Insurers Go Agentic: Tokio Marine’s OpenAI Pact Explained

Tokio Marine’s partnership with OpenAI signals a shift from pilots and chatbots to production agents in insurance. See how agents will change product planning, service, and sales, and the concrete steps US carriers should take next.

The day insurers turned the corner

On September 24, 2025, Reuters reported that Tokio Marine will co-develop AI agents with OpenAI to power product planning, handle customer inquiries, and inform sales strategies across its branch network in Japan. The report, based on Nikkei, is more than a headline. It signals that global insurers are moving beyond pilots and chatbots toward production agents that work across the front, middle, and back office. See Reuters on Tokio Marine’s plan.

Why does that matter for the rest of the regulated world, from banks to health plans to utilities? Because insurance long carried a reputation for slow modernization. If carriers can safely deploy agents around sensitive data, intricate workflows, and strict compliance, then every other regulated sector has a new playbook to follow. This shift echoes how the browser itself is becoming an agent runtime, as explored in The browser as an agent.

From chatbots to true agents

Chatbots answered FAQs. Agents take action. In insurance that means connecting to core systems, drafting quotes, triaging claims, scheduling inspections, reconciling documents, and teeing up decisions for licensed humans. The shift is not just about better natural language. It is about reliable tool use, memory that respects privacy rules, and audit trails that stand up to regulators.

Three near-term use cases are converging on production scale:

- Product planning: ingesting market data, competitor filings, and loss trends to propose coverage tweaks and rates, then packaging ideas into regulator-friendly memos.

- Customer service: handling eligibility checks, status updates, and document requests, with handoffs to live agents when conversations enter licensed territory.

- Sales strategy: analyzing branch performance, surfacing cross-sell opportunities, and generating talk tracks tuned to local demographics and prior interactions.

Tokio Marine’s focus areas mirror the pattern many carriers see. Triaging routine work to agents frees licensed staff for judgment calls that truly drive outcomes.

