Direct-to-device satellite just went mainstream in September

At World Satellite Business Week, mobile operators and low Earth orbit networks moved beyond emergency texting to real service bundles. SMS and low-rate IoT turn on first, with voice and data six to twelve months behind.

The month satellite-to-phone stopped being a stunt and became a feature

September’s World Satellite Business Week in Paris had a familiar rhythm: handshakes, glossy slides, careful language. What felt different this time was the posture. Mobile operators and low Earth orbit providers did not present satellite messaging as a neat demo or a crisis tool. They described it as a product line, with plan names, bundled tiers, and on-net integration. The pitch was simple. If your phone sees the sky, it will soon see a cell.

The industry has needed several pieces to click. Spectrum rules that let satellites speak the language of phones. Chips in those phones that understand that conversation. Constellations with enough capacity to carry more than a handful of texts. Billing and roaming that do not confuse customers. In the last 30 days, the pieces finally lined up in public, with operators putting dates and bundles on stage and satellite builders publishing the filings that make those dates feel real.

The short version: texting and low-rate machine messages first, then voice and basic data in six to twelve months. Launch campaigns this fall and winter add the missing radio capacity. Coverage everywhere is about to become a default, not a dream.

What changed in Paris

This year’s announcements did not try to invent a new category. They collapsed satellite into the existing one. Large carriers reaffirmed and expanded direct-to-device tie-ups with low Earth orbit networks, and they described how the offers fit standard plans. The focus moved from the one-off emergency text to bundled connectivity that works like roaming, yet shows up as part of your mobile plan.

Two patterns stood out:

