Sequencer Wars Go Permissionless as Shared Layers Launch

Shared sequencers are leaving the lab. Espresso’s Mainnet 1 introduces permissionless validation in Q4 2025, while Astria-backed rollups migrate to decentralized sequencing. Here is what changes and how to prepare.

The moment shared sequencers leave the lab

For years, rollups promised faster and cheaper transactions with the reliability of Ethereum settlement. The catch was hidden in plain sight: most rollups used a single, often private sequencer that decided who got into a block and when. That single box became the fast lane, the toll booth, and the traffic camera.

In Q4 2025 the map changes. Espresso is upgrading to Mainnet 1 with permissionless validation and a dynamic validator set that builders can join directly, rather than asking for an invitation. As detailed in the Espresso Mainnet 1 release plan, the initial release targets an open set of one hundred nodes with stake-based participation.

Meanwhile, live applications are switching on decentralized sequencing in production. Forma, a creator-focused network, migrated to Astria’s shared sequencer via its Palette hard fork on June 4, 2025, replacing a private sequencer with a permissionless network of operators. See the Forma’s Palette hard fork announcement for details.

Two independent efforts, a common direction. Sequencing, once a rollup-by-rollup decision, is becoming a shared public good.

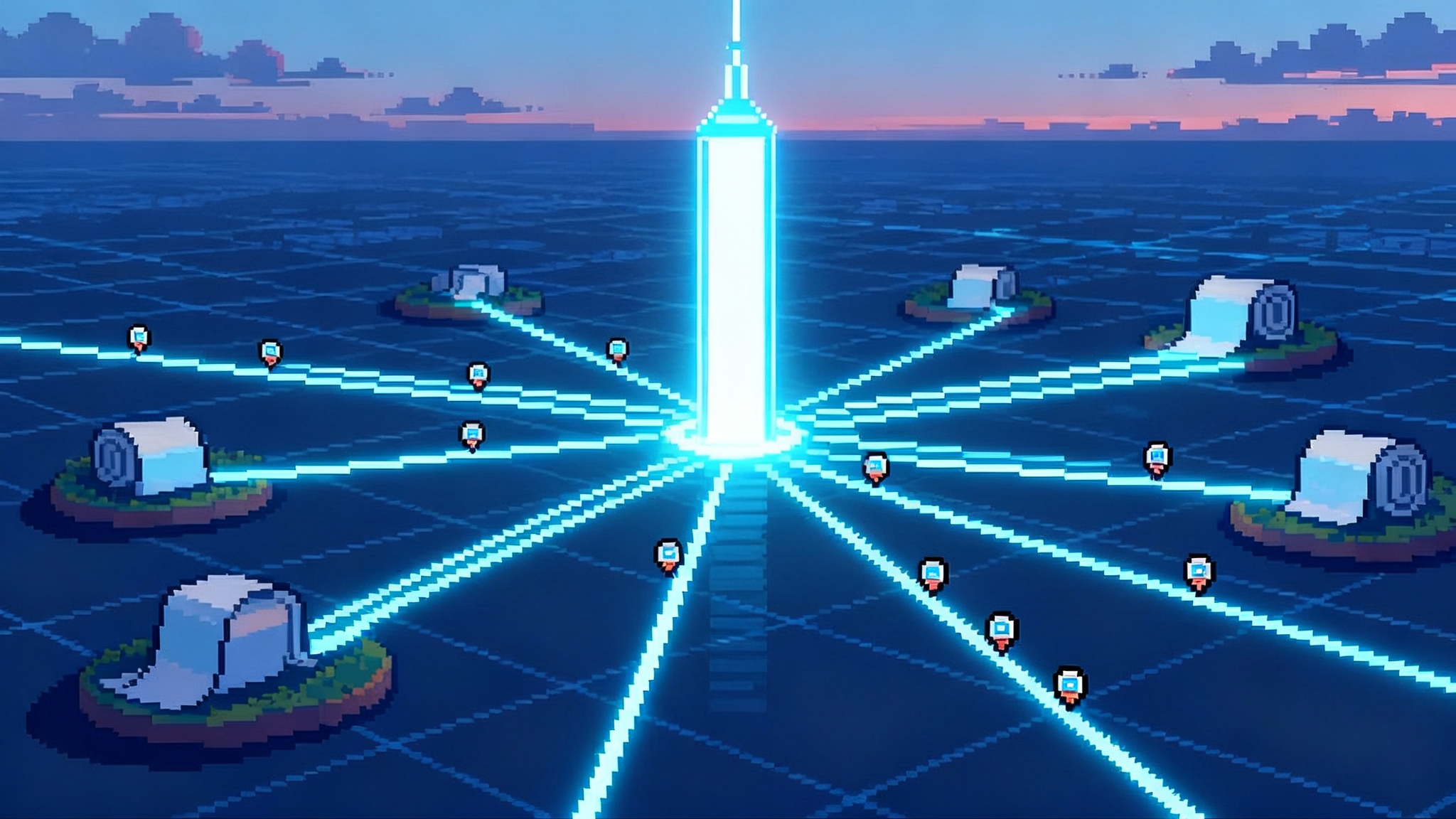

What a sequencer really does, in one picture

Imagine a city with many neighborhood markets. Each rollup is a market. The sequencer is the person standing at each entrance deciding the order of shoppers entering the aisles. If every market hires its own doorkeeper, you can shop quickly inside that market, but coordinating a two-store deal is awkward. You wait for receipts to travel across town, and you hope neither doorkeeper changes their story.

A shared sequencer is a single, citywide clock for entry. Many markets plug into the same line. You still check out inside your own market, but the order of who entered where and when is agreed by a neutral network. In practice, this means:

- Faster confirmations: Espresso’s HotShot consensus provides pre-confirmations within seconds. Pre-confirmations are signed statements by a large set of validators that a certain ordering is locked in. They are much faster than waiting for layer one settlement on Ethereum, which typically requires several epochs to be considered final.

