Vectis Puts CCA Into Focus: Stealth, Cost, and a New Race

Lockheed Martin’s Vectis is the clearest signal yet that collaborative combat aircraft are moving from slides to squadrons. Here is what it means for survivability, price, F-35 teaming, competitors, and procurement in the next two years.

The reveal that changes the tempo

Lockheed Martin just put a real shape to years of briefing‑slide aspirations. On September 21, 2025, Skunk Works introduced Vectis, a Group 5 collaborative combat aircraft pitched as survivable, lethal, and built for rapid iteration. The company describes a customizable airframe and an open mission architecture aimed at fielding relevant capability at speed and at a price point that invites quantity. That promise matters because the argument for CCAs has always hinged on numbers as much as performance. With Vectis, a top‑tier stealth house is saying it can deliver both. See Skunk Works’ announcement where the team introduced Vectis and its aims.

For months the CCA conversation has been dominated by Increment 1 prototypes from General Atomics and Anduril. Lockheed’s reveal is not a rewind of that decision. It is a marker for the next round of competition and a signal that CCAs are moving into test, into organizational planning, and soon into formations.

Why Vectis matters now

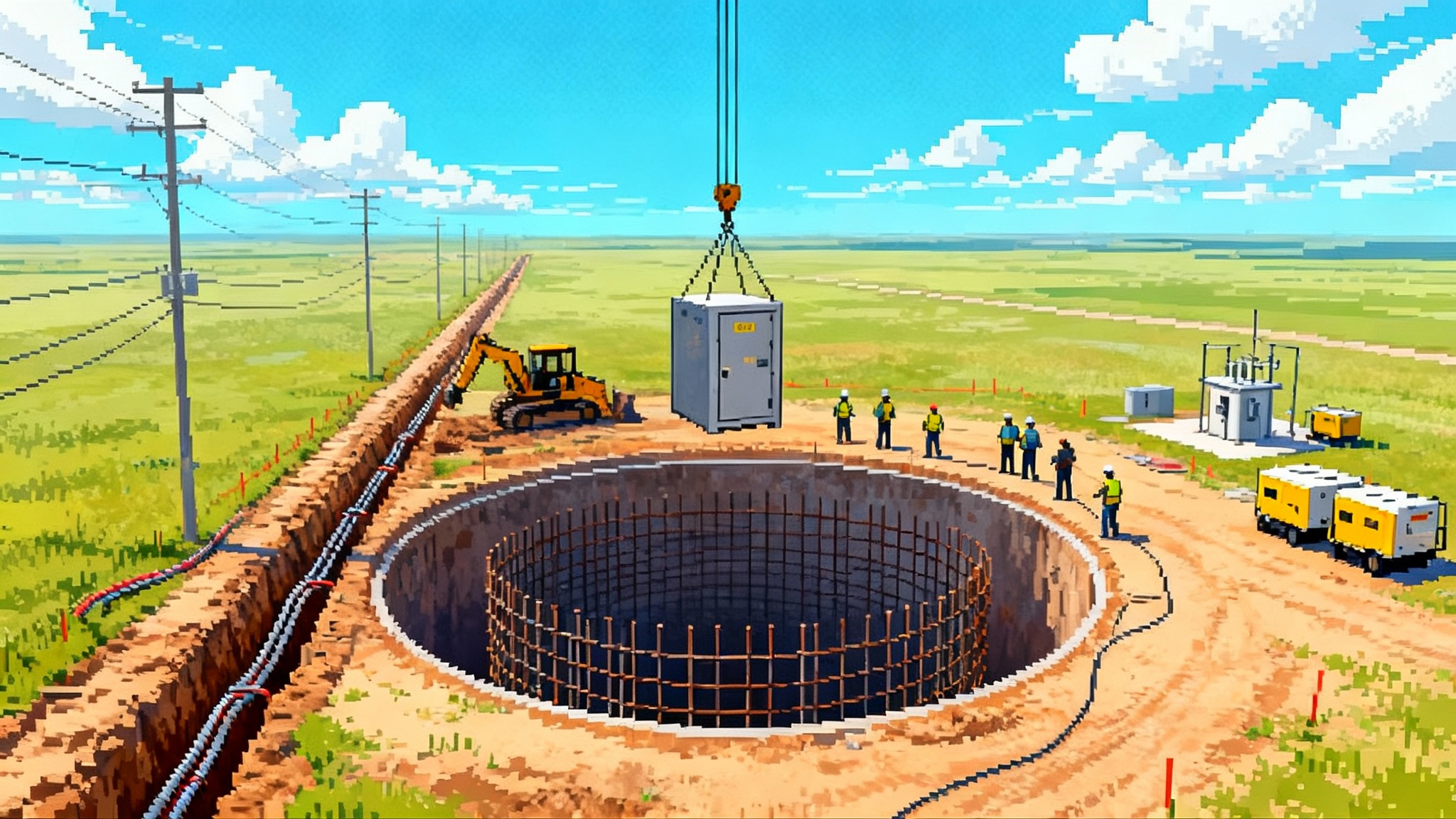

The timing is precise. In May 2025 the Department of the Air Force began ground testing of production‑representative CCA vehicles and identified Beale AFB as the preferred home for the readiness unit. Those steps are the connective tissue between demonstrations and a fielded enterprise. They show that the service is aligning hardware, software, and basing to scale a new category of combat power. The Air Force began ground testing for CCA with two vendor teams while it built the path to squadron‑level adoption.

That context gives Vectis a target‑rich opening. The Air Force will keep iterating on Increment 1, but it will also shape Increment 2 and parallel Navy and allied efforts. A stealth‑forward design that promises to plug into open architectures and integrate tightly with F‑35 mission systems will have a serious hearing in those rooms. For background on current thinking, see our CCA Increment 1 overview.

