Stablecoins Go Mainstream: GENIUS Act Sparks Payments Land Grab

Washington just turned stablecoins into regulated payment plumbing. With rulemaking now open, card networks, banks, and fintechs are racing to light up stablecoin settlement while Europe mobilizes a euro coin response.

The moment the rails changed

On July 18, 2025, the White House announced that President Donald J. Trump signed the GENIUS Act into law. For years, stablecoins lived in a gray zone. Overnight, the United States gave them a federal framework and a path to mainstream payments. That switch did not merely clarify rules for a niche crypto product. It changed the rails beneath commerce.

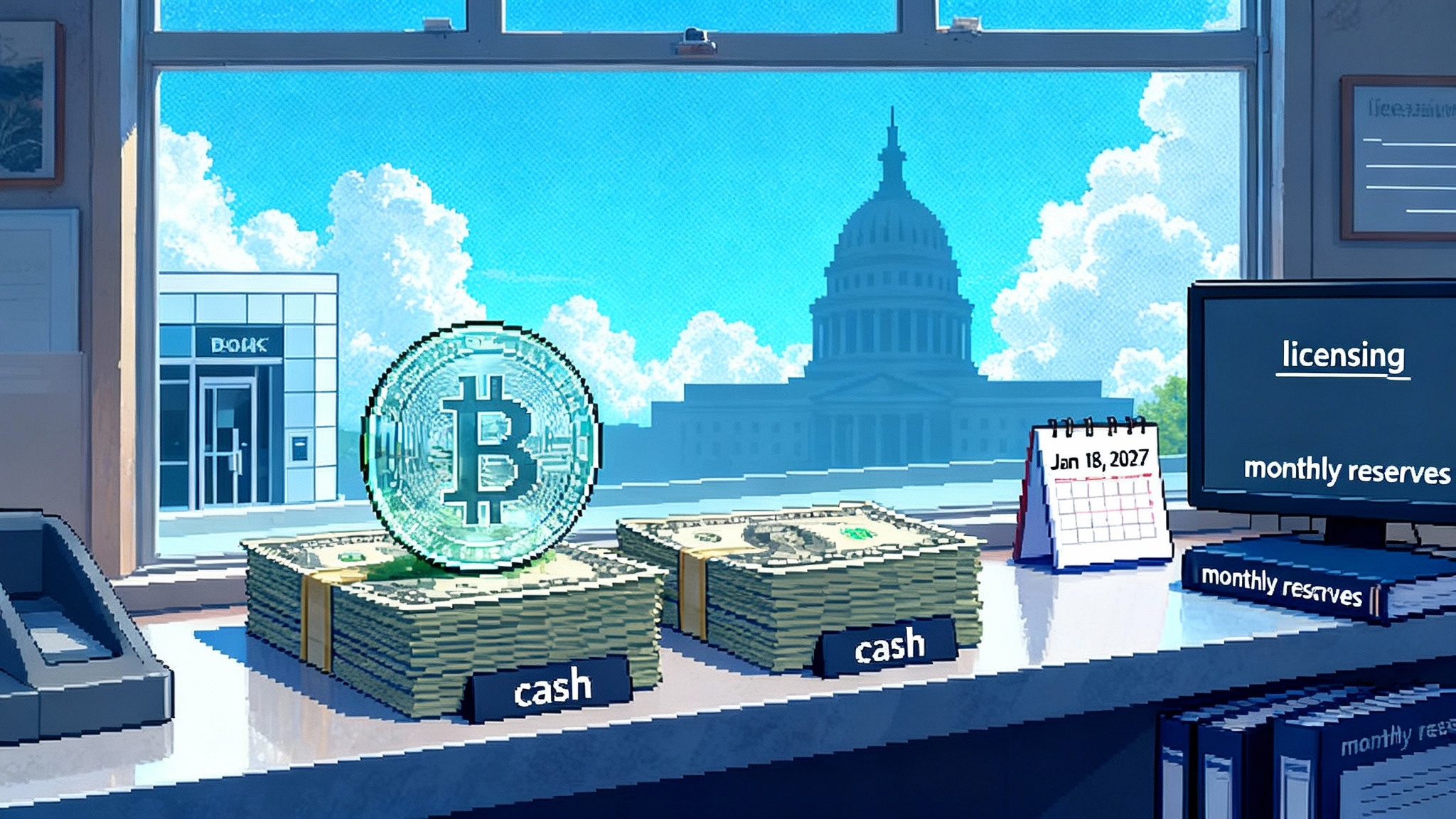

GENIUS set a simple but powerful standard: only licensed issuers can mint payment stablecoins, reserves must be fully backed by cash and short‑term U.S. Treasury assets, redemptions must be timely and clear, and issuers must meet bank‑grade anti‑money‑laundering requirements. It also created a federal and state on‑ramp, plus a new interagency committee that can certify when a non‑financial firm may issue a coin. In plain language, stablecoins just got bank‑style supervision without losing their instant, 24‑7, programmable character.

