Why New Glenn’s Second Flight Could Redefine Mars Missions

Blue Origin’s New Glenn is set to loft NASA’s twin ESCAPADE probes to Mars on its second flight. Here is why sending interplanetary science so early in a rocket’s life could reset expectations for cost, risk, and NASA–industry partnerships.

A second flight with interplanetary stakes

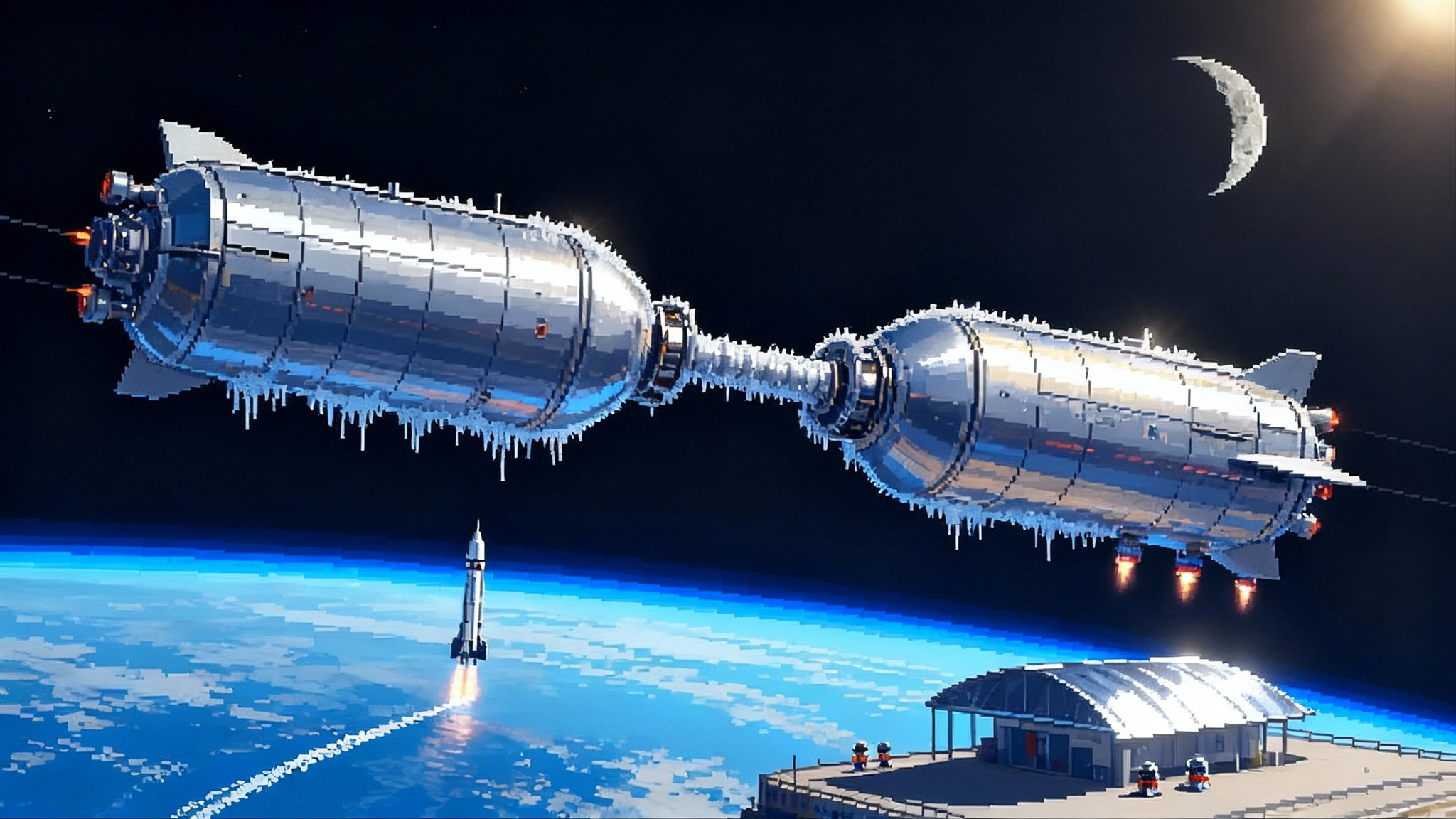

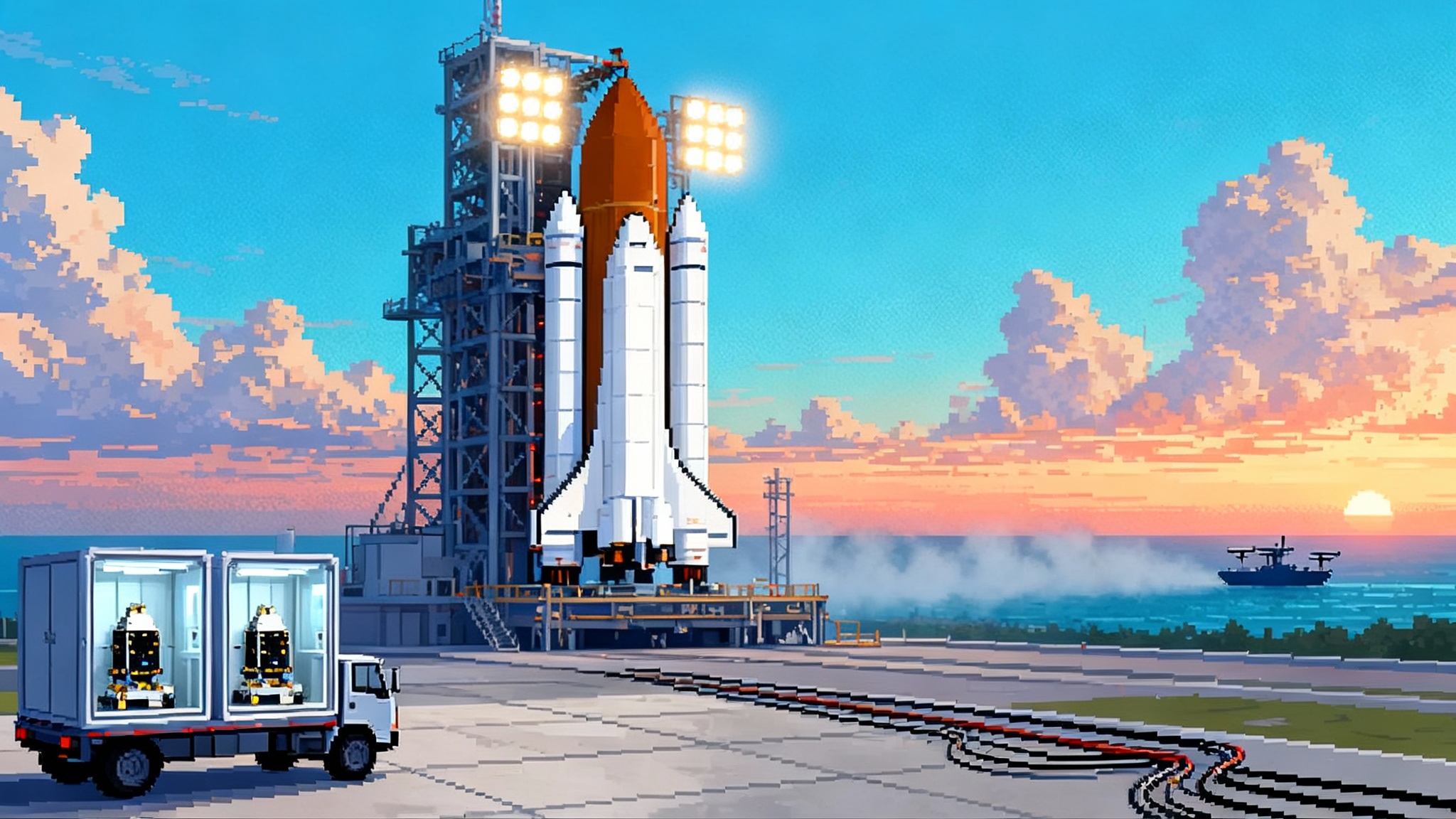

Blue Origin’s New Glenn is poised to attempt something unusual for a brand new heavy‑lift rocket: deliver a deep‑space science mission on only its second outing. NASA’s twin ESCAPADE spacecraft are targeting a no‑earlier‑than September 29 liftoff on NG‑2, a launch that would send the small orbiters on their way to study Mars. If that schedule holds, New Glenn will move from debut to interplanetary in a single step, a sequence that almost never happens in this field. Early interplanetary flights are rare because scientists and program managers tend to wait for multiple successful launches before entrusting a mission that cannot be replaced once it leaves Earth. Yet the ESCAPADE team and NASA’s launch services program see an opening, and Blue Origin is leaning in. The result is a watershed moment for how quickly commercial heavy‑lift vehicles can be trusted beyond Earth orbit. Blue Origin and NASA have set NET Sept. 29 for NG‑2 carrying ESCAPADE.

