Agent Marketplaces Go Live: The New AI Distribution War

Enterprise AI has entered its distribution era. Agent marketplaces and lifecycle platforms are becoming the rails for digital labor. Here is how winners in 2026 will be picked on channels, pricing, reliability, and operations.

The app store moment for digital labor

For a decade, the conversation around enterprise AI centered on how smart models were and how quickly new benchmarks fell. That era is ending. In 2025, the center of gravity shifted from raw model intelligence to distribution, governance, and day two operations. The clearest signal arrived in March when Salesforce launched the AgentExchange trusted marketplace, a storefront for partner built actions, topics, templates, and complete agents that plug directly into its Agentforce platform. One day later, Salesforce unveiled Agentforce 2dx with new proactive and multimodal capabilities, plus testing and monitoring features meant to make agents behave like accountable coworkers rather than unruly chatbots.

By June, Databricks announced Agent Bricks, a beta product that automatically generates task specific evaluations, synthetic data, and optimization loops so enterprises can build reliable agents on their own datasets without endless prompt tinkering. In October, Amazon Web Services moved its agent infrastructure out of preview and into production. Amazon Bedrock’s AgentCore is now generally available, bringing a runtime with long execution windows, identity and observability services, a standardized tool gateway, and support for the Model Context Protocol. Around the same time, Boomi pushed governance features into the spotlight with Agentstudio, including an Agent Control Tower, centralized registries, and anomaly detection to catch misbehaving agents before customers do.

Call it what it is: the app store moment for digital labor. In 2026, the winners will be decided less by whose model gets one more point on a leaderboard and more by who can distribute agents widely, price them transparently, and keep them dependable under real world pressure.

Why distribution beats IQ in the enterprise

Once model quality crosses a good enough threshold, the adoption bottleneck moves. Procurement leaders ask: Can I buy it from a trusted channel, install it quickly, govern it centrally, and hold someone accountable when it breaks? That is a distribution question, not a model IQ question.

- Distribution compresses time to value. If an agent is one click away inside a system employees already use, adoption starts tomorrow, not next quarter.

- Distribution enforces trust. Marketplace security reviews, standardized packaging, and usage analytics create a shared baseline for reliability.

- Distribution scales support. A crowded market will favor vendors who turn support, upgrades, and rollback into predictable operations instead of bespoke projects.

The new playbook looks much more like mobile in 2008 than machine learning in 2018.

Four vendors, four channels

Salesforce: the in workflow channel

Salesforce sells agents where work already happens: in the customer relationship management screens that plan a sales call, open a case, or issue a refund. With AgentExchange live on March 4, 2025, and Agentforce 2dx announced March 5, the company pairs a curated storefront with first party controls. That pairing matters. If you list an agent in a generic marketplace, you still need to wire it into data, identity, and workflow. Salesforce flips it. Agents show up already embedded in the workflow and authenticated against customer data. The marketplace entry is not the final mile. It is the on ramp.

Mechanically, Salesforce’s packaging model is opinionated: partner actions, topics, and templates map to how teams actually compose an agent. That encourages consistent behavior, safer defaults, and clear routes to reimbursement for partners who specialize in specific industries, such as insurance claims or field service.

Amazon Web Services: the infrastructure channel

AWS is designing for breadth. AgentCore ships the long running runtime, memory, identity vaults, and standardized tool discovery an enterprise will eventually need, then routes adoption through the familiar fabric of cloud services and the AWS Marketplace. This is a classic Amazon strategy. Make the primitives a team can scale with for five years, not five weeks. Identity aware authorization, private networking, and first class observability are not nice to haves when an agent can file a refund or alter a supply plan.

Two architectural choices will decide whether AgentCore becomes the backbone for many vendors’ agents rather than just Amazon’s own:

- The gateway that translates existing APIs and servers into agent ready tools. Translation beats rebuild nine times out of ten.

- Explicit support for the Model Context Protocol and other agent to agent patterns. Interop shrinks integration projects from months to days when agents can discover each other and communicate over a predictable spec.

