From Ghost Shark to Swarms: How XL-AUVs Scale to War

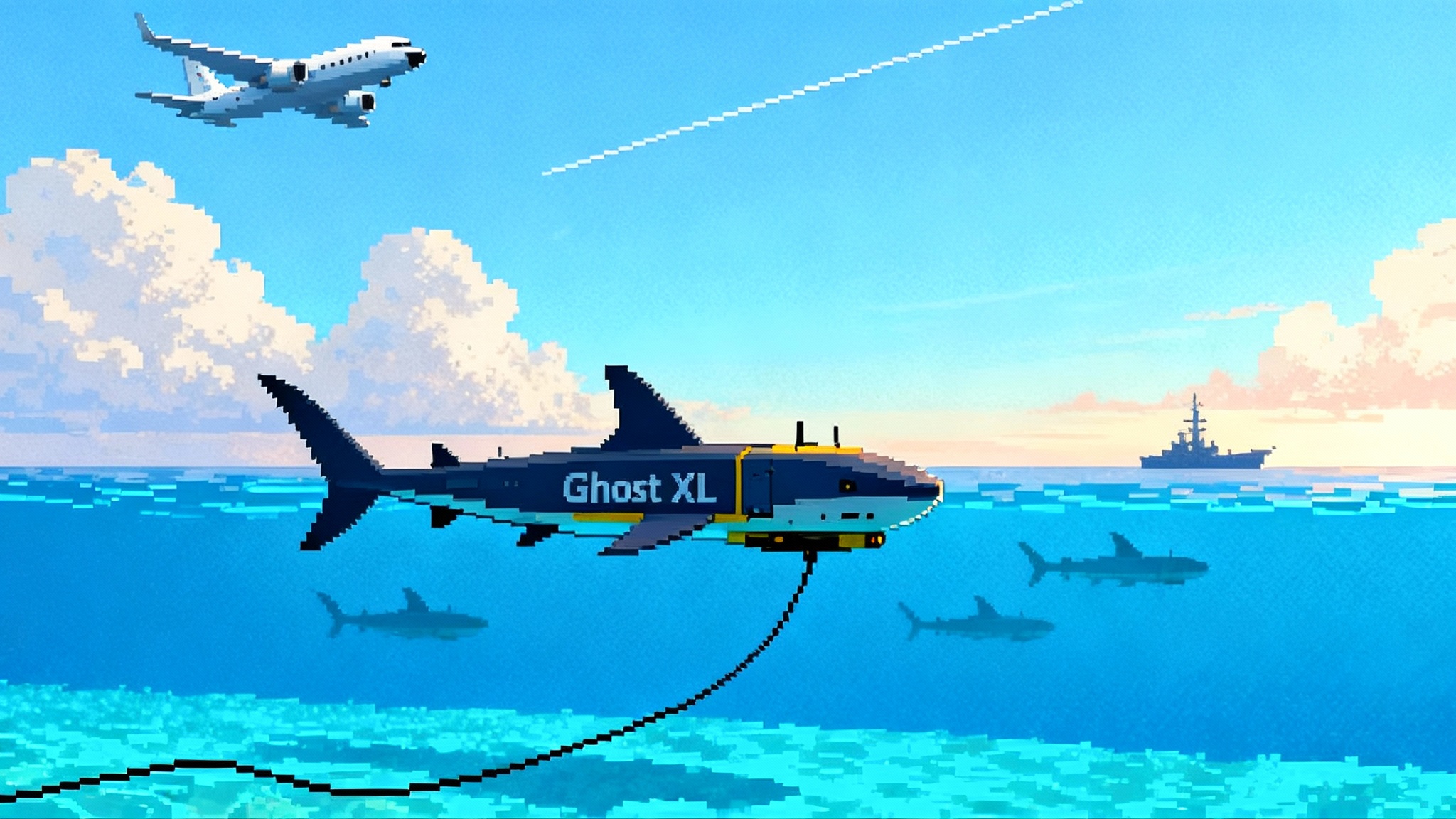

Australia just locked in a Ghost Shark fleet, signaling that extra‑large autonomous subs are moving from prototypes to massed systems. The shift will reshape anti‑submarine warfare, seabed security, and coalition kill chains across AUKUS.

