GLP-1s at the 2025 inflection: from weight loss to healthspan

Outcomes data and payer shifts have turned GLP-1s into a population health tool. Here is the biology, the care models, and the metrics that turn pounds into years lived better.

2025 is the turn

Every major medical shift has an inflection point where headlines become standard care. For GLP-1s, 2025 is that point.

Two converging forces

- Outcomes: In adults with obesity and established cardiovascular disease, the NEJM SELECT trial showed roughly a 20 percent reduction in major adverse cardiovascular events without requiring diabetes. That reframed obesity treatment as secondary prevention.

- Coverage: Medicare Part D formularies can cover semaglutide for cardiovascular risk reduction in eligible patients, and large reinsurers are modeling the population impact. A widely cited scenario from Reuters on Swiss Re suggests broad uptake could cut U.S. mortality by several percentage points over time Swiss Re mortality forecast.

Smart readers will recognize a familiar pattern from other longevity-adjacent turns, like when senolytics reach the clinic.

Why GLP-1s look like healthspan drugs

GLP-1 receptor agonists and newer GIP/GLP-1 co-agonists started as glucose drugs, then became weight loss drugs. The healthspan case rests on biology that goes beyond the bathroom scale:

- Inflammation dampening: Lower inflammatory cytokines, improved endothelial function, and more stable plaque.

- Ectopic fat clearance: Reductions in liver, visceral, epicardial, and perivascular fat improve insulin sensitivity and vascular mechanics.

- Cardiometabolic remodeling: Lower triglycerides, often lower ApoB, better blood pressure, and improved endothelial function. In HFpEF, incretin therapy has delivered fewer worsening events and better quality of life.

- Kidney signal: Slower albuminuria rise and eGFR decline in high risk patients, especially when paired with SGLT2 inhibitors.

Put simply, less inflammatory noise, less fat where it hurts, and an organ system remodel toward metabolic calm.

What the real world implies for mortality and quality of life

Trials ask narrow questions but point to broader gains. SELECT supports treating obesity as secondary prevention, and clinics report fewer urgent heart failure visits and better day to day capacity. The arc mirrors statins and SGLT2 inhibitors: fewer admissions first, then fewer events, then mortality effects with time.

A caution matters. Healthspan is not only about avoiding death. It is about preserving strength, stamina, and capacity to work and care for others. Pair GLP-1s with resistance training and adequate protein so weight loss does not cost muscle.

Payers move from trend to strategy

Insurers spent 2023 and 2024 trying to dam demand. In 2025 the math changed. When a drug lowers heart attacks and strokes, coverage shifts from lifestyle support to prevention. Expect three design moves:

- Risk gated coverage: Priority access for members with ASCVD, HFpEF, CKD, obstructive sleep apnea, or BMI thresholds plus multiple risks.

- Outcomes based contracts: Rebates tied to persistence, A1c or blood pressure response, and reduced inpatient utilization, with employers seeking a share of those terms.

