Agentic Commerce Arrives: Instant Checkout Is Live

OpenAI just turned on Instant Checkout in ChatGPT with Stripe, moving shopping from product pages into agent-guided conversations. Here is the map, the builder playbook, and what to expect over the next 12 months.

The moment shopping leaves the web page

On September 29, 2025, OpenAI launched Instant Checkout in ChatGPT, the company’s first full step from product discovery to purchase inside a conversation. The feature, powered by a new Agentic Commerce Protocol built with Stripe, starts with single-item purchases from U.S. Etsy sellers, with Shopify merchants coming next. It is the clearest signal yet that shopping is moving from search results and app tabs into agent-guided chats, where intent appears in plain language and checkout happens in a few taps. You can read the announcement for the core mechanics and scope in OpenAI’s post on Instant Checkout and the Agentic Commerce Protocol.

If you are a retailer, marketplace, or startup, this is a tipping point. A new stack is forming to let AI agents browse your catalog, verify policies, get trusted prices and shipping, authorize payment, and return a verifiable receipt. It reframes the storefront. It also reframes who controls discovery, attribution, and customer relationships.

What changed under the hood

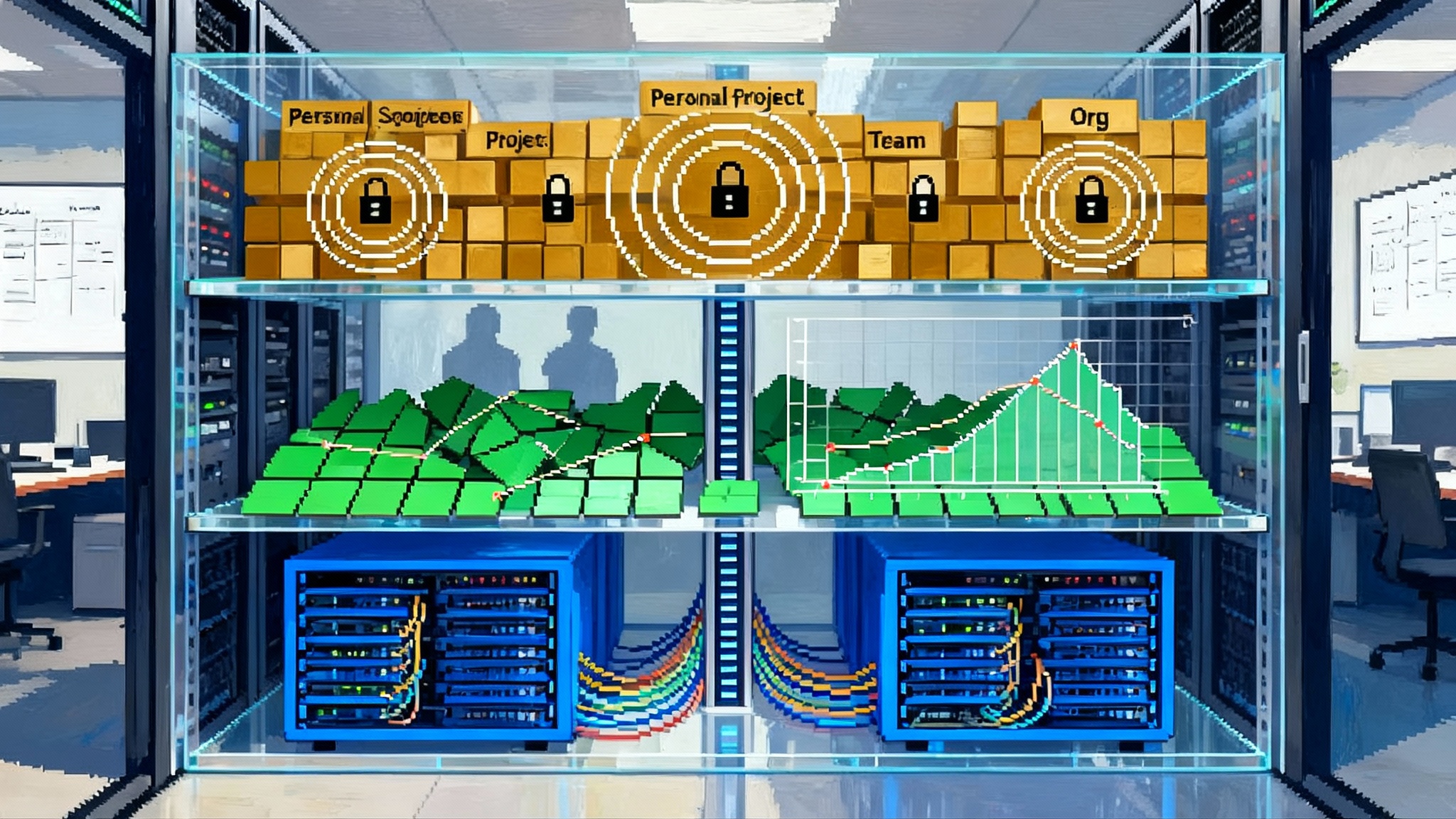

The Agentic Commerce Protocol, or ACP, is a structured handshake between three parties in a chat: a person, an AI agent acting on their behalf, and a merchant. Think of it as a flight plan for a small drone. Before takeoff, the agent declares where it is going, what it will pick up, who authorized it, and how it will pay. The merchant confirms the coordinates: price, taxes, shipping method, fulfillment promise, return policy, and identity of the seller of record. The agent then requests approval from the user and initiates payment through a connected rail. The result is a signed receipt and a set of events the merchant can reconcile in their systems.

Several design choices matter:

- Catalog legibility: Agents prefer structured product data, inventory, price, tax rules, shipping windows, and fees. Free-form pages still work, but structured feeds reduce errors.

- Trust signals: Clear return windows, seller identity, and fulfillment SLAs give agents the confidence to recommend a purchase and reduce post-transaction churn.

