Ghost Shark Goes Fleetwide as Australia Bets on Autonomous Subs

On September 10, 2025, Australia moved Ghost Shark from prototype to a fleet program of record, with first deployments slated for early 2026. Here is how long endurance autonomous submarines shift deterrence and kill chains across the Indo Pacific.

What just happened

On September 10, 2025, Canberra made it official. Australia signed a five year, 1.7 billion Australian dollar contract to buy a fleet of Ghost Shark large uncrewed submarines, with the first units entering service from early 2026. The government called it a sovereign capability that complements crewed surface combatants and the coming conventionally armed, nuclear powered submarines under AUKUS. The language was careful about numbers, but one word stood out: "dozens." For a country that has spent years waiting for big undersea programs to mature, this was a fast, concrete pivot from prototypes to production, and the government’s own release laid it out plainly in a way that leaves little room for hedging. See the Australian government announcement on 10 September 2025.

Ghost Shark is an extra large, long range, long endurance autonomous undersea vehicle. The Royal Australian Navy and Anduril Australia co developed three prototypes in a three year sprint that finished ahead of schedule. What began as a bold bet is now a program of record, and it builds on momentum seen in allied autonomy programs such as Anduril's autonomous aircraft tests.

Why Ghost Shark matters now

Think of a Ghost Shark as a submarine shaped battery with a brain. It carries sensors and mission payloads, cruises slowly to stay quiet, and can loiter for weeks. Because there is no crew, it can take risks and operate in places where a manned submarine would be too valuable to expose. That cost risk tradeoff is why autonomous undersea vehicles are not just add ons, but a new offset in the Indo Pacific.

Three shifts make Ghost Shark strategically important:

- Mass at sea without massed budgets: Dozens of autonomous hulls cost less than a single nuclear powered submarine. They put more nodes into the water, increase uncertainty for any adversary, and complicate planning.

- Persistent presence: Endurance measured in weeks allows Ghost Shark to watch chokepoints or patrol approaches without refueling stops or crew rotations.

- Payload flexibility: Modular bays can accept surveillance suites, mines, electronic warfare packages, or strike payloads. The same hull can be retasked as conditions change.

In an Indo Pacific defined by long distances and crowded littorals, these attributes reshape how navies think about presence and deterrence.

