Iron Beam Enters Service: Lasers Rewrite Air Defense Math

Israel says its Iron Beam high-power laser is moving into service after final trials. Here is how it reshapes layered air defense economics, concepts of operation, and export prospects.

A first-in-class laser is joining the fight

Israel’s Ministry of Defense says Iron Beam, the country’s high-power laser interceptor, has finished its final trials and will begin entering service in 2025. The announcement, made public on September 17, 2025, described weeks of testing in southern Israel and framed the laser as a low-cost complement to Iron Dome, David’s Sling, and Arrow. Reuters reported that the system is co-developed by Rafael and Elbit Systems and that each shot costs about as much as the electricity to power it, unlike Tamir interceptors that can run tens of thousands of dollars per engagement. The ministry called it the first time a high-power laser reached full operational maturity. See the details in this Reuters report on the fielding plan.

That may sound like a technical milestone, but it is really about money, tempo, and logistics. If a defender can reliably stop small rockets and drones with photons, magazines last longer, supply chains breathe, and commanders can hold expensive interceptors for the threats that truly demand them. The cost curve starts to bend.

What Iron Beam is designed to do

Iron Beam is a ground-based, high-power, electrically driven laser tied into Israel’s integrated air and missile defense network. Elbit provides the laser source and Rafael builds the beam director, tracking, and full weapon system. The laser rapidly concentrates energy on a small spot on the target until structure fails or control surfaces and sensors are burned through. In tests, the system engaged rockets, mortars, and UAVs; officials also referenced aircraft targets at short range within the test envelope.

You will not see Iron Beam replacing missile interceptors for long-range ballistic threats. Lasers are line-of-sight weapons with an engagement envelope measured in kilometers, not tens of kilometers, and their power on target falls with distance and atmosphere. Where they excel is the low-altitude, short-time-of-flight space: small rockets, mortars, and drones that try to saturate defenses, especially near population centers and high-value sites.

Rafael and the ministry also disclosed that prototype high-energy lasers were used in the Swords of Iron war to down enemy drones, providing a real-world shakedown before full deployment. The company summarized those field results in a May 2025 release about combat laser interceptions.

The cost curve flips

-

Interceptor economics: A Tamir interceptor for Iron Dome is often cited in the tens of thousands of dollars per shot. A laser shot draws grid or generator power and consumes no missile. That does not make Iron Beam free. You still pay for hardware, crew, maintenance, and power generation. But per-engagement costs drop orders of magnitude. In a long campaign, that delta compounds.

-

Magazine depth: Lasers have effectively bottomless magazines so long as you have electricity and thermal headroom. That reduces reload pauses and truck-to-battery resupply convoys, which are vulnerable and expensive.

-

Force design: With a laser layer, commanders can triage. Cheap, short-range threats go to photons first. Interceptors are held for heavy rockets, maneuvering UAS, or poor weather windows. This frees scarce missile stockpiles for worst-case peaks and reduces dependence on urgent resupply.

-

Industrial resilience: When your main consumable is electric power instead of advanced missile components, you reduce pressure on high-end manufacturing lines and complex supply chains.

How CONOPS will change

Think of Iron Beam as a new outer skin around defended sites, stitched into the existing radar and command network. Here is a likely engagement flow when weather is favorable:

