EigenLayer Multichain Restaking puts Ethereum Security on L2s

EigenLayer’s multichain verification began rolling out in July 2025 on Base Sepolia, extending Ethereum-grade security to Layer 2 networks. With slashing live since April 17, 2025, AVSs can now run on fast rollups, reshaping fees, MEV, and yield.

The week portable trust got real

In April 2025, EigenLayer turned on one switch that critics said would define whether restaking was a serious security model or just a TVL magnet. Slashing went live on April 17, with penalties for misbehavior enforced on mainnet by the protocol’s council. That flipped programmable trust from an idea into a rule set that operators and Actively Validated Services must respect, on chain and in code. EigenLayer’s forum announcement marked the moment.

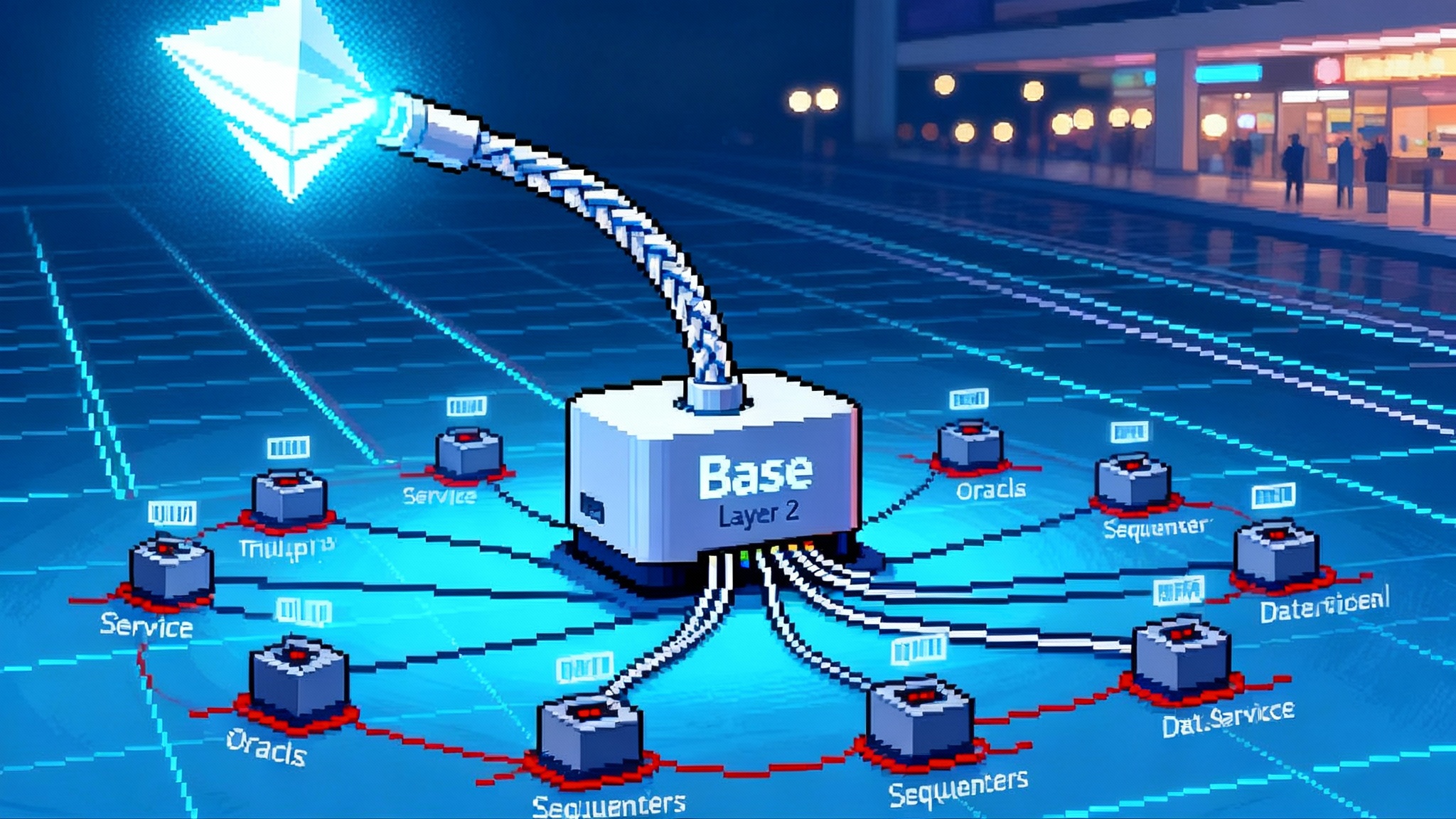

Now comes the second switch. In July 2025, EigenLayer’s multi-chain verification began rolling out, starting on Base Sepolia, with mainnet deployments planned through the second half of the year. The quiet but telling proof sits in the project’s own release matrix, which now shows multichain support across Ethereum and Base environments. For builders, that line item means AVSs no longer have to live on Layer 1 to inherit Ethereum’s pooled security. They can execute on a fast, low-fee Layer 2, validate against the same restaked capital, and still face slashing if they lie. Check the Supports Multichain column in the EigenCloud docs under the releases and compatibility matrix.

Think of it like this. Until now, AVSs were like shops that had to rent a storefront in the most expensive downtown block to access the best security guards. With multi-chain verification they can open at the mall, still hire the same guards, and keep the alarm wired to the same central station. Rent drops, foot traffic improves, and security does not degrade.

AVSs in one sentence, then the new trick

An Actively Validated Service is any off-chain or cross-chain service that needs its own set of validators to check claims or perform work. Examples include data availability networks, oracles, cross-chain messaging, zero knowledge proof verification, decentralized sequencing, and specialized compute. On EigenLayer, those validators are not built from scratch. They rent security from restaked Ether and related strategies. Slashing enforces truthful behavior. Restaking supplies the shared bond. The result is a marketplace for trust.

