Retro’s Autophagy Alzheimer’s Pill Enters Human Trials

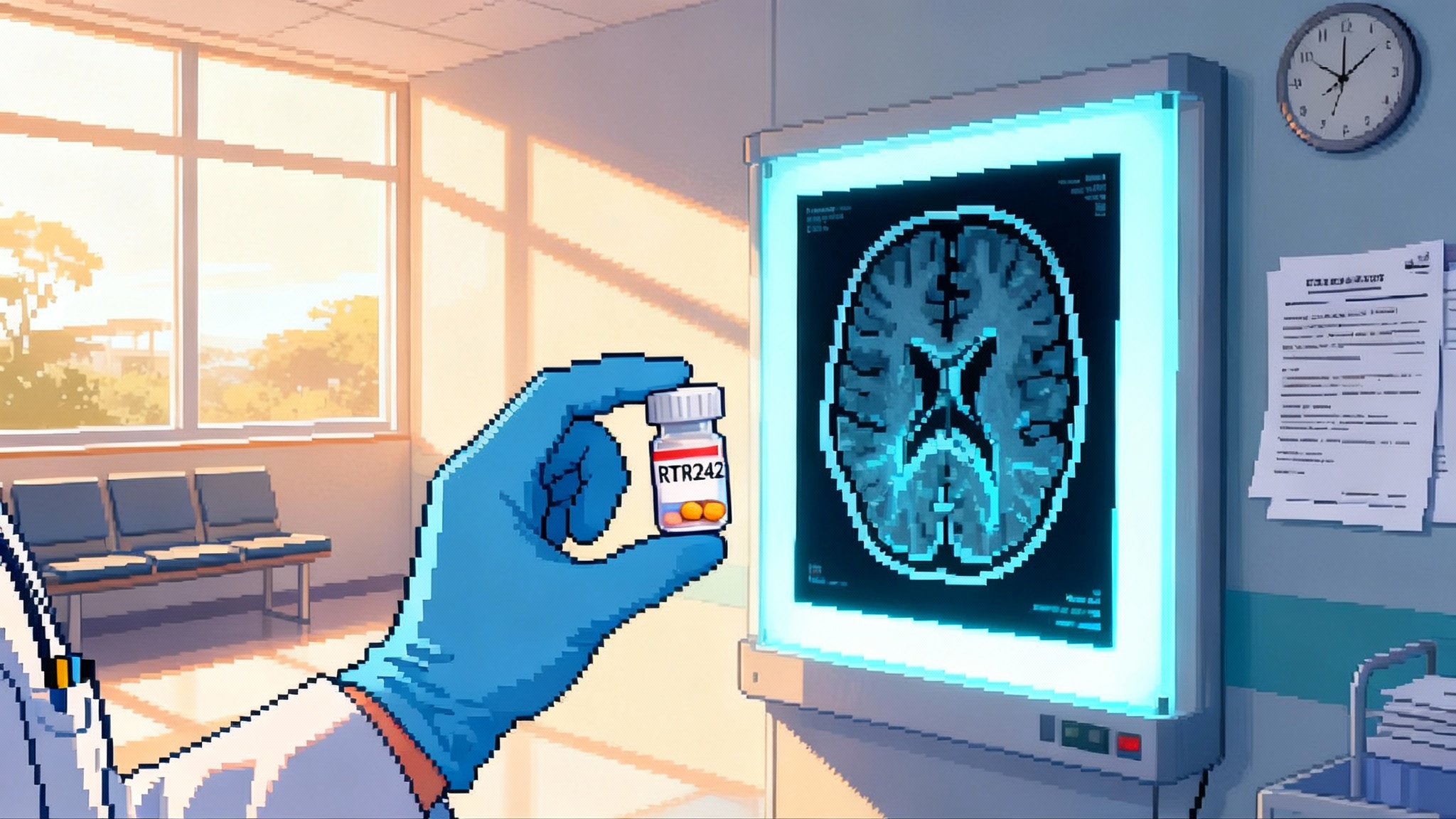

Retro Biosciences will dose its first Alzheimer’s patients in Australia with RTR242, an autophagy-boosting pill. The study is a test case for proving longevity mechanisms through disease endpoints, and for a new path in regulation and funding.

An Alzheimer’s trial with a longevity spine

Retro Biosciences plans to dose its first participants in Australia by late 2025 with RTR242, a small molecule designed to restore cellular cleanup in the brain. The company calls the target autophagy, the cell’s recycling system, and it is positioning this Alzheimer’s study as the first human test bed for a broader longevity thesis. The choice of Australia is tactical, where early phase startup timelines can be faster under the TGA’s Clinical Trial Notification pathway, and where sponsors can pair clinical work with an R&D tax incentive that softens cash burn. In other words, this is a disease trial with a longevity spine, built to both show patient benefit and de‑risk a mechanism that could carry across multiple age‑related conditions. Retro has publicly said it plans to dose in Australia by late 2025.