-

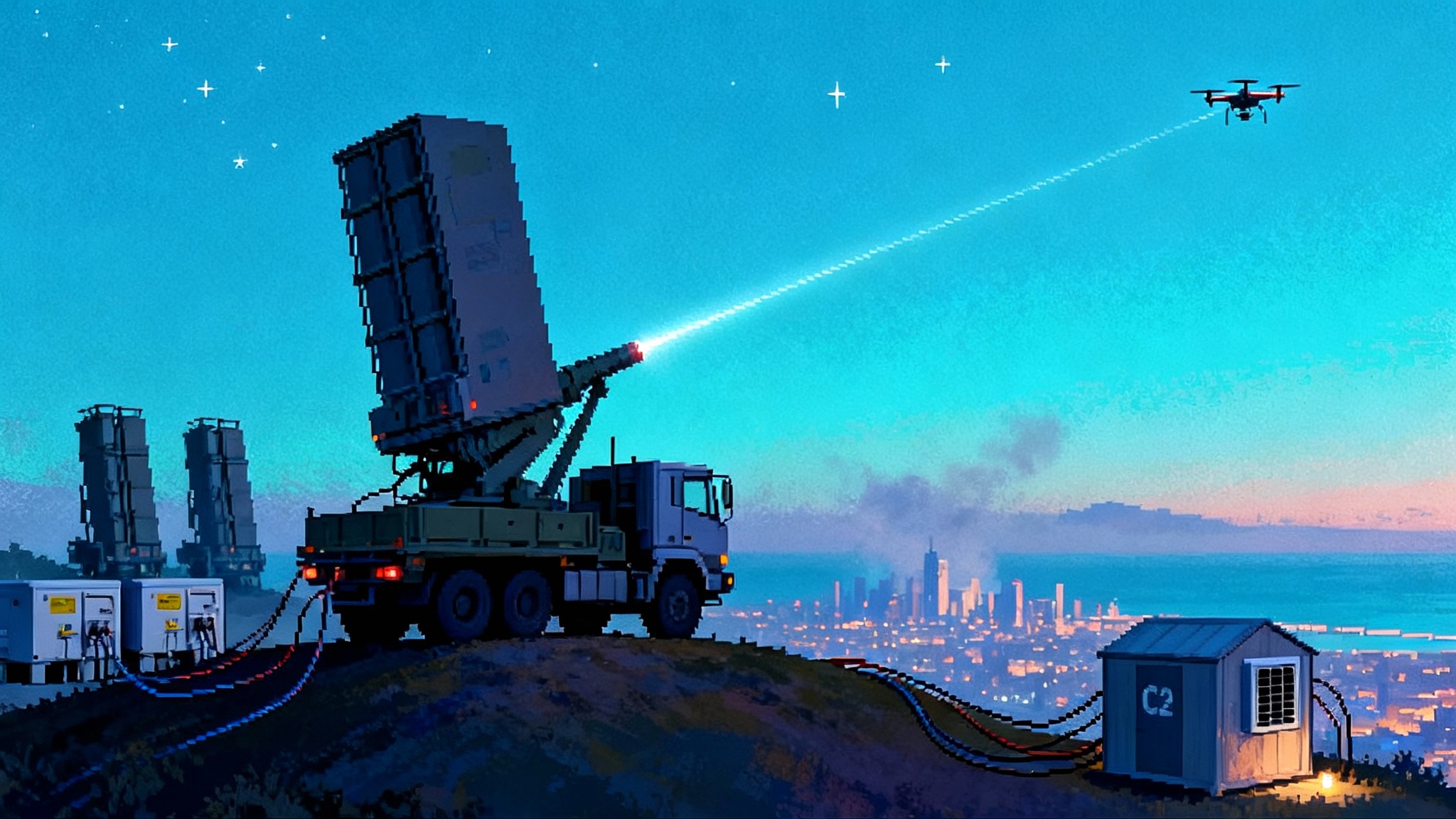

Sensor cue: Air picture comes from the IAF’s radars and electro-optical trackers. The C2 system assigns tracks by threat type, trajectory, and value.

-

Triage: The battle manager classifies a swarm into bins. Low-mass rockets and small UAVs in laser range with clean lines of sight get routed to Iron Beam. High-threat or fast, lofted trajectories get interceptor solutions.

-

Shoot-assess-reengage: The laser slews, locks, and holds beam on the target. If kill is assessed late or the target starts to tumble, the system either continues dwell, hands off to a second laser channel if available, or kicks to a missile. This minimizes leakage without wasting interceptors.

-

Salvo management: For mixed attacks, expect staggered timing. Lasers thin the herd in the opening seconds, then interceptors pick off leakers and the hardest tracks. The goal is graceful degradation under saturation, not perfection.

-

Safety and deconfliction: Laser rules of engagement must account for beam safety in the airspace, reflections, and backscatter. Expect no-fire azimuths and integration with flight corridors, with the beam director enforcing geofences in software.

In poor weather, the C2 flips the priorities. Missiles take the lead. Lasers may still prosecute close, slow targets where local viewing conditions allow, but they are no longer the first shooter.

