Golden Dome Goes Public: Space Defense Enters Acquisition

Golden Dome has moved from presidential reveal to acquisition. Here is what the selected architecture, Guetlein’s mandate, budgets, timelines, NORAD integration, industry capacity, and the test-and-risk outlook mean for fielding by 2029.

From podium to program

In May 2025 the administration moved a campaign headline into the acquisition queue. The White House announced the preferred architecture for Golden Dome, a homeland missile defense concept that for the first time places U.S. interceptors in space alongside a proliferated sensor grid. President Trump named Gen. Michael A. Guetlein to lead the effort and set an aggressive schedule to begin fielding before January 2029, while citing a notional total cost of about $175 billion. Those are high-stakes commitments, and the first tranche of funding has already begun to flow into early planning and requirements work. As reporting made clear at the announcement, the Pentagon is still turning concept into contract, but the direction is now set under Guetlein’s stewardship of a multilayered system that spans orbit to ground and integrates with existing regional and homeland defenses. AP’s selection and leadership report captured both the ambition and the caveats.

What “selected architecture” actually means

The architecture is layered. The space segment does two core jobs. First, it provides global missile warning and precision track custody, including dim targets like hypersonic glide vehicles. Second, it evolves toward space-based intercept capability for boost-phase kills. The ground and maritime layers close the fire control loop with interceptors for midcourse and terminal phases. The goal is custody from first photon to final shot with a resilient command and control backbone connecting NORAD, USNORTHCOM, the services, and select allies.