Databricks: the data channel

Databricks starts from a different premise: if agents will act on enterprise data, then evaluation and governance must live where that data already sits, with lineage, access controls, and audit logs close at hand. Agent Bricks, introduced June 11, 2025, marries automated evaluations with synthetic data and optimization search over cost and quality. Instead of asking teams to invent their own test harness for every new workflow, the platform composes them automatically and shows the quality cost tradeoff upfront.

The company also leans on its ecosystem. MLflow, long a standard for experiment tracking, now traces agent steps and versioned prompts across environments. That means a support ticket about a wrong refund can be traced to a specific agent decision with the same rigor as a failed data pipeline.

Boomi: the governance channel

Boomi comes from integration and automation, which frames agents as one more class of endpoint to govern. Agentstudio’s Control Tower aggregates agents built on other platforms, not just Boomi’s own, and can register, monitor, and eventually throttle them. That is attractive to enterprises that expect a mixed estate: one team standardizes on Salesforce, another uses AgentCore, a third pilots Databricks for analytics agents. Rather than force consolidation on day one, Boomi’s pitch is consistent guardrails across all of them. The September 2025 updates, including Model Context Protocol support and structured inputs and outputs, push toward a predictable runtime where agents compose more like microservices than mystery boxes.

Pricing will reward clarity, not cleverness

The last generation of enterprise software pricing was dominated by seats and tiers. Agent pricing will be different because work is different. A sales agent that drafts emails and updates opportunities eats token budgets and tool calls. An operations agent that audits orders runs batch jobs and sometimes launches another agent.

Expect three models to coexist by late 2026:

- Per operation bundles for transactional agents. Think refunds processed, invoices reconciled, or claims adjudicated. This aligns cost to a business event and is easy to forecast. It also forces vendors to publish definitions for what counts as an operation and what happens on retries.

- Runtime hours for complex workflows. Long running agents with background tasks need the equivalent of compute hour pricing, plus unit caps for safety. AgentCore’s long execution windows hint at this path.

- Value based pricing for outcome agents. High leverage agents that move revenue or reduce risk will see experimentation with value sharing. That only works when evaluations are rigorous and auditable, which is why platforms are racing to ship testing centers and traceable metrics. For context on model efficiency, see how adaptive reasoning resets cost curves.

The trap to avoid is clever pricing that hides risk. Enterprises will favor vendors who state the units, list the caps, offer circuit breakers, and publish a cost to quality curve that a business owner can understand.

