Ghost Shark Goes Fleet: Australia Bets on Massed UUVs

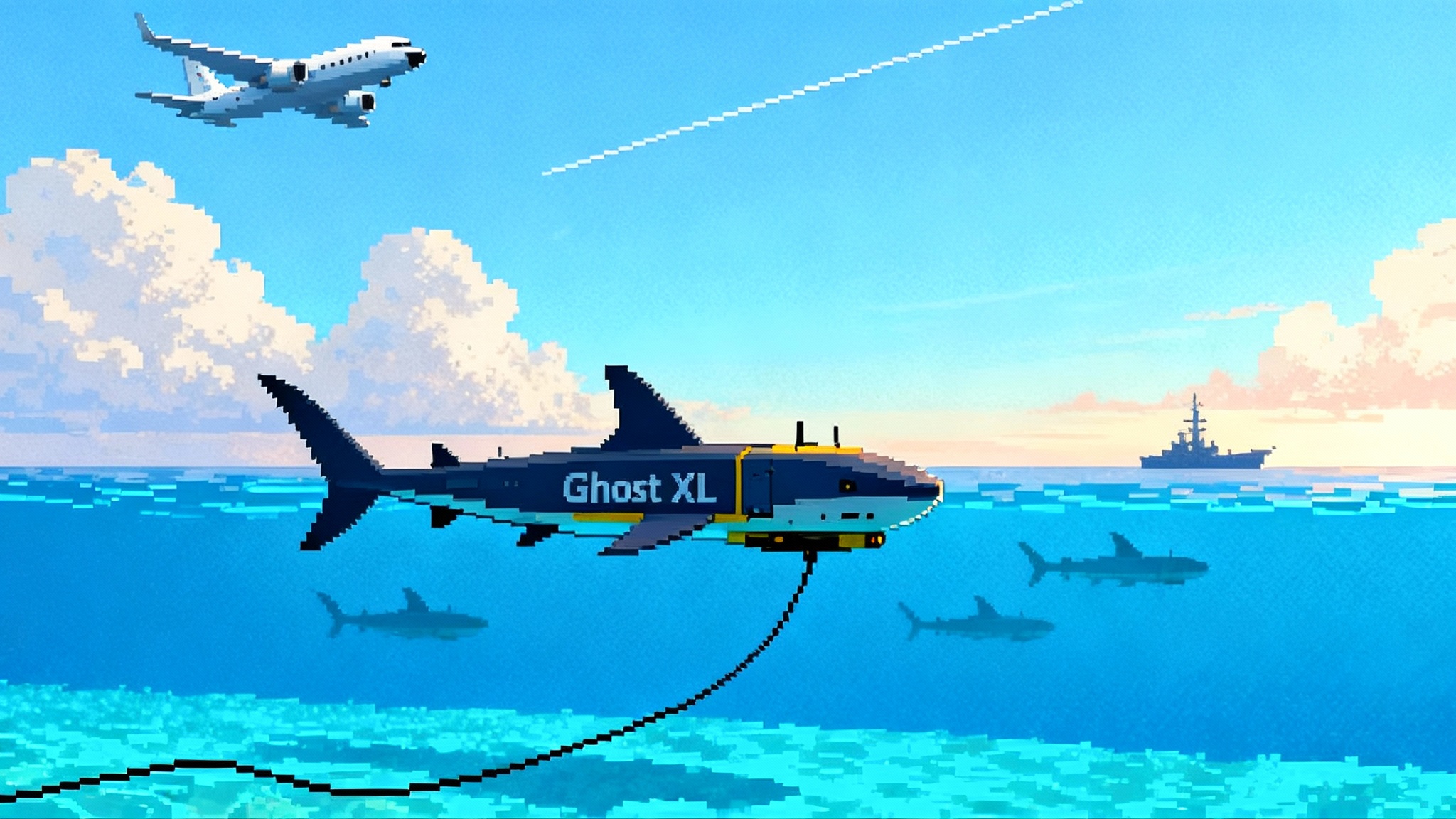

Australia just shifted Ghost Shark from prototypes to a funded fleet, with the first XL-AUVs planned to enter Royal Australian Navy service in early 2026. Here is how mass autonomy could reshape Indo-Pacific deterrence and how China may respond.