- Payment abstraction: ACP does not tie you to one processor. It defines the messages and receipts. You choose the rail behind the scenes.

Today, Instant Checkout supports single-item carts. OpenAI says multi-item carts are next, along with more regions and more sellers. That sequence tracks the technical reality: multi-merchant or multi-warehouse carts add complexity around inventory holds, split shipments, taxes, and dispute routing.

The payments stack is coalescing

A handful of large players are stitching together the rails agents will use. Here is the fast-forming map.

Mastercard Agent Pay

Mastercard’s Agent Pay program introduces agent-aware tokenization and a registration model for trusted AI agents. The idea is straightforward. Instead of an agent using a raw card credential, the agent carries an agentic token with narrow permissions: the merchant or merchant category allowed, spending caps, time windows, and whether a human approval step is required. Issuers can recognize an agent-initiated transaction at authorization and apply policy, risk checks, and step-up authentication. Merchants get clearer dispute treatment because the transaction includes flags that identify the agent’s role and the mandate the user granted.

Two near-term advantages for builders:

- Improved authorization rates from network tokens and explicit agent context, which can reduce false declines on legitimate conversational purchases.

- Cleaner dispute flows, since the mandate can show the user approved a specific item, price, and window. That supports faster resolution and fewer chargeback losses.

Visa Intelligent Commerce and the MCP Server

Visa’s Intelligent Commerce initiative packages a Model Context Protocol Server so agents can call Visa APIs with a single integration pattern. Developers can test payments actions in a sandbox, then graduate to production with the same agent instructions. Visa is also piloting an Acceptance Agent Toolkit that prebuilds common tasks such as Pay by Link, invoicing, and merchant onboarding into agent-friendly workflows. For a builder, the value is speed and consistency. You do not hand-craft custom adapters for every agent surface. You speak a known protocol and let the server bridge to card rails, risk services, and acceptance endpoints. This direction mirrors trends covered in MCP and A2A mainstreaming.

