AP2 and the era of paying agents: Google’s commerce layer

Google’s Agent Payments Protocol landed in September 2025 with a clear promise: give AI agents a safe, interoperable way to pay. With signed mandates and stablecoin-ready rails, AP2 aims to make agent-led purchases auditable, policy governed, and portable across platforms.

The moment AP2 arrived

In mid September 2025 Google introduced the Agent Payments Protocol, or AP2, with support from a broad set of payments and technology partners. The goal is simple and bold: give AI agents a safe, interoperable way to initiate and complete real transactions. In Google’s words, AP2 is a common framework that any agent, wallet, network, or merchant can implement so that payments become traceable, policy aware, and portable across platforms. For the foundational overview, see Google’s AP2 announcement.

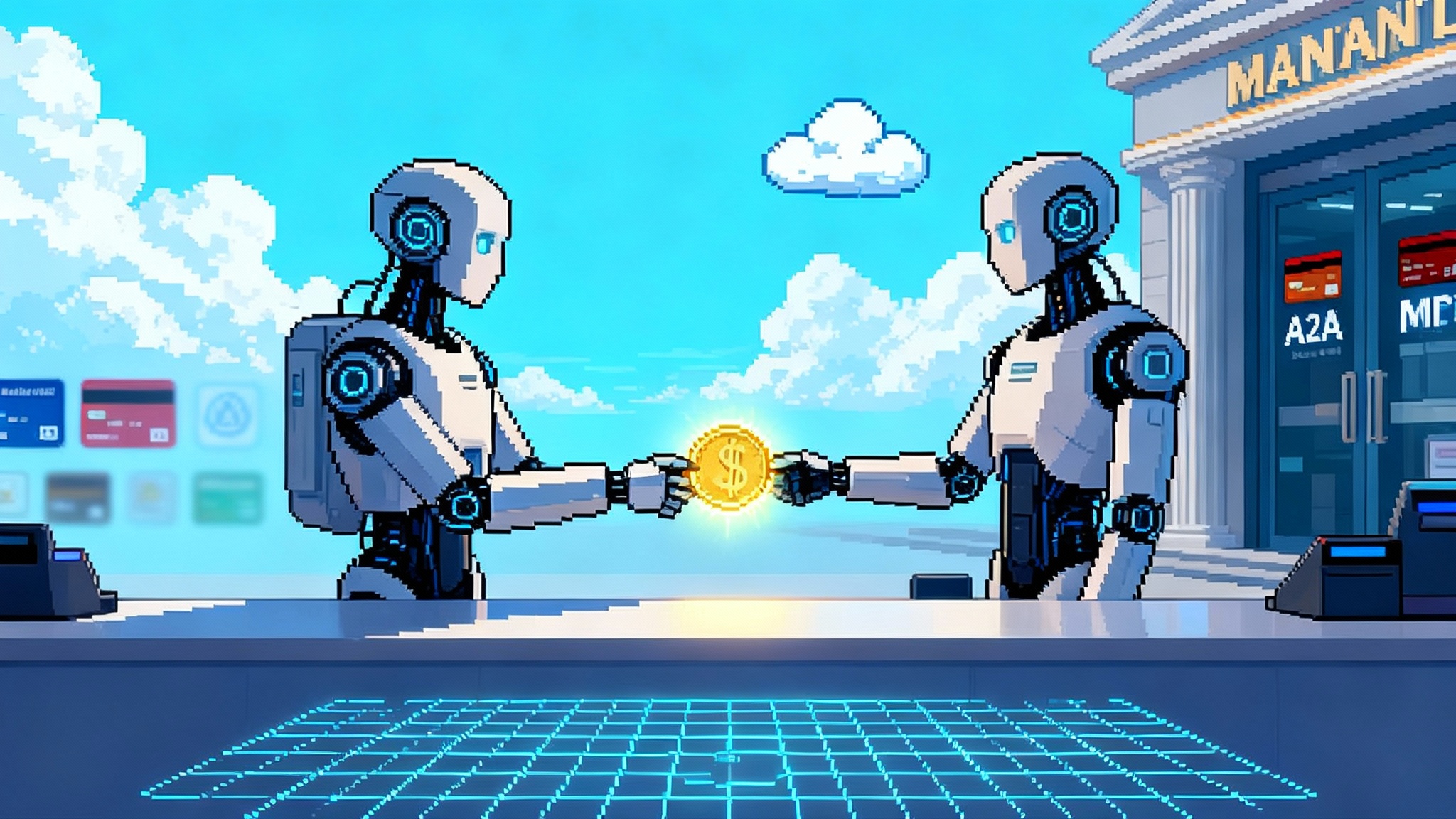

If the first wave of agent platforms gave us agents that can talk to one another, AP2 is what lets them pay one another. It is the difference between a helpful assistant and a trusted buyer.

Why payments need a new language for agents

Traditional payment flows assume a human is present at checkout. The browser shows a cart. A person clicks Buy. The network sees a familiar pattern and applies known risk rules. Agent led commerce breaks that pattern. An autonomous agent may assemble carts, negotiate bundles, and schedule shipments without the user sitting in front of a screen. Merchants and networks need unambiguous proof that the agent had the right to do that, and users need a way to set limits that machines can actually enforce.

