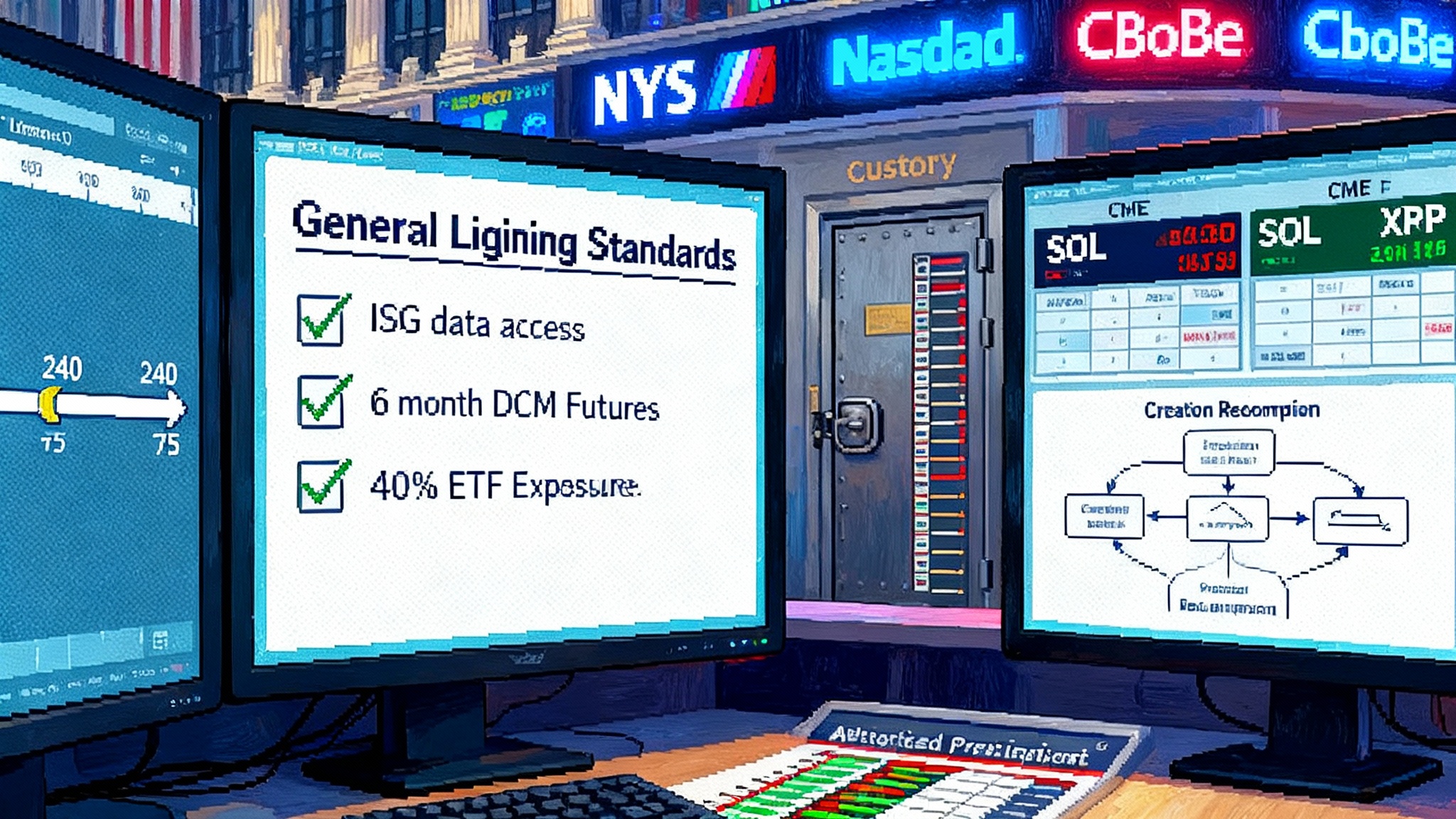

SEC’s new generic rules open floodgates for altcoin ETFs

The SEC's September 18 rule change lets NYSE, Nasdaq, and Cboe use generic listing standards for spot commodity ETPs, cutting timelines to roughly 75 days and paving a lane for Solana and potentially XRP as soon as October. Here is the market-structure playbook.

