Japan’s shipboard railgun resets the math of air defense

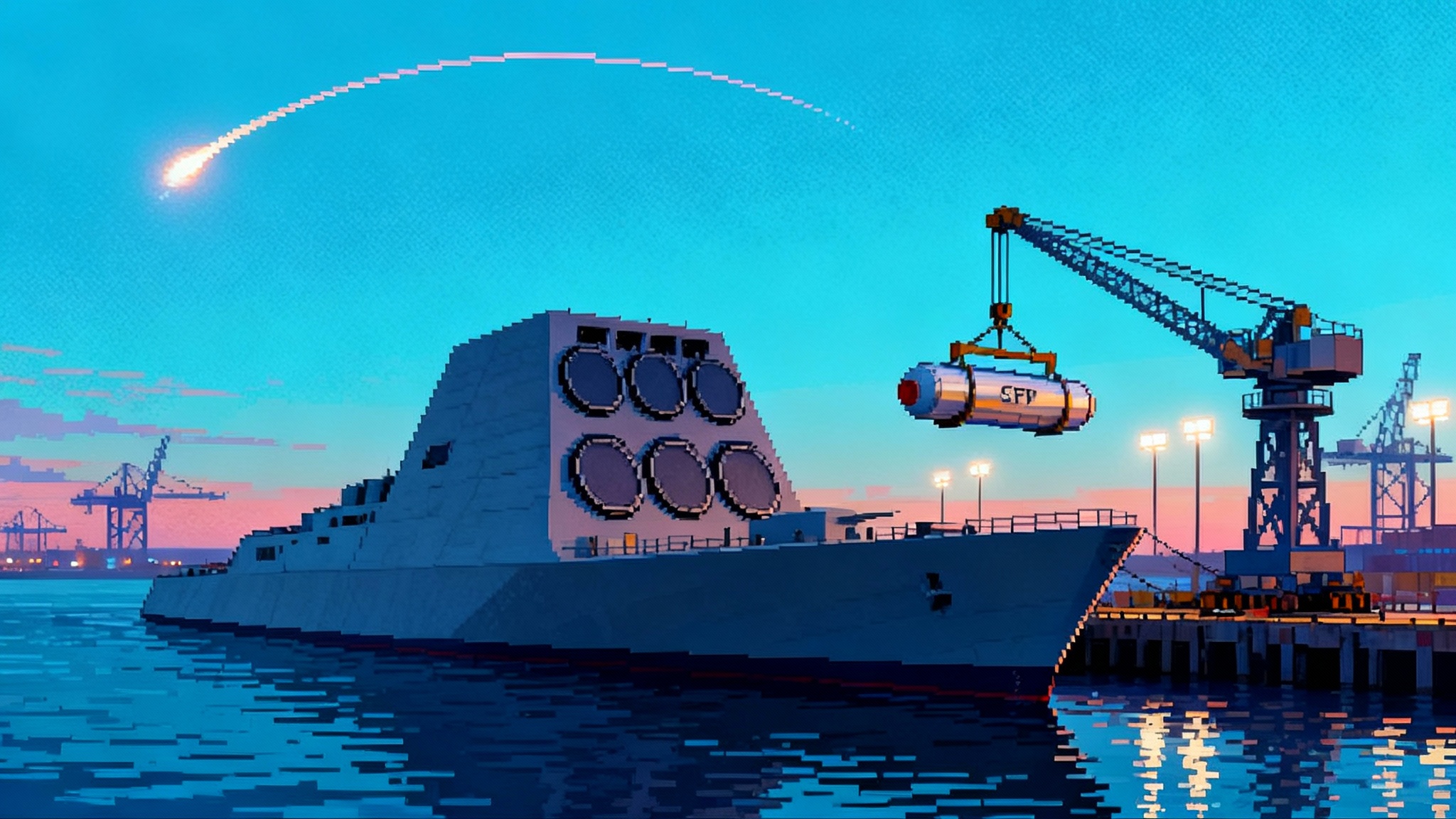

Japan’s ATLA confirmed in September 2025 that a prototype railgun aboard JS Asuka hit a moving target at sea. Here is why that trial could bend the cost curve of naval air defense and what to watch next.

