Post Pectra Ethereum: Smart Accounts and Staking Reset UX

Ethereum’s Pectra upgrade flipped two baselines at once: native smart-account powers with EIP-7702 and bigger effective validator balances. Here is how wallets, staking markets, and L2s will compete over the next six months.

What just changed with Pectra

On May 7, 2025, Ethereum activated Pectra on mainnet, a bundled upgrade that shipped three user facing changes. First, it gave externally owned accounts a native path to act like smart accounts. Second, it raised how much stake a single validator can effectively hold, which simplifies operations at scale. Third, it increased blob capacity for cheaper data, which fuels a new round of Layer 2 competition. See activation details in the Ethereum Foundation’s Pectra mainnet announcement.

This piece explains what those changes unlock, how they show up in products, and which teams benefit in the near term.

Native smart accounts move from theory to default

For years, account abstraction lived in two worlds. There was the research vision and standards work such as ERC 4337, and there were production smart wallets like Argent and Safe. Pectra narrows that gap by letting a regular address temporarily delegate to contract logic at the protocol level. The specific mechanism is defined in EIP 7702, which introduces a transaction type that allows an externally owned account to set a delegation pointer to contract code for the duration of execution. If you want the technical guts, the EIP 7702 specification is the canonical reference.

Think of EIP 7702 as a secure adapter that lets today’s keys speak the language of tomorrow’s wallets. You keep your address. For a given transaction, the address can delegate to audited wallet code that performs richer logic, then revert to being a simple address when done. That one change enables three visible upgrades to wallet experience.

Sponsored gas without hoops

Many first time users hit a cold start problem. They have no ether to pay fees, but they need to pay a fee to get started. With delegation, a wallet can point a transaction to well known paymaster code that accepts a signature and pays gas on the user’s behalf. The code can enforce policy, such as only sponsoring the first three transactions or limiting the maximum gas paid per day. The user sees a clean flow: sign up, approve one prompt, and their first action just works.

Expect paymaster providers to compete on reliability, coverage across chains, and fraud controls. Infrastructure outfits like Pimlico, Biconomy, Alchemy, and Stackup are positioned to offer production grade paymaster and bundler services to wallets maintained by Coinbase, MetaMask, Rainbow, and Uniswap.

Social recovery that fits human lives

People forget passwords, lose phones, and rotate laptops. Custodial services remove that risk by holding keys, but many users want self custody with a safety net. Delegation lets a user pre approve a recovery policy in wallet code. For example, three guardians can approve a key reset after a two day delay, or the user can set a second device as a recovery factor with a daily spend limit. This mirrors how financial apps work outside crypto.

Batched actions that feel like one click

Many onchain interactions require multiple steps. Approve a token, call a contract, then move the output somewhere else. With delegation, the wallet’s code can combine steps into a single atomic operation. The user sees a clear summary in one prompt, signs once, and either the entire plan succeeds or nothing happens.

Consolidated staking resets incentives

Before Pectra, the protocol capped a validator’s effective balance at 32 ether. Large operators who wanted to stake more had to spin up many validators, which multiplied keys, attestations, and operational complexity. Pectra raised that cap and introduced a consolidation path. In practice, this means big operators can merge many small validators into fewer larger ones, and solo stakers can compound without hopping in 32 ether chunks.

Why this matters beyond operator ergonomics:

- Lower overhead per ether staked. Running one heavier validator is cheaper to coordinate than running dozens of small ones.

- Clearer compounding for solo stakers. A solo staker with, say, 40 ether no longer needs two validators to get rewarded on their full balance.

- Fewer redundant keys, fewer failure modes. Fewer validators per operator can shrink blast radius in slashing scenarios and reduce network chatter.

Liquid staking tokens will revisit fees and node policies

LSTs such as stETH and rETH built around 32 ether units. With consolidation, two things change at once:

- Same capacity, fewer machines. Protocols can tighten standards without sacrificing throughput. Expect stricter hardware and networking requirements and faster offboarding for underperformers.

