EGS Breaks Out: Geothermal’s 500 MW Utility-Scale Turn

October 2025 locked in supplier awards and fully contracted offtake for Cape Station, signaling that enhanced geothermal has moved from pilot talk to 500 MW of real delivery with commercial operations set from 2026 to 2028.

The October inflection: from pilots to power stations

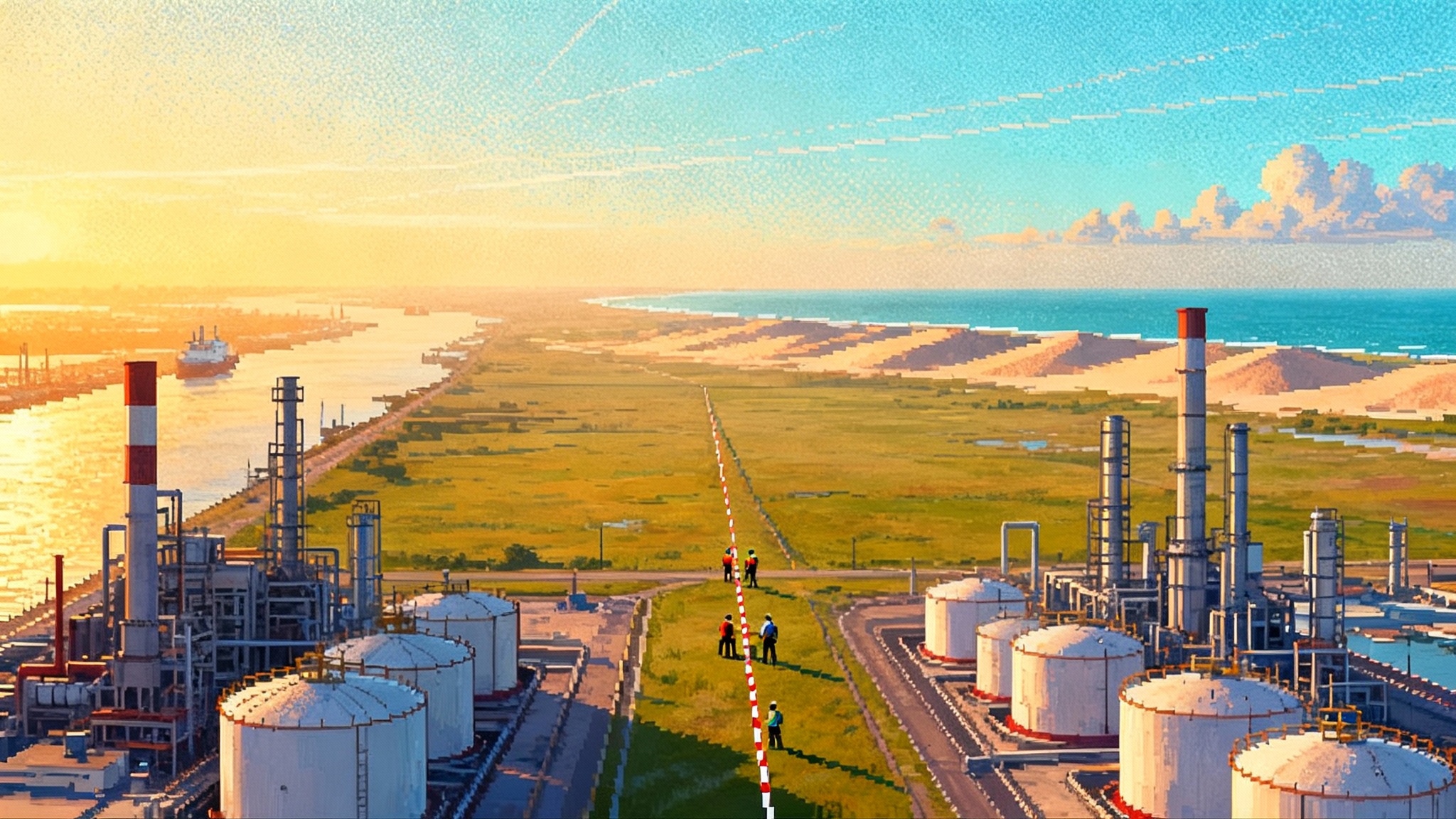

Every energy transition has a moment when the experiment becomes the product. For enhanced geothermal systems, that moment landed in October 2025. Supplier awards for Cape Station Phase II in Utah and a wave of offtake confirmations put steel and contracts behind a simple claim: next-generation geothermal has crossed the line from pilot to utility-class delivery. With Phase I targeting 2026 commercial operation and Phase II sequenced through 2028, the sector now has a concrete 500 megawatt buildout on the clock.