-

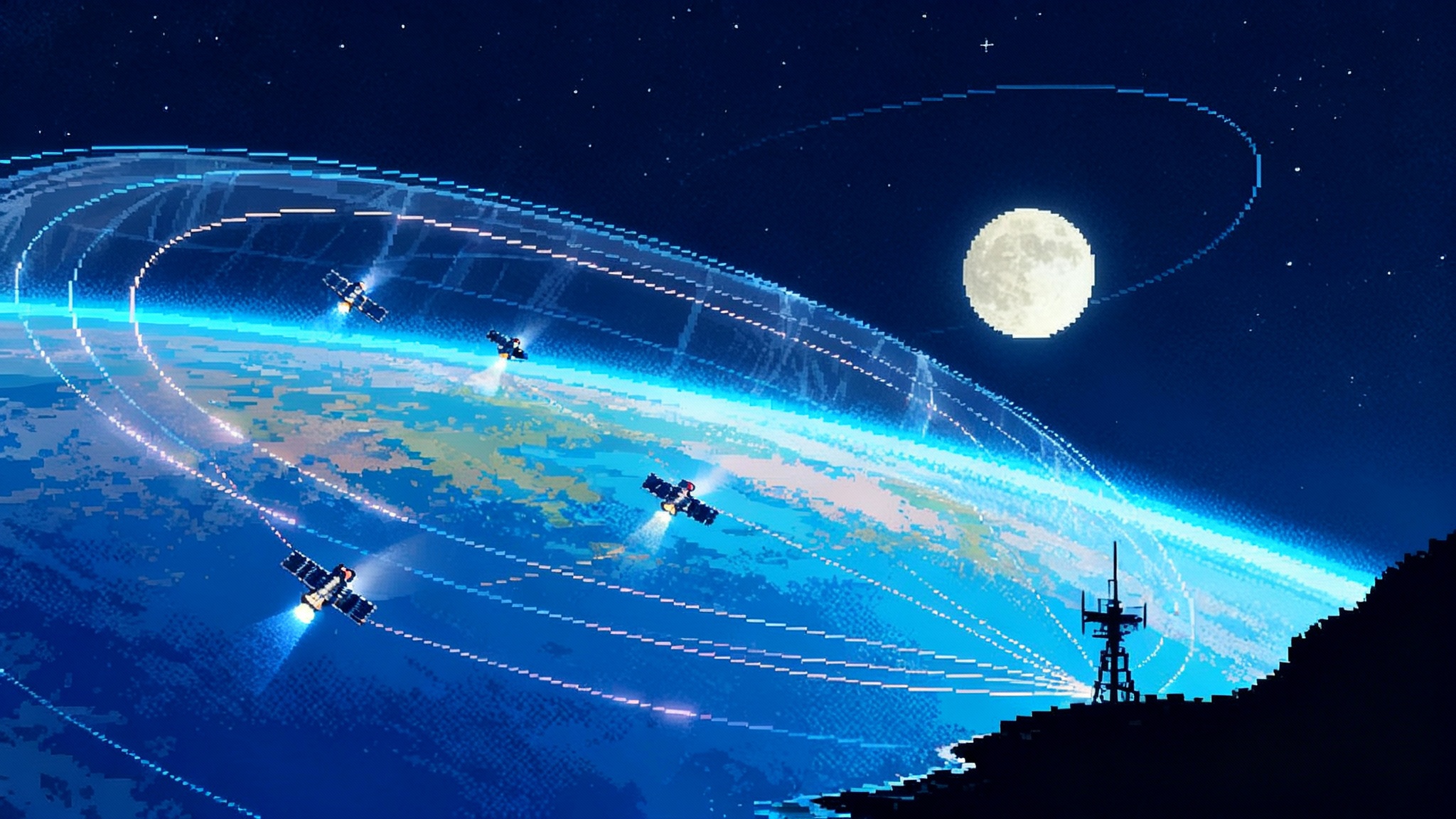

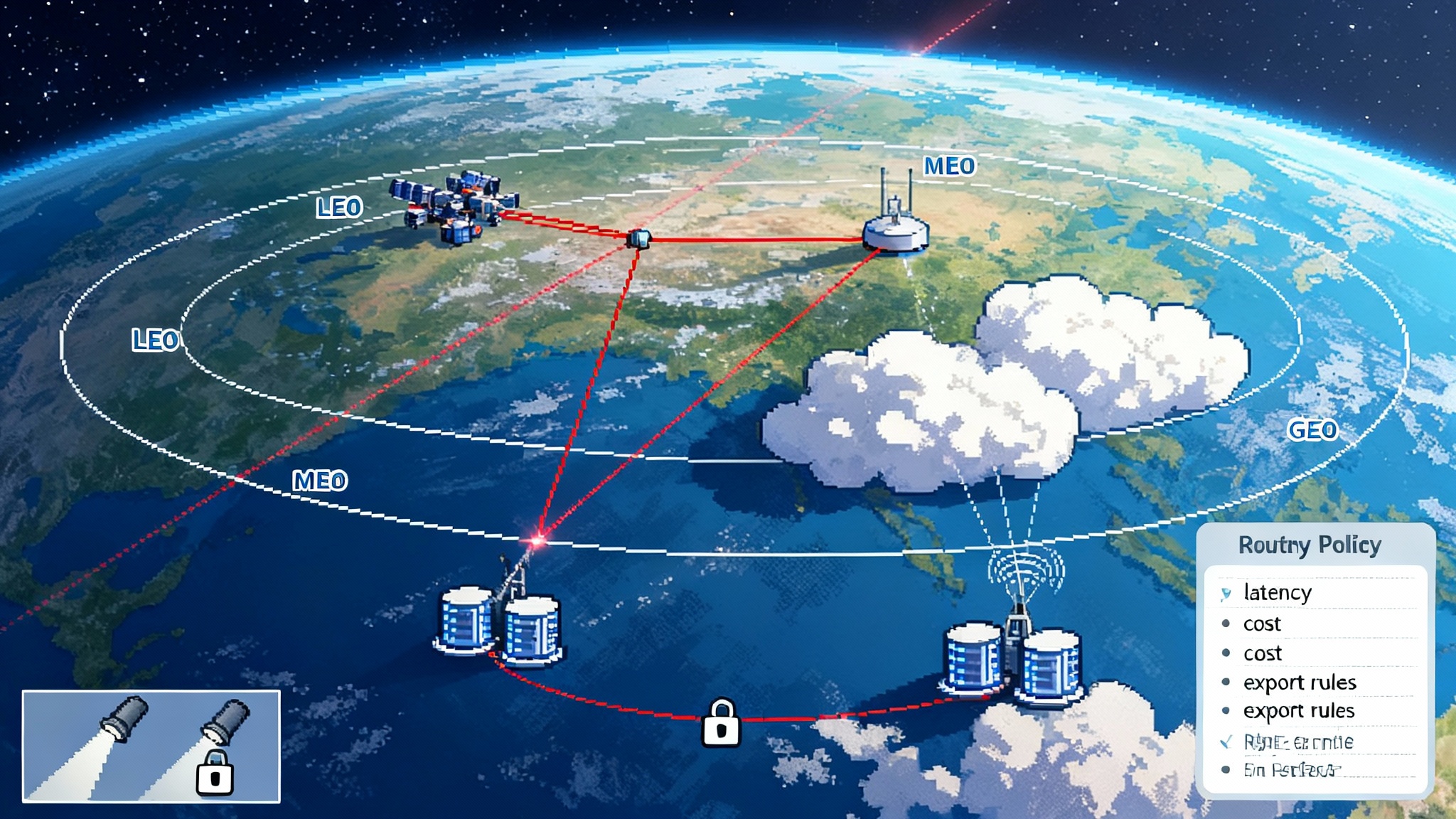

On-net supplemental coverage using the carrier’s own spectrum with a satellite acting like a very high cell site. Think of a satellite as a flying base station that your phone already knows because it broadcasts the same public land mobile network identity and uses the same terrestrial band. This is the model behind several Starlink Direct to Cell partnerships, where the satellite is just another sector of the carrier’s network.

-

Roaming-based satellite access where the satellite operator presents a partner network and the phone camps on it when there is no terrestrial service. This is the model behind AST SpaceMobile and Lynk Global deals, and it is also how new 3GPP narrowband IoT over satellite providers like Sateliot integrate. Your phone or device roams to the satellite, your identity remains the same, and the billing is handled like any other roaming event, often with zero-rated bundles.

Both models were present on stage, and both came with near-term timelines. Carriers in North America, Japan, Australia, New Zealand, and Europe reiterated that nationwide satellite texting turns on first. Several described named plan bundles that include a monthly allowance of satellite messages, escalation to per-use fees if you go beyond that, and options for business and maritime users.

Behind the marketing, the filings told the story. In the United States, the Federal Communications Commission’s supplemental coverage from space rules adopted in 2024 laid out conditions for satellites to use terrestrial spectrum in coordination with license holders. That gave mobile operators and satellite providers a clear lane. Similar test and market access filings in Canada and Australia showed geographic gating, power limits, and beam shapes tailored to protect terrestrial networks. The message was that the engineering is concrete and regulators are watching the dials.

What turns on first: SMS and low-rate IoT