A switch flips under the sea

Australia did not just buy a new widget. By putting Ghost Shark on contract as a program of record, Canberra signaled that extra‑large autonomous undersea vehicles are leaving the lab and entering the order of battle. The government confirmed an A$1.7 billion Ghost Shark program in September 2025, with dozens of vehicles to be built in Australia and fielded to the Royal Australian Navy. Three prototypes have already shaken out early risks. The next step is production, integration, tactics, and scale.

This is not a boutique science project. It is the first credible attempt by a U.S. ally to field a large fleet of extra‑large AUVs at speed, with long endurance, modular payloads, and a software pipeline designed for rapid iteration. It raises a bigger question for every navy in the Indo Pacific. How do you move from one or two prototypes to dozens that matter in a fight, and then network them into a coalition kill chain where humans, crewed platforms, and swarms of uncrewed systems cooperate under tight rules of engagement?

Why XL‑AUVs now

The oceans are getting more crowded and more wired. Submarines still matter, but cost, crew constraints, and maintenance cycles limit how many hours a navy can keep steel on station. XL‑AUVs, roughly the size of small submarines, offer long endurance, stealthy transit, and modular bays for sensors, mines, decoys, or strike payloads. They are expensive compared to small UUVs, but far cheaper than a submarine and available in larger numbers. In practice, they can do three things at scale that smaller robots or crewed boats cannot do as well:

- Persistent presence across chokepoints, with the patience to wait and the range to move when cued.

- Seabed effects, from cable surveillance to mine laying, and countering the same from adversaries.

- Risky first contact, where a commander wants to sense forward or deliver a blow without risking a crew.

Australia’s bet: software first, production fast

Ghost Shark’s most important feature is not a single sensor or secret payload. It is the industrial and software model around it. The program brought the Defence Science and Technology Group, the Royal Australian Navy, and Anduril Australia into a tight loop that treats autonomy software as a living system. Hardware is modular, payloads are containerized, and the production line is designed to ramp. The goal is to push updates and variant payloads on weeks and months cycles, not years. That mindset echoes how other programs are scaling autonomy, as seen when Replicator moves from hype to hardware.

That approach matters for three reasons:

-

The ocean fights back. Salinity gradients, currents, and acoustic clutter change daily. AUV behaviors improve fastest when teams can fly often, learn from real data, and ship autonomy updates.

-

Payload churn. Intelligence, surveillance, reconnaissance, deception, mine warfare, and strike each demand different combinations of sensors and effectors. A modular bay with well defined power and data makes it realistic to swap payloads without redesigning the whole vehicle.

-

Cost control. Rapid manufacture of a common hull and common control system lets a navy add capacity without requalifying a bespoke configuration every time.

Australia also made a choice on secrecy. The government is not publishing exact numbers. That protects operational security, and it underscores a reality about XL‑AUVs. Their value scales with uncertainty. If an adversary must plan against the possibility that several dozen stealthy vehicles are already in position, the deterrent effect arrives before the first sortie.

The U.S. Orca: a different route to the same destination

The U.S. Navy’s Orca XLUUV has taken a longer path. The program funded five operationally relevant prototypes in 2019 and a separate test and training asset. The Navy accepted the first test vehicle in late 2023 and planned further deliveries after developmental testing. For a current view of budgets, objectives, and the program’s transition plan, see the CRS report on Navy unmanned programs. The U.S. focus began with long range mining, notably concepts like Hammerhead, and is now broadening to multi mission roles.

The contrasts are instructive. Australia compressed co development and acceptance into three intense years, then jumped to production. The U.S. approach has been more traditional, with detailed requirements, extensive developmental testing, and a gradual transition toward procurement. Both routes can work. The choice reflects risk appetite, regulatory regimes, and the industrial base on hand. The practical lesson is to align the acquisition model with the intended scale. If the goal is dozens quickly, requirements must be modular and software must be easy to update inside a disciplined safety and security framework.

And China’s play: numbers, variety, and seabed focus

Beijing publicly revealed the HSU 001 large UUV in 2019, and open source imagery since shows a growing menagerie of large and extra large vehicles. The thread that ties them together is seabed operations and attritable mass. China’s shipyards can build hulls at volume, and its research institutes have churned through many configurations. Even if any single design is less advanced than Orca or Ghost Shark, the ability to field many, quickly, complicates allied planning.

