Space Force Activates CASR, A Wartime Lever for Commercial Space

The U.S. Space Force has moved the Commercial Augmentation Space Reserve from slides to practice, running a first wargame and pilot contracts that put commercial SATCOM, imaging, and space‑domain data on wartime footing. Here is how CASR will work and scale by 2026.

The reserve switch for space just flipped

For two years, the United States Space Force talked about a civil‑reserve model for space. In March and April 2025 it started using it. The Commercial Augmentation Space Reserve, or CASR, ran its first formal wargame with industry and kicked off pilot contracts that pay commercial providers to integrate with military workflows ahead of a crisis. In plain terms, CASR is a ready button that lets the government shift commercial satellites and data services from peacetime work to wartime missions on short notice. The Space Systems Command described pilot awards to four space domain awareness companies and ran the inaugural CASR wargame to burn down policy and technical friction before a real contingency. Those early steps moved CASR from theory toward operations and revealed what a space reserve actually needs to succeed. SSC documented the pilot and wargame milestone.

The model borrows from the Civil Reserve Air Fleet. Airlines get steady government business in peacetime, and in return they commit aircraft and crews for surge missions. CASR applies the same idea to satellites and related services. The government pre‑negotiates with companies that provide satellite communications, imaging and radar, radio frequency geolocation, and the space traffic data that tells commanders what is in orbit and who is moving.