The first switch is the simplest and the most useful: plain text. Short message service rides the control plane of cellular networks. It is low bitrate, latency tolerant, and robust at the cell edge. Those are the exact qualities that match a satellite link. When you step off-grid, your phone can register with a satellite cell and send a text without needing a full voice stack. Cell broadcast for public warnings fits the same mold.

Expect these first:

-

Basic texting. Outbound and inbound SMS, with delivery receipts. In many markets this will be bundled into mainstream postpaid plans with a monthly allowance. Prepaid packs and enterprise bundles follow.

-

Assisted emergency messaging. The curated flows that walk you through a distress text or roadside help continue, but under the hood they will share the same network paths used for everyday texts instead of a separate proprietary stack. That trims costs and unifies coverage.

-

Low-rate IoT. Narrowband IoT devices, from sensors on pipelines to wildlife tags, will roam onto satellites using standard 3GPP narrowband IoT over non-terrestrial networks. This is slower than traditional satellite modems but is cheap, tiny, and runs off coin-cell batteries. The integration is native to mobile operators’ core networks, so fleets can show up inside existing enterprise dashboards.

This early phase is not about browsing the web from a tent. It is about making sure a message gets out and that simple machine signals keep reporting in. The reason is physics and power. Your pocket phone has a small antenna and a tiny battery. A satellite link works, but the margin is precious. Keeping to low-rate services first lets operators cover whole countries from orbit without swamping their beams.

Your phone may already be ready

There is good news on the hardware side. Many of the phones in people’s pockets today have most of what they need.

Two paths exist.

-

Terrestrial bands to space. If a satellite speaks a band your phone already supports, such as personal communications service band 2 at 1900 megahertz in the United States, the phone can connect with a software update. The phone needs to accept longer signal delays, higher Doppler shift, and a slower timing advance. Release 17 of the 3GPP standards added these tolerances for both LTE and 5G. Vendors can ship firmware that enables a satellite cell to be treated like a very distant tower.

