Bitcoin-Native Staking Turns BTC Into a Security Cloud

In 2025, Babylon’s Bitcoin‑native staking moved from research to production, letting rollups and appchains rent BTC‑backed finality with real slashing. Here is how to integrate it, price it, and ship safely in the next 90 days.

Breaking through the last Bitcoin taboo

For years, the common wisdom said Bitcoin could not natively secure other chains without bridges, wrappers, or custodians. That changed in 2025. Babylon’s Genesis mainnet went live on April 10, introducing native Bitcoin staking that locks real BTC in Bitcoin scripts and uses those positions to secure other networks without wrapped assets or cross‑chain custodianship, as detailed in the official phase two launch announcement. The idea is simple to state and subtle to execute: turn BTC into a universal, programmable security budget that any rollup or appchain can rent.

The next upgrade is already in sight. Babylon’s dual virtual machine work, with a targeted late Q3 to early Q4 rollout, brings an Ethereum‑style environment into the same chain that coordinates Bitcoin staking, and sets the stage for multistaking in Q4 so that one BTC position can secure many networks at once, as outlined in the dual VM model and timeline. For builders, this is the moment to move from whiteboards to working integrations.

Native BTC staking in one page

Think of a hotel safe with three dials. You can unlock it with the guest key, after a waiting period, or by the hotel security office if the guest violates explicit rules. Native BTC staking uses a similar three‑condition vault on Bitcoin itself:

- A staker creates a special Bitcoin output that commits to three scripts: a timelock script, an unbonding script, and a slashing script. The stake lives on Bitcoin as a normal unspent transaction output.

- The staker broadcasts a metadata tag in an OP_RETURN that identifies the staker key, the chosen finality provider key, and the lock duration in blocks. Nothing leaves Bitcoin, there is no wrapped BTC.

- Finality providers use extractable one‑time signatures to attest to blocks on consumer chains. If a provider equivocates, the two signatures reveal the provider key and unlock the slashing path that burns a preset slice of the staked BTC. The slashing percentage, the burn destination, and the minimum unbonding period are all fixed in the original staking script.

This is security with real teeth. Unlike a token whose value can slide, a slash that burns Bitcoin is a credible deterrent. Unlike a bridge, the security rests on Bitcoin’s consensus, not on a centralized custodian or a federation.

