Drone-boat Alley: Gulf Coast shifts to 150-foot USV production

From Louisiana to Texas, commercial yards are shifting from prototypes to production on 150-foot unmanned surface vessels. Blue Water Autonomy’s pick of Conrad Shipyard and Saronic’s absorption of Gulf Craft point to a fast-forming cluster just as the Navy delays LUSV buys to Fiscal Year 2027.

Drone boat alley arrives on the bayou

The center of gravity for U.S. autonomous warship building is sliding down the Mississippi and across the Gulf. In late September, Blue Water Autonomy said it will build its 150-foot class unmanned ships with Louisiana’s Conrad Shipyard, a signal that production is starting to move from coastal labs to the heavy steel halls of the Gulf Coast. The news is a practical marker, not a paper plan, that the market is maturing. It also cements the region’s growing role as a cluster for unmanned shipbuilding, repair, and test ranges. The contract details are sparse, but the intent is clear in the company’s words about design underway now and welding to begin soon, as reported when Blue Water selects Conrad Shipyard.

That choice sits alongside Saronic’s earlier acquisition of Gulf Craft in Franklin, Louisiana, and the keel-laying of its first 150-foot Marauder. Taken together, these moves give the Gulf Coast two independent production paths for fully unmanned ships in roughly the same size class. The talent base from offshore energy, inland towing, and commercial workboats gives the region a ready pool of welders, fitters, electricians, and marine engineers who can scale hull fabrication quickly. Because much of the autonomy, sensing, and combat power rides as modular payloads, these yards can start with proven commercial steel and aluminum practices, then integrate government or vendor kits.

Why the 150-foot USV class matters

A 150-foot unmanned surface vessel hits a sweet spot. It is large enough to carry useful fuel and payloads, operate in sea states that challenge smaller drones, and host containerized mission modules. Yet it remains far cheaper and faster to build than a frigate or destroyer. This size can launch and recover smaller drones, tow specialized arrays, and carry vertical or angled launchers for decoys, interceptors, or other effects. The scale also allows more robust power generation and cooling to support electronic warfare payloads, higher bandwidth radios, and radar apertures without pushing the platform into large-combatant cost territory.

Designers also gain more margin for survivability features. Extra compartmentation, distributed power, and improved flooding tolerance are realistic in this envelope. The vessel can host redundant communications paths, from SATCOM to line-of-sight mesh and optical links, with enough topside real estate to separate apertures and reduce mutual interference. That combination of capacity and cost helps explain why multiple firms are converging on a common length and displacement.

The hybrid fleet’s near-term missions

The Navy’s concept for a hybrid fleet blends crewed combatants with unmanned adjuncts, a theme that echoes manned-unmanned air stack lessons from the aviation side. In practical terms, these 150-foot class ships enable four mission families that matter now.

- Picket ISR and EW: Push the sensor and jammer line outward. A small constellation of unmanned pickets can hold passive ears on likely threat axes, extend the radar horizon, or create a curtain of electronic deception. If a picket is detected and attacked, it forces the adversary to reveal intent and location while the crewed force remains outside the immediate danger zone.

- Magazine and relay: Move missiles and expendables forward to thicken air and missile defense or add strike volume. A 150-foot platform can carry bolted or containerized launchers for interceptors, loitering munitions, or decoys. It can also act as a data mule for cooperative engagement, ferrying tracks and fire-control-quality data between distributed units.

- Decoy and deception: Present false targets, shape adversary targeting cycles, and soak up expensive shots. A few robust decoys with believable signatures can protect high-value units by drawing fire and confusing seekers. They also force the opponent to spend time sorting the picture, which creates windows for crewed ships to maneuver.

- Logistics and sustainment: Shuttle spare parts, fuel bladders, sensors, and humanitarian supplies along contested littorals or across archipelagos. A 150-foot unmanned ship is small enough to access austere piers but large enough to move meaningful loads. It reduces risk to sailors on high-threat resupply legs and frees crewed auxiliaries for heavier lifts.

These roles are mutually reinforcing. The same hull can cycle from picket duty to logistics runs by swapping containers and software loads, then return to a strike support role with a new module set.

