Cryptocurrencies

Cryptocurrencies

Articles under the Cryptocurrencies category.

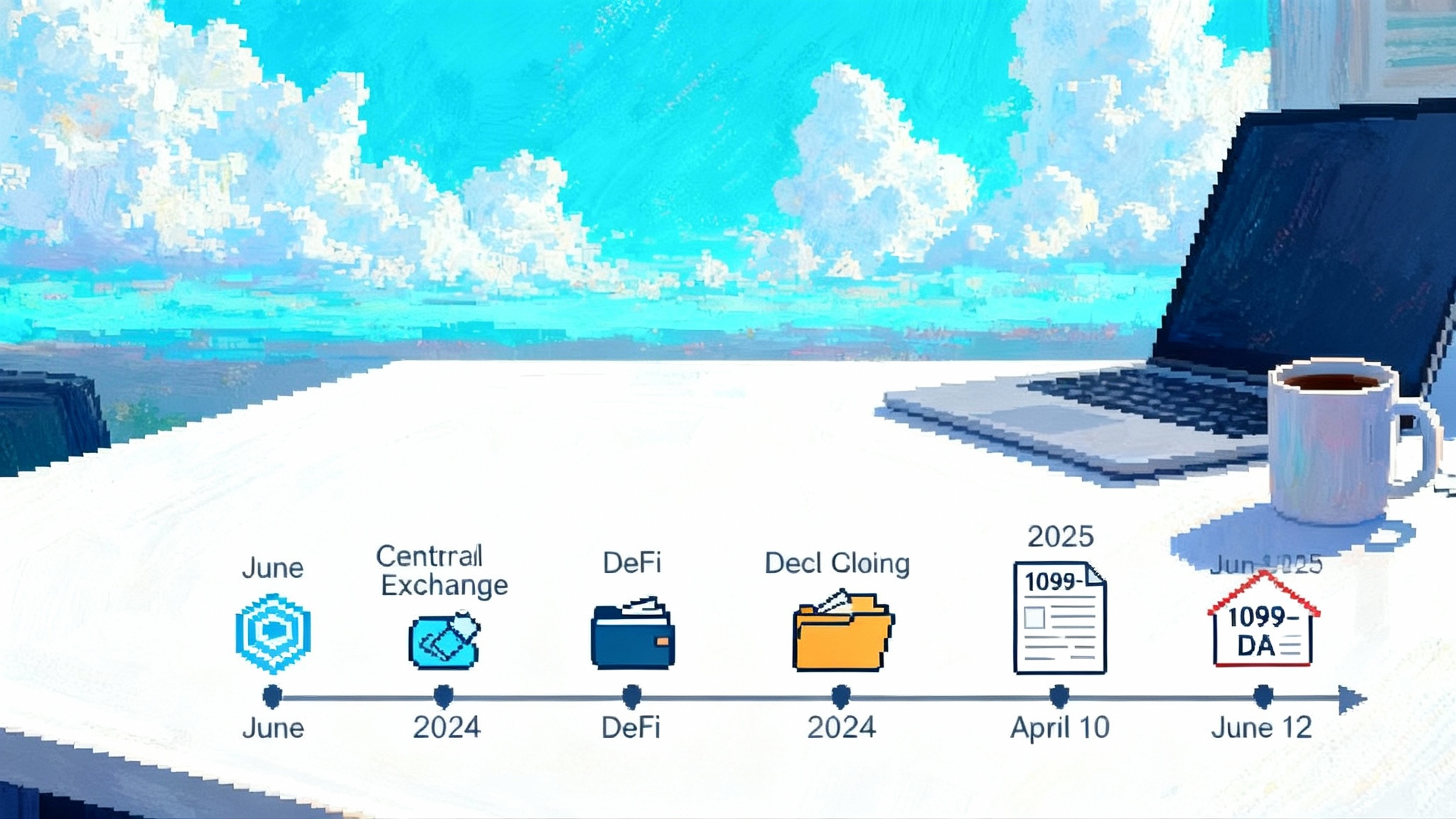

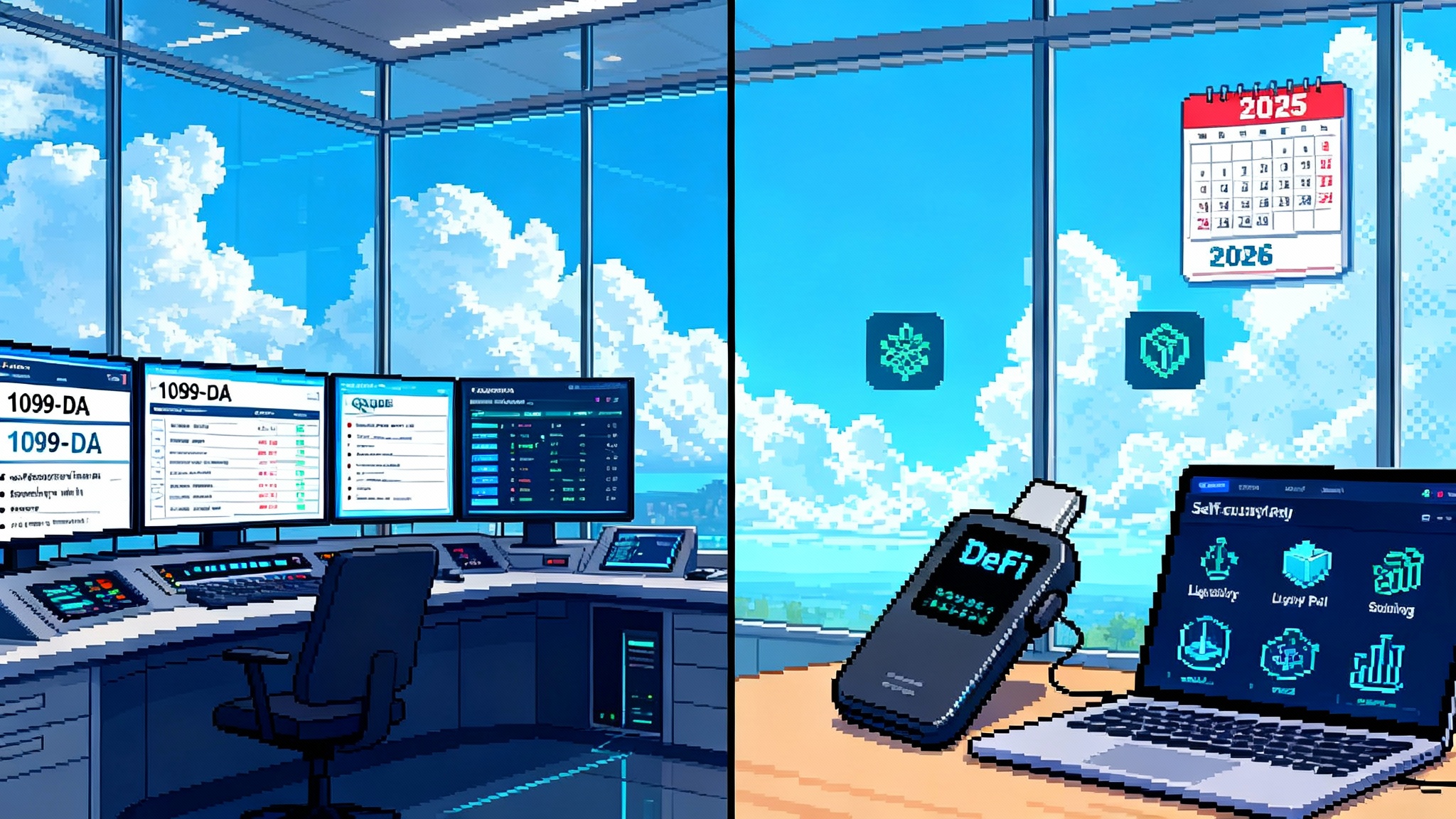

After the CRA Repeal: How 1099-DA Changes in 2025–26

Congress voided the IRS DeFi broker rule on April 10, 2025 and the IRS followed with June transition relief for Form 1099-DA. Here is what changed and what did not, who is affected, the exact timeline, and what platforms and users should do now.

Beijing’s pause tests Hong Kong’s tokenization ambitions

China’s securities watchdog reportedly asked mainland brokerages to halt RWA tokenization work in Hong Kong. Here is what the pause likely means for issuers, where liquidity shifts next, and how Project Ensemble and the new stablecoin regime shape the path forward.

sBTC Uncapped and Listed: Opening the BTCFi Floodgates

sBTC has removed mint caps and landed its first centralized exchange listing. Here is how redeemable, Bitcoin‑native liquidity on Stacks can pull volume from WBTC and bridges into BTCFi, plus a practical playbook to plug in this quarter.

