Fusaka starts PeerDAS and the blob fee wars across L2s

Ethereum’s Fusaka upgrade is moving through testnets in October with a tentative mainnet window on December 3, 2025. PeerDAS and staged blob increases aim to cut L2 costs, reshape sequencer economics, and reprice data availability markets.

Breaking: Fusaka lights the match

Ethereum’s next network upgrade, Fusaka, is now moving across public testnets in October with Holesky on October 1, Sepolia on October 14, and Hoodi on October 28. Core contributors signaled a tentative mainnet window for December 3, 2025, contingent on clean testnet runs. The plan also includes two post-activation parameter bumps to raise blob capacity in steps, rather than all at once. That gradual approach is designed to keep the network stable while pressure testing throughput. You can track the testnet schedule on the official announcement from the Ethereum Foundation’s protocol coordination team, which spells out the dates and the staged blob increases in detail: Fusaka testnet announcement.

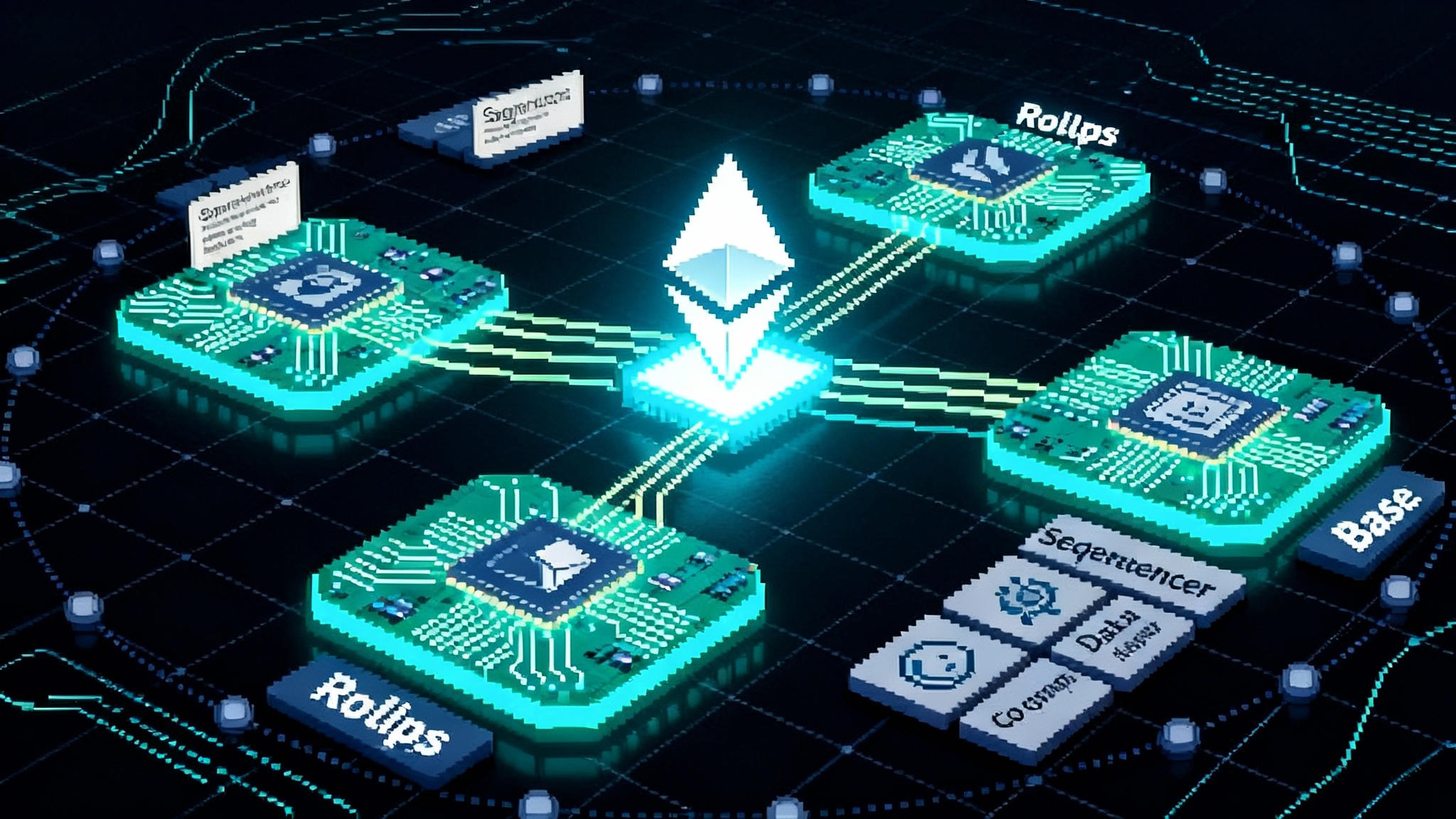

Why this matters now: Fusaka introduces Peer Data Availability Sampling, or PeerDAS, and adds a new policy for safely dialing up the number of blobs per block after activation. Together, they unlock cheaper and more abundant data room for rollups. When data room expands and stays available, the fee paid by rollups to publish their batches can fall. That is the fuse for what many builders are already calling the blob fee wars.

What PeerDAS actually is, in plain English

Imagine a stadium where a tifo covers the entire crowd. In the past, every usher had to inspect the full tifo end to end to confirm it was intact. That made inspections slow and expensive. PeerDAS changes the job. Now ushers can randomly check small squares of the tifo, and because of how it is woven with redundancy, those samples are enough to know the whole banner is present. In Ethereum terms, blobs are split and encoded so that nodes can verify data availability by sampling small pieces from peers instead of downloading it all.

That is the core of EIP 7594 PeerDAS specification. By lowering the bandwidth and storage burden of confirming availability, more blob capacity can be added without kicking smaller nodes off the network. With PeerDAS, Ethereum can raise the target and maximum blobs per block in steps, letting the base fee for blobs adjust to new supply.