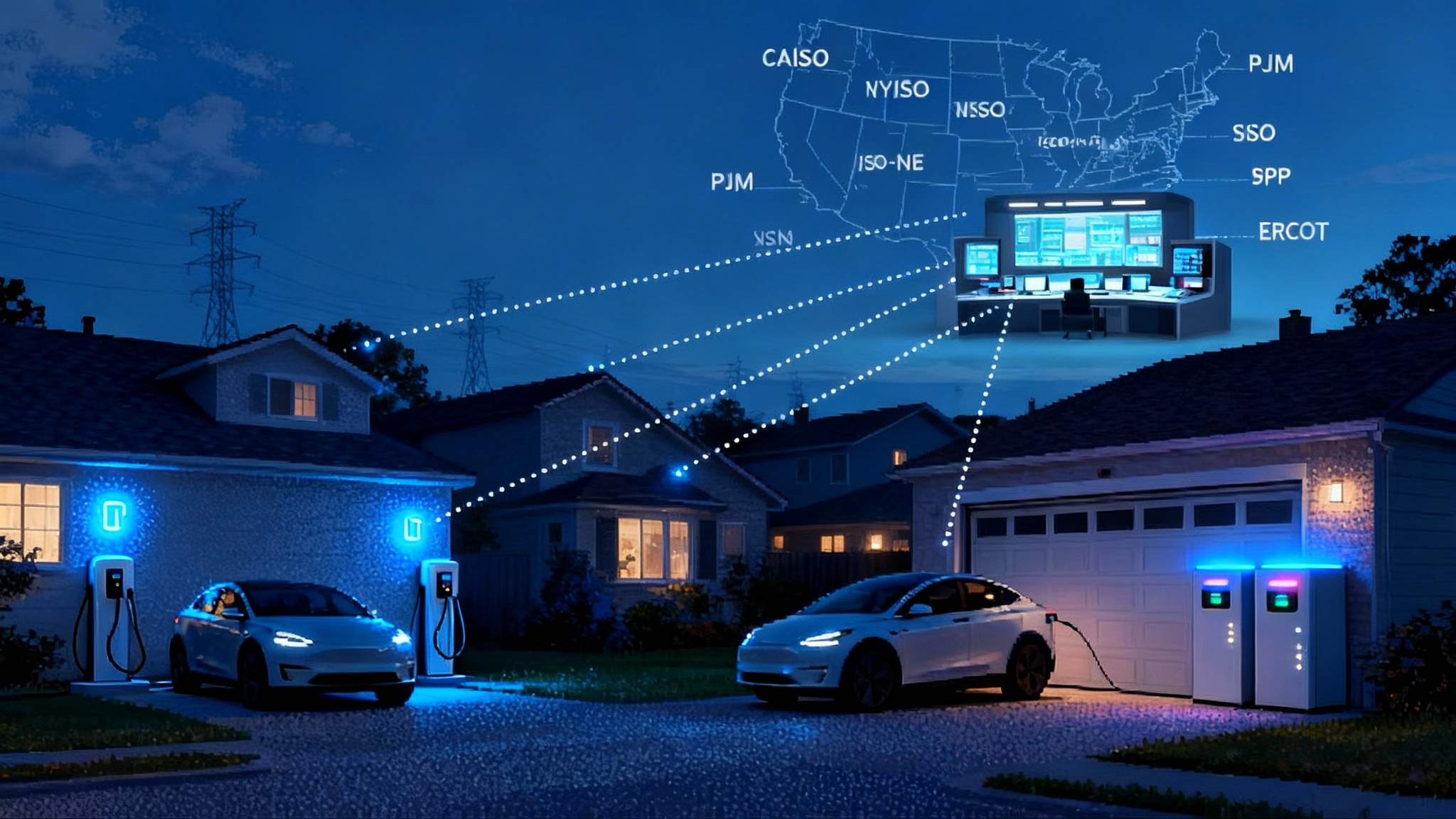

If you are a utility resource planner or a large power buyer, this is not just another ribbon cutting. It is the arrival of a firm, zero-carbon option that fits into integrated resource plans without a massive transmission build and without the intermittency penalties that complicate wind and solar portfolios. April’s power purchase agreement with Shell Energy made the full Cape Station 500 megawatts fully contracted and pulled forward a broader market signal: buyers want clean power that shows up every hour, not just when the sun or wind cooperate. That deal was publicly framed as the contract that fully contracted the 500 megawatts and as the first offtake to receive Phase I electrons beginning in 2026, as the Business Wire announcement summarized.