Telegram’s TON Wallet Puts Crypto On-Ramp in U.S. Chats

Telegram is rolling out a self-custodial TON Wallet to roughly 87 million U.S. users, turning chats into checkout. Here is the UX, growth, and compliance playbook teams can ship in Q4 to capture the moment.

Tornado Cash’s 2025 Pivot and the New Privacy Playbook

Tornado Cash’s March 2025 delisting and an August jury split reset the U.S. privacy perimeter. See what changes for wallets, mixers, and DeFi interfaces, plus a concrete 90-day plan.

SEC Fast-Tracks Crypto ETFs: What Generic Rules Unlock Next

On September 18, 2025, the SEC approved generic listing standards that let NYSE Arca, Nasdaq, and Cboe BZX list spot crypto ETPs without case-by-case rule changes. Approvals can now arrive in about 75 days. Here is what changed, why GDLC is trading, what is likely next, and a 30-60-180 day playbook.

Treasury's GENIUS Act resets stablecoins and retail payments

Treasury has kicked off rulemaking for the GENIUS Act, outlining licenses, reserves, redemption speed, disclosures, enforcement, and access to Fed settlement. Here is what the next 12 months mean for issuers, exchanges, fintechs, and merchants.

SEC’s new ETF rules put Solana and XRP ETFs within reach

The SEC just adopted generic listing standards for spot commodity ETPs, replacing case-by-case approvals. That shift can fast track Solana and XRP ETFs, shorten launch timelines, and reward issuers ready to move now.

FTX’s September Payout: Mapping the Next Crypto Liquidity Wave

FTX’s third distribution on September 30, 2025 will release about $1.6 billion to creditors. Here is how that cash could travel from BitGo and Kraken into majors, L2s, Solana and TON, and what to watch across spot, perps, bridges, and DeFi yields in the days that follow.

The GENIUS Act will rewire stablecoins, DeFi, and payments

A builder and investor playbook for the next 6 to 18 months under the new U.S. stablecoin law. Deadlines, winners and losers, DeFi yield shifts, exchange liquidity changes, and a clear U.S. vs MiCA roadmap.

SEC fast-tracks crypto ETFs as DOGE and XRP funds debut

A quiet SEC rule change replaces one-off approvals with generic listing standards, shrinking crypto ETF timelines from months to weeks. With DOGE and XRP ETFs trading, we break down what this means for liquidity, custody, surveillance, and the road to broader crypto exposure.

Generic Listing Unlocks Solana, XRP and Memecoin ETFs

On September 17, 2025 the SEC approved generic listing standards that let U.S. exchanges list crypto commodity-based ETPs without case-by-case 19b-4 reviews. Here is what changes for Solana, XRP and even memecoins across eligibility, liquidity, spreads and options.

L2s Finally Flip the Switch on Permissionless Fault Proofs

After years of delays, major optimistic rollups finally shipped permissionless fault proofs. Arbitrum flipped on BoLD and Base reached Stage 1 with a decentralized security council. Here is what changes for withdrawals, bridges, and integrations across the Superchain.

GENIUS Act resets stablecoins: USDC vs Tether’s USAT

With the GENIUS Act now law and Treasury racing into rulemaking, the onchain dollar market is entering a new phase. We map the rule timeline, disclosures, and how USDC and Tether's USAT could reset exchanges, DeFi, and payments from 2025 to 2026.

Saudi Awwal taps Chainlink. GCC banks race past US rails

Saudi Awwal Bank is plugging into Chainlink’s CCIP and CRE to run real onchain finance with audit-ready controls. That unlocks cross-chain DvP, tokenized sukuk servicing, and faster cross-border settlement — and it may let Gulf banks move faster than the United States.