The autonomy and command stack that makes it work

Hardware without a coherent autonomy and command architecture is just a steel canoe. The stack that matters runs from the waterline to the cloud.

- Core autonomy: Reliable navigation, collision avoidance, and station keeping in traffic and weather. Compliance with COLREGS and local rules is table stakes. Vendors are hardening perception meshes that fuse radar, AIS, EO/IR, and passive RF to maintain separation and build a consistent track picture without a human watching every pixel.

- Mission autonomy: Task execution that handles timing, routes, emissions, and failover behaviors. This includes constraint-based planners that obey geographic and legal keep-out zones, manage fuel and battery budgets, and dynamically reroute when comms drop or threats emerge.

- Human on the loop: Lethal effects remain under positive human control. The architecture must support low-latency tasking and timely revocation of permissions, with clear displays of what the autonomy intends to do next. The goal is to reduce cognitive load, not to create a game of whack-a-mole alarms.

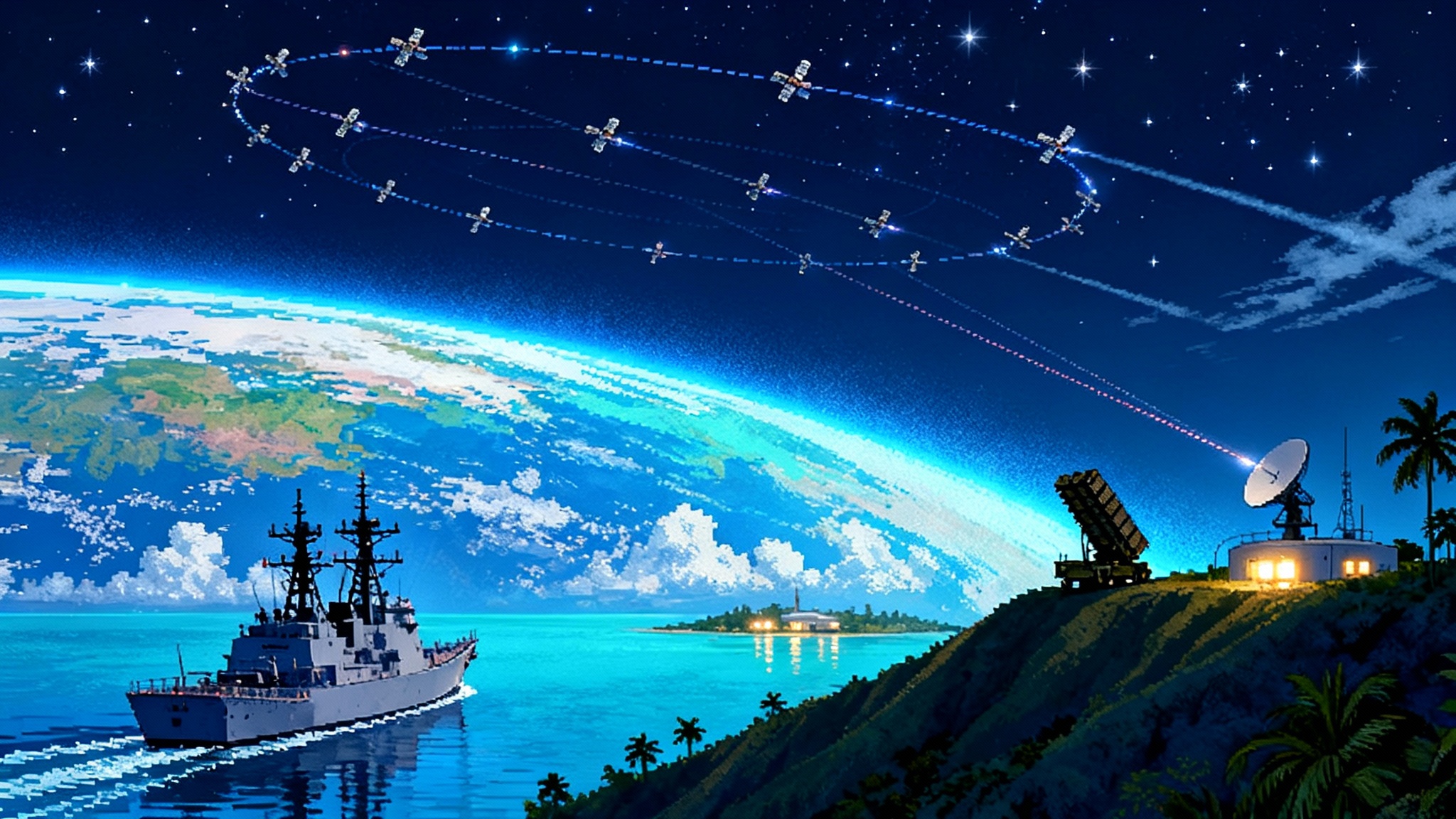

- Communications: Multi-path, frequency-agile, and adaptable to EMCON. Expect SATCOM for theater reach, line-of-sight mesh for local coordination, and optical links for high-capacity bursts. Space-based transport layers such as the SDA Tranche 1 transport mesh will increasingly shape how maritime nodes pass targeting and status data.

- Open architecture and modularity: Government reference architectures already push for open standards so payload vendors can plug and play. Containerized mission packages with common power, cooling, and data interfaces make the ship a truck for software and sensors rather than a bespoke one-off. That also allows classified payload work to happen in secure vendor facilities, then roll onto the hull late in the build.

- Cyber resilience: The attack surface spans shore stations, cloud services, radios, and the ship itself. Hardening includes secure boot, signed updates, hardware roots of trust, and continuous monitoring at the edge. The autonomy must assume sensor spoofing and data corruption attempts and use cross-checks to reject bad inputs.

Survivability when no one is aboard

No sailors means no traditional damage control, which shifts survivability design from reaction to resistance and graceful failure.

- Signature reduction: Hull and topside shaping, heat management, and emissions discipline keep detection ranges low. Unmanned ships can run radios quietly and accept slower transit speeds on approach since there is no crew endurance limit.

