Cheap Interceptors Flip C-UAS: Roadrunner and Coyote

After the Pentagon’s 2025 buys and first deployments, reusable and expendable interceptors are breaking the counter-drone cost curve. See what is fielded now, how the stacks are changing, and what comes next.

Breaking: cheap interceptors reset the counter-drone math

For two years, sailors and soldiers have been using million-dollar missiles to swat quadcopters that cost a used car. That equation finally shifted in 2025. The Pentagon funded two families of purpose-built drone killers, and early fielding followed fast. Raytheon’s Coyote teamed with KuRFS radar is now locked in for the long haul with a 5.04 billion Coyote contract. And Anduril’s jet-powered Roadrunner, including a high-explosive variant, moved from splashy demos to bulk purchases and operational tasking.

The core idea is simple. Instead of burning a cruise-missile budget to kill a camera drone, use a small interceptor that is cheap enough to buy by the pallet and fast enough to catch nimble targets. Think of it like shifting from bespoke arrows to a box of buckshot, except the buckshot is guided and networked. The result is a cost-per-kill that trends down, magazine depth that trends up, and a defendable base or ship that can ride out hours of harassment rather than minutes.

The throughline is not just money. It is speed. The services have learned that counter-UAS cycles move on consumer electronics time, not fighter-jet time. That is why open command-and-control, software-defined sensors, and swappable effectors are now must-haves rather than nice-to-haves. This mirrors the services’ broader move toward AI target fusion on wheels.

What changed in 2025

Three converging moves set the new baseline.

- Long-duration procurement. The U.S. Army’s multi-year Coyote and KuRFS buy gave the services a predictable supply of interceptors and sensors through the early 2030s. Stable orders let factories hire, tool up, and hold prices down.

- Bulk buys for reusable interceptors. The Department of Defense moved ahead with hundreds of Roadrunner rounds and associated electronic warfare kits, which let commanders mix kinetic and non-kinetic effects instead of defaulting to guns or missiles for every shot.

