Ghost Shark Goes Operational: AUKUS Undersea Strike Begins

Australia just opened a Sydney factory to mass-produce Ghost Shark, a containerized extra large undersea drone backed by a multibillion AUD program. The move signals an Indo-Pacific shift toward low-cost, persistent ISR and covert strike at scale.

Breaking in Sydney: Ghost Shark rolls into production

On October 31, 2025, Australia cut the ribbon on a 7,400 square meter facility in Sydney dedicated to building Ghost Shark, an extra large autonomous undersea vehicle that the Royal Australian Navy has elevated to a program of record. The factory opening followed a five year, 1.7 billion Australian dollars contract that moves Ghost Shark from sprint development into production for front line service. The first production vehicle has already rolled off the line and is slated for in water testing ahead of delivery to the Navy in January 2026, according to contemporaneous reporting from Reuters that was confirmed by Australian officials at the event factory opening and contract details.

This is not a typical defense timeline. Three prototypes were designed, built, and delivered in roughly three years by Anduril Australia in partnership with Defence Science and Technology Group and the Royal Australian Navy. Today’s ribbon cutting signals more than a new building. It caps a sprint that has pushed an autonomous underwater system from concept to production grade as regional navies race to add reach, mass, and resilience under the sea.

What went from whiteboard to water

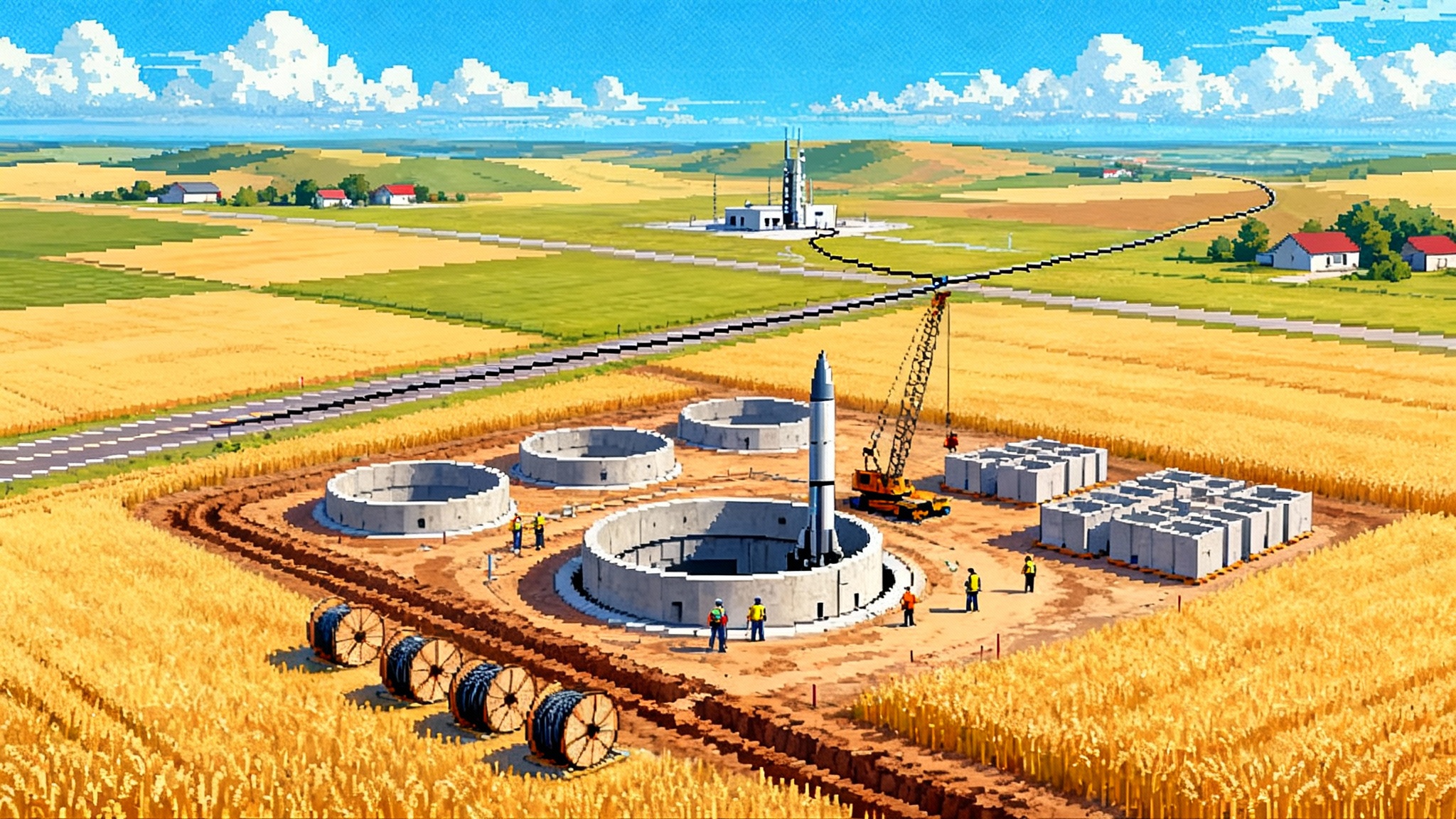

Ghost Shark is a large, modular, battery powered undersea craft designed for long duration missions. Think of it as a subsea pickup truck that can be outfitted for different jobs. It is built to carry multiple payloads, to operate with little external support, and to be moved and launched from ordinary maritime infrastructure. The development team stressed two design anchors: cost, so the platform can be bought in numbers, and logistics, so it can be shipped and operated using standard containers and cranes instead of specialized submarine tenders.

