Agentic Commerce Is Here: ChatGPT Checkout Meets Stripe

OpenAI turned chat into checkout on September 29, 2025. ChatGPT’s Instant Checkout is live with Etsy and coming to Shopify, while Stripe’s shared tokens show how agents pay safely. Here is what changes, why it matters, and how to prepare now.

The day chat turned into checkout

On September 29, 2025, OpenAI launched Instant Checkout inside ChatGPT for buyers in the United States. It works with Etsy today and Shopify is next in line. Shoppers can ask for a gift, pick an item, and finish the purchase without leaving the chat. OpenAI says the listings you see are not pay-to-play and that checkout availability does not influence discovery results. It does affect how ChatGPT chooses among merchants that sell the same item. You can read the official buyer guide that explains availability, rankings, and fees in plain language in this OpenAI help article: Instant Checkout details and ranking policy.

This is not just another shopping integration. It is a channel shift. The interface moved from pages and search results to dialogue, and that dialogue now ends in a completed order. The important change is not the button labeled Buy. It is the protocol that lets an agent act like a buyer while keeping payments safe and merchant systems in control. For standards context, see our note on the common language for enterprise agents.

From conversation to transaction

For a decade we optimized for search. People typed words into a box, landing pages competed for attention, and the best page that matched intent usually won. In chat, intent is expressed in full sentences and context. The agent collects preferences, compares options, and guides the buyer. The result is still a cart and a payment, but the path is different. There is no redirect, no tab switching, and no checkout page to abandon.