The mechanics behind blob fees

Blobs are cheap, time-bounded data chunks introduced with proto-danksharding. They live outside the EVM state, expire after a fixed window, and use a separate base fee adjusted by demand. When blocks are consistently full of blobs, the blob base fee climbs. When supply grows faster than demand, it falls. Fusaka’s PeerDAS makes it safe to raise blob supply. The Blob-Parameter-Only policy then dials the per-block target and maximum from today’s 6 and 9 toward higher levels in two steps. The expectation is not magic. It is simple market math. If the network can carry more cheap data each block, the marginal rollup batch becomes cheaper to publish.

Cheaper batches propagate in two ways:

- Rollups can post more often at the same cost, cutting the lag between user transactions and final batch inclusion on Ethereum. That can reduce the slippage and fee padding users apply when they fear long queues.

- Or rollups can keep the same cadence and reduce end-user fees directly. Many will do a mix of both, depending on demand.

The first order effects: lower L2 fees and faster bridges

- Cheaper swaps: For users on Base, OP Mainnet, Arbitrum, Scroll, zkSync, Starknet, Linea, and other big rollups, a meaningful slice of the fee goes to data availability. As blob supply increases, that slice shrinks. Expect visible reductions on simple trades and transfers during normal demand, with the biggest relief on chains that post large batches many times per hour.

- Faster bridging, in practice: Most canonical bridges finalize based on proofs and challenge windows, not just data fees. Still, lower blob costs let rollups post batches more frequently and predictably. That improves the economics of fast bridges that advance liquidity before finality. When risk and inventory costs fall, bridge fees have room to compress. For broader context on cross-chain UX, see our look at chain abstraction and one click swaps.

- Smoother UX during spikes: During memecoin frenzies or large airdrops, blob demand can still surge. The difference post-Fusaka is that the system can step up capacity via parameter increases, and PeerDAS keeps the burden manageable for nodes. The goal is fewer fee spikes that last hours, and more short humps that decay quickly.