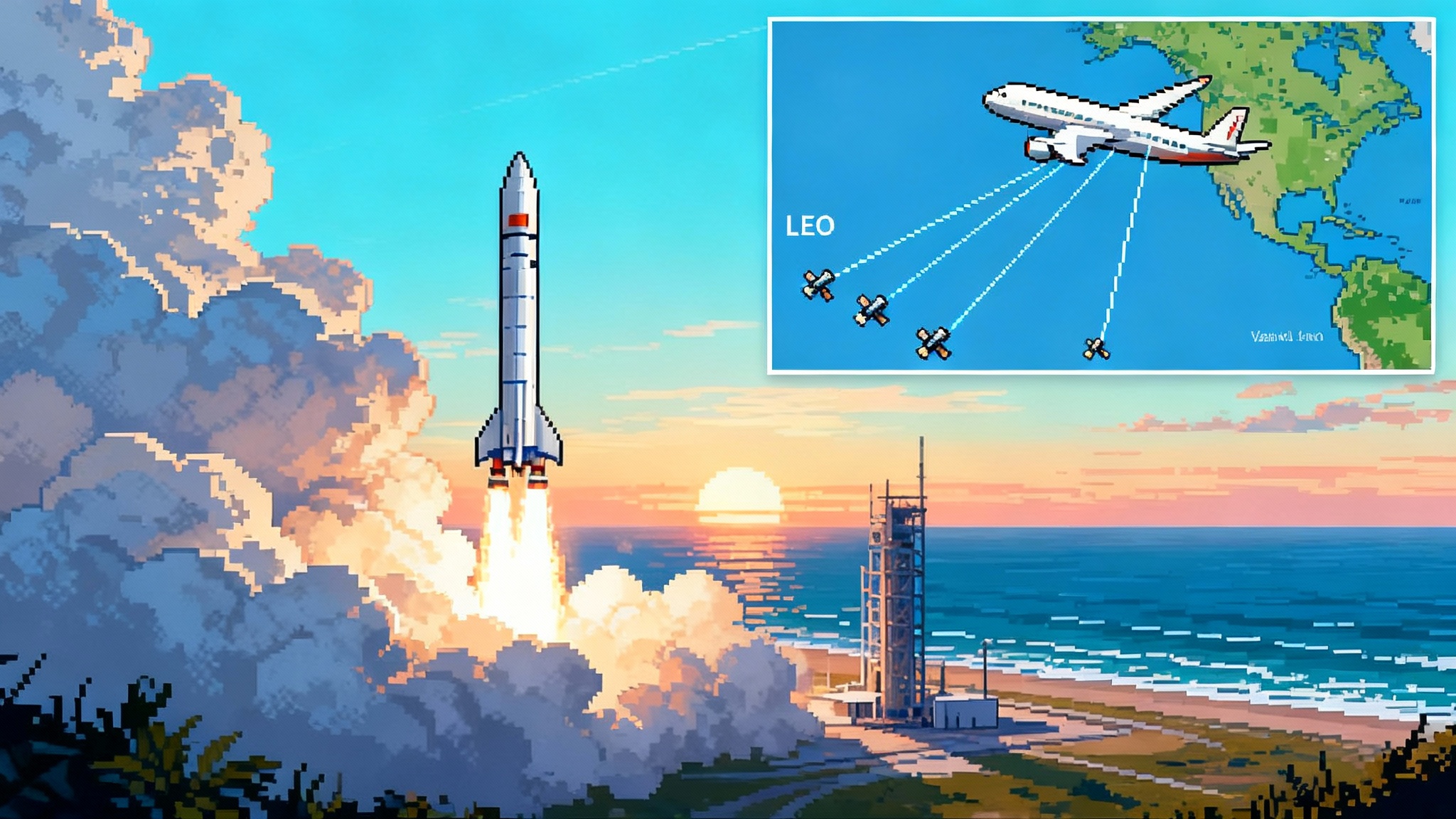

In practice that means the United States will build on two space constructs already underway. The Space Development Agency’s proliferated constellations provide wide field of view missile warning and tracking in low Earth orbit. Medium field of view payloads add the fire-control quality needed to hand off to interceptors. Parallel work in highly elliptical orbits covers polar approaches. Golden Dome intends to bind those pieces into a single fire-control fabric and then add space-based interceptors as technology matures. For context on the LEO approach, see SDA’s LEO mesh kill chains.

