Qcells Furloughs Expose UFLPA Choke Point in U.S. Solar

In November 2025, Qcells furloughed roughly 1,000 Georgia workers after Customs detained key inputs under the Uyghur Forced Labor Prevention Act. Here is a pragmatic 2026 playbook to de-risk procurement, speed domestic cells and wafers, and keep project schedules on track.

Breaking: A factory slowdown that was not caused by demand

One year ago, the biggest worry in U.S. solar was whether new Inflation Reduction Act factories could ramp fast enough to meet a tidal wave of demand. In early November 2025, the story flipped. Qcells, the largest crystalline silicon panel maker in the United States, announced furloughs for roughly 1,000 Georgia workers and cut about 300 contractor roles because U.S. Customs held up critical intermediate goods under the Uyghur Forced Labor Prevention Act. The company said detentions under the law, not a lack of orders, forced the slowdown. The headline that mattered was simple and blunt: enforcement was the constraint. See Reuters coverage of the furloughs.

If you configure projects, finance them, or supply them, this is your new baseline. The gating factor for 2025 was not megawatts of demand. It was the ability to prove, with documentary and data-level certainty, that every gram of polysilicon and every wafer in a module was untainted by forced labor.

Why enforcement overtook demand

The Uyghur Forced Labor Prevention Act creates a rebuttable presumption that any product that touched the Xinjiang region is barred from entry. The Department of Homeland Security expanded its UFLPA Entity List in January 2025, tightening scrutiny of companies tied to Xinjiang-linked materials. That expansion told the market that Customs would not just look at final modules. It would trace back through cells, wafers, ingots, and polysilicon. You can see this posture in the official announcement, where DHS expanded the Entity List in January 2025.