Integration with layered IAMD

Israel’s layered defense is already a choreography of sensors and shooters: Iron Dome for short-range rockets and small UAVs, David’s Sling for larger missiles, and Arrow for high-altitude ballistic tracks. Iron Beam does not add a new radar but plugs into the same picture and C2. The unique value is the new kill mechanism.

-

Sensor fusion: Lasers benefit from exquisite tracks. Expect Iron Beam batteries to carry or be paired with electro-optical sensors for final aim, while relying on network radars for cueing and track quality.

-

Fire control policy: The network must decide when to spend a Tamir and when to spend photons. Policy can be weather- and clutter-aware. A cloud ceiling at 800 meters and heavy dust will bias the algorithm toward missiles.

-

Geographic tactics: Lasers are line-of-sight. Terrain and buildings matter. Expect siting on high ground or rooftops near defended assets, with coverage footprints planned alongside interceptor defended areas to reduce gaps. This mirrors NATO progress with IBCS plug-and-fight integration.

-

Logistics and power: Batteries will be integrated with grid hookups where possible, plus generators and energy storage for ride-through. A mobile laser battery is now part of the defended site’s infrastructure plan.

Energy, thermal, and weather realities

There is no free lunch in physics. Several factors will bound performance:

-

Power on target: High power is good, but atmosphere is the real adversary. Water vapor, dust, smoke, fog, and rain scatter and absorb energy. Heat shimmer and turbulence bend the beam. Adaptive optics help but cannot conquer heavy fog.

-

Dwell time: A laser must hold aim long enough to ablate material, ignite fuel, or shatter critical components. Fast, spinning, or glossy targets can stretch dwell time, which matters during saturation.

-

Thermal management: High-power lasers generate lots of waste heat. Batteries need liquid cooling, heat exchangers, and possibly thermal storage. In hot climates, you pay a performance tax when ambient temperatures are high. Nighttime and winter may be the best windows.

-

Power generation: Sustained fire requires substantial electrical power. That means dedicated generators, grid access, or hybrid systems with batteries and flywheels to handle engagement transients.

Bottom line: Lasers will be brilliant some hours and mediocre in others. A layered force retains missiles to bridge the weather gap.

What adversaries will try next

Attackers adapt. Expect countermeasures and tactics that exploit laser physics:

-

Saturation timing: Larger salvos compress dwell time per target. More tracks than laser channels means leakers.

-

Aerosol and smoke: Obscurants and dust degrade beam quality. An attacker can time strikes during dust storms or deliberately seed obscurants upwind of defended areas.

-

Target dynamics: Spinning drones and slanted airframes keep hot spots moving. Highly reflective coatings can reduce absorption at certain wavelengths, though they will not stop ablation once surfaces heat and char.

-

Small cross-section: Tiny, low-and-slow UAS in ground clutter are harder to detect and keep in a tight aimpoint box.

-

Decoys: Foam or mylar balloons and cheap gliders can soak laser time and attention while heavier threats come in behind them.

Expect counter-countermeasures from defenders: more laser channels per battery, higher power levels, better aimpoint algorithms, integration with high-power microwave systems for swarm kills, and automated target ranking that ignores decoys. The defender’s advantage improves if it can fuse radars with EO/IR and classify targets quickly. The trend toward drone mass noted in Replicator and AI-driven mass will accelerate this cat-and-mouse.

Naval and mobile variants

Physics favors ships. Warships carry megawatts of power and vast cooling capacity, and they can elevate sensors and beam directors above layer-cake atmospheres near the surface. A naval Iron Beam would be a natural fit to protect ships against UAVs and short-range rockets, and to add a cheap layer against antiship drones. Expect early fits on corvettes or frigates where space, weight, and power margins allow. The key design tasks will be maritime stabilization, salt fog hardening, and integration with shipboard combat systems.

On land, mobility matters. A truck-mounted Iron Beam battery can shadow maneuver brigades or protect temporary bases, but it must carry fuel, spares, and cooling. Rapid emplacement and auto-alignment with the network will be decisive. Look for towed or palletized packages that can plug into site power where available.

