Guam’s Missile Shield Rewired for a Joint Kill Web

In January 2025 the Pentagon ended the AN/TPY-6 radar plan for Guam and shifted to a command and control first architecture built on JTMC, IBCS and Aegis C2. Here is how that pivot enables remote SM-6 shots against PRC missiles, and the risks between now and 2029.

The year Guam’s defense changed direction

On January 7, 2025, the Pentagon quietly rewired the blueprint for Guam’s missile shield. A memo from the Deputy Secretary of Defense directed the Missile Defense Agency to cease development of the planned AN/TPY-6 radar panel and to pivot resources toward the command and control backbone that will tie Guam’s sensors and shooters into a single, joint battle network. The Government Accountability Office documented the shift, including the decision to retain the existing AN/TPY-6 experimental panel for potential future use, and the push to accelerate joint C2 integration. The GAO report on the pivot is the clearest public signal that Guam’s defense is moving from a radar-first plan to a network-first plan.

This redesign does not shrink the mission. Guam still needs 360 degree protection against Chinese air and missile threats that range from subsonic cruise missiles to maneuvering hypersonic glide vehicles. What changes is the order of operations. Instead of fielding a bespoke land radar and building out from there, the Department of Defense is prioritizing the data fabric and battle management that can stitch together existing sensors and interceptors, afloat and ashore, into a fast, resilient kill web.

What the Pentagon is building now

The new center of gravity is joint, networked Integrated Air and Missile Defense, often shortened to IAMD. Three pieces define the shift:

- JTMC, the Joint Track Management Capability. Think of this as the joint track service that translates and transports sensor quality data across services so every shooter sees the same threat with the same identity, in near real time.

- IBCS, the Army’s Integrated Battle Command System. This is the Army’s combat system that connects any sensor to any shooter in its portfolio, while enforcing engagement doctrine and deconflicting fires.

- Aegis C2, the Navy’s combat system command layer ashore on Guam. It manages naval interceptors and integrates sea-based and land-based elements.

Under the 2025 guidance, remaining Aegis Guam development funds are being redirected to deliver minimum viable Aegis C2 and datalink capability that enables Standard Missile 6 shots using remote tracks flowing across JTMC from Army and MDA sensors such as AN/TPY-2 and LTAMDS. That is the headline. The system of systems will still include Patriot and THAAD batteries, along with the Army’s new Lower Tier Air and Missile Defense Sensor, but the glue comes first. Lessons from shore-based SM-6 employment, such as shore SM-6 lessons in Japan, underscore how remote fires can expand defended battlespace.

JTMC and the joint track architecture

The memo tasks DoD to upgrade the JTMC bridge to handle the full range of Chinese missile threats and to achieve a Joint Tactical Integrated Fire Control capability by the end of the decade. In practical terms, that means the joint track service must not only pass accurate kinematic data, it must sustain combat identification, electronic protection, and consistent latency so that an interceptor cued by a remote sensor can actually solve the engagement geometry. JTMC upgrades are targeted to complete by about 2029. That date matters because other elements can mature in parallel, but the kill web is only as strong as its track quality and timing. Space-based sensing will matter here, with architectures like the Tranche-1 PWSA buildout improving custody and timeliness.

IBCS as the Army brain

IBCS has spent years proving it can break Patriot’s old one-radar, one-battery model. For Guam, the directive accelerates getting THAAD under IBCS command, not just Patriot and LTAMDS. When THAAD’s AN/TPY-2 radar, LTAMDS, and other sensors publish tracks through IBCS and JTMC, shooters across the force can see and act on a single, coherent picture. That reduces duplicated fires, supports shoot-look-shoot doctrine, and lets commanders allocate scarce interceptors to the most dangerous tracks.

