Japan’s ASEV gets SPY-7, reshaping Indo-Pacific defense

Lockheed Martin’s July 2025 delivery of SPY-7 radar shipsets for Japan’s first Aegis System Equipped Vessel marks a turning point. Here is how ASEV replaces Aegis Ashore, extends Japan’s missile shield, and plugs into a U.S.-Japan kill web.

July 2025: The moment SPY-7 went to sea

On July 7, 2025, Lockheed Martin announced it had delivered the full shipset of four AN/SPY-7(V)1 radar antennas for Japan’s first Aegis System Equipped Vessel. The company emphasized that all four faces were accepted and would complete integration at its Moorestown Production Test Center before shipment to Japan, keeping the program on track for Japan’s FY2027-FY2028 commissioning targets. That single line in a press release carries strategic weight for the Indo-Pacific, because it means Japan’s long-planned, sea-based ballistic missile defense substitute for Aegis Ashore is becoming real. See the primary announcement on delivered SPY-7 shipsets.

From Aegis Ashore’s cancellation to ASEV at sea

Tokyo’s 2020 decision to cancel Aegis Ashore left a gap in plans to provide persistent, 24/7 ballistic missile defense coverage against North Korean and potentially Chinese missiles. The fix was to move the concept to sea. Two very large Aegis ships, optimized for high-end air and missile defense and designed for long on-station endurance, would shoulder the mission without tying up the JMSDF’s general-purpose destroyers. The result is ASEV: a pair of BMD-centric ships whose primary job is to keep a persistent sensor and shooter on station in Japan’s most threatened arcs while the fleet’s Atago and Maya destroyers retain flexibility for other tasks.

Japan’s defense ministry targeted an aggressive build and integration timeline. Hardware would be integrated and wrung out in the United States, then shipped to Japan for installation, reducing risk during dockside activation. With the first SPY-7 antenna shipset delivered in July 2025 and full system integration tests already planned, FY2027-FY2028 commissioning for the two ASEVs remains the working goal.

What SPY-7 brings to the fight

SPY-7 is a solid-state, S-band, gallium nitride AESA family derived from the Long Range Discrimination Radar technology base. Its architecture centers on modular subarrays that scale from land-based monoliths to shipboard faces without changing the core building block. For a maritime BMD ship, the relevant attributes are:

- High sensitivity and track quality for exo-atmospheric ballistic missiles, including discriminating lethal objects from debris and countermeasures during midcourse.

- Digital beam agility that allows simultaneous long-range volume search and precision tracking while sustaining clutter rejection and electronic protection.

- Graceful degradation and maintain-while-operating serviceability that keep faces up during extended patrols, crucial when a ship is the on-call BMD node.

- Tight integration with the Aegis combat system, including Japan’s J7 lineage and the J7.B variant tailored to SPY-7.

The net effect is a sensor built to feed clean, stable tracks to the interceptors that matter for Japan’s layered defense.

The interceptor pairing: SM-3 Block IIA and SM-6

The ASEV concept lives or dies on its pairing with interceptors. For the outer layer, SM-3 Block IIA is the workhorse. Co-developed by the United States and Japan and fired from Mk 41 VLS, the IIA’s larger motors and kinetic warhead give the altitude and range to prosecute medium and intermediate range ballistic threats in midcourse, outside the atmosphere. SPY-7’s ability to maintain track custody and discrimination across the engagement basket is intended to reduce shot doctrine burden and expand defended area.

Inside that outer ring, SM-6 adds a versatile terminal defense against endo-atmospheric ballistic reentry vehicles and cruise missiles, including difficult sea-skimming threats. As Japan fields Tomahawk and upgrades its domestic Type 12 missiles, the ASEV’s deep VLS magazine improves both defense and deterrence. For a broader view of how land-based and maritime SM-6 factors into regional deterrence, see our analysis of how Typhon in Japan resets deterrence.

