Carrier CCAs Are Go: Navy’s 2025 Contracts Launch Wingmen

The Navy’s fall 2025 awards, capped by General Atomics’ carrier‑capable CCA design win, mark the start of uncrewed wingmen at sea. Here’s how deck ops, autonomy, payloads, and production will shift from now to first detachments, with sea trials possible in 2027.

Breaking the pattern: the carrier air wing gets uncrewed wingmen

The U.S. Navy has flipped a long‑standing script. Instead of one big program that tries to do everything at once, it has kicked off a set of smaller, faster contracts for carrier‑capable Collaborative Combat Aircraft, or CCAs. The September awards created a competitive pack, and on October 17 to 18, 2025 the Navy confirmed General Atomics Aeronautical Systems for a carrier CCA design effort, a public marker that the wingman era is now an explicit flight deck goal. The company’s announcement described a modular, carrier‑ready system that fits the Navy’s new buy‑fast, iterate‑fast approach, not the old buy‑once, upgrade‑later mindset. General Atomics CCA design selection is the first clear flag on the pier.

Why this matters: carrier aviation succeeds when it scales. A carrier does not win by having a single exquisite airplane. It wins by launching and recovering the right mix of aircraft at the right tempo, hour after hour, in rough seas and under electronic attack. CCAs promise to change that mix, add mass where the air wing is thin, and take risk where humans should not. For broader context on the shift to distributed and uncrewed maritime power, see our take on the rise of uncrewed fleets.

What the September–October awards actually unlocked

From September into mid‑October 2025, Naval Air Systems Command pushed design contracts to a five‑company cohort and then signaled confidence by naming a known unmanned aviation leader for a carrier‑focused concept sprint. Taken together, these awards do three important things:

- Create a race to the deck. Multiple teams have money to mature airframes, control systems, and deck handling. That puts schedule pressure on everyone else who wants to join the follow‑on buys.

- Center the design on the ship first. The Navy is telling industry the carrier is not an afterthought. Catapult launches, arrested recoveries, spotting and towing, and safe movement in tight spaces must be designed in from day one.

- Normalize smaller, frequent buys. Instead of waiting a decade for a finished masterpiece, the Navy intends to purchase in shorter cycles, then fold in new autonomy, sensors, or engines as the technology and threat evolve.

Deck ops: from concept art to yellow‑shirt choreography

A CCA that cannot live on the flight deck is not a carrier CCA. The physical choreography is where many programs stumble. Here is what changes on deck:

- Spotting and towing. CCAs will need strong nose gear, tie‑down points, and folding wings sized for carrier elevators and hangar bays. A towbarless tractor and standardized pin locations mean a junior deckhand can move a CCA safely by following the same visual cues used for F‑35C or F/A‑18E/F.

- Launch and recovery. The airframe must be compatible with Electromagnetic Aircraft Launch System and Advanced Arresting Gear, and withstand the brutal sink rates of carrier landings. The Navy will likely require a conservative approach pattern at first, with a human landing signal officer monitoring and a shore‑based certification regimen that mirrors what the MQ‑25 program proved.

- Turn time. Think of the deck like a pit lane. Uncrewed jets cannot clog the cycle. Quick‑swap payload bays, standardized fueling and power connectors, and hot‑pit procedures will matter more than a glossy spec sheet. A 20‑minute faster turn on a six‑plane CCA detachment equals another full strike package over a long sortie day.

Control links and autonomy: certifying judgment, not just flight

The carrier CCA is a network node with wings. That means two certifications must happen in parallel:

- Flight safety certification. The Navy will validate lost‑link procedures, automatic wave‑offs, precision approach logic, and ship integration. The safety case has to convince skeptics that a CCA can taxi, launch, recover, and hold safely around people and jets.

- Mission autonomy certification. The harder piece is proving the on‑board software can interpret commander’s intent, execute under rules of engagement, and fail safe in a jammed, deceptive, or cyber‑contested environment. Expect a tiered autonomy rating that starts with supervised autonomy, shifts to mission‑level autonomy for routine tasks, and reserves lethal decisions for positive human control unless a very specific set of conditions are met.