Multi-chain verification adds a simple but powerful capability: AVSs can now run their logic on Layer 2s and other compatible chains, while their security, operator configuration, and slashing rules remain rooted in the same pooled stake. Verification becomes portable, so developers can chase cheaper blockspace without forking their trust model. As L2 data availability advances, expect fee pressure to intensify, especially with milestones like PeerDAS triggers L2 fee freefall.

What it unlocks for fee markets on L2s

-

Cheaper verification, more transactions: Many AVS workloads are chatty. Oracles update frequently. Fast finality layers run round after round. Zero knowledge services batch and attest. Shifting these hot loops to a low-fee rollup can cut cost multiplicatively while keeping the same security backstop. That makes previously marginal services viable and changes the breakeven point for new categories like micro-oracle feeds or high-frequency state committees.

-

New participants in L2 gas auctions: AVSs become recurring, predictable buyers of L2 blockspace. This is not just more users, it is a new class of programmatic demand that can shape fee curves, saturate off-peak blocks, and deepen the market for short-term fee futures offered by some sequencers. Expect L2s that attract AVS clusters to see steadier fee floors and more visible demand from operators hedging costs.

-

Fee routing as a product choice: An AVS can choose where to pay for computation. If Base, Optimism, Arbitrum, or Scroll offer lower effective cost for their specific transaction patterns, verification can move there. That turns L2s into suppliers in a wholesale verification market, not just retail user chains. Bundled discounts for AVS pipelines and gas rebates targeted at restaked services are likely next. For context on Base’s enterprise momentum, see JPM Coin debuts on Base.

MEV when verification travels

Maximal Extractable Value is the value captured by ordering, including or censoring transactions. When verification is portable, MEV changes in three concrete ways:

-

Cross-domain ordering pressure: If an AVS certifies outcomes that applications on Ethereum mainnet consume, then sequencing on the L2 that hosts the AVS can affect value on Layer 1. Searchers will pursue strategies that link the two timelines. Expect more demand for shared sequencing or at least coordination layers that can offer preconfirmations and integrity guarantees between an AVS chain and the destination chain.