Survivability versus cost: the trade that defines CCA

Every CCA program lives on a curve. On one axis sit mission survivability and payload. On the other sits unit cost and the ability to buy and replace aircraft at scale. Push too far toward exquisite stealth and payload and you drift into fighter‑like prices. Push too far toward cheap mass and you are limited to benign airspace or one‑shot missions.

Vectis appears to aim for a new center of gravity. The airframe imagery and Skunk Works language point to low observable shaping, internal or conformal carriage for sensitive payloads, and modular apertures for mission kits. If that survivability is good enough to stand in with fifth‑generation shooters and to penetrate at least the outer layers of modern integrated air defenses, Vectis changes the playbook. You can mount more complex sensors and carry weapons that demand stable carriage and accurate release without assuming that most aircraft will be lost.

Cost still rules the category. The Vectis pitch stresses a framework that can adapt to different price points by swapping payloads, sensors, and endurance packages without redesigning the airplane. That approach, if real, lets operators tune the bill for each mission set. Send the most survivable configuration when you must. Send a simpler or shorter‑range loadout for raids, feints, or decoy roles. The key is to give commanders a menu that pairs risk with price in a rational way.

There is also a logistics logic behind survivability. A platform that can ingress and egress without constant standoff support reduces tanker exposure and simplifies strike packages. If Vectis can do that while staying inside a CCA cost envelope, the aircraft becomes a force multiplier rather than a niche asset.

Open architecture and autonomy that can actually scale

The CCA revolution is a software story wrapped in an airframe. Open mission architectures really only matter if they let operators push new autonomy behaviors, electronic warfare techniques, and sensor modes without waiting for a new block upgrade cycle. That means standard middleware, portable autonomy stacks, and mission apps that can be certified and deployed like modern software, not like a bespoke avionics load. For a primer on the approach, see our open mission architecture guide.

