Private Markets Flip Onchain as Banks Tokenize PE Funds

On October 30, 2025 JPMorgan’s Kinexys quietly ran a live private fund transaction, signaling a shift from tokenizing assets to putting fund administration itself onchain. Here is how tokenized LP shares and programmable workflows could turn weeks of friction into minutes.

The week private markets went onchain

On October 30, 2025 a quiet but consequential switch flipped inside the private markets machine. JPMorgan’s blockchain unit Kinexys debuted its Fund Flow system and ran a first live private fund transaction with its own business lines and fund administrator Citco, signaling that fund servicing itself is moving onchain rather than just the assets that funds hold. CoinDesk reported the milestone as a production test of the rails that move investor data and money, not just a proof of concept demo of a token, a crucial distinction for private equity. See the coverage of the first live private fund transaction.

That one line in a press note carries a big implication. Tokenization is not only about creating a digitized claim to a Treasury bill or a share in a fund. It is about rebuilding the feeder pipes that carry subscriptions, capital calls, transfers, redemptions, and distributions. Private equity has always been a plumbing business dressed as a performance business. The plumbing just started to change.

What just changed, exactly

Until now bank pilots mostly put a single asset on a private ledger and called it progress. The October launch moved the workflow itself onchain. Think of it like electrifying a factory line instead of installing one electric drill. When the line is onchain, the instructions that run the line become code. That code can mint tokens that represent limited partner shares, update investor registers in real time, trigger payments at the precise moment conditions are met, and write a permanent audit trail that every permissioned party can read.

In practice the new rails do four things at once:

- Represent positions as tokens linked to a shared permissioned registry.

- Synchronize cash and ownership via programmable rules, reducing reconciliation across emails and spreadsheets.

- Expose a single source of truth to managers, administrators, and distributors so operational exceptions are caught early.

- Set the stage for interoperability with public chains when compliance conditions allow.

Tokenized LP shares, explained in plain English

A traditional limited partner interest is a bundle of rights captured in signed documents, tracked by an administrator, and moved through a chain of messages. A tokenized LP share turns that same bundle into a programmable object. The rights do not change. The mechanics do.

- Subscriptions: an investor passes onboarding and compliance, commits to a fund, and gets a token that represents the claim. The token cannot move unless conditions set by the fund documents are met.

- Capital calls: instead of sending notices and waiting, the smart contract can notify and collect from whitelisted accounts, with time based logic for grace periods and penalties.

- Distributions: the waterfall becomes code. Cash and records update together at the instant both sides meet their conditions.

- Transfers: side letter restrictions, minimums, and holding periods can be embedded so the token enforces the rule instead of a back office policing it after the fact.

This is not about turning private equity into a free trading stock. It is about making the existing rules transparent and executable. Liquidity emerges only where the rules allow it.

Real time cap tables beat overnight spreadsheets

Ask any fund administrator what breaks in quarter end crunch. It is reconciliation. Different systems hold slightly different truths. A shared onchain registry turns the cap table into a living ledger. If a feeder allocates to ten underlying funds, the feeder’s tokenized positions and the downstream fund’s tokenized LP entries reference the same state. When the feeder updates, downstream sees it. When the downstream calls capital, the feeder does not miss the timestamp.

The practical wins are boring and huge:

- Fewer failed wires because cash and entitlement settle together.

- Faster closings for feeders and wealth platforms because onboarding feeds directly into the ledger.

- Lower key person risk because a rule in code replaces a rule in someone’s inbox.

- Audits that read from the ledger rather than hunting for the latest spreadsheet.

