Cryptocurrencies

Cryptocurrencies

Articles under the Cryptocurrencies category.

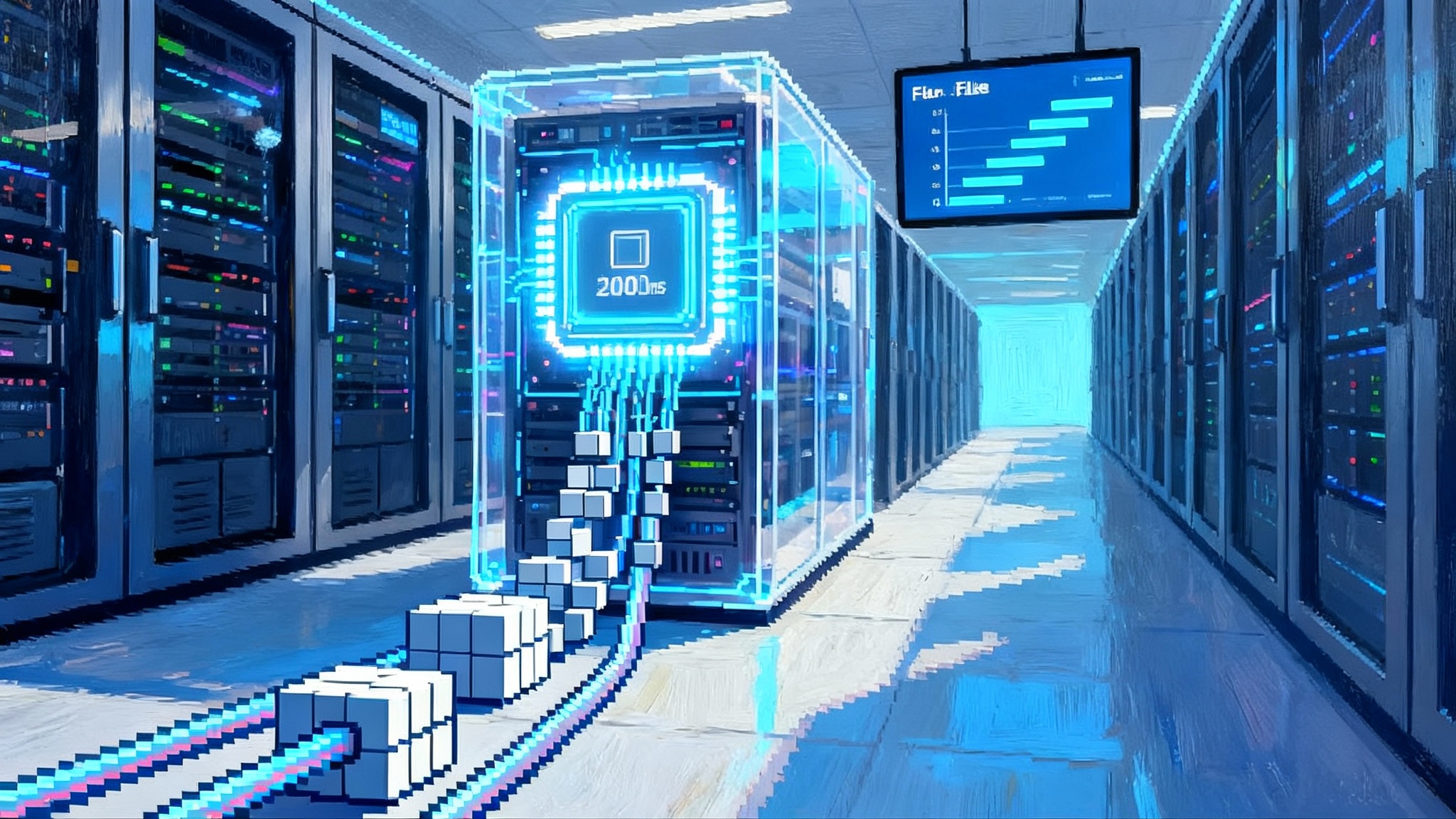

Unichain’s 200ms Flashblocks rewrite DeFi’s MEV playbook

Uniswap’s Unichain has switched on 200 ms Flashblocks. By pairing fee-first ordering inside a trusted execution environment with an encrypted mempool, it promises near‑instant preconfirmations, less extractive MEV, and a cleaner trading experience. Here is what changes for traders, LPs, and builders.