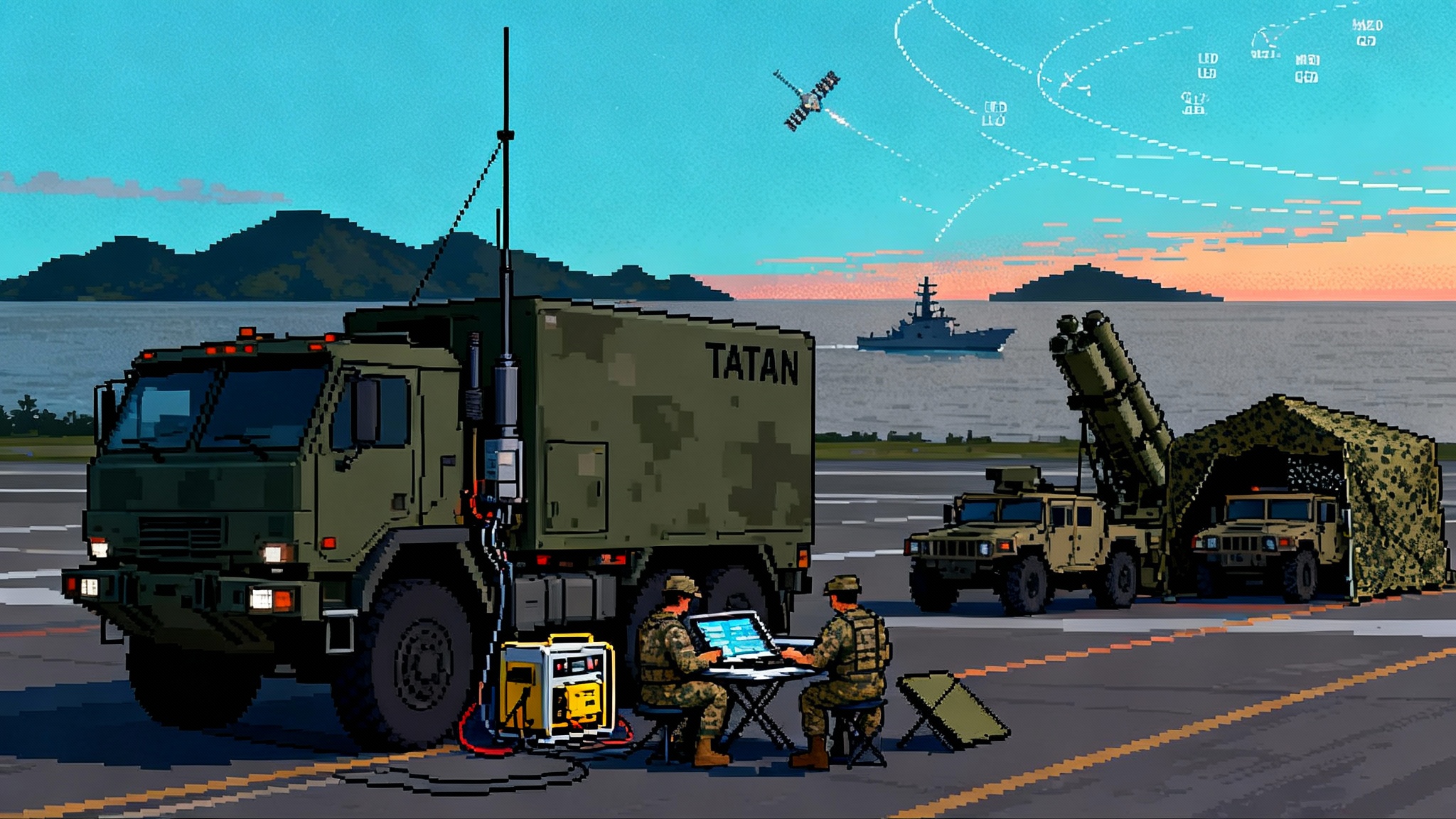

- First deployments to real bases and fleets. Fixed-site Low, slow, small, unmanned aircraft Integrated Defeat System batteries, mobile two-vehicle LIDS teams, and installation defense packages for the Marine Corps all went operational. Meanwhile, surface combatants began testing lower-cost shipboard counter-drone options to replace the habit of burning expensive surface-to-air interceptors on hobby-class threats.

What is actually fielded now

Here is the current picture, stripped of buzzwords and narrowed to what crews can use today.

- Coyote Block 2 kinetic interceptors. Jet-powered, radar-guided, proximity-fuzed interceptors launched from palletized or vehicle-mounted tubes. Designed to kill single drones or small salvos at tactically useful ranges. Many batteries keep them as the inner ring behind jammers and guns.

- Ku-band Radio Frequency System radar. KuRFS is the rotating wide-area radar that cues Coyote and helps sort birds, balloons, decoys, and drones in clutter. Its job is to find small cross-section objects early enough to give the interceptor a clean look.

- FAAD C2 and compatible stacks. Forward Area Air Defense Command and Control stitches the picture together across radars, optical trackers, electronic warfare tools, and launchers. It is the traffic cop that turns tracks into effects, whether the effect is a jammer, a gun burst, or a Coyote shot. Units like it because new sensors slot in without rewriting the whole playbook.

- Fixed-site LIDS. Palletized KuRFS, cameras, jammers, and a four-tube Coyote launcher built to protect airfields, depots, and ports. These kits sit on pads and can be packed up quickly if the unit moves.

- Mobile LIDS. Two tactical vehicles that hunt together. One carries extra sensors and electronic warfare. The other mounts a two-round Coyote launcher and a 30 mm cannon. Together they protect convoys, refueling points, and forward arming sites.