Skunk Works is underscoring that Vectis is built for this world. The practical test will be how quickly the aircraft can ingest third‑party autonomy, how easily it hosts different mission computers, and how well it separates safety‑critical flight code from adaptive mission code. A clean separation allows rapid tactics updates and new teaming behaviors while preserving airworthiness.

The autonomy itself must be explainable to crews and commanders. CCA tactics will rely on shared intent rather than joystick control. That demands transparent state reporting, crisp tasking interfaces, and predictable behavior under uncertainty. The fastest way to lose trust is a black‑box agent that surprises its human teammates. Expect rigorous flight envelope protections, conservative rules for weapons employment, and escalating demonstration gates that prove the agent behaves as briefed.

Teaming with the F‑35: the integration play Lockheed is built to make

One obvious Vectis advantage is proximity to the F‑35 enterprise. The Lightning II is the most prolific fifth‑generation sensor‑shooter in the democratic world. It already functions as a quarterback that fuses radar, electronic support measures, infrared search and track, and offboard feeds into a single picture. The best CCA partner for that jet is a platform that can consume and contribute to that fused picture with minimal translation and minimal latency. For tactics concepts, see our look at F‑35 loyal wingman tactics.

Lockheed does not need to be told how to move data inside an F‑35 formation or how to prioritize emissions and signature control in a contested environment. That knowledge could translate into cleaner tasking flows, more reliable guidance updates, and smarter use of air‑to‑air silence by Vectis until it needs to speak.

Consider a simple vignette. Two F‑35s nose into a contested sector with Vectis aircraft out front. The CCAs are tasked to open paths through electronic attack and to cue passive geolocation of emitters. One Vectis carries a small precision strike load. Another carries an air‑to‑air loadout. The F‑35s hold weapons in reserve while staying at optimum altitude for sensing. If the defenses light up, the team maneuvers to force tracking on the CCAs while the F‑35s stay dark and orchestrate fire control. The human pilots decide when to commit the shooters. The autonomy keeps the formation in a safe geometry and manages emissions.

The competitive field just shifted

Vectis does not erase the head start that General Atomics and Anduril have in Increment 1. It does, however, complicate the picture for the next tranche of buys and for allied customers.

- General Atomics brings deep experience in building and sustaining large unmanned aircraft and has invested in a modular, attritable design path.

- Anduril brings a software‑first culture, fast iteration cycles, and an industrial model built around autonomy as a product.

- Boeing has fielded the MQ‑28 with Australia and has a credible claim to scaled production and mission integration.

- Kratos has flown the XQ‑58 Valkyrie and has shipped affordable test aircraft to multiple users.

- Lockheed Martin now adds Vectis to a portfolio that includes the F‑35, advanced weapons, and mission systems integration.

The result is a broader market with real differentiation. Some customers will prefer a software‑forward vendor with aggressive autonomy claims. Some will prefer an airframer with decades of stealth manufacturing. Some will prioritize cost and quick delivery. Vectis gives procurement officials another credible option that leans into survivability and integration with fifth‑generation platforms.

The survivability stack that will decide winners

Survivability is not only shaping and coatings. It is an ecosystem decision.

- Signatures: Nose and inlet treatments, chine lines, weapons carriage, and edge alignments shape radar returns. The winner will be the team that keeps signature control consistent as payloads change.

- Emissions control: Smart LPI waveforms, passive‑only tactics, and disciplined communications schedules reduce the chance of being fixed and tracked. Tightly integrated datalinks help.

- Navigation: In a GPS‑contested environment, CCAs need alternative navigation. Think terrain relative navigation, signals of opportunity, and cooperative ranging with the formation.

- Battle damage tolerance: The platform that can take small hits and still limp home is worth more even if unit cost is modest. That implies smart system separation and fire protection.

Vectis will have to prove it can manage all four without forcing the price higher than commanders can tolerate. The best measure will be mission effectiveness per dollar over a campaign, not a single sortie.

Procurement and industrial base changes to watch through 2027

Here is what to track between now and late 2027.