What changed in October

Two details made October more than a headline month:

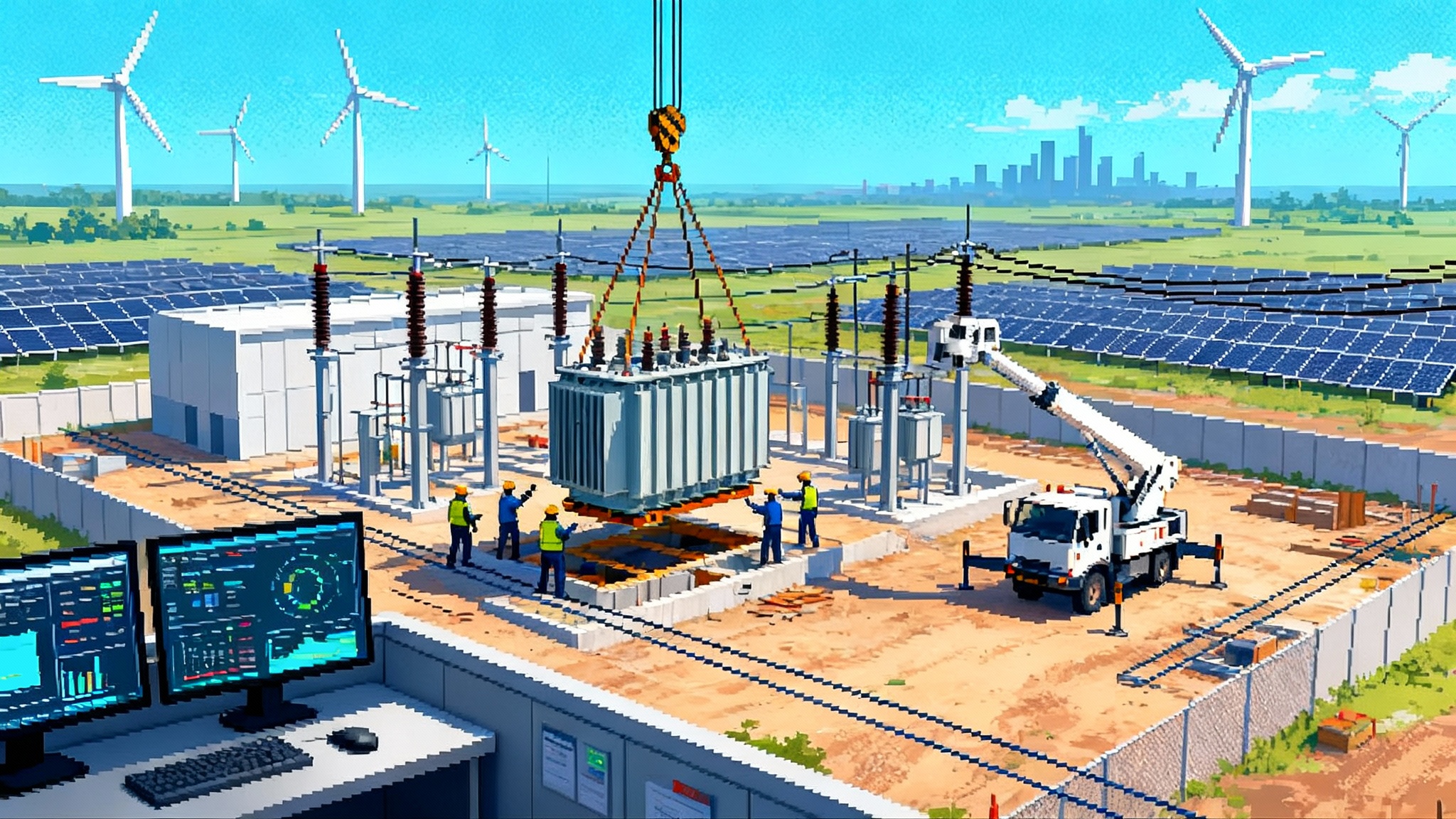

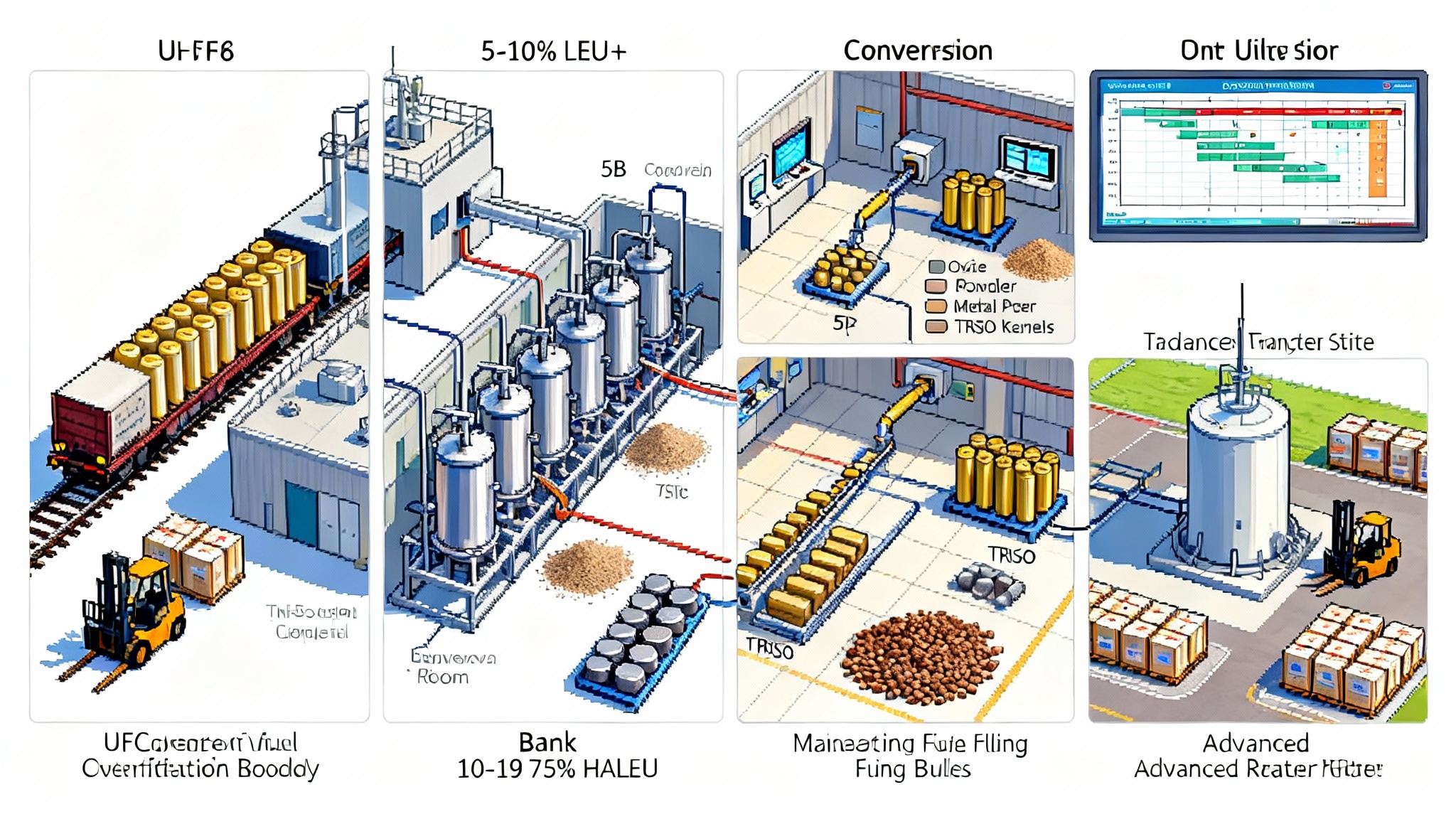

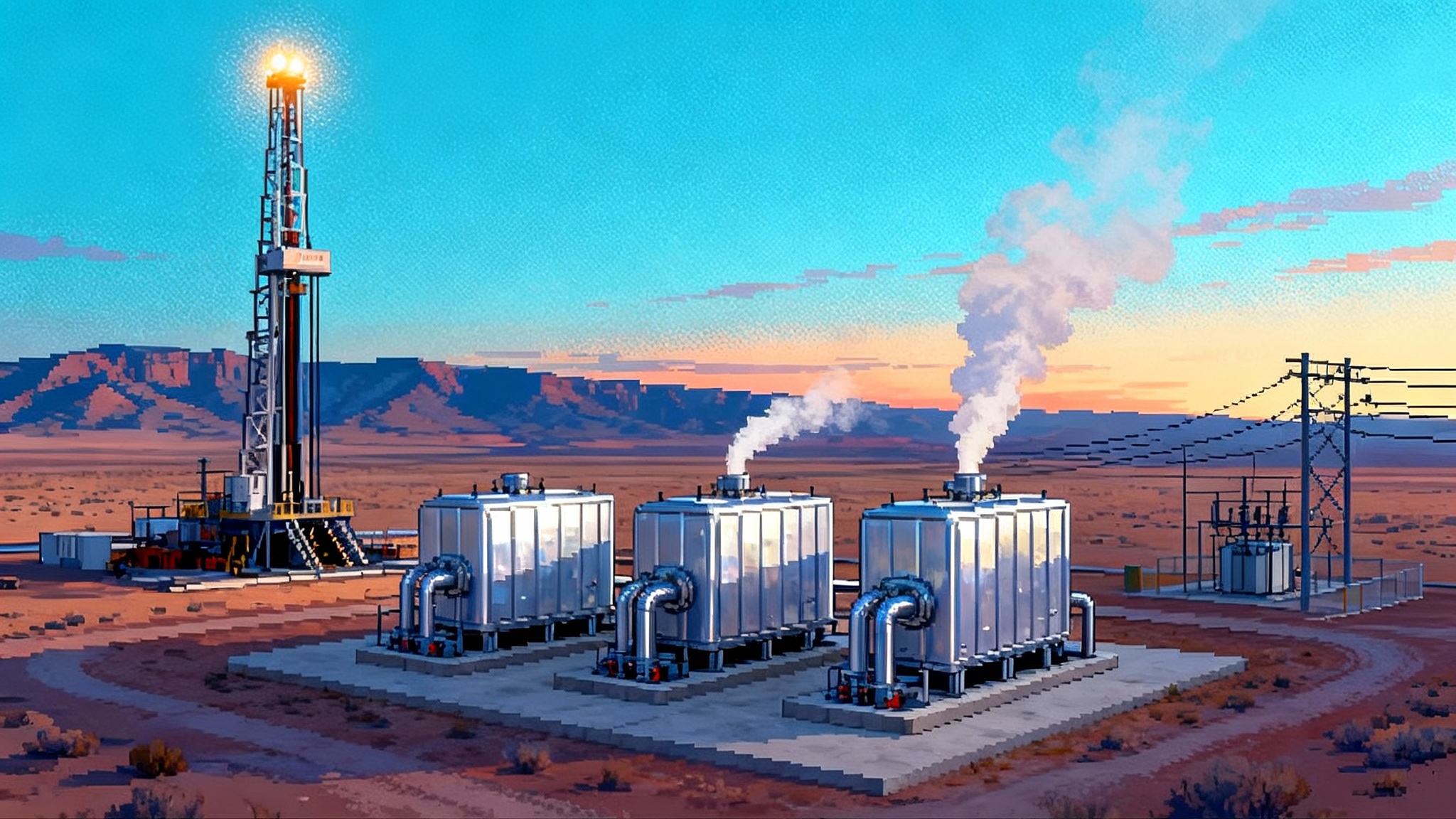

- Equipment awards that translate into delivered megawatts. Phase II at Cape Station moved from concept to hardware when major suppliers were tapped to deliver modular Organic Rankine Cycle equipment and associated turboexpanders and generators. The orders are sized in 60 megawatt blocks, which is how you build a 300 to 400 megawatt second phase on a schedule the grid can plan around.

- Evidence that offtake is not a science project. Between earlier utility agreements and the April 2025 Shell Energy contract, developers now have a fully sold 500 megawatt portfolio. That matters for financing, for factory production slots, and for utilities that have to justify long run capacity and reliability plans.

Combine those with federal tax credit clarity that arrived in January 2025 and you get a project finance recipe that looks familiar to banks. The Treasury and IRS finalized the technology neutral clean electricity rules in Sections 45Y and 48E, explicitly confirming geothermal as a qualifying zero emissions source, and then published the first Annual Table of qualifying technologies. The upshot is durable eligibility and the option to elect either a production tax credit or an investment tax credit, with transferability now routine in deals. For developers and lenders, that is the difference between we think this pencils and we know this pencils. See the Treasury final rules overview and our breakdown of why tech-neutral credits are live.