Building distributed undersea kill chains

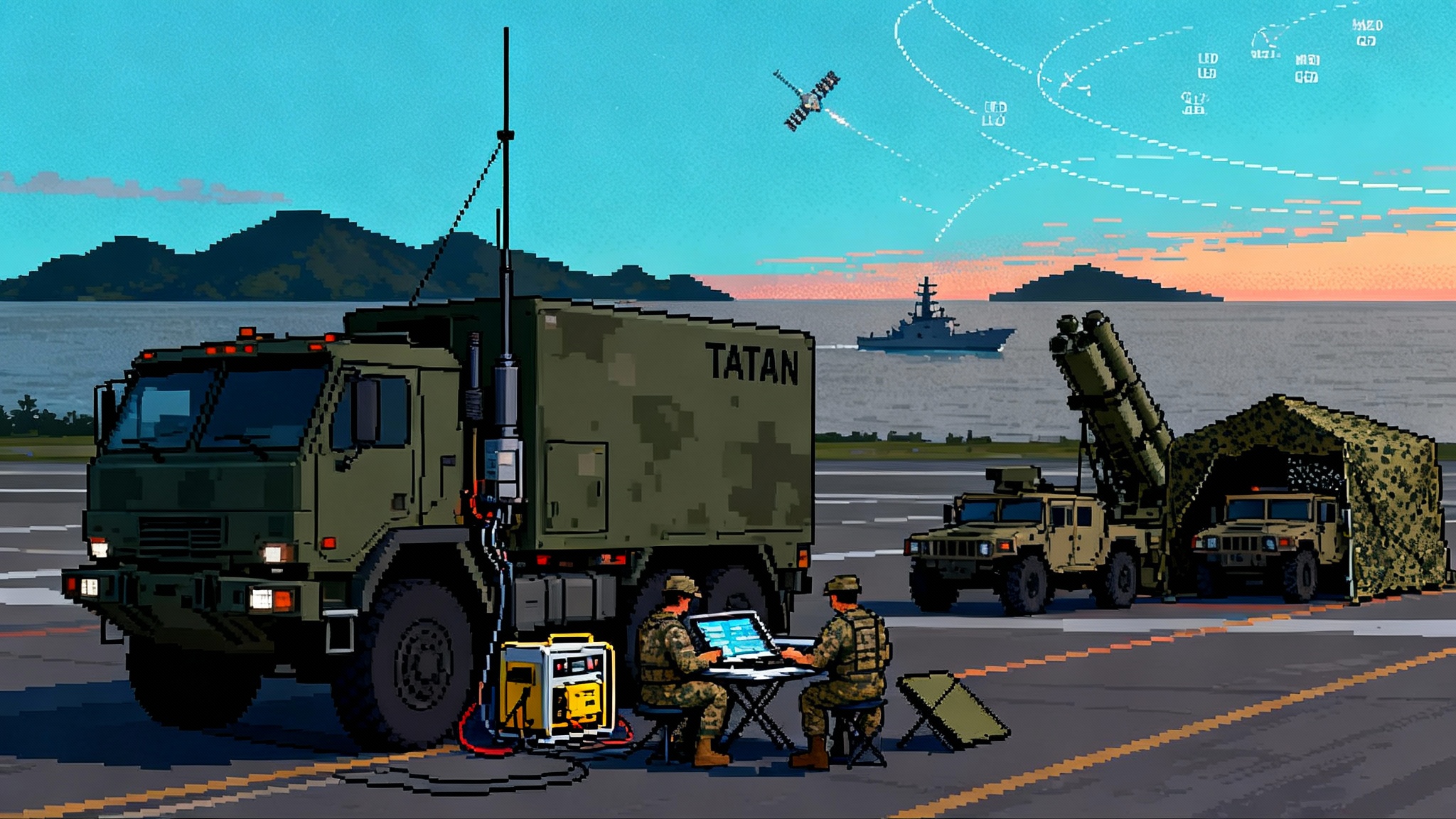

The headline is about buying hulls, but the real breakthrough is how Ghost Shark can be networked. A kill chain is the sequence from finding a target to deciding to engage and delivering the effect. Distributed kill chains break that sequence into pieces shared by many platforms, a theme we explored in AI target fusion with TITAN. Here is what that looks like under water.