What operational looks like in practice

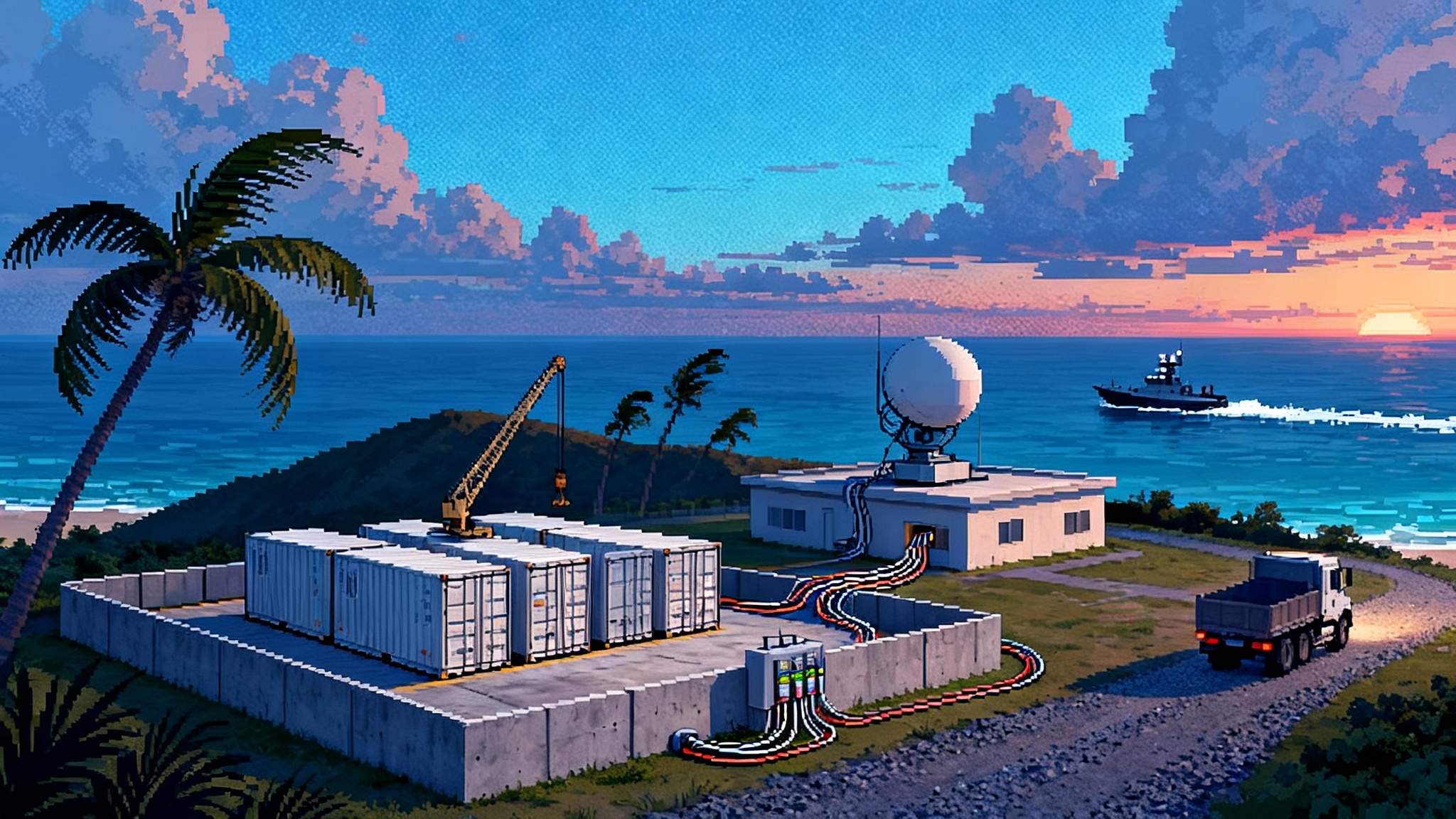

An operational reserve is more than a contract. Think of CASR as plumbing and playbooks. The plumbing connects commercial networks, data feeds, and operations centers to military systems. The playbooks define who can task what, at what priority, under what legal authorities, and with what protections for the companies doing the work.

Here is the practical stack the Space Force is building.

-

Priority tasking. When the government activates CASR, participating providers receive rated orders that move them to the front of the line. The Defense Priorities and Allocations System gives the government the ability to reprioritize industrial work, and CASR extends that logic to bandwidth, imagery collection windows, satellite relocations, and ground segment support. In a crisis the point is not only to buy capacity, it is to preempt competing demands so the joint force gets the first usable megahertz, millisecond, or pixel.