Replacing Aegis Ashore, not just relocating it

ASEV is not a one-for-one transplant of Aegis Ashore onto a hull. It adds mobility, survivability, and redundancy. Mobility lets Tokyo shift the defended footprint in response to North Korean salvo patterns or PLA Rocket Force behavior. Survivability comes from naval hardening, escorts, and the ability to maneuver, deceive, and complicate the enemy’s targeting cycle. Redundancy comes from the fact that one ship can be on the line while the other is in maintenance or training, with JMSDF destroyers and U.S. Navy assets able to surge and backstop.

Interoperability with Maya and Atago destroyers

Japan’s Maya-class entered service with Aegis Baseline J7 and Cooperative Engagement Capability, and Atago-class destroyers were modernized into the same family. That gives the fleet a common digital backbone and sensor-to-shooter data sharing, allowing a Maya to contribute high-quality tracks to an ASEV, or vice versa. In practice, this means remote engagements become routine. An E-2D or allied sensor may first detect a threat, Maya refines and maintains track, ASEV provides midcourse fire control quality, and an SM-3 IIA leaves the ASEV’s VLS on a remote shot. The point is not which ship pushes the button, but that the network produces a firing solution faster and with higher confidence.

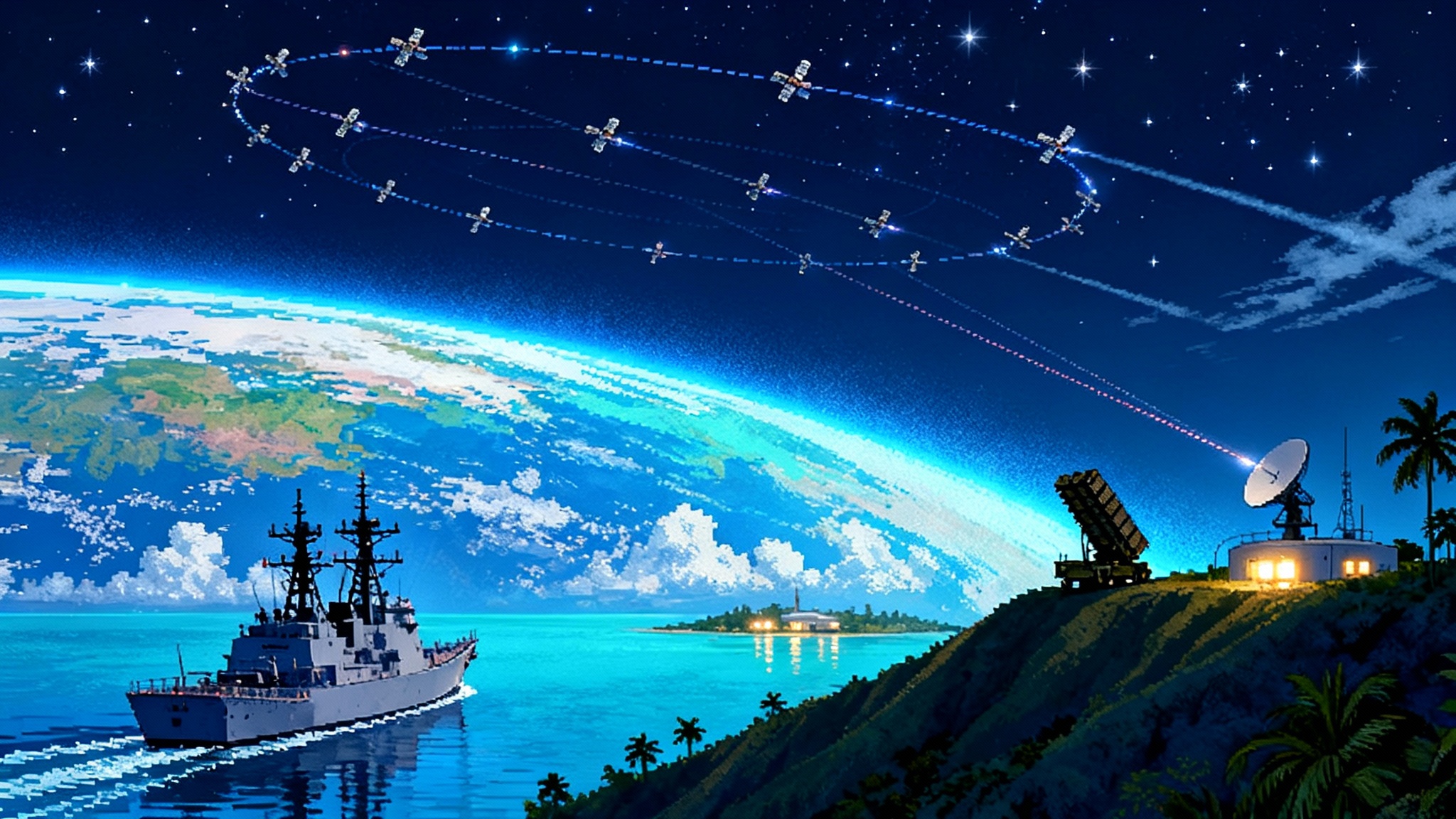

Building a U.S.-Japan distributed kill web

Two ASEVs create a sturdy backbone node in a regional kill web with U.S. and Japanese shooters and sensors:

- Sensor nodes: ASEV SPY-7, JMSDF SPY-1 and SPY-6 destroyers, JASDF ground-based radars, E-2D airborne early warning, and U.S. sensors afloat and ashore.

- Transport: Navy and joint links including CEC, Link 16, and other high-capacity waveforms, with cross-domain gateways to move track quality data where it is needed.

- Shooters: ASEV and JMSDF destroyers with SM-3 and SM-6, plus U.S. Navy combatants. Over time, land-based and air-launched shooters add flexibility for layered defense.

ASEV’s role is to keep a high-power, high-quality track generator on the line, so everything else in the web can trust it. For a theater example of the architecture and tactics this enables, see Guam’s missile shield kill web. Expanding space-based sensing and resilient transport, highlighted in SDA Tranche 1 transport mesh, will further compress timelines and improve custody.