-

New satellite bands with native support. Release 17 also defined two bands for 5G new radio over satellite. Band n255 covers S-band and band n256 covers L-band used by mobile satellite services. Several recent flagship chipsets advertise non-terrestrial network support in hardware, and radio front ends are beginning to include these bands. As these phones ship in larger volumes, direct satellite service that does not rely on borrowed terrestrial bands will widen.

Not every phone will get the update. Apple’s Emergency SOS uses a different satellite partner and protocol than Release 17, and it is still separate from the mainstream 3GPP path. Many older Android phones will remain terrestrial only. The carriers know this, which is why they are starting with SMS over familiar bands and with phones they can update over the air. Expect an opt-in prompt in your carrier app once your market lights up.

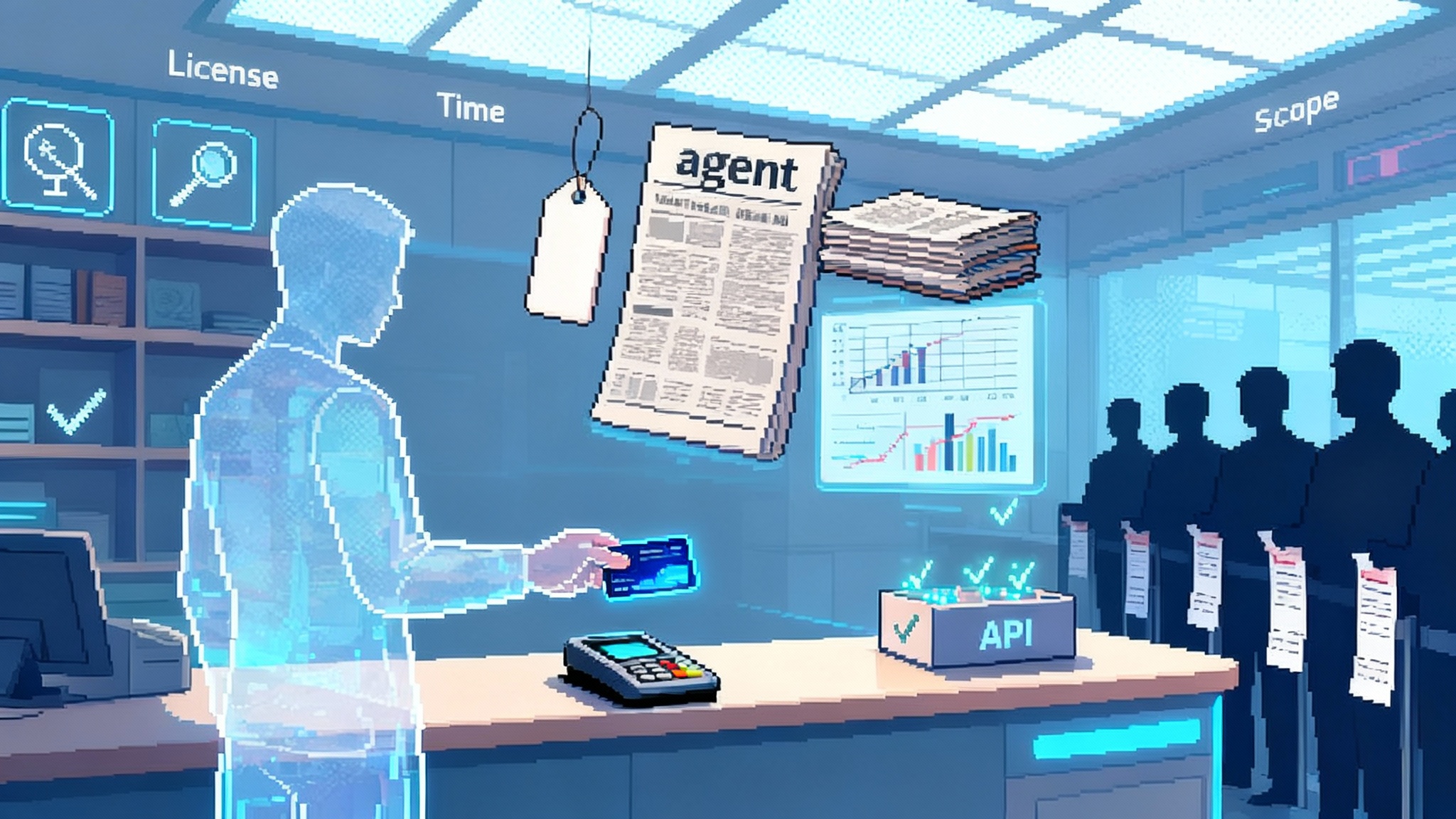

How it shows up on your bill and in your status bar

The experience will feel like roaming, but there are two flavors.