Why this is a sleeper pillar for U.S. grids

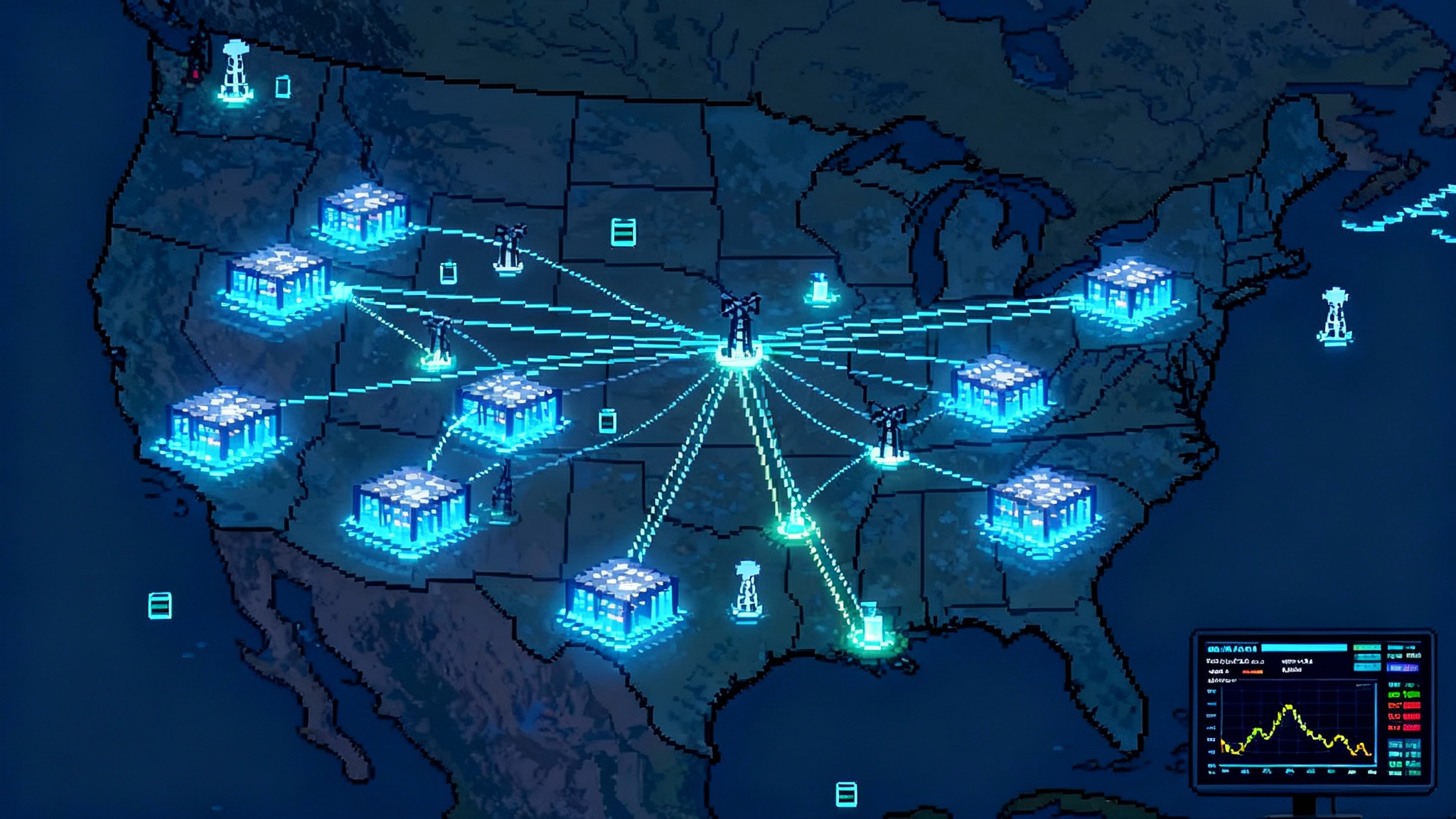

Think of the current grid as a stool that wobbles because two legs got very long very fast. Solar and wind grew explosively. Storage is the third leg, but it has been sized mostly for hours, not days or seasons. Enhanced geothermal adds a fourth leg that steadies the whole platform.