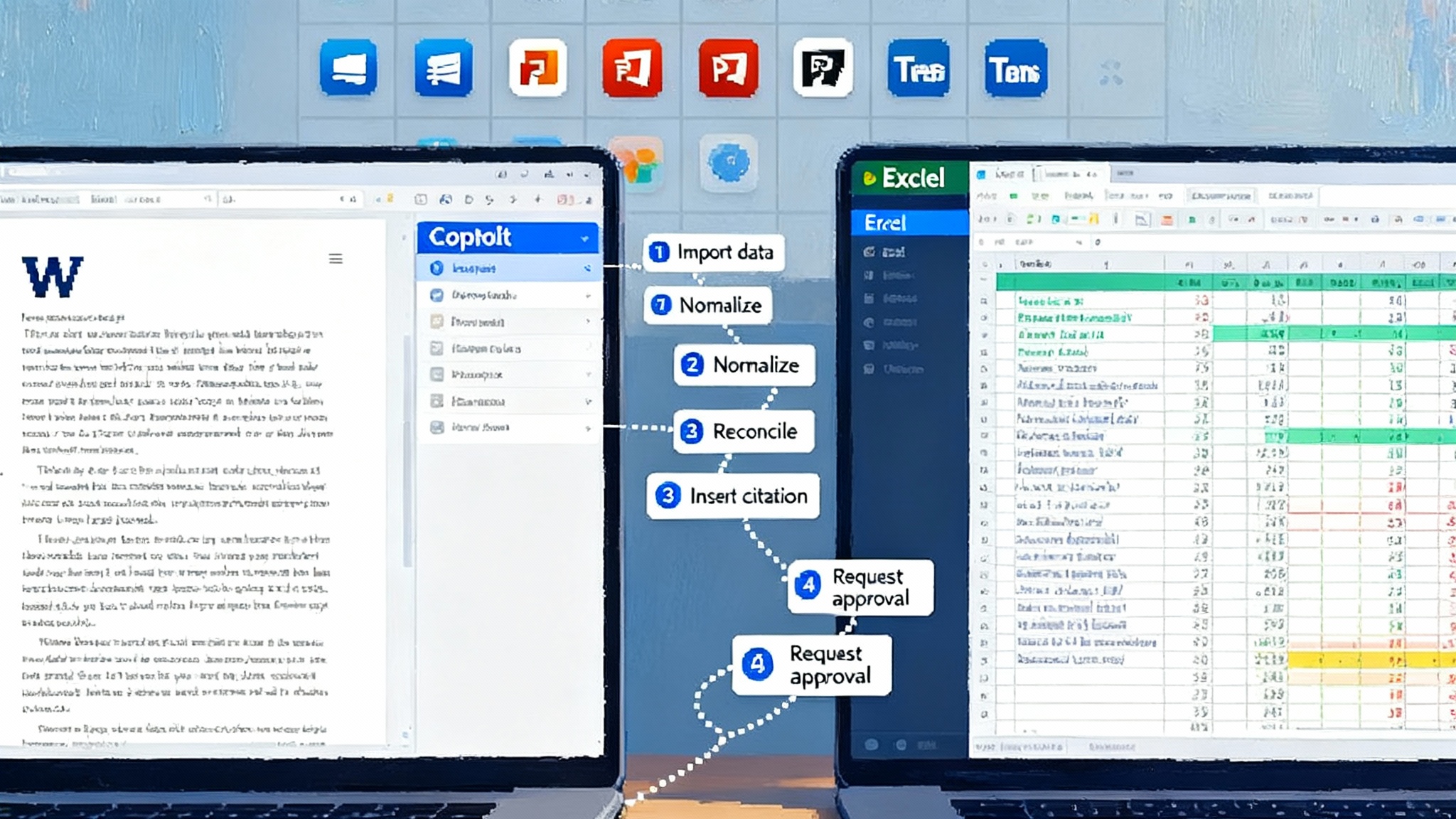

OpenAI calls this approach the Agentic Commerce Protocol. In practice, the protocol has three pieces that matter to merchants:

- An agent-readable product feed that ChatGPT can index and rank for shopping queries.

- Checkout endpoints that let ChatGPT create, update, and complete a merchant-owned order.

- A delegated payment handoff that allows the agent to pay on the buyer’s behalf without exposing raw card data to anyone new.

Together they turn a chat into a transaction on your rails. The buyer talks to ChatGPT, you still make the sale, and you still handle shipping, returns, refunds, and chargebacks with your payment service provider.

