Agentic Payments Go Mainstream with Mastercard Agent Pay

Mastercard is putting AI agents on real payment rails. Inside Agent Pay, the Agent Toolkit, Insight Tokens, FIDO-aligned credentials and what it means for developers, merchants and banks by the 2025 holidays.

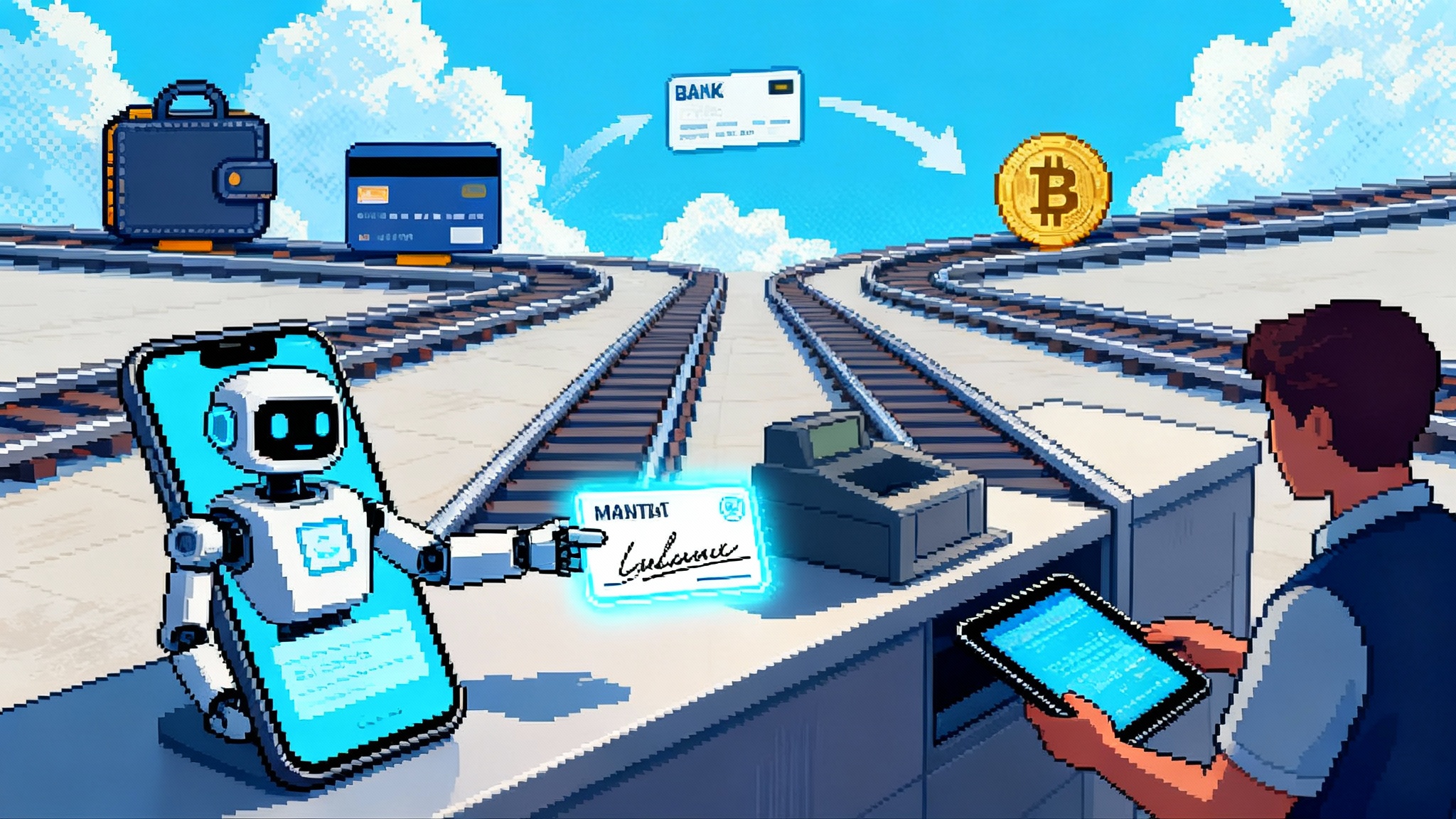

The moment AI agents shift from recommend to transact

After a year of prototypes and glossy demos, the switch flipped in September 2025. Mastercard moved agentic commerce from proof of concept to production by giving AI agents real payment credentials, clear rules and visibility across the value chain. With Agent Pay now rolling out and all U.S. Mastercard cardholders set to be enabled by the 2025 holiday season, the industry is staring at an inflection point: shoppers will not just ask agents for advice, they will let them pay.