- Lower risk of conflicting histories: Once ordering is certified by the shared network, individual sequencers cannot rewrite the entry log without getting caught by smart contracts or light clients.

- Easier cross-market coordination: When all participating rollups read the same clock, a two-store deal can either succeed everywhere or revert everywhere. No partial receipts.

Related background on scaling and costs appears in PeerDAS cuts L2 fees on Ethereum, while execution advances intersect with L1 zkEVM moving to reality.

Terms, explained once and used precisely

- Layer two (L2): a chain that executes transactions outside Ethereum but settles to Ethereum.

- Byzantine fault tolerant (BFT): consensus that remains safe even if some validators act maliciously, up to a threshold.

- Maximum extractable value (MEV): value from controlling transaction ordering.

- Data availability (DA): the guarantee that transaction data is published so any honest party can reconstruct state.

Why shared sequencers unlock fast, trust-minimized bridging

Bridges today often work like bank transfers across slow correspondent networks. A deposit on rollup A gets noticed on Ethereum. After a waiting period, a mint appears on rollup B. The waiting period is the cost of distrust. You wait for finality on the base layer because you do not trust A’s private sequencer to stick to its story.

With a shared sequencer, both A and B read from the same ordering log. That log is produced by a decentralized network rather than a single operator. Two benefits appear immediately:

-

Pre-confirmed, safer fast paths. A bridge can mint on B as soon as it sees a certificate that the deposit on A was included in block 10 of the shared log. If that certificate is signed by two thirds of the stake of the shared network, the probability of reversal becomes comparable to breaking BFT assumptions. You no longer wait for Ethereum finality to be comfortable moving small or even medium-sized amounts. For large amounts, protocols can still require base layer settlement, but they can offer users an optional fast lane with clearly priced risk.

-

Atomic cross-rollup actions. If both rollups pull from the same ordering feed, a cross-chain swap or a complex intent can be expressed as a bundle that either lands everywhere or nowhere. The shared sequencer can provide the ordering guarantees that let each rollup’s execution engine coordinate without bespoke off-chain relays or trusted custodians.

