Agents That Can Spend Arrive: ChatGPT Checkout and UPI

OpenAI added a Buy button inside ChatGPT and India launched a UPI pilot that lets the assistant complete payments. Here is how agentic checkout works, why it will scale first, and what retailers should do in the next 90 days.

The week agents learned to pay

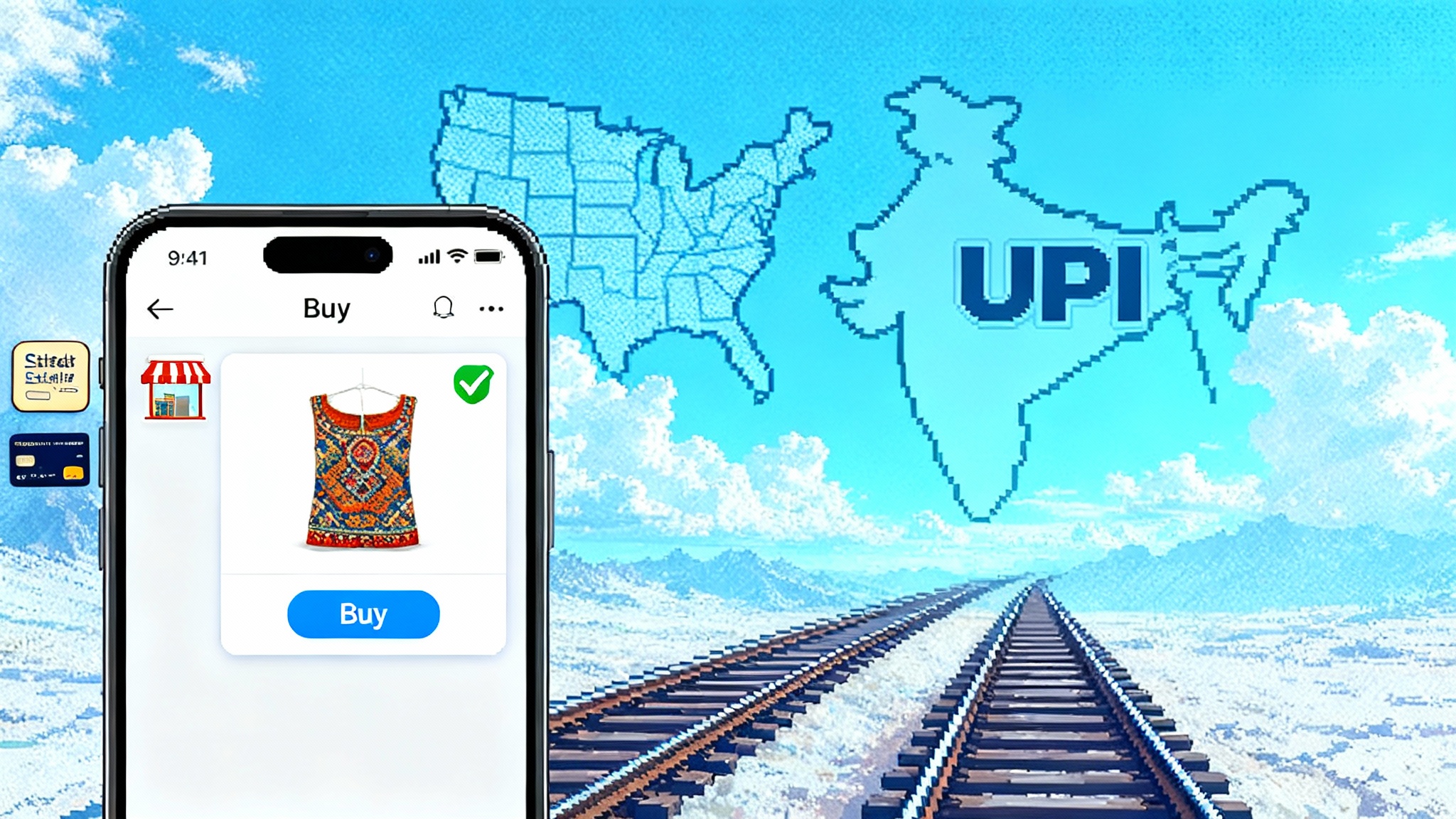

A quiet shift turned loud across commerce this fall. On September 29, 2025, OpenAI introduced Instant Checkout inside ChatGPT and a new Agentic Commerce Protocol built with Stripe. It is the first time a mainstream assistant can take you from search to purchase without sending you away to a website or app. U.S. users can already buy eligible Etsy items in chat, with a broader Shopify rollout on deck. OpenAI Instant Checkout details set the tone: agents are moving from helpful to transactional. For broader context on this shift, see our ChatGPT work takeover analysis.

Ten days later, India started a national pilot to let people shop and pay through ChatGPT using the Unified Payments Interface, the real-time bank transfer system that moves more than twenty billion transactions a month. The National Payments Corporation of India and Razorpay are running the pilot with Axis Bank, Airtel Payments Bank, and Bigbasket as early partners. The point is not novelty. It is to test how a user can safely let an assistant complete a purchase end to end on their behalf. Reuters on India’s pilot captured the scale and intent.

Two different rails. The same idea. Agents that can spend are no longer a demo. They are live.

What changed on September 29 and October 9

Before these launches, assistants were tour guides. They could recommend sneakers, compare coffee grinders, or find a flight, but the last mile still lived on a merchant site, a super app, or a separate wallet. That meant context switching, repetitive identity checks, and the familiar maze of fields at checkout.

Instant Checkout removes that last mile inside ChatGPT for supported products. The assistant keeps your shopping intent, shows an item, and presents a Buy button. You confirm and you are done. No new tabs. No brittle redirects. The protocol behind it describes how an agent and a merchant exchange the basics needed to complete a sale, like item details, price, shipping choices, taxes, and an authorization to charge a tokenized payment method.