-

On-net supplemental coverage. Your phone keeps the same public land mobile network identity. The satellite cell looks like a new sector on your carrier’s network. There is no roaming triangle icon and no carrier name change. Billing can be as simple as counting satellite SMS as a separate bucket in your plan. The network decides that you have no terrestrial signal and invites your device to camp on the satellite. When you come back to ground coverage, the handover is a simple reselection.

-

Partner satellite roaming. Your phone displays a different carrier name or a satellite indicator when it switches to the partner network. Behind the scenes the satellite operator’s core network authenticates your SIM, exchanges policy and charging rules with your home carrier, and counts usage in a satellite bundle. The customer sees a line item like international roaming, but at domestic prices and often zero-rated within an add-on.

Both models require tight control of where satellites are allowed to accept devices. Satellites consult geographic databases and beam-shaping rules to avoid interfering with terrestrial users. If a spectrum band is licensed to a different operator in a region, the satellite can be told not to serve users there. This gating is why coverage maps will show holes in some border zones and cities, even though the sky view is clear.

The six to twelve month path to voice and data

Voice over LTE and basic data are next. Operators in Paris put a six to twelve month window on these upgrades. Here is what has to happen between now and then.

-

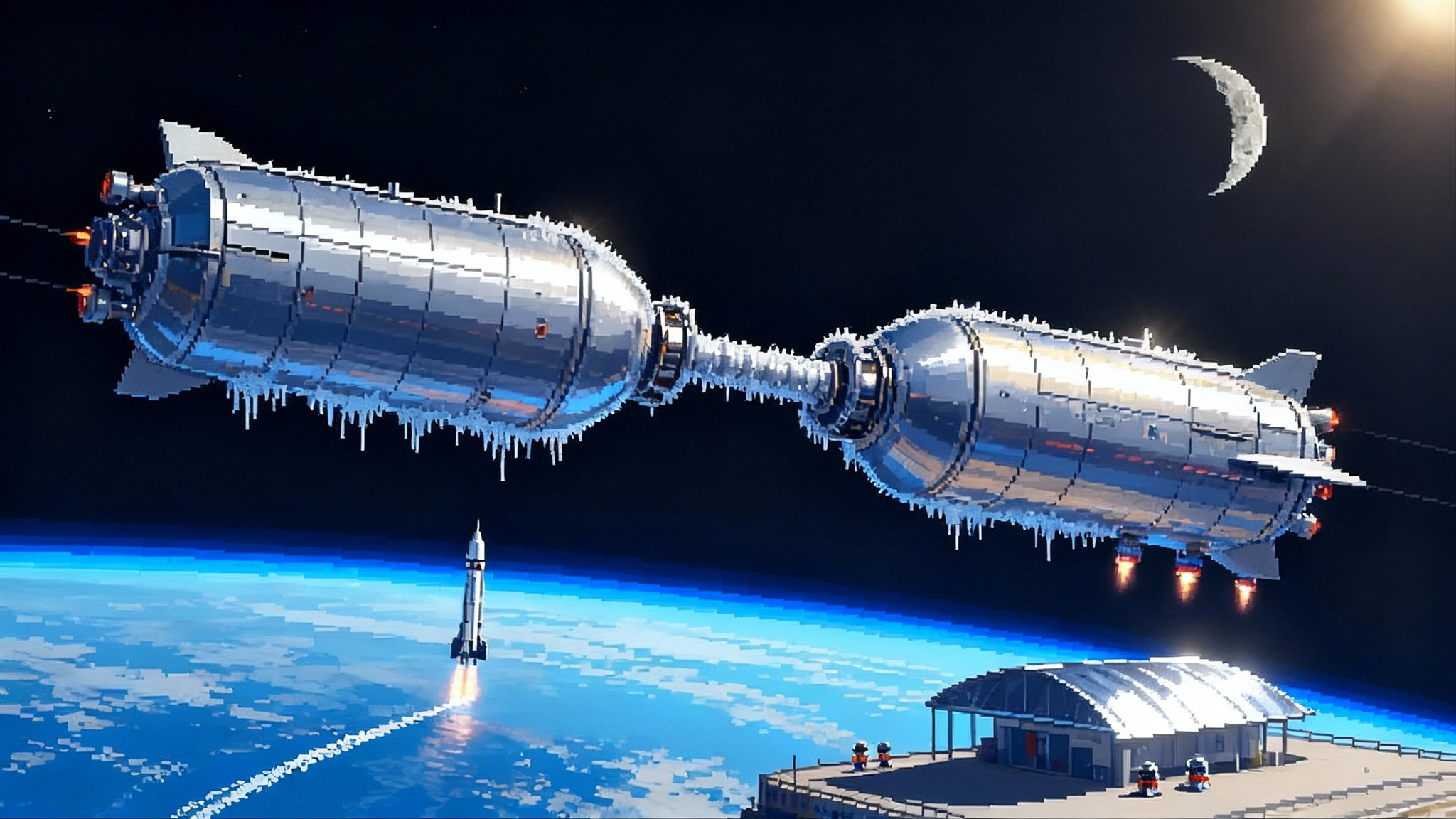

More satellites with the right radios. A handful of text-capable satellites can cover a country for emergencies, but they cannot support millions of users. Constellations are now launching satellites with larger arrays and more spectrum per beam. Fall and winter manifests include batches of these birds. Voice calls need stable signal-to-noise ratios and more consistent latency than a quick text.

-

Commercial core integration. Voice means IP Multimedia Subsystem registration and anchoring. The satellite network has to handle attach, registration, voice bearer setup, and emergency location handoff into the terrestrial core. First markets will be those where carriers and satellite partners share lab environments and field test teams. Expect coastal corridors and rural interiors before mountain valleys.

-