Those two anchors matter because they shape everything that follows, from how fast Australia can scale production to how easily allies can adopt the design. In practical terms, they turn Ghost Shark into a tool a fleet commander can position quickly and replace if lost, rather than a singular, exquisite asset that absorbs years of budget and can only be risked sparingly.

The containerized flip of the undersea cost curve

The most interesting change is not a single performance metric. It is the shift in economics. If a vehicle can ride inside a standard shipping container and launch from a pier, a landing craft, or a commercial vessel of opportunity, then the owner is buying effects without buying a vast support footprint. The container becomes both garage and shipping crate. It is the maritime equivalent of what palletized munitions aim to do in the air domain, but for sensors, decoys, and strike packages under the surface.

That logistics simplicity lowers total ownership cost and speeds deployment. A commander can pre position a dozen containerized vehicles across archipelagos and straits without tying up scarce warship pier space. In a crisis, those containers can be moved by rail, truck, or coastal freighter. The result is a more agile undersea posture, where mass and persistence come from numbers and distribution rather than a few very expensive crewed hulls. This mirrors the broader cost-per-effect trend highlighted in our analysis of the air domain’s missile evolution cost-per-shot shift in strike.

From ISR to covert strike

Australia’s public framing has been careful, yet clear. Ghost Shark is intended to deliver intelligence, surveillance, reconnaissance, targeting, and strike. The modular bay can accept different payloads. In peacetime it can map sea lanes and track submarines. In a gray zone it can seed or sweep sensors, shadow warships, or act as a communications picket. In wartime it can deliver effects against ships in chokepoints or threaten infrastructure in harbors. Think of it as a Swiss Army knife where the blade you select changes the mission.

There are hard engineering and policy choices embedded in that promise. Strike effects under the sea run from non lethal sabotage that buys time, to precision hits that deny access. Payloads must be designed for low signature carriage, safe handling, and assured positive control. The platform must manage enough onboard power and autonomy to complete missions, then either exfiltrate or hide. None of this comes for free. What changes now is that Australia will be building not one or two of these vehicles, but dozens.

The AUKUS path to exports, starting with the United States and Japan

Export controls will rightly gate who can buy Ghost Shark and what payloads they can receive. The likely near term customers are obvious. The United States Navy has been testing extra large undersea vehicles, and Australia already flew a Ghost Shark to Hawaii in 2024 to expand the joint trial envelope. The new Sydney line gives Washington a ready made path to fielding compatible vehicles for coalition missions in the first and second island chains.

Japan is the other near term vector. Tokyo joined allied experimentation on maritime autonomous systems this year, including underwater acoustic communications at Talisman Sabre under AUKUS Pillar Two. That participation signals a practical interest in interoperable uncrewed systems for anti submarine warfare and maritime domain awareness, and it begins the policy and technical work required for procurement. Japan’s Ministry of Defense described the exercise as an effort to evaluate interoperability and underwater messaging among allied systems Japan’s Pillar Two exercise participation. This aligns with Japan’s drive to field disruptive maritime capabilities, captured in our coverage of its at-sea energy weapons program Japan’s ship railgun signals.

If Australia, the United States, and Japan align on vehicle interfaces and mission software, Ghost Shark or a closely related variant could become the baseline for a shared undersea toolkit. The prize is not only shared hardware, but shared tactics and logistics.

How fast this scales, a 2027 snapshot

The contract Australia announced in September funds delivery, maintenance, and continued development over five years. With low rate initial production already underway in Sydney and full rate slated for 2026, the first operational detachment should be fielded in 2026 with additional vehicles arriving quarterly thereafter. A reasonable forecast has Australia operating several dozen production Ghost Sharks by the end of 2027, with a cadre of trained crews, maintainers, and tactics evaluators.

If the United States draws from the same production line for evaluation lots, and if Japan moves from exercises to procurement in that window, an allied pool of one hundred plus compatible extra large vehicles by 2027 is plausible. That number is not a hard target. It is a planning figure that follows from the new factory’s cadence, the stated Australian buy profile, and the realistic tempo at which a Navy can absorb and train on a new class of autonomous system.

What changes for anti submarine warfare

Anti submarine warfare has long optimized for finding and fixing a small number of valuable crewed boats. A world of many containerized undersea vehicles flips that script. Defenders must monitor for a larger population of small, quiet targets in cluttered coastal waters. That pushes investments into three areas:

- Seabed and pier side sensors that watch the approaches to ports and naval bases, installed like layered fences with short range high fidelity sonars at gates and wider area arrays in the roadstead.