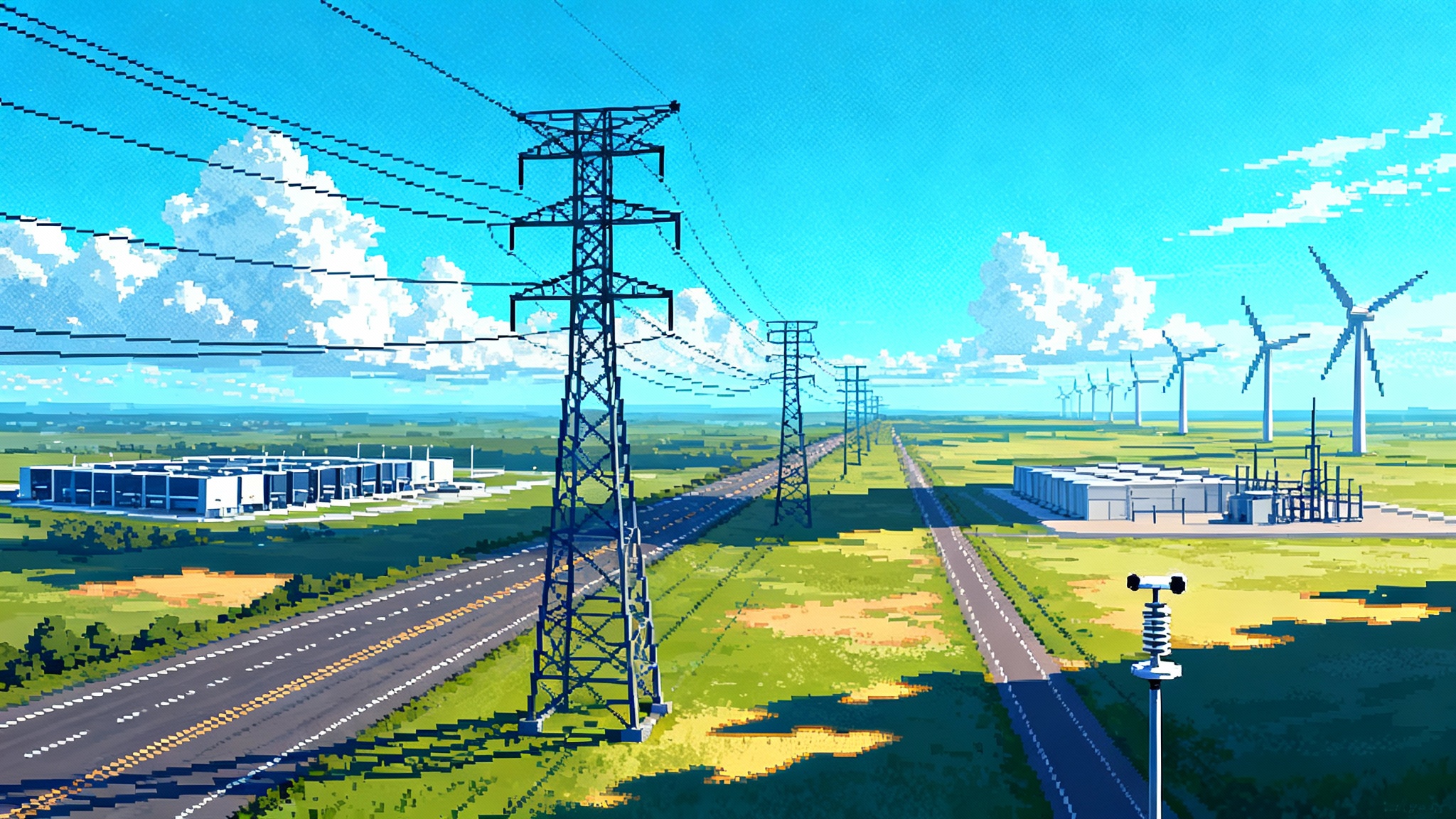

- Transmission light siting: Because geothermal can be developed near existing substations and load pockets, it does not always require hundreds of miles of new lines. Utilities can clear smaller interconnection queues faster and place projects where grid planners actually need capacity. That makes the megawatt year, not just the megawatt hour, more credible in resource adequacy studies. See how this interacts with queue reform in Interconnection 2025 first results.

- Oilfield workforce reuse: Drilling and completion look much more like shale than like wind tower erection. That means the crews, rigs, cementing services, mud systems, and safety procedures are familiar. Retraining time drops and the supply base is deep, especially across the Mountain West and Texas service hubs that already mobilize for big drilling campaigns.

- Modular ORC supply chains: The power plant on the surface is a thermal machine built from repeatable skids. Turboexpanders, generators, and condensers come in standard sizes. Suppliers can scale in 60 megawatt increments and replicate balance of plant designs with high learning rates.

- Bankability post guidance: With 45Y and 48E rules locked, projects can pick PTC or ITC to fit their capacity factor and capital stack, layer in transferability, and count on prevailing wage and apprenticeship rules that are now well understood by EPCs. That reduces term sheet guesswork and shortens the path to notice to proceed.

Delivery math: 500 megawatts with 2026 to 2028 CODs

Cape Station’s structure is intentionally modular. Phase I targets 100 megawatts online in 2026. Phase II builds out in 60 megawatt blocks through 2028, with the drilling program progressing in benches and the surface plants following as equipment ships. That is how you turn a first of a kind field into a production line rather than a moonshot.

Why this matters for the grid is simple. A 500 megawatt geothermal portfolio at 90 percent plus availability provides annual energy comparable to several gigawatts of solar once you account for winter output and evening peak coverage. It also shows up when the grid is stressed from cold snaps or smoke events, when solar and wind can underperform. In capacity accreditation terms, geothermal’s dependable output turns into a high effective load carrying capability without complex portfolio modeling.

The mechanisms behind the flip

- Subsurface learning loops: Fiber optic sensing, larger casing diameters, and optimized well spacing allow more heat and flow per well over time. That reduces the wells per megawatt ratio, which is the fundamental lever on cost and schedule.

