Onchain Dollars Go Retail: USDC Checkout, Visa, and PYUSD

Stablecoins just moved from speculation to settlement. Stripe and Shopify are lighting up USDC at checkout while Visa expands stablecoin settlement and PYUSD scales through PayPal and Coinbase. Here is what changes for fees, flows, and builders.

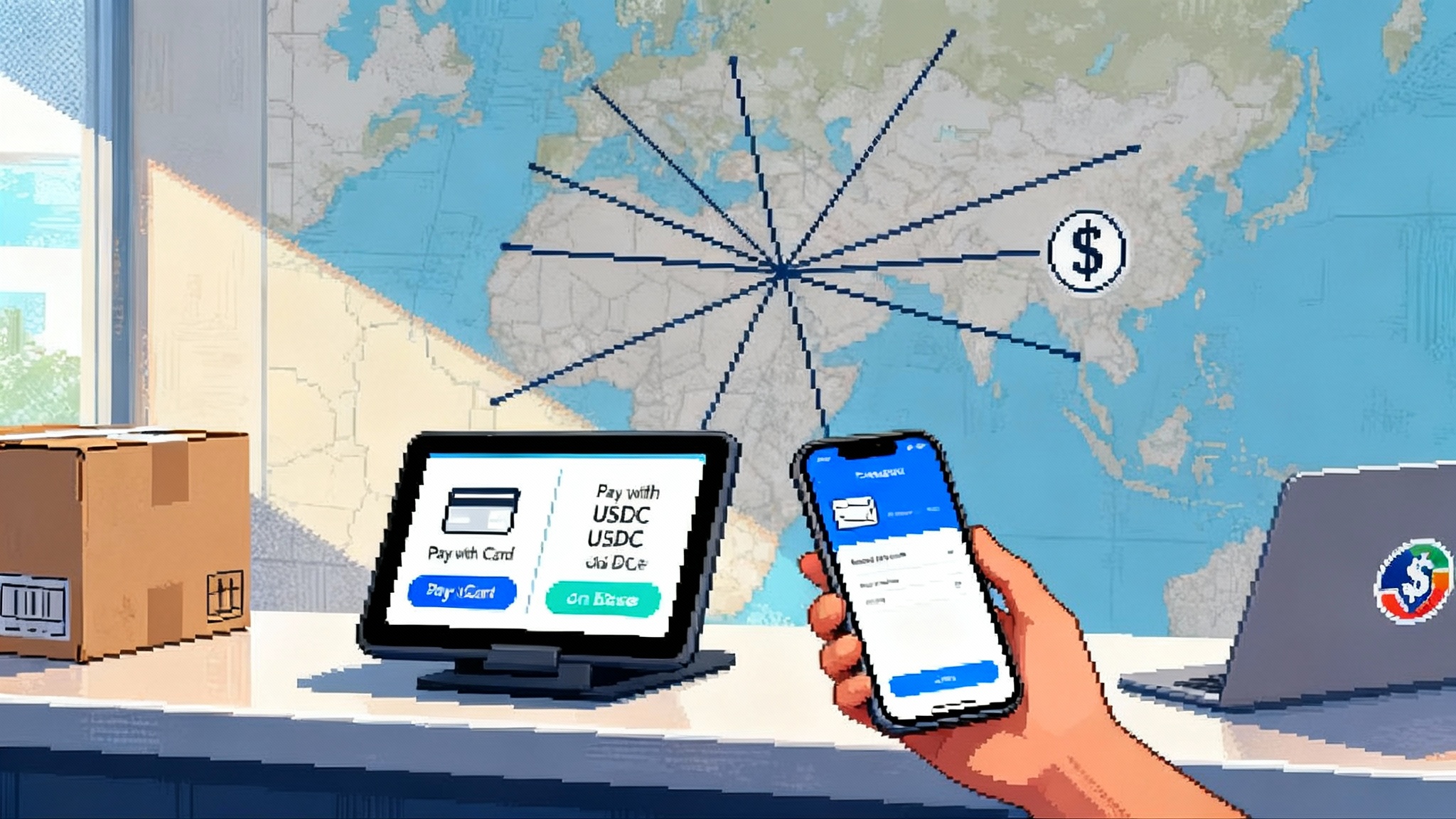

The moment stablecoins became a checkout button

For a decade, stablecoins lived in the trading pit. They greased crypto markets, parked cash between moves, and rarely touched everyday commerce. That wall just cracked.