Airborne lasers are further out but attractive. An airborne beam looks down through thinner air, can pursue line-of-sight more easily, and can maneuver to get clean look angles. Power and thermal constraints are tougher. Israel’s industry has said it is working on airborne options, which would pair naturally with persistent ISR platforms for counter-UAS patrols.

Exports and geopolitics

Laser weapons wander into a thicket of export law and alliance politics. Israel has strong incentives to export a laser layer, but will weigh that against the strategic value of holding a unique defense edge. Expect close alignment with the United States on any third-country sales.

Potential buyers will be countries with frequent drone and rocket harassment and the budgets to field integrated networks: Gulf states that face Houthi attacks, European nations worried about long campaigns of drone strikes, and East Asian countries building layered homeland air defense. Some will opt for technology partnerships rather than off-the-shelf buys, pushing for licensed production of subsystems like beam directors, power modules, and cooling.

The business model may look different from missile exports. Lasers shift costs from consumables to capital equipment and lifecycle support. Vendors may propose performance-based contracts tied to uptime, power availability, and average cost per intercept over a season.

Implications for the U.S. and allies

Iron Beam’s fielding validates directed energy as an operational tool, not a perpetual science project. It will reverberate through allied laser roadmaps:

-

U.S. Army: 50 kW class lasers on Stryker are already in limited fielding for short-range air defense. The Army’s goal for higher-power, fixed-site protection against rockets, artillery, and mortars aligns with what Israel is now deploying. Expect more emphasis on multi-channel architectures and rapid handoff between lasers and interceptors.

-

U.S. Navy: Surface combatants are the best near-term home for higher power lasers. Blue-water ships can carry the power and cooling to support multiple channels and long duty cycles. Expect a focus on hardening against maritime aerosols and heavy weather, and on doctrine for pairing lasers with missiles and electronic warfare.

-

U.S. Air Force: Airborne laser research is shifting from missile defense at long range to counter-UAS and self-protection. Iron Beam’s success will push investment in beam control and power-dense thermal management that can scale to pods or larger aircraft bays.

-

Europe: The UK’s DragonFire and German laser demonstrators have shown precision at tactically useful ranges. Iron Beam’s entry into service will embolden programs to move from “demo on a ship” to “defend a harbor for a season” with clear availability targets. Expect port and airbase defense pilots.

-

Indo-Pacific: Japan and South Korea are investing in both lasers and microwave systems for home-island defense. Iron Beam will offer a reference design and performance bar for short-range layers around cities and bases, complementing missile developments like Land-based Tomahawk and SM-6.

The broader strategic point is doctrinal. Lasers demand new metrics. Instead of “shots remaining,” commanders think in “kilowatt-hours available before thermal saturation” and “expected kills per hour at this humidity.” Training, logistics, and readiness reporting will adapt.

What to watch in 2026

-

Scale and density: How many batteries can Israel field and where are they placed. Site count drives real-world impact as much as lab performance.

-

Weather analytics: Expect public hints that the system is tied to micro-forecasting. Predictive models can allocate interceptor stockpiles and reposition mobile lasers ahead of dust and fog.

-

Multi-channel growth: The most powerful counter to saturation is more beams per site. Watch for dual-channel or tri-channel upgrades and for distributed batteries that can share targets.

-

Naval trials: Keep an eye on shipboard integration announcements. A successful sea trial will be a strong signal for allied navies.

-

Export pilots: Early export customers may field a single site to protect a critical plant or port as a technology pilot. Those pilots will shape global adoption.

-

Doctrine and safety: Lasers create new safety requirements. Rules for airspace deconfliction, eye-safety zones, and joint fires coordination will mature. Public reporting on safety procedures will help normalize the technology.

The bottom line

Iron Beam’s entry into service marks a pivot point for modern air defense. It is not a silver bullet and it will not erase the need for missiles. It is, however, a new lever that changes the math of defense under fire. In clear air with ample power, a laser can thin salvos, save interceptors, and deny the attacker the easy arithmetic of cheap rockets against expensive missiles. Integrated well into the layered network, it improves resilience over a long campaign. That is why this first operational laser matters far beyond Israel: it shows that with the right engineering and the right concept of operations, directed energy can finally pull its weight on the modern battlefield.