- Patrols by small craft and uncrewed surface vessels equipped with dipping sonars and high powered multistatic sonars, able to sprint to cues and persist for hours.

- New interceptors designed to disable or capture uncrewed vehicles without blasting apart a harbor, including low collateral nets, entanglers, or non kinetic jammers.

Ghost Shark also helps the defender. In anti submarine warfare you want more ears in the water, more often, in more places. A fleet of long endurance vehicles that can hold station at known transit points will complicate the life of any adversary submarine captain.

Port defense in a container era

Ports are both the heart and Achilles’ heel of maritime power. Containerized undersea vehicles make it cheaper to threaten them, so defenders must raise the cost of attack. The playbook is straightforward and actionable:

- Treat port security as a joint mission. Navy, coast guard, and port authorities need shared underwater pictures, shared incident response checklists, and shared training cycles.

- Build a layered gate around high value piers. Start with fixed sonar and cameras. Add autonomous surface patrol craft with acoustic interceptors. Finish with a rapid response dive team trained on uncrewed vehicle capture.

- Monitor the air and surface movements that can quietly seed a harbor with containers. Randomized inspections of inbound containers and barges that stop near naval facilities will prevent the simplest delivery methods.

None of these are science experiments. They are a matter of prioritization and procurement in the next budget cycle.

Submarine force structure, fewer queens, more rooks

Crewed submarines do missions that demand stealth, power, and judgment. That will not change. What will change is how they spend their time and how many are needed for specific jobs. Picture a future patrol where a crewed submarine launches several undersea vehicles to scout a strait, place sensors, or stand in as decoys. The crewed boat becomes the underwater equivalent of a carrier or a quarterback, holding the high value payloads and weapons while sending uncrewed teammates to do the dangerous midfield work, much as the surface fleet is beginning to do with autonomous wingmen Navy wingman drones go live.

This suggests three near term adjustments to force structure and training:

- Equip existing submarines and surface combatants with standardized interfaces to control and recover large uncrewed vehicles, then train teams to manage a mixed formation.

- Shift a slice of procurement from additional crewed hulls to uncrewed mass and the infrastructure that sustains it, such as charging, spares, and software updates. This is a budget trade that pays off in coverage and persistence.

- Build a doctrine cell that pairs submarine captains with autonomy engineers and legal advisors. Getting the tactics right is as much about what the captain should ask the vehicle to do as it is about what the vehicle can do.

The hard problems, autonomy, communications, and rules of engagement

Autonomy at sea is not a magic switch. Underwater communications are band limited and fickle. Acoustic links carry far less data than radio, and they are slow. That means most decisions must be made onboard, with human commanders setting goals in advance and adjusting only when the vehicle surfaces or reaches a buoy or gateway node.

A simple metaphor helps. Imagine sending a hiker into a canyon with a handheld radio that only works when the canyon widens. You can plan the route and define the stop points. You can pack extra batteries and a map. But when the hiker is out of range, they must rely on training and rules you set before they left. That is Ghost Shark’s operating reality. It pushes designers to build robust mission plans, layered fail safes, and clear on board rules that prevent the vehicle from doing something unsafe when communications drop.

Rules of engagement are the other hard edge. Democratic states insist on positive human control for the use of lethal force. In practice that means building in verifiable checks, such as requiring a burst of authenticated commands before any weapon can arm. It also means designing missions that deliver value without kinetic effects, for example planting sensors, spoofers, or non lethal stoppers during phases when communications cannot be guaranteed.

None of these hurdles are showstoppers. They are engineering and policy problems with clear mitigations. What the Sydney factory does is make it worth solving them at speed because a fleet is coming, not a handful of prototypes.

What industry and allies should do next

- Stand up a shared undersea software stack. Allies should agree on message formats and autonomy interfaces so a U.S. submarine can task an Australian vehicle, and a Japanese commander can ingest sensor feeds without bespoke adapters.

- Fund underwater communications relays at key straits. Fixed acoustic nodes, occasional surface buoys, and seabed gateways will increase the number of safe windows for positive control.

- Publish clear payload export tiers. A simple ladder will speed sales to trusted partners while protecting the most sensitive effects. Start with sensing, then denial tools, then more advanced strike packages.

- Procure anti UUV defenses now. Ports should buy off the shelf sonar and interceptor packages within the next fiscal year. Waiting for perfect systems is a recipe for an undefended harbor.

The takeaway

Australia’s late October factory opening in Sydney marks a pivot point. AUKUS partners have talked for years about delivering mass and persistence under the sea. Ghost Shark makes that concrete. It is a containerized, modular vehicle that can be built in numbers, shipped on ordinary transport, and tasked for missions that once required a billion dollar boat. If allied navies follow through with exports to the United States and Japan, and if they solve the communications and rules of engagement details with the same urgency they brought to development, the Indo Pacific undersea picture will look different by 2027. Not because one platform is unbeatable, but because a distributed fleet of them is hard to stop and easy to replace. That is how you flip a cost curve. That is how you change a theater.