- Fee structures get reviewed. If cost per unit of stake drops, protocols that share gains with token holders will attract flows. Transparent rebasing or loyalty tiers become differentiators.

Restaking and LRTs will chase safer yield

Restaking layers ride on top of base staking by letting staked ether secure additional services. Consolidation changes two inputs to that model:

- Operational risk can decline as professional operators run fewer keys with better tooling, making SLAs and slash insurance more credible.

- Exit logistics get simpler, enabling faster responses to liquidity crunches or market rotations.

More blobs, cheaper data, and an L2 UX war

Blobs are a special kind of data that rollups post to Ethereum to prove and settle their work. Before Pectra, the network targeted roughly three blobs per block on average. Pectra increased the target to six and raised the ceiling to nine per block, paired with changes that cap worst case block size so bandwidth usage stays sane. That gives rollups more elbow room and lowers their cost basis when demand spikes. For related background on data availability, see how PeerDAS triggers an L2 fee freefall.

Cheaper data alone does not win users. It removes excuses. With fee headroom, rollups must compete on experience and scope:

- Onboarding. Paymasters and delegated execution make it trivial for a rollup to sponsor the first mile. Expect Base, Optimism, and Arbitrum to showcase native gas sponsorship for new users inside branded wallets and partner apps.

- Intents and background trading. With batched execution and lower fees, wallets can route orders across venues and settle at the best price without nickel and dime costs. Rollups that offer good state access, fast preconfirmations, and reliable sequencers will be favored by these routers. The security side of this is evolving with OP fault proofs and Arbitrum BoLD.

- Faster bridges and clearer finality. As blob space gets less spiky, bridging paths can cut worst case fees and improve estimates. Rollups that publish proofs on a steady cadence and offer simple safety toggles in official bridges will gain trust with mainstream apps.

- Developer ergonomics. The cost decrease enables more frequent commits, richer indexing, and in wallet analytics.

What to watch next

Live now

- Early delegated flows for sponsored gas and batched approvals are shipping in leading wallets.

- Rollups and infrastructure providers are updating fee guidance to reflect cheaper blob space.

In 60 days

- LST governance updates propose revised fee splits, operator scorecards, and watchdog controls with side by side cost models pre and post consolidation.

- LRT insurance coverage launches with measurable, onchain triggers and clear claim processes.

- Rollup UX polish surfaces native sponsorship options and restartable batched actions with improved state access and debugging.

In 90 days

- Wallets expose delegated defaults for sponsored gas and one click approvals, with clearer summaries before you sign.

- Paymaster reliability dashboards report sponsorship rates, rejection reasons, and latency by chain.

- Staking operators publish consolidation schedules with downtime plans and updated monitoring for correlated failure modes.

- Rollups tweak fee markets to pass through cheaper blobs as lower recommended fees and saner gas curves.

In 120 days

- Social recovery goes mainstream with guardian based recovery and spending limits as first class options. Custodians and exchanges begin supporting these flows for withdrawals and allow listing.