Stripe now lets businesses accept USDC and similar dollar tokens at checkout, with funds settling as United States dollars in a merchant's Stripe balance, and with subscription support where applicable. The announcement sounds modest, but it flips the script from speculation to settlement by making onchain dollars behave like a familiar payment method in a familiar dashboard. See the Stripe stablecoin payments overview for current networks, fees, and billing support.

Shopify is rolling out USDC acceptance inside Shopify Payments on Base. Customers can pay from hundreds of compatible wallets, and merchants can choose to receive local currency automatically or claim USDC to a wallet. That means a brand can test onchain dollars without swapping gateways or retraining the team. Review the Shopify USDC payments details.

Visa, meanwhile, is extending stablecoin settlement across more blockchains and assets. That does not change the logo on the customer's card, but it changes how money ultimately moves between banks and processors. And PayPal with Coinbase are scaling PYUSD distribution and redemption, putting a regulated, consumer‑brand stablecoin into one of the largest retail crypto funnels in the United States.

Taken together, these moves plug onchain dollars into mainstream payment flows. You do not need a web3 team to try them. You need a settings toggle, a few lines of code, and a clear plan for fees, refunds, taxes, and risk.

From speculation to settlement: what actually changes

Think of card rails as highways with toll booths. Every booth takes a small cut. In domestic card payments, the cut often includes interchange to the issuer, assessment fees to the networks, processing fees to the acquirer, and extras for chargeback risk. In cross‑border transactions, merchants can also pay currency conversion and international assessments. This machinery is reliable and ubiquitous, but it is not cheap for international orders or micropayments.

Onchain dollars work differently. The customer pays from a wallet. The processor confirms the transfer on a blockchain, then credits the merchant. Two practical shifts follow:

-

Fewer middlemen per transaction. Processors still earn a fee, but stablecoin flows can compress layers that add cost in international card payments.

-

Programmable finality. Once a payment finalizes onchain, the state is set. That can reduce disputes and clawbacks for certain use cases, but it also changes refund and reconciliation playbooks.

Early stablecoin offerings make these trade‑offs explicit. Stripe settles in dollars to a merchant's Stripe balance at a posted fee and documents supported networks, subscription support, and dispute handling. Shopify's help center spells out network support, wallet compatibility, and what is not supported yet, like subscription products in the USDC early access flow.

Fee math you can explain to a CFO

Use concrete numbers in your model. For illustration only:

- Domestic card transaction for a 60 dollar order: effective cost often lands between roughly two and three percent plus a fixed fee, depending on your industry, card mix, and processor plan.

- Stablecoin checkout via a processor: one line‑item processor fee. Compare apples to apples. Include currency conversion, cross‑border surcharges, chargeback losses, and refund costs in your all‑in card rate. Include processor fees, onchain network behavior, and refund mechanics in your stablecoin rate.

For cross‑border orders, onchain dollars can remove currency conversion spreads entirely if you price in dollars and settle as dollars. That is especially helpful when your buyers already hold USDC. Combine that with faster settlement cycles, and your treasury team may cut pre‑funding buffers for certain markets.

What Visa's move signals for interchange and cross‑border

Visa's expansion of stablecoin settlement means issuers and acquirers can move value between themselves using onchain dollars on more networks. In the near term, retail merchants will not see a Stablecoin button under Card. The benefit shows up in the back office: less reliance on slow cross‑border bank wires for settlement, optionality in currencies, and the ability to program treasury rules around time zones and liquidity windows. Over time, competition at the settlement layer tends to pressure total cost of acceptance and speed of funds, which can flow through to merchant economics.