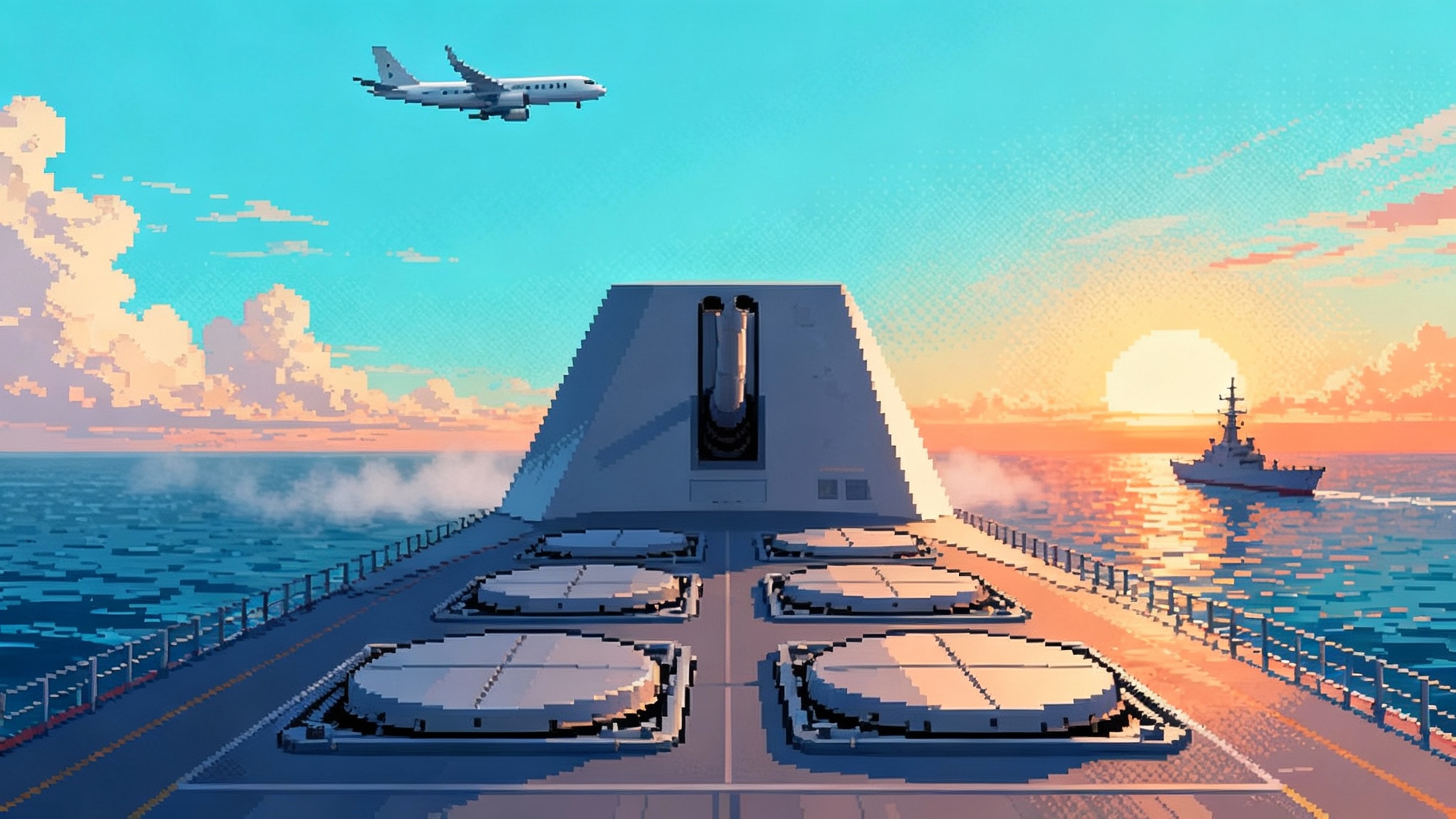

At sea and on land the program will lean on systems in service or nearing it. Ground-Based Midcourse Defense will get life-extension and discrimination upgrades while the Next Generation Interceptor augments capacity. Aegis Ballistic Missile Defense with SM-3 variants and the Army’s THAAD and Patriot families provide terminal defense and raid-handling. For hypersonic glide vehicles the plan aims for a new Glide Phase Interceptor capability as schedules and budgets allow. All of it rides on tighter sensor fusion and battle management than the enterprise has fielded before.

Guetlein’s playbook

Guetlein is a builder of complex space and C2 programs. As the first commander of Space Systems Command he inherited legacy portfolios, then accelerated delivery of proliferated space architectures and contracted for new constellations at production tempo. He is also fluent in the realities of ground integration, cybersecurity, and test infrastructure, not just satellites.

Expect three moves under his leadership. First, direct reporting and decision rights to collapse cycle time between requirements and contract awards, with an empowered program executive office structure and standing source-selection teams. Second, early down-selects to minimize concurrency risk while preserving competition on key subsystems like seekers, kill vehicles, and infrared sensors. Third, rigorous systems engineering on the ground segment, because C2 and battle management are the pacing functions when dozens to hundreds of platforms must produce fire-control tracks in seconds. These are the kinds of sprint tactics seen in Dual-ship B-21 test sprint.

Budget math and the timeline test

The White House has emphasized an initial down payment and a headline cost near $175 billion. Independent estimates that isolate the space piece are higher and emphasize uncertainties. The Congressional Budget Office’s May 2025 analysis of space-based interceptors, accounting for sharply lower launch prices, places a 20-year range of roughly $161 billion to $542 billion depending on constellation size, interceptor complexity, and refresh cycles. That estimate is for the space architecture alone, not the totality of Golden Dome’s ground and test enterprise, and it underscores why affordability hinges on interceptor design and constellation sizing, not just launch economics. See CBO’s May 2025 cost letter for the underlying assumptions.

The schedule is equally unforgiving. A credible path to initial capability by late 2028 or early 2029 requires that three parallel efforts succeed. The sensor layer must demonstrate repeatable fire-control quality tracks against stressing targets. The ground C2 must ingest that data and produce stable, low-latency tracks across echelons and classification levels. And the test program must close the fire control loop in live or live-virtual-constructive events that convince both operators and Congress that the shots will work under combat conditions.