In India’s pilot, ChatGPT becomes a trusted delegate on UPI. The flow is still consented by the user, but the assistant can carry the transaction to completion without forcing a hop to a separate UPI app for every small step. In both cases the human stays in charge of what to buy and how much to spend, yet the machine is finally allowed to move the cart.

Why spending agents will cross the chasm first

Most people do not need a robot lawyer or a lab-grade code cofounder every day. Everyone needs to buy things. That makes commerce an ideal beachhead for agent adoption. The value proposition is simple and immediate.

- Lower friction: Removing hops removes dropoff. If a chat can go from “find a black crewneck, under 80 dollars, ship by Friday” to “buy the Hanes medium, deliver to work,” conversion rises.

- Clear utility loop: Each purchase teaches the agent your sizes, preferred brands, shipping addresses, and spending boundaries. That memory compounds into better recommendations and fewer corrections.

- Routine tasks: Refills, reorders, and small household purchases are perfect for agentic flow. Think water filters, pet food, or school supplies. There is no creativity tax, only a time tax that automation can pay down.

- Trust anchor: Payments force rigor. An agent that can safely take money out of your account is an agent you will use for other tasks. Commerce becomes the trust on-ramp for broader delegation. For reliability context, see our take on agent reliability benchmarks.

Consent-first flows, in plain English

Letting software spend money demands new rules of engagement. Consent-first is the backbone. It works like this.

- Step one: Establish the relationship. You tell the agent who you are, where to ship, and what methods you allow it to use to pay. None of this requires storing your raw card details inside the assistant. Instead, a payments partner holds the sensitive information and issues a token the agent can use.

- Step two: Set the guardrails up front. You define spending limits, categories, and merchants you trust. For example, allow up to 200 dollars per week for household essentials, cap any single order at 75 dollars, and allow only merchants that ship within two days.