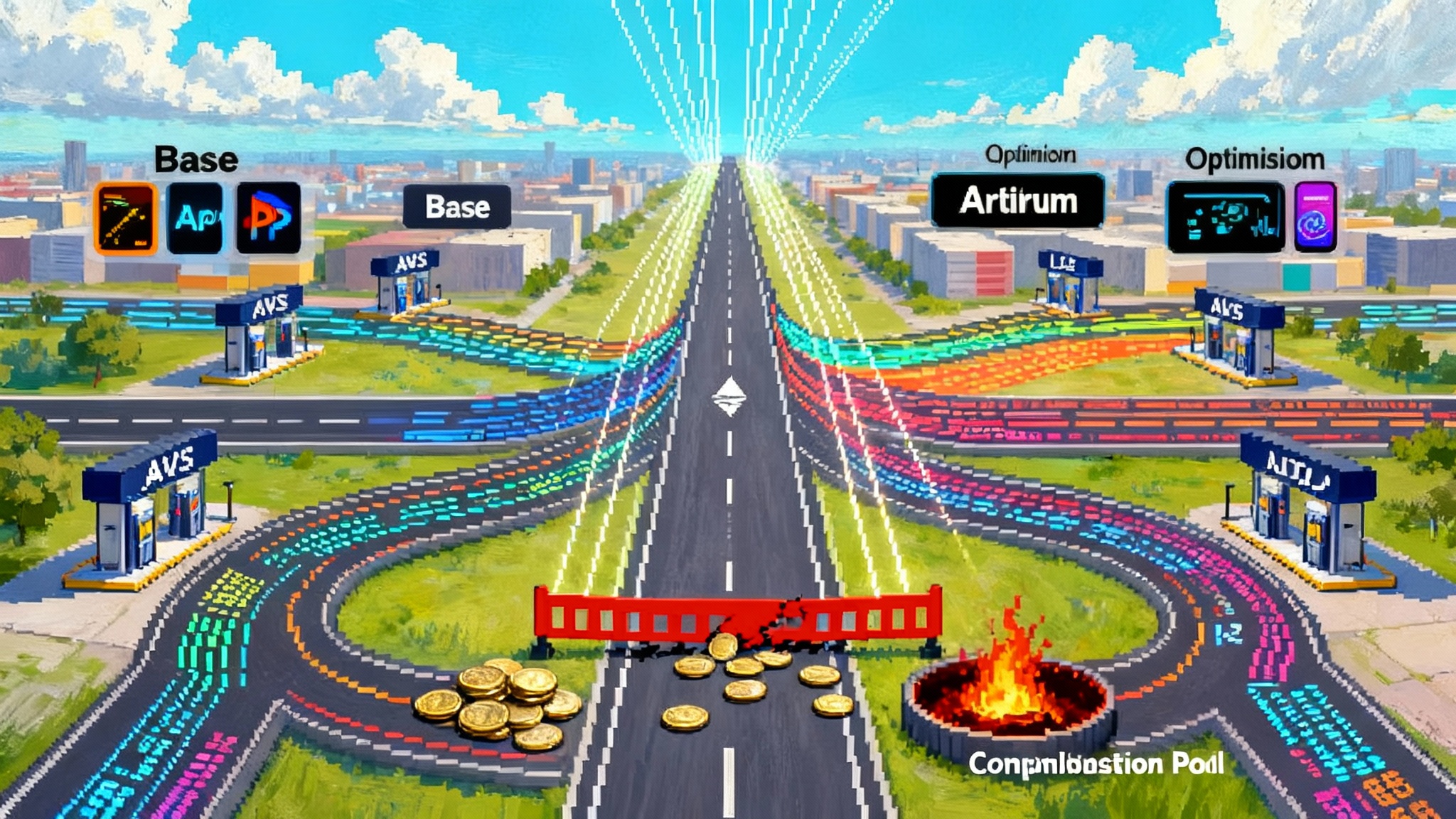

From protocol to product: security as a service

If you squint, this looks like a cloud model for security. Instead of buying and powering your own datacenter, you rent compute from a neutral provider. Here, a rollup or appchain rents economic security from BTC holders through a marketplace coordinated on Babylon. Stakers delegate voting power to finality providers. Those providers sign your chain’s checkpoints. Your chain measures and pays for that service with its own token budget or fee share. If providers break rules, your chain can trigger slashing that destroys the violator’s or the delegator’s BTC per the staking contract. Similar patterns are reshaping Ethereum as restaking goes multichain.

Why this matters now

- Capital efficiency: with multistaking, one BTC position can secure multiple chains. The staker diversifies revenue, and small chains access the same deep pool of BTC collateral.

- Neutrality: Bitcoin is the most widely held and politically neutral asset in crypto. Renting BTC security lets an appchain avoid picking sides in token politics.

- Simpler trust: there is no wrapped IOU. Your threat model centers on Bitcoin fees and honest‑majority assumptions, not on bridge multisigs.

How a Cosmos appchain can plug in this quarter

Most Cosmos teams do not need to change their base consensus. You add a finality layer that speaks to Bitcoin stakers and verifies signatures.

- Deploy the consumer contract: a CosmWasm contract receives and tracks the set of registered finality providers and BTC delegations propagated from Babylon. It exposes queries for block finalization and slashing state.

- Run or recruit finality providers: these are specialized actors who hold EOTS keys, collect BTC delegations, and sign your chain’s checkpoints. They earn a commission on your token rewards or a fee stream you define.

- Wire CometBFT to a finality gadget: after each block, your nodes wait for a quorum of finality provider signatures. When your threshold is met, the block is considered finalized. If a double sign is detected, your contract emits the evidence needed to activate the slashing path on Bitcoin.

