Digital Fort Knox: Inside America’s Strategic Bitcoin Reserve

On March 6, 2025, the White House created a no-sell Strategic Bitcoin Reserve funded with seized BTC. Here is how the policy rewires crypto market structure, from auction dynamics to custody design, and what builders should ship next.

The day Bitcoin became a reserve asset of the United States

On March 6, 2025, the United States drew a bright line through crypto history. A presidential order established a Strategic Bitcoin Reserve along with a broader United States Digital Asset Stockpile. The design choice that shocked markets was simple and powerful: bitcoin deposited into the reserve would not be sold. The reserve would be funded primarily with bitcoin that federal agencies had already seized and finally forfeited in criminal or civil cases. Other digital assets would be pooled in a separate stockpile under Treasury stewardship.

In one sentence, the federal government reframed bitcoin as a store of value held for national objectives rather than inventory to be liquidated. The order also set in motion a comprehensive accounting of all government digital assets and instructed Treasury and Commerce to develop budget neutral strategies for acquiring additional bitcoin.

Call it Digital Fort Knox. It is not a speculative trading desk. It is an explicit policy signal about scarcity, time horizons, and the role of cryptographic assets in a modern reserve mix.

The overhang that vanished overnight

For a decade, crypto traders watched government wallets with the same apprehension gold bugs once reserved for central bank sales. United States Marshals Service auctions of forfeited coins had become a recurring event. Each time coins moved from a government wallet to an auction house or exchange, the market braced for impact.

The Strategic Bitcoin Reserve slices away most of that anxiety for bitcoin. When forfeited coins are transferred into the reserve, the default action is to hold, not sell. There are narrow exceptions that matter for justice and process. Coins can be returned to victims, used for law enforcement operations, shared with state and local partners under statutory rules, or disposed of if a court orders it or to meet specific fund requirements in law. These carve outs are real, but they are not routine market supply programs.

The practical effect is that a major episodic source of forced selling has been removed. The removal is not merely psychological. It changes how market makers and risk desks model the forward float. Forced auctions are lumpy. A no sell reserve is steady. That shift alters the hazard function of large sell events that used to hang over the tape with every blockchain tracking alert.

Liquidity, float, and volatility in the new regime

A government that holds bitcoin as a reserve asset becomes, by definition, a large price insensitive holder. That changes both float and liquidity quality.

- Float: Coins that enter the reserve are taken out of tradable circulation for long windows of time. Traders care about what is for sale today. Removing a persistent source of forced supply reduces effective float even if total supply is unchanged.

- Liquidity quality: The market still has deep trading venues, from spot exchanges to futures and options platforms. What changes is the frequency of event driven lumps of supply that used to arrive with auction schedules. In their place, we get a slower cadence of transfers into reserve wallets.

- Volatility profile: The immediate effect is usually lower left tail volatility associated with surprise sell events. The medium term effect is more nuanced. As float tightens, positive demand shocks can create sharper upside volatility. A price insensitive holder on the bid is stabilizing during stress. A price insensitive holder on the offer does not exist. That asymmetry can amplify bullish squeezes when demand surges.

This does not mean price levitation. It means the market trades on fundamentals and flows rather than calendarized liquidation. The presence of large, rule bound holders also strengthens the case for sophisticated hedging and basis trading, since reserves generally move in predictable, publicly observable ways when they move at all.