Why this moment matters beyond insurance

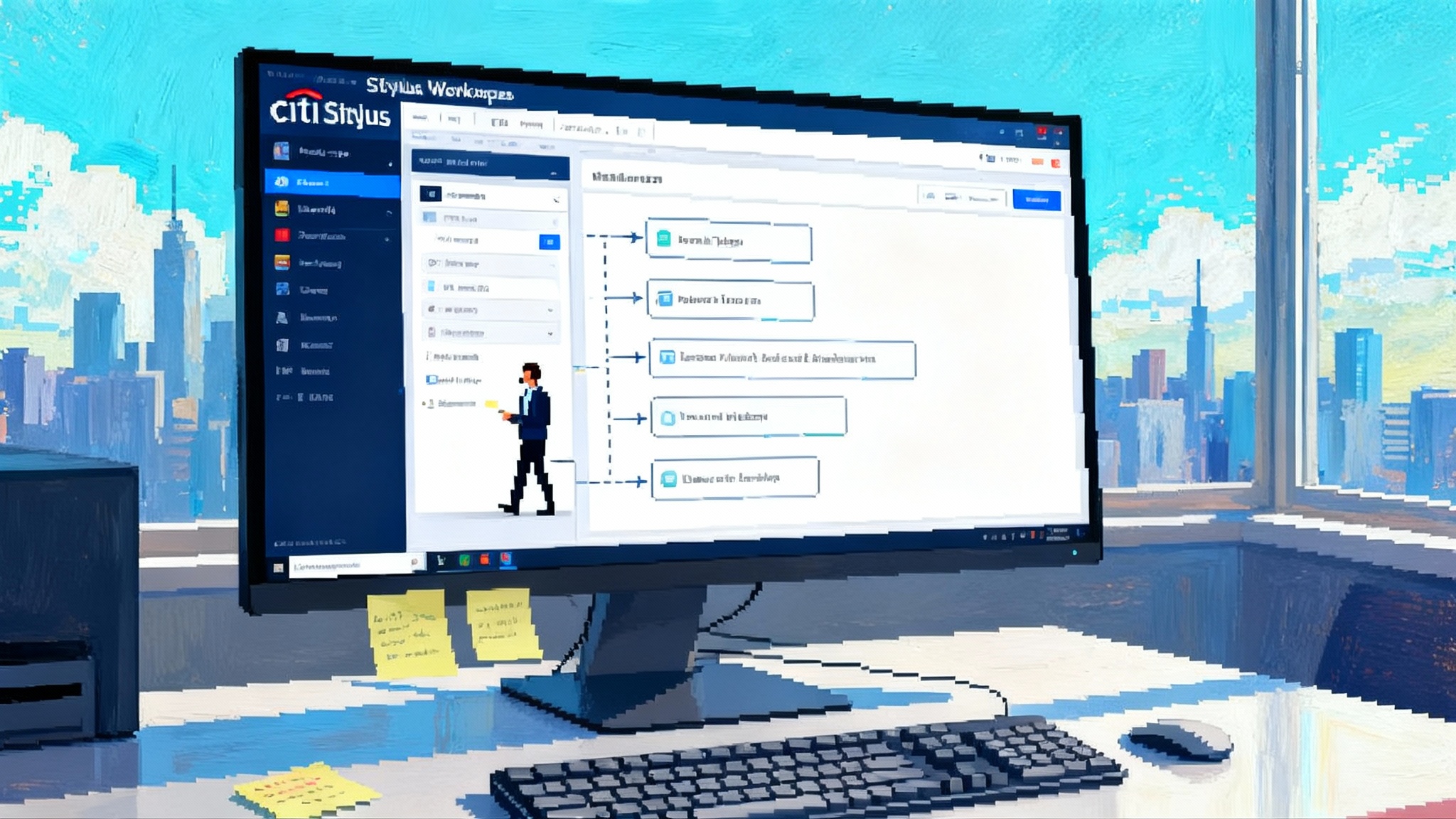

Other regulated sectors face the same puzzle: unlock productivity without breaking rules. Agentic systems are finally good enough to be embedded where compliance is nonnegotiable. The toolchains have matured, safety rails are improving, and regulators have published expectations for governance and testing. That creates a path to move agents from the lab to the line of business. For operating lessons at scale, see Citi’s 5,000 user agent pilot.

The emerging reference architecture

A repeatable architecture is taking shape across early enterprise deployments. At a high level, you will see five pillars.

1) Secure virtual desktops for computer-using agents

- Pattern: Run agents inside locked-down virtual desktops with ephemeral credentials. Give them the same sanctioned apps and SSO policies as humans. Record everything for replay.

- Why it works: You avoid risky direct API access to crown-jewel systems when those systems were never designed for programmatic calls. The agent operates like a human, but with sandboxes, allowlists, and session timeouts.

