Starship’s 2025 Pivot: From Test Shots to Real Payload Ops

Two late-summer flights turned Starship from spectacle into service. Here is how proven dummy deployments, tougher heat shields, and near-complete booster recovery set up rideshare payloads, depot demos, and cheaper cislunar logistics in 2026.

The moment the test program became a transport program

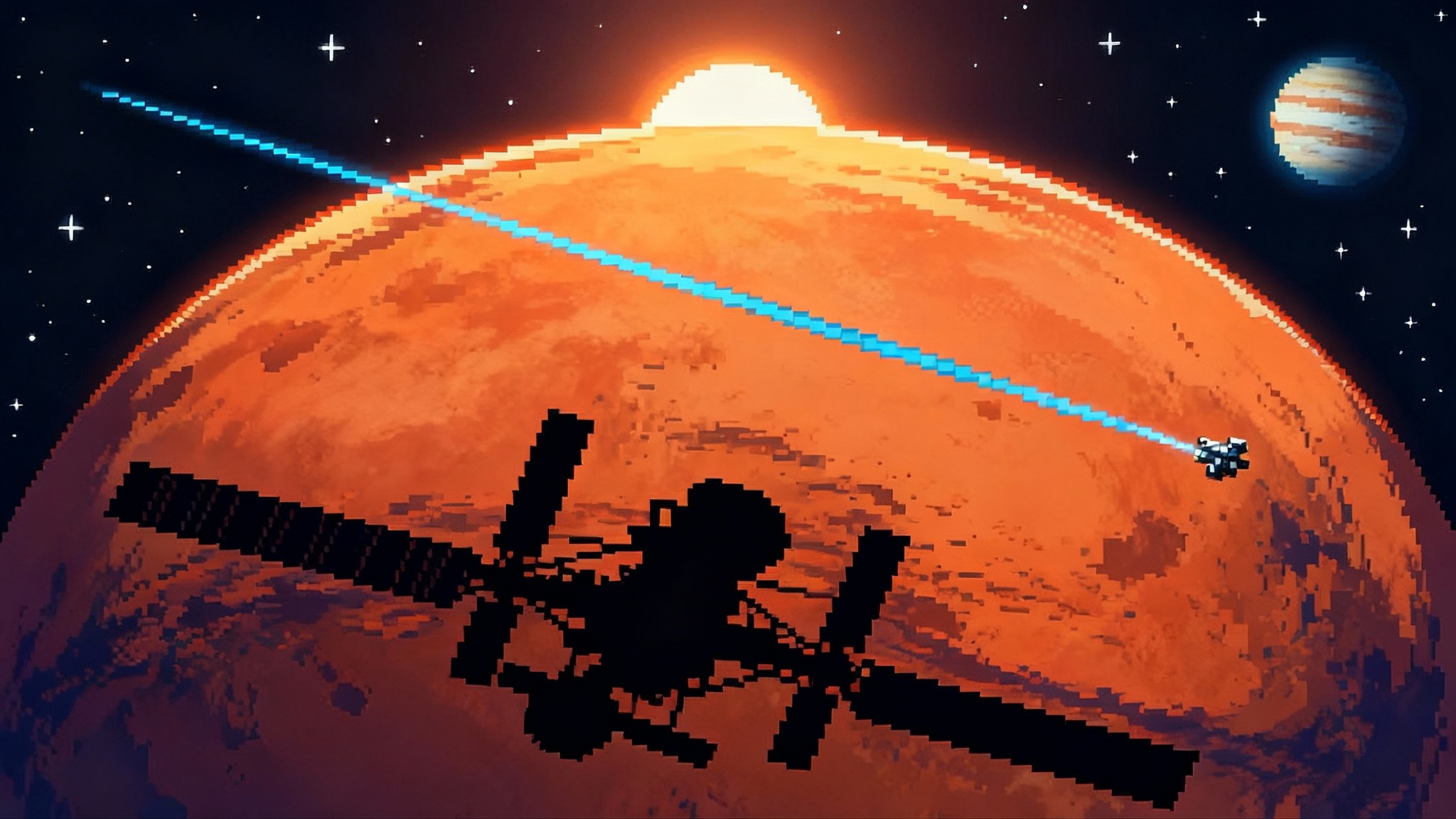

In late August 2025, Starship crossed a quiet but important threshold. The vehicle did not merely fly higher or longer. It opened its payload bay, released a cluster of dummy satellites, and proved a complete deployment sequence in orbit. Attitude control, door actuation, dispenser choreography, and post-release collision avoidance all worked together. For the first time, a Starship flight looked like a service a satellite operator could book, even if the passengers were only metal stand-ins.