-

Slashing as a preconfirmation tool: With April’s slashing live, AVSs can promise preconfirmations and penalize misbehavior. A fast finality AVS that runs on an L2 can issue time-bound commitments to users or dapps and back those promises with restaked collateral. That can compress certain MEV opportunities, especially those that rely on reorder risk within a wide settlement window, and route more value to users, protocols, and restakers.

-

Orderflow specialization: Some AVSs will vertically integrate with wallets or dapps to collect domain-specific orderflow, then sell integrity-protected preconfirmations to builders. Portable verification reduces their cost to run in high-throughput environments, which should widen the menu of orderflow markets beyond generalized mempools. Work like OP fault proofs and Arbitrum BoLD will coexist with restaked preconfirmation layers, each addressing different trust and latency needs.

Yield stacking is real, and risk stacking is too

Restaking allowed operators and depositors to earn base Ethereum staking yield plus rewards from the AVSs they support. Multi-chain verification can add yet another layer of potential rewards by lowering the cost to run services, increasing volume, and, over time, opening new fee splits tied to L2 activity. That is the appealing part.

The sober part is correlated risk. When multiple AVSs rely on overlapping operator sets and similar software stacks, failures rarely stay isolated. A buggy client, a bad build pipeline, or a misconfigured key management module could trigger simultaneous faults across several AVSs. With slashing active, that becomes a capital event, not just an uptime incident.

Practical guardrails developers and asset managers can use now:

-

Cap exposure per operator and per AVS: Publish a risk budget per liquid restaking token and per operator, measured as maximum slashable stake across correlated services. Make the caps enforceable in contracts where possible.

-

Enforce diversity at the edges: Require client and cloud diversity for operators, track it on chain, and pay more to operators who run independent stacks. A little redundancy is cheaper than a lot of slashing.

-

Stage rollouts with circuit breakers: For AVSs that move to L2s, start with low-value commitments and expand stake limits gradually. Include a kill switch that halts new attestations if predefined liveness or correctness thresholds are breached.

-

Separate duties: Do not let the same key material or signing service handle on-chain execution and off-chain verification across multiple AVSs. Segmentation limits blast radius.

Governance and the politics of portable verification

Slashing rules are policy. When an AVS moves verification to an L2, policy must travel with it. Conflicts can arise when an AVS upgrades its rules on one chain but not another, or if a sequencer outage on the host L2 causes missed attestations that look like faults.

Expect three governance pressure points in the year ahead:

-

Cross-chain rule synchronization: AVS teams need versioning that is explicit and machine-checked across chains. Publish hashes of slashing conditions, include activation epochs, and reject attestations from mismatched rule sets.

-

Appeals and adjudication: Create a shared playbook for disputes that spans chains. If an operator claims an L2 fault caused a missed attestation, who decides and on which chain is restitution recorded? Without clarity, operators will overprice risk.

-

Delegated power concentration: As more AVSs default to a small set of professional operators, vote power and upgrade keys will coalesce. Mitigate this by rewarding long-tail operators for reliability and by using committees with rotating membership for sensitive duties like emergency halts.

The competitive squeeze: alt-L1s and standalone sequencers

Alt Layer 1 chains have traditionally sold two things: speed and a fresh validator set. Multi-chain verification weakens both differentiators.

-

Speed without a new trust base: An AVS can now get speed from an L2 and keep Ethereum’s trust. That makes the new validator set pitch less compelling unless it delivers a clearly superior developer experience, dramatically lower hardware costs, or unique functionality like integrated high-performance data availability.

-

Financing and distribution: AVSs that would have launched as appchains can instead deploy on an L2 and inherit user distribution, tooling, and bridges. Capital that would have bootstrapped a new validator set can be spent on growth.

For shared sequencers, the message is adapt or specialize.

-

Integrate with restaking: Offer staking adapters, produce proofs or preconfirmations secured by restaked collateral, and make slashing or withholding penalties enforceable. Portable verification means customers will ask why they should trust a sequencer that cannot be punished.

