Wall Street Goes Onchain: Nasdaq Lights the RWA Fuse

Nasdaq’s SEC filing would let tokenized versions of listed stocks and ETFs trade on the same book as their traditional twins. Here is how exchange integration, DTC minting, and programmable settlement could push real-world assets into production.

The moment the plumbing changed

Markets rarely pivot on a headline. They pivot when the plumbing under the screen changes. Nasdaq’s September filing to the Securities and Exchange Commission asks for permission to let tokenized versions of listed stocks and exchange traded products trade on the same book, under the same rules, and at the same best bid and offer as their traditional twins. It is a quiet but historic ask, because it connects the most regulated matching engine in U.S. equities to public chain settlement rails through a controlled interface with The Depository Trust Company.

The proposal is precise. Tokenized shares must have the same CUSIP, the same material rights, and the same execution priority as their non tokenized counterparts. Members can flag an order for tokenized settlement at entry; Nasdaq will pass that instruction to DTC, which would mint and deliver a tokenized position to a DTC registered digital wallet. Until Nasdaq completes its plan for longer trading hours, tokenized shares would still trade during regular and extended sessions, with 23 by 5 service contemplated next. Read the primary text yourself in the SEC notice of Nasdaq’s tokenized trading proposal.

That is the breakthrough. A national market system venue is not launching a side chain casino. It is slotting a token settlement option into the same rulebook that already governs price priority, routing, market data, and surveillance. In practical terms, Wall Street is not creating a parallel market. It is proposing a new cable that can be plugged into the existing machine.

What “tokenized on Nasdaq” actually means

Think of today’s stock as an entry in a depository ledger. Tokenization does not change the economic claim; it changes how the claim is represented, moved, and reconciled. Under the filing, a limit order in tokenized QQQ looks like any other QQQ order to the matching engine. It participates in the same book, the same auctions, and contributes to the National Best Bid and Offer. The only difference is a post trade instruction: settle this position in token form. DTC then moves the member’s book entry into a control account, mints the corresponding tokens, and delivers them into a DTC registered wallet that sits at the edge of the public chain. From there, tokens can be custodied, transferred, and even pledged using smart contracts, within the constraints of transfer rules and whitelists.

This is not a theoretical bridge. It is a path that preserves investor protections and best execution while unlocking the programmability of assets once they leave the matching engine. If you are a market participant, the message is straightforward: keep trading as usual, but get new post trade superpowers when you opt into tokenized settlement.

Why exchanges, not standalone token platforms, matter

For a decade, tokenized securities tried to grow on parallel venues. Liquidity fragmented, investor rights were murky, and fair access suffered. Nasdaq’s approach flips the sequence. First, keep price discovery and surveillance where they already work. Second, let the cash and custody legs evolve. This alignment reduces three chronic risks:

- Price gaps between token and traditional shares shrink because both forms trade on the same book.

- Best execution remains auditably enforceable because tokenized trades still feed the consolidated market data.

- Surveillance does not bifurcate, since tokenized and traditional prints flow through the same rule set and oversight.

In other words, exchange led tokenization changes the default from siloed liquidity to integrated liquidity.

The near term build map

The proposal answers the where. Builders now need to ship the how. Here is the pragmatic roadmap that will move real world assets from pilots to production within the exchange centered model.

1) Onchain transfer agents that mirror cap tables in real time

Today, transfer agents keep the official ledger of security holders for many issuers. In a tokenized world, transfer agent logic must live onchain as the authoritative source of share movements outside DTC’s omnibus. Think of a smart contract as a continuously updated cap table with controls. It should handle restrictions, corporate actions, and proxy entitlements, and it must be provably consistent with the depository record.

- What to build: a transfer agent contract suite that maps every off chain action to an onchain state change, with issuer keys held under hardware security modules and regulated custody. Include upgrade paths that require multi party approvals from the issuer, transfer agent, and exchange operations.