Treasury’s new job: from a gold vault to a key vault

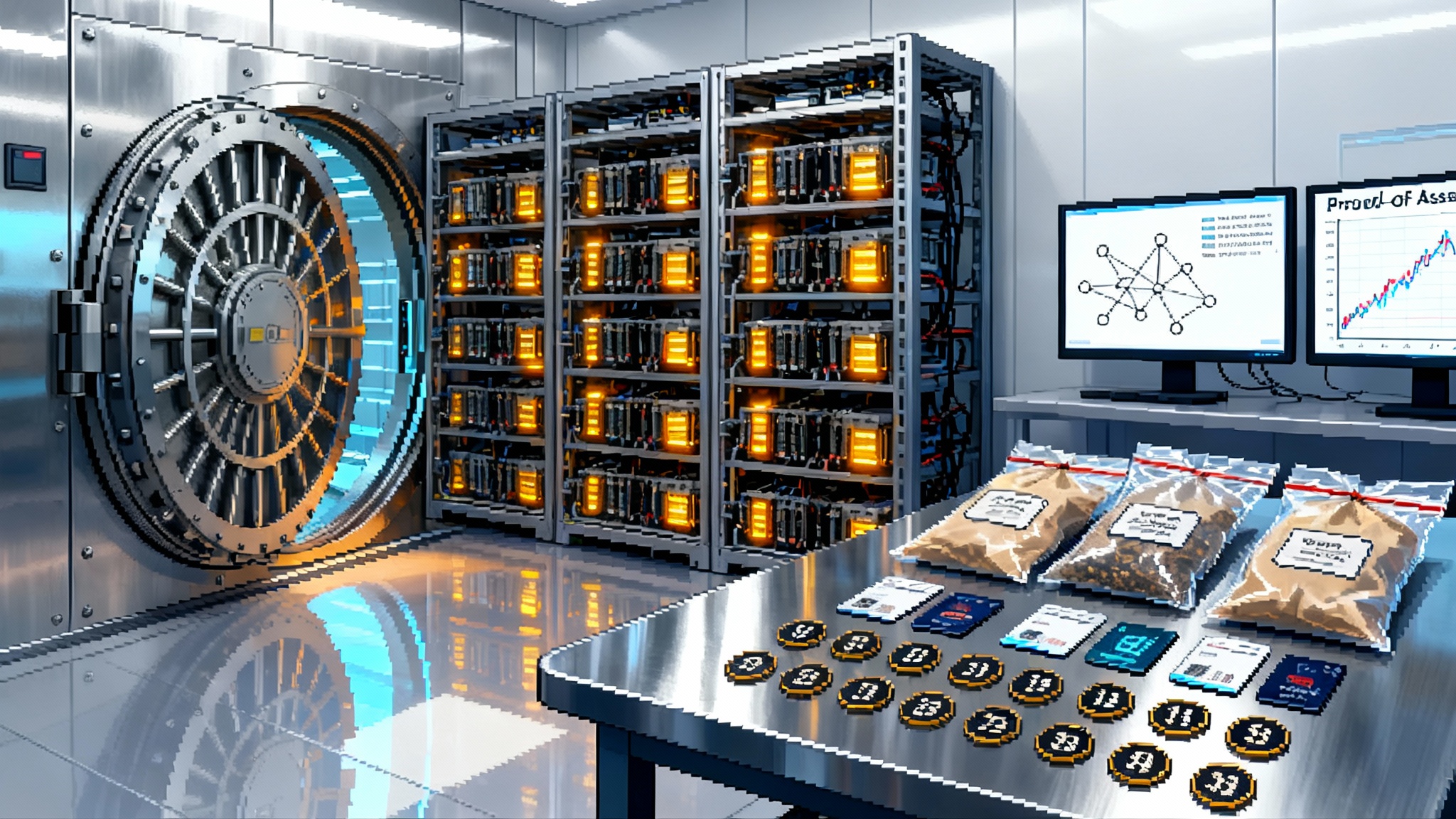

Turning a seizure pipeline into a reserve program forces a hard redesign of custody and governance. Unlike bullion, bitcoin is controlled by private keys, and whoever holds enough keys can move value. That reality pushes Treasury toward a layered architecture with no single point of failure.

Here is a plausible blueprint that aligns with how high assurance custodians already operate while satisfying public sector audit and control needs:

- Account structure: Create a parent reserve account with a public policy describing its mandate, and a tree of sub accounts for provenance. For example, coins from a specific case can sit in a labeled sub account until legal finality is complete. After finality, they roll up to a consolidated holdings account.

- Key management: Use multi party computation and multi signature arrangements with an M of N quorum. Keys are split across different agencies and vendors under strict contracts, with geographic separation and independent security teams. Hardware should be certified to Federal Information Processing Standard 140-3 or an equivalent assurance level.

- Dual control, always: No key shard should ever be used without dual authorization. Every movement requires a two person rule, and every policy change requires a recorded change request and approval trail.

- Cold storage by default: Keys remain offline except during key ceremonies. When online interaction is unavoidable, use session bound keys that auto expire, with ephemeral hardware enclaves to minimize exposure.

- Witnessed key ceremonies: Treat key generation and rotation like a rocket launch. Scripts are rehearsed. Rooms are cleared. Cameras and independent auditors witness the process. Attendants sign attestation packages that include hardware serials, firmware hashes, and environmental controls.