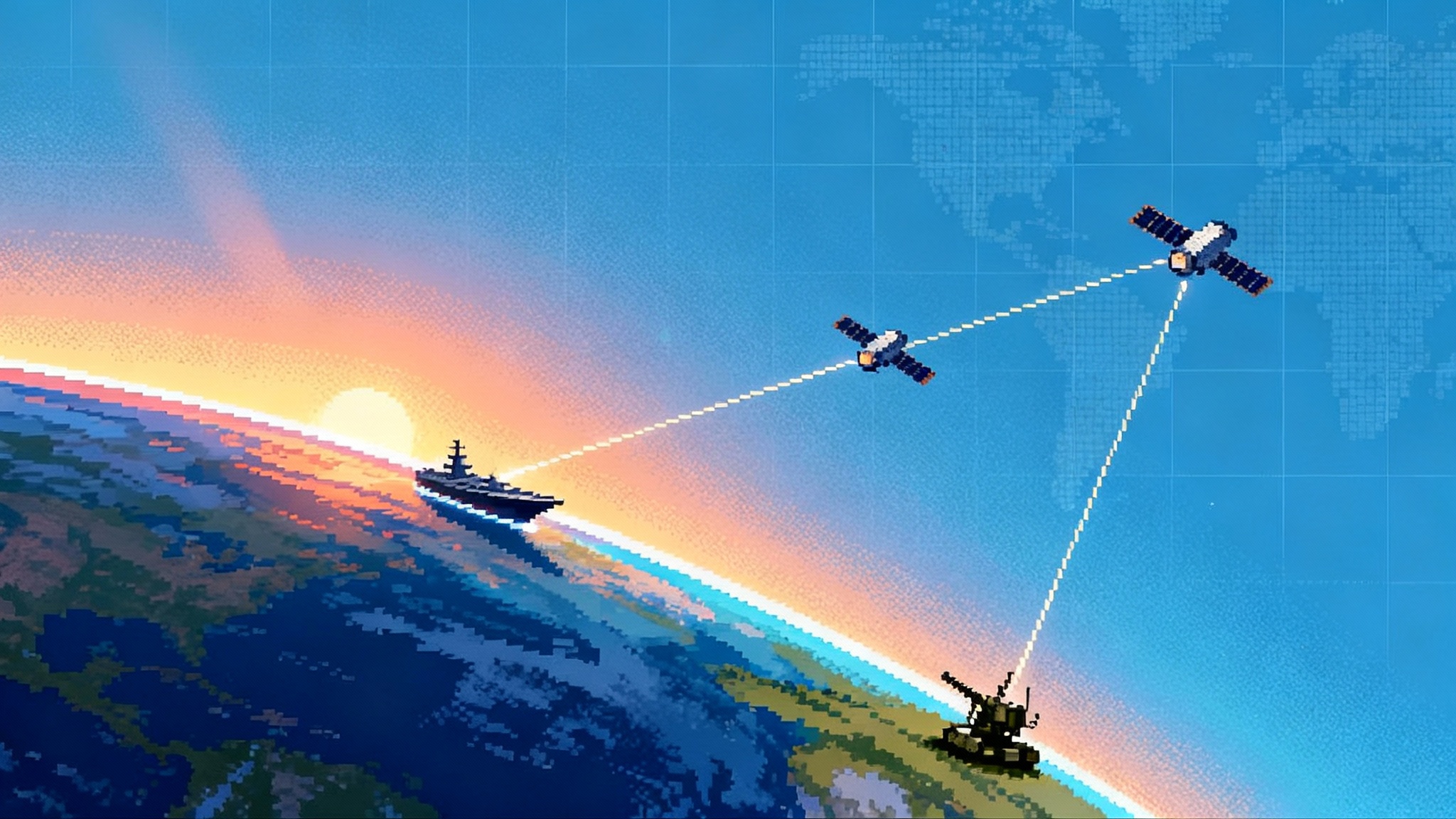

On links, no single radio will carry the day. CCAs will likely blend line‑of‑sight waveforms such as Link 16 and Tactical Targeting Network Technology for high‑rate data on the carrier air wing mesh, plus satellite communications for beyond‑line‑of‑sight control and updates. The ship’s combat system and the air wing’s mission computers must be able to hand a CCA from a controller in the E‑2D to a fighter pilot and then back to the ship without dropping packets or creating ambiguous tasking. This meshes with the broader kill web shift we covered in LEO kill web goes live and the “any sensor, best weapon” mindset in IBCS’ 2025 breakout moment.