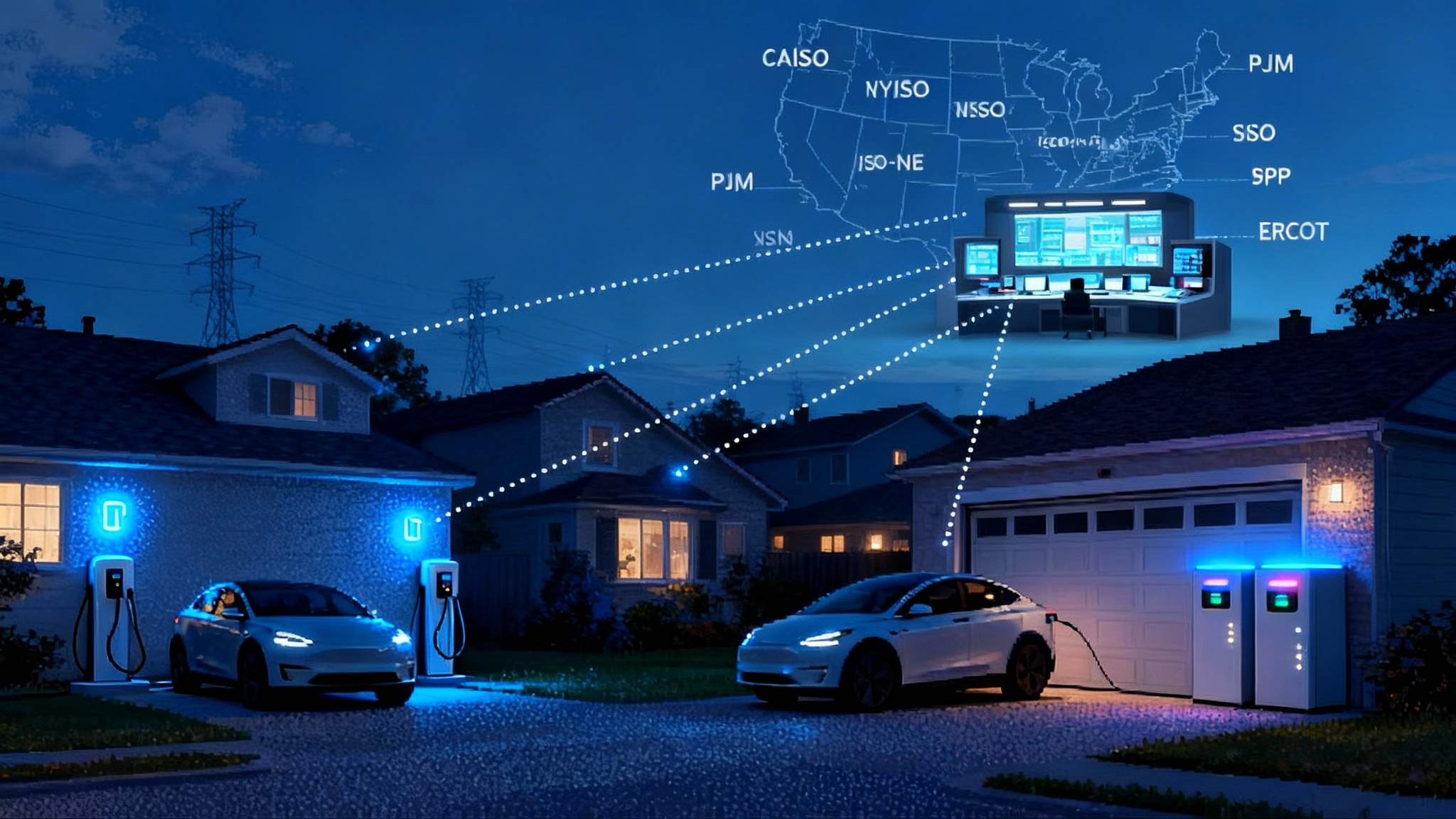

The immediate effect is operational. Detentions put pallets and containers into a queue. Even if many shipments are ultimately released, the calendar math hurts. A two week to eight week delay can knock a project off its interconnection milestone, complicate tax credit timelines, and force developers to pay extension fees. One detained lot in a 100 container portfolio can idle crews and cranes. For context on queue pressures, see Order 2023 interconnection results.

How UFLPA scrutiny actually plays out on a shipment

Think of a module as a layered story with a serial number. Customs now reads that story back to the quarry. The steps are straightforward to list and hard to prove at speed:

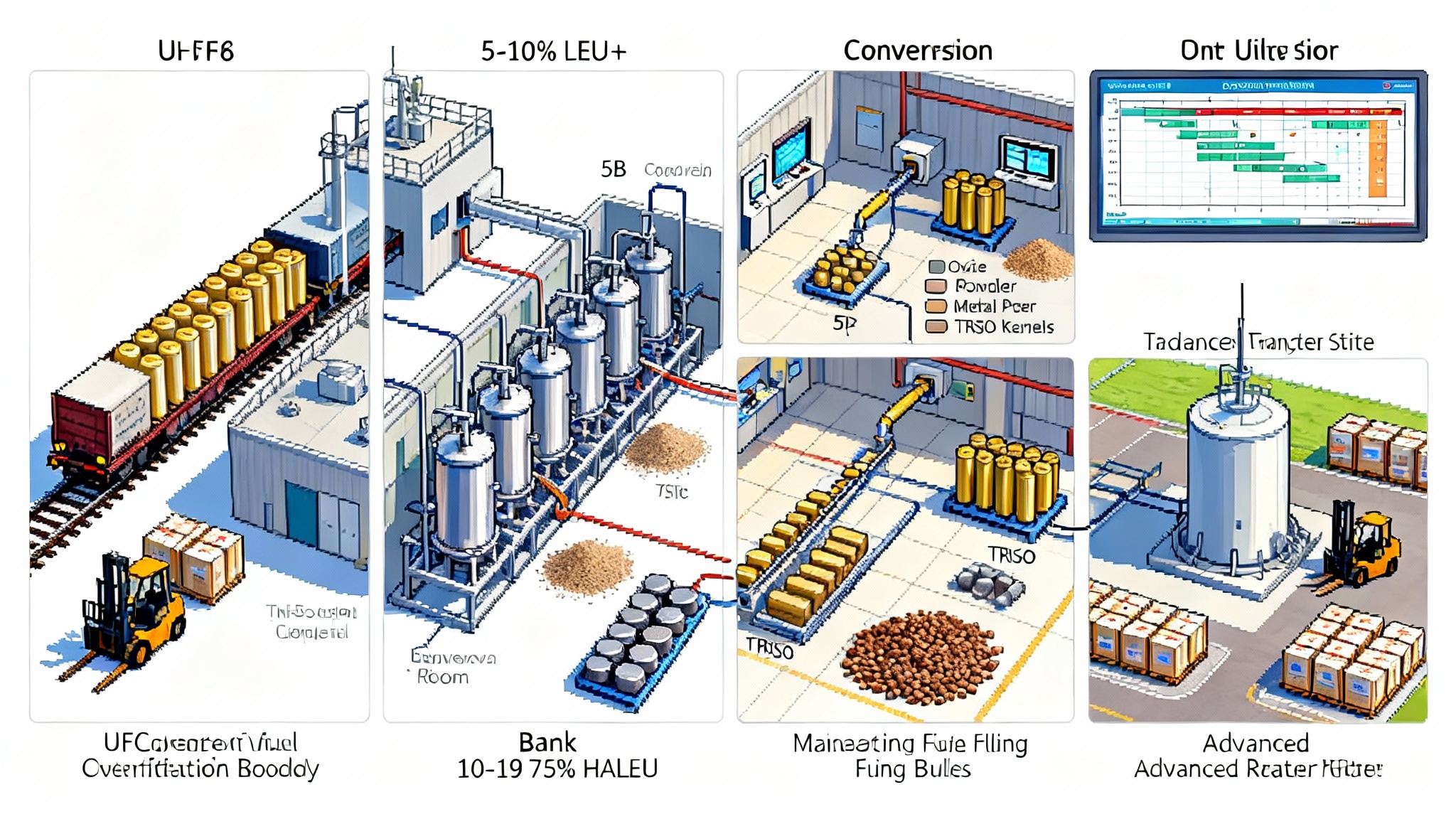

- Quartzite is mined and turned into metallurgical-grade silicon.

- That silicon is refined into polysilicon.

- Polysilicon is pulled into ingots and sliced into wafers.

- Wafers are processed into cells.

- Cells are interconnected into modules.

Customs wants documentary evidence for each step, tied to a specific lot, not a general corporate statement. Bills of material, production batch records, and transportation documents must reconcile. A broken link at any point creates detention risk. The most common breakpoints are wafer origin and polysilicon batch records because those often move through multiple tollers before landing in a cell line in Southeast Asia.

Developers sometimes assume that assembling in Malaysia or Korea is enough. It is not. If the polysilicon batch tied to the wafer touched a Xinjiang-linked entity, the presumption applies. The lesson from 2025 is that paper trails now need to be both true and structured so that a Customs officer can validate them without a scavenger hunt.

The timing gap: IRA factories rising into a volatile import regime

The United States is rebuilding its crystalline silicon supply chain. Qcells is standing up an ingot, wafer, cell, and module complex in Cartersville, Georgia. The plan is to cut the riskiest import layers by making wafers and cells domestically, then tie those into modules from Cartersville and Dalton. That is the right direction. The problem is timing. During ramp, even vertically integrated factories rely on imported tools, consumables, and sometimes interim volumes of cells or wafers to bridge gaps. In 2025, that bridge ran through a river of paperwork.

Other parts of the market coped by shifting mix. Thin film producer First Solar, which uses cadmium telluride instead of polysilicon, saw sustained demand because it sat largely outside the UFLPA polysilicon chokepoint. Utility developers who could switch modules did. Many could not, because project specifications, inverter pairings, and bankability tests were already locked.

The result is a very specific bottleneck. Demand is healthy, interconnections are scarce, tax credits are available, and factories are coming online. Yet a single missing wafer batch record can idle a gigawatt of projects.

A fast path for 2026

The quickest way out is to redesign procurement around traceability first, accelerate domestic wafer and cell production, fully leverage tax incentives that reward U.S. manufacturing, and add storage as a hedge against module volatility. Here is a practical playbook for each.

1) Make traceability the first filter in procurement

Price and efficiency used to be the first screen. In 2026, traceability should go first. Treat it as a product specification, not a compliance afterthought.