Reliability becomes a product, not a promise

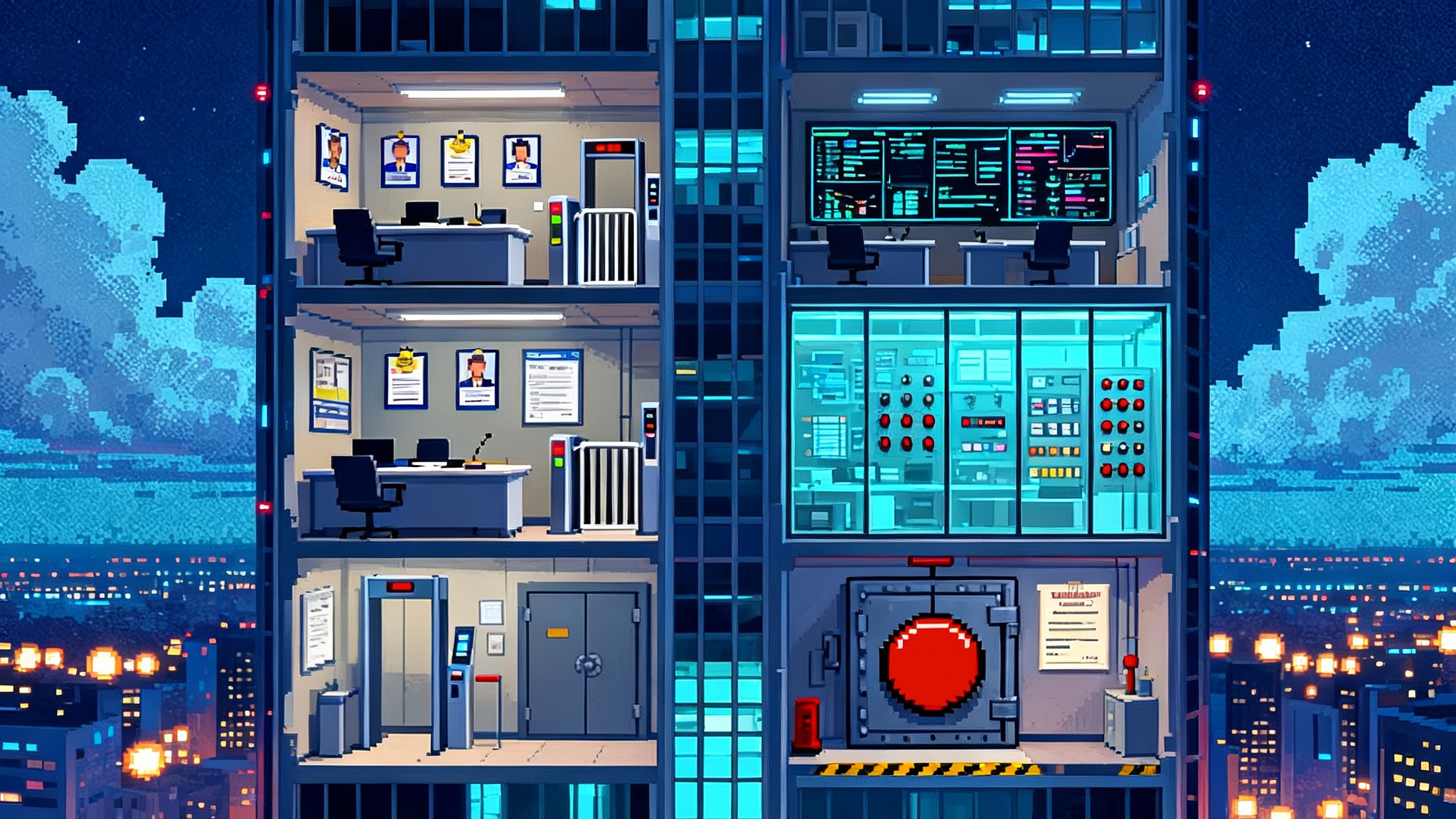

Agents fail differently than apps. They can change their minds, wander into loops, or make apparently reasonable decisions that violate policy. That shifts reliability from uptime to outcome consistency. The operational stack that wins the trust battle in 2026 will have five properties:

- Structured inputs and outputs. Free form text is useful for exploration. Production agents need typed schemas so downstream systems do not guess what a field means.

- First class evaluations. Every release should include agent specific test suites that run on representative data, capture regressions, and quantify quality and variance, not just average scores.

- Traceability. Teams need to reconstruct what an agent saw, thought, and did to explain decisions to customers and auditors. Tracing must be default, durable, and queryable across providers.

- Identity and secrets hygiene. An agent that acts on behalf of a user should use bounded credentials with explicit scopes, time limits, and clear renewal paths.

- Safe autonomy. Background agents should operate within declared budgets and blast radius. If an agent exceeds an error rate or uses too many retries, it should self downgrade or pause until a human reviews.

You can see these ideas materializing in vendor roadmaps. Salesforce added a testing center and analytics to Agentforce 2dx. AWS built observability dashboards and identity vaults into AgentCore. Databricks wired agent traces into MLflow to connect data lineage with agent decisions. Boomi added anomaly detection and registry driven controls to catch and quarantine agents that drift. For a deeper view of guardrails, read the agent trust stack.

The new routes to market

If distribution decides winners, then the practical question is where agents will be discovered and purchased. Three channels are emerging:

- In product marketplaces. Salesforce’s AgentExchange is the purest example. It places agents, actions, and templates inside the workflow surface where people already spend their day. The friction to try is low, and the context for governance is strong because listings pass standard security reviews.

- Cloud marketplaces. AWS has decades of muscle memory selling software through its marketplace. As more agent solutions package themselves for the cloud procurement model, expect standardized billing, consolidated invoices, and private offers to become normal for agents too.

- Data and integration platforms. Databricks and Boomi are not just selling agents. They are selling the ability to evaluate, deploy, and monitor agents that live on top of enterprise data and connect into existing processes. That turns procurement into a platform decision rather than a one off app purchase.