User equipment optimizations. Your phone has to manage power better and obey a different paging cycle when it is on a satellite. Long discontinuous reception cycles save battery but add delay. Vendors will tune these timers and push firmware that treats satellite connections like a special radio access technology. The bigger change is on the scheduler in the sky, which will carve time slots for short data bursts and small voice packets while preventing a few users from hogging the beam.

-

Policy and emergency services. Regulators want clear rules for emergency calling, location, and lawful intercept. Carriers have to map satellite calls into Enhanced 911 and equivalent systems, and to publish accurate limits, such as areas where satellite voice will not accept a call if there is terrestrial coverage.

The first voice calls you make over satellite will sound fine. They will not replace your home broadband or 5G midband. The bitrates will resemble a decade-old network. That is enough for maps, messaging apps, weather, and a light web page. It is also enough for many field workers and boaters who need to file a form or send a photo from offshore.

Capacity math and interference reality

It is easy to draw a satellite over a city and imagine everyone using it. The numbers say otherwise.

A single satellite beam at cellular frequencies covers hundreds to thousands of square kilometers. Even with clever frequency reuse and narrow beams, the capacity per user is tiny if many people connect at once. Satellites will be configured to prefer users far from towers. Urban cores will be geofenced off or power-limited so the beams ignore dense areas. This keeps interference low and preserves the link budget for the people who truly need it.

That is also why the rollout starts with SMS. A nationwide network can deliver texts to millions of people if only a small fraction are active at any moment. Voice and data will come with conservative rate limits, probably with hard caps per user per day in the first markets. The same is true at sea and in the air. Airlines and cruise ships will have dedicated beams and contracts so that a cabin full of phones does not starve a rural beam.

On interference, the regulatory filings are detailed. Beam edges must meet strict power limits to avoid harming terrestrial users on the same band. Satellites must coordinate with the license holder of each band, and must not serve users over areas where the partner does not control rights. The networks will use real-time location, earth station telemetry, and databases of spectrum ownership to decide where to light up. If you stand near a border where another carrier owns the band, your phone may not be able to attach to the satellite even though the sky is clear.

Why coverage everywhere becomes the default

The product is not a gadget. It is a quiet background feature. That is how it scales.