- Assembly line surface plants: Instead of bespoke thermal plants, developers are standardizing ORC blocks. Think shipping containers of heat exchangers, skids, and controls that connect like Lego pieces. Suppliers can book multiple identical trains, bake in quality improvements, and hold inventory of critical parts.

- Contracting maturity: Early buyers leaned on 24 by 7 carbon free energy commitments and clean firm carve outs. As the product matures, power purchase agreements incorporate availability guarantees, performance curves, and outage windows that look like conventional thermal contracts. That drives lender comfort and better pricing.

The bottlenecks that could slow the next 3 gigawatts

- Rig availability and the right rigs

- The constraint: You need high horsepower, top drive rigs with geothermal friendly blowout preventers, and you need them in sequence. Competing drilling demand from oil and gas can tighten the market.

- What to do: Utilities and large buyers can encourage developers to forward contract rigs by offering schedule sensitive offtake terms. State energy offices can support rig electrification programs that reduce diesel logistics and noise, making it easier to permit near existing substations.

- Subsurface data density

- The constraint: In new basins, data quality on heat, stress, and permeability is uneven. That pushes developers to over drill pilot wells before committing to full field development.

- What to do: Include pre commercial data cost recovery in procurement scoring. Fund shared seismic, magnetotelluric, and gradient mapping campaigns through state trusts or public private partnerships. Require that noncompetitive legacy data held by public agencies be digitized and posted.

- Long lead equipment

- The constraint: Turboexpanders, large generators, and condenser bundles carry 12 to 18 month lead times. When multiple projects order at once, the queue stretches.

- What to do: Align offtake commercial operation dates with supplier slot calendars. Offer milestone payments tied to factory acceptance tests so suppliers can finance line expansions. Encourage domestic content roadmaps that give vendors confidence to tool additional lines.

- Interconnection drag

- The constraint: Even for transmission light projects, queue studies and network upgrades can add years.

- What to do: Use cluster based interconnection for geothermal zones and apply fast track paths for projects at or near existing substations with demonstrated deliverability.

