Solid Rocket Motors 2.0: New Plants, Printed Propellant

A new Avio factory in the U.S. and X-Bow’s 3D‑printed propellant signal real relief for the missile motor bottleneck. Here’s what changes between 2026 and 2029, what still constrains output, and how policy can speed the turn.

The week the bottleneck started to crack

A fresh name is joining the tight club of U.S. solid rocket motor suppliers. Avio, the Italian propulsion company behind Europe’s Vega boosters, signed agreements to stand up a U.S. factory that will feed key American missile lines. Raytheon announced a U.S. SRM MoU with Avio, positioning itself for preferred access if the new capacity delivers.

At the same time, X-Bow Systems, a U.S. startup that 3D prints solid propellant and automates motor manufacturing, is expanding under Department of the Air Force and Navy efforts and a recent Army-backed investment. Public records include a USAF STRATFI follow-on award that helps mature additive methods for tactical-class motors.

Put together, these November signals matter. A U.S.-based Avio plant offers another full-up merchant supplier beside Aerojet Rocketdyne and Northrop Grumman. X-Bow’s additive workflows promise faster, more adaptable output. The combination hints at a U.S. missile industrial base that could finally move beyond the long queues for motors that slowed everything from tactical rockets to missile defense interceptors.

What broke and why it took years to fix

By 2022 the motor queue had become the queue. A small group of incumbents carried most programs, and the few factories capable of safely mixing, casting, curing, and qualifying motors ran at or near capacity. Any surprise demand spike or qualification rework rippled across schedules. The Department of Defense began to push new entrants, fund expansions, and diversify sub-tier suppliers via tools like the Defense Production Act.

Private moves mattered too. Anduril’s purchase of Adranos underscored how capital and software-driven manufacturing are entering propulsion. For context on Anduril’s broader approach to autonomy and rapid iteration, see Anduril’s robot wingmen test.