In mid October 2025, a follow-on mission built on that playbook. The ship carried additional mass simulators, then survived a longer, hotter reentry with an upgraded heat shield that showed fewer tile losses and cleaner acreage across the belly and nose. The Super Heavy booster, meanwhile, delivered the most polished recovery profile to date, returning to the Gulf on a tight trajectory that rehearsed the geometry of a full catch and hinted at rapid reflight. Together, the two flights shifted perception. Starship ceased to be a string of isolated experiments and began to look like a system preparing for routine payload work.

This pivot matters because the next 6 to 18 months have a very specific agenda: fly real secondary payloads, demonstrate on-orbit propellant transfer between tankers and a depot article, and activate a Starship-capable pad at Cape Canaveral. If those three things happen close to plan, Artemis logistics get simpler, private cislunar missions get cheaper, and the cost per kilogram to orbit starts sliding toward the low hundreds instead of low thousands.

What changed in those two flights

Three technical moves stand out from the late August and mid October sorties.

-

End-to-end deployment flow. A payload bay is only useful if the whole ballet works. The flights validated the door drive in vacuum, thermal control of the bay, dispenser timing, and safe separation maneuvers. Those are the often overlooked failure points. Hinges can bind in thermal gradients. Doors can induce unexpected torques. Deployment rails can flex under micro-g loads. Exercising all of this with inert mass is exactly how a launch provider de-risks rideshare customers before it moves real hardware.

-

Heat shield durability at operational speed. Test pilots say, fly the profile you plan to sell. The October flight pushed the reentry toward operational heating so the team could map out tile loads, bondline temperatures, and shock interaction near the chines and forward flaps. Reusable ships live or die on turn-time. Every crew that spends days replacing tiles is a hidden cost that ruins the business case. Fewer losses and tighter inspection data mean faster cycles, which matter as much as engine performance.

-

Booster recovery geometry that closes the loop. Recovery is a chain. Improve guidance on the boostback, shave dispersions on the entry burn, and you set up a precise landing window at the tower. Even without a full catch, the October profile showed the timing and control needed for repeatable returns. Repeatable returns mean the hardware comes back to the same crane stands, the same inspection stations, with minimal improvisation. That is how airline-style ops begin.

The 6 to 18 month plan

The next year and a half is a checklist. The steps are not glamorous, but they are the difference between a demo program and a logistics platform.

Phase 1: real secondary payloads on early flights

The first step is to replace dummy mass with low-risk, high-value riders. Expect hosted sensors, radiation monitors, technology demonstrators, and small imagers. Think of a Starship flight as a mobile rideshare hub. The vehicle’s sheer volume makes mixed cargo practical. Multiple dispensers can handle different deployment altitudes, and the bay has room for hosted payload racks that never separate at all. As heavy-lift competition intensifies with New Glenn’s ESCAPADE sprint, standardized rideshare offerings will shape schedules and pricing.

The implication is commercial, not just technical. Smallsat operators care about schedule certainty and gentle handling as much as price. If Starship offers quarterly or even bimonthly rideshare slots with standard electrical and thermal interfaces, it becomes a default choice for anything that does not require a bespoke orbit. The Falcon 9 rideshare program grew the smallsat market by providing predictable buses. Starship can do the same, only with more mass margin, larger form factors, and room for late load.

What to watch: a published rideshare interface control document, then a manifest line that includes two or three named secondary payloads with distinct mission classes. When that appears, the market will treat Starship as a real option rather than an aspirational one.