Google and PayPal’s Agent Payments Protocol

Google and PayPal are pushing a complementary standard called the Agent Payments Protocol, or AP2. It layers on top of popular messaging and tool protocols and adds the missing piece for payments: a cryptographically signed mandate that binds user intent, agent identity, and transaction details, along with a traceable receipt across fiat and crypto rails. The pitch is interoperability. Agents from different platforms can initiate payments through card networks, bank transfers, or stablecoins and still produce an auditable paper trail for merchants, processors, and issuers. For scope, see Google’s outline of AP2 in Powering AI commerce with Agent Payments Protocol. For broader context on the standard’s role in the agent economy, read AP2 and x402 overview.

Across these efforts, a pattern emerges. Agents will not hold your raw card. They will present limited-purpose credentials and verifiable mandates. Merchants will receive structured purchase orders and structured receipts. Networks and processors will see agent context and will authenticate accordingly.

From search pages to conversations

Shopping starts as intent in a sentence. An agent handles the tedious parts. Example: “Find a 20-ounce stoneware mug under 40 dollars that ships by Friday from a U.S. seller.” The agent fetches options, filters for price and timelines, checks return policies, and shows two or three candidates. If one supports Instant Checkout, the user taps Buy, confirms shipping and payment, and gets a receipt inside the chat. The merchant receives a standard order message, pays a small fee to the chat platform, and fulfills using existing systems.

Ranking in these new surfaces is not a bidding war. OpenAI states product results are organic and unsponsored, ranked first for relevance. The system can factor seller status, availability, price, quality, and whether Instant Checkout is enabled. That creates important incentives that look different from search engine optimization. Merchants who publish clean data, maintain inventory accuracy, price competitively, and enable the new checkout will rank better. Merchants who spam the agent with vague or duplicative listings will not.

A builder’s playbook for retailers and startups

Here is a practical plan you can execute this quarter without boiling the ocean.

- Pick your first rail and scope

- If you sell direct to consumer with Stripe already, start with ACP to enable Instant Checkout for single items. Keep the pilot in one category with tight inventory and predictable shipping.

- If you have a card-heavy audience and in-house risk teams, explore Mastercard Agent Pay or Visa Intelligent Commerce pilots to embed agent-aware tokens and add explicit agent context to authorizations.

- If you operate globally with diverse payment types or crypto adjacency, track AP2 and shortlist use cases where verifiable mandates create value, such as pre-approved replenishment or threshold-triggered buys.

- Make your catalog legible to agents

- Publish a structured product feed with canonical identifiers, price, tax class, stock status, shipping service levels, and return policy metadata. Include image alt text and concise feature bullets.

- Provide a seller-of-record record with legal name, support contacts, and policy URLs. Agents use this to verify that the merchant can stand behind a sale.

- Add granular availability windows and cutoffs. Agents need to promise ship-by times without human intervention.

- Wire payments and identity for agent context

- Use network tokenization or vaulted credentials behind the scenes. The agent should receive an agentic token or mandate, not the raw card.

- Limit scope by merchant, amount, and time. Cap spending and require biometric step-up for elevated risk signals.

- Attach a durable user identifier and agent identity to each order message. That creates traceability across support, reconciliation, and disputes.

- Ship with fraud controls tuned for agents

- Reject ambiguous orders. Agents should provide a complete item, price, quantity, and destination in one message.

- Set velocity limits per agent identity and per payment credential. Detect card testing and scripted retries.

- Use device and network signals when the user confirms a purchase in the chat client. Treat that as an authentication event and propagate it to your risk engine.

- Prepare for friendly fraud. Store the signed mandate and the per-item confirmation in your order record. That evidence will matter.

- Instrument attribution end to end

- Include campaign and query context in the agent’s purchase order message. Think of it like next-generation UTM parameters baked into the protocol.

- Fire server-to-server conversion events from your order system to your analytics and ads platforms. Do not rely on client-side pixels in a chat surface you do not control.

- Ask platform partners for impression and exposure counts at the agent result level. You need denominator metrics to judge ranking equity. For monitoring and governance patterns, see Agent observability control plane.