- Step three: Grant narrow, specific permission. When the agent proposes a purchase, you approve the transaction scope, like item A for 59 dollars, shipping option B, deliver Tuesday. If you have pre-authorized small purchases within a budget, the agent can complete those without interrupting you.

- Step four: Keep a receipt trail you can actually read. Every agentic order must leave a clear paper trail inside the chat and in your email. One tap should let you see what was bought, where it went, and how to contact the merchant.

This is not magic. It is the same consent logic banks use for recurring payments and the same clarity shoppers expect at a normal checkout, translated into a conversation.

Tokenized credentials, explained with a valet key

You would not hand a valet your entire keyring to borrow your car for ten minutes. You hand over a narrow key that starts the engine and nothing more. Tokenized credentials work the same way.

- Your card or bank account is never copied into the agent. A payments partner stores the real data and returns a token that represents your method.

- The token is locked to a context. It might only work for a specific merchant, a price range, a currency, or a time window.

- If the token leaks, it is useless outside those rules. The worst case is limited and reversible, unlike a raw card number.

- For wallets like Apple Pay or Google Pay, the device or wallet already uses network tokens. The agent simply orchestrates the request so that the wallet and the processor do the sensitive work.

A token is not a password. It is a sealed permission slip that can be revoked or replaced without touching your underlying account.

Fraud and chargeback guardrails that travel with the agent

The strongest controls are the ones that move with the transaction instead of living only on a website. For agentic payments, the right guardrails look like this.

- Risk scoring by default. Every attempted purchase should be evaluated against behavioral patterns and device signals from the agent session itself. Did the agent suddenly change shipping country or request a high-priced category outside your norms? That should trigger a step-up check.

- Adaptive authentication. If the risk score is high, require an extra tap, a biometric check, or a one-time code before the agent proceeds. If the risk is low and within a pre-approved budget, allow a silent flow.

- Delegated dispute rights. Chargebacks do not disappear. They move into the chat. The assistant should let you dispute a charge, message the merchant, or request a refund without leaving the conversation. Behind the scenes, the payment processor maps that to card network dispute codes or bank dispute flows.

- Transparent merchant of record. Even if the purchase happens inside ChatGPT, the merchant remains the seller. That means normal return policies, shipping liabilities, and tax handling still apply. You bought from the Etsy shop or the retailer, not from the model.

- Spend caps and timeboxes. Hard limits per day, week, and category, with a daily digest of what the agent spent. One tap to freeze all agentic spending if something looks off.

These controls mirror how mature e-commerce handles risk today. The difference is that the controls become portable and visible inside the assistant rather than embedded in a hidden risk engine on a checkout page.

What this means for U.S. retailers in the next twelve months

Expect a new source of high-intent demand that bypasses your homepage. When a shopper asks a general question in ChatGPT and sees a Buy button, your own site architecture may not get a visit. That is a shift in both marketing and merchandising.

- Merchandising becomes structured. Agents need well described catalogs, inventory, shipping rules, and return policies. If your product data is fuzzy, agents will undersell you.

- Conversion improves, but attribution blurs. You will see more first-contact to first-purchase journeys. You will also need a new way to attribute and cap performance marketing because traditional last-click models will not capture agent-led purchases.

- Search and chat blend. Your best product detail pages will be rewritten as concise, structured answers that an agent can quote. That work will sit alongside your normal content and schema markup.

- Customer service inside the order thread. Purchases that start in a chat should be supported in that same thread. Expect service requests to move into assistant conversations, with your brand responding through an integration rather than email tickets alone.

Retailers who start technical discovery now can meet this wave rather than get washed by it in spring. The integration lift will feel like adding a new marketplace channel, not like replacing your website. For a consumer-angle parallel on agent UX, see Apple on-device agents.

Card networks and banks are next in line for change

When agents sit at the point of intent, networks will compete on token performance, fraud tools, and developer friendliness rather than on checkout brand recognition.

- Network tokens matter more. Issuers that provision tokens quickly and handle lifecycle events cleanly will see fewer declines in agentic flows. Agents do not re-enter card numbers. They refresh tokens.