-

Launch cadence. Dozens of direct-to-device capable satellites are already in orbit, and more are queued for launch through winter. Each batch increases revisits and adds beams. As revisit times shrink from tens of minutes to single digits, services can flip from store-and-forward to near real time.

-

Backhaul and direct converge. Carriers have spent the last two years using low Earth orbit for rural backhaul and disaster recovery. Those teams are now the same teams that will light up direct-to-device. They know the ground equipment, the support scripts, and how to manage outages. This speeds the practical launch of customer-facing satellite features.

-

Churn economics. A small monthly fee for satellite messaging or voice is cheaper than losing a customer who camps in the mountains on weekends or works offshore. Carriers will treat coverage from the sky as a retention tool. That is why they are bundling it rather than selling it as a standalone novelty. Enterprises will pay for it because it lets them simplify device fleets.

-

Developer awareness. Once apps see that their users can deliver a message from almost anywhere, product teams will design for it. Simple store-and-forward modes, text-first fallbacks, and offline-first patterns will make satellite feel normal without the user thinking about it.

What builders, operators, and policymakers can do now

-

App builders. Add a satellite-friendly path. If your app depends on chat, let users force a text-only fallback and queue messages for delayed send. Offer a low-bandwidth map tile pack for offline use. Use short, idempotent requests so retries do not multiply usage. Respect the user’s battery by probing for satellite availability no more than a few times per minute when off-grid.

-

Device makers. Ship firmware that enables Release 17 non-terrestrial network tolerances on supported chipsets. Expose a simple status API so apps can learn when the device is on a satellite cell. Tune paging and discontinuous reception timers to preserve battery during satellite attach.

-

Mobile operators. Finalize clear plan names and limits. Publish simple coverage maps that show when satellite takes over and when it will not. Train support to explain why the service is off in cities and on in rural areas, to avoid confusion. Integrate satellite events into standard network operations views so field teams can troubleshoot them like any other sector.

-

Policymakers. Finish the playbook for emergency services over satellite. Define how Advanced Mobile Location and emergency routing should behave when a device is on a satellite cell. Maintain transparent processes for geographic gating and interference reporting. Encourage cross-border coordination in mountain and coastal border zones where beams overlap.

Edge cases and honest trade-offs

-

Battery. Satellite attach and paging consume more power than a normal idle state. Phones will manage this with longer wake intervals. Users should expect battery drops if they spend hours on a ridgeline with satellite enabled. Providing a manual toggle may help hikers and field crews.

-

Weather and canyons. Rain fade is mild at these bands, but tree cover and rock walls matter. Expect the best performance in open skies and at sea, and weaker links under canopy or in narrow valleys.

-

Cross-border complications. If the band your phone uses on the satellite is licensed to a different operator across a nearby border, your device will be blocked from attaching. The satellite sees your location and obeys the rules. This is why maps will show gaps, especially near coastlines and borders.

-

Privacy and legal. Satellite roaming involves more parties. Operators need clear retention and lawful intercept policies when a device roams to a partner satellite network, even domestically. These flows are already standard for international roaming, but customers deserve clarity when the roaming is in the sky above their own country.

Takeaways and what to watch next

-

The service is real. SMS and low-rate IoT are turning on first, with named plan bundles and clear coverage rules. Expect opt-in prompts on mainstream carriers as markets light up.

-

Your phone is closer than you think. Many devices can join with a firmware update, especially for services that use familiar terrestrial bands. New phones with Release 17 non-terrestrial network support will broaden the footprint in 2025.

-

Voice and data are months, not years, away. The gating factors are satellite launches, core integration, and emergency policy. Operators have set six to twelve month windows for basic voice and data in first markets.

-

Capacity is limited by design. Satellites will serve rural, maritime, and disaster zones first. Cities will be gated to protect terrestrial service and preserve beam capacity.

Watch next:

-

Launch cadence and payload mix this fall and winter. The number and type of satellites put up will tell you which markets get voice first.

-

Firmware releases from major phone vendors that mention Release 17 non-terrestrial network support or satellite texting on specific bands.

-

Carrier plan pages and apps adding satellite bundles with clear allowances.

-

Regulatory updates that finalize emergency calling and cross-border coordination for supplemental coverage from space. These will unlock broader service areas.

The sky is becoming a quiet extension of the network you already use. It will start with a delivered text from a place where bars used to vanish. After that, a voice call that simply works. The rest will follow.