SPY-7 versus SPY-6: different paths to similar goals

Both radars are modern, GaN-based, S-band, solid-state AESAs designed for integrated air and missile defense, but they arrive via different lineages and design choices. What matters to Japan and its allies are the operational consequences.

-

Design heritage

- SPY-7: Derived from the Long Range Discrimination Radar program, emphasizing ballistic missile discrimination and midcourse tracking as a foundational capability.

- SPY-6: The U.S. Navy’s Air and Missile Defense Radar family, optimized for multi-mission performance across many ship classes with a common Radar Modular Assembly building block.

-

Modularity

- SPY-7: Scales by adding subarray suites to grow effective aperture. Maritime variants configure four fixed faces sized for the hull and mission.

- SPY-6: Scales by combining 2x2x2 radar modular assemblies into fixed or rotating arrays, from nine-RMA rotators to 37-RMA faces on Flight III destroyers.

-

Maturity and fielding

- SPY-7: Operational on land in the LRDR family, with first naval faces delivered for Japan’s ASEV and sea deployments planned for Spain’s F-110 and Canada’s River-class.

- SPY-6: In service on U.S. Navy Flight III destroyers and moving into carriers, amphibs, and backfit destroyers.

-

Emphasis in performance narratives

- SPY-7: Highlights exo-atmospheric BMD tracking and discrimination, persistent availability while under maintenance, and integration with Aegis J7.B in allied fleets.

- SPY-6: Stresses multi-mission sensitivity gains, electronic protection, and scalability across many planned U.S. hulls.

This is less a contest than an ecosystem. U.S. destroyers with SPY-6 and Japanese ASEVs with SPY-7 can share tracks, cross-cue, and collaborate in engagements. The different design approaches give the alliance resilience through diversity while keeping the Aegis combat system as the common language.

Likely Sea of Japan CONOPS

Expect a two-ship model that keeps one ASEV on the line while the other cycles through maintenance and training. The on-station ship would patrol in the Sea of Japan, moving among preplanned picket boxes that balance coverage of North Korean launch corridors with survivability from both kinetic and non-kinetic attack. Key features of this concept of operations:

- Endurance and crew habitability to sustain long patrols without degrading watchstanding performance.