2) Tool use and orchestration

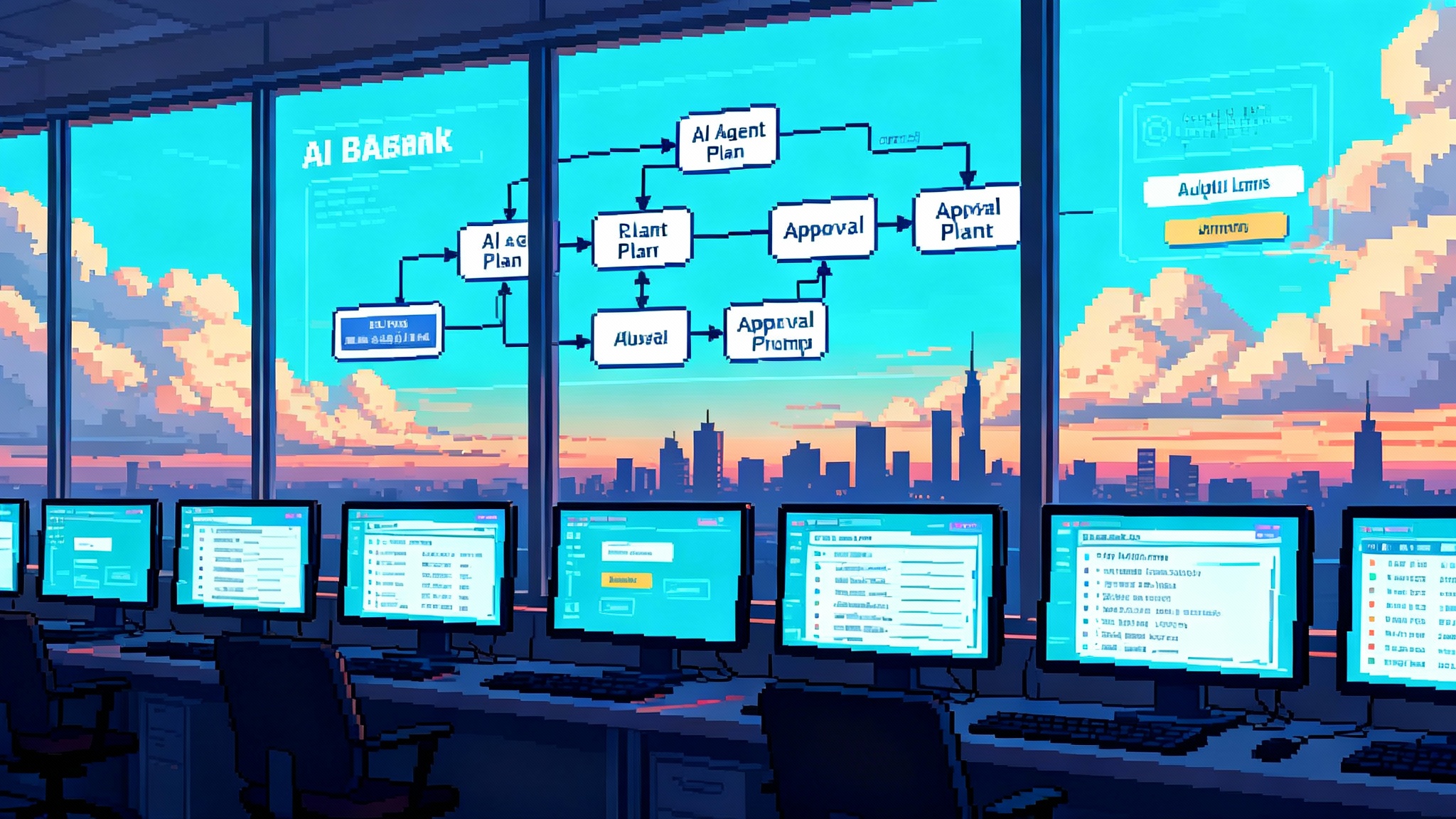

- Pattern: The agent never free-forms behind the scenes. Instead it calls a curated set of tools, each with explicit contracts and permissions. Tools might include policy search, FNOL intake, document classification, pricing calculators, calendar booking, or RPA adapters for legacy screens.

- Why it works: Deterministic tool calls make behavior traceable. You can simulate, approve, and monitor each tool independently, and gate sensitive tools behind multi-factor prompts or human approvals.

3) Memory with boundaries

- Pattern: Store short-term conversation context separately from long-term institutional memory. Long-term memory is a governed knowledge base with retention rules, role-based access, and redaction for PII.

- Why it works: You prevent the agent from learning the wrong lesson from a single quirky interaction, and you keep personal data from polluting shared memory.

4) Guardrails at multiple layers

- Input filters: PII detection and redaction, prompt linting, and allowlists for URLs and file types.

- Policy engines: Check outputs for prohibited content, unfairness markers, or missing disclosures. Attach confidence scores and require human review below thresholds.

- Rate limits and egress controls: Prevent runaway actions or data exfiltration. Enforce least-privilege by default.

5) Auditability and replay

- Pattern: Treat the agent like a regulated user. Capture prompts, tool calls, system screenshots, model versions, and final actions with cryptographic timestamps.