- Structural margin: More watertight subdivision than a comparably sized crewed workboat, blast-tolerant routing of cables and piping, and distributed power zones prevent single hits from mission-killing the platform.

- Autonomy for damage response: Sensors detect flooding, fire, or shock. The system isolates compartments, reroutes power, and evaluates whether to continue, divert, or scuttle. Self-rescue options include beaching in preplanned safe havens.

- Formation survivability: Unmanned pickets do not sail alone. They operate as parts of adaptive formations where roles shift as casualties occur. The aim is to keep the sensor and shooter network intact even if some nodes go dark.

- Cost-imposed survivability: If an adversary must spend a high-end missile to kill a relatively low-cost unmanned target, the exchange still favors the defender. That logic only holds if procurement and sustainment costs stay in check.

Cost per effect beats cost per hull

Comparing sticker prices misses the point. The right metric is cost per effect delivered over time. A large crewed combatant provides radar reach, command and control, sea keeping, survivability, and a flexible set of weapons in one package. Unmanned ships break that package into smaller pieces. A 150-foot hull can carry a specific effect module and push it closer to the fight with lower fuel, crew, and maintenance costs.

Consider a layered air defense scenario. A destroyer can protect a carrier group, but its missile cells are finite and precious. If a handful of unmanned magazine ships add extra interceptors or decoys forward, the group gets thicker defenses without committing another billion-dollar hull. In strike warfare, unmanned platforms can loiter in launch boxes for days, waiting for a manned asset to deliver a fire control solution. The destroyer spends fewer hours in the highest-risk geometry and preserves sortie time, aligning with the Navy’s broader joint kill web plan.

To realize these gains, the industrial base must deliver hulls, power systems, and payload interfaces cheaply and repeatedly. The Gulf Coast advantage is a workforce used to building commercial steel boats that meet classification standards at scale. If autonomy kits reach automotive-like reliability and payloads standardize around container footprints, cost per effect drops sharply.

The Navy just pushed LUSV procurement to FY27

The Navy’s plan now shows procurement of Large Unmanned Surface Vessels beginning in Fiscal Year 2027 after previously targeting FY25. Independent summaries of the budget justification outline a first unit near the half-billion mark and a ramp to two units in FY28, then three in FY29. The stated reason for the slip is risk reduction in requirements, designs, and machinery reliability testing. Those details are captured in a standing report to Congress on LUSV timing.