The second order effects: sequencer economics get rewritten

A sequencer’s basic profit model is simple. Revenue comes from user fees and potential reordering value. Costs come from posting data, paying for proving or challenge infrastructure, and running validators or operators. When data availability gets cheaper and more plentiful, two things happen:

- Margins improve for rollups that use Ethereum blobs directly. A chain like Base or OP Mainnet can cut prices and still maintain or grow contribution to their treasuries. If they hold prices steady, they create budget for user incentives, rebates, or ecosystem funds.

- Competition intensifies among rollups that lean on alternative data availability. If Ethereum blobs get much cheaper, the price gap that justified moving data off Ethereum narrows. That reshapes negotiations with EigenDA, Celestia, and NEAR DA. The market will push toward pay-as-you-go and burst-friendly pricing rather than flat minimums, and toward features like longer retention and audited retrieval guarantees that differentiate beyond headline cost per megabyte.

Expect sequencers to respond tactically:

- More frequent batches to signal low latency. Faster L1 inclusion is a marketing metric chains will highlight. For the governance and design backdrop, see our guide to permissionless L2 progress and proofs.

- Tiered fee classes. Priority lanes for time-sensitive order flow may emerge, where users pay slightly more to dodge congestion while the average transaction gets a discount.

- Preconfirmation markets. Shared sequencer projects and independent builders will sell quick soft confirmations that settle into blobs later. As data posting gets cheaper, preconfirm fees can drop without killing margins, making them more ubiquitous in wallets.

The third order effects: the DA market reprices

- EigenDA: Built on Ethereum restaking economics, EigenDA has sold itself on cost and Ethereum alignment. In a world where blobs on Ethereum are cheaper and more abundant, EigenDA will emphasize flexible service level objectives and deep operator sets. For some rollups that want Ethereum-centric trust but lower variance in fees, EigenDA remains a credible path, especially if it can meter costs by payload and by hour in a way that matches traffic patterns. For more on where EigenLayer is going, see the EigenLayer multichain AVS shift.

- Celestia: Celestia’s pitch is modular, cheap data availability with namespaced data. If blob base fees fall on Ethereum, Celestia’s advantage compresses. That does not erase its value. It forces a pivot toward app-specific chains where data volumes are large and predictable, and where developers want data features Ethereum does not prioritize. The likely move is dynamic fees and clearer enterprise-grade retention guarantees so that cost comparisons are apples to apples.

- NEAR DA: NEAR’s data availability offering will compete on predictable fees and robust retrieval. Its path is to publish transparent dashboards, expand tooling that plugs into OP Stack and ZK Stack, and win chains that value clarity over the absolute lowest price. If Fusaka chops Ethereum blob fees enough, NEAR DA will meet customers halfway on terms and multi-year commitments.

The broad takeaway is not that one wins and others lose. It is that pricing power shifts back toward buyers in the near term. If you operate a rollup, you will get better quotes this quarter. If you sell DA, you will need more flexible pricing and clearer reliability metrics.

A simple playbook for three audiences

For users: how to capture the savings

- Time your transactions to new cadence: Watch your rollup’s batch posting rhythm. If batches arrive every few minutes instead of every 10 to 15, you can cut gas tips on swaps and still clear quickly. Many explorers display batch times. Your wallet will start reflecting lowered suggested fees.

- Use fast bridges for cheaper exits: When posting costs drop, fast bridge providers face lower capital and risk costs. Compare bridge quotes again. The spread between canonical exits and fast exits should narrow. If it does not, it means competition has not passed savings through yet.

- Try heavy data apps: Social, gaming, and onchain media apps are most sensitive to data availability costs. Post-Fusaka, feeds should load faster and uploads should fail less during busy hours.

For builders: a migration and tooling checklist

- Test against Holesky and Sepolia today. Validate your batcher or poster against the raised blob target and max on testnets. Make sure your posting code handles larger blobs and denser schedules.

- Update client combos and watch PeerDAS metrics. Monitor node memory, bandwidth, and sampling behavior. The point of PeerDAS is to keep resource use sane while you post more data. If your telemetry spikes, check for misconfiguration.