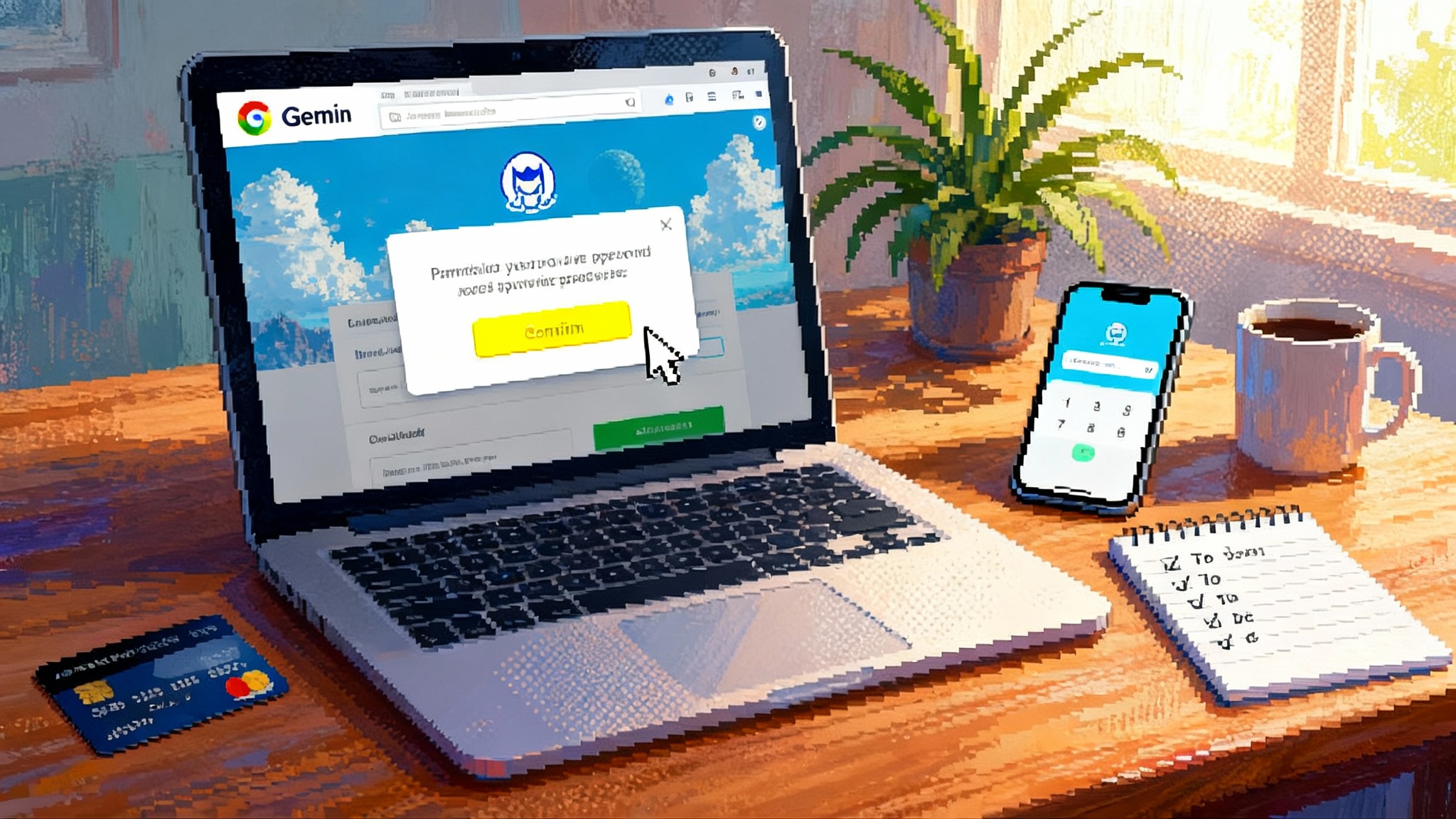

How agents pay without handing over your card

If you have ever used a valet key that unlocks the car but caps the speed, you already understand delegated payments. Instead of sharing a full card, the buyer authorizes the agent to mint a one-time, tightly constrained credential for a specific seller and amount. That credential cannot be reused outside its scope, so it is safer for the buyer and cleaner for the merchant’s risk controls.

Stripe’s implementation is called a Shared Payment Token. The agent stores a buyer’s payment method in its own Stripe account, then issues a token that is scoped to the seller, set to a maximum amount, and set to expire. The token never contains the primary account number or other raw credentials. The merchant processes the payment on their usual stack by creating a PaymentIntent with the token, receives webhooks just like a normal order, and keeps settlement and refunds under their existing policies. Read Stripe’s official explanation of token scope and usage limits here: Shared Payment Tokens for agents.

Security is not just tokenization. The protocol layers on constraints the buyer and agent can set, like currency, amount ceilings, and time windows. The token is bound to the seller’s identity, so it cannot be replayed somewhere else. If something looks off, the agent can revoke the token before it is used. For merchants, that means you can honor an in-chat checkout without punching holes in your PCI posture or changing how you reconcile.

The net effect: you get the conversion lift of a one-click flow, keep your own merchant of record status, and inherit fewer credential-stuffing headaches because the credentials are never exposed as reusable data on your systems.

Ranking neutrality and the new marketplace physics

OpenAI’s stated policy is simple to say and complex to implement. Instant Checkout items do not get special treatment in discovery results. Once the buyer has chosen a specific item, ChatGPT may rank which merchant to buy from based on inventory, price, seller quality, and whether Instant Checkout is enabled. That last signal matters. It tilts the competitive field in the moment of purchase.

Think of it like a rideshare app that lists drivers by proximity and rating but also prefers drivers who have already accepted the ride. Is that fair? Maybe. It is also understandable. A smoother checkout shortens the path to fulfillment, reduces drop-off, and aligns with what the buyer wants. The takeaway for merchants: treat checkout readiness as a ranking signal in the final mile and prepare your catalog and endpoints accordingly.

In marketplaces like Etsy, where many sellers offer similar goods, this will change sell-through patterns. Being in stock and price competitive still matters. So does having agent-ready checkout. If two merchants are tied on product attributes, the one that can complete the order in-chat is now more likely to win the transaction.

ACO is the new SEO

Agentic Commerce Optimization, or ACO, asks you to do three things well:

1) Structure your product data for agents

- Provide a complete product feed with strong identifiers, variant clarity, and accurate availability. Use canonical titles, precise attributes, and consistent units. Include shipping methods and delivery estimates so the agent can answer the buyer’s timing questions without guessing.

- Treat descriptions as machine-readable first. Put key facts in fields, not prose. If size, material, or compatibility are critical, make them explicit attributes.

- Keep feeds fresh. Rapid updates reduce out-of-stock frustration and price mismatches that cause the agent to fall back to a link-out instead of Instant Checkout.

2) Expose a robust checkout interface

- Implement the required endpoints to create, update, and complete a checkout session. Always return a full authoritative cart state. The agent will retry on network hiccups and expects idempotent responses.

- Publish order lifecycle events via webhooks so the chat stays in sync. If shipping options change after an address update, reflect it immediately.

- Keep payments on your rails. If you adopt delegated payments, accept the token and run your normal authorization and capture policies.

3) Align operations to agent-led purchases

- Ensure customer service can look up orders created by the agent, match email identifiers, and handle returns as if they came from your site. The buyer will reach out to you, not to OpenAI, for help.

- Adjust fraud playbooks to the agent context. The buyer is not on your site, so device fingerprinting may be weaker. Lean on token constraints, email verification, shipping address validation, and behavioral signals like velocity across accounts.

Near-term plays that pay off fast

Here are concrete steps a merchant or brand can take this quarter.

-

Catalog structuring

- Normalize titles and variants so the agent can match shopper intent to exact SKUs. Add alternate names and compatibility tags where shoppers might use brand or colloquial terms.

- Provide complete shipping matrices. Faster delivery wins when buyers ask for gifts needed this week.

- Enrich with trust signals that agents can parse. Return windows, warranty length, and verified review counts can all be fields, not paragraphs.