For planners in Canberra, Washington, and Tokyo, the simple takeaway is that the undersea domain will no longer be a duel between a handful of crewed submarines. It is becoming a combined arms environment with many uncrewed systems operating at once, each trying to find, fix, deceive, or disable the other.

From prototype to massed combat system

Fielding one impressive demonstrator is easy to celebrate. Turning that into decisive combat power is a grind. Four transitions determine whether an XL‑AUV program can scale.

-

Reliability at sea. Autonomy frameworks are only as good as the propulsion, power, and navigation stacks that carry them. Programs need mean time between mission failure metrics that climb with each software release and each batch of hulls.

-

Mission autonomy that grows. Early deployments will be supervised, with operators handing off waypoints and approving behaviors. Real scale arrives when behaviors can be pre authorized, with onboard sensing and classification good enough to execute within a commander’s intent without constant communications.

-

Manufacturing flow. XL‑AUVs need automotive discipline more than artisanal shipbuilding. Build stations, common test harnesses, and repeatable quality checks allow a navy to add ten more hulls without multiplying risk. Lessons from uncrewed surface vessels are relevant, as Defiant sea trials signal crewless era.

-

Training and TTPs. Tactics come from repetition. Crews on P‑8s, frigates, and submarines must learn when to cue a swarm, how to deconflict with friendly robots, and how to interpret robotic sensor feeds. That training has to include coalition partners from day one.

What swarms mean for ASW

A dozen XL‑AUVs do not replace a submarine. They change the shape of anti‑submarine warfare in three ways:

- Find and fix. Distributed XL‑AUVs can carry low frequency passive arrays, magnetic anomaly detectors, or active sources that ping rarely and in coordination. Broader baselines yield better target tracks when fused with sonobuoys and seabed arrays.

- Persist and pounce. Robotic pickets can sit on the approaches to key waterways for weeks, then cue aircraft or a hunter killer submarine when signatures cross a threshold. If an engagement is authorized, they can deliver lightweight torpedoes or armed decoys to slow and mark a contact until a crewed shooter arrives.

- Saturate the problem. Even high end submarines struggle when faced with many sensors from many bearings. XL‑AUVs provide that saturation at manageable cost.

Guarding the seabed

Pipelines, power interconnectors, and a spiderweb of fiber optic cables are now strategic terrain. XL‑AUVs bring the right mix of endurance, payload capacity, and stealth to monitor and defend them. Three practices will matter most:

- Routine route surveys, with change detection that flags anomalies faster than human analysts can manage.

- Covert tagging, where suspicious contacts receive a persistent tracker rather than an immediate confrontation, letting authorities build a case and plan an intercept.

- Rapid response kits, containerized payloads that pivot a hull from ISR to interdiction in hours.

Defending cables is not only a naval job. Utilities, oil and gas operators, and cable consortia must share plans and data, with disclosure pathways that protect sensitive methods while allowing practical coordination.

AUKUS Pillar II and coalition kill chains

AUKUS Pillar II is about advanced capabilities, not submarines. XL‑AUVs are natural Pillar II citizens because they force integration across the enterprise. A credible coalition kill chain looks like this:

- Space and airborne assets detect pattern breaks along a likely submarine track. Think synthetic aperture radar from space, multispectral cues from high altitude drones, and P‑8 acoustic fleets. Space transport and routing improvements like the SDA Tranche 1 LEO mesh help move the right data to the right shooters.

- Ghost Sharks and U.S. Orcas reposition to a picket line. Some carry active sources, others carry passive arrays or deployable sensors. A few tote expendable decoys that emulate submarine signatures.

- A coalition undersea picture assembles from many imperfect pieces. Classification confidence crosses a threshold. A commander authorizes an autonomous track and trail, with engagement preconditions set.

- If conditions are met, the robots slow the target with harassment tactics, reveal it to coalition aircraft or a submarine, and hold contact through handoff.

The glue here is shared software, common data models, and gateways that translate between national systems without leaking crown jewels. Pillar II can earn its keep by funding shared autonomy test ranges, cross certification of safety cases, and a catalog of containerized payloads that plug into either Ghost Shark or Orca with minimal integration overhead.