- Onchain transparency with privacy: Publish reserve addresses or, if operational risk dictates caution, publish a rolling proof of assets anchored to a public address that commits to all balances via a Merkle tree. Anyone can verify the proof without learning sensitive address details.

- Oversight: The Inspector General and the Government Accountability Office receive read only access to audit logs, plus the right to call surprise proof of control challenges where Treasury must sign a message from reserve addresses within a defined window.

- Incident response: Pre stage emergency playbooks for compromised keys, data center failures, or vendor insolvency. Include a maximum tolerable downtime, an order of operations for rotating keys, and a dead man’s switch to pause all outbound transfers.

If this sounds like mission control, that is the point. Reserve management is a reliability problem more than a trading problem. The technology exists. What the reserve does is force the government to adopt it at scale and with consistent documentation.

What changes for the Digital Asset Stockpile

The stockpile holds non bitcoin digital assets that the government has acquired through forfeiture or penalties. Unlike the bitcoin reserve, the stockpile is not a no sell commitment. Treasury is explicitly told to exercise responsible stewardship. Expect a different policy toolkit here.

- Active risk management: For volatile, thinly traded tokens, Treasury can sell positions to reduce risk, especially when restitution obligations require cash.

- Consolidation and conversion: Tokens with tiny market share, weak security, or limited legal clarity can be consolidated or converted. Think of the stockpile as the triage area, and the bitcoin reserve as the long term safe.

- Programmatic disposals: Where the law requires equitable sharing or fund transfers, Treasury can create scheduled, transparent disposal windows to minimize market impact.

This two tier design clears up market confusion. Bitcoin is the strategic asset with a hold directive. Everything else is an operational position managed under statute.

A sovereign accumulation cascade begins

Policy is a coordination signal. Once the United States constructs a no sell bitcoin reserve, other governments must at least consider whether to follow. Some nations already hold bitcoin, usually through seizures. Others, like El Salvador, have pursued accumulation as a national strategy. The United States move normalizes a path that until now was either incidental or iconoclastic.

Expect three types of followers:

- Quiet bookkeepers: Finance ministries that already control seized coins formalize a hold policy rather than liquidate. They do not announce purchases. They simply stop selling.

- Selective accumulators: Countries with strong financial centers and technology sectors treat bitcoin as an option on future influence. They buy small, publish addresses, and invite local custodians to compete for government mandates.

- Resource adapters: Hydro rich or energy exporting countries explore mining, power offtake, or state backed custody as industrial policy. Their goal is to earn or gather bitcoin without spending taxpayer cash.

Every copycat raises the opportunity cost of waiting for the next administration or legislative cycle. The scarce asset narrative works differently when governments join the holder base.

Markets will reprice the lack of sellers

When you remove a seller the market was forced to accommodate, two things happen. Dealers need less inventory to hedge auction risk. Long only buyers do not need to budget for regular supply shocks. Over time, that reprices both convenience yields and risk premia.

Two more feedback loops matter:

- Institutional plumbing: Spot exchange traded products, futures basis trades, and structured notes all benefit from predictable public sector behavior. The reserve turns government wallets from wildcards into reference points. Related trends like ETF-ization comes to DeFi and U.S. derivatives come onshore strengthen this market backbone.

- Credit normalization: Lenders can underwrite collateral that sits adjacent to a sovereign sleeve with higher confidence in market integrity. More credit creates more market depth, which lowers execution cost, which attracts more hedgers and allocators. Banking rail improvements, including reopening U.S. crypto banking rails, reinforce the cycle.

None of this suspends gravity. Bitcoin remains volatile. What changes is the distribution of shocks and the credibility of buy and hold at the very top of the capital stack.

The builder’s playbook for 2025-26

The next 18 months are a once in a decade opportunity to ship the missing infrastructure that a public sector reserve makes unavoidable. Here is a concrete checklist.

- Attestation rails

- What to build: A standard that packages cryptographic proofs, operational metadata, and human attestations into a single, machine readable envelope. Think of it as Proof of Reserves Plus. It should include signed messages from reserve addresses, Merkleized balance proofs, hardware attestation reports, and role based sign offs.

- Why it matters: Agencies need a way to prove control and policy compliance to inspectors without doxxing sensitive addresses. Auditors need repeatable procedures. Markets need public artifacts they can verify.