That is the job of AP2. It introduces explicit, signed authorizations that travel with a transaction. It standardizes the signals that link a user’s intent to a payment request. It defines how those signals are verified by merchants, wallets, and networks. The result is accountability that does not fall apart the moment a non human actor takes the wheel.

Mandates: explicit authority meets money movement

AP2’s centerpiece is the mandate. Think of a mandate as an auditable permission slip, expressed as a verifiable credential, that is issued by a user or an administrator and carried by an agent. It is cryptographically signed, scoped to specific conditions, and designed to be checked by every party in a payment flow.

There are three core mandate types you will see in early implementations:

- Intent mandate. A standing authorization that defines what an agent is allowed to do. It encodes guardrails such as a monthly budget, merchant allowlists, product categories, time windows, and quantity caps. It turns a vague instruction like buy office supplies into a precise policy that software can enforce.

- Cart mandate. A human reviewed approval bound to a specific cart. The agent assembles the items and price, then surfaces a summary for one tap confirmation. The signed cart mandate becomes a non repudiable record of what the user saw and accepted.

- Payment mandate. A minimal credential derived from an intent or a cart. It gives downstream networks enough signal to route, authorize, and audit the transaction without revealing more data than necessary.

Mandates are intentionally boring. They are deterministic statements, not guesses about what the user probably wanted. That shift is what makes AP2 a foundation for real money rather than demo theater.

Stablecoin rails and x402: programmable settlement that audits itself

AP2 is payment method agnostic. It works with cards, real time bank transfers, and digital assets. One of the first extensions lights up stablecoin settlement through Coinbase’s x402, which packages payments directly into standard HTTP flows. x402 is attractive to agent ecosystems because it supports instant, low cost micropayments and it embeds programmatic checks before funds move. In practice, that means an agent can request a resource, receive a 402 Payment Required challenge, satisfy the policy, and obtain the good or service in a single, measurable exchange.

Why does this matter? Because usage priced automation becomes viable only if the settlement layer is fast, cheap, and programmable. Imagine agents that pay per document crawl, per inference, or per minute of API access. Stablecoins on modern L2 networks make those patterns realistic. Combine that with mandates and you get machine initiated payments that are both granular and governable. Merchants receive cash like settlement with a signed trail. Enterprises get a policy hook that can enforce compliance tasks such as sanctions checks or tax evidence before value leaves a wallet.

What AP2 unlocks next

- Agent to agent micropayments. Agents will begin pricing their own capabilities and paying other agents for services on the fly. A research agent might pay a few cents to a translation agent for a paragraph, then tip a data agent for a proprietary dataset.

- Usage priced automations. Instead of subscriptions and overprovisioned bundles, expect per use payments for compute, data, or model access. Agents can meter consumption precisely and stop when policies say the budget is exhausted.

- Autonomous purchasing. Reorders, renewals, and spot buys shift from nagging todos to background tasks. The user sets intent and guardrails. The agent executes within that scope and every action is logged against a mandate.

- Faster settlement and fewer disputes. Payment methods that support immediate or final settlement reduce chargeback dynamics. When a dispute occurs, the presence of a signed mandate and a tamper evident receipt moves the conversation from opinion to verifiable facts.

- Cross platform portability. Because AP2 is designed as an open protocol, merchants and developers can implement it once and receive compatible signals from a range of agent platforms, wallets, and networks.

The open standards stack: A2A, MCP, and AP2

AP2 is not a standalone island. It sits on a stack of open standards that are beginning to cohere into a workable ecosystem.

- A2A for agent collaboration. Google’s Agent2Agent protocol provides the messaging layer that lets agents discover each other, exchange tasks, and coordinate work. This complements the rise of browser agents and paywalls.

- MCP for tool access. The Model Context Protocol is a vendor neutral way for agents to reach out to tools, files, and external systems. For how MCP shows up in enterprise stacks, see Agentforce and MCP.

- AP2 for commerce. AP2 adds a payment authorization and accountability layer. It defines how an agent presents proof of intent, how merchants and wallets verify it, and how networks receive a consistent signal about agent involvement. Alongside voice first interfaces like voice native agents, the stack provides a lingua franca for collaboration, action, and settlement.

Obstacles ahead

The launch solves architecture, not adoption. Several hard problems must be tackled before AP2 becomes boring plumbing.

- Developer adoption. Protocols win only when developers ship production use cases. That requires strong tooling, straightforward sample code, stable types, and test sandboxes. It also requires clear documentation on how to bridge AP2 semantics with existing checkout stacks and POS systems.

- Compliance and liability. Mandates create a cleaner audit trail, but rules vary by jurisdiction and by rail. Card networks have dispute codes and friendly fraud patterns. Bank transfers have distinct consent and recall models. Digital assets face travel rule requirements and sanctions screening. The industry will need playbooks that map AP2 artifacts to each regime, and contracts that clarify who is accountable when an autonomous agent makes a bad call within scope.