- Why it works: When a complaint or regulatory exam arrives, you can reconstruct exactly what happened, who approved what, and which model produced the output. For practical controls and observability, see Salesforce’s Agentforce and AgentOps.

Compliance patterns carriers are adopting

US carriers are aligning agent deployments with the NAIC’s expectations and emerging state-level bulletins. The common playbook looks like this:

- PII handling: Classify data on ingest, tokenize high-risk fields, and redact sensitive attributes in prompts unless strictly required. Maintain separate storage and access paths for customer identifiers, documents, and analytical features. Enforce customer consent flags on retrieval.

- Human approvals: Define clear tiers. Level 1, the agent drafts and a human sends. Level 2, the agent executes low-risk tasks like scheduling and document requests. Level 3, the agent proposes a decision that always requires licensed review. Move work up the tiers only after passing documented tests.

- Logging and retention: Log every interaction with hashed IDs for customers and staff. Retain raw artifacts for your standard claim or policy record retention period. Maintain a tamper-evident audit store that your compliance team can query by policy number, claim number, or conversation ID.

- Vendor governance: Conduct security and model risk reviews for any external model, vector store, or orchestration layer. Require attestations on training data usage, privacy, and incident response.

- Model risk management: Document use cases, data lineage, validation methods, drift monitoring, and fallback plans. Align with your institution’s broader model governance standards and keep a register of AI systems in scope for audits.

The NAIC’s Model Bulletin on the use of AI has become a north star for many state regulators and carriers. It is guidance rather than law, yet adoption is growing, and examiners increasingly ask to see a written AI program, vendor controls, and evidence that outcomes are fair and accurate. See the NAIC Model Bulletin on AI.

What to measure, and why it matters

Agent programs stall when success is fuzzy. Set hard targets early and track them weekly.

- Handle time: For service and claims, measure average handle time per interaction, plus time to first response and time to resolution. Separate agent-only, human-only, and hybrid flows.

- Containment rate: Percent of contacts resolved without human intervention while meeting quality thresholds.

- Rework rate: How often a human reverses or amends an agent action. Anything over a few percent merits root cause analysis.

- Loss ratio impact: In claims, track leakage reduction from better triage, improved subrogation identification, and fraud flags. Use matched cohorts to isolate agent impact.

- Quote-to-bind lift: In sales or pre-quote underwriting, track completion and conversion, and measure abandonment reduction when agents prefill or resolve questions.

- CSAT and DSAT: Capture customer satisfaction and dissatisfaction specifically for agent-handled interactions. Add a simple disclosure so customers know a digital assistant helped, and offer easy escalation.

- Compliance quality: Monitor approval bypasses, policy violations caught by guardrails, and time to respond to regulator inquiries using audit logs.

Insurance workflows vs banking pilots

Insurers and banks share the need for rigorous controls, yet their workflows differ in where agents add the most value.

- FNOL triage vs KYC onboarding: Insurers gain immediate ROI by guiding first notice of loss, collecting photos and incident details, validating coverage, and routing to the right adjuster. Banks often start with KYC, document intake, and identity proofing. Both use document understanding, but FNOL benefits from structured decision trees and integrations with telematics or repair networks.

- Subrogation vs transaction monitoring: Claims agents can spot recovery opportunities by cross-referencing police reports, claims histories, and liability rules, then drafting demand letters. Banks focus agent time on alert triage in transaction monitoring, gathering supporting evidence for investigators.

- Underwriting pre-quote vs credit decisioning: Insurance pre-quote agents enrich data from third-party sources, summarize risk factors, and draft correspondence for producers. Banks must stay within strict adverse action and explainability requirements, often limiting agents to drafting memos and assembling reasoning rather than making final decisions.

Both sectors need strong model risk governance, clear human-in-the-loop checkpoints, and replayable audit logs. Insurance often sees faster wins in service and claims where decisions are procedural and traceable. Banking typically moves slower in credit adjudication due to explainability and adverse action obligations.