Nasdaq’s Tokenized Shares: What ‘Same CUSIP’ Really Means

Nasdaq has asked the SEC to let listed stocks and ETFs settle in tokenized form without splitting liquidity. Here is what same CUSIP and same rights really require, how DTC would move tokens, and why this is not the offshore mimic market.

DeFi after Tornado Cash: the new line on dev liability

A Manhattan jury’s partial verdict against Tornado Cash developer Roman Storm just reset the U.S. risk line for non-custodial crypto builders. Here is the new liability map, who is most exposed, and how to design with less risk.

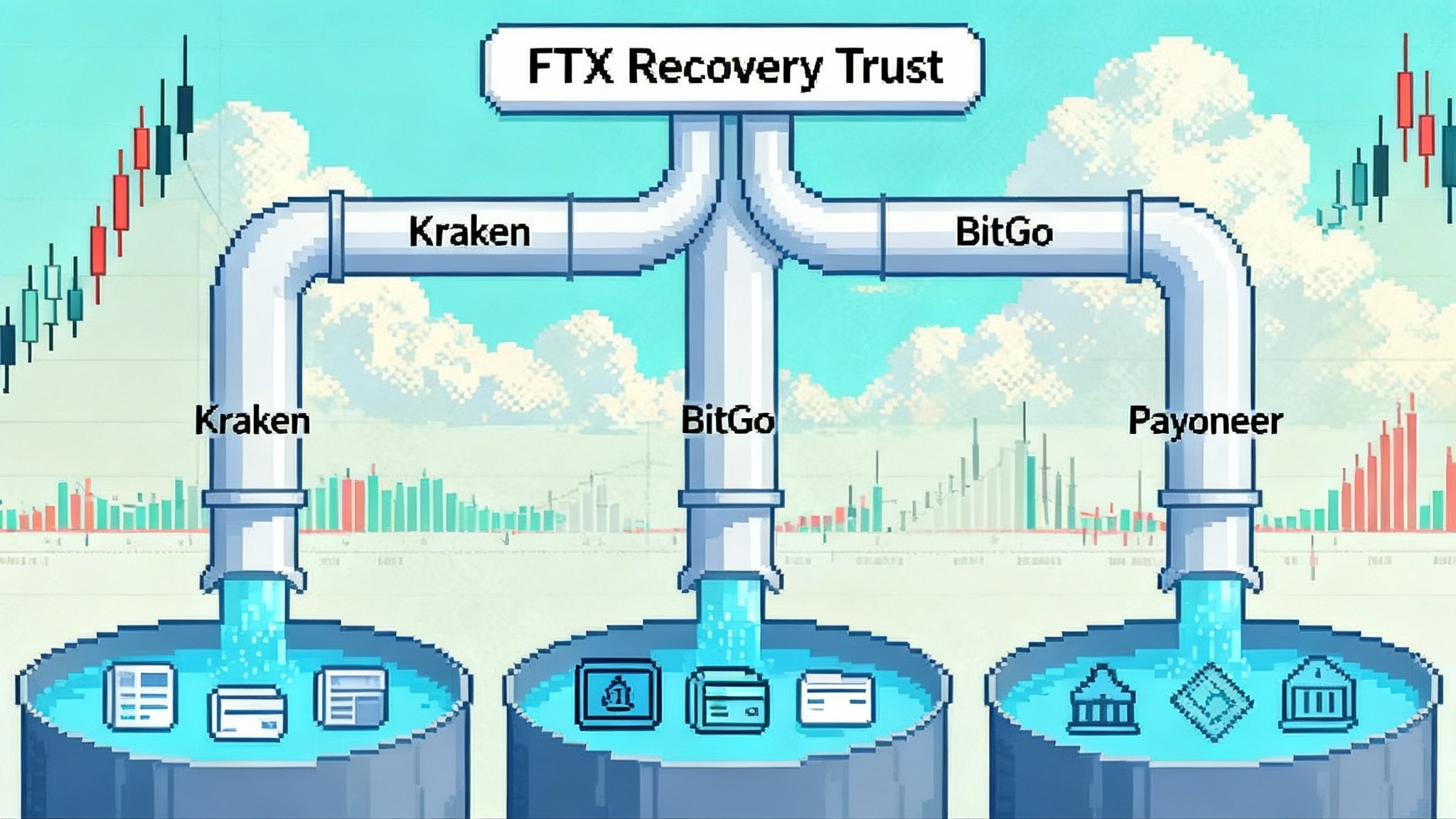

FTX Payouts Hit Markets: Liquidity, Flows, and Scenarios

On September 30, the FTX Recovery Trust begins a roughly $1.6 billion distribution to creditors via Kraken, BitGo, and Payoneer. Here is how the cash may route, what to watch in spot and perps, and the scenarios that could shape basis and rotations.