-

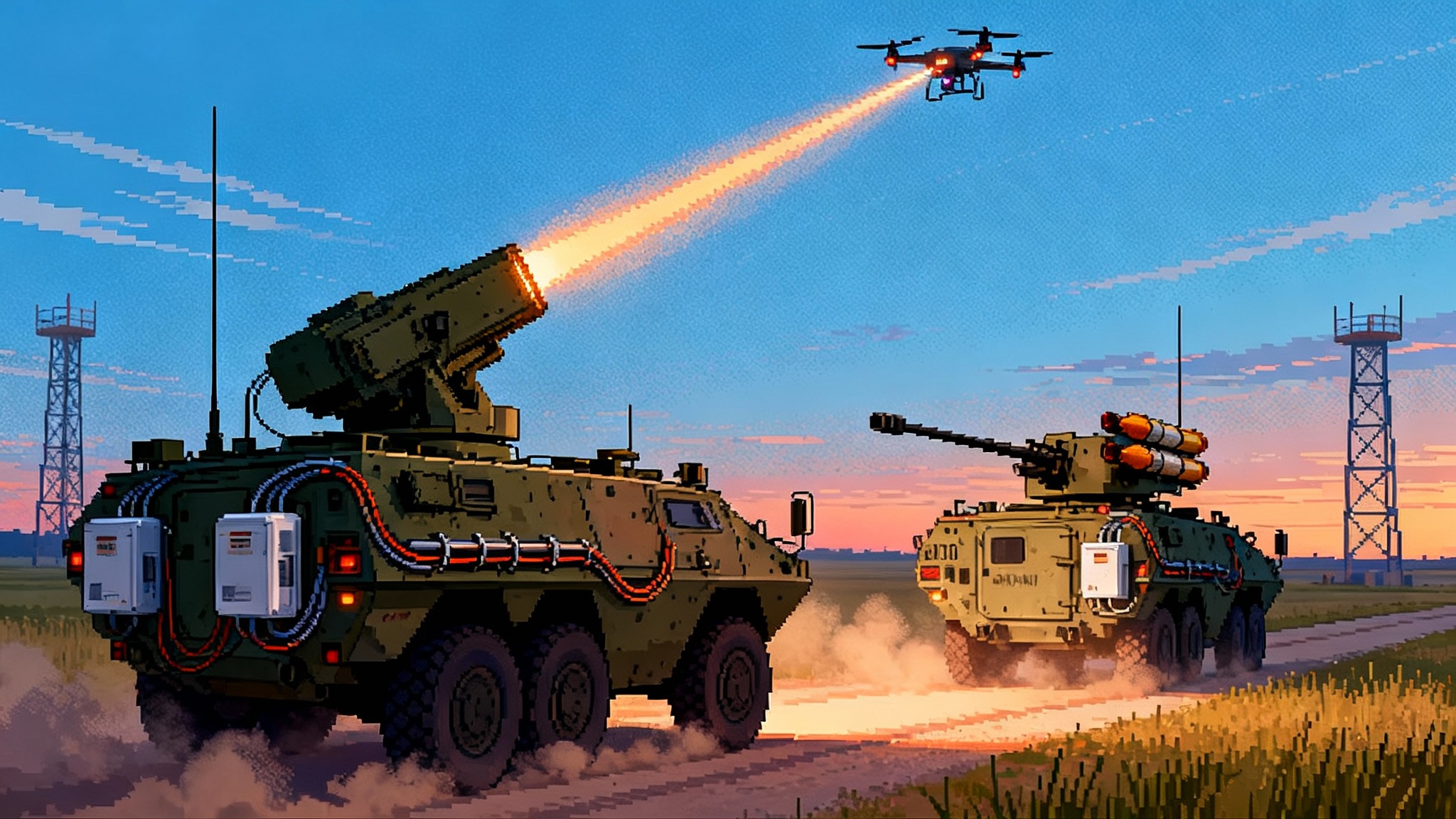

Hardening and resilience by default. CASR asks vendors to meet defined thresholds for electromagnetic resilience and cybersecurity. On the satellite communications side that includes protected waveforms, spread spectrum techniques, beam hopping, null steering, and flexible power allocation so that a jammer has to chase a moving target. For imagery and radio frequency data providers it means authenticated tasking, secure distribution with zero trust network controls, and rapid cross‑cueing so that one sensor can confirm what another thinks it saw. On the ground it includes redundant gateways, cloud‑based mission systems, and trained watch floors that can swap to backup paths without waiting for human approvals. This aligns with fielded spectrum kit such as spectrum power to the platoon.

-

Cyber hygiene at speed. The reserve construct is only as strong as the weakest vendor laptop. CASR pilots are already exercising software bill of materials reporting, secure‑by‑design ground software, endpoint detection on mission networks, and incident response drills that practice closing a compromised path while the mission keeps flowing through an alternate route.

-

Legal cover and risk‑sharing. Companies that sign up are taking real risks. If a hostile power targets a commercial satellite because it is supporting a U.S. operation, who pays for the loss or for the downtime that kills a company’s revenue? CASR is evolving policies for war‑risk insurance and indemnification so participants are not betting the company. The objective is simple and specific. If a firm follows the playbook under government direction and suffers attack‑induced losses, the government will make them whole within defined limits. The details matter, from definitions of covered events to caps and claim timelines, and those details are being hammered out now.

-

Interoperability by rehearsal. The first wargame surfaced where interfaces were brittle, who could accept priority orders, and how quickly alternative ground paths came online during simulated jamming and cyberattacks. Expect more exercises that pull in commercial operations crews, tactical users, and the joint electromagnetic warfare community to practice collective defense of the commercial links the force now depends on.

The commercial space stack behind CASR

CASR is not a single program. It is a way to plug several programs together so the joint force can lean on commercial capacity without breaking it. The backbone is launch and logistics. The Space Force’s National Security Space Launch Phase 3 procurement created two lanes. Lane 1 opens more missions to a broader bench of providers. Lane 2 secures assured access for the most demanding payloads with three certified heavy providers. Those awards set the pace and price for getting warfighter payloads on orbit through 2029. The service detailed the Lane 2 awards and the first fiscal year 2025 mission assignments publicly. Lane 2 awards and assignments.