- New dispute patterns. Expect a spike in low-dollar disputes as agents begin to handle everyday purchases and subscriptions. Banks that expose better tooling for granular permissions and spend alerts will see fewer friendly fraud cases.

- Real-time rails rise. The U.S. will not become India overnight, but agent-friendly bank rails like instant push to debit, real-time payments, and account-to-account tokenization will become table stakes for small purchases that do not need the credit function of a card.

- Wallets as the bridge. Apple Pay and Google Pay will remain key in the U.S. because they provide device-level security and simple biometric confirmation inside agent flows. The fastest path to agentic scale stateside is tokenized cards in a wallet, orchestrated by an assistant.

Networks and issuers that act early can shape the rules. Those that wait will be price takers inside someone else’s agent.

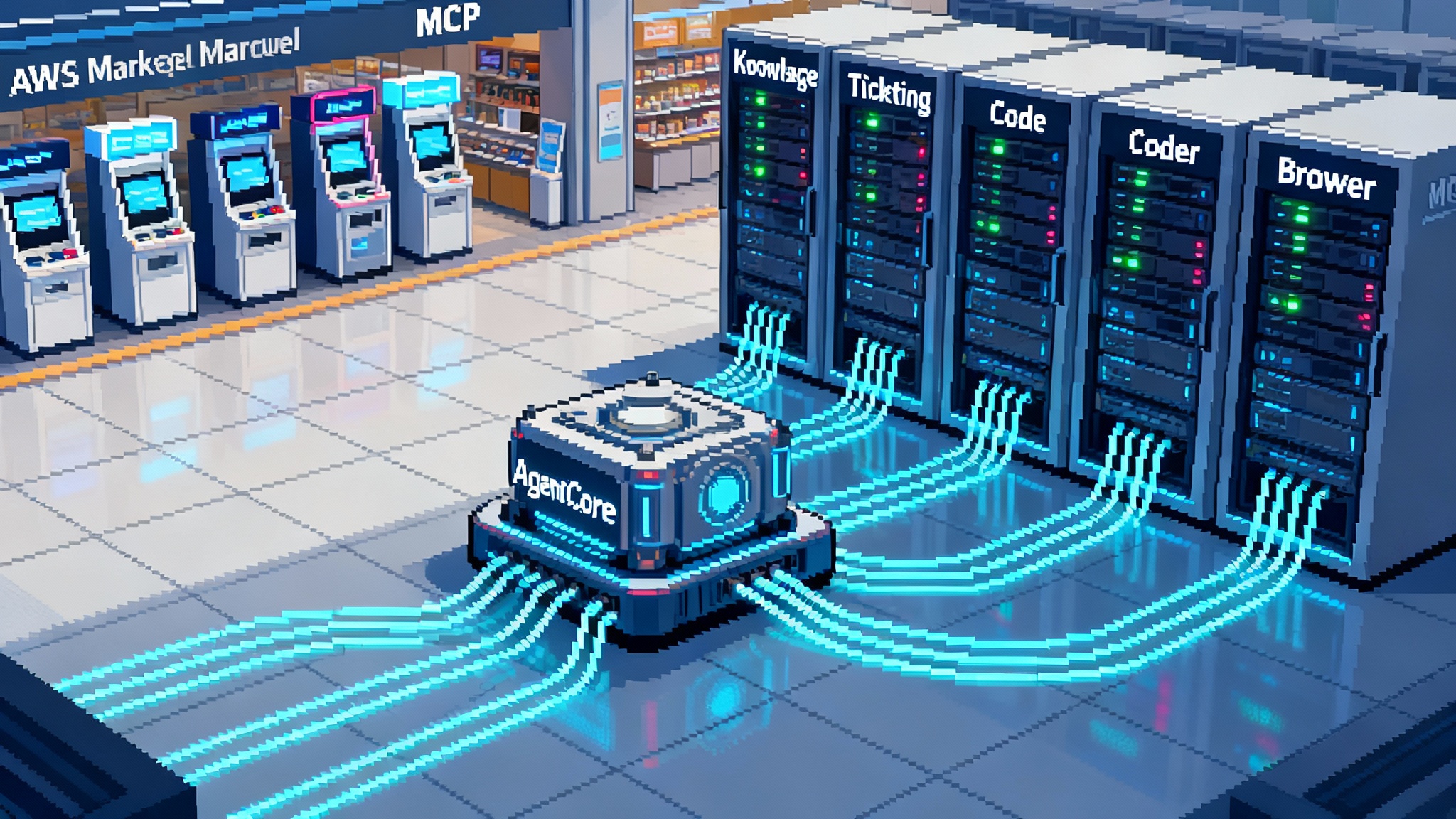

A simple mental model for the protocol

Think of the Agentic Commerce Protocol as checkout made composable. Instead of a webpage and a form, it is a structured conversation between the agent and the merchant.

- The merchant says what it sells and how it ships.

- The agent says what the user wants and proposes a basket.

- The merchant computes taxes and totals and requests an authorization.

- The agent presents a clear summary to the user, then returns a tokenized approval.

- The merchant charges and confirms. The agent logs the receipt.

This is not a new payment network. It is a common language for the rendezvous between demand and fulfillment when the interface is a chat instead of a cart.

How to get ready in 90 days

Here is a practical checklist for merchants and platforms who want to be early.

- Clean your product data. Provide titles, attributes, images, variants, delivery estimates, return windows, and price in a predictable schema. Agents cannot sell what they cannot parse.

- Map your policies to simple prompts. Write plain language versions of your shipping, returns, and warranty rules. If an agent can explain your policy in one sentence, customers will not abandon.

- Decide your guardrails. Choose spend caps for agent purchases, categories you will allow, and thresholds that trigger manual review. Hook into your processor’s risk engine to apply adaptive authentication when scores exceed your comfort level.