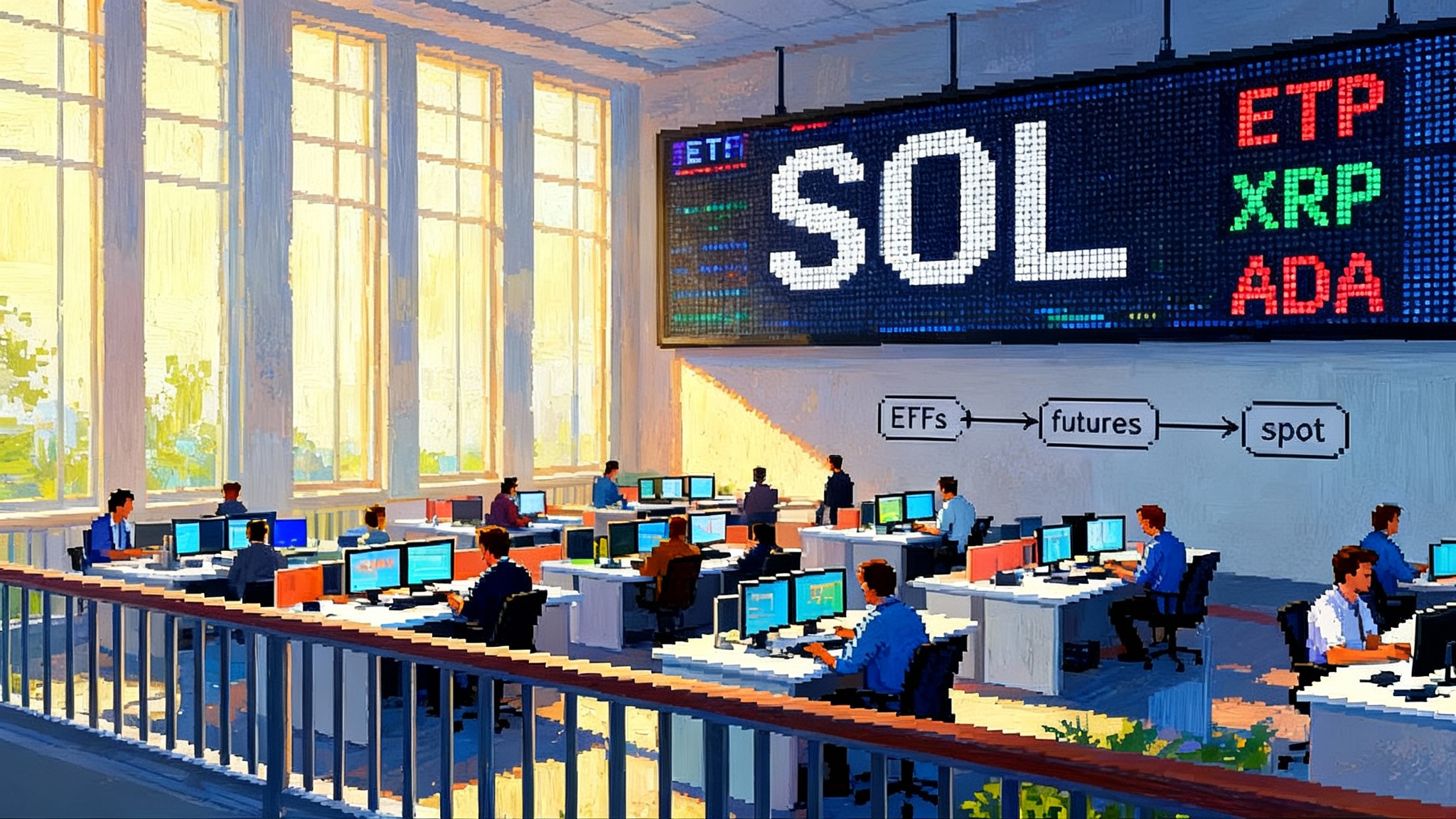

ETF Floodgate Moment: SEC’s generic rules reset crypto

The SEC just cleared generic listing standards so NYSE, Nasdaq, and Cboe can list spot crypto ETPs without bespoke 19b-4 approvals. Here is what changed, which tokens qualify first, and how in-kind creations will reshape spreads, liquidity, and costs.