On September 10, 2025 Mastercard unveiled new components and partnerships designed to make that shift safe and scalable. The company introduced a developer-facing Agent Toolkit, an MCP server to make APIs agent readable, an Agent Sign-Up flow, and a new class of governed Insight Tokens, while confirming joint work with partners like Stripe, Google and Ant International’s Antom, and early issuer pilots at Citi and U.S. Bank. See how Mastercard unveiled new tools.

This is not just another checkout button. It is an architecture that lets agents be first-class actors in payments with consent, spend controls, provenance and dispute clarity built in.

What Mastercard shipped in September

Here is the practical core of the rollout and why it matters.

Agent Pay becomes the default agentic payment rail

Agent Pay is Mastercard’s agentic payments program. It binds agent identity, user consent and tokenized credentials so an agent can initiate a purchase at millions of online merchants that already accept card-on-file or tokenized card payments. The key idea is continuity: merchants do not need to reinvent checkout, while agents can present a verified, token-backed payment on the user’s behalf. This moves agents from a recommendation layer to a transaction layer.

Agent Toolkit and MCP server

Documentation and integration are usually where agent projects stall. Mastercard’s Agent Toolkit publishes structured, machine-readable API content through an MCP server, which is consumable by modern agent frameworks and developer copilots. That means your agent can discover capabilities like token provisioning, spend limits or dispute inquiry in context, then call them safely with typed parameters. The Toolkit’s MCP availability complements Agent2Agent patterns so your agent can iterate with other agents and services without custom adapters. For stack-level context, see our primer on the 2025 enterprise agent stack.

Agent Sign-Up and agent registration

Only registered, verified agents can transact. Agent Sign-Up ties an agent’s identity to network tokens and policies, making the agent recognizable throughout the transaction lifecycle. That gives issuers, acquirers and merchants a way to flag the transaction as agent initiated, route it through appropriate risk controls and display that context in receipts and statements. The result is traceability without adding friction for the end user.

Insight Tokens

Insight Tokens are a governed mechanism for agents to apply permissioned Mastercard insights with user consent. Think of them as scoped capabilities that can inform a purchase without leaking raw data. Over time they will support more personalized experiences, like better price or benefit selection, while keeping data access auditable and revocable. The initial enterprise pathways lean on tech already used with partners like SAP Concur, so this feature has a clear operational precedent.

Standards work with the FIDO Alliance

To reduce ambiguity at the moment of approval, Mastercard is collaborating within the FIDO Alliance Payments Working Group on a verifiable credential standard that binds the payment context to user intent. The credential can attest to key facts like amount, merchant and item category. If an issuer or merchant later needs to investigate a dispute, the credential provides a compact, cryptographically verifiable proof that the shopper approved this specific transaction.

Partnerships and the holiday timeline

- Distribution: Partnerships with Stripe, Google and Ant International’s Antom aim to make agentic checkout available where AI-driven shopping and platform commerce already happen. Google’s privacy approach aligns with the AP2 trust-and-consent layer.

- Issuer pilots: Citi and U.S. Bank Mastercard cardholders are first to experience agent-enabled shopping. For background on enterprise adoption patterns, read Citi’s 5,000-user agent pilot.

- Enablers: Agentic providers like PayOS, Firmly.AI and Basis Theory are going live, giving developers off-the-shelf components for orchestration, token vaulting and data governance.

Why this changes the job to be done for each stakeholder

For developers: consent, controls and agent-native integration

- Consent as a first-class API: Build a consent store that records who approved what, for how long, with what limits. Align scopes to real-world tasks such as groceries up to 200 dollars weekly or work travel hotels up to 300 dollars nightly. Persist consent artifacts so you can present them during disputes and renewals.

- Spend controls and policy guardrails: Expose native controls to users. Include per-merchant and per-MCC caps, time windows and step-up triggers. When an agent hits a policy boundary, raise a passkey prompt and describe the reason in plain language.