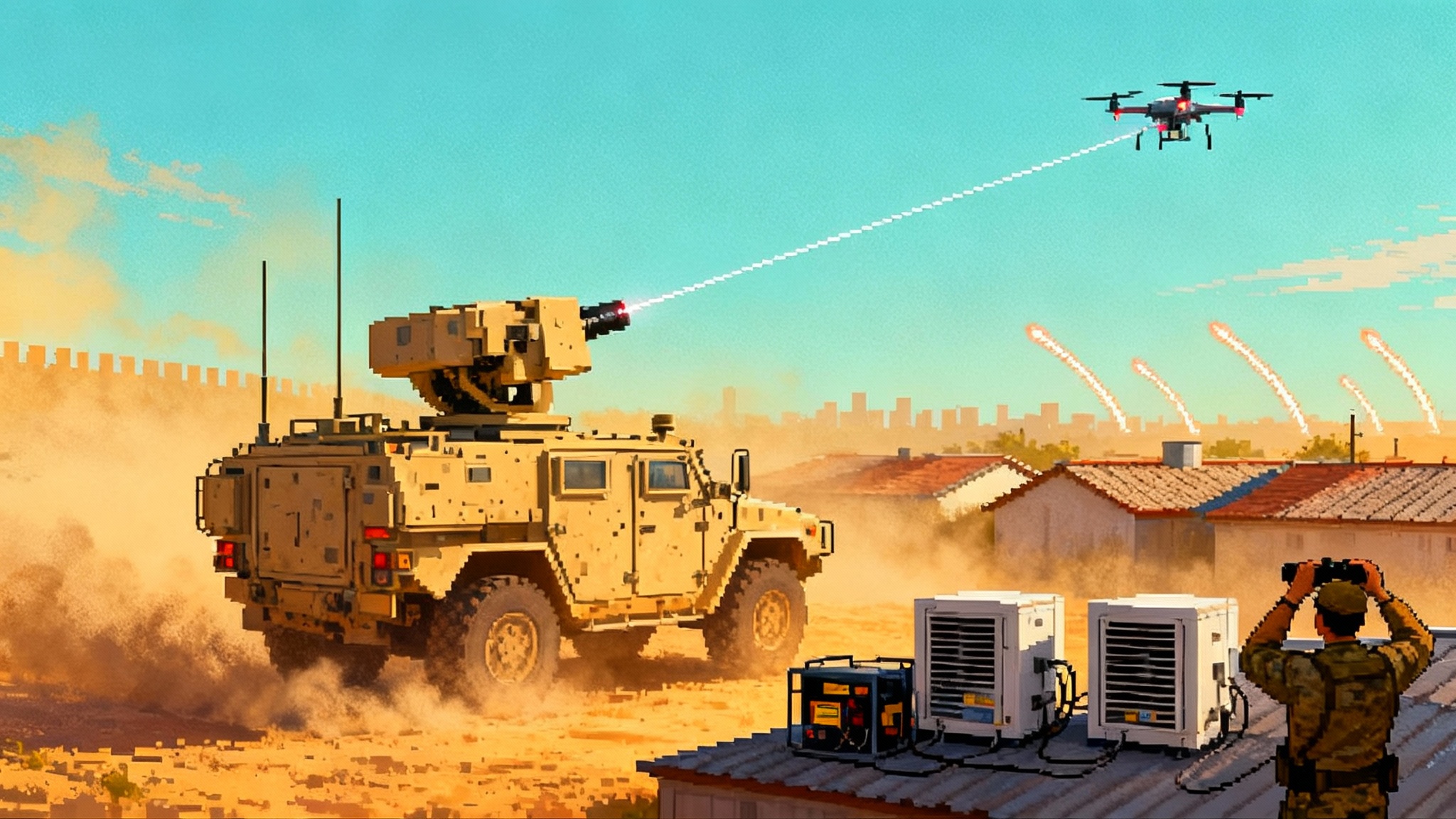

Aegis C2 and remote SM-6 shots

Aegis on Guam will not be a stand-alone island of capability. It is being wired to take high-quality remote tracks, manage naval interceptors, and coordinate with Army fires. The near-term goal is explicit: enable SM-6 engagements based on remote sensor data riding the JTMC bridge. That design choice pulls engagement timelines forward and extends defended battlespace because an SM-6 can be launched before an inbound threat crosses the horizon of a local radar, if the joint network maintains a stable track. The pivot and its technical intent were first laid out publicly in reporting that quoted the GAO’s language on remote SM-6 shots and JTMC upgrades. See Defense News on Guam pivot.