-

Specialize where needed: Global fairness, privacy-preserving ordering, verifiable low latency, and audited fallback protocols for censorship resistance. If those are provably better than restaked alternatives, there is room for a premium.

Early adopters to watch

Status varies across testnets and mainnet, but these named projects have publicly aligned with the AVS model or restaked security and are well positioned to be first movers on L2s as multi-chain verification matures:

-

Data and proofs: EigenDA from Eigen Labs, Lagrange state committees for zero knowledge light clients, and Brevis for proving and query services.

-

Oracles and data services: RedStone, which announced an AVS model and integrations with restaked collateral, and eOracle, which has pursued AVS-based delivery of feeds.

-

Cross-chain and interoperability: LayerZero and Consensys’s Infura Decentralized Infrastructure Network are early slashing adopters and natural multi-chain candidates. Hyperlane and Omni target cross-rollup messaging with restaked security.

-

Sequencing and preconfirmations: AltLayer’s MACH AVS for fast finality on rollups, Espresso and Radius exploring shared sequencing with economic guarantees, and Polymer for interoperability with routing.

-

Security and monitoring: Witness Chain for location and work attestations, Automata and Fairblock for programmable privacy and execution controls.

This list is not exhaustive, and in several cases the current deployments are in test or phased mainnet rollouts. The important signal is that the builder pipeline is broad, and the cost to place verification on an L2 is dropping as tooling matures.

Concrete playbooks for builders and investors

-

If you operate an AVS today: Benchmark your workload on at least two L2s. Model fee sensitivity for your attestation cadence and data footprint. Replace a portion of on-chain checks with a pattern that posts succinct claims to Layer 1 and performs heavy work where blockspace is cheap. Keep slashing checks and dispute resolution visible on Ethereum for credibility.

-

If you run a rollup: Court AVSs as enterprise buyers. Publish a pricing page for verification workloads with estimates for 100, 1,000, and 10,000 attestations per hour, plus storage tiers. Offer observability hooks tailored to AVSs so operators can prove they met service level objectives.

-

If you manage a liquid restaking token or operator set: Publish a correlation map of your AVS exposures. Use explicit opt-ins for higher risk AVSs and charge basis points that match their slashing severity. Share client and cloud diversity stats.

-

If you are evaluating alt-L1 strategy: Either become a restaked rollup that uses Ethereum as an anchor, or deliver a clear user-facing win that a restaked L2 cannot copy. Speed alone is not a moat once portable verification is available.

Why this changes the 2026 roadmap for RWA, DePIN, and cross-chain infra

-

Real World Assets: Off-chain registries, oracles, and attestations can run where fees are pennies, while final commitments settle to Ethereum and remain slashable. Expect asset issuers to migrate verification to L2s, enabling higher update frequency for price or compliance checks, and tighter service level agreements.

-

Decentralized physical infrastructure networks: Sensor attestations, location proofs, and job marketplaces can run as AVSs on L2s, with work receipts anchored to Ethereum and dishonest behavior slashable. This reduces the cost of high-frequency proofs and makes business models with many small payments viable.

-

Cross-chain infrastructure: Messaging, bridging, and liquidity routing services benefit the most. With portable verification, teams can co-locate execution with the most active user base and still keep a single, punishable trust root. That reduces fragmentation and should compress the time to launch cross-chain products from quarters to weeks.

The bottom line

EigenLayer’s April slashing activation gave restaking teeth. July’s multi-chain verification gave it reach. Together they turn Ethereum’s pooled security into a portable good that AVSs can take to where the users are, without trading away accountability. Fee markets on L2s will thicken, MEV will reorganize around enforceable preconfirmations and cross-domain orderflow, and yield stacking will continue, now with risk management in the foreground. Alt-L1s and standalone sequencers will either integrate with restaked security or prove new value that portable trust cannot replicate.

That is the real breakthrough. Security used to be a place on a map. In 2026 it looks more like a network service, rented by the hour, priced by the attestation, and carried to any chain that can host it.