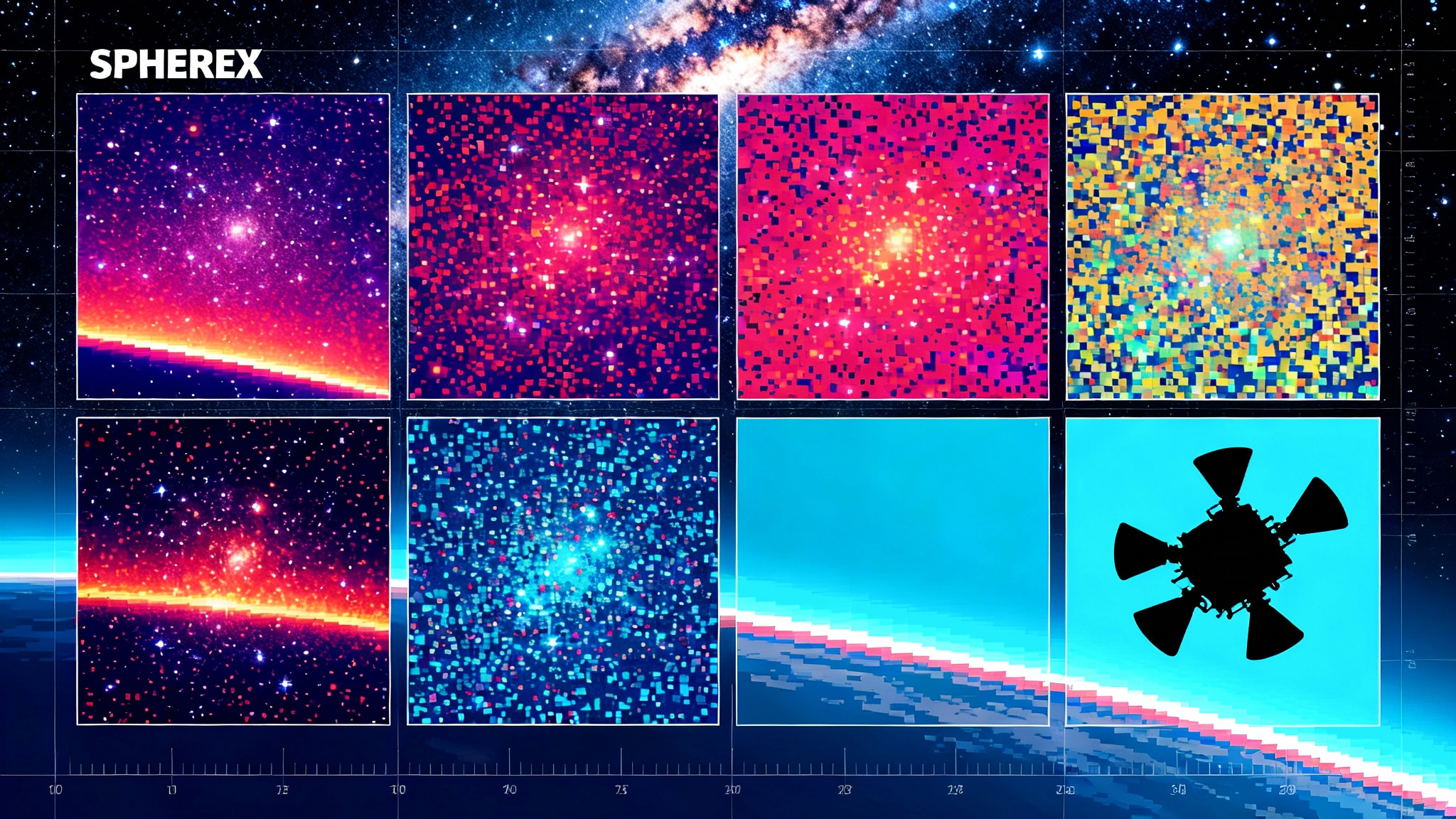

Phase 2: on-orbit propellant transfer and a depot article

Artemis depends on this step. The Human Landing System plan requires large quantities of cryogenic methane and oxygen to be moved from tankers into a waiting vehicle or depot. This is a fluid mechanics and thermal problem layered on top of rendezvous and docking. Long-duration cryo management in space means coping with boil-off, stratification, slosh, and propellant gauging under microgravity.