Space interceptors and sensor layers

Space-based intercept has been the hardest problem in missile defense for four decades. The physics are not the issue. The geometry and the economics are. Boost-phase exposure is short, typically a few minutes for liquid boosters and even less for some solid systems. To catch that window the constellation must place shooters where they can see and reach the plume in time, then deliver a closing speed and guidance solution that survives countermeasures and off-nominal trajectories. Add in satellite maneuver budgets, thermal limits, and the need for robust kill vehicle seekers that can operate in clutter, and you begin to see why past concepts required large satellite counts and frequent replenishment.

Golden Dome’s bet is that modern infrared sensors, digital engineering, and proliferated architectures can raise track quality and reduce the number of shooters required for coverage. Even so, the space layer will likely deploy in phases. Phase one focuses on tracking and custody for both ballistic and maneuvering threats, using proliferated LEO sensors and polar coverage to reduce gaps. Phase two experiments with limited on-orbit intercept, probably in designated test corridors and with strict safety envelopes. Phase three scales to operational coverage with a replenishment pipeline that looks more like continuous production than bespoke space acquisition of old.

The killer variable is fire-control quality. Wide field sensors detect, but they do not always deliver the precision to cue a weapon. That is why medium field payloads, crosslink timing, and calibration against real targets matter. It is also why data handling at the edge, not just in ground stations, is being emphasized. The system must get inside threat timelines, not just watch them.

C2 with NORAD is where this becomes real

All of the orbits and interceptors in the world will not matter if operators cannot fight the network at the speed of the threat. NORAD’s modernization plan already includes cloud-based command and control, data fusion improvements, and upgrades to fixed battle control systems that feed continental defense. The Army is fielding the Integrated Battle Command System to connect disparate sensors and shooters. Golden Dome’s battle management should not reinvent that wheel. It needs to plug into the binational NORAD enterprise, respect release authorities, and deliver fused tracks that can be acted on from Alaska to Florida without brittle handoffs.

The watch floor reality is simple. Operators need an unambiguous track picture that survives latency, classification, and cyber turbulence. They also need authorities mapped to that picture so that a shot doctrine can be executed when seconds count. For Golden Dome, that means early integration testing with NORAD sectors, USNORTHCOM’s joint fires cells, and the service air defense commands that will actually push the buttons. The integration burden is not just technical. It is legal and procedural, particularly where Canadian authorities and cross-border rules of engagement are concerned.

Industrial base implications

A program of this size will touch nearly every tier of the defense industrial base. Three pressure points stand out.

-

Interceptors and boosters. Solid rocket motors are already a bottleneck for tactical and strategic programs. Space-capable interceptors with high-energy kill vehicles will add demand for propellants, composite cases, divert and attitude control systems, and radiation-hardened avionics. The supplier pool has consolidated and is still recovering from quality escapes and workforce churn. Golden Dome will need multi-year procurement to justify capacity expansions, second sources for key energetics, and early long-lead awards to avoid starving other munitions lines.

-

Space sensors and buses. Infrared payloads with both wide and medium fields of view are moving toward production, but scaling to dozens or hundreds of units requires standardized interfaces, test rigs, and thermal-vacuum throughput that the current base has only recently begun to build. Radiation-tolerant processors and crosslink modems are pacing items. Vendor lock on key focal plane arrays could become a single point of failure if not addressed with dual sourcing and data rights strategies.

-

Launch and ground. Launch capacity has expanded, yet a frequent-refresh constellation still competes with national security and commercial manifests. The ground segment will need secure cloud infrastructure, nimble software release trains, and cyber hardening baked into contracts. Standing up additional mission operations centers and test-as-you-fly labs will be essential to keep operations and integration from becoming the long pole.

These are solvable with predictable funding and program discipline. They are not solvable with annual churn or one-year buys.

Feasibility in the shadow of testing cuts and hypersonic delays

Two realities complicate the timeline. First, the Department has reduced the size and authority of its independent operational test and evaluation function. That shift is meant to accelerate fielding, but it also removes a layer of skeptical oversight that historically surfaced integration flaws and survivability shortfalls before deployment. The risk for Golden Dome is straightforward. Without tough operational testing that stresses the whole kill chain, the program could field hardware that works in lab conditions yet fails under cluttered, contested scenarios with adversary countermeasures and degraded communications.