The shot that reopened a debate

On September 10, 2025, Japan’s Acquisition, Technology and Logistics Agency said its prototype shipboard railgun, mounted on the test ship JS Asuka, successfully fired at a target vessel during trials held in June and July. The announcement carried photos and a clear message. This was not a pier-side demonstration. It was live fire against a moving target at sea, and it put electromagnetic artillery back on the naval planning table. The news was carried by national outlets and confirmed by the agency’s public channels. For clarity of record, see a concise account that summarizes the event and dates the trials to early summer 2025: Japan’s cutting-edge railgun strikes target vessel.

The milestone matters because it crosses a threshold that previous railgun programs struggled to reach. The 2010s produced memorable videos and headline velocities, but the path from laboratory gun to combat-relevant ship system stalled over power, thermal limits, rail wear, and fire control. Japan’s test does not solve those problems, but it shows a government moving the work from engineering teaser to naval experiment with tactical intent.

Why this time is different

Two quiet changes have accumulated at sea since the last railgun hype cycle.

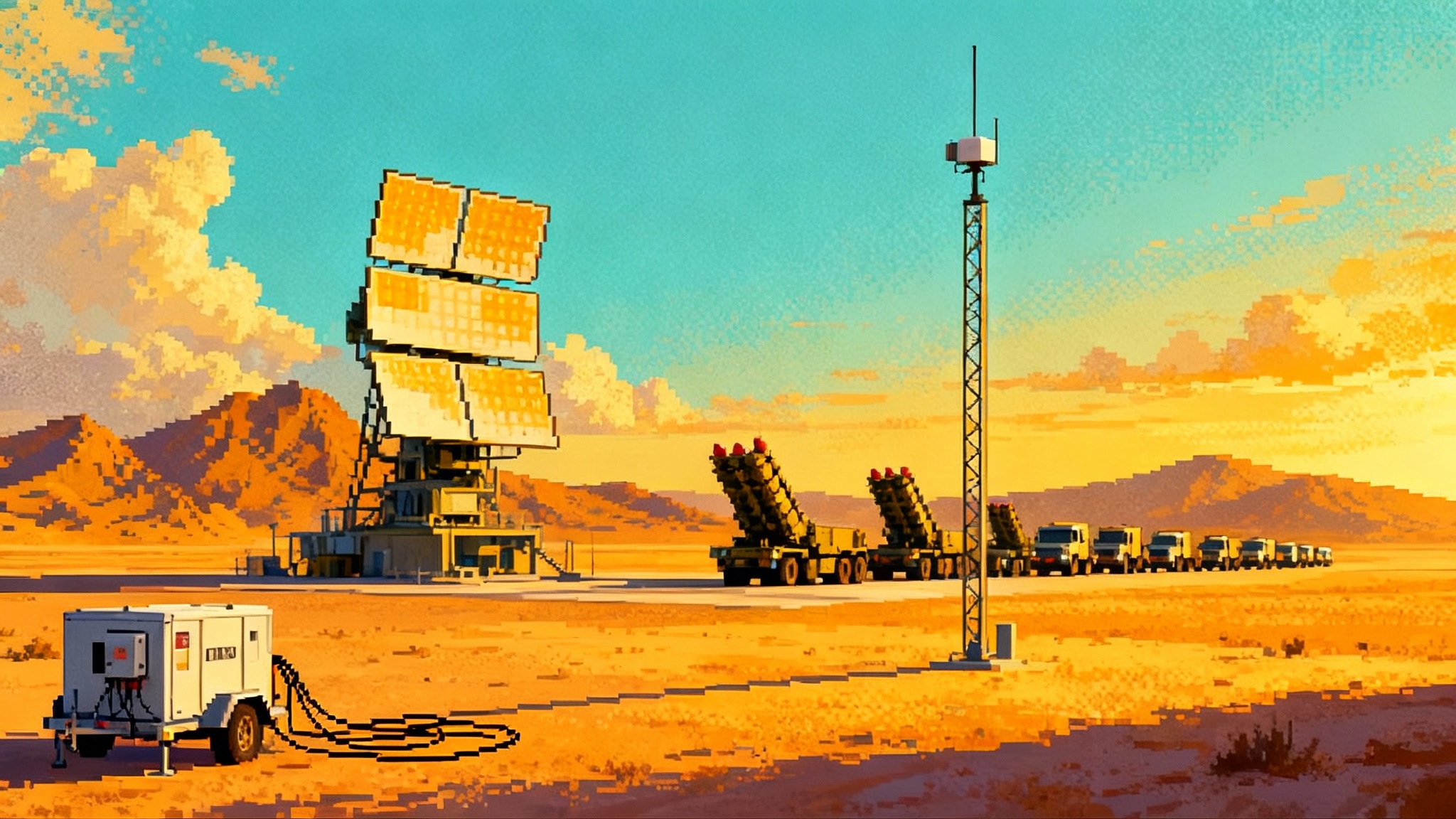

First, today’s surface combatants are being designed around high electrical loads. Sensors such as the United States Navy’s SPY 6 family and Japan’s SPY 7 based Aegis System Equipped Vessel radar suites pull far more power and cooling than legacy arrays. That has pushed navies toward larger ship service generators, more resilient power management, and space for energy storage modules. For a land-based parallel on radar evolution that underscores this power trend, see Patriot’s LTAMDS radar enters production.

Second, pulse power electronics are not what they were a decade ago. Silicon carbide switches, compact solid state capacitor banks, and modular pulse power racks scale better, fail more gracefully, and fit more easily into ship service bays. In the 2010s, a railgun battery looked like a handful of one-off science project containers. In the mid 2020s, a pulsed power module looks closer to a standard line replaceable unit. That does not make integration trivial, but it turns a bespoke install into an engineering trade.