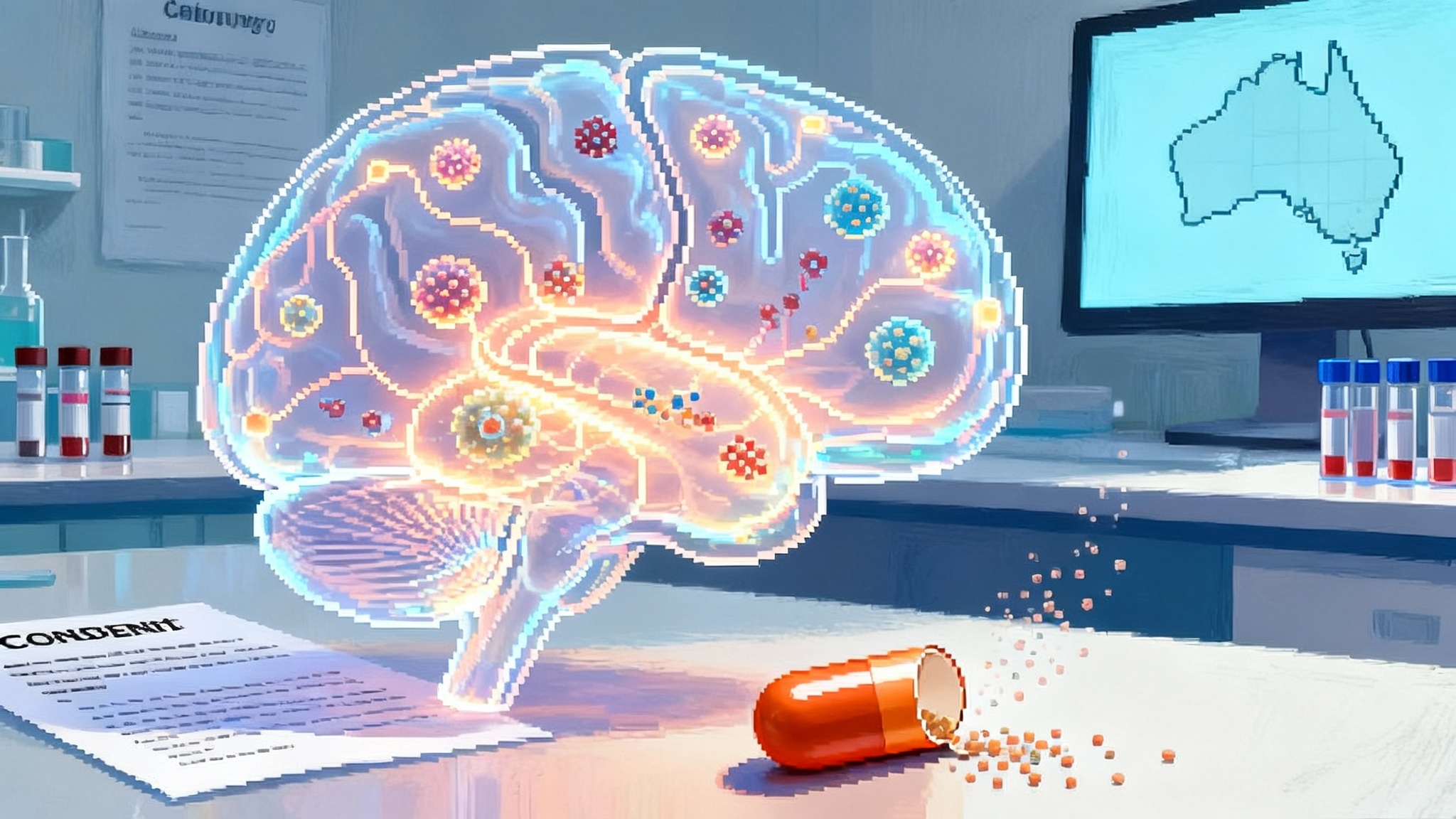

Why autophagy is a high leverage lever

Autophagy is a housekeeper that becomes sluggish with age. Neurons accumulate misfolded proteins, damaged mitochondria, and lipids. In Alzheimer’s, protein quality control fails, and compartments that normally fuse and digest cellular waste get clogged. Turning that system back on is attractive because it sits upstream of many age‑linked pathologies. It is also one of the few conserved mechanisms that has extended healthy lifespan in animal models when boosted, and that has clear ties to neurodegeneration when it falters. A strong clinical win for an autophagy enhancer would validate a mechanism that is plausibly relevant to dementia, metabolic disease, cardiovascular aging, and even aspects of immune senescence. For a primer on the pathway’s role from cancer to neurodegeneration, see this overview of autophagy in human disease.