A mid-September pivot with regional shockwaves

Canberra’s mid-September 2025 decision to move Ghost Shark from a rapid prototyping sprint into a true fleet purchase is a watershed. The government committed A$1.7 billion for a multi-year buy and sustainment package, with the first extra-large autonomous undersea vehicles entering Royal Australian Navy service in early 2026. The announcement formalized Ghost Shark as a program of record and locked in a near-term path from a trio of demonstrators to dozens of operational vehicles. The public facts are sparse by design, but the headline is clear enough. Australia is buying mass under the sea, on an urgent clock, to complement its future nuclear-powered submarines. For an official baseline, see the government’s A$1.7 billion fleet decision.

Why Ghost Shark matters now

Speed and scale are the strategic differentiators. Australia’s nuclear boats will not arrive in numbers for years, yet the undersea domain is already crowded and contested. Ghost Shark targets that gap by pairing high endurance with a production model geared for iteration rather than one-off naval artistry. The prototypes arrived ahead of schedule, manufacturing lines are standing up in Australia, and officials say production will ramp to higher rates in 2026. In any deterrence contest that may tip quickly, a platform you can build by the dozen and update every software cycle carries disproportionate weight.

Cost per effect also changes the game. A single crewed nuclear submarine concentrates capability, but it also concentrates risk and time. An attritable XL-AUV shifts the math. You can distribute risk across many hulls, flood more patrol boxes, and accept losses without strategic paralysis. In peacetime, a large inventory enables persistent presence around chokepoints and critical infrastructure. In crisis, it yields options short of escalation, from covert surveillance to non-kinetic disruption of adversary sensors. In conflict, it offers a way to saturate the battlespace with autonomous scouts, decoys, and strike nodes that force the opponent to spend precious sorties and munitions on hunting robots.

What an XL-AUV brings to the fight

Ghost Shark is built around a modular payload philosophy. Think of the vehicle as a long-range, long-endurance carrier for mission packages rather than a single-purpose drone. Likely payload families include:

- ISR: broad area acoustic and non-acoustic sensing, seabed mapping, signals collection, and periscope-style masts for visual custody at range.