Crucially, the story is not finished. On September 18, 2025, the U.S. Treasury opened an advance rulemaking that will shape how these coins operate in the wild, from analytics and identity controls to consumer protections. Comments are open through early November in the current window. Read the notice in Treasury’s ANPRM on the GENIUS Act. Between now and final rules, the market is moving. Fast.

What the law actually unlocks

Think of GENIUS as two things at once. First, it is a licensing gate for issuers. Second, it is a compatibility layer for payments. Once a stablecoin is issued under this regime, banks, card networks, acquirers, and large merchants can treat it like a regulated settlement asset. That is the difference between a clever demo and production money.

Here are the practical levers the law pulls, explained simply:

- Who can issue. Subsidiaries of insured banks and federally supervised nonbanks can issue payment stablecoins. State‑regulated issuers under a substantially similar regime can participate up to a size threshold, at which point they transition to federal supervision. That reduces fragmentation and gives CFOs someone accountable to call when something breaks.

- What backs the coin. Reserves are limited to cash and very short‑duration Treasuries or Treasury‑backed repo, with frequent public disclosures and audits. That aligns coins with the safest plumbing in the dollar system and lets treasurers treat them like a new class of cash equivalent, not a speculative token.

- How redemptions work. Issuers have to publish clear redemption policies and process them in a timely way. That resolves the nightmare scenario for merchants and payroll teams who need to turn tokens into dollars on demand.

- What compliance looks like. Issuers sit under the Bank Secrecy Act. They must be able to freeze or burn coins when legally required and prove strong sanctions and anti‑money‑laundering controls. That gives banks and networks cover to plug coins into existing risk programs.

The land grab has started

Payments is a scale game. Whoever onboards the most merchants, integrates the most acquirers, and wins the most developer mindshare during a window like this tends to keep that lead for years. We are already seeing three fronts open up.

-

Card networks lighting up stablecoin settlement. Visa announced in late July that it would support additional United States dollar stablecoins, add more chains to its treasury tooling, and enable euro‑stablecoin settlement for select partners. Mastercard has followed with end‑to‑end capabilities that let acquirers settle in United States dollar and euro stablecoins and is deepening partnerships with major issuers. These are not experiments. They are production treasury operations designed to help issuers and acquirers net out obligations in tokens while merchants can still get paid in fiat or choose to hold some float on‑chain.

-

Banks and processors positioning for issuance and flow. Several large processors are working to plug stablecoins into merchant settlement, payouts, and cross‑border disbursements. Expect bank‑backed stablecoins and white‑label issuance to appear under the GENIUS umbrella, with national trust or special purpose charters handling reserves and custody. The reason is straightforward: if stablecoins settle faster, on weekends, and across borders without intermediaries, then processors that offer them first can reduce working capital, cut chargeback windows, and win new categories like instant creator payouts and marketplace escrow.

-

Wallets and commerce platforms making stablecoins invisible. For consumers, the best version of this future looks boring. You pay with your usual card or tap to pay in an app, and the merchant chooses to receive part of settlement in a compliant coin. That reduces foreign exchange friction for cross‑border sellers and shortens the time between a sale and available cash. The user experience stays familiar. The rails underneath change. Retail on‑ramps like Square fee‑free bitcoin rollout hint at how mainstream checkout can mask new rails.

Europe mobilizes a euro‑stablecoin response

Europe is not standing still. Finance ministers are debating how to grow euro‑denominated stablecoins under the Markets in Crypto‑Assets framework, and a new consortium of major European banks, including ING and UniCredit, has announced plans for a MiCA‑compliant euro stablecoin targeted for first issuance in 2026. The strategic aim is clear: provide a euro‑native token that can settle commerce, remittances, and securities on public or permissioned chains while keeping activity onshore and supervised.