- MCP and Agent2Agent: Attach the Mastercard MCP server as a capability feed so your agent can auto-discover available payment actions. Use Agent2Agent patterns when delegating to a price-comparison agent or a travel-booking agent. Pass along consent and policy context, not raw credentials.

- Receipts as data objects: Emit receipts with agent identity, consent scope, token reference and purchase context. Store them in an inbox the user and issuer can access. Receipts are your Rosetta stone for support and chargebacks.

- Privacy and data minimization: Use Insight Tokens in place of raw datasets. If your agent needs loyalty, shipping or benefit selection context, request only the minimal insight and record that purpose in your consent ledger.

For merchants: tokenization, acceptance and clearer disputes

- Tokenization by default: Agent Pay leans on network tokens, so your existing token-on-file setup carries forward. You benefit from lifecycle management like credential updates and fewer declines due to expired cards.

- Recognizable agent transactions: The network and acquirer can flag agent-initiated purchases. That gives you better order scoring, a consistent way to request step-up and more relevant customer service scripts when something looks off.

- Dispute clarity: With verifiable credentials and context-rich receipts, you can respond to inquiries with evidence that the user consented to this merchant, amount and item type. That drives down representments and accelerates resolution.

For banks: risk, controls and compliance

- Risk models see the agent: Registered agent identity and token provenance become inputs to authorization. That enables tailored risk rules, like tighter spend controls for new agents and higher throughputs for known-good agents.

- Customer protection: Strong device biometrics and passkeys reduce account takeover. Clear consent artifacts shorten the loop from inquiry to outcome and align with fair credit billing timelines.

- Compliance posture: Consent records and verifiable credentials support auditability. They also help with explainability when regulators ask how autonomous systems are allowed to move money on behalf of customers.

How it compares to emerging alternatives

Visa is pursuing a parallel path with Intelligent Commerce, introduced on April 30, 2025, which opens Visa’s network to agentic use cases and emphasizes developer access through AI platforms and partners. See the Visa Intelligent Commerce announcement. The strategic direction mirrors Mastercard’s focus on agent identity, consent and token-backed credentials. For merchants and developers, the main differences will surface in SDKs, available pilot issuers and how each network exposes consent artifacts and verifiable proof to downstream systems.

On the enabler side, PayOS and peers are stitching these network capabilities into agent-first orchestration platforms. Expect these providers to compete on developer experience, token vaulting flexibility, multi-processor routing and prebuilt consent UX.

A practical build guide for AI-native checkout

This section lays out a reference architecture, trust-and-consent UX patterns, a fraud and threat model, and KPIs you can use to prove ROI. It assumes you will integrate with Agent Pay through a PSP or directly via the Mastercard Developer ecosystem.