Payload mix: treat the CCA like swappable mission kits

A useful way to picture the payload problem is a set of color‑coded mission cassettes that slide into a common bay. The Navy does not need every CCA to do everything. It needs enough of the following to plug specific gaps:

- Off‑board sensing stations. Think long‑range infrared search, passive radio frequency sensors, and wide‑area radar modes that extend the eyes of the F‑35C and the future F/A‑XX. One CCA might do nothing but scan and whisper in the team’s ear.

- Launch and leave effects. Small decoys, jammers, or air‑launched uncrewed systems that peel off and multiply the formation’s presence. These will be crucial against modern integrated air defenses that punish big radar signatures.

- Electronic attack. Pods that blind or confuse, paired with route autonomy that flies pre‑briefed jamming geometries without micromanagement.

- Strike stores. A lighter weapons set for runway denial, surface warfare, or suppression of enemy air defenses, sized so a CCA can carry at least two short‑to‑medium‑range standoff weapons without compromising launch‑and‑recovery safety.

The point is not to replace the Super Hornet, Growler, or Lightning II. The point is to add the missing chess pieces that make the whole board playable again at range.

Cost bands and production tempo: design to the rhythm of a deck cycle

The Air Force has been explicit about affordability and mass. In April 2024 it funded Anduril and General Atomics to build production‑representative test aircraft under its CCA program, with a production decision targeted in fiscal 2026. That selection, recorded in an official service release, set the bar for rapid design and build, not slide decks and studies. See the Air Force’s announcement, which also laid out the plan to keep a larger vendor pool engaged for future increments: Air Force CCA option awards.

For the Navy, the money logic is similar but the hardware is harsher. Launch bars, arresting hooks, and corrosion control add weight and cost. A practical way to think about the portfolio is three cost bands, each tied to a production rhythm that industry can actually sustain:

- Light CCA, roughly 5 to 15 million dollars unit cost. Focus on sensing, decoying, jamming, or one‑way effects. Production rhythm: monthly batches that can surge before deployments.

- Medium CCA, roughly 20 to 30 million dollars. Multi‑mission, recoverable jets with the structure and avionics for repeated carrier cycles. Production rhythm: steady cadence, with one new lot each quarter that folds in software and payload upgrades.

- Heavy CCA, above 35 million dollars. Larger range and payload, possibly with stealth shaping and deep integration for loyal wingman roles. Production rhythm: lower volume, targeted buys to anchor a detachment.

The precise numbers will move as designs harden, but the bands reinforce a critical idea. The Navy should buy to the deck cycle, not to the budget line. If a carrier deploys every 24 to 36 months, the industrial plan must deliver and retrofit CCAs on that rhythm, so air wings leave with the latest software and compatible spares.

How this differs from the Air Force path

The Air Force’s CCAs have already reached ground test and flight test milestones, and the service has named early aircraft designations such as YFQ‑42A and YFQ‑44A. It aims to ramp to hundreds of aircraft by the end of the decade. That runway‑based model lets the Air Force push more risk into early flight and software sprints, then iterate in large‑area test ranges.

The Navy’s carrier CCAs must survive salt spray and non‑negotiable landing loads. That will force a slower structural maturation but can reward more aggressive mission autonomy, since deck cycles reduce the number of total sorties each airframe flies on deployment. The Navy can afford to buy more airframes with simpler individual service lives, as long as the software and payloads stay current.

Replicator lessons: speed is a process, not a slogan

The Department’s Replicator initiative set a simple yardstick in 2023 to field thousands of attritable, autonomous systems inside 18 to 24 months. The headline was the goal, but the real lesson was the process. Replicator relies on rapid money reprogramming, Commercial Solutions Openings that pull in non‑traditional vendors, cybersecurity pre‑screening for the supply base, and frequent updates that harden autonomy against jamming and deception. Those are exactly the mechanics the Navy now needs for its carrier CCA lines.