Why that matters in the next 12 months: If the United States makes dollar stablecoins safe, global platforms will default to dollar rails unless the euro offers a comparable, regulated alternative. A bank‑led euro coin gives European acquirers and marketplaces a native option for payouts, programmable supplier financing, and cash management. It also lets European treasurers keep their float aligned with euro interest rates rather than holding dollars just to gain access to on‑chain settlement.

Four unlocks over the next 6 to 12 months

- Merchant settlement that closes the cash gap

- The problem today: Card settlement cycles and cross‑border payout delays leave merchants waiting days for cash, and weekends create dead zones.

- What changes: Acquirers can net their positions in a licensed stablecoin on Friday night and still push available funds to merchant wallets on Saturday morning. Merchants can auto‑sweep a percentage to bank accounts or keep a portion on‑chain to fund ad campaigns or supplier payments that run over the weekend.

- Concrete example: A marketplace that pays millions of micro‑sellers can move from T+2 payouts to same‑day. Fraud controls and dispute rights stay in place because the network rules do not change, only the settlement asset does.

- Cross‑border remittances that feel like messaging

- The problem today: Remittances incur high fees and slow delivery because they traverse correspondent banks and country gatekeepers.

- What changes: Licensed wallets can send compliant, screened stablecoins to partner wallets abroad and let recipients cash out to local rails. The transfer rides a single token format end to end, which makes compliance auditing simpler.

- Concrete example: A fintech in the United States pushes same‑hour payouts to gig workers in Mexico on Saturday. The worker can spend instantly with a card connected to the wallet or convert to pesos at a partner agent. The app shows the fee upfront because there is only one hop.

- On‑chain treasuries that behave like modern cash management

- The problem today: Corporate treasurers want intraday liquidity, proof‑of‑reserves visibility, and programmable controls but are stuck stitching together wires, sweep accounts, and reconciliations.

- What changes: Under GENIUS, regulated coins backed by cash and T‑bills let treasurers hold small operating balances on‑chain with rules. For example, a CFO can approve a daily cap for supplier payments that resets at midnight, auto‑convert idle balances above a threshold to bank deposits, or prove holdings to auditors with on‑chain attestations.

- Concrete example: A software company keeps two days of payroll on‑chain in a permitted coin. A smart policy releases pay on a schedule and auto‑tops the wallet from a bank account when the balance dips, with every movement logged for audit.

- Programmable commerce for real business rules

- The problem today: Escrow, rebates, volume discounts, and revenue shares are reconciled after the fact with spreadsheets.

- What changes: Stablecoins with policy controls let businesses encode terms. A supplier can be paid 80 percent on delivery and 20 percent after quality checks. A creator can receive 2.5 percent of gross at the moment a product sells, not the next month when reports run.

- Concrete example: A travel platform releases hotel payouts only when the guest checks in. If a cancellation triggers a refund, the token escrow reverses instantly. Disputes are rare because both sides see the same programmatic terms.

Who stands to win

- Card networks that integrate fast. They already manage risk, onboarding, and dispute rules at global scale. Adding a new settlement asset deepens their value to issuers and merchants without asking consumers to change behavior.

- Compliant stablecoin issuers. Coins with transparent, high‑quality reserves and clean attestation histories will become settlement favorites. That draws more institutional volume and improves spreads and liquidity.

- Banks that move early. National banks and trust banks that can custody reserves, provide attestations, and run token operations become the default partners to fintechs and processors who do not want to build issuance from scratch.

- Acquirers and processors with developer‑first platforms. The first plug‑and‑play software kits for stablecoin settlement, payouts, and treasury controls will capture startups and mid‑market merchants that need speed and documentation.

- Chains with payments‑grade reliability. Public networks that deliver cheap finality, predictable fees, and well‑understood compliance tooling will carry the bulk of payment tokens. Where settlement reliability looks like Five 9s, developer adoption follows. See the Polygon Rio performance update for what near‑instant finality looks like.

Who risks losing ground

- High‑fee cross‑border corridors. If you take 5 to 8 percent and deliver in days, you are vulnerable. Licensed token corridors will compress fees and make speed the default.

- Gatekeepers that rely on float from slow settlement. Faster token settlement reduces net interest income that some intermediaries earn on held funds. They will need new services and pricing to replace it.

- Offshore, lightly supervised issuers. Networks and banks will de‑risk to permitted coins. Even if offshore tokens keep large retail markets, they will be marginalized in formal merchant and payroll flows.