- Incentive plumbing: pay providers in your native token or a share of protocol fees. Expose a parameter for minimum BTC stake per provider to limit Sybil risk.

- Observability and incident playbooks: run Bitcoin mempool watchers, track pending unbonds and staking renewals, and define who can submit slashing proofs and how disputes are handled.

Result: you get faster, slash‑protected finality without forking your chain or inventing a new validator economy.

How an EVM rollup can prepare for Q4

With the dual virtual machine path, EVM contracts will live alongside CosmWasm on Babylon. That gives rollup teams a clean integration path, just as Arbitrum BoLD on permissionless L2s expands the L2 design space.

- Finality contract: deploy an on‑chain verifier that checks an aggregated set of finality provider signatures against the registered set. The contract marks L2 block hashes as finalized when a threshold of signatures arrive.

- Sequencer discipline: set your sequencer so it only posts batches that meet finality conditions, or posts with a bond that is forfeited if a later slash proves equivocation. Either pattern lowers your reorg surface.

- Payment rails: define how providers get paid. You can stream your L2’s token, pay in native Ether on L2, or allocate a portion of proposer revenue. Keep this simple at launch and publish a clear rate card.

- Bridged safety: if your L2 settles to Ethereum, keep the current fraud or validity proofs. BTC‑backed finality is a complement, not a replacement, in early stages. The extra layer deters short‑range attacks while your canonical proof remains the ultimate arbiter.

What you can ship right now

Even before multistaking goes live on mainnet, teams can put real pieces into production.

-

For Cosmos appchains:

- Stand up a test integration with Babylon’s consumer contract and run a finality provider on a devnet. Measure signature latency and finalize threshold effects under load.

- Add indexing endpoints for finalized height, slashing events, and stake concentration by provider. Expose these in your explorer and dashboards before you turn on rewards.

- Convert one critical module to require finalized blocks, for example your token issuance or governance actions.

-

For EVM rollups:

- Prototype the signature verifier in Solidity and fuzz it. Align your block cadence with the expected signature arrival window.

- Design a sequencer policy that handles partial finality. For example, include a two‑tier fee market that discounts transactions admitted only to the non‑finalized mempool.

- Publish your provider pay schedule and list the metrics you will use to select and rotate providers at genesis.

-

For both:

- Draft your slashing specification. Pick the slashing percentage for equivocation, the burn address, and the minimum unbonding period. Write this in plain English and put it in your docs. The whole point of native BTC slashing is credible deterrence. That starts with clarity.

The near‑term risk map, with fixes you can apply

- Bitcoin fee market shocks

A staking system that lives on Bitcoin inherits Bitcoin’s fee weather. If fees spike the week you need to unbond or execute a slash, transactions can stall or become expensive.

- Overfund fee paths: when you craft staking and unbonding transactions, reserve space and value for fee bumps using child pays for parent. Automate fee management rather than relying on manual bumping.

- Choose sane timelocks: short enough to roll stake as fees fluctuate, long enough to deter griefing where an attacker forces many renewals during a fee spike.

- Batch where possible: allow providers to aggregate metadata updates in fewer on‑chain writes, and set dust thresholds that avoid fragmenting stake across too many tiny outputs.

- User experience and custody

Native BTC staking crosses the wires between Bitcoin, Babylon, and your chain. That is a new motion for most users and institutions.

- Wallet flows: prefer partially signed Bitcoin transactions and tested hardware wallet paths over custom signing code. Show users a single checklist that covers Bitcoin confirmation count, Babylon registration status, and your chain’s finality height.

- Institutional access: list which qualified custodians support the staking scripts you require and whether they can auto‑renew timelocks. If you target United States users, ask custodians how they segregate staked UTXOs on their books.

- Key hygiene: finality providers should run dedicated EOTS modules, with strict separation from ordinary validator keys. Practice a tabletop exercise where a provider rotates a compromised key without halting finality.

- Maximum extractable value and ordering

If your chain takes finality from Bitcoin‑backed providers, you still need a market design for block building and ordering. Without it, you will attract toxic order flow and leave value on the table.