Pull three specific lessons forward:

- Make software the main event. The winners in Replicator sprints were not always the slickest airframes. They were the teams that shipped reliable autonomy and telemetry that operators could trust. Navy CCAs should be budgeted with a software‑first mindset and a strict monthly release train.

- Certify in slices. Replicator broke the habit of waiting for a giant test report. The Navy can do the same by certifying discrete behaviors, such as taxi logic or off‑board sensing, and clearing them for fleet use while higher‑risk behaviors mature.

- Use mixed buys to manage risk. Replicator split money across multiple vendors and domains. The Navy can mirror that with light, medium, and heavy CCA buys that do not all hinge on a single architecture.

A credible path to sea trials by 2027

If the Navy wants carrier CCAs on a real deck in 2027, here is a practical, testable path, with concrete gates that program managers can brief to leadership:

- Late 2025 to mid‑2026: shore‑based integration sprints. Finish avionics and mission management integration with carrier radios and networks. Prove taxi and spotting autonomy at a Navy replica flight deck ashore with yellow‑shirt choreography and safety observers. Begin electromagnetic compatibility tests with shipboard emitters simulated at power.

- Mid‑2026: Lakehurst catapult and arrestment testing. Use instrumented airframes for electromagnetic launch and arrestment loads. Complete thousands of simulated launches and recoveries on the test track to lock structural margins and hook dynamics.

- Late 2026: autonomous pattern trials. Fly Case I and Case III approach profiles at a naval air station with carrier landing aids. Validate automatic wave‑off, bolter recovery, and deck motion compensation in simulators tied to real flight data.

- 2027: first at‑sea trials. Embark two to three CCAs on a training workup with a Ford‑class carrier. Limit operations to day sorties at first and expand to night and higher sea states as confidence grows. The objective is not exotic missions; it is proving the deck cycle and safe recovery around humans.

From demos to detachments: how to field by 2029

A 2027 demo earns credibility. A 2029 detachment delivers combat value. To bridge the gap, the Navy should plan for these steps:

- Stand up a Fleet Replacement Detachment. Train the first cadre of maintainers and operators on a specific CCA block. Co‑locate with an existing air wing training pipeline to share sims, procedures, and instructors.

- Pick two narrow missions for the first cruise. For example, off‑board sensing for counter‑air and stand‑in decoy or jammer for strike ingress. Write short, crisp tactics manuals for those missions and avoid gold‑plating.

- Contract for a tempo, not a total. Buy enough airframes to equip two carriers with 4 to 6 CCAs each, plus shore spares, and lock an annual software release schedule that aligns with carrier deployment workups.

- Build the spare parts and depot plan early. The fastest way to stall a CCA detachment is to wait 10 months for a composite panel or a unique landing gear part. Co‑design the support plan with the ship and air wing maintainers and stock the top 50 spares before the first embark.

What to watch in 2026 and 2027

- Modular payload standards. A published electrical and mechanical interface will tell us whether the Navy is serious about vendor diversity and rapid upgrades.

- Autonomy safety cases. Aviation mishap boards demand crisp logic. Expect to see service‑level guidance on how to prove that a mission autonomy stack will not wander into a no‑go box or misinterpret a controller’s reassignment.

- Network hardening. The fleet will push for real jamming trials and cyber red‑team events that mirror the electronic battlespace of a peer fight. A CCA that fails gracefully under attack will be valued more than one that only flies perfectly in calm air.

- Production capacity. Watch which vendors stand up extra shifts, second lines, or shared composite shops. Fielding detachments on two carriers at once by 2029 will likely require dozens of airframes and repeatable quality, not one‑off prototypes.

The bottom line

The Navy’s fall 2025 actions took CCAs from briefing slide to ship schedule. Industry now has an unambiguous message: design for the deck, certify the autonomy like you certify the airframe, and deliver at the tempo of a carrier workup, not the tempo of a paper plan. The Air Force’s head start shows that mass is possible when software and manufacturing run in parallel, not in sequence. Replicator proved that speed is a process you can institutionalize. If the Navy holds to those three truths, a small CCA detachment can be launching from a Ford‑class carrier in 2027 and reporting for combat duty by 2029. That is not a slogan. It is a checklist the fleet can follow.