Subscriptions and payouts move onchain too

Recurring billing and payouts are where stablecoins shine because programmability translates directly into simpler automation.

-

Subscriptions: Stripe supports recurring billing flows with stablecoins, including via invoices. Keep your catalog and dunning while accepting onchain dollars. Shopify's current USDC early access does not allow subscription products at checkout, so treat Shopify as one‑time payments for now and Stripe for recurring.

-

Payouts: Shopify allows merchants to claim USDC to a connected wallet or take local currency automatically. That gives you a simple way to push onchain dollars to a treasury wallet without a separate crypto gateway. If your marketplace or gig platform uses Stripe, payees can still receive funds in fiat, but expect processors to expand onchain payout options as stablecoin settlement becomes ordinary.

The result is a cleaner loop: charge in USDC where it makes sense, settle as dollars by default, keep subscriptions in Stripe if you need them, and gradually route selective payouts onchain for suppliers, creators, or international contractors.

Base plus wallet UX are becoming the default consumer rails

Two signals matter for builders:

-

Shopify's USDC runs on Base. That choice standardizes the buyer experience across many wallets and removes gas fees for the buyer in this flow. Merchants get simplicity. Customers get a clear path to pay on a single, low‑cost network.

-

Stripe already supports Base among its stablecoin networks. When the checkout surface and the processor both speak Base, you can design a wallet experience that just works for mainstream users without chain hopping. For context on consumer wallets going mainstream, see how Galaxy Wallet goes crypto native.

A pragmatic builder playbook for U.S. merchants and apps

Start with the simplest objective: lift conversion on international checkouts while lowering cost and operational drag. Then expand to subscriptions and payouts.

Step 1. Identify the right products and countries

- Use your analytics to find markets where card declines, chargebacks, or cross‑border fees are highest.

- Choose one or two product lines with high international demand and low return rates, plus digital goods with instant fulfillment.

Step 2. Turn on USDC in the easiest channel first

- If you use Shopify Payments and are eligible, enable USDC in settings. Default to automatic conversion to your local currency to minimize accounting changes. If you want onchain treasury exposure, claim USDC to a wallet once per week and reconcile.

- If you bill subscriptions, prototype with Stripe's stablecoin payments instead. Keep everything in your existing invoices and customer objects and let Stripe settle as dollars.

Step 3. Design the wallet journey

- Offer a clear Pay with USDC on Base entry and list supported wallets. Keep a plain English explainer at payment selection that tells buyers two things: which network you accept and whether they will pay any extra fees.

- Add a help link for moving USDC to Base. Do not make customers hunt for bridges at the final step.

Step 4. Update refunds, receipts, and customer support

- Define refund rules per rail. For USDC, automate full refunds on the same network with audit logs. If you auto convert to fiat, implement a refund reserve so you can credit customers in dollars or USDC consistently.

- Train support to recognize onchain transaction identifiers and to verify receipt without asking customers to paste sensitive data.

Step 5. Reconcile and report

- Create separate ledger accounts for USDC accepted, USDC claimed to wallet, and USDC auto converted to USD.

- Record the dollar value at the time of receipt for tax and revenue recognition, even when you settle instantly to dollars.

- Store transaction hashes, network, and wallet addresses with order IDs for auditability.

Step 6. Expand to payouts and partners

- For marketplaces and creator programs, test vendor payouts in USDC for cross‑border recipients who already use onchain dollars. Keep caps and fallback to wires for high value transfers until you are satisfied with your controls.

What this means for interchange, cross‑border, and pricing

-

Interchange pressure will not vanish overnight. But if settlement upgrades reduce costs for issuers and acquirers, the market tends to pass some of that efficiency onward. Expect pilot pricing for international volumes, especially for digital goods and software as a service in high adoption regions. For a deeper policy backdrop, read our take on the stablecoin rewards versus interest.