- Separate proposing and building: adopt a proposer‑builder split or a sealed‑bid block auction. Require builders to reference a finalized parent, or forfeit a bond if they include a block that gets slashed.

- Preconfirmations with teeth: let sequencers offer soft confirmations that are upgraded to hard finality once the provider threshold is met. Price the preconfirmation service and watch the failure rate.

- Cross‑domain protections: if you settle to another base layer, coordinate your inclusion lists and censorship policies there too. Publish an arbitration path for disputes about out‑of‑band payments to providers or builders.

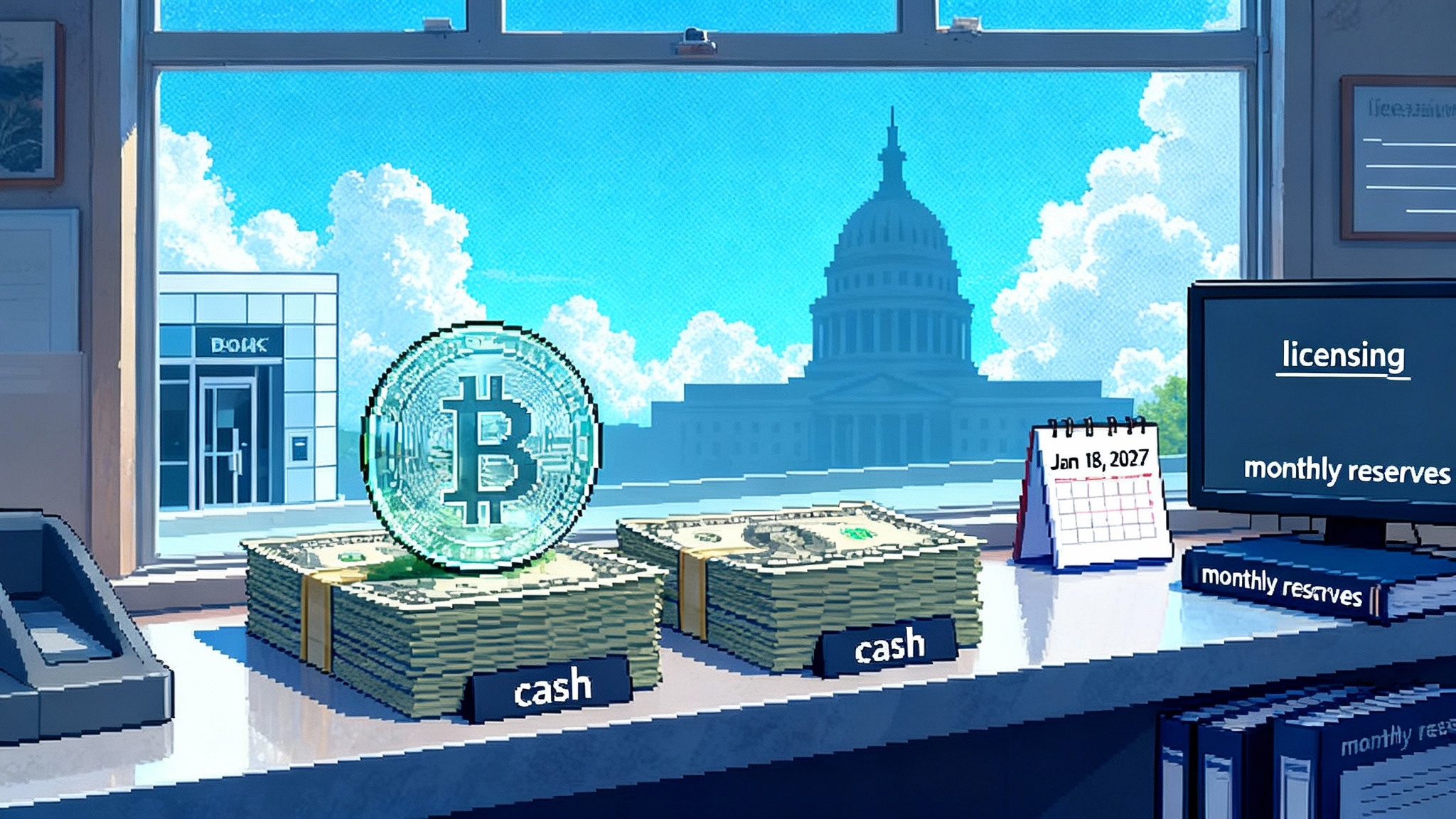

- United States regulatory gray zones

Native BTC staking touches familiar points of contention: pooled staking services, reward expectations, and marketing language. The tactical steps are straightforward, even if the law is not settled. Watch the SEC innovation exemption outlook as policy evolves.

- Split product and protocol: keep your finality provider operation and your wallet experience clearly separate from any user‑facing reward pooling you might offer.

- Avoid promises: describe rewards as variable protocol emissions or fee shares, not fixed yields. Show live data and past performance with clear caveats.

- Know your users: if you serve United States customers through a custodial path, assume know‑your‑customer obligations and publish a policy for chain‑level sanctions handling. If you do not, state that plainly and geofence.

- Get counsel on slashing: a Bitcoin burn embedded in a staking script is novel. Document why it is a rule‑driven protocol action, not a discretionary penalty by any single party.

Multistaking changes your threat model

Multistaking is the headline feature for Q4 because it supercharges capital efficiency: one BTC position can secure an EVM rollup, a Cosmos zone, and your own appchain at once. That bundling also concentrates risk. If a finality provider acts maliciously on any one chain, their BTC can be slashed according to the largest penalty among the chains they serve. Stakers will start pricing that correlated risk into their delegation choices.

What to do about it:

- Publish per‑chain risk: if your chain sets a 5 percent equivocation slash and a seven‑day minimum unbonding period, write it down. Stakers cannot price what they cannot see.

- Stagger upgrades and elections: avoid scheduling governance changes that impact finality in the same window as other chains you know share providers.