- Why it matters: without an onchain system of record, tokenized shares drift into reconciliation purgatory, which kills downstream use cases like collateral posting and intraday repo.

2) KYC gated wallets that travel across venues

Tokenized public assets still need private access control. The solution is not one more walled garden. It is a portable, attestations first wallet framework. Wallets carry cryptographic proofs of identity checks, sanctions screening, and investor status, issued by regulated verifiers that exchanges and custodians trust.

- What to build: a whitelist registry with revocation, plus a wallet SDK that can check attestations on the fly without exposing personal data. The registry should support rule expressions like “U.S. accredited or non U.S. professional investor and not on any sanctions list.”

- How to deploy: integrate the registry with exchange member gateways so that a single wallet works across primary issuance, secondary trading, and post trade settlement.

3) Compliant stablecoin settlement for the cash leg

Tokenized assets are only half of delivery versus payment. The cash leg must be programmable too. That means settling with well regulated, bankruptcy remote stablecoins held in ring fenced accounts, or eventually with tokenized bank money at clearing banks. Atomic DvP between tokenized shares and cash reduces counterparty risk and slashes the time capital sits idle.

- What to build: a settlement controller that supports multiple stablecoins, enforces per issuer and per venue policies, and can swap cash tokens for central bank funds through bank partners when required by rule or client mandate.

- Why it matters: traders will not move size over a system that occasionally settles like a wire and occasionally settles like a smart contract. Cash must be as programmable as the asset. This aligns with the broader stablecoin payments land grab.

4) Oracleized net asset value and corporate actions

For tokenized funds and exchange traded products, blocks need believable numbers. Net asset value and basket composition should arrive onchain via multiple independent oracles that reconcile against fund accounting systems. Corporate actions such as splits, dividends, and rights issues must be broadcast onchain as machine readable events.

- What to build: an oracle pipeline that signs each data update from three sources, enforces quorum, and can pause if feeds disagree beyond a tolerance. Add proofs that link the oracle update to a timestamped off chain system snapshot.

- Outcome: intraday creations and redemptions can be automated, automated market makers can price accurately, and clearing brokers can verify that what they receive matches fund instructions.