- Roadrunner and Roadrunner-M. Anduril’s twin-jet, vertical-takeoff interceptor comes in a reusable test and training configuration and a high-explosive variant intended for hard kills. It takes cues from a mix of radars and cameras, then climbs and dashes to intercept. Because it can launch vertically and sprint, units can employ it from cramped sites where trailer launchers struggle.

- Installation counter-drone packages for bases. The Marine Corps program of record stands up persistent defense at major installations. These stacks mix radar, radio frequency detection, cameras, and effectors, all tied together by software that helps a small watch team manage many small events.

Under the hood, two shifts matter. First, tactical crews now expect to see automated track classification and shot recommendations on their displays. The system tells the team not just what is in the air, but what to do first. Second, units are provisioning power, networking, and mast space for growth because every quarter brings a new sensor or effector worth integrating.

How the stacks are evolving

The 2023 to 2025 generation was about proving that a low-cost interceptor plus a good radar solves the immediate pain. The 2026 to 2028 generation is about scale, automation, and the ocean.

- Deeper magazines by design. Batteries are reconfiguring for density. A single pallet that used to hold four interceptors now sits next to an auxiliary pallet with eight or more. Roadrunner batteries emphasize rapid reload and re-arming workflows so crews can keep launch cells full. The goal is to outlast a noisy two-hour window, not a five-minute pop-up.

- Mixed effects, not single tricks. Crews are learning to pair a blinding radio frequency effect that forces a drone into a predictable path with a timed interceptor shot. That wastes fewer rounds and lowers the cost per kill without letting leakers slip through, including emerging directed-energy options tracked in HPM weapons move to fielding.

- Autonomy in the loop, not over it. Commanders want human judgment to stay in charge, but they also want automation to do the boring math. The hunt is for software that fuses multiple radars, radio frequency sniffers, and cameras into a single track file, then proposes the cheapest reliable way to end the flight.

- Open architecture as logistics. FAAD-style command and control and Anduril’s software approach both emphasize drop-in adapters. When a battalion receives a new electro-optical sensor, the crew should cable it, power it, and see it on the board that day. That reduces the cost of innovation more than any single new sensor or missile can.

The shipboard shift

Ships have the hardest cost curve of all. In the Red Sea and elsewhere, destroyers have used high-end interceptors against low-end threats because that was what was bolted to the deck. Surface Navy leaders responded by accelerating tests of lower-cost counter-drone options for destroyers and littoral ships, including palletized launchers, improved radio frequency effects, and software that prioritizes cheap shots first. The Navy’s message to crews is clear. If a threat can be jammed or downed by a small interceptor, do that before you touch the vertical launcher. On the laser side, cost-per-shot trends from Iron Beam’s 2025 debut foreshadow similar calculus at sea.

The near-term play is pragmatic. Fit a palletized counter-drone kit where you can, pipe its tracks into the combat system, and write tactics that place interceptors and jammers at the front of the firing sequence. The follow-on play is maritime LIDS for pier security, expeditionary logistics nodes, and tenders. Those kits show up with their own power and networking, talk to shipboard systems, and clear the air around the hull without eating combat-system bandwidth.

Why the cost curve finally bent

You can understand the change using three numbers.

- Cost per shot. A small kinetic interceptor costs a fraction of a high-end surface-to-air round. Even if you fire several per event, the math stays favorable.

- Reload time. A palletized launcher or a vertical-takeoff reusable interceptor can be refilled by a small crew. Keeping the launcher fed is part of the daily routine, not a depot event.

- Engagement density. KuRFS-class radars with good command and control let one battery handle many tracks in succession, which turns a saturation attack back into a sequence of solvable problems. Throughput matters as much as range.

Put together, that turns a base or ship from a brittle glass cover into a shock absorber that soaks up pressure without cracking.

What to expect in 2026 to 2028

- AI cueing becomes table stakes. Expect watch floors that look more like air traffic control than arcade games. The software will fuse radio frequency, radar, and optical tracks, auto-associate decoys, and offer shot solutions in order of least cost and highest probability. Humans will confirm and fire, but the machine will do the stacking and sorting.