- Compete on ranking neutrality, not pay-to-play

- Optimize product data quality, inventory accuracy, landed price, and ship speed. Those are the stated inputs to organic ranking.

- Do not expect ads to carry the day. Even if sponsored placements appear later, poorly structured data will still depress organic results.

- Track your share of voice in agent responses the way you track search share today. Build a weekly report that shows queries, appearances, and wins.

- Prepare for support and disputes now

- Send structured receipts that include the agent identity, mandate hash, itemized contents, and seller of record.

- Expose a simple return flow. If you require a label request, make that agent-friendly so the chat can initiate a return without handoffs.

- For split shipments or bundles, emit separate fulfillment events with line-level mapping. That keeps the dispute flow clean.

- Organize for conversational merchandising

- Assign a product manager to agent surfaces. Treat it like a new storefront with its own analytics and content standards.

- Pair that PM with an engineer who owns the protocol integration and the data pipeline to your order management system.

- Pilot four scripts a week. For example, “under 50 dollars gifts,” “eco-friendly cleaning,” “size 8 hiking boots,” and “next-day delivery beauty.” Measure wins and iterate.

What this means for marketplaces and ad platforms

Marketplaces will face a trade-off. Participating in agentic rails increases reach, but it also risks shifting discovery to the agent surface, where the marketplace brand is less visible. Two practical responses are common. First, marketplaces can expose a high-quality feed to agents while requiring marketplace-level fulfillment guarantees to protect their reputation. Second, they can negotiate attribution rules that credit marketplace merchandising for conversions initiated in agent results.

Ad platforms will evolve toward conversation-level performance media. Sponsored answers and affiliate-like fees may appear, but platforms will have to disclose how ads interact with organic ranking signals that emphasize relevance and user value. Expect claims-focused regulation to follow. In the near term, the safest bet is to treat these surfaces as organic while they mature, and invest in measurement that does not depend on pixels or last-click heuristics.

6 to 12 month forecast

- Multi-item carts become available in major agent surfaces. Expect phased support. Single-merchant, single-warehouse carts first. Then split shipments with per-line fulfillment and tax calculations. Bundles and kits will require explicit structure so agents can explain what the user is buying.

- Agent identity tokens stabilize. Networks and processors will converge on a small set of fields that identify an agent at authorization. Merchants will see improved approval rates when those fields are present and signed. Consumer consent will tighten around reusable mandates with explicit limits.

- Dispute flows get clearer. Chargeback reason codes will add agent flags, and evidence sets will add mandate details and chat confirmations. That reduces gray-area cases where a user claims they never authorized a purchase.

- Marketplaces adapt their economics. Some commission models will shift toward lower take rates for agent-referred orders in exchange for guaranteed structured data, fast fulfillment, and low return rates.

- Ad products reposition. Expect pilot programs for conversation-level sponsorship that require side-by-side organic disclosure and cap the number of paid slots. Measurement will rely on server-side events and signed receipts rather than web cookies.

- Compliance and privacy frameworks harden. Expect guidance on age gating, sensitive categories, and explicit opt-in for autonomous repeat purchases. Merchants that over-automate without clear consent will face customer backlash and lost card trust.

What to do this quarter

- Enable a structured product feed with inventory, shipping windows, and return policies.

- Implement agent-friendly checkout for a single popular category using ACP. Do not boil the ocean.

- Turn on network tokens and prepare to attach agent context to authorizations.

- Build a dispute evidence pack that includes mandate details, chat confirmation, and itemized receipts.

- Stand up a weekly agent search share report. If you cannot measure appearances and wins, you cannot improve them.

- Draft an internal policy on agent-initiated purchases that defines caps, categories, and required approvals.

The bottom line

Shopping used to flow from ads and search boxes to product pages to a checkout form. Now intent emerges in a conversation, and checkout flows through a signed protocol. The companies moving fastest are not waiting for every standard to settle. They are publishing clean data, piloting one rail, and learning from real orders. The checkout has moved into the chat. The winners will meet it there with trustworthy rails, traceable receipts, and products that are easy for agents to understand.