Above launch sits a mesh of commercial services that now look less like tactical add‑ons and more like a true reserve.

-

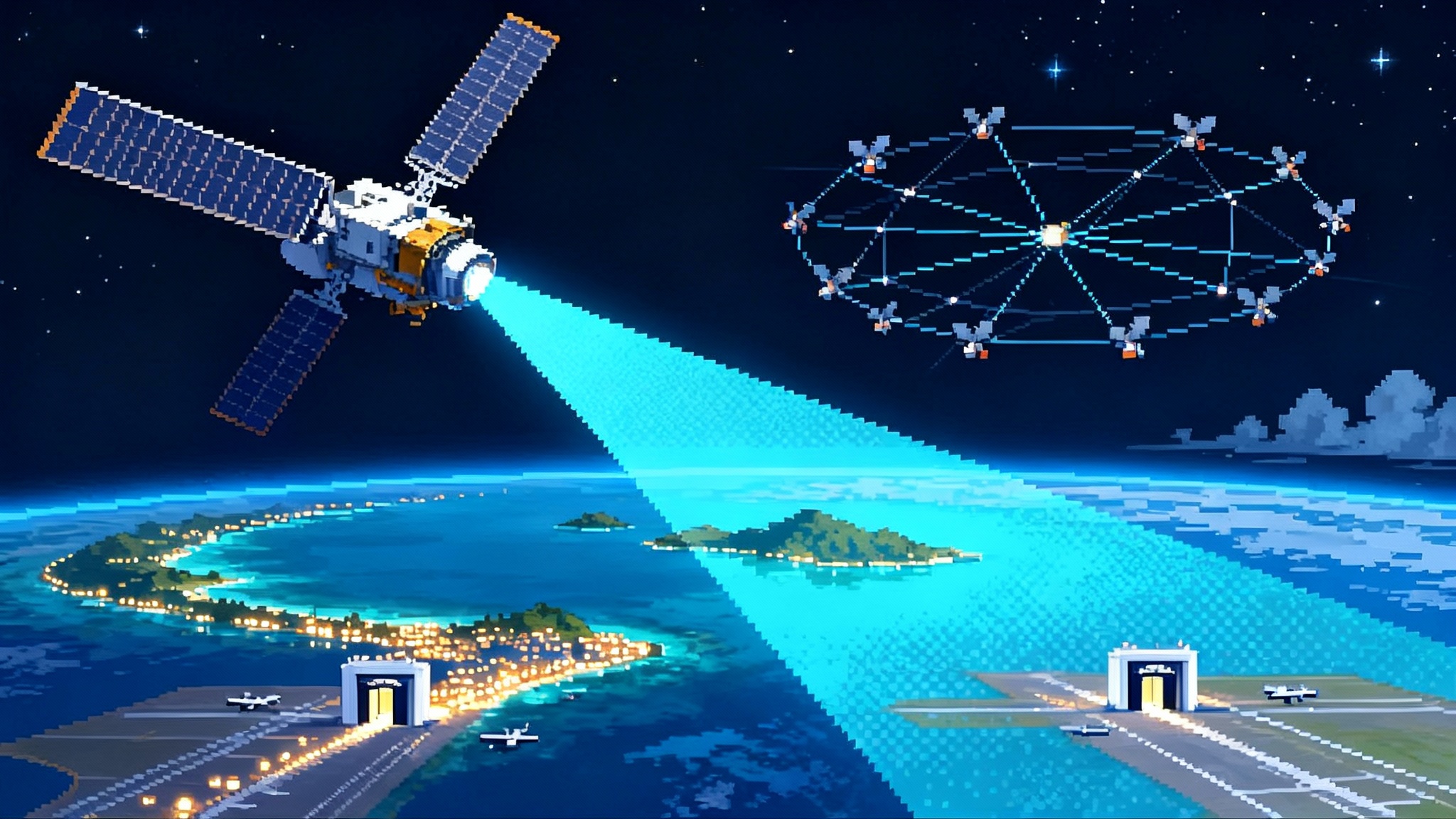

Satellite communications. Software‑defined satellites in geosynchronous orbit, like the new digital payload classes from Airbus and Boeing, can retune beams, shuffle bandwidth, and steer nulls to burn down jamming. Medium orbit networks add lower latency and high‑throughput trunks. Low orbit constellations provide enormous capacity and path diversity. CASR contracts can reserve surge bandwidth, pre‑position protected modems, and exercise gateway failover so that brigades, ships, and aircraft can switch paths as interference ebbs and flows.