Visa Switches On Stablecoins as GENIUS Act Reshapes Payouts

Visa is piloting stablecoin payouts just weeks after the US GENIUS Act set federal rules for payment stablecoins. Here is how this shifts settlement, compliance, and treasury over the next six months.

Firedancer's plan to uncap Solana blocks after Alpenglow

Jump Crypto’s Firedancer team is pushing SIMD-0370, a proposal to drop Solana’s fixed per-block compute ceiling once Alpenglow lands. Here is what changes, why it could cut congestion and fees, and the tradeoffs validators and builders should prepare for.

Inside Rio: Polygon’s bet on stateless speed and 5,000 TPS

Polygon’s Rio upgrade brings stateless verification and validator‑elected block producers to target near‑zero reorgs, lower node costs, and a clear runway to 5,000 TPS. Here is what changes and how to build for it.

Inside Aave V4: a modular hub to unify liquidity this Q4

Aave V4 unifies liquidity into a single hub per chain, shifts balances to ERC-4626 shares, and adds targeted liquidations plus optional reinvestment. Here is the plain-English guide for builders and users ahead of the Q4 2025 launch window.

Starknet’s leap to decentralized sequencers, tested by a reorg

On September 1, 2025, Starknet shipped v0.14.0 with decentralized sequencers, Tendermint-style consensus, pre-confirmations, and EIP-1559 fees. A day later it faced an outage and two reorgs. Here is what changed, what broke, and what builders should do next.

Tether’s mega-raise and USAT pivot reset the stablecoin race

Reports in late September indicate Tether is lining up a multibillion private raise and a U.S.-focused stablecoin, USAT. This analysis explains what that signals for compliance and institutions, how market share could shift, and how builders should prepare through Q4 2025.

Sky’s migration crunch: penalties, stUSDS, and the Q4 reset

Sky has activated a quarterly penalty on MKR-to-SKY conversions and advanced stUSDS onboarding. Here’s how the new economics, governance rules, and yield routes will push upgrades, rewire liquidity, and shape DeFi decisions through Q4 2025.

World Chain uses Chainlink CCIP to make WLD natively cross chain

On September 25, 2025, World Chain enabled native WLD transfers between Ethereum and World Chain using Chainlink CCIP and the Cross-Chain Token standard. The move replaces fragile custom bridges with audited rails and pushes cross-chain toward enterprise-grade interoperability.

Tempo’s testnet makes onchain checkout finally feel real

On September 4, 2025, Stripe and Paradigm unveiled Tempo, a payments-first blockchain in private testnet. With sub-second finality, stablecoin-native fees, and issuer-neutral conversion, it pushes onchain checkout and payouts toward mainstream scale.

Plasma’s Mainnet Lands: Gasless USDT and a Neobank Inside

Plasma launches its EVM chain with XPL, zero fee USDT transfers, and Plasma One, a built in neobank. If it scales, on chain payments could jump in emerging markets and push wallets, exchanges, and L2s to compete on user experience by 2026.

USDC Gets Refunds: Circle’s Arc and the New Payments Era

Circle is pushing USDC into credit card style refunds via Arc, a programmable settlement chain for institutions. With the GENIUS Act now law and Visa expanding stablecoin settlement, onchain payments are set for a reset.

SEC generic listing rules spark a rush for SOL and XRP ETFs

A September 2025 rule change gives U.S. exchanges a standing pathway to list qualifying spot commodity ETPs without bespoke 19b-4 approvals. That unlocks a faster, broader lineup of crypto ETFs, with Solana and XRP poised to lead.