What does that mean in practice?

- Industry will not wait. Saronic is already cutting steel in Franklin. Blue Water is moving designs into production with a commercial yard partner. Private capital and dual-use customers will bridge some of the gap, then compete for Navy orders once procurement opens.

- Prototypes will look more like products. Companies are standardizing hull forms, power trains, and interfaces so that a prototype can turn into a first article with minimal redesign. That shortens the crawl-to-walk-to-run cadence the Pentagon prefers.

- Mission focus will stay in the near term. Expect more ISR and EW packages, more logistics trials, and deliberate steps toward magazine roles where safe handling, fire control, and positive human control impose extra integration work.

- The services will sharpen command and control. Delaying major buys buys time to harden the autonomy stack, mature the human interfaces, and refine concepts for manned-unmanned teams. That work is unglamorous but decisive.

Gulf Coast scale and the emerging production model

The Gulf Coast has a hard-to-replicate combination of capacity and culture. Yards there know how to turn out offshore supply vessels, inland towboats, ferries, and specialty barges on repeatable lines. They can stage steel by the acre, load out heavy blocks with their own cranes, and barge finished hulls to sea trials without a multi-day tow. Suppliers within a day’s drive make shafts, gearboxes, HVAC units, and switchboards. That density shortens lead times and eases rework.

The production model for unmanned ships will look more like commercial aviation than bespoke warship building.

- A baseline hull and power package built to a class standard, with tweaks by block, not by keel.

- A final integration phase inside controlled bays for wiring harnesses, sensors, and autonomy hardware, followed by secure payload installation and software load.

- A test and burn-in period that is longer for the autonomy stack than for the hull, with regression testing every time the software moves up a major version.

- A sustainment model that treats the hull like a long-life asset and the sensor or weapon package like a mid-life refreshable module.

With two paths at 150 feet coming online, competition will pressure schedules and cost curves in a healthy way. It will also spread risk. If a single supplier misses, the fleet still gets hulls.

Technical friction points to watch

- Power and cooling margins: EW payloads and active sensors are hungry. Designs that bake in extra kilowatts and chilled water will outlast those that do not.

- Launch and recovery: Modular boats need modular boats. Integrating unmanned boat and UAV handling systems without adding crew is a solvable challenge that still trips up programs.

- Autonomy certification: The path for certifying safety-critical autonomy at sea will evolve. Expect iterative approvals that expand operating envelopes over time, tied to performance data.

- Networks under attack: The comms stack will face jamming, spoofing, and cyber probes. Systems that degrade gracefully and keep commanders informed of confidence levels will win trust.

- Human factors at a distance: Operators need clear status pictures, not cluttered fault trees. The best systems will surface what matters, explain intent, and let humans redirect with a few crisp inputs.

What success looks like by the end of 2027

By the end of 2027, success would look like this. Multiple 150-foot unmanned ships completing repeated workups from Gulf Coast yards. ISR and EW modules passing fleet exercises with reliable autonomy and useful data. A handful of logistics sorties that deliver real cargo to real units in contested waters under realistic comms constraints. Early magazine trials that demonstrate safe handling and clean, human-authorized engagements in a live environment. Maintenance turnarounds measured in weeks, not months, with software updates landing on a predictable train.

If the Navy keeps procurement aligned with those milestones, the fleet will enter the 2030s with a real hybrid backbone rather than a stack of demos. If it waits for perfection, the industrial base will move ahead anyway, and allies and adversaries will set the pace.

The bottom line

The Gulf Coast is becoming drone boat alley because the ingredients are there today. Blue Water pairing with Conrad brings a commercial shipyard’s cadence to a defense-grade unmanned design. Saronic’s absorption of Gulf Craft adds a second lane with momentum. The Navy pushing LUSV procurement to FY27 buys technical breathing room but also creates space for industry to prove it can deliver cost per effect at scale. If the autonomy stacks hold up and the yards hold schedule, a 150-foot unmanned workhorse will stop being a headline and start being a hull number, which is exactly what the hybrid fleet needs.