- Water management and induced seismicity

- The constraint: Make up water, brine handling, and microseismic management need robust plans to keep community confidence high.

- What to do: Bake in transparent monitoring with real time dashboards for regulators and local stakeholders, paired with binding operational thresholds and third party verification.

The acceleration playbook for 2026 to 2030 IRPs and procurements

Here is a practical checklist utilities, community choice aggregators, and corporate buyers can execute now.

- Put geothermal in the core stack, not the appendix

- Action: Model 5 to 10 percent of peak load as clean, firm geothermal in your next integrated resource plan base case, with sensitivity bands for higher penetration. Use realistic capacity factors and winter peak contributions.

- Why: This reveals portfolio savings from reduced curtailment and smaller storage and transmission needs.

- Carve out a clean firm tranche in solicitations

- Action: Create a technology agnostic, clean firm bucket that geothermal can compete in, with minimum availability and ramping characteristics.

- Why: It avoids pitting geothermal against solar on a raw energy price basis and recognizes reliability value.

- Offer shape aware contracts

- Action: Structure products around hourly delivery requirements that match local peaks or data center load. Include bonus pricing for critical hours and shoulder seasons.

- Why: Geothermal can tailor output to meet local reliability needs and capture better economics. For data center dynamics, see AI’s power land rush.

- Align CODs to factory slots

- Action: Ask bidders to disclose factory slot reservations for long lead components and require delivery schedules in bid evaluation.

- Why: This compresses execution risk and avoids unpleasant surprises 18 months in.

- Pay for progress, not just power

- Action: Allow milestone payments at drilling completion and factory acceptance, secured by performance bonds.

- Why: It lowers the developer’s cost of capital and speeds procurement of rigs and equipment.

- Target transmission light nodes

- Action: Publish a map of substations and feeders with spare thermal capacity and invite geothermal proposals within those catchments.

- Why: You unlock near term capacity additions without waiting for new high voltage lines.

- Standardize geothermal PPAs

- Action: Adopt a template with availability guarantees, planned outage windows, heat degradation curves, make whole provisions for supplier delays, and clear force majeure definitions.

- Why: Fewer bespoke clauses shorten negotiations and improve lender terms.

- Use the tax toolbox intentionally

- Action: For high capacity factor projects, consider electing the production tax credit and monetizing it via transferability. For projects with higher upfront costs or unique heat exchange designs, evaluate the investment tax credit election.

- Why: Optimizing the credit election can change levelized cost by double digits and make bids more competitive in your stack.

- Build an oilfield workforce bridge

- Action: Partner with service companies to cross train drilling crews for geothermal best practices and community standards, including seismic monitoring and water stewardship.

- Why: It increases the qualified labor pool and lowers incident risk.

- Design for portfolios, not one offs

- Action: Run multi site procurements that allow developers to propose staggered blocks across a basin and score them as a portfolio with shared interconnection and logistics.

- Why: Portfolios smooth learning curves and timelines, delivering better price and reliability.

What this means for buyers beyond California

The early offtakers include California load serving entities and corporate buyers that value 24 by 7 carbon free electricity. But the template scales. Mountain West utilities can add geothermal at local substations to firm wind, the Texas market can site projects close to data centers and industrials that want clean steam or power, and Midcontinent utilities can pilot smaller blocks as hedges against gas price volatility.

Regulators also have a role. They can recognize geothermal’s winter reliability in capacity accreditation, allow cost recovery for early subsurface data gathering, and enable performance based ratemaking that rewards utilities for integrating clean firm resources that reduce curtailment and congestion.

How the next wave arrives

Expect three developments between now and 2028 if October’s signals hold:

- More factory footprints: As orders stack, suppliers add North American assembly for ORC skids, turboexpanders, and generators, cutting lead times and import exposure.

- Rig electrification: As more pads connect to the grid, rigs and mud systems electrify to cut emissions, noise, and fuel logistics. This improves community acceptance and site permitting.

- Basin clustering: Developers build multiple fields around the same transmission nodes, sharing logistics, workforce, and water treatment capacity.

The combined effect is a step change in cost and bankability. When factory slots are real, when rigs are booked, and when offtake is standardized, project finance behaves predictably. That is how a 500 megawatt headline becomes a multi gigawatt market.

The takeaway

October 2025 was not a single press release. It was a proof of maturity. Equipment is on order for the next blocks of capacity. The 500 megawatt portfolio is fully sold. Federal tax rules are clear. Utilities now have a clean, firm resource that is modular, transmission light, and built by a workforce the energy industry already has. The path from 2026 to 2028 commercial operation dates is mapped, not guessed.

If you plan the grid, the move is simple. Treat enhanced geothermal as a core reliability asset in your next resource plan, align procurements to long lead equipment schedules, and write shape aware contracts that pay for reliability. Do that, and by the end of this decade geothermal will not be the sleeper pillar of U.S. grids. It will be the quiet backbone that kept the lights on while everything else changed.