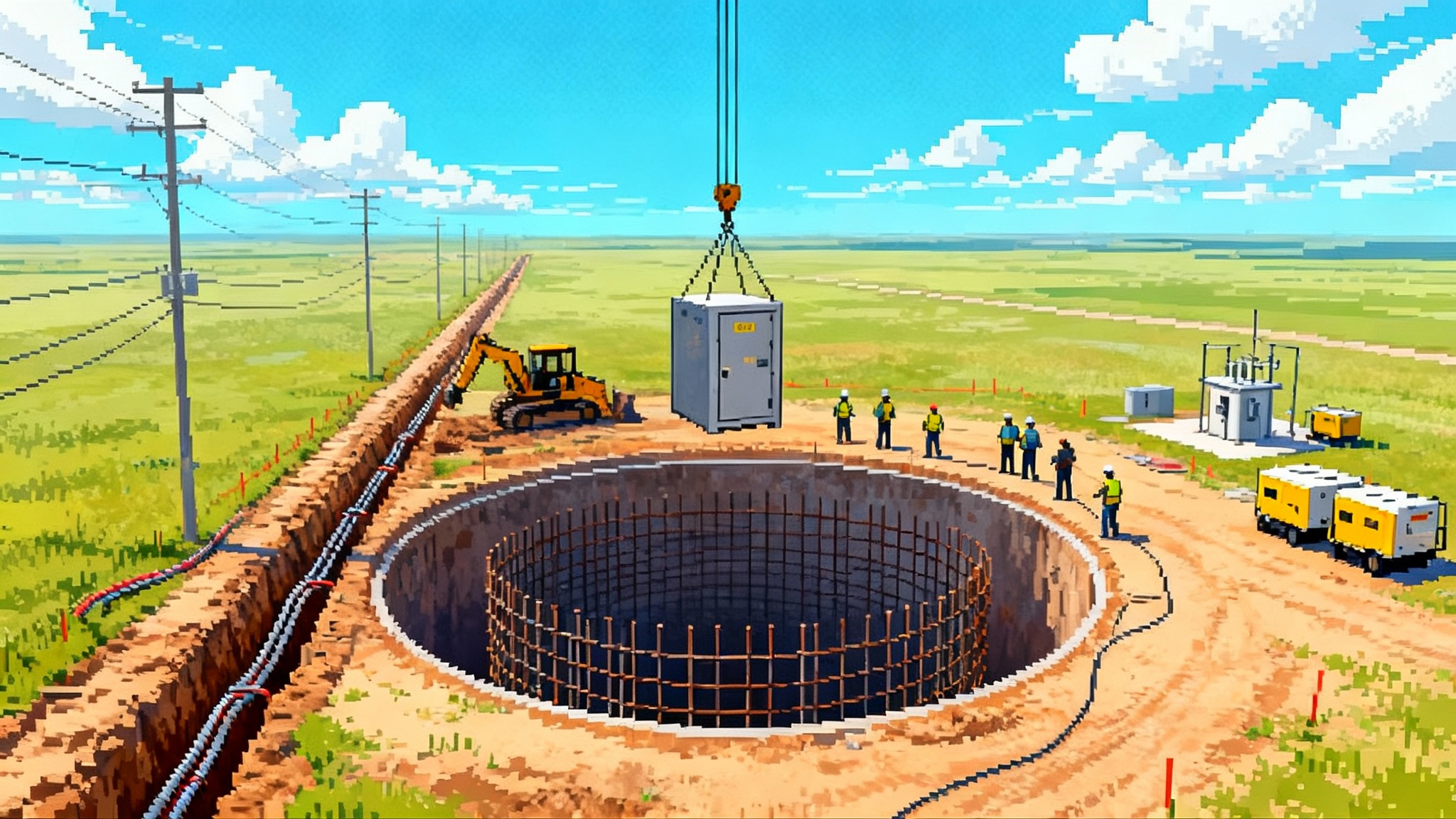

- Seabed warfare: sensors and effector placements on or near the bottom, inspection and tamper detection around cables, pipelines, and energy infrastructure, and discreet delivery of resident nodes.

- Mine warfare: covert minelaying and counter-mining packages for clearing approaches or closing straits.

- Strike and sea denial: external or internal carriage of light torpedoes or loitering munitions, and potentially networked targeting to cue allied shooters.

The power of modularity is not only mission variety, it is production leverage. Australia can produce a common hull at scale while payload teams iterate on timelines measured in months. If a new algorithm improves passive detection in tropical littorals, or a better battery extends endurance, that upgrade can ride the next lot or even be retrofitted across the fleet. The result is a capability that improves while in service rather than waiting for a mid-life refit.

Mass autonomy and the deterrence equation

Undersea deterrence is about uncertainty. If an adversary cannot be sure what is lurking beyond the next thermal layer, it must plan around worst cases, slow its operations, and allocate more force protection. A massed XL-AUV fleet multiplies that uncertainty. Swarms of uncrewed scouts complicate anti-submarine warfare search plans. Distributed nodes extend the reach of allied sensors into gray gaps. Autonomous pickets can shadow high-value units, passively collect, and silently cue a kill chain without revealing a human-crewed submarine.

This is not redundancy for redundancy’s sake. It is a deliberate attempt to build a layered, mixed fleet where humans and machines trade roles as risk and mission dictate. Crewed submarines retain decisive advantages in complex judgment, high-end strike, and the most sensitive tasks. Uncrewed vehicles take the attrition, push into contested straits and island chains, and persist around seabed infrastructure for months.