Astria hardens this story with its native bridging design, where transfers between rollups and the sequencing layer can be enshrined at the protocol level. Espresso arrives at a similar place from a different angle. Its Global Confirmation Layer publishes quorum certificates that other chains and contracts can verify on chain. In both designs the trust assumption shifts from a private sequencer to a decentralized network whose rules are public and whose incentives are visible.

A concrete example you can reason about

You want to move ten ether from rollup A to rollup B and immediately use it in a market-making position.

- Step 1: You lock ten ether in the bridge on rollup A. The transaction enters A’s mempool.

- Step 2: The shared sequencer includes your deposit in block 10, view 3. Validators sign a certificate attesting that block 10 is final in the shared ordering.

- Step 3: The bridge on rollup B sees the certificate for your deposit in the shared log. It mints ten wrapped ether on B. A matching burn unlock path exists for withdrawals.

- Step 4: Your wallet shows a green check for the shared certificate and a yellow check for base layer settlement. You choose to deploy the funds on B now and accept the vanishingly small BFT-level risk or you wait for base layer finality to convert the yellow check to green.

No trusted custodian, no multi-hour pause. If a later reorganization somehow invalidates block 10, the mint on B reverts because its cause never existed in the shared ordering. The two receipts move together.

Cross-rollup composability moves from brochure to button

Composability is the superpower of blockchains. Within one chain it is natural. Across chains it has been fragile, slow, and packed with bespoke trust. Shared sequencing changes the default.

- Intents can span rollups. A user can express a goal such as buy on rollup A, hedge on rollup B, and settle on rollup C. Solvers can route through the shared log, earn fees for meeting the intent, and rely on certificates that prove the bundle’s ordering. Reversals become all or nothing.

- Market structure cleans up. Liquidity can splinter across many rollups without turning cross-rollup trades into an exercise in patience. The shared sequencer acts as a coordination backbone.

- Wallets can finally show a single state across chains. If the same clock stamps all transactions, a wallet can render a user’s cross-chain portfolio in near real time without guessing which sequencer to trust.

For how proof systems will interact with this backbone, see ZK compute markets hit mainnet.

Why this flips layer two security and MEV economics in 2026

Follow the money. Today, private rollup sequencers capture most of the ordering value on their chain. They can run private order flow relationships, bundle auctions, and priority gas auctions. As more rollups delegate ordering to a shared network, the center of gravity moves.

-

MEV consolidates at the shared layer. If the shared sequencer decides ordering for many rollups at once, cross-domain arbitrage appears as normal internal flow. The network can sell ordering rights in open auctions, specify inclusion rules that mitigate harmful extraction, and distribute revenue pro rata to validators and delegators. Astria has already begun experimenting with top-of-block auctions, a design that sells a single slot for guaranteed first position and leaves the rest to the normal mempool. Expect similar experiments on other shared layers.

-

Security budgets rebalance. Instead of each rollup bootstrapping its own staking token or trusting a company to run a single server, security concentrates where it is most valuable: the service that orders many chains at once. In 2026, the most credible rollups may be those that lean into neutral ordering and invest their community treasuries into validator operations and delegations on the shared layer.

-

Rollups compete on execution, not ordering. User experience will shift toward execution environment quality, state growth management, prover performance for zero-knowledge systems, and data availability costs. Ordering becomes a utility with known properties and a published price.

-

Restaking and infrastructure marketplaces grow around the sequencer sets. Operators that already run Ethereum validators or data availability nodes will seek revenue by joining the shared sequencer. That enlarges the operator set and reduces concentration risk.

The change is not only technical; it is a balance sheet change. The entity that once captured a rollup’s private ordering profits becomes a customer of a public network. That pushes profits and governance power toward neutral infrastructure and away from single-chain silos.

What builders should do now

-

Integrate a confirmation client. If you run a rollup or an application that depends on cross-chain state, add a lightweight client that verifies certificates from the shared network. On Espresso, that means ingesting quorum certificates and using the sequencer contract to check membership. On Astria, that means subscribing to the shared block feed and honoring its finality signals. Start with a low-risk pathway, such as showing soft confirmations in user interfaces, then graduate to enabling fast bridge mints and atomic bundles once you have tested your failure cases.