These two shifts help explain why Japan can mount a railgun on an at-sea test ship and tie it into fire control that can track, cue, and record useful data. They also explain why allied navies are taking another look. The railgun conversation has moved from whether to how and where.

The cost curve that tempts planners

Electromagnetic railguns are not a magic wand. They are another tool in a layered defense. Yet railgun math is hard to ignore. A hypervelocity projectile fired from an electromagnetic barrel is widely assessed to be a five figure round rather than a six or seven figure missile. Congressional Research Service reporting placed the unit cost for the U.S. Hypervelocity Projectile at about twenty five thousand dollars per round, a figure that, even with guidance and packaging, sits well below typical interceptor missiles. For background on the earlier cost estimates that shaped this debate, see this CRS compilation page: EM railgun and HVP cost exchange.

When a ship faces a raid of drones and cruise missiles, cost exchanges matter. A magazine of two hundred inert slugs that can be fired rapidly is not a replacement for surface to air missiles, but it is a way to push the opponent into an unfavorable trade. Put simply, if you can swat a low cost inbound with a sub fifty thousand dollar shot instead of a multi million dollar interceptor, you stretch your missile magazine for the threats that truly demand it.

What counts as combat relevant

The phrase combat relevant does not mean perfect. It means good enough to begin shaping tactics and budgets.

For a naval railgun, that bar likely includes the following:

- Repeatable hypersonic velocities with tight shot to shot consistency. Consistency feeds predictive fire control and lets crews trust tables rather than improvisation.

- Enough barrel and rail life to allow training and a realistic firing schedule without swapping critical parts after a handful of shots.

- A fast fire control loop that turns radar tracks into aim points with low latency and high confidence, including against maneuvering drones and sea skimmers.