Actions you can take now:

- Require serial-level traceability that links every module to the originating polysilicon batch, wafer lot, and cell line. Ask suppliers to provide a standard data package that includes bills of materials, batch numbers, and transport documents for each manufacturing step. If a supplier cannot show this on sample serials before you sign, they will not be able to satisfy Customs after you ship.

- Use independent traceability frameworks and auditors. Whether you use the industry protocol or a similar one, do not rely only on supplier letters. Commission a third party to test reconciliation on random serials from past deliveries.

- Negotiate documentation service levels into contracts. Set clear timelines for producing complete data packs when Customs requests them. Make documentation delays a supplier responsibility with defined penalties or replacement obligations.

- Align logistics to reduce detention friction. Choose ports with demonstrated UFLPA processing experience, engage customs brokers early, and pre-stage data with your broker so that a detention does not start a frantic document chase. Build buffer time into schedules based on the longest recent detention, not the average.

- Structure incentive-compatible terms. Offer modest price uplifts for verifiably low-risk lots, for example wafers sourced from known non-Xinjiang polysilicon producers with strong documentation histories. Developers who made this shift in late 2025 reported fewer surprise detentions and easier releases.

2) Cut import risk at the root by accelerating domestic wafer and cell ramp

Relying on imported wafers and cells keeps the riskiest links offshore. The near-term fix is to help U.S. factories pull those steps forward faster.

Actions for buyers and suppliers:

- Lock in multi-year offtake tied to domestic wafer and cell milestones. Offer volume commitments that escalate as each line passes qualification. Pair those commitments with progress payments that arrive when equipment is installed, when first articles pass, and when yield thresholds are met.

- Pool demand. Utilities and large commercial developers can form a buyers club that aggregates 2026 to 2028 wafer and cell needs across projects. Bigger and steadier offtake schedules help manufacturers justify adding shifts and pulling forward tool orders.

- Support the ramp with people, not just purchase orders. Co-fund training programs with states and community colleges near factories. Wafering and cell lines depend on technicians who can keep crystal growth, slicing, and diffusion equipment within tight windows. Having trained operators on day one reduces scrap and speeds qualification.

- Coordinate polysilicon and ingot inputs domestically where possible. U.S. polysilicon producers have capacity that can be tied to domestic ingot and wafer lines. This is lower risk for UFLPA and shortens the documentation chain, which speeds any Customs review of imported subcomponents that remain in your bill of materials.

The point is simple. The fewer foreign wafer and cell inputs you rely on, the less you need to prove at the border. Every step brought onshore removes a major node of uncertainty.

3) Treat 45X and the domestic content bonus as operating tools, not just headlines

Two parts of the Inflation Reduction Act are designed for moments like this. Section 45X pays manufacturers for each eligible domestic component they produce, from wafers and cells to modules and certain inverters. The domestic content bonus increases the Investment Tax Credit or Production Tax Credit for projects that meet U.S. content thresholds across steel, iron, and manufactured products. For broader policy context, see tech-neutral credits 45Y and 48E.

Practical ways to use these incentives in 2026:

- Convert 45X into price stability. If you are buying from a U.S. factory that earns 45X on wafers, cells, and modules, structure contracts so that a portion of that credit backstops delivery schedules. For example, if a Customs delay on imported consumables slows a line, the supplier can use 45X proceeds from another product lane to keep labor in place and catch up rather than pausing shifts.

- Trade domestically made content for interconnection certainty. Projects that meet domestic content thresholds can claim higher credits. Use that premium to justify switching from risky imported cells to domestic cells even if the nameplate price is higher. The net after-tax cost can be equal or lower once the bonus is applied, and the schedule risk is lower.

- Use transferability and tax insurance to lock the value. Treat the domestic content bonus as a bankable stream by pairing it with transferability contracts and, if needed, tax insurance. That lets you commit to domestic supply before a financial close that depends on every module being on site.