-

Intelligence, surveillance, and reconnaissance. Commercial electro‑optical imaging, synthetic aperture radar, radio frequency geolocation, and hyperspectral sensing have matured from niche tools to routine command inputs. CASR pilots in space domain awareness are the blueprint. The same pre‑negotiated tasking, data rights, and distribution rules that let the U.S. see what is happening in orbit can be applied to queues for moving targets on the sea, missile transporter‑erectors under camouflage, or radio frequency emitters that betray air defense radars.

-

Space domain awareness. This is the connective tissue. Telescopes and radars that watch geosynchronous belt maneuvers, optical sensors on commercial satellites, and catalog enrichment algorithms produced by private firms are feeding the Space Force with indications and warning. CASR starts here because you cannot defend what you cannot see. It then generalizes to other missions. For a broader defensive architecture, see America’s space shield takes shape.

-

Maneuverable geostationary communications satellites. Reconfigurable payloads and on‑orbit servicing mean geostationary assets are less fixed than they used to be. Service vehicles can relocate or augment a satellite’s station‑keeping, giving operators freedom to reposition coverage. Digital payloads can redraw beams over the Western Pacific in hours, not months. CASR can turn that technical possibility into a standard wartime play by rehearsing fuel budgets, relocation timelines, and customer migration so warfighters see a change in minutes rather than a brownout.

-

Responsive launch as a reserve function. The Commercial Space Office is exploring how to use CASR authorities to create on‑call launch and integration pools. The near‑term goal is to codify the vendors and interfaces, then run tabletop and hangar‑floor drills that prove you can move from an urgent requirement to a ride to space without months of custom contracting. This is not science fiction, it is checklists, manifests, and people who already know each other.

The policy mechanics that make surge real

Policy determines whether surge is possible when the first GPS jamming alert hits a Pacific airbase or a naval task group loses a satellite link. The broader PNT resilience push, including reprogrammable GPS enters the fight, complements CASR activation.

The key mechanics are specific.

-

Priority orders with real teeth. Rated orders must explicitly include service preemption for bandwidth, collection windows, and gateway time. The government must also practice the industrial side of priority, such as reallocating scarce antennas, laser terminals, and modems in vendor supply chains when a crisis starts.

-

A one‑page activation order. In an emergency, there is no time to negotiate a new task order. CASR needs a standard activation memo that flips the playbook across multiple contracts, sets the mission and region, and authorizes cyber protection measures that might otherwise require lengthy approvals. Think of it as a simple set of switches that every participating operations center understands.

-

War‑risk insurance that companies can bank. Providers need clear, prepriced coverage for physical loss, service outages caused by attack, and government‑directed actions that degrade normal revenue. If the policy requires months of forensic proof, it is not a reserve. If it pays within days based on agreed triggers and logs, companies will keep capacity on standby without fear of financial ruin.

-

Classification that enables collaboration. If the government wants commercial crews in the fight, it must create releasable threat data and procedures that can be shared in real time. That means sanitized jamming geolocation data, redacted cyber indicators, and unclassified tactics and techniques for immediate use.

What this means in a contested Indo‑Pacific by 2026

Picture a plausible 2026 crisis. The People’s Liberation Army ramps up exercises around Taiwan while conducting cyber probes across the region. Commercial imaging cues show unusual maritime traffic patterns. Electronic warfare blooms in the Philippine Sea. Within hours the joint force needs more resilient satellite communications, faster tasking of synthetic aperture radar satellites to watch weather‑degraded sea lanes, and continuous space domain awareness of suspicious objects in geostationary orbit.

With CASR active, the Space Force can press the following buttons.