- Fraud and adversarial agents. Proof of intent stops some scams but not all of them. Attackers will attempt to forge or replay mandates, hijack agent identities, craft adversarial prompts, or manipulate agent to agent negotiations. Expect a new category of fraud tooling that monitors mandate issuance, detects unusual delegation trees, and scores agent behavior over time.

- User consent UX. If consent becomes a barrage of pop ups, people will approve everything. If it becomes too abstract, confidence erodes when things go wrong. The winning designs will make mandates legible. Users should see what will happen, when it may happen, and how to revoke it instantly. Enterprises will want bulk controls, expirations, and review queues that humans can manage.

- Ecosystem coordination. AP2 spans merchants, wallets, networks, and agents. Interop test suites, reference validators, and conformance marks will be needed so that one team’s interpretation does not create costly edge cases for everyone else.

Build now: an enterprise checklist

You do not need to wait for full ecosystem saturation to get started. There is real work to do inside the firewall that pays off even if your external partners move at different speeds.

1) Agent native wallets and custody choices

- Decide what holds value for your agents. Options range from commercial wallets to MPC based enterprise custody to bank integrated accounts. Align custody with your risk posture and regulatory footprint.

- Separate operational hot wallets from treasury. Create clear funding paths and automated top ups with daily and monthly caps.

- Implement per agent keys and rotate them on a schedule. Tie keys to decentralized identifiers so that revocation and delegation are auditable.

2) Spend policies that map to mandates

- Define tiers of autonomy. For example, carts always require a human review, while reorders below a set threshold can proceed under standing intent. Encode those rules as policies your agents can enforce.

- Use allowlists and blocklists. Approve specific merchants, categories, and networks. Maintain them centrally so that a single change propagates across agents.

- Add rate limits, time windows, and budget alarms. Require fresh approval when an agent approaches a monthly ceiling, or if it attempts a purchase that deviates from historic patterns.

3) Observability and audit from day one

- Treat every AP2 action as a ledger event. Store mandate issuance, verification, and payment metadata in a tamper evident log that your auditors can query.

- Instrument the full path. Correlate agent prompts, tool calls, mandate checks, and settlement events so that engineers and investigators can reconstruct any transaction.

- Build a rapid revoke loop. Users and admins need a single place to view active mandates, kill them, and trigger downstream cancellations or refunds.

4) Sandboxes and red teams

- Stand up an internal AP2 sandbox that mirrors production policies. Run fire drills where agents face adversarial inputs and try to breach spend controls.

- Simulate human in the loop bottlenecks. Measure how long it takes to review a cart mandate at peak load and design for that reality.

5) Partner outreach

- Ask processors, gateways, and networks on your roster how they plan to expose AP2 signals in their APIs. Volunteer to pilot conformance tests that validate mandate verification and dispute mapping.

- If stablecoin settlement is in scope, evaluate how x402 style flows would integrate with your invoicing, tax, and risk systems. Treat programmability as a feature for compliance, not just speed.

For implementers: where to look in the spec

Google has published an open repository with the core objects, sample scenarios, and runnable code. It is the fastest way to see AP2’s mandates and receipts in action, including human present card flows and a digital asset variant. Start with AP2 spec and samples.

A practical path is to clone the samples, run the end to end demo with a test merchant, then swap in your own policy engine. The more your mandates map to your actual business rules, the less glue code you will need later.

Roadmap: what to watch as pilots roll out

The most important signal in the next year will be production pilots that put AP2 artifacts in front of real risk engines and settlement systems. Here is a simple field guide for what to watch.

- Card networks. Look for rules that define how the payment mandate should be attached to an authorization message and how that affects liability and chargebacks. Watch for alignment with network tokens and 3DS prompts so that agent led flows do not break existing security layers. Expect early pilots to focus on low ticket, low risk categories.

- Banks and real time payments. AP2 fits rail agnostic flows where a mandate drives a push payment from a bank account. Watch for RTP, FedNow, and SEPA Instant proofs of concept that tie a payment mandate to irrevocable transfers, with policy checks enforced by the sending wallet.

- Crypto providers. Stablecoin flows will be the fastest moving lane. Expect more concrete patterns for escrow, refunds, and partial fills. Also watch for travel rule payloads bound to mandates so that compliance checks can be proven after the fact.

- Merchants and marketplaces. The early wins will be in replenishment and renewals, where customers already expect automation. As confidence grows, you will see bundles negotiated agent to agent and paid for with a single signed cart.

- Regulators and auditors. Mandates give supervisors something they can inspect. Expect guidance on how explicit consent must be captured for autonomous purchases and how revocation should work in a multi agent environment.

The bottom line

AP2 marks the beginning of an auditable, policy governed commerce layer for autonomous AI. The protocol does not pick winners among payment methods. It provides a shared grammar for intent, approval, and accountability so that agents can move money in ways that enterprises and networks can trust. Extensions like stablecoin rails bring the speed and programmability that make new business models possible, from agent to agent micropayments to pay per use automation.

If your organization plans to deploy agents that do real work, you want this plumbing to become boring as soon as possible. The fastest path is to build the controls you will need anyway while engaging partners on AP2 conformance and pilots. The agents are learning to talk. Now, with AP2, they can learn to pay, and to do so with proof in hand.