The demonstration sequence is likely to unfold in three bites. First, a short-duration transfer that moves a modest quantity between two docked Starships to prove plumbing and controls. Second, a longer dwell that holds propellant cold while the sun bakes the tanks through multiple orbits, validating insulation, autogenous pressurization, and vapor cooling. Third, a depot article that stays on orbit for weeks while tanker flights top it off, culminating in a drawdown test that simulates fueling a lunar vehicle. For a broader logistics comparison, see how industry rethinks cadence in Mars Sample Return 2.0.

If the transfer rates and thermal stability close the math, the tanker stack count drops and the schedule margin grows. The bottleneck in the Artemis architecture has always been the number of tanker flights needed and the time window to keep the depot cold enough. Improving transfer efficiency by even 10 to 20 percent can remove entire tanker launches and reduce risk across the board.

What to watch: a docking test with propellant lines mated, a publicly stated mass of fluid transferred, and temperature-pressure traces that show stable conditions over multiple night-day cycles.

Phase 3: Cape Canaveral pad activation

Launching Starship from Boca Chica proved the machinery. Activating a Starship-class pad at Cape Canaveral turns the program into an industrial operation. Florida brings integration buildings sized for heavy payload processing, established barge and rail logistics, and a range infrastructure that already supports high cadence Falcon missions.

Cape access also unlocks more orbits without complex plane changes. Equatorial, mid-inclination, and a range of cislunar departure windows become easier to hit on time. For government customers, Florida proximity to the Eastern Range, the Space Force, and existing payload facilities reduces friction. For commercial players, it concentrates launch prep in a location that already has suppliers, specialty machining, and a workforce trained for flight hardware.

What to watch: fit checks of a Starship on a Cape tower, cryo loading rehearsals, and the first static fire on Florida soil. Those are the rituals that signal operations, not experiments.

From spectacle to supply chain: what this means for Artemis

Artemis needs a freight plan as much as it needs a rocket. The program’s architecture calls for crews to stage through a near-rectilinear halo orbit around the Moon, meet a lander, descend, and then return. That dance depends on prepositioned propellant and cargo. A Starship that can move 100 to 150 metric tons to low Earth orbit per flight and then refuel in space changes the cadence from occasional to regular.

Here is a concrete picture. A depot article occupies a stable orbit. Tanker flights top it off over several weeks. A lunar lander Starship launches dry or partially fueled, mates with the depot, and fills its main tanks. It departs for the Moon, meets Orion or another crew vehicle in the halo orbit, executes descent, and later returns to orbit for rendezvous. The key is that the depot and tanker trains run whether a crewed mission is near or not. That creates a cislunar freight lane where propellant and cargo keep flowing, just as container ships keep schedules independent of any one passenger voyage.

This is not only about landers. With frequent heavy lift and in-space fueling, NASA can pre-deploy logistics modules, pressurized cargo, surface power systems, and communications relays. Gateway elements become easier to ship. Contingency planning improves because reserves can be stockpiled in orbit. If a lander needs a margin bump, the answer is more propellant rather than a new rocket development.

The governing metric is dollars per kilogram delivered to the right place at the right time. If Starship flights trend to tens of millions of dollars each and deliver hundreds of tons to orbit, the per-kilogram price to low Earth orbit can plausibly dip into the low hundreds. Even after accounting for tanker overhead and depot losses, cislunar delivery costs fall by roughly an order of magnitude compared with today’s norms. That delta does not just save money. It lets mission designers carry more redundancy, more science instruments, and more surface time without breaking the budget.

Private cislunar business models that now make sense

Lower cost and higher cadence create new categories that did not quite pencil out before.

- Surface cargo on demand. Prospecting missions and robotic construction efforts can request heavy tools and replacement parts on a quarterly schedule. That stability encourages private financing, because lenders can model delivery risk like they do maritime shipping.

- High-bandwidth relay networks. A handful of medium to large satellites in cislunar orbits, supported by Starship rideshare and depot fueling, can offer steady coverage for landers and rovers. Expect optical links to build on the deep-space laser internet.

- On-orbit assembly with real elbow room. Starship’s bay can carry long truss segments, inflatable habitats, or monolithic mirrors that cannot fit on current fairings. Assembly crews can work inside the volume of a ship before deployment, which reduces the number of risky extravehicular steps.