-

Shift geostationary beams and power to thicken coverage over the First Island Chain. Prepositioned protected modems on ships and at expeditionary airstrips switch to anti‑jam modes. Gateways outside the missile threat ring shoulder more traffic.

-

Expand radar imaging collections over choke points and redirect radio frequency sensing to map jammers and air defense radars. Cross‑cue collections so that when a radar satellite spots a change, an electro‑optic satellite gets the next cloud‑free look.

-

Increase watch on orbit. Commercial telescopes and optical sensors raise alerting thresholds for co‑orbital approaches near high‑value government satellites. Space domain awareness data feeds move to a contingency portal that combines commercial and military tracks for unified deconfliction and warning.

-

Bring on rapid logistics. If a satellite suffers a non‑kinetic hit that shortens its life, CASR activation pulls a servicing window forward or moves a mission extension vehicle into position. If a niche sensor must launch fast, the responsive launch pool spins up an integration flow that was rehearsed in peacetime.

Outcomes are measured in mission continuity. Carrier strike groups keep their beyond‑line‑of‑sight links. Air bases keep routing data through multiple paths that force a jammer to work harder. Theater commanders see moving maritime targets through cloud and darkness, not just when the weather clears.

Red‑team counters and how to blunt them

Any plan has an adversary. Here are likely counters and what to do about them.

-

Flooding the commercial stack. An adversary could buy competing capacity, launch cyberattacks that look like routine outages, and file regulatory challenges to slow reconfiguration. Counter with preemption clauses that override commercial queues, with cyber threat intelligence sharing and mandatory incident reporting inside CASR, and with regulatory playbooks coordinated in advance with host nations and the International Telecommunication Union.

-

Targeting the ground layer. Fiber cuts, power disruptions, and harassment of third‑party teleport operators can do more damage than spaceward attacks. Counter with geographic dispersion of gateways, sovereign partners hosting backup ground nodes, battery and generator capacity sized for multi‑day autonomy, and rehearsal of manual cutover procedures.

-

Co‑orbital harassment in geostationary orbit. Slow approaches near commercial communications satellites can spook operators and create pressure to move. Counter with joint commercial and military space domain awareness, clear redlines, and on‑orbit servicing options that allow temporary relocation without losing mission.

-

Spoofing priority orders. A sophisticated actor could try to inject fake activation messages. Counter with strong authentication, out‑of‑band verification between government and vendor watch floors, and audit trails that are reviewed in real time by mixed teams.

Acceleration levers to pull before 2026

-

Contract for outcomes, not only capacity. Write tasking contracts that pay for assured availability in a crisis. Tie dollars to time to restore after a jamming event or to minutes from activation to first protected link.

-

Preposition the kit. Field protected modems, multi‑orbit terminals, and encryption modules at units likely to deploy. Training and hardware in hand beat paper readiness.

-

Bake in cyber from the start. Require modern authentication, software bill of materials, and continuous monitoring on vendor ground systems that will touch government networks when CASR activates. Certify once, use many times.

-

Practice with allies. Indo‑Pacific operations depend on access and overflight, spectrum coordination, and shared sensing. Run allied CASR drills so partner teleports, cloud regions, and legal authorities are part of the playbook.

-

Fund war‑risk coverage now. The premium is cheaper before the crisis. A defined pool for CASR participants will signal seriousness and help small and mid‑size firms commit capacity.

-

Finish the priority schema. Publish the short activation order, the escalation ladder for electromagnetic protection measures, and the data release rules that vendors can adopt in their standard operating procedures.

The bottom line

CASR is no longer a concept pitched on stage. It has pilot contracts, a playbook, and real exercises under its belt. It slots into a broader commercial space stack that includes reconfigurable geostationary satellites, proliferated low orbit constellations, and a launch market that now fields multiple certified heavy providers. The hard part is finishing the plumbing that turns capacity into effects under attack. If the Space Force and industry finish the priority and protection mechanics, the joint force will enter 2026 with a reserve that can actually surge in the Indo‑Pacific. That is not a slogan, it is a checklist, and it is finally being written in the right order.