- Cap restaking fanout: at genesis, limit how many consumer chains any provider can serve with a single BTC vault. You can raise the cap after live testing.

Economics that make sense on day one

Security as a service lives or dies on unit economics. Run the numbers before your first block.

- Target security spend: define a security budget as a percentage of protocol revenue or token issuance. As a starting point, many teams model 5 to 15 percent of emissions in year one and taper from there.

- Set a base rate and a bonus: pay providers a base rate for meeting the threshold plus a small bonus for low‑variance latency or for signing a higher fraction of blocks. Keep it simple and transparent.

- Make slashing rare and real: a penalty no one believes will be difficult to execute is not a deterrent. Run a public fire drill once per quarter on a test chain where you demonstrate the full slash path from evidence to Bitcoin transaction.

A builder’s checklist for the next 90 days

- Integrate a finality gadget in your devnet. Measure signature arrival and end‑to‑end finalization time under stress.

- Publish your slashing spec, in human‑readable form and in the contract. Include the exact burn route on Bitcoin.

- Choose and announce a starting provider set. Diversity matters more than size at launch.

- Ship dashboards that show finalized height, provider performance, and stake concentration.

- Dry‑run incident response: simulate a provider double sign and walk the team through the Bitcoin transaction that executes the slash.

- If you are an EVM project, finish your signature verifier now so you can flip it on when the dual VM upgrade lands.

The bottom line

Bitcoin native staking has crossed the line from research to live infrastructure. The Genesis launch gave builders a real control plane anchored in Bitcoin, and the forthcoming dual virtual machine and multistaking upgrades will make BTC security accessible to EVM and Cosmos teams without heroic custom work. The opportunity is to treat BTC as a neutral, programmable security budget that you rent, measure, and hold accountable. If you can design your finality, fees, and slashing with the same rigor you would bring to a payment system, you can ship an appchain or rollup that inherits Bitcoin’s credibility without giving up your design space. That is the promise of turning BTC into a security cloud. It is not marketing. It is software, incentives, and a set of transactions on the oldest chain we have.