From permissioned islands to interoperable liquidity

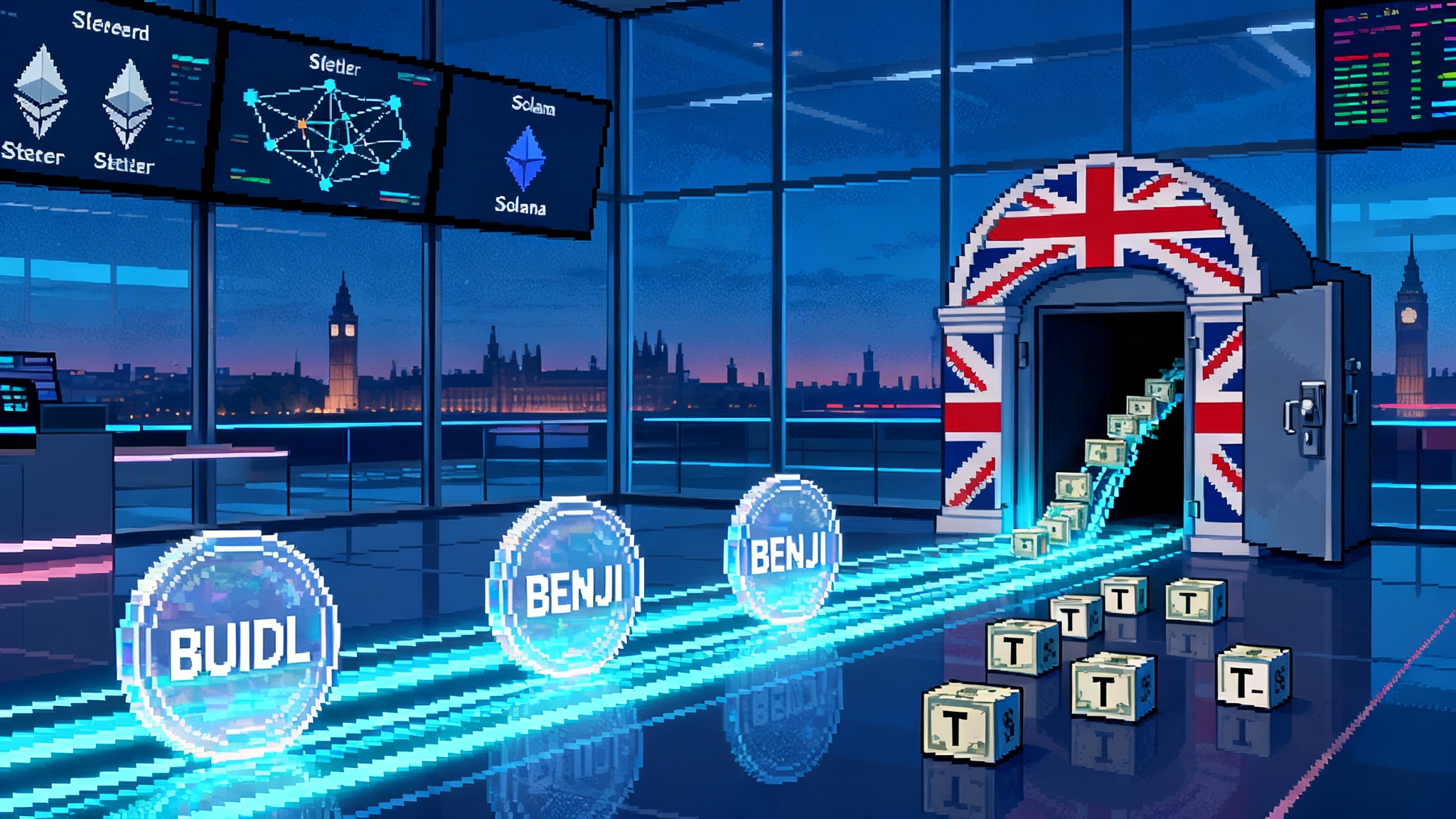

If October’s news is about turning on the factory line inside the bank, the line also needs loading docks to the outside world. In May 2025, Kinexys, Chainlink, and Ondo Finance ran a cross chain Delivery versus Payment test that settled a tokenized asset against deposits at the bank in real time. The asset moved on a public test network while the cash leg settled inside the bank’s permissioned network, with an orchestration layer coordinating finality across both. That is the model for how bank money can safely meet public chain assets without breaking compliance. Read J.P. Morgan’s summary of the cross chain DvP test.

This direction rhymes with broader policy shifts like the UK moves to allow tokenised funds, and it will lean on stable cash rails as onchain dollars go retail.

Why it matters for private equity

Once LP shares live on a ledger, secondary transfers, collateralization, and fund of funds allocations can be synchronized with money that settles atomically. A wealth platform could subscribe to a feeder at 10:00 a.m., fund it at 10:01 a.m., and see positions reflected in both the feeder and the underlying cap tables by 10:02 a.m., subject to rules. That is not speculative crypto flow. That is workflow automation that banks can supervise.

Who benefits first

- Fund administrators and transfer agents: immediate defect reduction, faster quarter end, and better exception management. First moves: integrate onboarding, sanctions screening, and investor registry into a single token aware workflow and map side letter logic into code templates.

- High net worth investors through private banks: faster access and clearer position data, particularly via evergreen or tender offer structures. The near term reality is still semi liquid, not fully liquid, but settlement windows compress from days to minutes.

- Retail via feeders: feeder funds on compliant rails can place retail friendly wrappers over institutional funds. The gating mechanism remains, but subscriptions and redemptions become predictable, and cap table transparency improves. Platforms that already distribute interval funds and evergreen vehicles will be first to bolt this on.

General partners see benefits as soon as capital calls and distributions are synchronized end to end. Back office costs fall and control of data improves. The real unlock comes when secondaries desks plug into the same rails with pre trade checks baked into tokens, so transfers run with fewer legal escalations.

The next 12 months: a map, not a wish

- Q4 2025: more bank run fund servicing rails switch on for pilot clients. Expect two types of launches. Payments and onboarding embedded into tokenized registries for buyout, growth, and private credit funds. Evergreen vehicles that batch subscriptions onchain at set windows.

- Q1 2026: first wave of tokenized LP positions used as collateral inside the same banks that service them. It will start with lines of credit to wealth clients and cash management overlays at the private bank.