-

Enshrine the bridge. Move bridging logic from application code into your rollup’s core contracts. Treat cross-chain deposits and withdrawals as protocol functions that read the shared log and act deterministically. This closes room for ad hoc relayers or proprietary custodians to introduce risk.

-

Prepare for top-of-block and inclusion policies. Decide whether you will allow first-slot auctions, inclusion lists that protect certain order types, or fair ordering rules. The shared layer can implement auctions, but your rollup still sets policies for what your contracts will accept.

-

Budget for two classes of finality. Design flows that react to a fast pre-confirmation within seconds and a firm base layer settlement later. Price each path. For example, allow users to pay a small fee to use the fast lane and receive insurance coverage that pays out if a rare reversion occurs.

-

Run or delegate to validators. If your team or community can operate nodes, register to validate on the shared network once permissionless participation opens. If not, delegate to reputable operators and treat it like security-critical spending, not pure yield farming.

What wallets should do now

-

Display two clocks. Show the shared sequencer confirmation separately from base layer finality. A green check for the shared certificate and a distinct indicator for base layer settlement gives users clarity without hiding risk.

-

Route cross-rollup actions as bundles. When a user wants to bridge and swap across chains, submit it as a single atomic package that the shared network will order. Use the certificate to decide when to show funds as available.

-

Warn on private sequencer paths. If a user initiates a transfer that depends on a single rollup’s private sequencer, show an explicit warning and offer a route through a shared layer when available.

-

Cache proofs and make them portable. Users and developers should be able to export the certificate and Merkle proof that justify a balance change. That makes cross-application trust easy to verify.

What users should do now

-

Prefer apps and rollups that publish shared confirmations. If a bridge or exchange shows you the shared certificate and explains its risk, it is treating you like an adult.

-

Start small on fast paths, then scale. Try the fast mint on a trusted bridge with a small amount. Watch how your wallet displays the two clocks. Once comfortable, scale up to amounts that fit your risk tolerance.

-

Delegate to the networks you rely on. If you use applications that depend on shared ordering, consider delegating to validators. It supports the security of the very service that gives you speed and composability.

Open risks and how to manage them

-

Operator concentration. A shared sequencer is only as decentralized as its validator set. Builders should watch the distribution of stake across operators, and networks should apply caps or dynamic auctions that penalize concentration.

-

Cross-domain griefing. Attackers can attempt to create bundles that lock liquidity on one rollup while failing elsewhere. Protocols can mitigate this with refundable deposits, solver slashing, and circuit breakers that pause on anomalous failure rates.

-

Light client complexity. Verifying certificates on chain or in clients adds complexity. Use audited libraries, ship explicit test vectors, and expose proof payloads so other teams can cross-check your work.

-

MEV policy spillovers. Selling top-of-block position affects inbound order flow. Publish clear rules, log all auctions on chain, and give users toggleable privacy or anti-frontrunning options where possible.

How to measure impact before 2026 arrives

-

Latency: Track median and tail confirmation times from the shared layer. The tail tells you how your flows behave under stress.

-

Reversion rate: Publish dashboards for pre-confirmed actions that later reverted. If this metric is near zero, your fast paths are working.

-

Cross-rollup volume: Watch the share of transactions that touch more than one rollup. If shared sequencing is doing its job, this number should climb without a matching increase in failed bundles.

-

Operator diversity: Monitor the number of independent operators, their geographic spread, and the percentage of stake they control. Diversity equals resilience.

The bottom line

The sequencer wars were never only about who gets to order your transaction. They were about who earns the right to coordinate many chains at once. With Espresso opening permissionless validation on Mainnet 1 and Astria already carrying real networks into decentralized sequencing, the coordination layer is stepping into production.

Shared sequencers turn bridging from a waiting room into a handshake you can verify. They give wallets a clock users can read. They move MEV from private booths into public markets and they align security spend with the public utility that most needs it. Builders, wallets, and users do not need to wait for 2026 to act. Add the confirmation client. Enshrine the bridge. Show two clocks. Then let the market sort the rest under a shared, neutral sky.