-

Cross‑border spreads and delays are the near term win. If your buyer already holds USDC, you can price in dollars, accept on Base, and settle as dollars without paying currency conversion. That is simpler for buyers and cleaner for your reconciliation team.

-

Subscriptions become globally consistent. A ten dollar monthly plan paid in USDC behaves predictably regardless of country. Stripe's support here lets you standardize billing logic across fiat and onchain methods.

-

Global context matters. Banks outside the United States are also building shared stablecoin rails, as detailed in our piece on the shared yen stablecoin rail.

Grounded risks and how to mitigate them

Regulation and compliance

- Know your processor controls. When you accept stablecoins through Shopify Payments or Stripe, the processor handles blockchain monitoring, sanctions screening, and travel rule obligations where applicable. Your compliance team should still document how those controls map to your policies.

- Watch for state and federal updates on stablecoin issuers and reserve rules. Merchants do not need to be experts in charter types, but issuer regulation affects risk.

Tax handling

- Treat stablecoin receipts like any other dollar receipt for sales tax. Taxability follows the product and nexus, not the rail. Record the dollar value at the moment of payment authorization. If you hold USDC and later convert it, any gain or loss should be captured in your accounting policies.

Operational resilience

- Plan for chain specific issues. Congestion, halted markets, or contract pauses can affect refunds and payouts. Keep a fallback playbook to temporarily disable a network.

- Control treasury exposure. If you choose to hold USDC, set limits, counterparties, and custody rules. Diversify issuers if you scale exposure beyond working capital.

- Prepare for issuer mishaps. In mid October 2025, Paxos, the issuer of PYUSD, acknowledged an internal technical error that accidentally minted and then burned a very large amount of PYUSD within minutes. No customer funds were reported at risk. Build circuit breakers such as payment caps per minute, automated alerts on supply anomalies, and the ability to disable a specific stablecoin at checkout.

Fraud and disputes

- Stablecoin payments can reduce classic card fraud vectors, but they raise new ones, like social engineering to redirect wallet refunds. Require message signed refund addresses for high value cases and maintain a whitelist of customer payout addresses when possible.

Customer experience

- Do not force crypto on everyone. Keep cards, bank, and wallets side by side. Use geotargeting and show USDC more prominently in regions with high wallet adoption.

- Make the network clear. If you accept only Base, say so early. Confusion about networks drives abandonment at the last step.

What to do this quarter

-

If you are a U.S. brand on Shopify: join the USDC early access if eligible. Run a four week test on one product line and one international market. Default to automatic conversion to dollars. Measure conversion rate, refund rate, and support tickets.

-

If you are a subscription app: add a small plan tier that accepts USDC through Stripe. Pilot with friendly users first, then roll out to a country where card declines are costly.

-

If you have global payouts: select a single cohort of creators or contractors to offer USDC payouts. Document the tax and support process before scaling.

-

If you run finance or risk: draft a stablecoin policy. Define approved networks, caps, refund procedures, and an emergency off switch. Add alerting for issuer supply anomalies and exchange rate deviations across token pairs.

The bottom line

The payments stack just gained a new rail that behaves like software. Stripe and Shopify are standardizing USDC at checkout. Visa is moving settlement onto programmable dollars. PayPal and Coinbase are scaling PYUSD access. The strategic play is not to replace cards. It is to route the right transactions over the right rail.

Start small. Pick a clear use case with measurable upside. Write down the controls that keep you safe. Then turn on the settings that let onchain dollars do their job: settle quickly, travel globally, and make the hard parts of money movement feel a little more like the internet. As buyers and wallets normalize Base and other low cost networks, the advantage will flow to merchants that learn to speak both languages: card for what cards do best, and onchain dollars for everything they can now settle.