What ESCAPADE will do at Mars

ESCAPADE stands for Escape and Plasma Acceleration and Dynamics Explorers. It is a pair of near‑identical small satellites designed to fly in complementary orbits around Mars and observe the planet’s magnetosphere from two points at once. The spacecraft carry a concise instrument suite:

- A magnetometer to measure local magnetic fields

- An electrostatic analyzer to sample ions and electrons

- A Langmuir probe to monitor plasma density and the Sun’s extreme ultraviolet flux

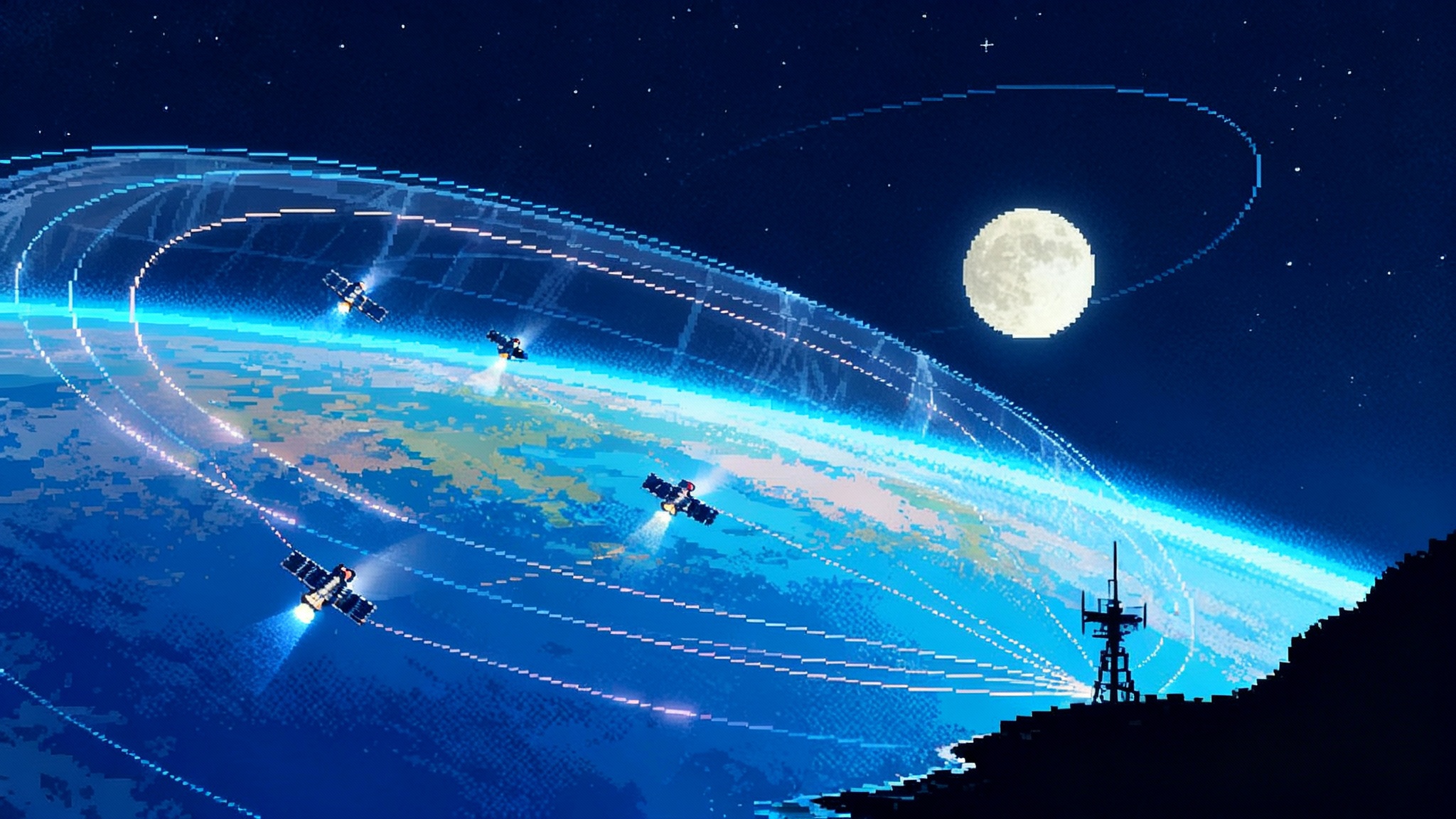

By operating as a duo, the probes can triangulate how energy and charged particles move through Mars’ patchy, remnant magnetic environment. Unlike Earth’s global magnetic field, Mars has a hybrid system shaped by crustal fields and the solar wind. ESCAPADE’s two‑point measurements will let scientists answer practical questions: How does the solar wind erode Mars’ upper atmosphere today? Where does plasma enter and leave the system? How do sporadic solar events change those flows in real time? The answers matter well beyond Mars. They inform how space weather affects spacecraft, and they help us model atmospheric loss on rocky planets, including worlds that might be habitable elsewhere.