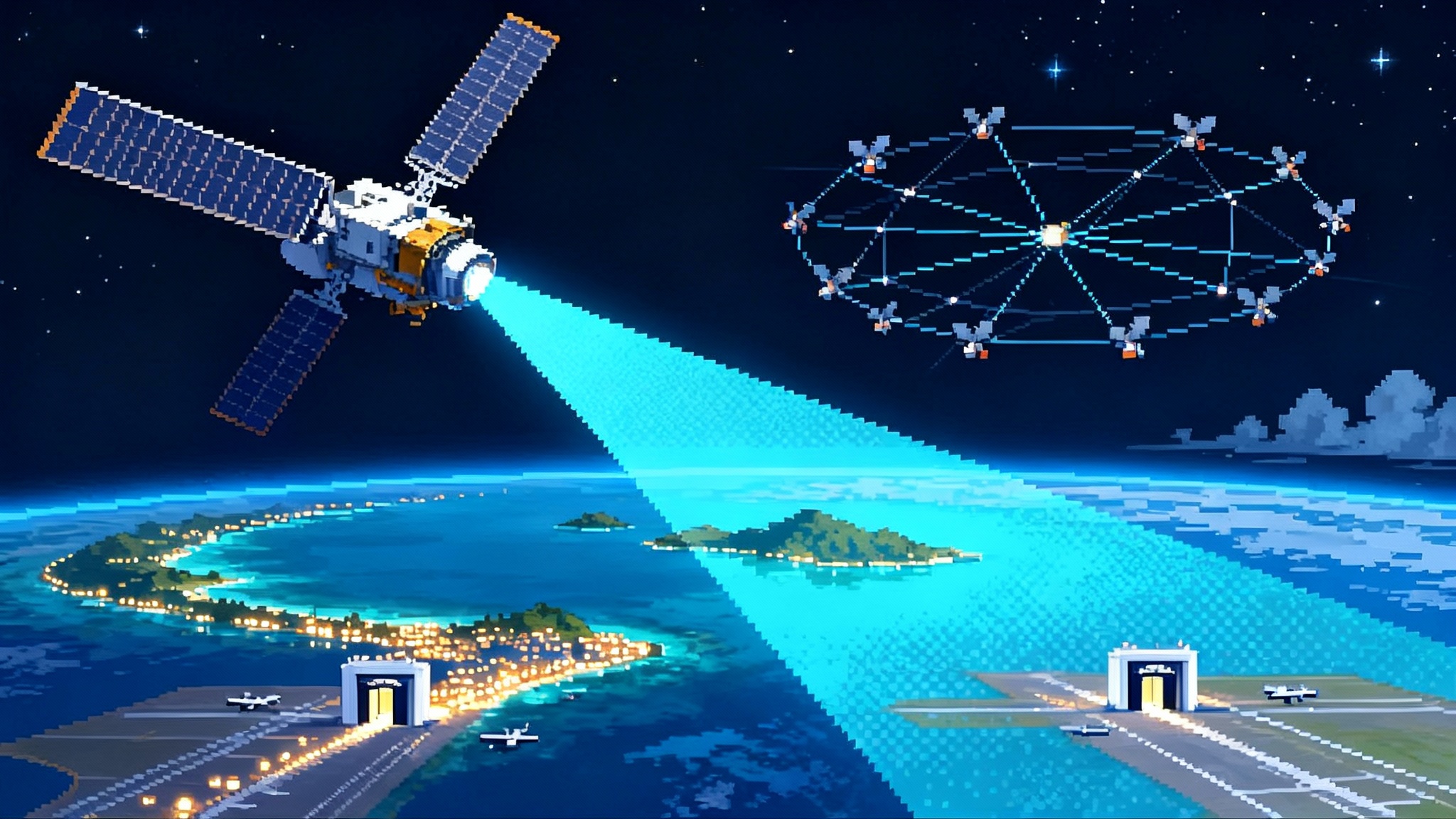

- Seabed sensors detect and classify: Fixed hydrophone arrays and portable seabed nodes act like doorbells on the ocean floor. When a submarine or ship passes, they pick up acoustic signatures. Australia and its partners can seed chokepoints such as the Lombok Strait or the waters east of Taiwan with acoustic and non acoustic sensors. Those small devices whisper to a passing Ghost Shark using short range acoustic messages that are hard to intercept.

- Ghost Shark stalks and confirms: After a cue, a Ghost Shark can creep closer, switch to a fine grained sonar sweep, and confirm the contact. It can shadow a submarine, plant a covert marker, or hand off the track.

- P-8 patrol aircraft and surface combatants bring speed and weapons: A Boeing P-8 maritime patrol aircraft can drop sonobuoys to widen the search or deliver a torpedo. A surface ship can launch a long range anti ship missile. If the target turns away, the Ghost Shark continues to trail at low cost and with no crew at risk.

- Command decisions flow across the network: Data moves via acoustic modems under water, and via satellite or line of sight radios when Ghost Shark briefly raises a communications mast. The decision authority can sit on a ship, inside a maritime patrol aircraft, or in an operations center ashore.

This is not theory. It is the architecture that AUKUS partners can build by linking Ghost Shark with seabed sensors, P-8 patrol aircraft, and surface combatants. It creates more ways to find, fix, and finish a threat. It also creates more ways to confuse an adversary, because the sensing and the striking can be separated by geography and by time.

What this means for anti-submarine warfare

Anti-submarine warfare is a chess match in slow motion. Traditionally, you send a valuable asset to find an even more valuable asset. With large autonomous submarines, you can turn the board.

- More contact time: Ghost Shark can dwell quietly in areas where diesel electric submarines must surface to snorkel. Longer contact times mean more chances to catch a periscope wake, a battery recharge, or the faint rhythm of a propulsion system.