- Tokenize everything. Use wallet tokens where possible and card network tokens for saved cards. Ensure you can rotate tokens without breaking customer accounts.

- Build service hooks. Expose order lookup, status updates, and refund initiation via APIs that an agent can call with the user’s permission. Keep responses short and machine friendly.

- Pilot narrow use cases. Start with reorders, gift cards, or a small set of high-intent SKUs. Measure conversion, dispute rates, and service volumes. Expand when the numbers prove out.

- Train your brand voice for chat. In an agent-mediated purchase, the last thing the user sees is your post-purchase message. Make it helpful, human, and short.

What could go wrong and how to guard against it

- Over purchasing from aggressive prompts. Fix with spend caps, per-order ceilings, and a daily summary that highlights anything unusual.

- Confusion about who sold the item. Fix with clear on-screen merchant of record labels, plus a one-tap link to contact the seller.

- Abuse by kids or shared devices. Fix with biometric gates for high-risk actions and the ability to lock agentic purchases behind a family organizer role.

- Merchants gaming rankings. Fix with transparent criteria for how items appear in agent results, separate from Instant Checkout eligibility. Keep a merchant feedback loop to flag bad experiences.

- Privacy drift. Fix with a permissions dashboard that lets users revoke access to addresses, payment methods, and order history without deleting the entire account.

None of these are new. They are the same commerce concerns we already handle, now applied to a conversational surface.

The bottom line

Commerce is where agents will go mainstream because the value is obvious, the risks are manageable, and the infrastructure is ready. September 29 gave assistants a native checkout. October 9 proved that even national payment rails can trust an agent to carry a transaction end to end. The next year will not be about flashy demos. It will be about boring, repeatable tasks handled by software that knows your sizes, your addresses, and your limits. Start by giving your business a clean catalog and a clear set of rules. Agents that can spend will do the rest, and your customers will thank you for every minute they do not spend at a checkout form.