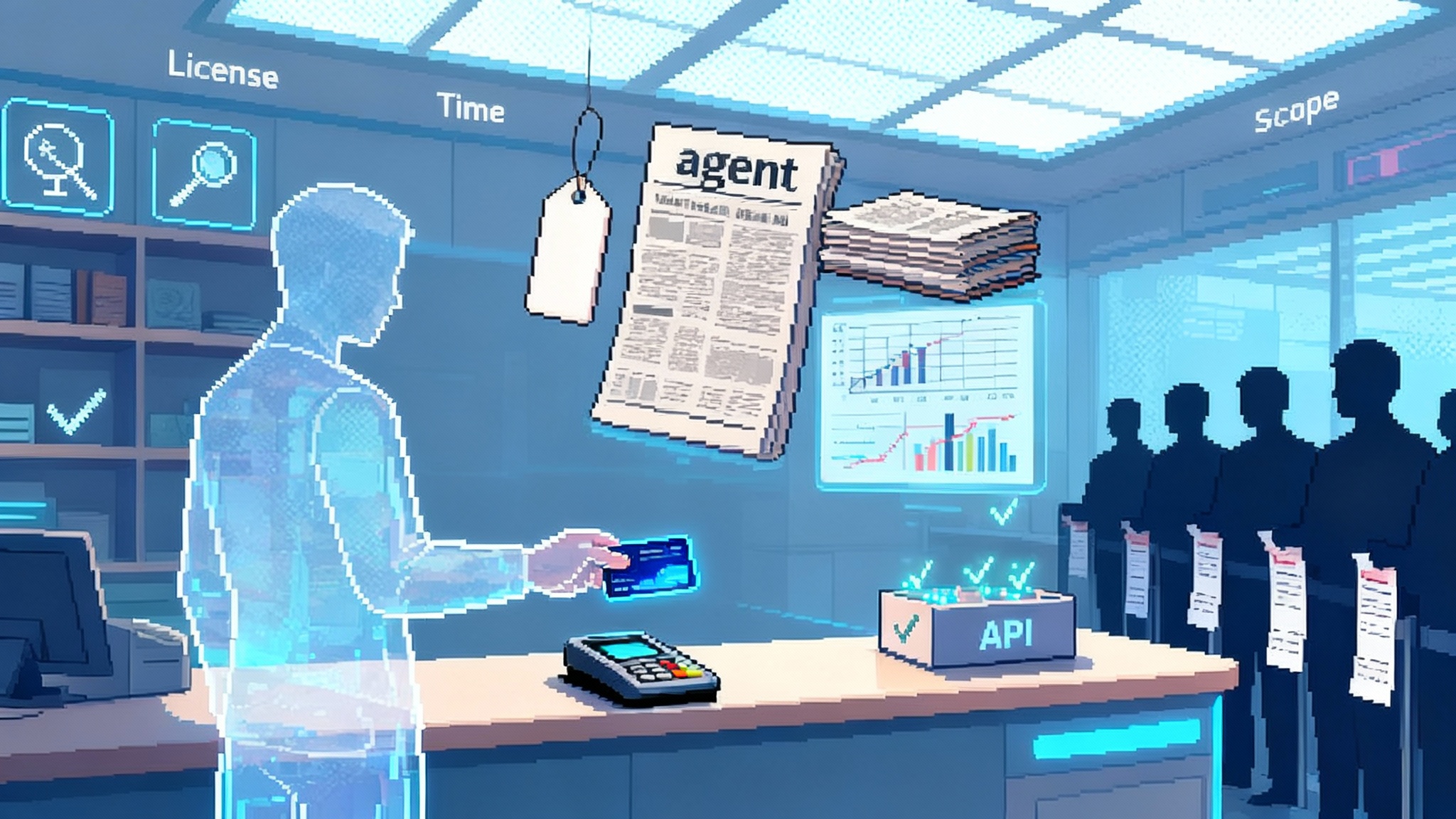

A key piece of the story is the mission’s price tag and scale. ESCAPADE is a Small Innovative Missions for Planetary Exploration selection, with a cost that is a fraction of large flagships. The spacecraft themselves were built by Rocket Lab for the University of California, Berkeley’s Space Sciences Laboratory, which leads the science and operations. NASA’s Launch Services Program procured the ride under its VADR framework, which is designed to match lower‑cost, lower‑assurance payloads with newer rockets. NASA’s own contract release describes the VADR approach and the ESCAPADE instrument suite in plain terms, a signal that the agency is intentionally accepting measured risk to expand access to interplanetary science. See NASA’s ESCAPADE contract release and instrument summary.

Why flying interplanetary on flight two is a big deal

Traditionally, expendable rockets built flight heritage over years: a demo launch or two, then commercial comsats, then perhaps government payloads, and eventually the high‑stakes science. Reusable boosters disrupted cadence and cost, but the trust curve still looked similar. Putting an interplanetary science mission on flight two changes that curve. Three forces make it feasible now:

-

Payload class and cost. ESCAPADE is small and relatively inexpensive by planetary standards, so the risk calculus is different from a billion‑dollar flagship. The science is still valuable, but the program can tolerate more launch risk in exchange for schedule and price.

-

New procurement tools. NASA’s VADR contracts explicitly accommodate commercial best practices and newer vehicles for missions that can accept higher risk. That policy creates demand early in a rocket’s life, which helps the launcher mature faster.

-

Rapid learning loops. New Glenn reached orbit on its debut, and the team has already digested lessons from that flight as it prepares NG‑2. Modern manufacturing, instrumentation, and ground systems make it possible to iterate between flights without waiting years.