SEC’s generic rules open floodgates for crypto spot ETFs

The SEC just approved generic listing standards that let NYSE, Nasdaq, and Cboe list spot digital asset ETPs without bespoke 19b-4 orders. Timelines compress to roughly 75 days and the first wave could include Solana, XRP, and diversified baskets as soon as October.

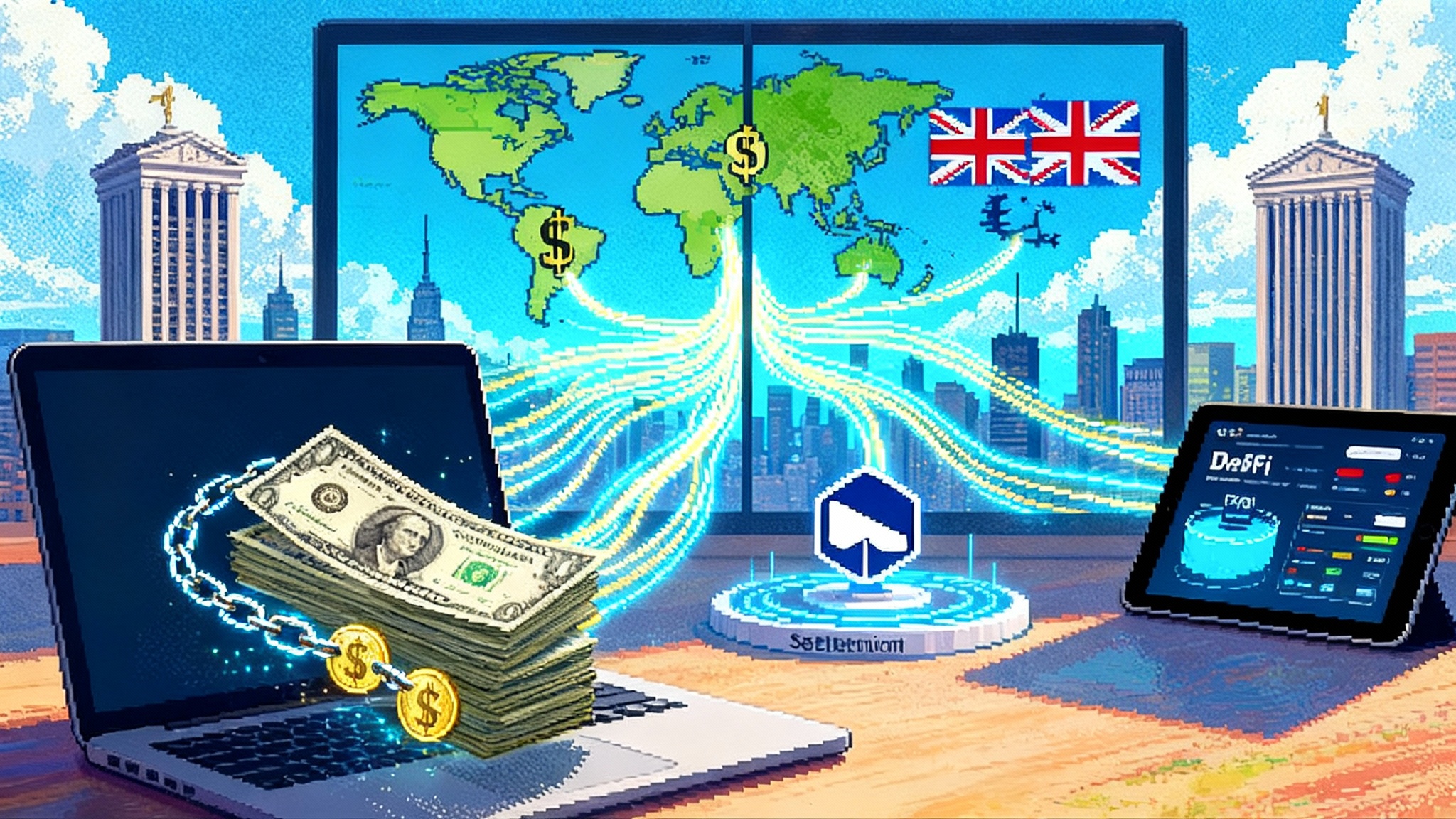

America’s Stablecoin Shockwave: Inside the GENIUS Act Race

The new U.S. stablecoin law hardcodes full reserves, standardized disclosures, and KYC at the edges. Issuers, banks, and card networks are racing to plug in while DeFi pivots to permissioned pools and on-chain telemetry. Here is how payments, liquidity, and winners shift next.

Treasury starts GENIUS Act rules: the new stablecoin playbook

Treasury opened an ANPRM on September 18, 2025 that starts the GENIUS Act rulemaking for U.S. dollar stablecoins. Here is what it means, the likely pillars of the rules, and concrete steps issuers, exchanges, DeFi teams, and retailers should take before the 30 day comment window closes.

SEC generic listing rules unlock a wave of altcoin ETFs

The SEC’s September 17, 2025 decision to adopt generic listing standards lets major exchanges list spot crypto ETPs without case-by-case approvals. Here is what changed, why the first multi-asset fund matters, which tokens are next, and what to watch as October listings approach.

SEC’s generic listing rules reshape the crypto ETF playbook

The SEC just greenlit generic listing standards for commodity-based ETPs, giving spot crypto ETFs a rules-based on ramp instead of one-off approvals. Here is how Rule 19b-4(e) works in practice, who benefits first, what could list next, and the risks to watch.

SEC Opens Door to Multi-Asset Crypto ETFs and In-Kind Flows

In 48 hours the SEC approved generic listing standards for spot commodity ETPs and permitted in-kind creations. The combo unlocks multi-asset and altcoin ETFs, tighter spreads, and deeper price discovery heading into Q4 2025.

Solana ETF verdict in October could reshape altcoin market