AUKUS Pillar 2 is the accelerator

Ghost Shark’s shift to a fleet intersects with a broader tri-national push to move autonomy and AI from labs to line units. Under the evolving AUKUS Pillar 2 roadmap, the partners have been running a rolling series of experiments on maritime autonomy, communications, and interchangeability. One proof point arrived in July 2025, when the United Kingdom demonstrated remote control of its 12-meter Excalibur XLUUV from a command center in Australia while the vehicle operated in UK waters. The Royal Navy described this as a first for Pillar 2 interchangeability and part of the Maritime Big Play series. See the official account of UK XLUUV remote control.

For Ghost Shark, Pillar 2 means faster tech sharing on autonomy stacks, cross-loading payloads and tactics across allied hulls, and maturing command-and-control for mixed teams. It also signals an industrial intent. Australia is standing up sovereign manufacturing but wants lines sized for export or allied co-production if policy allows. The United Kingdom’s experimentation track with Cetus, and the United States’ Orca program, now have an allied benchmark for timelines and scale.

How the PLA Navy is likely to counter

No plan survives first contact with a determined opponent. The People’s Liberation Army Navy has invested heavily in anti-submarine warfare across the South China Sea periphery, blending seabed sensors, fixed arrays on reclaimed features, and patrols by aircraft and surface combatants. Expect four broad families of countermeasures as Ghost Shark scales up:

-

Sensor nets and acoustic fences. Fixed seabed arrays and deployable acoustic lines in key straits and approaches remain the most efficient way to raise detection probability against quiet vehicles at low speed. Saturating chokepoints with hydrophones and low-frequency active systems could push XL-AUVs into slower, more predictable transit patterns where mobile forces await.

-

Unmanned hunters. China is fielding and exporting uncrewed surface and underwater systems tailored for patrol, barrier operations, and point defense around high-value bases. Torpedo-capable UUV concepts, USV swarms equipped with dipping sonars, and resident seabed sentries would give the PLA a layered counter-drone ecosystem.

-

Gray-zone maritime pressure. Fishing fleets, coast guard hulls, and maritime militia can complicate launch and recovery along Australia’s north and around allied bases, while also creating noise and clutter that masks sensor deployments.

-

Targeting the nervous system. The most lucrative strategy is often to attack the network rather than the vehicle. That means jamming or spoofing acoustic communications, cyber pressure on ground stations and logistic chains, and probing for legal and diplomatic seams that slow allied sensor deployments in disputed waters.

Australia’s answer will blend quieter vehicles, better autonomy that reduces comms exposure, deception with decoys and emitters, and an undersea picture fused from tri-national sensors. Mass helps too. If an adversary must hunt many vehicles with a limited number of high-end assets, the cost curve bends toward the side that can replace losses faster.

Seabed infrastructure moves to the center of strategy

Undersea cables and offshore energy are now front-line targets. The Indo-Pacific’s digital and energy lifelines crisscross shallow tropical shelves where fishing, anchoring, and storms already cause frequent breaks. Recent years added suspected sabotage in the Baltic, repeated cable cuts around Taiwan, and growing concern about repair capacity and at-sea attribution. Australia’s own energy future includes massive seabed infrastructure from the Northwest Shelf to the Timor and Arafura seas, along with planned expansions in offshore wind.

Ghost Shark gives Australia a resident, stealthy, and persistent presence to monitor this seabed terrain, investigate anomalies, and recover evidence. With the right payloads, XL-AUVs can map and harden cable routes, place attended or unattended guardians, and deliver rapid inspection after earthquakes or suspicious outages. The same vehicles can quietly survey adversary installations, complicating any calculus that assumes the seabed is a permissive sanctuary. For background, see our primer on seabed infrastructure security.