- Align your procurement calendar with ramp schedules. If Cartersville or another U.S. cell line adds capacity in the second half of 2026, front-load site work, civil, and balance of plant in the first half. Then slot domestic cells into the back half. Treat construction as a choreography problem that places the most UFLPA-exposed components last.

4) Pair storage to hedge module volatility and keep the pipeline moving

Storage is a schedule hedge in a market where modules can get stuck at the border. Standalone batteries now qualify for the Investment Tax Credit, and storage paired with solar can capture additional grid services revenue that is decoupled from module delivery timing.

How to put this into practice:

- Build storage-first at interconnection points. If solar modules slip, you can still install containers, switchgear, and controls. Commission storage for capacity or ancillary services, then add solar later when module supply stabilizes. This preserves interconnection and commercial operation milestones.

- Shift some projects to standalone storage with offtake structures that look more like tolling. Utilities can run resource adequacy or clean peak procurements that pay for storage availability, independent of a particular solar delivery calendar.

- Use storage to shape partial solar deliveries. If only a portion of a project’s modules clear at first, storage can time-shift the delivered energy to meet peak commitments. This allows phased energization rather than a binary on or off.

- Hedge price spikes. If module prices jump due to a wave of detentions, storage revenue from peak hours can offset the temporary premium for traceable modules and cells.

A Customs-ready playbook for developers and buyers

You cannot control enforcement. You can control how ready you are when enforcement arrives.

- Build a container-level document room before anything ships. For each container number, store the full chain of documents: commercial invoice, packing list, bill of lading, wafer batch certificates, polysilicon batch origin attestations, and process flow maps. Do not accept PDFs that cannot be searched or matched to serials.

- Pre-clear data with your customs broker. Treat your broker like a project partner, not a courier. Share your documentation standard and ask for a dry run based on a recent import from the same supplier.

- Create a detention response team. Name the people in legal, procurement, the supplier, and the broker who will respond within 24 hours to any Customs request. Set service level agreements for document retrieval.

- Pick ports and lanes with experience. Not all ports process UFLPA detentions at the same speed. Ask your broker for cycle times by port for solar shipments, then route accordingly even if freight cost is slightly higher.

- Stage critical spares and non-UFLPA consumables domestically. Keep a cushion of glass, frames, junction boxes, and backsheets so that once cells and wafers are available, module lines can run without new import dependencies.

- Maintain a rolling nine month risk scorecard by supplier and product type. Score on documentation quality, detention history, release times, and audit responsiveness. Use the scorecard to set bid weights and decide who gets volume.

- Track what matters to Customs. Update your specifications and data templates when the agency’s public actions change. The January 2025 Entity List update focused attention on particular wafer and polysilicon entities. As that list evolves, your risk screen should evolve with it.

What the next 12 months could look like

Expect more of the same in the short run. Enforcement will remain aggressive because it is part of a broader human rights policy. More entities may be added to the list. Every Customs region will continue to learn by doing, which means variability by port and over time. Grid-side policy shifts also matter; see Transmission 2.0 compliance and fights for how evolving rules can affect project pacing.

The difference in 2026 will come from domestic integration. As U.S. wafer and cell lines cross their reliability milestones, and as documentation around imported inputs stabilizes into repeatable templates, the rate of surprise detentions should fall. It will not go to zero. It will become more predictable. That is enough to plan again.

There is also a strategic upside. The companies that solve documentation and domestic integration first will have the most reliable delivery schedules. In a market where time is money, reliability is a product feature that earns a premium. Expect buyers to value it explicitly in bids and power purchase agreement negotiations.

The bottom line

The November 2025 Qcells furloughs were not a story about weak demand. They were a public reminder that the U.S. solar sector now runs through a narrow gate labeled forced-labor enforcement. The fastest way through in 2026 is to treat traceability like a product spec, pull wafer and cell risk onshore as quickly as possible, put 45X and the domestic content bonus to work as operating tools, and use storage to keep your project pipeline moving when modules are stuck in review.

We are past the phase where a good module at a good price is enough. The winners will be the teams that can show their supply chain on a whiteboard from quarry to module, produce every document on a tight clock, and shift construction schedules to match the new reality. Do that, and the shock of 2025 turns into a competitive advantage in 2026.