The SEC’s October 2025 window for multiple Solana spot ETFs is the next big catalyst for crypto market structure. Here is how approve, deny, or conditional outcomes could ripple across flows, staking, DeFi, and the path for other altcoin ETFs.

How SEC’s new rules unleashed Dogecoin and XRP ETFs overnight

The SEC’s Sept 17 approval of generic listing standards for commodity-based ETPs, paired with July 29 in-kind creation and redemption orders, cleared the path for Cboe to list REX‑Osprey’s Dogecoin and XRP ETFs on Sept 18. Here is what changes next.

SEC opens the gates: generic rules for spot altcoin ETFs

The SEC just approved generic listing standards that let NYSE, Nasdaq, and Cboe list spot crypto ETPs without case-by-case reviews. Here is what changed, which tokens likely go first, and how liquidity, custody, and DeFi could shift next.

Tether brings USAT stateside, and the stakes get real

Tether just unveiled USAT, a U.S.-regulated stablecoin issued by Anchorage Digital with Cantor Fitzgerald as custodian. After July’s GENIUS Act, this could reshape the U.S. stablecoin stack, pressure USDC, and redraw compliance lines.

Altcoin ETFs Are Coming: How New SEC Rules Reshape Crypto

The SEC just cleared a fast track for spot ETFs beyond bitcoin and ether. Here is how generic listing standards set up Solana and XRP first, what it means for liquidity, custody and staking, and who wins as Q4 2025 nears.

Altcoin ETFs Are Here: SEC Fast-Tracks and Doge Debuts

On September 18, 2025 the SEC’s new generic listing standards turned crypto ETFs into a rules-based process. Hours later the first U.S. Dogecoin ETF hit the tape. Here is how Solana and XRP could follow, who wins, and where risks now live.

SEC Fast-Tracks Spot Crypto ETFs Beyond Bitcoin and Ether

A September rule change lets NYSE, Nasdaq, and Cboe use generic listing standards for spot digital‑asset ETFs, speeding approvals for tokens like Solana and XRP. Here is what it means for the pipeline, liquidity, and investor risk.