- A power and thermal envelope that a real ship can service in heavy seas without shutting off vital sensors or overheating a machinery space.

Japan’s June–July trials show a government testing toward this bar. The country has publicly discussed prior targets such as 120 shot durability regimes and velocities above two kilometers per second. Now, with maritime firings against a moving target, it can begin validating the whole chain from track to hit.

The engineering problems that still decide the schedule

-

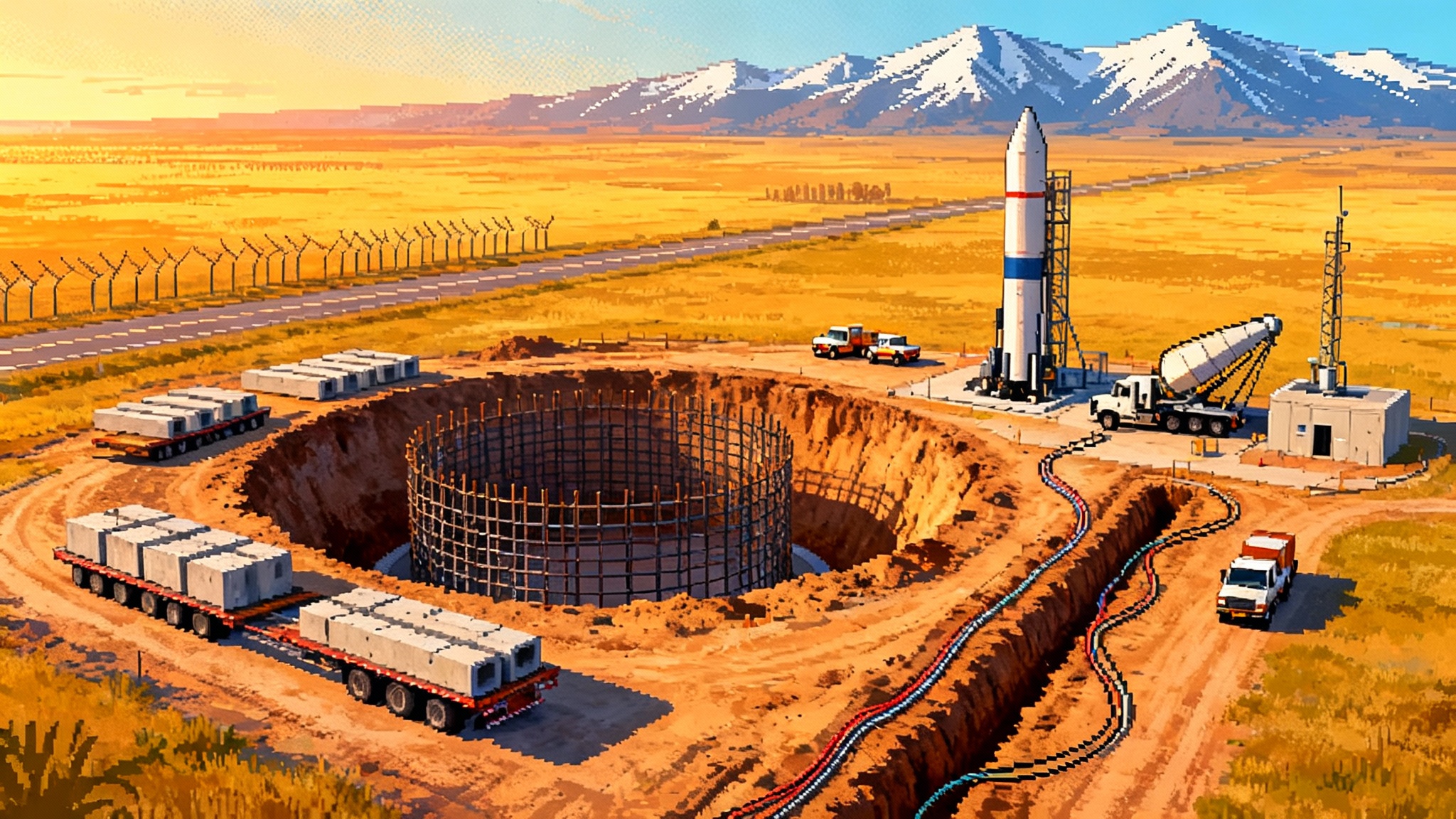

Power quality and pulsed demand. A railgun fires by dumping a large pulse of energy across two rails. Shipboard power systems must buffer this so the pulse does not brown out sensors or interfere with radios. The near term solution is modular solid state pulse power racks and energy storage sitting between the ship grid and the gun. These racks need to scale to megajoule class bursts, hot swap under way, and present a predictable draw to ship service generators.

-

Thermal management. Every shot turns some electrical energy into heat in the rails, armature, and barrel structure. Seawater cooling loops, phase change materials, and conductive paths into the mount are engineering tools, but the performance question is simple. How many shots can the crew fire in one minute and in one hour without cook off or thermal runaway. The answer determines whether a railgun can ride herd on a swarming raid or is held for single shots.

-

Rail and barrel life. Rail erosion and armature arcing chewed up early barrels. Material advances and armature design are improving this, but operators will care about a number they can plan around. If the barrel lasts hundreds of shots between depot swaps and thousands before replacement, sailors can train and commanders can schedule. If not, it stays a science project.

-

Fire control and aim point stability. A Mach 6 or Mach 7 shot sounds fast, but at 30 to 50 kilometers it still takes several seconds to arrive. That demands good target motion analysis, high update rate radar tracks, and smart aim point selection that anticipates weaving drones and sea skimmers. The arrival of modern active electronically scanned array radars and better combat direction software helps close this loop.

How fleets would actually use it