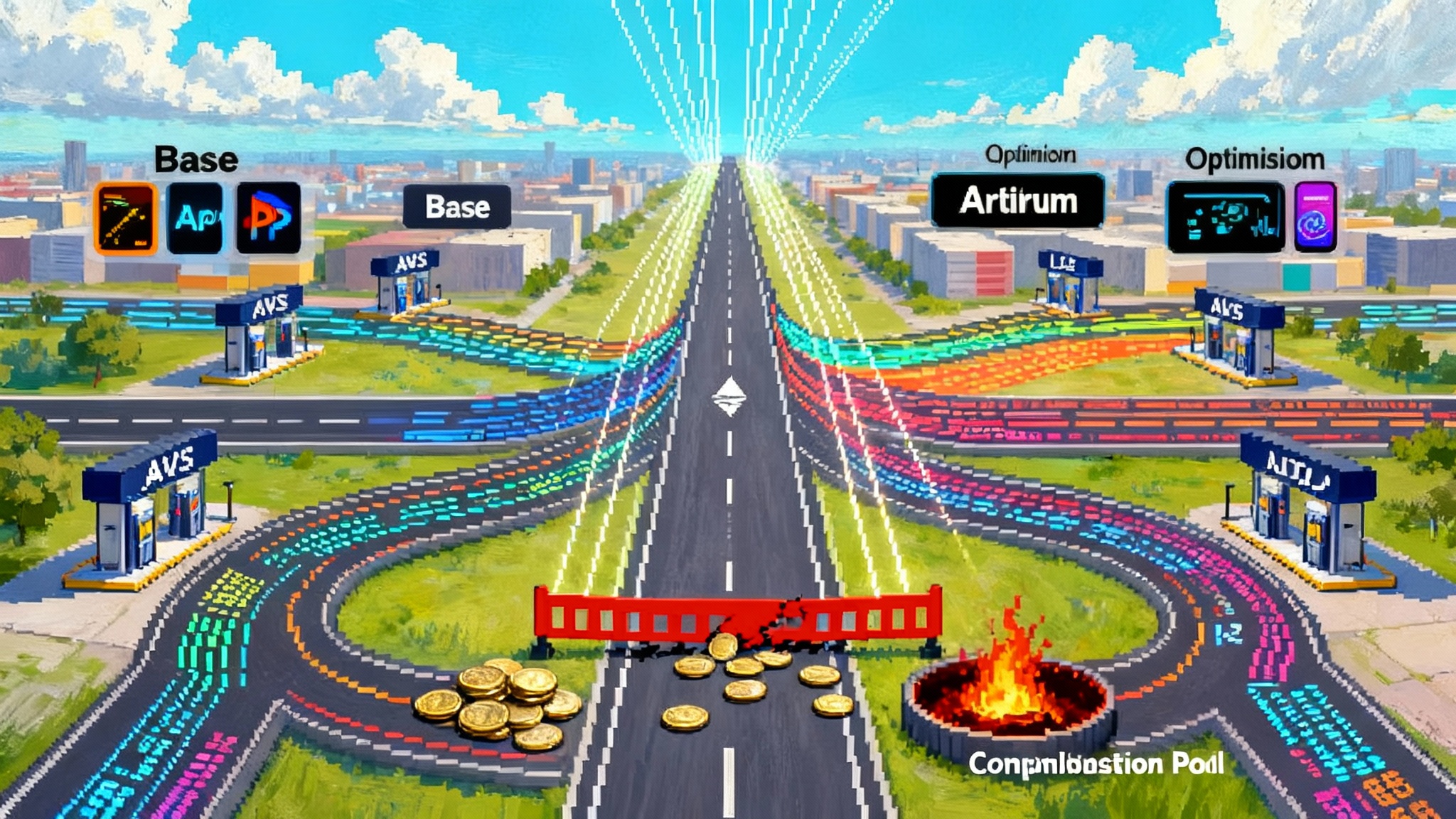

5) MEV aware matching and fair sequencing

If parts of the order journey touch public mempools, value extraction by front running and sandwiching becomes a live risk. Exchanges should not rely on hope. They should treat the chain like a hostile network and design for it.

- What to build: an order flow firewall that uses private transactions and secure relays for any onchain settlement step; frequent batch auctions or random time slicing to blunt latency games; commit reveal for large prints; and cryptographic attestations that show no party saw the order flow before a fair sequencing point.

- Why it matters: institutional flows will not route through rails that leak. Proving fair sequencing is table stakes for serious size, and advances in interoperability and intents can help inform the design.

What changes for market structure

Two words: inventory optionality. When a trade prints on Nasdaq and settles as tokens, that position can immediately be re pledged to a lender, placed into an automated market maker that supports whitelisted assets, or parked in a smart contract that issues intraday credit. That does not require new trading rules; it requires risk managers to see a token as a first class collateral object with enforceable rights.

The exchange filing also nods at time. The document contemplates 23 by 5 operation before any move toward always on. Even that is a deep change. Asset managers will face a choice between concentrating liquidity into fixed sessions for price discovery or letting a tokenized after market absorb cross time zone demand. Expect the first phase to keep primary price discovery where it is while using programmable settlement for global client convenience.

Finally, post trade data becomes richer. When a position lives in a wallet, it can carry machine readable proofs of settlement time, beneficial owner status, and encumbrances. That compresses reconciliation cycles and reduces fails.

Open risks to solve head on

- Investor rights parity: the filing requires identical material rights for tokenized and traditional shares. Builders must prove that every right is actually enforceable onchain. That means proxy voting that travels with the token, dividend logic that respects record dates, and default paths when smart contracts fail.