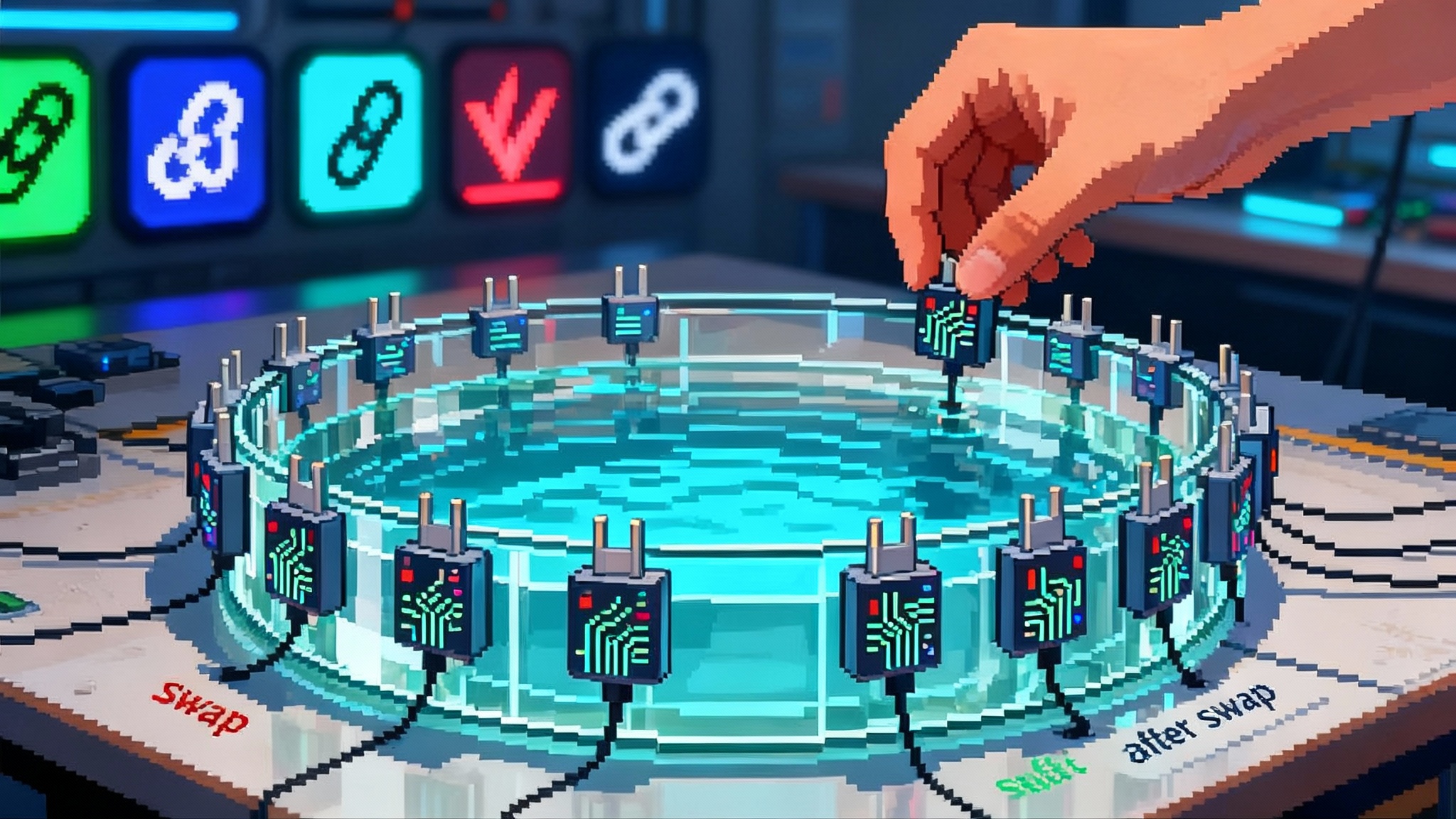

- One click complex actions arrive in top DeFi apps, combining approvals, swaps, locks, and claims into a single signature that reads like a receipt. Expect deeper integrations as Uniswap v4 hooks reshape DeFi UX.

- LST scorecards mature with operator consolidation progress, post incident reviews, and standardized compounding disclosures.

- LRT safety rails highlight not only yield, but also quantifiable risk scores tied to operator quality, exit times under stress, and correlated risk hedging.

In 180 days

- L2 feature races showcase fewer failed transactions, better preconfirmations, and cross chain intent routers. A new user should be able to install a wallet, receive a sponsored starter balance, and complete a multi step action in under a minute without buying ether.

Pectra’s through line is simple. With native smart account powers, consolidated staking, and more blob headroom, excuses fall away. The next cycle of competition will be won on reliability, clarity, and default safety rather than on complexity.