- How to ship: Start with an open specification, implement a reference library in two languages, and publish a validator that flags missing elements. Target Federal Risk and Authorization Management Program compatibility for any cloud components. Make it easy to embed in a government change management system.

- Compliant custody APIs

- What to build: A set of policy aware APIs that sit on top of multi party custody. APIs should expose fine grained approval workflows, geofenced rules, velocity limits, and case identifiers tied to forfeiture statutes. Every endpoint should emit structured logs for downstream analytics.

- Why it matters: Treasury will coordinate with the Department of Justice, the United States Marshals Service, and other agencies. They need interoperability, not bespoke file drops.

- How to ship: Start with a policy engine that reads a human friendly configuration. Build connectors for major custodians and hardware security modules. Offer software development kits with mock signers so agencies can test without touching real keys. Document every response code, especially failure modes.

- Auditability tooling

- What to build: A pipeline that ingests blockchain data, custody logs, and legal metadata, then produces dashboards for chain of custody, provenance, and exception handling. Include red team simulations where an auditor can ask the system to prove that no outbound transfers occurred without quorum during a date range.

- Why it matters: Auditors must confirm both what happened and what did not happen. Negative proofs matter as much as positive ones.

- How to ship: Use an event sourced data model where every change generates an immutable record. Provide canned reports that satisfy Government Accountability Office and Inspector General requirements. Add a one click export for congressional briefings.

- Onchain transparency primitives

- What to build: Public facing commitments that prove balances without revealing sensitive operational details. Examples include rolling proofs of assets anchored weekly, commit only reserve addresses that can sign to prove liveness, and transaction labeling standards for movements into and out of reserve buckets.

- Why it matters: Public trust rests on verifiability. The goal is to avoid security theater while giving citizens and markets enough visibility to hold institutions accountable.

- How to ship: Collaborate with analytics firms and universities to design proofs that are understandable and testable. Release a public verification tool so independent researchers can check the math. Publish a transparency calendar that sets expectations for when proofs appear.

- Vendor readiness for public procurement

- What to build: Everything above, but packaged for government buying. That means Section 508 accessibility, modern documentation, price books, and tamper evident deliverables. It also means well formed responses to Requests for Information and Requests for Proposals with clear service level objectives.

- Why it matters: Great code does not matter if it cannot pass procurement.

- How to ship: Get your security certifications in order. If you are a custodian or infrastructure vendor, line up Service Organization Control 2 Type II, International Organization for Standardization 27001, and relevant cryptographic module validations. Map your controls to federal baselines so acquisition teams can check boxes without chasing you for weeks.

- Traceability that respects due process

- What to build: Tooling that links every coin in the reserve to its legal provenance and current status. Each unit should carry tags for case numbers, restitution obligations, and encumbrances. Build views for both public transparency and internal case management.

- Why it matters: The reserve improves market structure, but it exists within law enforcement and victim restitution frameworks. Builders must respect that.

- How to ship: Combine onchain analytics with court document ingestion and entity resolution. Offer a redaction layer so sensitive victim information never leaves restricted systems.

- Education for risk officers and committees

- What to build: Credible curricula for public sector financial stewards. Modules should cover key management, attack surfaces, incident drills, and board level risk questions. Use tabletop exercises that mirror real key ceremonies and emergency rotations.

- Why it matters: The best systems are only as strong as the teams who run them.

- How to ship: Partner with business schools, professional associations, and inspector general academies. Build a corpus of case studies that includes both success and failure.

The next two years

Policy clarity is a force multiplier. A no sell Strategic Bitcoin Reserve converts ad hoc seizures into a long horizon reserve strategy. It removes a predictable source of market supply, tightens float, and raises the bar for custody governance. It also sets off a wave of sovereign contemplation, from quiet holds to more public programs. Related advances in public market plumbing, from ETF-ization comes to DeFi to the rise of tokenised funds and onchain Treasuries, will compound the effect.

For builders, this is not theory. Agencies will need attestation rails they can adopt, custody APIs they can plug into mission systems, audit consoles that satisfy demanding oversight, and transparency primitives that earn trust without handing a roadmap to attackers. The United States just created the customer and the use cases. The window for shipping is open now.

The story of Digital Fort Knox will not be about a single transaction. It will be told in key ceremonies, audit trails, and quiet dashboards that simply reconcile every time. If we do this correctly, the reserve will become boring in the best possible way, a fixed point in a still volatile market that proves cryptography and institutions can work together when the stakes are national.