- Attritable stalkers: If a Ghost Shark is detected and chased off, the loss is painful but tolerable. The fleet learns from the encounter and sends the next vehicle with a tweaked acoustic profile or a different approach route.

- Cross domain finishing moves: A Ghost Shark does not need to carry the torpedo to be decisive. It can illuminate a target with active sonar at the right moment to let a P-8 or a surface ship deliver the weapon while the vehicle slips away.

For allies, this means more persistent search in busy sea lanes, better coverage of chokepoints, and more flexible response options when a hostile submarine probes a coastline.

Mining with precision and accountability

Naval mining is often imagined as indiscriminate. That is changing. An autonomous submarine can place smart, target discriminating mines in patterns that are both effective and compliant with the law of armed conflict. Mines can carry sensors that recognize the acoustic fingerprint of a specific class of ship. They can self deactivate after a set time. They can be placed in deep water where only a particular draft will trigger them.

A Ghost Shark can chart a path through a narrow channel, plant a string of devices at precise depths, and leave a sterile corridor for friendly shipping. In a crisis, a fleet of vehicles could silently block a strait for a short period, then withdraw the barrier by remote command. That blends deterrence with control, rather than blanket denial.

Anti-ship strike from unexpected angles

Surface ships expect threats from the air and from over the horizon. A large autonomous submarine adds a low angle attack path. A Ghost Shark could surface briefly, receive an updated target location, then submerge and approach to launch a torpedo. It could also act as an underwater scout, feeding targeting quality data to a destroyer hundreds of kilometers away. With enough vehicles, a navy can create uncertainty along an entire coastline. The point is not that a single vehicle replaces a destroyer. It is that a network of vehicles changes the calculus for any adversary trying to mass ships within range of an allied coastline, a theme tied to land based sea strike in the Pacific.

From prototype to production, and the rise of an autonomy industrial base

The move to production is not just a procurement milestone. It is the seed of an industrial base that builds and sustains autonomy at maritime scale. Anduril has opened a 7,400 square meter factory in Sydney to produce Ghost Shark at low rate initial production, scaling to full rate in 2026. The plant brings robotics, a custom test tank for in water checks, and a supply chain that includes more than 40 Australian companies. Officials expect more than one hundred and fifty new jobs at the facility and hundreds more across suppliers as production ramps. See Reuters coverage of the Sydney factory opening.

This matters for three reasons.

- Learning by building: Every hull teaches the software and the factory something. Reliability improves. Costs become predictable. Mission modules can be swapped faster. The only way to gain that muscle memory is to build at scale, not in boutique batches.

- Sovereign control of core technologies: Power systems, acoustic treatments, quieting techniques, and autonomy stacks are sensitive technologies. Domestic manufacturing lets Australia decide how these components are integrated and upgraded, and it keeps the talent base at home.

- Export potential and allied commonality: If allies buy compatible vehicles, they can share spares, training, and mission payloads. A Japanese operator learning to plan a mission for one large autonomous submarine should be able to do the same on another, just as pilots convert between allied aircraft today.

The production story is moving quickly, and the public signal of momentum was clear when Anduril opened the factory at the end of October. That event linked the September contract to a physical place with people and machines, a sign that Ghost Shark is moving from PowerPoint to pier.

The coming counter UUV arms race

Every move has a countermove. As Ghost Shark and similar vehicles proliferate, navies will invest in finding, frustrating, and legally framing them. Expect four races to accelerate.

-

Detection: Quieting is a moving target. Today’s large uncrewed submarines shape their hulls and propulsors to reduce noise, and they manage speed to stay under the background ocean hiss. Countermeasures will push the other way. Low frequency active sonar can wash large areas with long wavelength pulses that bounce off big shapes. Magnetic anomaly detectors can catch subtle disturbances in the Earth’s magnetic field. Non acoustic sensing, from wake detection to bioluminescence trails, will get research dollars. The advantage will swing with ocean conditions. In shallow, noisy water, a small vehicle may hide. In cold, deep channels, active systems might reach farther.