Imagine a destroyer with three defensive layers. Out at range, it holds long range surface to air missiles for high performance threats. For a sense of how long range strike is maturing at sea, see sea-based hypersonics get real. Inside that, a laser or high energy microwave mounts to blind sensors and burn down cheap drones. For non-kinetic options scaling in 2025, see microwave counter-drone hits scale. Sitting between those is a railgun that hammers robust threats with inert slugs.

In a saturation raid, the railgun fires early and often at the cheaper and medium grade targets. Lasers and microwaves sweep the very cheap expendables and sensor pods. The long range missiles are kept for the leakers that matter. The railgun does not replace either neighbor. It turns the overall exchange into something the defender can afford and sustain.

Pairings will matter. Lasers give precise damage on exposed sensors and control surfaces but struggle in rain and fog. High power microwave bursts ride line of sight and punish clustered electronics. Railgun shots do not care about aerosols, and time of flight can be short enough to make the window for evasive maneuvers small. A ship that can choose among these on the fly creates uncertainty for the attacker and reduces its own per shot costs.

Ripple effects across allied navies

Japan Maritime Self Defense Force has just signaled first mover intent. That alone will prompt staff studies elsewhere.

-

United States. The Navy shelved its public railgun program, but it has kept alive work on guided hypervelocity projectiles and gun-launched intercepts. Japan’s results and the growing power budgets on Flight III destroyers will encourage a new look at a railgun or at least at electromagnetic launch for certain projectiles. If an ally can shoulder the gun development, the United States can focus on projectiles, guidance, and tactics.

-

Republic of Korea. Seoul is investing in shipboard lasers and modern combat systems. A railgun that dovetails with common projectiles for five inch guns or with alliance logistics would fit its layered defense studies, especially for drone swarms around littorals and bases.

-

Europe. Germany, Italy, the United Kingdom, and Spain are fielding new sensors and experimenting with high energy lasers at sea. A railgun adds another way to manage raid costs. Even if European navies do not buy a Japanese gun, they can reevaluate guided projectiles and pulse power modules on future frigates.