-

Risk controls tuned to agent flows

- Set velocity and amount limits for delegated tokens on your side, even if the agent sets its own. Add rules for high-risk categories, virtual goods, and cross-border shipments.

- Use allow lists for fulfillment addresses that often recur in your business and add friction for one-off addresses on high value orders.

- Monitor agent-led chargeback rates separately from site-led sales so you can tune authentication and step-up rules without hurting web conversions.

-

Attribution and measurement

- Attach metadata to orders created by the agent so analytics can attribute revenue to the channel. Use consistent source and campaign values in your order objects.

- Compare conversion and return rates for agent-led versus web-led orders. If agent returns are lower, shift more catalog into Instant Checkout eligibility.

- Share a minimal set of performance signals back to partners when available, such as stockouts or cancel reasons, to improve ranking and recommendations.

Competitive implications for Amazon and Google

Amazon owns high intent product searches and the fastest checkout for many buyers. Google surfaces options and monetizes clicks through shopping ads. Agentic commerce threatens both models in two ways.

First, the interface collapses. Buyers ask for what they want. The agent compares across merchants, then finishes the order without a redirect. There is no search results page to monetize and fewer opportunities for paid placements. Second, the agent can arbitrage fulfillment by mixing merchants. If a bundle requires components from different stores, the agent can build it and issue multiple delegated payments behind the scenes. Cost dynamics are shifting too; see how new models flip the cost curve for long-context agents.

Amazon will not sit still. Expect it to push harder on Prime benefits, reliability guarantees, and maybe its own agent that stays inside the Amazon ecosystem. Google will double down on product feeds, structured data, and integrations into its own conversational products. The battleground will be which agent has the highest quality catalog coverage, the most reliable checkout endpoints, and the clearest policy enforcement.

What happens next: multi-item carts and repeat agents

Today’s rollout handles single item purchases. Multi-item carts are the obvious next step, and they change the economics. The agent can build a cart from one merchant or orchestrate a bundle across sellers, optimizing for total cost, shipping speed, and returns simplicity. Merchants that expose accurate combined shipping and discounts will win here.

Autonomous repeat-purchase agents will be the next frontier. Think restocking coffee pods, pet food, printer ink, and household essentials. The buyer sets preferences and budgets. The agent watches consumption patterns in the background, checks price and availability, and reorders within approved constraints. This is different from a subscription. It is dynamic replenishment that can change merchant choice when stockouts or prices shift.

For brands, this means two things. First, loyalty has to be machine-readable. Offer repeat benefits that the agent can parse and apply, like automatic discounts after the third purchase or free returns on replenishments. Second, reduce the number of reasons the agent would switch the buyer to another seller. That means stable stock, predictable shipping, and clear guarantees that help the agent justify sticking with you.

What to build this quarter

A practical roadmap for an engineering and operations team:

-

Product feed

- Export a complete feed with identifiers, variant attributes, availability, price, media, shipping options, and policy links. Validate daily, update at least every 15 minutes for fast-movers.

- Map synonyms and compatibility. If your product works with specific devices or sizes, make that a field.

-

Checkout endpoints

- Implement create, update, and complete endpoints that return an authoritative cart state on every call. Support idempotency and retries.

- Emit order webhooks for state changes. Ensure support teams can search by the order identifier returned to the agent.

-

Delegated payments

- If you use Stripe, enable processing of Shared Payment Tokens and bind them to your existing authorization and capture logic. Keep your risk rules and refunds unchanged, but track this channel separately.

- If you use another payment service provider, evaluate support for OpenAI’s delegated payment spec or plan to add it.

-

Measurement and control

- Tag agent-led orders for analytics. Compare conversion, fulfillment time, and return rates to your web and marketplace channels.

- Build a simple health dashboard for feed freshness, endpoint uptime, webhook delivery, and payment success. Agents are ruthless about fallback. If your endpoints fail, the agent will link out to your site and you lose the benefit. For org-grade operations, see how to run governed agent workloads on Azure.

The bigger shift

When browsers arrived, merchants learned to build pages. When search engines dominated, they learned to structure content for crawlers. Now that agents can buy, merchants must build for machine customers. The work is familiar in spirit. Clean data. Reliable endpoints. Simple payments. The difference is where the decision gets made, and by whom. It is moving inside a trusted assistant that makes the short list, asks a few clarifying questions, and then buys.

This shift rewards operational truth. If your feed is accurate, your checkout is resilient, and your payment flow is agent friendly, you will win the final mile. If not, the agent will route around you. The good news is that the technology favors merchants who already run a tight ship. The better news is that you can start now. Structure your catalog, expose checkout, and accept delegated payments. The next time a buyer asks for the perfect gift in a chat, your product can be the one that gets bought in a single reply.