Exports and the Indo Pacific ripple effect

An Australian production line for XL‑AUVs, built around modular payloads and secure autonomy, is an export engine in waiting. Countries that cannot crew more submarines can still buy undersea presence at scale. Likely early adopters include Japan for chokepoint surveillance, South Korea for peninsula defense, and Southeast Asian states that want to watch cables and gas fields without sending crews into harm’s way.

Export success will hinge on three policy moves:

- Clear pathways for autonomy software export, with guardrails that separate core navigation and safety code from mission behaviors.

- Pre approved payload packages. ISR bundles will travel farther and faster than strike modules. That is fine, ISR at scale still changes deterrence math.

- AUKUS aligned security frameworks that let partner operators train together and share underwater air tasking orders without creating new intelligence risks.

If Australia can show that fielding and supporting dozens of Ghost Sharks is routine, not exotic, it will set the regional standard for how to buy, train, and sustain these fleets.

The hard questions: C2, ROE, and accountability

Autonomy underwater is constrained by physics. Radios do not work at depth, acoustic comms are slow and reveal position, and surfacing to phone home is often unacceptable. That makes command and control and rules of engagement the crux of responsible fielding.

A practical approach looks like this:

- Human on the loop by design. Commanders pre authorize behaviors tied to geofenced areas and time windows. The vehicle executes within that box and logs everything for audit.

- Positive control, even if intermittent. Vehicles carry multiple communications options, from very low probability of intercept acoustics to fiber optic tethers for pier side uploads. They surface only in preplanned windows and at covered positions.

- Engagement logic as a sealed module. Lethal behaviors live in a separately validated package that checks for multiple independent cues, such as acoustic classification plus non acoustic confirmation, before arming. If confidence falls, the logic reverts to trail and report.

- Fail safes. If the vehicle loses navigation integrity or cannot confirm target identity within the ROE window, it stands down and exfiltrates.

Accountability follows the same pattern as with mines and torpedoes. Humans set the conditions. The system records decisions and sensor context. After action reviews can assign responsibility and improve the logic.

The other hard question: what stops a swarm

Counter UUV defenses will mature quickly. Expect a layered approach.

- Sensing. Variable depth sonars on frigates, low frequency active sources, seabed arrays that listen for pumpjets and motor harmonics, and uncrewed surface vessels towing compact sonars.

- Targeting. Acoustic and magnetic change detection fused with space and airborne cues. If an XL‑AUV must rise to communicate, aircraft and satellites watch for that.

- Effects. Small anti UUV torpedoes, entangling nets near ports, shaped charges placed by divers along funnels, and expendable devices that flood a volume with confusing sound to break autonomy classifiers.

- Deception. Acoustic decoys that look like a submarine from one bearing and a reef from another. False seabed anomalies to soak up survey time.

XL‑AUV designers can respond with quieter drives, smarter behaviors, and more passive sensors. The race will resemble the mine and countermine duel at larger scale and with more software on both sides.

What to watch next

The measure of success will be visible in a few concrete signals:

- Production cadence. Are new Ghost Sharks rolling out on a drumbeat, and are upgrades hitting the fleet without long recertification delays?

- Hours, not headlines. Are vehicles accumulating thousands of safe, boring hours at sea between major failures?

- Joint exercises. Do P‑8 crews, surface combatants, and submariners treat XL‑AUVs as normal teammates during allied drills, with shared undersea pictures and clean handoffs?

- Payload diversity. Do we see repeated mission packages cycling through the same hulls, ISR this month, counter mine next month, and deception later?

If the answer is yes, then Australia’s decision will have done more than buy a fleet. It will have accelerated a coalition wide shift in how undersea power is generated and applied.

Bottom line

Ghost Shark’s leap to a program of record compresses a decade of promise into a near term reality. The U.S. Orca is converging on the same goal along a heavier path, while China presses a numbers and variety strategy. XL‑AUVs will not replace crewed submarines, but they will change the geometry of anti‑submarine warfare, raise the bar for seabed security, and stitch new links into coalition kill chains under AUKUS Pillar II. The navies that win this race will be the ones that treat autonomy as software first, train with their robots as teammates, and answer the hard questions about control and responsibility before the first shot is fired.