The industrial side will also stir. Japan’s yard and systems base, including Mitsubishi Heavy Industries, Japan Marine United, and major electronics firms, are deeply engaged on power, cooling, and radar. Suppliers of silicon carbide switches, compact capacitors, and thermal composites now have a concrete naval use case rather than a speculative military requirement.

What to watch from late 2025 through 2026

Set a simple scorecard. It will keep the conversation grounded.

-

ATLA technical disclosures. The agency plans to present program details at its November 11 to 12, 2025 symposium in Tokyo. Watch for specifics on barrel life, thermal limits, and power module architecture. If numbers appear for shots per minute or sustained firing, that is the headline.

-

Sea trial cadence. One or two events prove the gun can live on a ship. A drumbeat of quarterly trials with different target sets shows the system can mature. Look for asymmetry in the schedule. If trials cluster in good weather only, integration is still fragile.

-

Power module demonstrations. Vendors will showcase solid state power modules sized for combatants. The tell is not raw megajoules. It is swappability and graceful degradation. If a ship can lose one module and keep shooting at a lower rate, the system is becoming a naval weapon, not a lab rig.

-

Fire control integration with modern radars. Japan’s SPY 7 based programs are hitting integration milestones in 2025. As radar testing proceeds, expect incremental tie ins with railgun tracking and shot recording. Any demonstration of automated shot recommendation from the combat system will be a major step.

-

Projectile maturity. Guidance kits, glide bodies, and fuzing designed for electromagnetic launch will show up in industry days and trials. Expect a split between simple inert slugs for short range hard kills and more complex rounds for longer reach.

-

Export conversations. Even without exports, watch for memoranda of understanding on data sharing among Japan, the United States, and close partners. Railgun performance data is what others need to make decisions.

The near term integration path

The most credible progression is not dramatic. It is a series of engineering sprints that make the railgun dull in the right ways.

- Move the pulse power racks from cargo container size toward ship service cabinet footprints. This increases the number of hulls that can trial the system.

- Prove three shot salvos with accurate grouping against sea skimmer speed targets. That tests barrel heating and fire control in one go.

- Qualify rails and armatures for hundreds of shots between maintenance actions, then push durability upward with coatings and materials. The specific number matters because it defines the training model.

- Tie the mount into ship combat systems so the weapon behaves like a native effector. Operators should see tracks, recommendations, and safe firing arcs inside the same console logic used for missiles and guns.

Get these right and a limited early operational capability on a test ship or a single front line hull is realistic before decade’s end. The wider fielding question then becomes a budget call, not a physics seance.

The risks that could still stall it

-

Overpromising range. Hypersonic muzzle velocity does not automatically yield long range accuracy against agile targets. If program communications oversell reach and underdeliver hit rates, patience will erode.

-

Hidden thermal penalties. If sustained fire curves collapse under warm seawater or tropical ambient temperatures, ships in the Indo Pacific will be constrained to short bursts.

-

Power integration taxes. If pulse draw forces compromises on radar or electronic warfare uptime during raids, commanders will not accept the trade.

-

Logistics surprises. Rails, armatures, and unique spares that cannot be delivered at sea or swapped by ship’s force will keep the railgun in demonstration status.

Each of these risks has a practical mitigation. But they must be surfaced and measured in public trials to persuade operators, not just engineers.

A practical way to think about it

The best mental model for a shipboard railgun is not a supergun. It is a very fast, very precise, electrically powered club that knocks pieces off incoming threats so other layers can finish the job. It is a cost lever. When paired with modern sensors and other directed energy, it lets a commander decide how much to spend on each inbound.

Japan’s announcement matters because it shifts the question from whether electromagnetic artillery belongs at sea to which ships will carry it and how soon. Two to three years of disciplined integration, paired with honest public data on barrel life and firing rates, are the difference between a test mount and a watch bill line on an operational destroyer.

If that data arrives on the schedule Japan has set, 2025 will read as the year railguns reentered the naval air defense conversation and the moment the cost curve started to bend back in the defender’s favor.