There is another reason autophagy is high leverage. Biology provides many downstream symptoms to treat, but relatively few upstream levers that touch several at once. Autophagic flux sits close to the root of proteostasis, organelle quality control, and cellular energy balance. A pill that safely increases flux in brain cells without deranging other tissues would be a rare general purpose tool. The risk is that autophagy is context dependent. Too little is toxic, too much or mistimed could stress cells or support survival of cells we would rather remove. Any first‑in‑human program has to thread that needle.

The longevity via disease playbook

Aging is not an approved indication. Regulators in the US, Europe, and Australia evaluate drugs against diseases with accepted diagnostic criteria and clinical endpoints. The way around that constraint is straightforward. Pick a disease in which your aging lever is clearly implicated, run a solid study, and if you show benefit on the accepted endpoints for that disease you get a label. Then expand. The strategy is not new, but what is new is using a mechanistic lever like autophagy and instrumenting the trial so it reads out not only disease outcomes but also evidence that the lever moved in humans.

Retro’s choice of Australia fits the pattern many small biotechs follow. Under the TGA’s CTN pathway, early phase studies can start once a Human Research Ethics Committee and the site approve the protocol, with the sponsor notifying the regulator rather than submitting a full pre‑study review. That can compress timelines and reduce friction for dose‑finding and mechanistic work. Pair that with an R&D tax incentive that can return a portion of eligible spend, and you have a jurisdiction that is friendly to first‑in‑human programs. The tradeoff is that you still need rigorous data and follow‑on studies in the regions where you eventually seek market approval.

What endpoints could validate longevity mechanisms in humans

If RTR242 is an autophagy enhancer, the trial should try to prove two things at once. First, that patients with early Alzheimer’s do better on recognized measures. Second, that the drug engaged the intended longevity mechanism in human tissue and shifted broader aging biology in the right direction. That second goal is where the field can make a leap.

Build the endpoint stack like this:

-

Clinical cognition and function. Use ADAS‑Cog, CDR‑SB, and ADCS‑ADL to anchor the primary and key secondary outcomes. These are the currencies regulators already accept. Even small but reliable improvements or a slowing of decline can justify moving to Phase 2 or 3.

-

Disease biology imaging. Include amyloid and tau PET to show that any cognitive effect is not simply a placebo artifact. FDG‑PET can capture regional brain metabolism. High quality MRI with hippocampal volumetrics and diffusion metrics can detect structural and microstructural changes. Even if the mechanism is not amyloid centric, these scans triangulate on disease activity and safety.

-

Fluid biomarkers of neurodegeneration. Plasma and CSF neurofilament light chain and GFAP provide sensitive indicators of axonal and astroglial injury. If a drug reduces these levels or the slope of change, it suggests real impact on ongoing brain damage. It also gives an early read before clinical scores diverge.

-

Markers of proteostasis and autophagic flux. This is the heart of the longevity validation. Plan to measure p62 and LC3 in peripheral blood mononuclear cells to assess flux surrogates. Consider a small, optional CSF sub‑study to look at autophagy‑linked cargo or proteostasis indices. Time your sampling to capture dynamic changes after dosing. Use transcriptomic signatures of lysosomal and autophagy gene activation in blood as orthogonal support. No single marker is definitive in humans today, but a convergent pattern across assays would be persuasive.

-

Microglial state and neuroinflammation. PET with a second generation TSPO ligand and CSF cytokine panels can show whether immune tone in the brain is normalizing. Given that Retro is also pursuing microglia replacement as a separate program, showing that autophagy modulation nudges microglia toward a homeostatic state would link programs conceptually.

-

Systemic aging signals. Include exploratory epigenetic clocks in blood, circulating proteomic clocks, and functional measures like gait speed or grip strength. These are not approvable endpoints for Alzheimer’s, but they are valuable for the longevity case. If you can show a small but consistent shift in biological age markers, you create a through‑line from an Alzheimer’s label to a prevention or multi‑indication strategy later.

-

Safety with special attention to dose and tissue selectivity. Because autophagy affects many tissues, watch liver enzymes, cardiac conduction, and muscle metabolism. If you see clean safety across organs, you lower the risk for translation into other age‑related diseases.

The goal is not to prove aging reversal in one go. It is to publish a data package that says: we made neurons better at cleaning up their own mess, brain injury signals went down, and cognition tracked in the right direction. That moves autophagy from mouse success story to human mechanism with clinical relevance.