-

Communications: Autonomy does not remove the need to coordinate. Acoustic communications are slow and reveal position. Optical links in blue green wavelengths are fast but require close alignment and clear water. Satellite links are plentiful but demand a mast above the surface. The race is to mix these methods so that vehicles can share enough data to cooperate without lighting up for every listener in the ocean. Expect more use of burst communications, relay buoys, and clever deception, such as decoy modems emitting fake traffic while real vehicles slip away.

-

Energy: Batteries and power management are the truest rate limiters. Large uncrewed submarines will stretch endurance with higher energy density cells, better hull coatings that reduce drag, and smarter route planning that rides currents like underwater gliders. Fuel cells and aluminum seawater batteries may appear in specialized variants. The more efficient the platform, the more payload space becomes available for sensors or weapons.

-

Legal norms: The oceans are governed by law, and autonomous platforms will stress those norms. States will argue over whether an uncrewed vehicle operating within a contiguous zone is conducting innocent passage or surveillance. The rules for naval mining require detectability and self neutralization under certain conditions; autonomy makes compliance easier to prove with logs and arming profiles, but it also raises questions about accountability when a mission goes wrong. Expect draft guidance inside alliances that covers identification, mission authorization, and recovery rights if a vehicle is found or disabled in neutral waters.

What AUKUS partners can do next

Buying vehicles is the beginning. The advantage comes from how they are used and how quickly the ecosystem around them matures. Here are concrete steps that Australia, the United States, and the United Kingdom can take over the next eighteen months.

- Field mixed squads: Pair a Ghost Shark with two smaller uncrewed undersea vehicles as scouts. Use a standing playbook for littoral surveillance in a named operating area. Rotate the squad across allied ports to normalize joint logistics.

- Standardize mission payload bays: Adopt a common mechanical and electrical interface so that a mine neutralization module built in one country snaps into a vehicle built in another. Publish the interface specification across the AUKUS industrial base to invite small companies into the supply chain.

- Build a shared training range: Instrument a coastal area with seabed sensors, mobile acoustic sources, and range tracking so that each partner can run full mission profiles from detection to strike in realistic conditions. Capture data for joint machine learning models.

- Codify release authorities: Write and exercise policy that sets who authorizes autonomous missions, what the abort conditions are, and how handovers to crewed platforms work. Do this in peacetime to avoid confusion in crisis.

- Start the counterplay: Fund allied programs in counter uncrewed undersea warfare. That includes quiet hulls to stalk hostile vehicles, surface drones that lay nets of small acoustic sensors, and legal frameworks for interdiction when a foreign vehicle is detected near critical infrastructure.

These are not big bang ideas. They are the routine steps that turn a fleet of machines into a capability that can be trusted on a rainy Tuesday when something unexpected pops up on a sonar screen.

A note on risk and resilience

Autonomous fleets thrive on numbers and iteration. That brings real benefits and real risks. Software supply chains must be secured. Mission planning tools must be designed to avoid one button automation that hides bad assumptions behind a clean interface. Human operators should remain in the loop for target identification and weapon release. Reliability must be demonstrated in salt water, not in slides. None of this argues against Ghost Shark. It argues for disciplined fielding and transparent metrics: availability rates, mission completion rates, and the speed of software updates.

The bottom line

Australia’s decision in September 2025 to take Ghost Shark from a trio of prototypes to a fleet is a line of demarcation. By early 2026, the Royal Australian Navy will be operating long endurance, strike capable autonomous submarines at useful scale. That shifts how allies patrol chokepoints and coasts, how they set tripwires under sea, and how they plan for surprise. It also signals a broader shift, from treating autonomy as a garnish on existing forces to treating it as a core ingredient.

The next offset in the Indo Pacific will not arrive as a single wonder weapon. It will arrive as networks that mix seabed sensors, large uncrewed submarines, patrol aircraft, and surface warships into kill chains that are harder to see and harder to break. Ghost Shark is the first mover at fleet scale, and that matters. Not because it ends arguments about the future of naval power, but because it starts the practical work of building it.