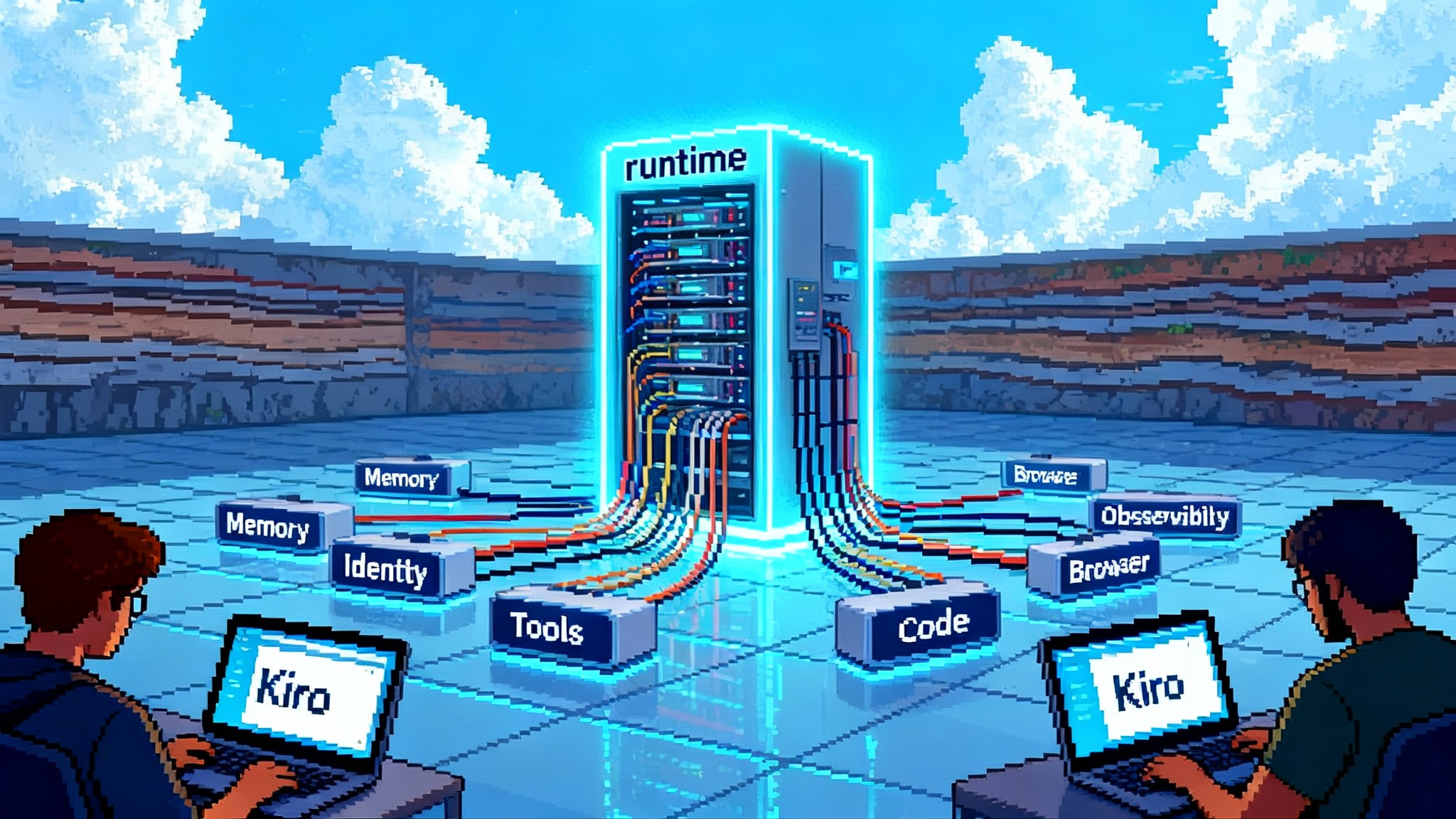

Reference architecture

- Agent layer: Your shopping or travel agent with retrieval, planning and tool use. It consumes the MCP feed to discover payment and consent endpoints.

- Consent and policy service: A service that issues and stores consent grants. It supports scopes, limits, expirations, revocation and human-in-the-loop prompts.

- Wallet and tokenization: A vault for network tokens tied to the user and the registered agent. It handles provisioning, lifecycle updates and token binding to agent identity and device signals.

- Payment orchestration: Routes payment requests to your PSP or directly to the acquirer with agent flags. It normalizes responses and feeds risk signals back to the agent.

- Agent registry client: Registers your agent, maintains its credential and publishes its identity to downstream systems so they can recognize agent-initiated transactions.

- Receipt and ledger store: Holds structured receipts, verifiable credential proofs and consent artifacts for customer support and disputes.

Data flows at a glance:

- User links a card and grants task-scoped consent. The consent service issues a tokenized grant.

- Agent plans a transaction, validates scope and limits, then requests a spend token from the wallet.

- Payment orchestration submits the transaction with agent flags and context. The issuer sees agent identity and consent scope.

- Receipt service stores a verifiable proof of approval plus line items and policy references. The agent shares a human-readable receipt.

Trust and consent UX patterns

- Link once, delegate safely: At first link, show the agent’s legal name, publisher, version and capabilities. Explain exactly what the agent can do and not do.

- Offer templates: Provide prebuilt scopes like Everyday Essentials, Travel Booking and Subscriptions Manager, each with default caps and categories the user can edit.

- Progressive authorization: If an agent needs to exceed a cap or add a new merchant type, prompt with passkeys and show the delta. Never reuse an old approval for a meaningfully different request.