The practical implication for buyers is to decide whether you want your procurement gravity to sit in a workflow suite, a cloud console, or a data platform. Once you choose, momentum builds around that choice.

What builders should do now

The next 12 months will separate teams that ship production agents from teams that ship demos. Here is a concrete plan.

-

Pick one distribution channel and optimize for it.

- If your users live in Salesforce, treat AgentExchange as your primary storefront. Package actions and templates the way Salesforce prescribes so customers can discover you inside Agent Builder. If you target cloud buyers, certify for the AWS Marketplace and wire billing into private offers early.

-

Treat evaluation as the backbone, not an afterthought.

- Write task specific test suites that mirror how customers use your agent. Include pass fail checks, tolerance bands, and cost targets. Automate regression runs against every change. If you are on Databricks, use the Agent Bricks pattern of synthetic data plus LLM judges to get depth without risking private data.

-

Instrument everything.

- Capture traces for inputs, tool calls, model responses, decisions, and outputs. Adopt a common trace schema so you can compare behavior across vendors. Connect traces to ticket systems so support can reproduce incidents in minutes, not days.

-

Make identity and policy part of the runtime.

- Issue short lived, scoped credentials for privileged actions. Store secrets in a vault and rotate them automatically. Encode policy checks as steps in the agent plan so they are tested and versioned like any other code.

-

Ship with circuit breakers.

- Define error budgets and cost budgets per agent. If an agent exceeds its budget, auto downgrade to a safer plan or pause. Expose override controls in your admin console so operators can triage live incidents without redeploying.

-

Publish a buyer friendly bill of materials.

- Document models, tools, data sources, and evaluation scores in human terms. List failure modes and mitigation steps. Buyers are going to compare your transparency against their internal risk templates. Help them say yes.

-

Run pricing experiments with real users.

- Try per operation and runtime hours on the same workflow to see which aligns better with value. Track support volume and refund rates by price plan. If you cannot explain your unit economics to a finance leader in five minutes, simplify.

-

Prepare for multi agent interop.

- Design your agent to communicate over a standard protocol and to accept structured messages from other agents. Even if you sell a complete solution, customers will stitch together heterogeneous agents for complex workflows.

How 2026 could shake out

- Workflow suites will win by proximity. If an agent is surfaced in the same place a rep logs calls or a dispatcher schedules routes, it will benefit from immediate context and faster approvals. Expect Salesforce and similar suites to dominate in their core domains.

- Clouds will win by scale and trust. Identity, networking, and observability are comfort food for enterprise security teams. If AWS makes it trivial to deploy third party agents with these baked in, the Marketplace becomes the path of least resistance for many buyers.

- Data platforms will win by rigor. When results must stand up to audit, the ability to tie an agent’s decision back to governed data and a reproducible evaluation will trump convenience. That positions Databricks to lead on analytics and operations use cases where correctness beats speed.

- Integration platforms will win by control. In mixed estates, Boomi’s promise of a single control plane and anomaly detection across providers speaks directly to operations leaders whose first job is preventing surprises.

The equilibrium will not be winner take all. The decisive factor will be how well each vendor turns distribution into dependable outcomes for specific jobs. Customers will prefer a boring agent that always closes the ticket correctly over a brilliant one that occasionally frees an invoice that should be blocked.

A buyer’s quick due diligence

If you are evaluating agents for 2026 deployment, insist on the following:

- A marketplace or channel listing with clear packaging and security review status

- Published evaluations on representative tasks, including variance not just averages

- Structured I O contracts and a schema registry

- Traceability with export to your observability stack

- Identity scopes, vault storage, and secret rotation plans

- Circuit breakers for cost and error budgets

- A pricing unit you can map to business value

If any vendor balks at these, that is your red flag.

The bottom line

Enterprise AI has moved from intelligence to infrastructure, from models to markets. Agent marketplaces and lifecycle platforms are not side shows. They are the new rails for digital labor. The vendors that master channels, price with clarity, and make reliability obvious will look like the winners by the end of 2026. Builders who align to those rails now will not just ride the wave. They will help lay the track.