Why a C2-first redesign makes sense against China’s missiles

The People’s Liberation Army has built its conventional missile force for mass, surprise, and maneuver. A defense optimized for one radar per battery will struggle when salvos arrive from many axes with mixed seekers and flight regimes. Building the command and control that lets any sensor cue any shooter is how Guam’s defense stays ahead of that problem.

- Cruise missiles and low flyers. Cruise missiles can terrain mask and arrive from unexpected bearings. Fusing AN/TPY-2 ballistic tracking, LTAMDS look angles, and maritime sensors creates persistent custody even when one sensor loses line of sight. When Aegis can take a remote track and fire an SM-6 early, defenders extend the engagement timeline and free Patriot batteries to handle leakers or simultaneous raids.

- Ballistic missiles with countermeasures. The PLA’s intermediate-range ballistic missiles use depressed trajectories, staging, and decoys to complicate discrimination. Networked C2 lets defenders layer engagements. A higher tier shot can be taken when the track is clean, and THAAD can prosecute in endoatmospheric conditions if needed, all while IBCS prevents redundant engagements that waste interceptors.

- Hypersonic glide vehicles. Hypersonic glide vehicles fly lower than classic ballistic arcs and maneuver to break tracks. No single radar covers that entire profile. The only way to maintain custody is through multi-sensor, multi-geometry track fusion with high-confidence ID. A C2-first design prioritizes that fusion, then lets whichever shooter is best placed, perhaps SM-6 or a future effector, take a shot on a stable remote track.

The benefits compound. Joint C2 reduces engagement latency, expands defended area, and makes the most of limited magazines. It also creates options. If a typhoon, a cyberattack, or an enemy strike degrades one radar node, the network can route around it.

The risks and tradeoffs, from now to about 2029

A pivot like this carries real risk. The most obvious is integration complexity. JTMC must translate track data from different services and message sets without degrading quality or introducing delays that break the geometry of an intercept. IBCS must manage both Patriot and THAAD, while deconflicting with Aegis C2 and any afloat shooters in the area. That is hard engineering, hard testing, and hard doctrine.

- Schedule risk. The target to complete JTMC upgrades by around 2029 sets a natural pacing item. If software integration slips, the network’s most important feature, engage on remote, will be throttled. Concurrency compounds this risk because LTAMDS production, THAAD integration, and Aegis ashore C2 all mature in overlapping windows.

- Cyber and electronic protection. A networked defense is a bigger digital target. JTMC and IBCS will carry mission data that must be protected against spoofing, jamming, and latency attacks. This calls for aggressive red teaming, layered communications that include LOS, SATCOM, and line-of-bearing paths, and the ability to degrade gracefully when parts of the network are stressed. Timing assurance is a key dependency, which is why reprogrammable PNT resilience matters.

- Magazine depth and sustainment. A smarter network does not erase the need for enough interceptors and reload capacity. Guam’s logistics and rearmament plan remains a gating factor, especially under sustained attack. The C2-first approach is necessary but not sufficient.

- Industrial and programmatic impacts. Halting AN/TPY-6 shifts money and focus from hardware to integration. Radar vendors may see near-term loss of a program of record, while software and C2 integrators gain. The retained experimental AN/TPY-6 panel could still inform future capability, but industry road maps will adjust to the new emphasis on JTMC bridges, data standards, and cross-service test events.

- Site and infrastructure realities. Guam’s defenders still live with power, water, hardening, and housing constraints. Without timely support facilities, even the best network underdelivers. The GAO has already warned that support planning must catch up to avoid delays.

How remote engagements change the playbook

Engage on remote is more than a phrase. On Guam it is a way to buy time and battlespace.

- Earlier shoots. If a long-range sensor or an off-island asset holds a stable track through JTMC, an SM-6 can be launched when kinematics are favorable rather than waiting for a local radar to establish custody. That creates more intercept opportunities per threat, especially for maneuvering targets.