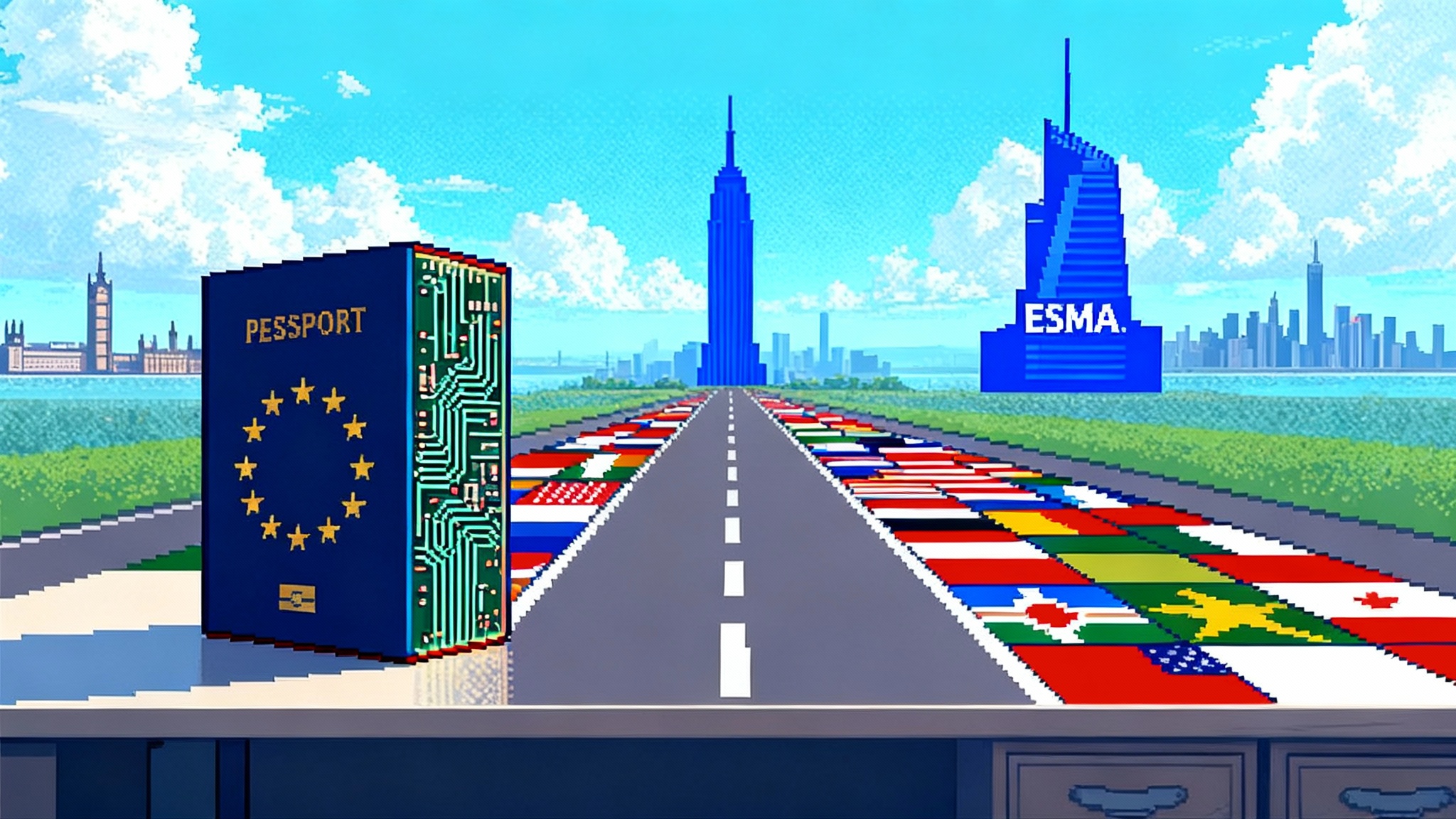

MiCA’s Passporting Showdown Tests Europe’s Unity

France and allies just challenged MiCA’s single license promise, hinting at passport vetoes and a push to shift big‑firm oversight to ESMA. We map the legal mechanics, three scenarios, near‑term risks, and how a tightening UK and US corridor could siphon activity.

Telegram brings TON Wallet to the U.S., a new web3 onramp

Telegram is rolling out a self-custodial TON Wallet for U.S. users, bringing USDT payments, swaps, and mini-apps into the chat interface. Here is what it unlocks for payments, games, and developers.

1099-DA arrives: 2025 crypto reporting reset after DeFi repeal

Custodial exchanges, hosted wallets, and payment processors are brokers in 2025. Expect 1099-DA for gross proceeds in early 2026, with basis reporting starting in 2026. DeFi front ends and self-custody remain outside broker rules after Congress repealed the late-2024 DeFi measure.