Second, the counter-hypersonic portfolio has absorbed schedule slips. The Glide Phase Interceptor entered a more constrained development path, and booster and seeker work remain technically demanding. Since hypersonic defeat is a central part of Golden Dome’s value proposition, delays here can ripple across the architecture, forcing a heavier reliance on terminal defenses that are expensive and geographically limited for homeland coverage. For a parallel case study in schedule realism, see Sentinel reset and ICBM pivot.

A grounded program fights these two headwinds by overinvesting in integrated testing early and by being brutally honest about physics. That means building an end-to-end test campaign that puts sensors, networks, and shooters in the same loop well before Milestone C decisions. It means red teaming seeker discrimination against realistic decoys and penetration aids. It means contested environment drills that include cyber degradation, GPS denial, and intermittent crosslinks. It means joint exercises where NORAD, USNORTHCOM, services, and allied operators train with the same software loads they will use in a crisis.

A practical test blueprint

-

Phase 1, sensor truth and custody. Fly medium and wide field payloads against live targets with dissimilar phenomenology. Require repeatable fire-control track quality at tactically relevant latencies. Validate calibration and crosslink timing in cold and hot backgrounds and at high look angles.

-

Phase 2, C2 fusion under stress. Connect the space layer to battle management, then to sector and service C2 nodes, and finally to fire units. Run live-virtual-constructive events that force track handoffs across classification and coalition boundaries. Measure decision time, not just throughput. Tie shot doctrine to track confidence and automate where possible with human-on-the-loop oversight.

-

Phase 3, surrogate shots. Before space-based intercept is ready, close the loop by cueing ground or sea interceptors from space tracks. Require real-time handoff to an Army or Navy shooter and a live shot on a stressing trajectory. Grade end-to-end performance, not just individual silos.

-

Phase 4, on-orbit intercept experiments. Start with controlled geometry and safety corridors. Prove seeker discrimination and divert authority. Expand to more complex trajectories and raid scenarios after initial success. Keep debris and range safety authorities in the room throughout.

-

Phase 5, operational trials. Put operators in the loop across NORAD sectors with the same software loads and data links that will go operational. Include cyber opposition forces and space weather events. Publish test cards and operator feedback, then iterate in software every quarter.

If the Department insists on a compressed path to fielding, it should compensate by publishing an integrated test master plan that survives budget turbulence and by appointing an independent red team with authority to halt deployment on safety or effectiveness grounds.

What to watch next

-

FY26 budget lines. Look for clear separation of funds for space sensors, space interceptors, ground C2, and test infrastructure, not amorphous program elements that obscure tradeoffs.

-

Down-selects and data rights. The first round of awards should lock in open interfaces, modular payloads, and government purpose data rights for critical software and sensor models. That reduces lifetime vendor lock and speeds integration.

-

NORAD milestones. Cloud-based C2 expansions, battle control system upgrades, and cross-border data arrangements will tell you whether the operators can actually fight this network.

-

Industrial base moves. Awards for additional solid rocket motor capacity, divert thrusters, focal plane arrays, and radiation-hardened processors will signal whether the supply chain is being grown in time.

-

Hypersonic defeat progress. Glide Phase Interceptor risk retirement on boosters and seekers, plus terminal system raid-handling upgrades, will determine how balanced the architecture can be by 2029.

The bottom line

Golden Dome is no longer a podium line. It is an acquisition path with a named leader, a layered blueprint, and early dollars on contract. That is progress. The hard part starts now. Success depends on getting three fundamentals right. Build a space layer that produces fire-control tracks at combat-relevant latencies. Tie it to a battle management backbone that NORAD and the services can actually fight. Test the whole kill chain like you intend to use it, with an independent red team and operators in the loop. If those things happen, the United States will not just buy satellites and interceptors. It will buy time in a crisis and options for national command authority that did not exist before. If they do not, Golden Dome will become another ambitious chart that could not survive contact with physics, integration, and the calendar.