- Clear receipts and dashboards: Show agent name, merchant, amount, category, time and scope used. Let users pause or revoke an agent with one tap.

- Family and team controls: Allow shared cards with role-based caps. A parent can authorize the Household agent for groceries, while a teen gets a 50 dollar weekly limit at approved MCCs.

Fraud and threat model for agentic checkout

Key threats and recommended mitigations:

- Agent spoofing: A malicious service pretends to be your registered agent. Mitigate with agent registration, signed requests from a bound key and token binding to agent identity.

- Prompt injection on merchant content: An agent scrapes a page and executes untrusted instructions. Use retrieval sandboxing, allowlist tool invocation and human confirmation for atypical flows.

- Data poisoning of catalogs and rates: Attackers skew agent recommendations. Validate with multiple sources, apply provenance scoring and alert when price variance exceeds thresholds.

- Token replay: Stolen payment tokens are replayed. Bind tokens to the agent, device and consent scope, and enforce one-time use per transaction.

- Merchant in the middle: Fake stores harvest approvals. Leverage merchant attestation signals from the network and require step-up on unknown merchants with high-risk MCCs.

- Policy evasion by agents: An agent tries to split purchases to bypass caps. Detect burst patterns, aggregate across merchants and enforce cumulative limits.

- Synthetic identities: Fraudsters create accounts to farm approvals. Use KYC, device fingerprinting and network risk scores. Require funding source verification before enabling high caps.

- Dispute abuse: Bad actors claim ignorance of approved agent purchases. Provide verifiable credentials of approval and show the shopper exactly what was authorized, when and for which agent.

KPIs and how to prove ROI

Define a baseline on your classic checkout, then instrument these.

- Adoption and activation: Agent-linked cards per 1,000 active users, consent opt-in rate and time to first purchase.

- Checkout performance: Conversion rate uplift over classic checkout, time to checkout from intent to authorization, false positive decline rate on agent transactions.

- Customer economics: Average order value and frequency for agent-initiated orders, incremental revenue from agent-enabled cross-sell or loyalty optimization, refund and return rates versus baseline.

- Risk and trust: Dispute rate and time to resolution for agent purchases, share of disputes closed with verifiable proof presented, fraud loss rate per 1,000 agent transactions.

- Operations: Customer support contacts per 1,000 agent orders, consent change and revocation rates, token refresh success rate and credential update coverage.

Run controlled rollouts: start with a single category like travel, compare cohorts with and without agentic checkout, then expand to groceries and digital goods. Make sure your analytics pipeline tags agent identity, scope ID and the presence of a verifiable credential in each purchase event. Those tags are critical for attribution and for root-causing failures.

Implementation checklist

- Register your agent and integrate Agent Sign-Up. Store the agent ID securely and rotate keys on a schedule.

- Wire up the MCP feed from the Agent Toolkit so your developer copilot and the agent can auto-discover Mastercard endpoints and message formats.

- Build a consent store that issues and enforces scopes with amounts, MCCs, merchants, time windows and step-up policies.

- Provision network tokens for the user and bind them to the agent identity. Support renewal and lifecycle events.

- Update risk models to consume agent signals and consent artifacts. Treat first-time agents like new devices with graduated limits.

- Generate structured receipts and attach verifiable credentials of approval. Expose them to customers and to support tooling.

- Coordinate with your PSP or acquirer to ensure agent flags and context are captured end to end.

What happens next

By putting registered agents, tokenized credentials, consent artifacts and verifiable proof on the same rail, Mastercard has given AI agents a safe way to act. Issuers get visibility, merchants get continuity and clarity, developers get a modern integration path and customers get control that feels native.

Visa is moving in parallel, startups are racing to streamline orchestration and major platforms are integrating agentic shopping into everyday experiences. The result will be less clicking and more delegating. The winners will be the teams that invest early in consent UX, verifiable proof and measurement, then iterate as real-world data arrives through the 2025 holiday surge. For a broader look at what teams need to ship, see the 2025 enterprise agent stack alongside the September network rollouts.

If you are building agentic checkout right now, the blueprint is concrete. Register the agent. Tie consent to scoped, revocable capabilities. Bind payment tokens to agent identity. Emit verifiable approval. Measure ruthlessly. The rails are ready, and the shift from recommend to transact has begun.