- Q2 2026: cross chain pilots move from testnets to restricted mainnet channels. Banks will whitelist specific public networks and use an orchestration layer to achieve atomic settlement between a permissioned cash ledger and tokenized assets.

- Q3 2026: secondary market transfers of tokenized fund interests expand beyond bilateral deals. Expect bulletin board style venues with embedded rule checks. Prices still opaque, but time to settle falls sharply.

- Q4 2026: multi bank interoperability tests. Administrators begin to standardize token schemas for LP claims so a transfer across administrators and banks does not require bespoke mapping.

Compliance and governance risks you can name and fix

- Whitelists and portability: if an investor is whitelisted at Bank A’s permissioned network, can their token move to Bank B’s network without a full re papering of know your customer and anti money laundering checks. Plan for portable attestations and define who is the accountable identity provider.

- Transfer restrictions: fund documents are full of non standard clauses. Encode them as machine readable rules and store the human readable text alongside the token. During audits, you need to show both the code and the clause it implements.

- Smart contract control: upgradability is a feature and a risk. Boards and limited partner advisory committees should approve change control policies that define who can push an upgrade, how emergency pauses work, and how investors are notified.

- Privacy: use permissioned views. Administrators need investor level detail. General partners need aggregates. Co investors and feeders need their slice. Do not put sensitive personal data onchain. Keep identifiers off ledger and link them through privacy preserving keys.

- Valuation and oracles: private equity valuation is periodic and judgmental. If tokens reference a net asset value, specify the cadence, the sign off process, and the fallback if an oracle feed is delayed. Secondary transfers must reference a price source that all parties agree on.

- Key management and custody: retail feeders will concentrate many end investors into few onchain accounts. Design custody so a single operational error cannot freeze an entire feeder sleeve.

- Cross chain risk: if you plan to settle against public networks, keep instructions crossing chains rather than assets whenever possible. That minimizes bridge risk and keeps compliance checks anchored on the cash side inside the bank.

For policy context on cash like rails, see our breakdown of the stablecoin rewards debate.

Why this RWA wave is bigger than tokenized Treasuries

Tokenized Treasuries were a helpful first act. They showed that yields can live onchain and that wallets can hold clean, regulated instruments. But Treasuries were already liquid and easy to settle. The efficiency gain was real but modest.

Private funds are different. The operational friction is massive. A single capital call can touch a manager, an administrator, a wealth platform, a broker, a bank, and an investor. Each touchpoint adds time and cost. By putting the data model and the money movement on the same rails, tokenized LP shares compress an entire chain of tasks. The gain is not a few basis points of settlement speed. It is a step change in how fast funds can take commitments, move capital, and report positions.

There is also a network effect. When cap tables and cash settle on programmable rails, new services cluster around them. Lines of credit secured by tokenized LP interests. Automated coinvest allocations. Secondaries that pre clear transfer restrictions. Wealth platforms that can show real time exposures across ten funds without ten data pulls. None of those make sense if only an isolated Treasury token exists. All of them make sense when the fund itself lives on rails.

Concrete actions for the next quarter

- General partners: pick one evergreen or interval vehicle and map its subscription, call, and distribution logic into smart contract templates. Run a tabletop exercise with your counsel and administrator to translate two side letters into code. Measure time to close before and after.

- Administrators: build a rules library for common clauses, like minimum transfer size, hold periods, and right of first refusal. Treat it like a product. Publish which rules you support on day one and which will follow.

- Private banks and wealth platforms: set up a controlled feeder that can subscribe and redeem onchain on fixed windows. Train advisors to explain what is changing and what is not. You are replacing faxes and files, not the risk profile.

- Technology providers: focus on boring excellence. Make reconciliation disappear, make permissions simple, log every change for audit, and do not leak personal data. Offer a migration path from your permissioned instance to a future restricted mainnet channel.

- Regulators and policy teams: prioritize guidance on portable know your customer attestations and on the classification of tokenized LP interests for custody and capital rules. Clarity on these two points unblocks most near term pilots.

What to watch to separate progress from publicity

- Are capital calls and distributions settling atomically with books and records. If yes, rails are real. If not, it is still a demo.

- Are multiple administrators writing to the same token standard so transfers do not require custom work. Interoperability is the leading indicator of scale.

- Are secondaries desks executing transfers with embedded rule checks. When that happens, liquidity is no longer a promise. It is a capability.

- Are banks connecting permissioned cash ledgers to public chains via orchestrated instructions rather than shipping assets across bridges. That design choice will define risk profiles for years.

The bottom line

Late October did not give us a flashy new token. It gave us something more important. A bank turned on fund servicing rails that make subscriptions, calls, transfers, and distributions programmable. In parallel, cross chain settlement models matured so that bank money can safely meet public chain assets. Put those together and private markets become more legible, more reliable, and faster to move. The first to feel it are the administrators and wealth clients who live inside the workflows. The next to feel it will be retail, through better feeders. The result is not a speculative casino moving faster. It is the slowest corner of finance learning to move at software speed.