If NG‑2 succeeds, it will give New Glenn immediate credibility as a beyond‑Earth‑orbit launcher. If it stumbles, it will offer hard data on the specific failure modes that matter for deep‑space trajectories, not just low Earth orbit. Either outcome accelerates learning for a rocket built to carry big payloads to high‑energy destinations.

The magnetosphere map that two cubes cannot make alone

Mars’ magnetic environment is a moving target. Solar wind pressure rises and falls. Coronal mass ejections can slam into the planet and scramble fields. Localized crustal anomalies bend particle paths in complex ways. A single smallsat can sketch parts of this picture over time, but it cannot separate what changed in space from what changed in time. Two synchronized probes fix that. They can watch the same region nearly simultaneously from different vantage points, isolating cause and effect. That is why ESCAPADE’s twin approach is so potent despite its modest size. A well‑timed pass during a solar storm could yield a data set with impact disproportionate to the mission’s cost.

Success would be a green light for commercial heavy‑lift beyond LEO

If New Glenn nails trans‑Mars injection and ESCAPADE checks out on the way to cruise, several things happen at once:

- Commercial heavy‑lift gains a real deep‑space reference. Operators looking to orbit the Moon, fly asteroid probes, or send logistics to Mars will have one more provider with demonstrated high‑energy performance.

- Schedules compress. Programs that were waiting for a third or fourth flight might decide a second is enough, especially for lower‑cost missions.

- Insurance and pricing evolve. Underwriters respond to demonstrated capability. A second‑flight interplanetary success could ease terms for similar trajectories or for high‑energy Earth missions like direct‑to‑GEO.

The downstream effect is more competition for deep‑space launches, which tends to reduce prices and widen access. That is how you go from a handful of planetary missions every few years to a steady cadence of targeted, lower‑cost probes.