Why additive manufacturing changes the tempo

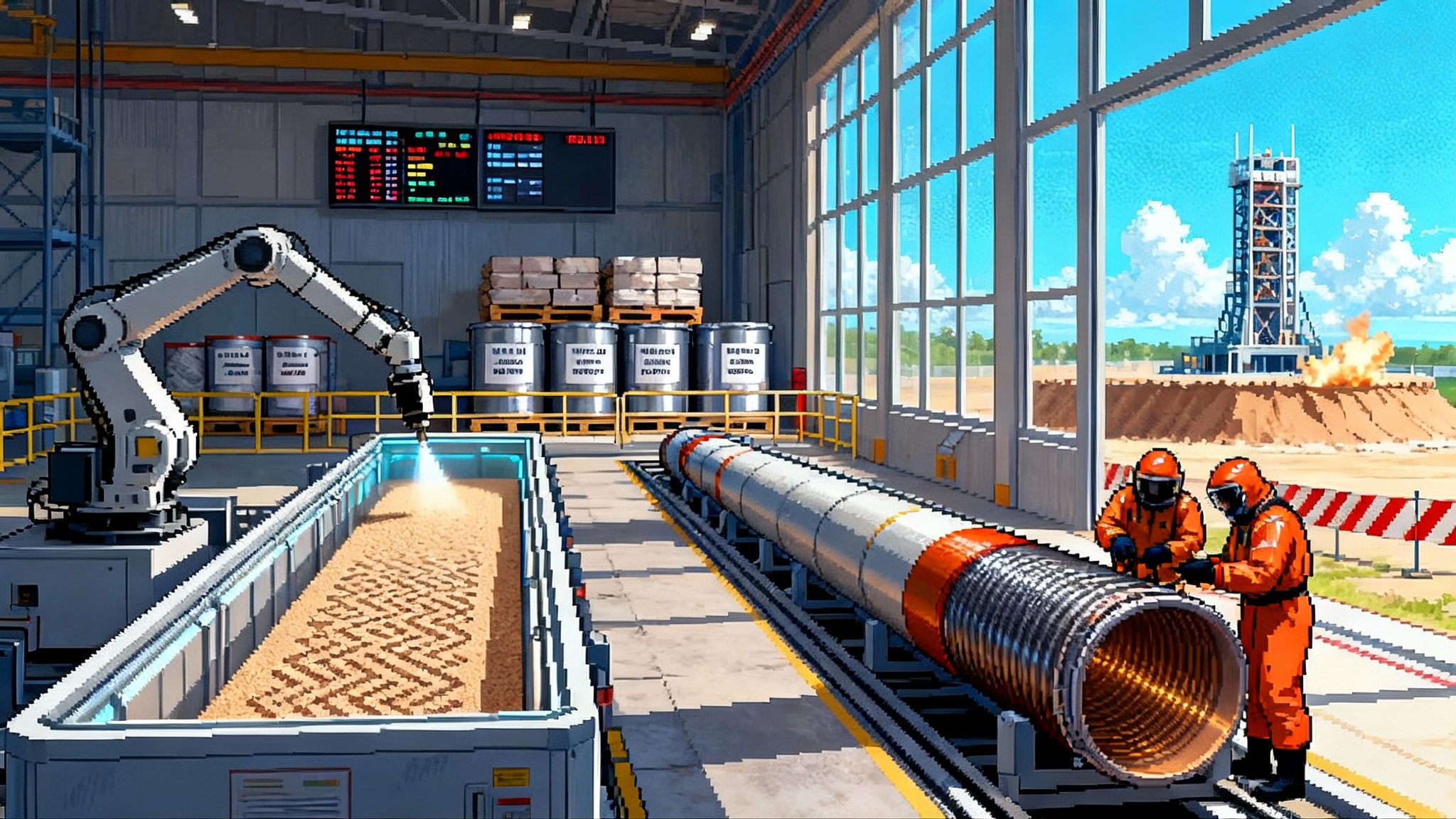

Solid rocket motors look simple. They are not. A typical motor is a precision pressure vessel with a molded energetic core whose internal geometry must burn in a controlled way, within tight tolerances, across a wide temperature band. Traditional cast-and-cure production is batchy, labor intensive, and stop-and-wait. For many motors, the critical path is the calendar time it takes to condition ingredients, cast propellant, cure the grain, inspect, and move everything under explosive safety rules.

Two technologies are shifting that tempo:

-

Additively manufactured propellant grains. X-Bow’s process prints energetic material in controlled layers, so internal ports and inhibitors can be made to spec without hard tooling, and small design tweaks do not require retooling an entire line. That makes engineering-change loops faster and turns configuration control into software plus process parameters rather than long-lead hardware. The approach has been supported by a USAF STRATFI follow-on award.

-

Automated case, mixing, and inspection. New entrants design plants around robotics and digital quality from day one. That means consistent mixing, closed-loop environmental control, and in-line non-destructive inspection that shortens the lag between a process step and the data that qualifies it. Automation does not remove safety rules or qualification. It strips out tool-change latency, reduces scrap and rework, and converts what used to be calendar time into machine time.

Where this reaches front-line programs

-

Standard Missile and Naval Integrated Air and Missile Defense. The Raytheon–Avio agreement targets the Mk 104 motor behind the Standard Missile franchise. Diversifying Mk 104 sources is the straightest line from today’s news to more interceptors on U.S. and allied decks. For the broader air-defense context, compare the economics in Iron Beam’s 2025 debut.

-

Long Range Hypersonic Weapon and Conventional Prompt Strike. These weapons require large-diameter boosters and reliable throughput, not just exquisite performance. Capacity translates into battery-level combat power rather than one-off demos.

-

Precision Strike Missile. As the Army shifts to Increment 2 and beyond, solid boosters remain the pacing item for higher volumes and variants. Every additional qualified supplier for tactical-class motors eases reallocation headaches across priority lines.

-

Missile defense interceptors. Next Generation Interceptor and Glide Phase Interceptor programs will demand multistage solid propulsion at scale later this decade and into the 2030s.