- Implement a blob fee policy. Decide when to pass savings through directly and when to buy latency with more frequent posts. Codify this as rules in your batcher. For example, trigger a batch post when the pool holds N transactions or when blob base fee falls below X for Y blocks.

- Harden your DA abstraction. If you offer multiple DA backends, keep your dispatcher stateless and log retrieval proofs. Fusaka does not remove the need to prove you can fetch your own history.

- Prep your sequencer for preconfirmation markets. Users will expect soft confirmations in seconds. Integrate with shared sequencers or run your own preconf service. Wire these into wallets so users see a clear confidence bar.

- Update public docs and wallets. Users should know that fees might fall and that batch cadence is increasing. Document new limits, including any maximum blob size you enforce application side.

For investors: where the near-term edge likely sits

- Heavy-throughput L2s are set to benefit first. Chains that publish many large blobs every hour stand to gain the most from lower per-blob fees and larger targets. In the OP Stack family, watch Base, OP Mainnet, and the creator-centric Zora Network. In the Arbitrum family, watch Arbitrum One and high-volume Orbit deployments. Among zero-knowledge rollups that post full data, watch Scroll, Linea, and zkSync for changes in batch cadence and fee policy.

- Shared sequencers and preconf specialists may see rising volumes. As data costs fall, selling low-latency confirmations gets easier. Keep an eye on teams that integrate deeply with major wallets and exchanges.

- DA providers face margin pressure in the short run. The next quarter is about price discovery. Look for signals that providers are moving to dynamic pricing, public reliability dashboards, and longer retention. Those are the levers that can protect revenue while staying competitive.

- Infra blends matter more. Rollups that can switch between Ethereum blobs and an alternative DA in a single click have bargaining power. Tooling companies that make this switch simple are leveraged to the fee curve without taking direct market risk.

What to watch on the calendar

- October testnets: Expect minor hiccups as client teams and rollups iron out PeerDAS edge cases. If the scheduled Blob-Parameter-Only bumps on testnets hold without incident, confidence rises for mainnet.

- Mainnet activation window: The current target is December 3, 2025, but final slot selection depends on testnet outcomes. Be wary of over-optimistic timelines in trading chats. Watch for a final mainnet slot announcement from the protocol coordination team.

- Two weeks after activation: The first post-activation blob parameter increase is expected to raise the target and maximum blobs per block materially. A second increase follows shortly after. Those steps are the catalyst for the biggest fee cuts.

- Quarter after launch: Measure the follow through. Did fee reductions stick during peak hours or just on quiet days. Did batch cadence rise across the board. Did bridge spreads narrow. Did DA providers revise pricing.

Edge cases and real risks

- Short bursts of congestion can still bite. If everyone tries to post larger blobs at once, the base fee rises. Fusaka makes it cheaper on average, not free always. Builders should throttle batch size during spikes and keep reserve headroom.

- Tooling debt can mute savings. If your gas estimation library does not understand blob dynamics, you can overpay for weeks. Builders should update gas price oracles and expose hints specific to blobs.

- Retrieval is still a product. Lower posting costs are great. Long term access to history is a separate promise. DA vendors that can audit retrieval, provide on-chain proofs, or offer verified mirrors will stand out.

The bottom line

Fusaka is not a flashy feature for end users. It is a plumbing upgrade that alters the economics of blockspace. PeerDAS makes it safe to add more blob capacity. Blob-Parameter-Only raises the ceiling in two deliberate steps. When you increase the supply of what rollups need most, fees fall and business models adapt. Users feel it as cheaper trades and faster outbound transfers. Builders feel it as simpler capacity planning and less defensive engineering. Sequencers feel it as a new margin stack where speed and reliability become the battleground. Data availability providers feel it as a market that demands both better prices and better guarantees.

If you want a shorthand for the next quarter, use this. First the network widens the pipe, then the market explores the new room, and then the winners are the teams that convert cheaper data into better experiences without wasting the headroom. Fusaka lights the match. The blob fee wars decide who learns fastest.