- Smarter layering. With IBCS adjudicating tracks and doctrine, THAAD and Patriot can hold fire until the system sees whether the forward shot succeeded, conserving rounds for the next wave.

- Afloat plus ashore. Aegis destroyers, E-2D aircraft, or other maritime sensors that see a raid inbound can feed tracks into the Guam network. If afloat shooters are busy guarding carrier groups or chokepoints, Guam’s land launchers can still exploit the maritime picture.

The cost is dependence on the network’s health. Custody breaks, misaligned time sources, or misclassified tracks can ripple across the system, which is why the 2025 pivot puts emphasis on joint track management, combat identification, and electronic protection as part of the C2 baseline.

What success looks like by 2029 and beyond

By about 2029, Guam’s defense should operate as a coherent joint kill web that does four things well:

-

Maintains custody across regimes. Cruise, ballistic, and hypersonic threats remain tracked through sensor handoffs without losing ID confidence.

-

Assigns the right shooter. IBCS and Aegis C2 coordinate to give each interceptor a geometry it can win, while avoiding duplicate shots unless doctrine calls for a raid annihilation tactic.

-

Shrinks decision timelines. Operators see the same picture, can trust it, and can execute automated or semi-automated doctrine with human on the loop.

-

Recovers from damage. The system routes around failed nodes and keeps fighting with degraded but sufficient performance.

If that state is achieved on Guam, the island becomes more than defended territory. It becomes a template for the Indo-Pacific.

Guam as the template for joint kill web defense across the theater

Guam is the right laboratory for a simple reason. It concentrates critical logistics and power projection assets within range of a growing PLA missile complex, yet it sits at a joint crossroads of Army, Navy, Air Force, Marine Corps, Space Force, and allied presence. A C2-first Guam shows how to build an alliance-ready kill web.

- Repeatable architecture. JTMC plus service combat systems create a standards-based pattern that can be repeated on Tinian, Palau, northern Australia, or parts of Japan. Each site can tailor the mix of sensors and shooters, but share the same track services and doctrine.

- Allied integration. A track-oriented architecture provides clean interfaces for allies to contribute sensors or shooters without exposing full combat systems. Shared tracks with robust ID and data quality flags are easier to federate than bespoke radars.

- Maritime ties. The Pacific is a naval theater. Aegis C2 ashore that speaks the same language as afloat Aegis makes every destroyer and cruiser a potential sensor and, when authorities allow, a shooter on the Guam network.

The long-term prize is a theater where any sensor can cue any shooter under a common set of tactical data services and doctrinal rules. Guam can demonstrate that model under real operational pressure.

What to watch next

- JTMC bridge upgrades. The technical milestones that harden combat ID, timing, and electronic protection will determine whether remote engagements are routine or rare.

- THAAD under IBCS. Live force-on-force tests that put THAAD and Patriot under one brain will show whether the Army can truly collapse stovepipes.

- Remote SM-6 shots. Demonstrations that start with a nonlocal track, pass through JTMC, and result in a clean intercept from a land launcher will be the proof point for the pivot.

- LTAMDS deployment and integration. The radar’s field-of-view and discrimination performance, once fused with other sensors, will reveal how well the joint picture holds up under saturation raids.

- Construction and sustainment. Power, hardening, rearmament, and housing timelines will either support or slow the operational dates implied by the C2 software plans.

Bottom line

Killing the AN/TPY-6 program of record was not a retreat, it was a reprioritization. The Pentagon chose to make Guam’s brain before its brawn, to invest first in the glue that holds together THAAD, Patriot, LTAMDS, and Aegis, and to enable remote SM-6 shots that open the battlespace. If the services deliver JTMC and IBCS integration by about 2029, Guam will gain a credible, resilient shield against China’s most stressing raid problems. If they slip, the island will have capable pieces that cannot fight as one.

Either way, what happens on Guam will write the playbook for joint kill web air and missile defense across the Indo-Pacific. The stakes are measured in defended time, defended area, and the confidence of every aircrew and sailor who depends on the island staying in the fight.