For land-based maritime strike and munitions demand pacing, see the related perspective in Typhon goes forward.

What still constrains the system

Even with new factories and printed grains, three chokepoints will decide how far and how fast the United States can scale.

- Energetics feedstocks

- High-melting explosives and related fills remain concentrated at a small number of government-owned, contractor-operated sites. When one plant spikes, the shock travels across programs that depend on RDX- or HMX-based formulations.

- Aluminum powder and binders such as hydroxyl-terminated polybutadiene determine burn rates, stability, and manufacturability. Domestic upstream capacity needs depth to ride out surges without price or quality shocks.

- Qualification and safety

Solid propulsion has no shortcuts. Every new process needs a statistically significant run of proof articles, thermal cycling, aging data, and static fires. Additive grain printing changes the geometry-control problem, but safety boards care about repeatability, defect detection, and how a process behaves when the humidity spikes or a mixer valve drifts. The good news is that automation and a secure digital thread give program offices more granular data earlier, which can compress qualification without asking for waivers.

- Workforce and site infrastructure

Energetics plants sit behind blast berms for a reason. You need licensed blasters and energetic chemists, but also electricians, controls engineers, and quality technicians willing to work in exclusion zones. Many sites must add secured utilities, magazines, and roads before they can add shifts.

What policy can do next, and how automation multiplies it

-

Lock in multi-year demand signals. Missiles behave like ships and aircraft from a supplier’s point of view. Bundling two to three years of buys where statute permits lets suppliers finance mixers, casting pits, and autoclaves at bankable terms.

-

Expand Defense Production Act use to the sub-tier. Keep targeting upstream pinch points: propulsion-grade aluminum powder lines, binder chemistry, liner materials, nozzle ablatives, and rayon-based precursors for thermal protection systems. Measured cost share and schedule milestones matter as much as total dollars.

-

Treat digital accreditation like a machine tool. Factories that manage classified or export-controlled data need accredited networks and software toolchains. Funding those controls accelerates every subsequent contract because vendors are ready to ingest models and release travelers without stop-start security audits.

-

Make qualification data portable. When a government-funded program qualifies a propellant recipe, layup, or inspection method, package the artifacts so another program can reuse them with minimal deltas.

-

Train the workforce where the plants are. Fund regional apprenticeship pathways with community colleges near production hubs. Pay for the certifications that matter on day one: hazardous operations, non-destructive testing, programmable logic controller maintenance, and high-reliability soldering for control systems.

How this plays out from 2026 to 2029

-

Avio’s U.S. plant, if it hits its schedule, gives Raytheon and other primes a second source for Standard Missile class motors by the late 2020s. That is not just supply insurance. It creates a test-and-learn loop between an American line and Avio’s European heritage that can feed improvements into qualification faster.

-

X-Bow’s automation-heavy campuses, paired with Air Force and Navy qualification pathways, should start producing at meaningful monthly rates for tactical-class motors in this window. The Army-backed GMLRS prototype work is a forcing function to prove cost and rate, not only performance.

-

Incumbents will still carry the heaviest loads for large boosters and complex interceptors, but they will be doing so with more automated, higher-yield mixes and with relief at the sub-tier.

-

If industrial-base investments keep targeting upstream materials, the worst single-point risks shrink. A second domestic line for a critical binder or nozzle material does more for schedule certainty than another concept motor.

The takeaway

The United States has spent three years learning that missile power is propulsion power. November’s developments show a path out of the jam. A new U.S. plant from Avio promises real diversity for a staple motor. X-Bow’s additive and automated lines aim to turn drawings into motors with fewer tool changes and fewer months on the calendar. If policymakers keep investment focused on sub-tier materials and digital accreditation, and if programs share qualification data rather than re-run it, the 2026 to 2029 window can be the one where the motor queue finally shortens and fielded inventories actually grow.

Do not think of this as a silver bullet. Think of it as more lanes on the same highway, smoother pavement, and better traffic control. You still need fuel and drivers. With a little discipline and steady funding, there is enough room to move.