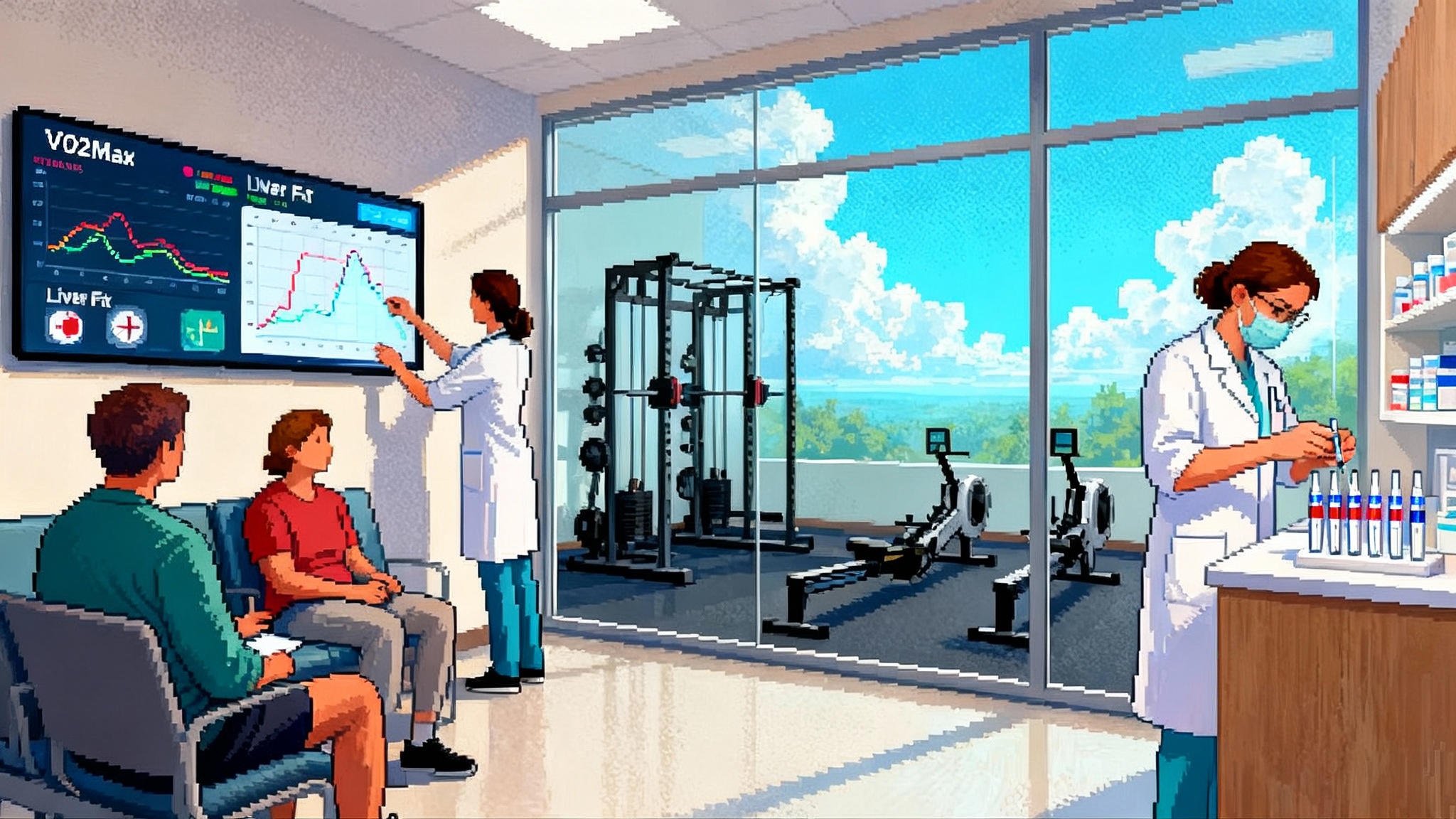

- Integrated programs: Medication plus coaching plus monitoring. Twelve months of therapy paired with strength programming, nutrition, and digital follow up to preserve lean mass and adherence.

The smart stack: combinations that preserve function

- GLP-1 or GIP/GLP-1 plus SGLT2 inhibitor: The cardiometabolic keystone for type 2 diabetes, CKD, or heart failure risk.

- GLP-1 plus resistance training: Two to three weekly sessions, progressive overload for major muscle groups, and roughly 1.2 to 1.6 g protein per kg of goal body weight unless contraindicated. Consider creatine when appropriate.

- GLP-1 plus metabolic liver agents: FGF21 analogs and THR beta agonists are advancing for metabolic liver disease. Expect combination protocols once approved in clinics that manage liver fat as a cardiovascular risk factor.

Clinical rule: Protect muscle, protect mitochondria, protect organs.

Unknowns that still matter

- Lean mass and bone: Guard against losses with programmed resistance work, protein targets, vitamin D and calcium adequacy, and periodic strength and DEXA checks.

- Micronutrients: Monitor iron, B12, folate, vitamin D, and in some cases thiamine and zinc. Supplement deliberately.

- Gallbladder and GI tolerance: Titrate slowly, manage nausea, and watch for gallstones in high risk patients.

- Adherence and cycling: Many stop within a year and regain risk. Design maintenance dosing, off ramps, and re induction rules.

- Long horizon safety: Personalize for cognition, pancreas, and thyroid risk groups as long duration data mature.

Supply, cost, and access in 2025

Manufacturing is catching up, but some pen strengths still cycle through shortages. Coverage is broadening for high risk groups in commercial plans and public programs when the indication is cardiovascular risk reduction. Medicare Part D introduces an annual cap and payment smoothing in 2025, which can improve persistence for seniors.

Equity needs more than coverage. Rural members need injection training, side effect support, and strength options. Medicaid members benefit from streamlined prior authorization and access to community strength programs. Avoid compounded versions unless sourced from a reputable 503B facility and local supply of approved products is truly inadequate.

What to measure beyond the scale

If the goal is longevity rather than thinness, the dashboard must change. Tie access to function, not just weight.

- Cardiorespiratory fitness: VO2max when feasible, or a Cooper test or submaximal cycle estimate every 3 to 6 months.

- Strength and function: Grip strength, five repetition sit to stand, and estimated one rep max for compounds if the patient trains.

- Liver and ectopic fat: MRI PDFF where available, or ultrasound CAP; waist circumference and DEXA for visceral proxy when budget allows.

- Inflammation and lipoproteins: hs CRP, ApoB, triglycerides, HDL, non HDL cholesterol. If ApoB is high, investigate even if LDL looks fine. See how the UK Biobank proteome project is reshaping targets, and how the FDA LDT rollback reshapes biomarkers affects real world measurement.

- Glycemic tone: A1c, fasting insulin, and an OGTT in high risk or athletic patients with deceptively normal A1c.

- Blood pressure and heart rate: Ambulatory monitoring when possible. Resting heart rate should fall with improved fitness and weight loss.

- Kidney risk: eGFR and urine albumin to creatinine ratio for diabetes, hypertension, or family history.

- Sleep and recovery: Simple apnea screens and actigraphy or wearable derived sleep efficiency where feasible.

A playbook for employers and plans

- Segment your population: Start with ASCVD, HFpEF, CKD, or high liver fat. Event reduction and near term ROI are strongest there.

- Pair meds with programs: Contract for resistance training and nutrition support, not just tele coaching. Make protein and creatine eligible HSA expenses with clinical sign off.

- Define persistence and exit rules: Monthly tolerability and adherence checks. Continue if fitness, liver fat, or other risk markers improve alongside weight.

- Measure quarterly: Admissions for MI, stroke, heart failure, and acute kidney injury, plus ER cardiac or renal visits. Track statin and antihypertensive adherence.

- Consider outcomes based contracts: Rebates tied to persistence and reduced inpatient utilization, not only pharmacy volume.

The near future of combinations

Expect more oral incretins and small molecules that help adherence, and combination incretins plus liver targeted agents in clinics that treat fatty liver as a cardiovascular risk factor. Protocols will look less like weight loss programs and more like cardiometabolic remodeling with explicit fitness and liver targets.

The bottom line

GLP-1s crossed a line in 2025. With credible outcomes in people without diabetes and payer models that treat them as risk reduction tools, they are moving from weight loss meds to population health instruments. Translate pounds lost into capacity gained by pairing drugs with strength training, tracking the right biomarkers, and designing benefits around persistence and function.