- Maritime LIDS becomes a standard kit. Expeditionary pier defense, ship-to-shore connectors, and logistics ships will carry compact counter-drone pallets that run on their own power and network into the host ship. That lets the big combat system focus on missiles while the pallet handles buzzing drones and one-way attack aircraft.

- Export races heat up. Allies that face daily drone harassment will move fast. Expect a split market. Some will buy full U.S. stacks tied to FAAD C2 and KuRFS. Others will mix local jammers with imported interceptors to control costs and localize sustainment. Interoperability at the command-and-control level will decide who can fight together.

- Reusability matures. Non-kinetic Coyote configurations and reusable Roadrunner operations will become routine. Units will treat interceptors more like aircraft sorties than single-use munitions, with maintenance, inspection, and turnaround standards that preserve reliability without wasting time.

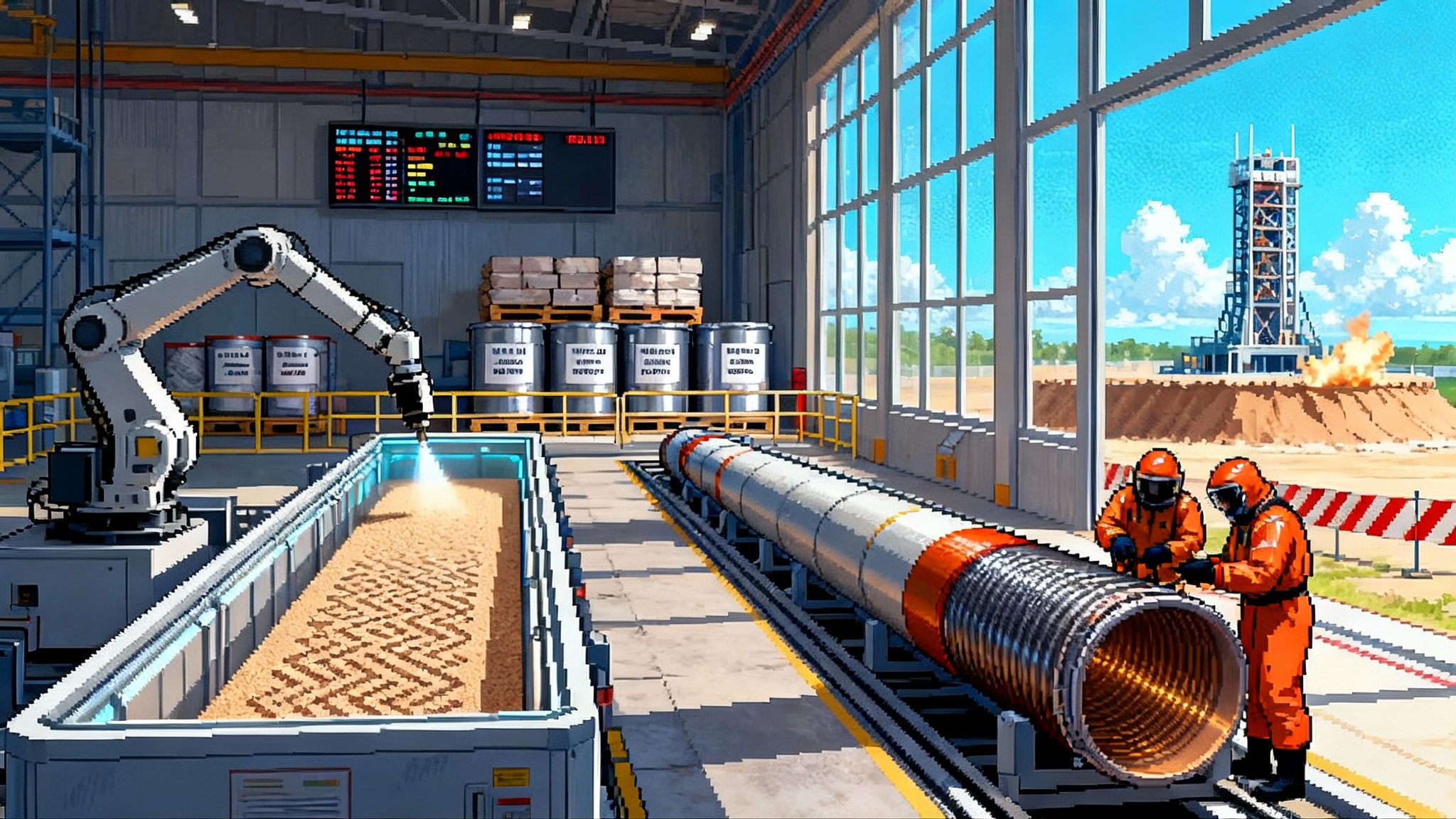

- Industrial scale shows up. Anduril’s domestic scaling plan includes Ohio Arsenal 1 megafactory output beginning in 2026, and traditional primes are adding lines for Ku-band sensors and interceptors. The next bottleneck will be skilled technicians and critical subcomponents, not floor space.

Risks the Pentagon must still solve

- Electronic warfare hardening. Interceptors and seekers need better resistance to noisy spectrum, deceptive jammers, and spoofed navigation. The answer ranges from multi-band seekers and optical backups to tighter command-link discipline and spectrum monitoring. Programs should budget now for mid-life seeker refreshes.

- Decoy saturation. Adversaries are learning to pad their salvos with cheap foam and foil to waste your magazine. The fix is smarter track association, better classification, and layered effects that do not spend a kinetic shot on a decoy. If the radar is unsure, force the track into a gate with a jammer, then commit a shot when the behavior confirms a real target.

- Supply chain scaling. Interceptor engines, compact warheads, seekers, and Ku-band transmit-receive modules are all pinch points. Programs should dual-source critical components, pre-fund long-lead parts, and keep a rolling six-month stock of consumables. This is a place where multiyear buys actually matter.