-

Flight testing tempo and autonomy gates. Watch how quickly the services expand the flight envelope, add multi‑ship autonomy, and clear weapons carriage.

-

Software certification pipelines. Expect named baselines for autonomy, rapid patch cycles, and digital evidence to speed approvals. Vendors that show repeatable pipelines will gain margin.

-

Open mission architecture reality. The claim only counts if third‑party payloads and autonomy stacks can be integrated fast. Look for public demos where a new mission app rides on a CCA after weeks of integration, not months.

-

Weapons roadmaps for CCAs. Air‑to‑air loadouts, compact strike weapons, and stand‑in EW payloads will define mission value. Watch for early fits that keep mass and drag low and that preserve signature.

-

Sustainment models that favor affordability. Expect performance‑based logistics at the mission‑system layer and simpler airframe spares concepts.

-

Engines and supply chain resilience. Powerplants set range and cost. Vendors that lock reliable engines with stable suppliers will avoid schedule slips.

-

Composites and coatings throughput. Stealth is a factory problem as much as a design problem. The best teams will show repeatable low observable quality with fewer labor hours and higher yield.

-

Basing and training plans. The choice of Beale AFB for a readiness unit suggests a focus on rapid conversion of maintainers and operators.

-

Contract structures that reward speed. Watch for multiple award IDIQ contracts with delivery orders tied to capability drops and software maturity.

-

Cyber hardening and mission data management. Data stores, autonomy models, and mission recordings become crown jewels.

How Vectis could be used first

Early Vectis taskings are likely to be practical and repeatable. Think of stand‑in electronic attack to open lanes for human shooters, pop‑up ISR to confirm a target set just before a strike, or air‑to‑air pickets that extend the radar horizon of an F‑35 formation while the crewed jets preserve stealth. In each case, Vectis would take the higher‑risk position and handle the most predictable tasks while pilots keep decision authority and reserve complex judgment calls.

A useful rule of thumb is that first missions go to the most automatable steps in kill chains. That includes search patterns, emitter triangulation, decoy generation, and initial target classification. As trust grows, expect more dynamic assignments like multi‑axis timing with crewed jets, ad hoc retasking based on emergent threats, and cooperative weapons employment where the CCA executes the shot the moment a human authorizes it.

Implications for allies

Allied interest in loyal wingmen has turned into programs and flying hardware. Australia’s experience with MQ‑28 showed how a partner can buy into a design early and shape it for local needs. Vectis, paired with Lockheed’s global sustainment footprint and F‑35 relationships, offers a familiar path for countries that want a survivable CCA without building a new ecosystem from scratch. Expect pilots and maintainers in F‑35 squadrons to move fastest because many of the tactics, maintenance practices, and security rules are already in place.

Exportable autonomy remains a policy puzzle. The most valuable autonomy will be the hardest to release. The likely path is a tiered autonomy stack with some core behaviors common across customers and more advanced behaviors gated by bilateral agreements. Vendors that design for export from day one will move faster across borders.

What could slow the momentum

- Software‑risk incidents that erode trust.

- Cost creep from chasing exquisite survivability.

- Industrial bottlenecks in stealth materials or engines.

- Weapons integration delays that blunt early mission value.

The counter to each risk is transparency about performance, honest growth plans, and measured mission expansion that builds confidence.

The bottom line

Vectis is not a paper airplane. It is a public commitment from a prime that knows stealth and integration at scale. It enters a field that is already accelerating into test and early operational planning. That makes the reveal important. It suggests that the next phase of the CCA race will be less about who can fly and more about who can deliver survivability, software, and squadron‑level integration at a cost that keeps quantity on the table.

If Lockheed can prove that formula with Vectis, the company will have reset expectations for what a survivable CCA should be and how soon operators can depend on it. If competitors meet the mark first, the user wins anyway. Either way the era of speculative loyal wingman slides is ending. The era of fielding, training, and tactics is starting to begin.