How this reframes regulation and funding

Regulators care about patients getting better or declining more slowly, and they care that mechanisms are plausible and monitored for risk. If a first Alzheimer’s trial of RTR242 hits disease endpoints and shows target engagement for autophagy, it does three things at once.

-

It opens a clear follow‑on path in Alzheimer’s, where later phase studies can be powered for clinical effect and safety over longer periods. That is the traditional path to approval and coverage.

-

It provides human evidence that an autophagy lever can be tuned in a living brain. That is the bridge to prevention cohorts and to indications like Parkinson’s, frontotemporal dementia, and even systemic diseases where proteostasis loss matters.

-

It gives investors a way to fund longevity without waiting for regulators to define aging. Capital can flow into disease trials with accepted endpoints, yet still de‑risk mechanisms that have multi‑disease upside. If the Alzheimer’s signal is clean, the same pill can justify studies in metabolic liver disease, certain cardiomyopathies, or combination regimens with senolytics, each with clear endpoints and payers.

On the financing side, this matters. Drug development is a sequence of risk gates. A company that can show target engagement and a plausible disease benefit will find it easier to raise large late‑stage rounds or strike partnerships. If Retro’s plan works, it validates a template for others in the longevity space to follow. We will see more programs that start in a disease hot zone, pack their protocols with mechanism readouts, and then fan out across the age‑related disease map.

Risks and tradeoffs versus amyloid‑first strategies

The last two years put anti‑amyloid antibodies on the map. Lecanemab and donanemab showed that clearing amyloid can slow clinical decline in early disease, and they won approvals, coverage, and real world uptake. That is the benchmark any new Alzheimer’s approach must meet or beat. Both drugs also carry risk of ARIA brain swelling and bleeding, require infusions and MRI monitoring, and come with substantial costs for health systems.

An autophagy pill has a different profile. If it works, it could be easier to administer, cheaper to scale, and less dependent on imaging infrastructure. It might also treat a broader slice of Alzheimer’s biology, because proteostasis and organelle quality control do not stop at amyloid. Yet there are clear risks.

-

Mechanistic uncertainty. Amyloid removal gives a measurable target. Autophagy flux is harder to quantify in humans. Negative or ambiguous biomarker results could leave even a modest clinical signal open to skepticism.

-

Off‑target or on‑target toxicity. Enhancing cellular cleanup too aggressively might harm cells under certain stress conditions. Peripheral tissues could react in unexpected ways. Safety will dominate early interpretation.

-

Heterogeneous patients. Alzheimer’s is not one disease. If benefits cluster in molecular subtypes, the first trial may miss them without pre‑specified stratification.

-

Payer realism. Even if effects are real, payers will ask how the pill stacks against antibodies, or whether it should be combined with them. Combination studies add cost and time, but they may be the best way to show additive benefit, for example pairing amyloid removal with improved intracellular cleanup.

The fairest view is that autophagy and amyloid are not rivals so much as layers. Clearing extracellular plaques while improving intracellular recycling could be synergistic. The question is whether RTR242 can deliver enough signal on its own to merit that next wave of combination work.

What to watch as dosing begins

-

Dose and schedule. Look for whether the program starts with single ascending dose and multiple ascending dose cohorts in healthy older adults or moves quickly into early Alzheimer’s. The balance between speed and interpretability will matter.

-

Biomarker transparency. Companies often hesitate to show mechanistic data early. Here, transparency is leverage. Clear, time‑locked changes in flux surrogates, neurodegeneration markers, or imaging would build confidence and momentum.

-

Patient selection. Early disease with biomarker confirmation has been the winning zone for antibodies. Expect a similar focus here. If the study enrolls too broadly, signals will blur.

-

Safety gradient. A clean safety profile in brain and periphery is the foundation for a larger longevity vision. Watch for class‑like effects that might limit dosing. Also watch for any suggestion of sleep, mood, or metabolic side effects, since autophagy intersects with those axes.

-

Secondary hints of general aging impact. Even small shifts in systemic aging markers would be a landmark. The first study will not decide that question, but it can lay track for future work.

The bigger bet

The most important thing about RTR242 may be what it represents. The longevity field has spent years collecting wins in worms, flies, and mice. It has also collected disappointments when those wins did not translate cleanly to humans. A mechanistic, disease‑anchored human trial with rich endpoints is a different kind of bet. It recognizes that regulators pay for disease benefit, that payers demand clear outcomes, and that investors need concrete milestones. It still lets science answer the deeper question: can we move an upstream aging lever in people and see the downstream benefits that models promised.

If the answer is yes, the space opens fast. If the answer is no, the field gets a rigorous negative that will shape better approaches. Either way, dosing a first autophagy Alzheimer’s trial is a hinge moment. It is longevity argued with data.