- Training for tempo. A good battery can shoot itself dry in an hour if the crew is not disciplined about shot doctrine. Units need drills that rehearse the full cycle: detect, decide, jam, shoot, reload, and hand off across sectors. Magazine management is a skill, not a spreadsheet entry.

- Policy and airspace. Base defense teams are more effective when they can kill at the edge of the fence, not over the runway. Rules of engagement, domestic airspace coordination, and data sharing with local authorities must be worked out before an event, not during one.

A buyer’s checklist for 2026 budgets

- Insist on open command and control. If a vendor cannot show a new sensor integrated in hours, not weeks, keep looking.

- Buy mixed effects as a package. One palletized jammer plus one kinetic launcher beats two of either alone. Require a playbook that sequences them for minimum cost per kill.

- Budget for magazines and reload gear. A launcher without a reload trailer and crew training is a sculpture.

- Fund seeker upgrades on purpose. Assume your seekers get worse every year as the enemy learns. Refresh them on a scheduled cycle.

- Measure cost per defended hour, not cost per round. The mission is to keep the base open and the ship sailing, not to win a single intercept video.

What all this means

We are watching a once-in-a-generation shift in air defense. In the last decade, small drones made traditional systems look clumsy and expensive. In 2025, cheap interceptors, smarter radars, and open command and control caught up. The next three years will decide whether that progress hardens into a durable advantage at sea and ashore.

If the services keep buying at scale, keep software open, and train for tempo, then Roadrunner and Coyote will do more than plug a gap. They will change the rhythm of modern defense. Bases will stay open under pressure. Ships will stop burning million-dollar shots on hundred-dollar targets. And operators will spend less time juggling screens and more time running the fight.

The breakthrough is not a single missile or a single radar. It is a new pattern. Build defenses that are cheap to shoot, quick to reload, and smart enough to choose the least expensive option that works. That is how you win a long game against a cheap and creative adversary.