Command, control, and autonomy questions that matter

Autonomy at sea is not only a software problem. It is a command and legal problem that grows sharper as fleets scale. Three questions loom:

-

Who decides when a robot can use force. Australia and the United States both require meaningful human judgment over the use of force, with rigorous testing, certification, and oversight for any weapon system with autonomous functions. As autonomy improves, the practical issue is not whether a human approves force, but how to design engagements so operators retain context and time for good judgment even with denied communications.

-

How to manage escalation when attribution is murky. An XL-AUV shadowing a destroyer, a cable inspection that trips a proximity sensor, a resident node found near an adversary pipeline. Any of these could spark a crisis if misread. That argues for unambiguous markings, logging and traceability in autonomy stacks, and well-rehearsed playbooks for incident response.

-

How to fight through comms loss. The most dangerous opponent for an autonomous fleet is a clever jammer. Ghost Shark must default to graceful degradation, local teaming behaviors, and time-bounded autonomy. Experiments under AUKUS Pillar 2 roadmap are already trialing contested communications and remote control across continents, which is the right focus.

Implications for U.S. and allied UUV roadmaps

Australia just set a near-term bar for speed. The United States has struggled to turn prototypes into scale with the Orca class, though the program is now moving through deliveries and test events. The United Kingdom’s Cetus demonstrator, now sailing as Excalibur, is maturing tactics and communications fast under Pillar 2. Ghost Shark’s production model suggests three clear signals for allied roadmaps:

-

Move from exquisite to iterative. Commit to a common hull and powertrain, then compete payloads and autonomy stacks. Reserve the highest requirements for a few roles, not for the whole class.

-

Fund the factory as much as the vehicle. The advantage is not only the first unit, it is the tenth and the thirtieth. Lines sized for surge matter. Tooling and workforce plans that can flex matter. Allied co-production options matter.

-

Design for coalitions. Payload interfaces, command-and-control message sets, and secure autonomy assurance methods should be aligned early so that a UK vehicle can carry an Australian payload and be cued by a U.S. sensor without a bespoke bridge. For context, see our overview of the U.S. Orca XLUUV program.

If allies execute on those three, they can field an interoperable XL-AUV family in the second half of the decade, with Ghost Shark as the first operational node.

The risks that still need work

-

Navigation and deconfliction. The more uncrewed vehicles you send into busy sea lanes, the more you must invest in collision avoidance, maritime law compliance, and engagement rules that protect shipping and ecosystems.

-

Supply chain exposure. Batteries, sensors, and high performance computing stacks are global commodities. Securing trusted supply chains for undersea systems takes planning measured in years, not months.

-

Secrecy versus deterrence. Autonomy thrives on data, and deterrence thrives on visible capability. Yet the most sensitive Ghost Shark missions will be invisible by design. Canberra will need a balanced communications strategy that signals scale and resolve without revealing tactics.

What to watch between now and early 2026

-

Production rhythm. Do the first operational vehicles arrive on time and in useful numbers. Announced milestones point to low-rate output now and higher rates next year.

-

Payload maturation. Watch for ISR, seabed warfare, and mine packages moving from trials to fielding, and for software updates burning down the backlog of requested features from fleet operators.

-

Pillar 2 experiments moving to routine tasking. The more often allied operations centers task each other’s vehicles and share undersea pictures, the faster the ecosystem will mature.

-

PLA Navy behavior. Expect more acoustic clutter near straits, more USV patrols, and more attention to seabed infrastructure across the South China Sea and Bashi Channel.

The bottom line

Australia just made the first allied move to mass autonomous undersea warfare. By locking Ghost Shark into a fleet purchase with units entering service in early 2026, Canberra has chosen speed, scale, and modularity. The payoff is a sharper undersea deterrent in the near term, a hedge against uncertainty in the 2030s, and a template for the United States and the United Kingdom to follow. The risks are real, from PLA sensor nets and unmanned hunters to legal and ethical thorns around autonomy and seabed operations. Yet the strategic logic is hard to miss. In a region where time and distance favor whoever can move fast and stay hidden, massed XL-AUVs could be the lever that shifts the undersea balance.