- Emission control and deceptive posture management to complicate adversary ISR and cueing.

- Dynamic repositioning based on indications and warning, allied space and air sensors, and missile force activity.

- Escort and support from a rotating mix of JMSDF destroyers and U.S. Navy ships to add ASW cover, surface security, and more layers of air defense.

The presence of a second ASEV adds strategic depth. If tensions rise in the East China Sea or Philippine Sea, Tokyo can reposition the on-station ship to weight coverage against PLA missile arcs without fully uncovering the North Korean vector, because surge capacity exists in the network.

Survivability against anti-ship ballistic and cruise threats

A BMD picket attracts attention. ASEV’s survivability will rely on a layered approach:

- Hard-kill air defense: SM-6 for terminal ballistic and complex cruise threats, backed by ESSM-class missiles, a dense VLS magazine, and last-ditch CIWS.

- Electronic warfare: Japan is fitting ASEV with the U.S. Navy’s SEWIP Block 2 modules, a first for an international customer, enabling improved detection and soft-kill options against seekers and datalinks. This detail surfaced alongside other fit highlights such as dual 64-cell VLS for a total of 128 cells. See reporting on SEWIP and 128 VLS.

- Deception and signature management: Low side-lobe emissions, LPI waveforms, and decoy employment coupled with maneuver to force adversary missiles into bad geometry.

- Escorting and distribution: ASEV should rarely operate alone. An escort screen adds ASW and additional AAW layers, while the distributed kill web complicates an opponent’s ability to fix, track, and target the BMD node.

ASEV’s job is not to sail into the teeth of the PLA’s anti-ship complex but to make that complex spend ISR and strike resources just to find a mobile node whose position and emissions are under active management.

Industrial base and schedule risks to watch

- Integration concurrency: Hardware delivery in 2025 supports FY2027-FY2028 commissioning, but software maturation of J7.B and end-to-end combat system testing remain pacing items. The Production Test Center strategy reduces risk but does not eliminate shipboard integration surprises.

- Supply chain fragility: SPY-7’s GaN subarrays, high-power RF components, and specialized coolers depend on a transnational supply base that must ramp for Japan, Spain, and Canada simultaneously. Any bottleneck can ripple across programs.

- Yard throughput: Splitting construction between major Japanese yards spreads risk, yet both face workforce, material cost, and schedule pressures common across global shipbuilding since 2020.

- Crew pipeline: ASEV will run with a smaller crew than earlier JMSDF Aegis destroyers, but sustained BMD watchstanding and new EW fits require training and retention attention.

- Budget sensitivity: Exchange rates and inflation can squeeze margin. Delays in complementary munitions, such as Tomahawk or SM-6 procurement lots, can create capability gaps even if the hull commissions on time.

Export ripple effects

Two allied surface combatant programs are already tied to SPY-7. Canada has selected SPY-7 for its River-class destroyers, the production name for the Canadian Surface Combatant, which will field CEC and a high-end Aegis integration. Spain’s F-110 frigates are moving through SPY-7(V)2 integration milestones with national industry heavily involved. As these fleets come online, the alliance benefits from greater radar commonality, code reuse, and parts interchangeability, which can stabilize supply and sustainment for Japan’s ASEVs over decades.

The bottom line

The July 2025 delivery of SPY-7 shipsets to Japan is more than an industrial milestone. It signals that Japan’s answer to Aegis Ashore’s cancellation is on track and that the alliance will soon add two purpose-built BMD ships that anchor a wider, increasingly resilient U.S.-Japan kill web. With SPY-7’s exo-atmospheric tracking strengths matched to SM-3 Block IIA and SM-6, ASEV is poised to expand defended area, complicate adversary planning, and buy time and space for the rest of the force. The work now is to execute integration cleanly, keep the yards and suppliers on schedule, and field the trained crews who will turn four radar faces into a dependable shield for the Indo-Pacific.