- Liquidity fragmentation: integration on the matching book helps, but token settlement may tempt issuers or intermediaries to spin up bespoke token variants. Resist that. Favor a single fungible class per CUSIP and avoid chain exclusive wrappers that cannot be redeemed one for one.

- Chain risk and key management: DTC registered wallets will hold serious value. Keys must be shard secured, with hardware backed recovery and human in the loop policies. Chains must offer finality guarantees that risk committees can underwrite.

- Compliance drift: KYC standards vary across jurisdictions. Without portable attestations, each venue will rebuild the same checks, increasing friction and error. Standardize attestations early, agree on minimum datasets, and keep revocation lists synchronized.

- Operational surprises: 24 by 7 settlement sounds attractive until you discover which teams carry the pager. Phase rollouts. Start with 23 by 5, rehearse incident response, and only then open the overnight window.

Where the alpha is for builders

- Transfer agent onchain services: own the boring but critical layer that maps investor rights to contracts. Revenue comes from issuer subscriptions, event processing, and compliance modules.

- Wallet compliance rails: sell the enterprise toolchain for KYC gated wallets and attestations that pass exchange audits. Think of it as SAML for wallets.

- Stablecoin settlement controllers: become the orchestration layer between stablecoins, bank money, and clearing. If you support policy based routing and pre funded netting, you reduce capital drag and win market share.

- Oracle stacks for NAV and corporate actions: multi source feeds with proofs, distributed signing, and pause logic. Funds will pay for reliable pipes that regulators understand.

- MEV defense as a service: private order relays, fair sequencing proofs, and batch settlement tooling that integrates with exchange workflows. Sell to exchanges and to the largest market makers.

Where the alpha is for traders

- Cross form basis: when tokenized and traditional shares trade on the same book but settle differently, small and temporary basis opens between cash and token settlement windows. Build models that predict settlement congestion and monetize the spread.

- Global time zone liquidity: use 23 by 5 windows to warehouse risk for clients outside U.S. hours. Token settlement lets you move inventory and collateral instantly. Price the convenience.

- Collateral velocity: tokenized positions can be pledged, rehypothecated within limits, or placed into automated lending markets with allowlists. That turns inventory into funding faster. The edge goes to desks that integrate custody and credit engines with onchain hooks.

- Programmatic corporate actions: if dividends and splits land onchain, you can automate entitlement capture and reduce operational slippage that competitors still absorb manually.

What happens next and what to watch

- The rulemaking clock: the SEC notice is published, with comments due on a fixed timeline. Approval will likely hinge on DTC’s readiness and the clarity of investor protection controls. Read Nasdaq’s own framing of the proposal in Nasdaq’s Q&A on tokenized securities and consider how a potential SEC innovation exemption could accelerate compliant experimentation.

- The DTC milestone: the filing describes DTC minting and wallet delivery. When DTC flips that switch in production, the settlement leg is real. Builders should design to DTC’s policies, which will define wallet registration, token standards, and reconciliation.

- The first issuers: expect large, liquid exchange traded products to be early token candidates. They are basket driven, operationally standardized, and already thrive on arbitrage between forms. Watch for separate filings by sponsors to authorize tokenized creations and redemptions.

- The hours: once 23 by 5 stabilizes with token settlement, pressure will mount to test always on sessions around corporate events and macro prints. Risk teams need hard rules for when tokens can move and when the book rests.

A simple metaphor to end with

Think of the equities market as an airport. For years, tokenization tried to build a new runway far away in a field. It remained quiet because planes would not leave the main terminal to use it. Nasdaq’s proposal does something different. It adds a high speed taxiway from the main runway to a new logistics park next door. Planes still land and take off where air traffic control works best. But once they roll through the gate, cargo moves on a smarter network that runs around the clock.

If you are building, you now know where to pour concrete. If you trade, you know where the spreads will appear and disappear. And if you regulate, you can see how to keep the sky safe while expanding the airspace. The plumbing changed. Markets will follow.