- Slow acquirers. If your rival can give merchants Saturday payouts and token escrow, you will lose marketplace and platform clients who build global businesses on weekends and nights.

The rulemaking window: a short calendar with long consequences

The law is real, but the details that will govern day‑to‑day operations are still being written. Two dates matter now:

- August 18, 2025: Treasury opened a request for comment on tools to detect illicit activity in digital assets, with comments due by October 17, 2025.

- September 18, 2025: Treasury released its advance notice of proposed rulemaking on GENIUS implementation, inviting comments through November 4, 2025.

Why this matters to builders: definitions, thresholds, and supervisory expectations that get locked in now will shape everything from chain selection to travel‑rule messaging. Sitting out the comment process is a strategic mistake.

A builder’s checklist to ship before the rules harden

You have 6 to 12 months to turn compliance clarity into product advantage. Use this list to move fast without breaking the parts that get you banned.

- Pick your regulatory path

- Decide whether you will issue a coin, hold balances, or just settle in a permitted coin. If issuing, determine whether you will do so under a bank subsidiary, a federal qualified nonbank, or a state path with a roadmap to federal supervision when you scale.

- Identify your primary regulator before writing code. Map the audit cadence, disclosure obligations, and attestation providers you will need.

- Choose your settlement topology

- Integrate with at least two networks that your partners already support to avoid single‑chain dependency. Test failure modes, chain halts, and fee spikes. Have a policy for fallback to fiat. For deeper context on cross‑chain coordination, see Ethereum interop moment insights.

- Implement deterministic routing. If a token is available on multiple chains, your treasury chooses the cheapest route that meets your policy and uptime threshold.

- Build for redemption and disclosures from day one

- Publish a plain‑English redemption policy and automated workflows for redemptions. Treat this like customer support, not legal boilerplate.

- Automate reserve reporting. Even if you do not issue, you will be asked for on‑chain proof of funds and cash‑equivalent audits. Make your dashboards auditor‑ready.

- Treat compliance as a product feature

- Bake in sanctions screening, blockchain analytics, and travel‑rule messaging. Store explainable evidence for each risk decision. Expose a clear appeal path.

- Implement controls to pause, freeze, or reverse transfers when legally required, and document the trigger conditions. Make those controls auditable.

- Ship merchant and marketplace primitives

- Offer programmable escrow, split payments, and instant refunds as native features. Provide software development kits and clear examples in at least two languages.

- Make Saturday payouts a default switch. Prove it on a pilot merchant cohort and publish the cash‑flow uplift.

- Design treasury policies for real businesses

- Give CFOs knobs: daily spend caps, auto‑sweeps to bank accounts, exposure limits by chain, and conversion rules by currency.

- Provide a one‑click audit export that reconciles on‑chain movements with invoices and bank statements.

- Prepare for a euro coin world

- If you operate in Europe, plan for a euro‑stablecoin default for local settlement once bank‑issued coins launch. Design contracts and user interfaces that let merchants choose payout mix by currency and day.

- Get into the room while the rules are written

- Submit comments on Treasury’s notices with concrete data from pilots. Volunteer to run supervised sandboxes that test identity, analytics, and consumer disclosures. The burdens you document today become the thresholds everyone lives with tomorrow.

What success looks like in 12 months

By mid‑2026, here is the most likely picture if current trends hold: permitted dollar stablecoins are a standard settlement option for large acquirers in the United States, and a bank‑led euro coin is in pilot with select European merchants. Merchants receive weekend payouts. Marketplaces use programmable escrow by default. Cross‑border gig payouts happen in minutes, not days. Corporate treasurers keep operating balances on‑chain with automated policies and clean audit trails. Consumers hardly notice. Their card still taps. Their checkout still works. The money simply settles faster, cheaper, and with fewer hops.

The competitive map will look different too. The networks and processors that shipped early will have a new moat: token settlement relationships and developer mindshare. Issuers that nailed transparency will command liquidity. Banks that leaned in will own the premium compliance business. And the laggards will be catching up in a world where speed and programmability are table stakes.

The bottom line

GENIUS did not just make stablecoins legal. It made them legible to the institutions that move money. With the rulemaking window open, the next six months will set defaults that last a decade. If you build or buy payment infrastructure, this is the moment to ship. Treat stablecoins like a new rail in the stack, not a side bet. Get licensed partners in place, wire in programmable features that solve real merchant pain, and show your regulators how you manage risk. The rails just changed. Those who move first will decide where they lead.