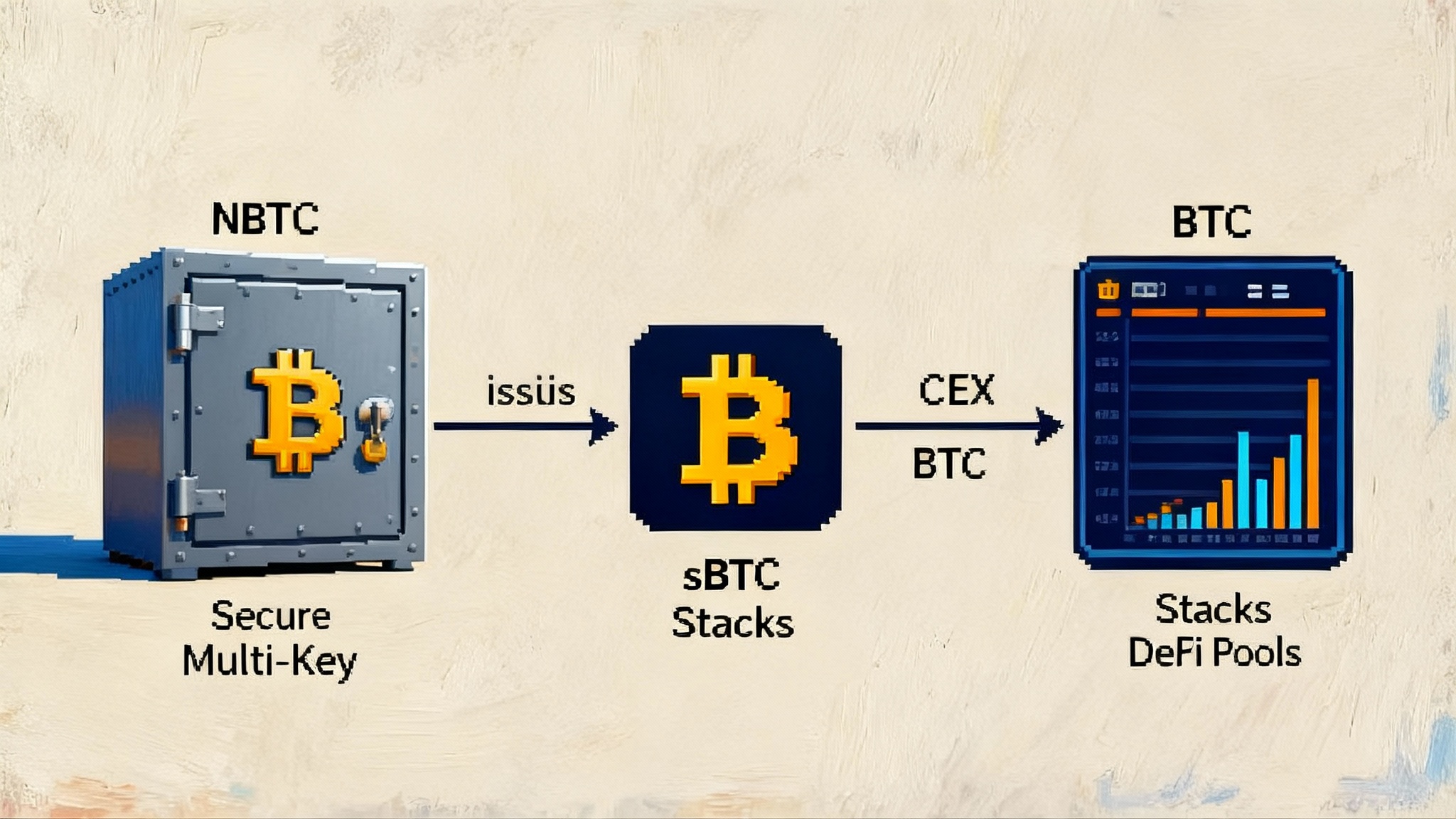

sBTC uncapped and listed: Stacks’ Bitcoin liquidity unlock

In September 2025, Stacks removed the sBTC supply cap and landed its first centralized exchange listing, opening mint and redeem flows to a wider audience. Learn what changes for BTC-native DeFi, how the peg works, what early data shows, and the risks to watch.