A pragmatic blueprint for US carriers on legacy cores

Most carriers run on decades-old policy, billing, and claims systems. That is not a blocker. It simply shapes the order of operations.

What to build now

- An agent gateway: A thin service that brokers identity, policy, and logging between your core systems and any agent runtime. It should expose standard tools like policy search, claim intake, payment status, document fetch, and appointment scheduling. Keep the gateway stateless and idempotent.

- A governed knowledge base: Centralize product manuals, underwriting guidelines, and standard letters. Use a retrieval layer with entitlements and a redaction step for PII. Version content like code, and require approvals for high-risk updates.

- A safety and approval service: Create a common policy enforcement layer for all agent actions. This service runs guardrail checks, assesses confidence, and routes to human approval queues when needed. Instrument it with metrics so you can prove policy adherence.

- Audit and replay: Implement a journal that captures prompts, tool calls, screenshots for computer-using sessions, model IDs, and outputs. Use write-once storage settings that satisfy your records policy. Make replay a first-class feature for compliance, QA, and training.

- A human-in-the-loop workbench: Give supervisors a place to review drafts, approve actions, send feedback to the agent, and escalate to specialists. Include reason codes to train both models and staff.

What to buy

- Secure VDI or browser isolation: Choose a vendor that supports ephemeral desktops, session recording, and granular policy controls for computer-using agents.

- Guardrail and observability stack: Adopt tools for input filtering, output policy checks, prompt change control, and behavior analytics. Prioritize products that integrate with your SIEM and case management.

- PII detection and redaction: Use a service that understands insurance documents and can redact at capture, in prompts, and at rest.

- Document AI and OCR: Buy specialized models for ACORD forms, ID cards, repair estimates, and medical bills. Precision here drives real-world ROI.

- Integration accelerators: Consider RPA for green-screen systems and packaged connectors for common cores. You can swap these out over time as APIs mature.

Where to start pilots

- FNOL assistant: Let the agent prefill forms from photos and voice notes, confirm coverage basics, and schedule next steps. Keep final approvals with human adjusters until metrics prove quality.

- Claims document concierge: Have the agent request missing documents, verify completeness, and route to the right queue. Measure cycle time reduction and rework.

- Producer pre-quote: Allow producers to ask natural language questions about appetite, get checklist answers, and generate draft outreach emails with embedded disclosures.

Operating model and controls

- RACI and ownership: Assign a business owner, a product manager, and a model risk lead for each agent use case. Make compliance a daily partner, not an end-stage reviewer.

- Change management: Treat prompts, tools, and policies like code. Use version control, peer review, and change tickets with rollback plans.

- Testing: Establish golden datasets, adversarial prompts, and sandboxed desktops for pre-production. Gate go-live on predefined quality thresholds and safety tests.

- Incident response: Extend your security runbooks to agent incidents. Define severity levels for policy violations, incorrect actions, and data leaks. Practice tabletop exercises.

What to watch next

- Regulatory harmonization: State adoption of AI bulletins continues. Track which states align to NAIC language and where extra obligations emerge, especially around consumer notices and audit requests.

- Explainability and disclosures: Expect pressure to show why an agent took an action and what data it used. Build explanation features into your tools now, with logs that map from output back to inputs.

- Computer-using agents at scale: As more vendors ship safer desktop automation, expect a shift from RPA scripts to agent sessions that handle variable tasks. Maintain a strict session policy and keep a human on-call for escalations.

- Shared industry datasets: Carriers and vendors will push for privacy-preserving ways to train on de-identified claims and fraud patterns. Watch for standards on contributions and usage rights.

The bottom line

The Tokio Marine news is a clear line in the sand. Agents have left the demo booth and entered regulated production work. The lesson for US carriers is to start with a reference architecture that regulators can audit, deliver measurable wins in claims and service, and expand scope only when quality clears a bar you define in advance. Build the connective tissue once, buy specialized components where it saves time, and keep logs and approvals ironclad. Do that, and agents shift from science project to competitive advantage.