- Deep space missions with heavy shielded buses. Planetary probes can launch with larger radiation vaults, bigger power systems, and higher delta-v stages. The result is faster transfers or more ambitious trajectories on shorter timelines.

Each of these cases benefits not only from price but from predictability. Starship’s size makes it less sensitive to marginal mass increases. That reduces the painful last-minute tradeoffs that plague small fairings. When adding a kilogram no longer knocks a mission out of compliance, teams make better decisions.

The caveats that matter

Every giant step in launch vehicles comes with stubborn problems. Three constraints deserve special attention because they connect directly to cadence and cost.

- Heat shield life. Reentry loads will not be identical from flight to flight. Vehicle-to-vehicle variation in tile bond quality, gap fillers, and under-tile insulation can stack up to create long inspection queues. The metric to watch is tile touches per turnaround. If that number trends down toward airline-like weekly cycles, the business case holds. If it balloons, cadence suffers.

- Cryogenic propellant management. Even a perfect transfer experiment must scale to operational timelines. Holding methane and oxygen cold while waiting for a weather scrub or a late tanker arrival is hard. The solution mix includes sun-shielding attitudes, vapor cooling loops, and carefully tuned pressure ranges. Expect software updates to matter as much as hardware here.

- Range and regulatory throughput. A Cape pad adds capacity, but every catch attempt, static fire, and scrub consumes range resources. Close coordination with the Federal Aviation Administration and the Space Force will decide whether Starship flies weekly or monthly from Florida. Permitting, environmental mitigations, and community impact plans all affect the real schedule.

These are not unsolved mysteries. They are engineering and governance challenges that improve with data and repetition. The recent flights supplied exactly that and reduced uncertainty where it hurts the most.

Who should do what next

- NASA. Publish clear acceptance criteria for propellant transfer milestones, including mass moved, temperature bands, and dwell times. Tie tanker counts in the human landing sequence to those criteria so the schedule impact is transparent.

- SpaceX. Lock in a rideshare standard for Starship, with payload mechanical, electrical, and thermal envelopes that match what smallsat manufacturers already use. Keep the heat shield inspection time public enough to build customer confidence.

- Department of Defense. Use early secondary payload slots to fly navigation, timing, and secure communications experiments in orbits that are expensive to reach today. Treat Starship as a strategic logistics node, not just a rocket.

- Startups and primes. Design payloads for the volume and power budget Starship offers. That means wider instruments, larger antennas, and more capable propulsion. Use the mass margin to simplify designs instead of chasing exotic materials.

- Insurers. Create products that price in Starship’s high volume and early cadence variability. Offer discounts for customers that accept flexible deployment altitudes or rideshare slots. The market needs insurance that matches the new risk profile.

- Regulators and ranges. Pre-plan for higher launch density with procedures that allow back-to-back operations when weather and hardware permit. The point of reusability is speed. The range must be ready to match it.

How to tell if the promise is real

Hype is a poor guide. The following five numbers will separate reality from narrative in 2026.

- Flights per quarter from both Texas and Florida.

- Average tile touches per ship between flights.

- Measured kilograms transferred of cryogenic propellant, along with hours held on orbit without venting.

- Named secondary payloads delivered to operational orbits on schedule.

- Dollars per kilogram invoiced to customers across a sample of flights.

If those numbers move in the right directions, the order-of-magnitude price drop will not be a forecast. It will show up in invoices and payload mass margins.

The bigger picture, told simply

Think of orbital logistics as a railroad. For the last decade we have had good locomotives pulling small freight cars. The two 2025 flights were the moment a much bigger locomotive coupled to a train of full-size cars and moved them without breaking the coupler. The next year and a half is about laying double track to the Cape, proving the fuel depot works, and inviting paying customers to ride.

Get those pieces right, and cislunar space becomes normal work. Crews will step onto landers that were fueled last week, not last quarter. Rovers and drills will arrive on a reliable schedule. Science teams will plan around delivery dates that stick. The spectacle of launch will matter less because the supply chain will matter more.

That is the real inflection. Starship is shifting from the drama of firsts to the discipline of freight. The sooner we treat it that way, the sooner the Moon becomes a destination served by timetables rather than special occasions.