Failure would still move the ball

Rocket development is hard. If NG‑2 suffers an anomaly, it would be a public setback, but not a dead end. The useful questions become specific and pragmatic:

- Did the failure stem from upper‑stage engine performance, guidance, or staging dynamics unique to high‑energy burns?

- Was the issue repeatable or tied to an edge‑case condition like thermal management late in the ascent?

- How quickly can the team verify a fix and return to flight with instrumented hardware that proves the remedy?

For NASA, the lesson would be about where the VADR risk envelope draws the line for interplanetary payloads. For industry, the takeaway would be which subsystems need extra margin before routinely flying beyond Earth orbit. Either way, the feedback loop is short and the learning is banked.

The bigger picture: low‑cost planetary science vs flagships

ESCAPADE sits on one side of an important divide. On one end are billion‑class flagships that tackle once‑per‑generation objectives: sample return, ocean worlds, complex landers. On the other end are focused missions that answer pointed questions with small teams, off‑the‑shelf hardware, and short development cycles.

We need both. Flagships deliver definitive, system‑level breakthroughs. But they are slow and vulnerable to cost growth. Small missions deliver agility. They test ideas, provide context, and sometimes surprise everyone with outsized discoveries. The trick is to balance the portfolio, not pit one against the other.

If New Glenn’s second flight delivers ESCAPADE cleanly onto its Mars trajectory, it strengthens the case for flying more small planetary missions more often. Launch costs are a big chunk of any interplanetary budget. If commercial heavy‑lift creates more options and more confidence, programs can buy margin elsewhere: better instruments, longer operations, or an extra rideshare probe that turns a single‑point measurement into a stereo map.

How this reshapes NASA–industry partnerships

There is a policy angle here that matters. VADR is not about taking reckless chances. It is about matching mission assurance to mission needs and letting the commercial market compete. Pairing a small, resilient payload with a young heavy‑lift rocket is exactly the kind of risk trade the framework was built to enable.

A successful NG‑2 would validate that model for deep‑space trajectories. It encourages NASA to:

- Keep mixing payload classes across a range of vehicles instead of reserving new rockets for LEO test runs only.

- Write performance‑based requirements that give providers flexibility on how they meet high‑energy targets.

- Use milestone payments tied to visible risk‑retirement steps between flights.

For providers, it sets a bar. If you want early interplanetary work, show crisp data from your debut, close your corrective actions fast, and prove you can integrate across agency interfaces without drama. That is how a second flight becomes a trust‑building event, not a gamble.

What to watch between now and liftoff

- Trajectory design details. ESCAPADE’s cruise and Mars arrival dates depend on the final injection energy and timing. Expect teams to converge on a transfer plan that balances cruise time with fuel margins for Mars orbit insertion.

- Upper‑stage profiles. High‑energy missions stress upper‑stage engines and thermal systems. Look for notes on coast phases, restart timing, and propellant conditioning before the trans‑Mars burn.

- Booster recovery attempts. While recovery is not required for mission success, a clean landing would immediately expand New Glenn’s reusable data set. That matters for cadence and cost.

- Spacecraft checkouts. After separation, early telemetry on power, thermal, attitude control, and communications will set the tone for cruise. Two spacecraft mean twice the redundancy but also twice the housekeeping.

If it works, the center of gravity shifts

Imagine the headline a few weeks after launch: two small orbiters on the way to Mars after the second flight of a new heavy‑lift rocket. That is not just a line in Blue Origin’s brochure. It is a signal that the commercial sector can shoulder interplanetary trajectories earlier and more often, and that NASA can buy more science per dollar by matching payload class to procurement model.

Planetary science has lived for decades with a scarcity mindset. Launch windows, budgets, and heavy‑lift options were too precious to risk until everything was proven. ESCAPADE on NG‑2 is a pragmatic break with that pattern. It is not reckless. It is targeted, bounded, and aligned with a mission built to take smart risks. Whether the result is two healthy smallsats en route to Mars or a tough post‑flight anomaly report, the arc bends toward faster learning and more flights.

That is how exploration accelerates. Build capable rockets, trust them sooner with the right payloads, and let the data lead. If NG‑2 delivers, expect more pairs and trios of focused probes heading for Mars, the Moon, and small bodies. If it stumbles, expect a sharper, better New Glenn on flight three. Either way, the old cadence is gone. A new tempo is starting to take hold, and ESCAPADE is about to conduct the downbeat.